Who needs to provide a 2-NDFL certificate?

Certificate 2-NDFL will contain information about the income of individuals and the amount of personal income tax for the tax period.

The tax agent provides 2-NDFL certificates to the Federal Tax Service within the following deadlines:

| Help Feature | Sign | Submission deadline |

| Income is reflected regardless of personal income tax withholding | 1 | Until April 1 of the year following the reporting year |

| Income for which personal income tax is not withheld is reflected | 2 | Until March 1 of the year following the reporting year |

In addition to the Federal Tax Service, the tax agent or employer is obliged to provide a 2-NDFL certificate to the employee upon his written request.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Deadline for submitting a tax certificate

It is important to submit the reporting document to the Federal Tax Service office in a timely manner. If the deadline established by law is violated, a fine will be imposed on the organization or individual individual.

The deadlines for submitting documents on the income of individuals are indicated in the Tax Code of the Russian Federation, namely in Article 226 :

- declarations in form 2-NDFL are sent by March 1, if it is impossible to withhold tax from an individual;

- before April 1, income reporting is sent to the Federal Tax Service if the amount of tax is withheld.

Individual entrepreneurs are also required to report income. We are talking about individual entrepreneurs on OSNO. The individual entrepreneur must submit the 3-NDFL certificate by April 30.

If the employer realizes that he made a mistake when calculating the tax base, filling out personal information or calculating income tax, he can submit an adjustment. If an error is made regarding only one employee, then the certificate is submitted specifically for him. In the line “Adjustment number” you must write “01”.

Why do you need a 2-NDFL certificate?

Certificate 2-NDFL is required by the Federal Tax Service. From this document the tax authorities receive the following information:

- employee's salary;

- tax deductions;

- deductions that were made from the employee.

In addition to the Federal Tax Service, where the 2-NDFL certificate is provided by the employer or tax agent, this document can be requested from the taxpayer in the following cases:

| Situation | Who can request a certificate? |

| Getting a loan | An employee of a credit institution to confirm the income declared in the application form |

Receiving a tax deduction in the case of:

| Inspectorate of the Federal Tax Service |

| Change of place of work | New employer |

| Applying for a visa to travel abroad | Employee of a foreign state mission |

| Getting a mortgage loan | An employee of a credit institution to confirm the income declared in the application form |

In all cases, the form of the 2-NDFL certificate is unchanged; there are no specific features for filling out the certificate depending on the situation.

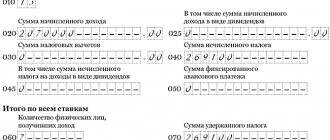

Sample certificate 6-NDFL

The sample annual report 6-NDFL has been valid for about a year, but tax agents and accountants have many questions about filling it out.

The certificate has a title page and a second page, which has two more sections. If there are not enough lines for the report, you can number additional sheets. Usually there is not enough space when filling out the second section, which is on the same page as the first. In this case, there is no need to copy the contents of the first section.

In the footer of the first sheet, fill in the TIN and KPP of the organization that submits the reports. If the information is provided by a branch of the company, then the checkpoint of the branch is filled out.

Under the heading there is a line “Adjustment number”, suggesting the ways in which the report is filled out. If errors or inaccuracies are found in the report, they can be corrected by sending a modified version of the report. Accordingly, if the report is sent for the first time, three zeros are indicated in the required column. If it is necessary to clarify the calculations, indicate the numbers “001”, “002”, etc.

Previously, when submitting personal income tax reports, the year was not divided into reporting periods; accordingly, according to the Tax Code of the Russian Federation, the “reporting period” in relation to this tax did not matter. Now the value “submission period” has been added to the sample report; this is the deadline for submitting the annual 6-NDFL report for which the report is submitted.

Below is the tax code to which the employer sends reports. The code is four digits: the first two numbers are the region number, and the second two numbers are the inspection code. It is necessary to remember that the report is submitted to the inspectorate at the actual location of the enterprise or branch. Individual entrepreneurs send reports to the tax office at their place of residence.

By the code in the line “By location (accounting)” you can determine which organization submits the report. These codes are indicated in the Procedure for filling out the annual report 6-NDFL:

- where the Russian organization is registered – “212”;

- where the branch is registered;

- large taxpayers indicate “213”;

Individual entrepreneurs have their own codes:

- IP on the simplified tax system or the general system - “120”.

- Individual entrepreneur on UTII or patent – “320”.

In the line about the tax agent, indicate the name of the organization. You can also indicate a short name, if available.

When filling out the All-Russian Classifier of Municipal Territories (OKTMO), it is mandatory to indicate the code of the entity on the site of which the organization or its branch is located and registered (when submitting a report for the branch). That is, annual report code 6-NDFL. It happens that employees receive income, such as wages, bonuses, etc., both from the parent company and from its divisions. In such a situation, the inspectorate is provided with two calculations with different OKTMO codes.

The procedure for issuing a 2-NDFL certificate to an employee

In accordance with Art. 230 of the Tax Code of the Russian Federation, tax agents are required to issue to individuals, upon their applications, certificates about the income received by individuals and the amounts of tax withheld.

The deadline for submitting a 2-NDFL certificate is regulated by Art. 62 of the Labor Code of the Russian Federation and is no more than 3 days from the date of submission of the employee’s written application.

There are cases when an employee requires a 2-NDFL certificate for previous years - the employer is obliged to provide it. There is no statute of limitations that would limit the issuance of a certificate.

So, in order to obtain a 2-NDFL certificate:

| Worker | Employer |

| Must provide a written application for a 2-NDFL certificate | Must provide a 2-NDFL certificate within three days |

Deadline for submitting 2-NDFL for the year

The report on Form 2-NDFL contains a sign that reflects the following information:

For 2020, tax agents are required to submit reports for each employee within the following deadlines:

Also, the Tax Code of the Russian Federation provides for deadlines for submitting reports by organizations that carry out reorganization or liquidation procedures during the year - 2-NDFL is submitted from the beginning of the reporting period until the date of changes.

Methods for filing a 2-NDFL report depend on the number of employees:

Get 267 video lessons on 1C for free:

- Free video tutorial on 1C Accounting 8.3 and 8.2;

- Tutorial on the new version of 1C ZUP 3.0;

- Good course on 1C Trade Management 11.

- on paper - if there are no more than 25 employees;

- electronically – if the staff number is more than 25 people. Reporting can be transmitted electronically only through an operator performing electronic document management. The use of electronic storage media – disks, memory cards – is prohibited.

Actions of an employee in the event of an employer’s refusal to issue a 2-NDFL certificate

In some cases, the employer refuses to provide the employee with a 2-NDFL certificate upon his written request. Most likely the reason lies in the presence of tax or administrative offenses. In this case, it is recommended to send an application for a 2-NDFL certificate by registered mail with notification to the employer and, in the absence of a certificate, contact the labor inspectorate.

It should be remembered that failure by an employer to provide a 2-NDFL certificate upon a written application from an employee is a violation of labor legislation and entails administrative sanctions (Article 5.27 of the Code of Administrative Offenses of the Russian Federation):

| Violator category | Administrative punishment |

| Executive | Warning or fine 1000-5000 rubles. |

| Individual entrepreneur | Fine 1000-5000 rubles |

| Entity | Fine 30,000-50,000 rubles |

| In case of repeated violation | |

| Executive | Fine 10,000-20,000 rubles or disqualification for 1-3 years |

| Individual entrepreneur | Fine 10,000-20,000 rubles |

| Entity | Fine 50,000-70,000 rubles |

If the applying citizen is not a current employee of the enterprise, in relation to this case the effect of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation does not apply, but Art. 5.39 Code of Administrative Offenses of the Russian Federation. According to Art. 5.39 of the Code of Administrative Offenses of the Russian Federation, an unlawful refusal to provide a citizen with information, the provision of which is provided for by federal laws, untimely provision of it, or provision of knowingly false information shall entail the imposition of an administrative fine on officials in the amount of five thousand to ten thousand rubles.

2-NDFL and 6-NDFL in accounting

In the 1C accounting program, an income tax return is generated based on data received from the 1C: ZUP program. There, information for reporting 2-NDFL and 6-NDFL on dividends is generated on the basis of documentation.

When using the 1C accounting program, you don’t have to worry about meeting the ratios in the annual report 6-NDFL and 2-NDFL. The automatic reporting mode guarantees mandatory automatic compliance with all necessary control ratios. To do this, you need to monitor the current version of the program and update if necessary.

After filling out the sample reports, the accountant is obliged to check all the information entered in order to be sure of the correctness and reliability of the information provided. Annual report 6-NDFL and 2-NDFL must match. If there are still any discrepancies, the Federal Tax Service has the right to send the employer an order to make adjustments to the Calculation, or to provide explanations in writing for a period of five days. Also, if an error is detected in the Calculation, the Federal Tax Service has the right to collect a fine from the employer.

How to obtain a 2-NDFL certificate in case of liquidation of an organization?

In the event of liquidation of the organization, the employee will not be able to obtain a 2-NDFL certificate from the former employer.

In accordance with the legislation of the Russian Federation, it is possible to obtain a 2-NDFL certificate as follows:

| Who requests a 2-NDFL certificate? | Procedure | A comment |

| New employer | Sending a request to the Pension Fund and the Federal Tax Service | The new employer is obliged to explain the need to obtain a 2-NDFL certificate without the participation of the employee (calculation of the amount of temporary disability benefits, tax deductions, vacation pay) |

| Insured person | Sending a request to the Pension Fund | The form was approved by Order of the Ministry of Health and Social Development of the Russian Federation dated January 24, 2011 No. 21n “On approval of the application form of the insured person to send a request to the territorial body of the Pension Fund of the Russian Federation for the provision of information on wages, other payments and remunerations, the form and procedure for sending request, form and procedure for submitting the requested information by the territorial body of the Pension Fund of the Russian Federation" |

| Insured person | Receiving information through the taxpayer’s personal account | On the website of the Federal Tax Service |

Reporting in a new way

Important innovations in tax reporting. They relate primarily to the work of accountants:

- Deadlines for submitting annual reports 2-NDFL and 6-NDFL. The usual deadline until April 1 has been shortened by a month. Based on the results of 2020, the forms must be submitted by March 1, 2020.

- Electronic reporting. An organization with more than 10 employees is required to submit reports electronically. Information on paper will be considered not provided. Federal Tax Service officials promise to apply sanctions for the incorrect way of drawing up a document in accordance with Art. 119.1 of the Tax Code of the Russian Federation – 200 rubles for each document (calculation, certificate). Let us recall that previously the “threshold” for the application of mandatory electronic reporting was 25 people.

- Changing control ratios. The innovations concern the same forms of 2-NDFL and 6-NDFL. The control tools embedded in them will be linked to data on the minimum wage and regional averages in the context of OKVED. It must be said that if the requirements for payments not lower than the minimum wage are already included in the Labor Code of the Russian Federation (Article 133), then the requirements relating to industry wage indicators are an innovation. Employers are afraid that they will become a new “punitive” instrument of the Federal Tax Service, because the specifics of doing business are individual and, for one reason or another, may violate certain average indicators. Officials promise to be flexible and remind that the request for explanations (which must be answered within 5 days) does not mean an automatic admission of guilt of the tax agent. In addition, according to Federal Tax Service specialists, all calculations will be carried out using the arithmetic average for the year in order to exclude “differences” in accruals for a particular month (for example, if employees are sick and have just been hired).

- Separate units. If an organization has several separate divisions located geographically within one OKTMO, it will be able to transfer all personal income tax amounts and submit reports at the place of registration of either the organization itself or one of the divisions. Tax authorities must be notified of the decision made. Let us recall that until this moment, each separate division and parent organization submitted separate reports at the place of registration. In connection with the innovation, the Federal Tax Service promises to extend at the initial stage the time frame within which the tax agent must make a choice, but they recommend that if the decision has already been made in January, the tax must be transferred in accordance with it. Otherwise, if transfers are done “in the old way” and reporting is done “in the new way”, difficulties may arise for the tax agent.

On a note! 1/03/2020 is a day off according to the calendar. According to the law, the deadline is postponed to the next working day after the day off - 03/2/2020. This is confirmed by the Federal Tax Service (see document No. BS-4-11 / [email protected] dated 11/15/19).

What should accountants expect? Changing the reporting deadlines is not a random step. The ultimate goal of this work is to simplify income tax reporting. Already this year in the spring it is planned to make corresponding changes to the legislation. Forms 2 and 6 for personal income tax will be combined into one document provided at the end of the year. As officials explain, form 2-NDFL will be “absorbed” by form 6-NDFL and will become its integral part. Real changes are scheduled for 2021, but it is advisable to prepare for them now.

Important! A decision has been made at the highest level, and a bill is being prepared to reduce the tax rate for non-residents. The document should be released in March. The rate will be reduced to 13%, so the income of residents and non-residents will be taxed equally by default. The prepared changes should come into force in 2021.

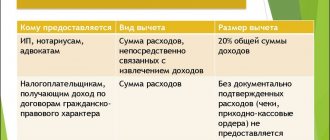

How can an individual entrepreneur provide a 2-NDFL certificate?

An individual entrepreneur, in the case of payment of income subject to personal income tax, along with organizations, is obliged to provide a 2-NDFL certificate both to the Federal Tax Service and personally to the individual.

The legislation does not provide for a specific form of 2-NDFL certificate intended for individual entrepreneurs in case of confirmation of their own income. An individual entrepreneur has the right to draw up a 2-NDFL certificate, because calculates and pays taxes to the budget. In this case, an individual entrepreneur can confirm his income by providing a copy of a tax return or other documents containing information about receipt of income.

Help 6-NDFL

Certificate 6-NDFL is a document for reporting by an employer paying income to individuals. Presented as a summary of general information about employee income for a certain period and the tax withheld on these amounts. Reporting is submitted quarterly, that is, every three months. Reporting must be submitted electronically. But if the organization has less than 25 employees, you can send it in paper format.

When filling out the certificate, you need to make sure that all the boxes are filled out. Empty columns are filled in with a dash, both on the title page and on the second page. All tax agents are required to submit this form. These include individual entrepreneurs, lawyers, and notaries. Income should be reflected for all individuals who work at the enterprise. When talking about income, we mean wages, dividends, and remuneration under civil contracts.

How can people who are retired or unemployed get a 2-NDFL certificate?

Unemployed people registered with the Employment Center can obtain a certificate of income by submitting a written application directly to the Employment Center.

If a citizen did not work, was not registered as unemployed at the Employment Center, you should not count on receiving a certificate of income for one simple reason - there was no income and, accordingly, personal income tax was not calculated and paid.

Citizens receiving state pensions cannot apply for a 2-NDFL certificate, because Pension benefits are not subject to personal income tax.

Where is it usually provided?

In most cases, a certificate in form 2-NDFL is requested by banks and other credit organizations. The data reflected in the document allows you to make a positive or negative decision on the issue of granting a loan.

https://youtu.be/https://www.youtube.com/watch?v=x53REcKxEq0

For large amounts of lending , in particular mortgages, the provision of a tax certificate of income is a fundamental and mandatory condition for concluding a loan agreement.

In addition to credit institutions, a unified form of certificate can be requested by:

- Federal Tax Service for calculating tax deductions.

- Pension Fund when assigning and calculating pensions.

- Guardianship authorities for the adoption of children.

- Social protection authorities for processing benefits for low-income citizens.

- Judicial authorities to approve the legality and calculation of alimony amounts.

- TsN for assigning and establishing the amount of unemployment benefits.

- Embassy when applying for a visa.

In addition, the need for a 2-NDFL certificate arises when:

- 3-NDFL reporting is filled out

- a former employee gets a new job.

Questions and answers

- We provided the Federal Tax Service and the employee with a 2-NDFL certificate. During the audit, errors were discovered, which we notified the tax authorities by sending an adjustment certificate. Is it necessary to provide a new certificate to the employee?

Answer: Yes, if an error is discovered in the 2-NDFL certificate, the employee must be provided with a new certificate in which the errors have been corrected.

2. I received income, but did not record it anywhere. What should I do to get a 2-NDFL certificate?

Answer: In this case, you need to fill out form 3-NDFL, calculate and pay personal income tax yourself. The tax return will be the document that confirms your income and the tax paid.

Actions to take if there is an error in the help

There are times when errors are made in the certificate. In this case, you need to act in accordance with the procedure for correcting errors. The header has a special field “Adjustment number”. The adjustments have their own numbers:

- “00” means filling out the primary form;

- “01”, “02”, etc. are indicated when filling out the corrected certificate, which is issued in place of the previous one, one more than what was indicated in the previous certificate;

- “99” means cancellation of the certificate.

The corrected form of the 2-NDFL annual report form is submitted to eliminate an error in the form that was submitted initially, and the cancellation form is submitted to cancel data that is unnecessary to provide. If the tax authority does not accept the certificate (for this purpose errors with format control are indicated in the protocol), a new certificate is written, not an adjustment. Therefore, when filling out a new certificate, indicate the number “00” and the new date.

How to fill out and submit the 2-NDFL register in 2020

If the 2-NDL is submitted in paper form, it is also necessary to draw up an accompanying register in two copies . When submitting 2-NDFL electronically, you do not need to submit the register. The register is compiled according to the form found in Appendix 1 to the Procedure for filling out certificates. This Procedure was approved by Order of the Federal Tax Service No. ММВ-7-11/ [email protected] dated 10/02/2020. If the 2-NDFL certificates indicate different characteristics, then a separate register will need to be compiled for each characteristic.

The register contains the following information:

- reference number;

- name of organization, individual entrepreneur;

- attribute number;

- number of certificates;

- surnames, first names, patronymics, date of birth of individuals who appear in the certificates;

What are the errors in 2-NDFL?

The main mistakes when filling out 2-NDFL are:

- confusion in codes;

- wages are indicated in two amounts per month;

- OKATO is indicated incorrectly;

- indicate the wrong date of receipt of income under the contract

The employer must pay wages twice a month, but the certificate must show it in one amount. This is due to the fact that the date of receipt of income is considered to be the last day of the month.

If a company has several branches located in different places, then it is necessary to indicate OKATO in the certificates, which correspond to the location of the employee’s workplace.

Under civil contracts, the date of receipt of income is the date of payment under the contract. For example, the agreement was concluded in December 2020, the act was signed in February 2020, and the money was received in March 2020. In this case, the income date will be March 2020.