Fine for non-payment of personal income tax by a tax agent

As a general rule, if a tax agent does not withhold and/or transfer personal income tax from the taxpayer’s income, or does not fully withhold and/or does not fully transfer the tax, then a fine in the amount of 20% of the amount that was required to be withheld may be collected from the tax agent. transfer to the budget (Article 123 of the Tax Code of the Russian Federation). True, only in the case where the agent had the opportunity to withhold personal income tax from the income of an individual. After all, if a citizen was paid income, for example, only in kind, then tax cannot be withheld from him (clauses 4, 5 of Article 226 of the Tax Code of the Russian Federation, clause 21 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57). And in such a situation, the fine is not applicable to the tax agent.

A fine can be avoided in case of non-withholding/non-transfer if the following conditions are met (clause 2 of Article 123 of the Tax Code of the Russian Federation):

- the personal income tax calculation is submitted to the Federal Tax Service in a timely manner;

- in the calculation there are no facts of non-reflection or incomplete reflection of information and (or) errors leading to an underestimation of the amount of tax payable to the budget;

- the tax agent independently paid the amount of tax not transferred on time and penalties until the moment when the agent became aware of the discovery by the Federal Tax Service of the fact of untimely transfer of personal income tax or the appointment of an on-site tax audit for this tax for the corresponding tax period.

In some cases, tax authorities try to collect from the tax agent, in addition to a fine, arrears and penalties.

| Situation | What can be collected from an agent other than a fine? |

| The tax agent did not withhold personal income tax from the individual’s income | Nothing. The arrears cannot be collected, since payment of personal income tax at the expense of the tax agent is not permissible (clause 9 of Article 226 of the Tax Code of the Russian Federation). And if it is impossible to collect the arrears, then there is also no reason to charge penalties for personal income tax (Letter of the Federal Tax Service dated 08/04/2015 No. ED-4-2/13600) |

| The tax agent withheld personal income tax from the income of an individual, but did not transfer it to the budget | - arrears; — penalties (clause 1, 7, article 75, clause 5, article 108 of the Tax Code of the Russian Federation) |

How to write a petition to reduce the personal income tax fine

If the norms of the Tax Code are violated, the tax is not transferred to the budget on time, the tax authorities impose a fine on the guilty party, which may be the taxpayer himself or the tax agent. All that remains is to make the payment. However, there are legal ways to reduce the fine. How? For example, draw up a petition to reduce the fine and send it to the tax authorities for consideration.

It is necessary to submit the application to the tax office within a month from the date:

- receiving an inspection report (office or on-site);

- receiving a report from the Federal Tax Service on a tax violation.

The application must indicate the reasons that influenced the delay in payment. These may include:

- lack of intent;

- difficult financial situation;

- the presence of complex family, personal circumstances, serious illnesses in an individual;

- conscientiousness of the person - here we can refer to the fact that the taxpayer or tax agent always fulfills his tax obligations in a timely manner;

- committing an offense for the first time;

- force majeure circumstances - natural disaster, flood, etc.

The presence of at least one mitigating circumstance may well lead to a reduction in the fine (but, unfortunately, not to its cancellation).

https://youtu.be/DEPDDvfVG4s

Penalty for non-payment of personal income tax by the taxpayer himself

Taxpayers - individuals who are not individual entrepreneurs must independently pay personal income tax on certain types of income, for example, received from the sale of property (clause 2, clause 1, article 228 of the Tax Code of the Russian Federation). Individuals who are individual entrepreneurs must make advance payments during the year, and at the end of the year also pay the tax amount (clauses 6, 9 of Article 227 of the Tax Code of the Russian Federation).

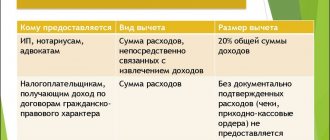

For non-payment or incomplete payment of tax resulting from an understatement of the tax base, an individual may be fined in the amount of 20% of the unpaid tax amount or 40% if the act was committed intentionally (clauses 1, 3 of Article 122 of the Tax Code of the Russian Federation). An understatement of the base may occur, for example, if you show deductions in your personal income tax return that you were not actually entitled to apply. Or declare income in a smaller amount.

But there will be no fine for late payment of personal income tax (clause 19 of the Resolution of the Plenum of the Supreme Arbitration Court of July 30, 2013 No. 57). Although penalties for personal income tax will be charged for late payments (Article 75 of the Tax Code of the Russian Federation).

It is also impossible to impose a fine on an individual entrepreneur for failure to pay advance payments. At the same time, tax authorities will charge penalties for personal income tax for late payment of advances (clause 3 of Article 58 of the Tax Code of the Russian Federation).

If personal income tax was paid later - what is the fine?

If the amount is paid later, a penalty is charged for each day of delay.

Example. The payer was supposed to pay personal income tax on May 17, but in fact made the payment on May 20. In this example, the penalty will be accrued for 4 days: May 16, 17, 18 and 19. May 20 – the day of tax payment is not subject to sanctions. For example, the tax for individual entrepreneurs is 72 thousand rubles. Then for 4 days the penalty will be 72,000 rubles. × 10% / 300 × 4 days = 96 rub. The fine will be 20% of 72,000 – i.e. 14,400 rub. Total: 14,496 rub.

Taxpayer pays overdue debt at Sberbank

Important! Penalties are assessed not only for late payment, but also for deliberate understatement of taxable income. In this case, the amount from 20% increases to 40%. Wrongful use of deductions and declaration of income in a smaller amount are punishable.

A representative of the inspectorate is authorized to impose a fine. The fine for non-payment of personal income tax and penalties are calculated automatically in the database if the payment with the required payment is not received on time.

For personal income tax, posting deadlines have been established - payment calendar:

- forms 6-NDFL and 2-NDFL for the reporting year are submitted to the Federal Tax Service by April 2 inclusive by agents - organizations and individual entrepreneurs;

- 6-NDFL for the 1st quarter of 2020 – until May 3;

- 6-NDFL for six months – until July 31;

- 6-NDFL for 9 months – until October 31.

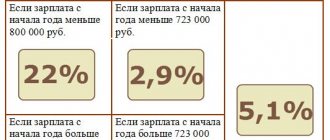

Employers make contributions for tax purposes to the Federal Tax Service no later than the day following the day of payment of wages to employees. Individual entrepreneurs on OSNO, notaries, lawyers and other persons engaged in private practice pay taxes to the budget on January 15, July 15 and October 15. If the money is not received into the Federal Tax Service's account by the specified dates, a fine will be assessed for late transfer of personal income tax.

Object and tax base of personal income tax

In the context of the Tax Code of the Russian Federation, income as an object of taxation is formulated as follows. This is an economic benefit if it can be identified and valued in monetary form (Article 41).

In relation to personal income tax, according to Art. 210 of the Tax Code of the Russian Federation, is income in cash and in kind, material benefits, the types of which are named in Art. 212 of the Tax Code of the Russian Federation.

It should be noted that the right to dispose of income is equivalent to receiving it. For tax residents, the tax base also includes income received abroad.

What amount is tax paid on?

The tax base that must be paid is, according to Art. 210 of the Tax Code of the Russian Federation, any income and benefit according to Art. 212. Benefit is the funds that a person could receive through turnover from delayed payment for days of delay.

Important! Income received abroad is also subject to taxation.

This is interesting: How to find out where my pension savings are

You can find out the size of the tax base on a website with online tax calculators.

Is there any liability for individuals and individual entrepreneurs for non-payment of personal income tax?

The tax period for personal income tax is a calendar year. An individual pays the due amount of NLFL on self-declared income no later than July 15 of the year following the given tax period (clause 6 of Article 227, clause 4 of Article 228 of the Tax Code of the Russian Federation).

Failure to pay personal income tax means the occurrence of tax arrears subject to payment to the budget. Penalties are charged on the amount of overdue debt as compensation for losses to the treasury for failure to fulfill the taxpayer’s obligations within the due time limit.

To individual entrepreneurs and notaries (lawyers) with private practice, for non-payment (or late payment) of advance payments during the tax period in accordance with clause 9 of Art. 227 of the Tax Code of the Russian Federation, a requirement to pay a penalty may also be presented.

Part of the income that is subject to taxation under Art. 209 of the Tax Code of the Russian Federation, is subject to personal income tax by the tax agent (Article 226 of the Tax Code of the Russian Federation). The tax agent’s improper fulfillment of the obligation to pay the tax withheld from the taxpayer’s income has nothing to do with the taxpayer.

When a taxpayer is not held accountable for non-payment of personal income tax

In order to be held accountable, in addition to the event of an offense (non-payment of tax), the guilt of the taxpayer is necessary (Article 109 of the Tax Code of the Russian Federation). For example, the taxpayer’s guilt is obvious if, even though he had such an obligation, he did not declare the income received and, accordingly, did not pay tax on it to the budget. This gives every reason to fine him for non-payment of tax.

The situation is different with respect to income, from which tax must be withheld by the source of payment—the tax agent. The taxpayer should not be held responsible for his actions (inaction). So, if an agent has not withheld tax from a taxpayer, he must notify the taxpayer and the tax authorities about this. The notification period is no later than March 1 of the next year (clause 5 of Article 226 of the Tax Code of the Russian Federation). Based on this message from the tax agent, tax authorities must present this personal income tax amount for payment to the taxpayer by sending him a tax notice. If the agent did not fulfill his notification function, or if the tax authorities for some reason did not send a notification, it is illegal to fine the taxpayer.

A duly established circumstance that the taxpayer did not know that personal income tax was not withheld from him is proof of his innocence. And this is by virtue of clause 2 of Art. 109 is considered an independent and sufficient argument for non-collection of the fine established by Art. 122 of the Tax Code of the Russian Federation. The Ministry of Finance also speaks about this in letter dated June 10, 2013 No. 03-04-05/21472. However, the department does not make an unambiguous conclusion, but only indicates that in the event of non-payment of personal income tax arising in such circumstances, liability is assigned taking into account the presence of guilt.

You can learn about which income is not subject to income tax in this article.

What sanctions are provided for late payment of personal income tax?

Failure to pay personal income tax by an individual, coupled with the absence of tax declaration in cases established by law, entails liability in the form of a fine provided for in Art. 122 of the Tax Code of the Russian Federation.

According to Art. 229 of the Tax Code of the Russian Federation, individuals are required to file a tax return no later than April 30 at the end of the tax period:

- on income from business activities;

- for remuneration from the sale of property, etc. income;

- persons recognized as tax residents - when receiving income from foreign sources.

Failure to pay personal income tax, aggravated by failure to submit a 3-personal income tax return, leads to the collection of a fine in the amount of 20% of the amount of unpaid tax (clause 1 of article 122 of the Tax Code of the Russian Federation).

Lack of awareness of an individual about the existence and amount of the obligation to pay personal income tax may turn out to be a very unpleasant surprise, since the tax authority will present a lump sum payment of arrears, penalties and, possibly, a fine.

Personal income taxes

Personal income tax is the main type of direct tax. It is calculated as a percentage of the taxpayer’s total, summed-up income minus expenses, officially confirmed by documents, naturally, in accordance with current legislation. The taxpayer in this case is an individual who has legal, taxable income, confirmed by certified documents from the place of work.

- Persons who are tax residents of the Russian Federation (Arrived in the territory of the Russian Federation for at least six months in total over the next 12 months in a row)

- Persons who are not tax residents of the Russian Federation (Receive income in Russia, but are abroad all the time or more than the limit established in the first paragraph)

In order to correctly and in accordance with the law pay all necessary taxes on personal income, it is necessary to notify the state of your official, legal income. Typically, all such issues are regulated by the company or production - the employer. But there are special cases in which the taxpayer is obliged to provide a declaration of his taxes himself.

The main rule for this method of notification is the need to provide a correctly executed, reliable document before April 30 of the current year. If the state does not receive information about your income, then in the future failure to pay taxes on it may be considered evasion of duties and an offense. Persons who are required to declare their income independently:

- individual entrepreneurs;

- persons engaged in private practice (notaries, lawyers, etc.);

- persons who received remuneration not from the tax agent, but from another source;

- persons who received funds from the sale of property;

- persons who are residents of the Russian Federation, but receive income from abroad;

- persons on whose income tax was not withheld by tax agents upon receipt;

- persons who have received winnings paid by the organizers of lotteries or other risk-based games;

- persons receiving income in the form of remuneration paid to the heirs of the authors of the property of science, literature, art;

- persons receiving income as a gift.

All of the above persons may have variable income, where every month at the same rate, the amounts vary. In this case, such taxpayers must also notify the tax office of changes in income through a declaration.

What happens for non-payment of income tax by a tax agent?

Tax agents charge tax on income subject to personal income tax on a monthly basis on an accrual basis from the beginning of the year. Timely identification of the obligation to pay personal income tax and fulfillment of the deadline for its payment is important from the point of view of the amount of losses for economic entities that are tax agents.

In addition to the collection of arrears and penalties (clause 1 of Article 46 of the Tax Code of the Russian Federation), Art. 123 of the Tax Code of the Russian Federation gives the tax authority grounds to impose a fine on tax agents not just for non-payment of tax, but even for delay in payment, for example by one day. At the same time, tax and judicial authorities can reduce the amount of the fine on the basis of subsection. 3 p. 1 art. 112 of the Tax Code of the Russian Federation.

NOTE! From January 28, 2019, the Tax Code of the Russian Federation introduces grounds for releasing a tax agent from liability for late payment of personal income tax. Find out what these reasons are here.

For example, an organization carries out retail trade and pays salaries using cash in the cash register received in cash from customers. Personal income tax is paid within 2-3 days after payment of income.

An example of the amount of a fine for late payment of personal income tax by a tax agent

There are penalties for late payment of personal income tax. But if the taxpayer independently corrected the error, submitted an adjustment and paid the obligations before the audit, then the penalties will be canceled. Let’s figure out what amounts we are talking about and how to legally avoid paying a fine to the Federal Tax Service. We have prepared a convenient table of all personal income tax fines, download and use in your work. And at the end of the article there is a table with the correct payment deadlines, so as not to be late with taxes.

The amount of penalties in 2020 for tax agents for being late in transferring personal income tax

Type and amount of late payment

Tax agents (organizations)

Tax is withheld, but not transferred to the Federal Tax Service

Personal income tax is not withheld from income There are no penalties. Provided that the tax agent did not have the opportunity to withhold personal income tax from employee income. Payment of tax at the expense of the employer is not allowed (clause 9 of Article 226 of the Tax Code of the Russian Federation). Reports submitted late 6-NDFL - will be punished by 1,000 rubles for each full and partial month of delay. 2-NDFL - 200 rubles for each certificate submitted late. False, unreliable information in reports For errors in 6-NDFL and for each 2-NDFL certificate, you will be fined 500 rubles. Failure to comply with the order of presentation 200 rubles for submitting a report on paper, when the company is required to report in electronic format. |

In what cases does personal income tax liability arise?

Liability for income tax arises if the taxpayer, within the established time limits:

- Did not pay tax or did not pay the full amount of tax;

- Didn't provide a tax return.

In case of failure to submit a tax return, the payer is subject to a fine of 5% of the unpaid tax for each month of delay in accordance with Part 1 of Art. 199 Tax Code of the Russian Federation:

“Failure to submit a tax return (calculation of insurance premiums) to the tax authority at the place of registration within the deadline established by the legislation on taxes and fees shall entail the collection of a fine in the amount of 5 percent of the amount of tax (insurance contributions) payable not paid within the period established by the legislation on taxes and fees (additional payment) on the basis of this declaration (calculation of insurance premiums), for each full or partial month from the date established for its submission, but not more than 30 percent of the specified amount and not less than 1,000 rubles.”

Please note: In accordance with Part 5 of Art. 174 of the Tax Code of the Russian Federation, the taxpayer is obliged to submit a declaration no later than the 25th day of the month following the expired tax period.

Payment of personal income tax by the tax agent must be made no later than the next day on which the income was paid to the taxpayer.

“Tax agents are required to transfer the amounts of calculated and withheld tax no later than the day following the day the income is paid to the taxpayer.” (Part 6 of Article 226 of the Tax Code of the Russian Federation)

How can a tax agent avoid punishment?

Article 123 of the Tax Code of the Russian Federation provides for the possibility of not paying fines for late payment of personal income tax in 2020. To do this, you only need to fulfill two conditions:

- Always submit fiscal reports on time. If you find an error in 6-NDFL, then immediately send a corrective report. Check your personal income tax calculation before submitting. Information about income, deductions and deductions must be reflected reliably and in full.

- At the same time as the adjustment, pay the identified arrears, as well as the amount of the penalty. Make the calculation according to the new rules (clause 3 of article 75 of the Tax Code of the Russian Federation, part 5 of article 9 of the Federal Law of November 27, 2018 N 424-FZ).

Please note that a fine can only be avoided if the errors are corrected before the Federal Tax Service inspectors find out about them. For example, until the moment when the Federal Tax Service issued a demand for payment of arrears and tax penalties. Or before scheduling a desk audit by the Federal Tax Service for the corresponding period.

An example of calculating a personal income tax fine for a tax agent

Information is included in the calculation of 6-NDFL for the 1st quarter of 2020.

The tax and late fees were paid to the budget only on April 10.

In this case, the Federal Tax Service will impose a fine of 20% of the underpaid amount - 2,340 rubles ((13,000 - 1,300) * 20%).

How to avoid a fine

Mitigating legal circumstances for late personal income tax are:

- absence of earlier delays for individual entrepreneurs and individuals. faces;

- inability to prove malicious intent;

- admission of guilt, attempt to negotiate;

- conscientious payment of taxes;

- pre-bankruptcy;

- bankruptcy;

- dismissal of an accountant, search for a new employee;

- status of a budgetary and city-forming company;

- non-profit nature of the organization's activities.

Important! In 95% of cases, tax authorities do not accommodate defaulters: the agent, as part of his duty, must fine the offending person. In this regard, only early payment of taxes can guarantee the absence of sanctions.

This is interesting: Is it possible to exchange goods without a receipt?

An individual calculates what penalty he will have to pay

You can try to petition for a reduction in the fine. The deadline for filing an application, in accordance with clause 5 of Art. 101.4 of the Tax Code of the Russian Federation, is 1 month from the date of notification of the existence of an offense by an employee of the Federal Tax Service.

In the application, indicate point by point circumstances mitigating the taxpayer’s guilt.

If the Federal Tax Service ignores the petition even after the 2nd attempt, you will have to go to court. But you need to think carefully about whether this step is correct: if you go to court, other violations on the part of the person may be discovered during the forensic examination. In addition, since 2020, the legislation has become noticeably stricter: now it has become much more difficult to win cases related to non-payment of personal income tax.

Unfortunately, personal income tax fines for late payment in 2020 are not uncommon. It doesn’t matter whether the payment deadlines were deliberately violated or not - the Federal Tax Service is unlikely to look into this. And the automation factor plays an important role - sanctions are calculated automatically. Therefore, it is necessary to make payments on time. There are a lot of convenient tools for this – payment calendars and planners, available to everyone.

https://youtu.be/BXLPU_U2HlQ