Collecting a debt against a receipt is a headache for many lenders who have formalized the transfer of money without drawing up a loan agreement at interest or on interest-free terms.

With our lawyer, you will learn how to collect funds against a receipt, file a claim, or entrust us with the management of your case until the court decision is fully executed.

ATTENTION: interesting on the topic of how to recognize a receipt as void following a link on a lawyer’s blog.

The procedure for drawing up a receipt when transferring a loan

To most effectively protect the interests of the creditor, in order to collect the debt on a receipt from an individual in the future, it is necessary to take into account the following features when drawing up this document:

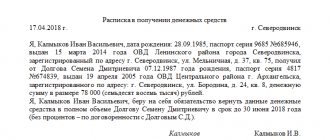

- It is better to prepare the document manually, but preparation using technical means is also not prohibited;

- It is necessary to fully reflect the details of the creditor and debtor, including passport details and place of residence;

- The receipt must necessarily reflect the date of drawing up and repayment of the debt; in the absence of a repayment date, the funds are transferred on demand;

- Signatures of both parties are required; it is better if these signatures are accompanied by transcripts;

- The document can additionally reflect interest on the use of funds, interest on late repayment of the debt, or other ways to secure the obligation.

ATTENTION : if the interest is not indicated in the receipt, this fact is not a basis for refusal if the debt is collected on the receipt with interest, however, the interest is established by law,

List of documents

In order to collect a debt under a receipt, the plaintiff must collect a package of documents confirming the existence of debt obligations:

- statement of claim and its copy for the defendant;

- receipt of payment of state duty;

- originals and copies of documents confirming the fact of the loan - receipt, loan agreement, documents confirming a bank account transaction, etc.;

- postal receipts and a copy of the defendant's pre-trial notice demanding repayment of the debt (if any);

- calculation of the amount of penalties for late payment.

This is also important to know:

How to recover a penalty through an arbitration court

Deadline for debt collection by receipt

As a general rule, the legislator defines the period for collecting a debt on a receipt as three years from the date of return established by the receipt. At the same time, the deadline for collecting interest on the use of funds should be separately noted, because in this case, the three-year period is calculated from the moment when the debtor had to pay the interest due to the creditor.

It should be noted that the expiration of the statute of limitations is not an obstacle to filing a statement of claim or a court order, since these lines apply only at the request of the Defendant. If the other party does not submit a written statement about the expiration of the limitation period, then the court cannot, on its own initiative, refuse the claims.

In addition, when questioning the deadline for collecting a debt on a receipt, it is important to take into account the possibility of their restoration at the request of the plaintiff, who, for example, declares illness, death of a loved one, or other grounds that the court will evaluate for a valid reason for reinstating the statute of limitations.

ATTENTION : the deadline may also not be recognized as missed due to partial payment of the debt, recognition of it by the debtor, when providing evidence of these circumstances at the court hearing.

Pre-trial debt collection by receipt

The legislation of the Russian Federation provides for a judicial procedure for collecting debt by receipt, however, from judicial practice it is also possible to determine other methods of collecting funds:

Extrajudicial procedure

Before preparing a statement of claim to collect a debt under a receipt, you should try to come to an agreement with the debtor before filing a claim in court. To implement an out-of-court collection procedure, you can take the following steps:

- Negotiations with debtors, during negotiations through mutual concessions it is possible to obtain funds without resorting to court;

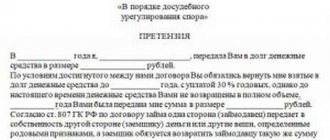

- Submitting a claim, requesting in writing from the debtor to repay the debt within the period specified by the claim;

- In addition, you can assign the debt and involve collection agencies.

Additionally, it should be noted that in the process of out-of-court negotiations, specific terms for return should be determined, otherwise, by setting vague terms for return, the debtor simply delays the collection time, for the subsequent application of the statute of limitations.

Lawyers' services

Our company provides the following services for debt collection from individuals:

- settlement before trial. This procedure implies the fastest solution to the problem, in which the debtor himself agrees to return the required amount after a conversation with our lawyer;

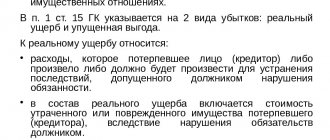

- filing a claim in court. If the debtor does not agree to voluntarily return the funds, a corresponding application is drawn up and submitted for judicial review. It is worth remembering that the creditor (the person who gave the loan) has the right to demand payment of an additional amount for late repayment of the debt;

- resale or assignment of debt. This method is quite fast, since there are quite a large number of companies engaged in purchasing debts of individuals. The only thing worth remembering is that it will not be possible to repay the entire debt in this way. Companies charge themselves a certain remuneration (usually 50%). If this method suits you, we will help you implement it quickly and most profitably.

It is worth noting that we use exclusively legitimate legal methods of influencing the debtor, which do not contradict the legislation of the Russian Federation.

How to return money on a receipt through the court?

The court for debt collection by receipt is initiated by filing a statement of claim, while in the legislation of the Russian Federation, depending on the conditions, two types of collection are distinguished

Court order to collect debt against receipt

Issued by a magistrate based on an application from the creditor, and the amount of recovery should not exceed 500,000 rubles.

Additionally, you should note that the state duty for collecting a debt on a receipt under a court order is half of what is payable when filing a statement of claim.

A court order is introduced by a judge alone and, after entering into force, is an independent writ of execution and no additional writs of execution are required. And with this order you can directly apply for recovery to the bailiff service. However, it should be taken into account that the court order is canceled at the request of the debtor without any major problems and the proceedings begin in the claim proceedings.

Claim proceedings

In order to answer the question of how to return money on a receipt through the court, you need to correctly draw up a statement of claim. Why the following information must be included in the claim:

- address of the court; as a general rule, a statement of claim is filed with the court at the debtor’s place of residence;

- the data of both the borrower and the lender is reflected;

- the circumstances of the transfer of funds are reflected;

- indicates a delay in the return of funds;

- the amount of debt subject to collection is reflected - the cost of the claim;

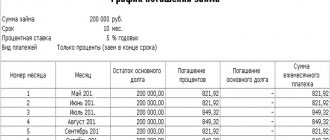

- a debt calculation is drawn up on a separate sheet, and interest is also calculated if you decide to collect them simultaneously with the amount of the debt;

- the state fee is calculated and paid, the original of which is attached to the claim;

- Copies of all materials are made according to the number of parties and to formulate a legal case on the part of the court (the court will send copies of the materials independently to the defendant after making a positive decision to accept the claim for proceedings).

If you used legal assistance to prepare your statement of claim, you can additionally claim the recovery of these expenses. All money spent on a lawyer is assessed by the court taking into account the principle of reasonableness and expediency and is subject to recovery from the debtor, through whose fault you are forced to go to court and enter into an agreement on legal assistance.

The statement of claim must be accompanied by an original document confirming the transaction, in this case a receipt; if the debt was collected without a receipt and a full-fledged loan agreement was being prepared, this document is attached. It is stored along with the file and is no longer subject to return to the lender to prevent him from re-presenting the debt.

Based on the filed statement of claim, a trial is held, after which the court makes a decision to collect funds in favor of the lender.

Thus, in the case of transfer of a large sum of money and if there is a refusal on the part of the debtor to return this money, collection of the debt by receipt is simply necessary.

After the judicial act comes into force, the claimant must receive a writ of execution, and then the collection is carried out through the bailiff service.

Collection stages

If the issue of return of funds cannot be resolved through amicable agreements between the parties, the lender may initiate legal proceedings. On the way to the forced collection of funds borrowed against a receipt, the plaintiff will have to go through the following stages:

Preparation of a statement of claim

A correctly drawn up claim must comply with the form provided for in Article 131 of the Code of Civil Procedure of the Russian Federation. The claim must contain:

- Name of the court,

- Full name, address and contacts of the plaintiff and defendant,

- description of the situation and circumstances in which the plaintiff’s rights were violated,

- the amount of debt and penalties with detailed calculations,

- a package of documents and evidence, as well as links to legislative acts.

The statement of claim must be signed by the plaintiff and submitted to the court no later than three years after the date indicated in the receipt as the deadline for repayment of the debt. However, if this period has expired at the time of filing the claim, the plaintiff’s claims can still be considered by the court, since this issue remains at its discretion. Also at this stage, the plaintiff must pay a state fee, the amount of which is determined by the loan amount.

Trial

Unlike most lawsuits, the court has only five days to consider a claim for collection of a debt under a receipt. After this period, a court date is set. If the court considers the plaintiff’s demands to be unfounded, the statement of claim is returned or remains without progress. All parties to the process are involved in the trial. The court will examine all the evidence provided by the parties, and also hear opinions, on the basis of which a final decision is made.

The claim may be satisfied in full or in part. If the plaintiff's demands are partially satisfied, the debtor may be provided with an installment plan or a debt restructuring scheme. Such an outcome of the trial is possible only if the defendant provides sufficient evidence that his failure to fulfill his debt obligations is due to valid reasons - difficult financial situation, loss of ability to work, dismissal, etc. After the court decision has been made and entered into force, the plaintiff is issued a writ of execution, which will subsequently become the basis for the forced recovery of financial resources from the defendant.

This is also important to know:

How to write an application for a court order to collect wages: detailed instructions

Debt collection

After the writ of execution has been handed over to the plaintiff, and its copy has been received by the losing party, a period begins when the decision can be appealed to the appellate authorities. This period is 10 days from the moment the decision is made or a copy is handed over to the defendant, if he did not personally participate in the trial. Next, the lender faces the question of executing this decision. The option of voluntary debt repayment and compensation for the period of delay is not always realized in practice. Often the debtor ignores the court decision and delays the process of repaying the debt. In this case, the law provides for a procedure for the creditor to contact the Federal Bailiff Service (FSSP).

The FSSP is engaged in forced collection of debt by court decision, using mechanisms to influence the income and material property of the defendant. You should contact the department located at the defendant’s place of residence. Next, the bailiffs will begin measures aimed at collecting the entire amount of the debt from the loser. The law allows a period of up to two months for this, but judicial practice shows that such cases often continue for several years.

The first thing the bailiffs do is analyze the debtor’s income level and the possibility of collecting the debt through wages. The fact is that collection must be carried out in such a way as not to put the borrower in a very difficult financial situation. Another mechanism for enforcement is the seizure and subsequent sale of the defendant’s tangible property. In this case, a special auction is organized. In order to speed up the procedure for collecting debt by court decision, the lender can reserve time and personally take part in all activities aimed at executing the court order.

Separately, it should be noted that the participation of a professional lawyer in all stages of debt collection under a receipt in court greatly increases the plaintiff’s chances of a positive outcome. But the services of a good specialist are not cheap. If you are confident that you are right and that your claims are legal, you can contact a truly reliable lawyer who, after making a decision on the main case, will also demand that the losing party cover all legal costs, including state fees and the plaintiff’s expenses for hiring a lawyer.

Challenging a receipt for lack of money

In a number of cases, people wonder how not to repay a debt on a receipt, if this receipt was not drawn up by the debtor; in this case, this receipt should be recognized as invalid.

In addition, in a number of cases, when drawing up a receipt, under certain conditions, funds were not actually transferred to the borrower; in this case, there are grounds for recognizing this agreement as not concluded.

Challenging receipts occurs exclusively in court, and the applicant should stock up on a certain set of evidence, since in this case the burden of proof lies with the plaintiff.

In particular, evidence is provided:

- lack of transfer of money at the time of concluding the loan agreement;

- presence of threats and coercion to sign the disputed receipt;

- other grounds that are provided for in the chapter on the invalidity of transactions and can be applied in relation to the controversial situation of the transaction.