When lending money, most are confident that the money will be returned on time. In practice, situations are common when the debt is not repaid, the debtor stops answering phone calls, avoids communication, or disappears altogether, being confident that you will not be able to forcibly collect the loan.

To prevent this from happening, it is important to seek the help of a lawyer in a timely manner.

Ideally, this should be done at the stage of providing funds. Otherwise, the likelihood of documents being drawn up in such a way, when they really do not allow collecting the debt in court, increases. Often, at the analysis stage, we inform the client that debt collection under the loan agreement in court will most likely fail due to incorrect documentation. The receipts that clients bring to us confirm the fact of transfer of money, but do not contain an obligation to return.

Ask for help or ask a question

Procedure for drawing up a loan agreement

A money loan agreement is an agreement under which one party (the lender) transfers money into the ownership of the other party (borrower), and the borrower undertakes to return the same amount of money to the lender (clause 1 of Article 807 of the Civil Code of the Russian Federation). The period and procedure for returning this amount are determined by agreement or law (clause 1 of Article 810 of the Civil Code of the Russian Federation).

In accordance with paragraph 1 of Art. 807 of the Civil Code of the Russian Federation, the lender transfers to the borrower money or other things determined by generic characteristics. The loan agreement comes into effect from the moment the money or other things are transferred. Thus, it is important to provide the text of the loan agreement and evidence of the transfer of the loan amount. When providing a loan by bank transfer, such a document is a payment order. When providing a cash loan - a receipt. The parties are not recommended to transfer bills of exchange instead of cash under a cash loan agreement, since in judicial practice there is no clear position on this issue. Some courts take the approach that a bill of exchange is an individually defined thing, not the object of a loan, since this contradicts the provisions of Art. 807 Civil Code of the Russian Federation. Others believe that a loan agreement is concluded in relation to the bill.

Preparation of necessary documentation

When providing a cash loan, special attention is paid to issuing a receipt. Practice shows that it is better when such a receipt is made in the borrower’s own handwriting, indicating passport data and data of the lender, the amount of debt in words, and the repayment period of the debt. If the defendant denies the fact of issuing a receipt or signing an agreement, then the court orders a handwriting examination, for which the borrower’s handwritten notes will be useful, and not just his signature, which is easy to change when writing a receipt and extremely difficult to examine during the examination. When transferring money by bank transfer, the purpose of payment indicates the loan repayment period and the amount of interest. Executing a payment order in this way will help to collect interest under the loan agreement, if the agreement does not allow obtaining a categorical conclusion about the signing of the loan documents by the debtor as a result of challenging the signature. Unscrupulous borrowers often resort to this step in order to challenge the amount of interest agreed upon by the parties for using the loan.

Consult a specialist about your problem

What is debt collection under a loan agreement?

If the borrower does not receive money within the period agreed upon in the agreement, a delay occurs. In this situation, under the terms of the agreement, the creditor has the right to demand satisfaction of financial claims. The borrower must transfer the money within 30 days from the date of receipt of the claim from the lender. This complies with the mandatory out-of-court procedure for the consideration of a controversial legal relationship.

Borrower debt arises for various reasons. There may be extenuating circumstances, such as loss of a job. Also malicious actions on the part of the borrower and unwillingness to repay the debt. For a bank or another creditor, the qualification of the actions of the second party is not so important. The main thing for them is that the money be returned back, with interest for using it + payment of a penalty.

The likelihood of a refund increases if:

- the borrower has left a pledge, which the bank has the right to realize in case of debt;

- use not only a property, but also a physical method of securing a loan;

- thoroughly study the potential client and the history of previously issued loans.

The collection procedure is different, it all depends on the amount of debt and other conditions of the loan issued:

Option 1: The Bank operates through the Security Service. If the process does not bring results, then the debt is transferred to collectors by assignment.

Option 2: The bank transfers the claim to the debtor. If he ignores it or refuses to satisfy the demands of the credit institution, he goes to court.

Option 3: debt collectors are in charge of repaying the debt under rental agreements, since they bought it from the bank. If work with the debtor is ineffective, the agency goes to court.

Regulation of settlements

The regulation of cash payments varies depending on who the participants in the payments are. Thus, if one of the parties to a cash loan agreement is an individual and the conclusion of the agreement is not related to the implementation of entrepreneurial activity by this citizen, then payments under the agreement are made in cash without restrictions on the amount (clause 1 of Article 861 of the Civil Code of the Russian Federation). Cash payments by legal entities and citizens engaged in business activities are permitted by current legislation (clause 2 of Article 861 of the Civil Code of the Russian Federation). However, for such calculations there is a limit on the size of payments. The total amount of cash payments under one agreement cannot exceed 100,000 rubles, or an amount in foreign currency equivalent to 100,000 rubles. at the official exchange rate of the Bank of Russia on the date of cash payments (clause 6 of Bank of Russia Directive No. 3073-U dated October 7, 2013 “On making cash payments”).

Unless otherwise provided by law or the loan agreement, the lender has the right to receive interest on the loan amount from the borrower in the manner prescribed by the agreement. If there is no provision in the agreement on the amount of interest, their amount is determined by the existing bank interest rate (refinancing rate) at the place of residence of the lender, and if the lender is a legal entity, at its location on the day the borrower pays the loan amount or its corresponding part.

DEBT COLLECTION UNDER A LOAN AGREEMENT

| The material was prepared by Law Firm Logos lawyer Dmitry Yakovlev |

Quite often, people who lend money have problems repaying the money.

If the debtor fails to fulfill his obligations to return the money, it is possible to return it only by filing a claim in court. This article will discuss how to properly collect debt. Quite often, people who lend money have problems repaying the money. If the debtor fails to fulfill his obligations to return the money, it is possible to return it only by filing a claim in court. To correctly determine judicial prospects, i.e. In order to make a positive decision for the lender, it is necessary to evaluate several points that are essential for obtaining a positive result in the form of a court decision to collect the debt. The law establishes that a loan agreement

between citizens must be concluded in writing if its amount exceeds at least ten times the minimum wage established by law, and in the case where the lender is a legal entity - regardless of the amount (Article 808 of the Civil Code of the Russian Federation).

Thus, a loan agreement

between citizens must be concluded in writing if its amount exceeds 1000 rubles.

The requirement for a written form of a loan agreement is important when considering a dispute in court, since if the requirement for a written form of the transaction is not met, it will not be possible to refer to witness testimony, but at the same time it will be possible to provide written and other evidence. Since a loan agreement between citizens

is not always drawn up in writing; the law stipulates that in confirmation of the loan agreement and its terms, a receipt from the borrower or another document certifying that the lender has transferred a certain amount of money to him may be presented.

Not always in receipts issued to confirm the loan agreement

, indicates the period during which the borrower must repay the borrowed amount.

For such cases, the law stipulates that the loan amount must be repaid by the borrower within thirty days from the date the lender submits a request for this

, i.e.

the borrower must submit a written request for repayment of the loan amount

, and after the expiration of the thirty-day period, if the loan amount is not repaid, it is possible to go to court.

The issue related to the calculation of interest is also of no small importance, since quite often the amount of interest to be collected from the debtor is equal to or even exceeds the amount of the principal debt.

If the loan agreement does not indicate that it is interest-free, the lender has the right to receive interest from the borrower. for the loan amount in the amounts and in the manner specified in the agreement. If there is no provision in the agreement on the amount of interest, their amount is determined by the existing bank interest rate (refinancing rate) at the place of residence of the lender, and if the lender is a legal entity, at its location on the day the borrower pays the amount of the debt or its corresponding part. The law specifically stipulates cases when a loan agreement

, under which money is transferred, can be considered

interest-free

: when an agreement is concluded between citizens for an amount not exceeding fifty times the minimum wage established by law (i.e., no more than 5,000 rubles), and is not related to the entrepreneurial activity of at least one of the parties , or if under the loan agreement it is not money that is transferred, but other things defined by generic characteristics (i.e. things that have characteristics inherent in all things of the same kind, and are determined by number, weight, measure).

Timing also matters

, during which it is possible to make a claim for repayment of the loan.

As a general rule, this is a three-year period from the date of conclusion of the loan agreement

.

However, in the case where the borrower repaid the debt (even partially) after concluding the loan agreement, these actions are considered recognition of the debt on the part of the borrower and interrupt the limitation period. As a general rule, after a break, the limitation period begins anew; the time elapsed before the break does not count towards the new term. Thus, at first glance it may seem that there is nothing complicated in collecting a debt under a loan agreement

, but this is not always the case, since the issue of collecting a debt under a loan agreement may hide several pitfalls associated, for example, with evidence of the conclusion of a loan agreement , evidence of the return of funds (or, conversely, non-repayment), as well as the period during which claims can be made to collect the debt under the loan agreement through the court. To overcome these problems, turning to qualified lawyers who have not only knowledge, but also practical experience in resolving such problems will help.

Foreign currency loan agreement

As you already understand, the subject of a cash loan agreement is money. As a general rule - Russian rubles. However, paragraph 2 of Art. 807, as well as paragraph 2 of Art. 140 and paragraph 3 of Art. 317 of the Civil Code of the Russian Federation indicate the possibility of using foreign currency as a loan object, subject to compliance with the procedure specified by law. According to the provisions of this Law, a foreign currency loan agreement can be concluded:

- if one of the parties to the agreement is a non-resident of the Russian Federation (Article 6, 10 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”);

- between credit institutions (banks) that, on the basis of a license from the Bank of Russia, are entitled to carry out currency transactions (Part 2 of Article 9 of Federal Law No. 173-FZ dated December 10, 2003 “On Currency Regulation and Currency Control”, Directive of the Bank of Russia dated April 28. 2004 No. 1425-U “On the procedure for carrying out foreign exchange transactions on transactions between authorized banks”);

- between banks licensed by the Bank of Russia to carry out foreign exchange transactions and residents of the Russian Federation (Part 3 of Article 9 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”).

Parties who are residents of the Russian Federation, as a general rule, do not have the right to enter into a loan agreement, the object of which is foreign currency.

This prohibition follows from Art. 9 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”. If persons who are residents of the Russian Federation have entered into a foreign currency loan agreement in violation of the requirements established by the currency legislation of the Russian Federation, then they will be held administratively liable under Art. 15.25 Code of Administrative Offenses of the Russian Federation. In this case, they will be required to pay an administrative fine in the amount of 75 to 100% of the amount of the illegal currency transaction (Resolution of the Federal Antimonopoly Service of the Volga Region dated May 24, 2006 in case No. A49-13188/2005-95OP/2). An agreement that does not comply with current legislation is declared invalid by the court on the basis of Art. 168 Civil Code of the Russian Federation. Persons who are residents of the Russian Federation enter into a cash loan agreement in rubles, indicating the loan amount in the equivalent of an amount in foreign currency.

Cash loan agreement: differences from other types of agreements

An analysis of current legislation and judicial practice allows us to establish that a cash loan agreement has a number of features that distinguish it from other types of agreements. In order for the provisions of §1 “Loan” of Ch. 42 of the Civil Code of the Russian Federation, the text of the agreement must include conditions that are distinctive features of a money loan agreement:

- provision by the lender of the loan object into the ownership of the borrower;

- lack of obligation of the lender to issue a loan;

- the borrower's obligation to return an amount of money equal to what was received.

The absence of the lender's obligation to issue a loan distinguishes a cash loan agreement from a credit agreement (§ 2 of Chapter 42 of the Civil Code of the Russian Federation), under the terms of which the lender (only a credit institution acts in this capacity) undertakes to provide funds to the borrower (clause 1 of Article 819 of the Civil Code of the Russian Federation ).

So, the wording “the lender undertakes to transfer” is incorrect and inconsistent with the law. If a money loan agreement contains a condition on the obligation of the lender to transfer the loan object to the borrower, then such a condition is contrary to the nature of the money loan agreement, which is unilaterally binding. Despite the inclusion in the agreement of a condition on the lender’s obligation to issue a loan, the borrower does not have the right to demand payment to him of the loan amount specified in the agreement or part of it. The lender is not liable to the borrower for failure to issue the loan in whole or in part, as well as for untimely provision of the loan (Resolution of the Nineteenth Arbitration Court of Appeal dated August 12, 2011 in case No. A08-657/2011).

Specifics of debt collection under a loan agreement

In all cases, debt collection under a loan agreement has specifics that do not always allow one to count on an easy trial and recovery of previously provided funds. A timely request by the lender for help from a lawyer allows for the actual collection of funds.

With the assistance of our organization at the stage of granting a loan, you will be sure that the completed documents will allow you to recover the funds provided. When collecting a debt in court, the lender claims:

- main debt;

- penalty (penalty);

- interest on the use of other people's funds;

- legal costs incurred.

If we accompanied the issuance of the loan, the dispute will be considered in fewer meetings, since you initially have the correct package of documents. We provide a significant discount on legal support.

Preparation of necessary documentation

The process of debt collection under a loan agreement consists of several stages:

- We provide assistance in the collection of loans provided both non-cash and in cash (money is transferred against receipt). Claims for debt collection under a loan agreement are indicated by a statute of limitations of 3 years, which is often calculated starting from the debt repayment date specified in the agreement. When such a period expires, the court has the right to refuse to satisfy the claims.

- Please note that when executing collection under a loan agreement, the lender will have to submit to the court original documents confirming the execution and issuance of the loan, and a statement of claim. In our practice, the average period for judicial review of a simple loan collection case before receiving a writ of execution is 5 months.

- The timing of debt collection under a loan agreement depends on the good faith of the borrower and the activity of his actions in the legal process. Thus, the examination increases the consideration period by 1-6 months, the appeal by up to 5 months. The sooner you apply, the greater the likelihood of actual execution of the judicial act.

Please note that if the debt is recognized by the defendant, but is not fulfilled, the case is subject to consideration under simplified proceedings (Article 227 of the Arbitration Procedure Code of the Russian Federation). Advantages of simplified production:

- short time;

- positive decision;

- savings on lawyer services.

Loan agreements are no exception. Documents acknowledging the debt: a letter of guarantee, a debt repayment schedule under the loan agreement, a reconciliation report on the calculation of the debt under the loan agreement, which reflects the existence of the debt and/or the debtor’s request for an installment plan.

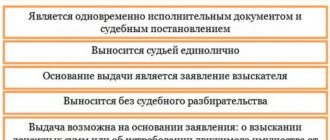

How debt is collected under a loan agreement

Debt collection under a loan agreement from an individual can take place in three stages:

- The out-of-court stage is the collection of the loan through a contractual procedure. The lender draws up a claim for repayment of the loan, which indicates the amount and term of payment of the debt. Also at this stage, you can resort to the help of collection agencies, which will negotiate with the borrower.

- The judicial stage is debt collection through legislation. The borrower draws up a statement of claim, supported by all loan documents, pays the state fee and waits for the court’s decision.

- The post-trial stage is direct debt collection. As a result of the court hearing, when a verdict is rendered in favor of the lender, an executive document is issued, according to which the loan debt is forcibly collected by the enforcement service.

Judicially

If the loan amount exceeds the minimum wage established by law by 10 times, the loan agreement is concluded only in writing.

Failure to comply with this form of transaction may result in problems with testimony during the court hearing.

Since there is also an oral form of a loan between individuals, if its amount is less than 10 minimum wages, in this case there must be a receipt or other document that indicates the transfer of money to the borrower.

Debt collection under an oral loan agreement occurs in exactly the same way as when concluding an agreement, but if the borrower has written a receipt. Without a certificate of transfer of the loan subject, it will be very difficult to prove the fact of the loan in court.

If extrajudicial methods of debt collection do not help, you should resort to a forced method of collection - go to court, which will consider the case and issue an order to collect the debt under the loan agreement. Judicial practice shows that in most cases a decision is made in favor of the plaintiff.

To do this, it is necessary to draw up a statement of claim for debt collection, not forgetting that it must be submitted to the court at the debtor’s place of residence.

If the debtor’s place of residence is currently unknown to the claimant, the claim is filed at his last place of residence. This may be the address specified when concluding the loan agreement or the place of registration of the borrower.

If the loan amount is more than 500 minimum wages, then the claim is filed in the district court, if less - in the world court.

Any inaccuracies in the claim, such as incorrect amount of debt, lack of calculation of interest on an interest-bearing loan, incorrect payment of state fees, errors in filling out the data of the plaintiff and defendant, etc.

When the court has accepted the statement of claim, a date is set for a court hearing at which the claims made for collection of the debt under the receipt or loan agreement will be considered.

The claim must be supported by documents that indicate the fact of the loan, as well as references to legislation. If necessary, witnesses, other specialists, additional documents, etc. are involved.

Bringing a qualified attorney to the case can speed up the collection process and save the plaintiff from wasting time.

According to the law, civil cases are considered in a district court within 2 months from the date of receipt of the statement of claim, and in a magistrate court - within a month.

The court decision comes into force if, within 10 days from the date of this decision, the defendant does not request an appeal to the appellate court.

The legal process helps the lender get his money faster, because in most cases, debtors quickly repay the loan, since lengthy proceedings require large material costs, which is even more disadvantageous for him - fines, penalties, penalties, etc.

After receiving a positive decision to collect the debt under the loan agreement and interest, the last part comes - receiving a writ of execution and transferring it to the bailiff service, which will begin collecting the debt.

The collection process can be accelerated by securing the claim, namely by seizing the debtor’s property.

The plaintiff also has the right to demand from the debtor to cover the state fee and attorney's fees that he incurred by filing an application with the court. All expenses must be documented.

Having received in court a decision to collect the debt under the loan agreement, as well as a decree to seize the debtor’s property equivalent to the amount of the claim, it is quite possible to return the amount of the debt.

How to challenge a loan agreement due to lack of money is described in the article: challenging a loan agreement due to lack of money. Read reviews of loans from the company Money Will Be in the comments.

By extrajudicial procedure

The extrajudicial procedure for collecting a loan involves concluding an additional agreement between the lender and the borrower containing the necessary new conditions. To do this, the borrower must provide consent certified by a notary to an out-of-court debt collection procedure.

There is also a procedure for economic debt collection - selling the debt to another organization. An agreement on the assignment of rights of claim is concluded, according to which the lender receives the amount he needs, and the new owner begins to collect the debt from the borrower.

But in this case, some financial losses are possible for the lender, but this is a guarantee of quick receipt of part of the borrowed funds.