How are minimum wages and salaries related?

Before presenting you with a sample order to establish an additional payment up to the minimum wage, we will find out the relationship between wages and the minimum wage (minimum wage).

Minimum wages and salaries are closely interrelated. According to the norms of Art. 133 of the Labor Code of the Russian Federation, an employee’s salary for 1 month cannot be lower than the minimum wage. In this case, the employee must work a monthly working time standard and fulfill his job duties (labor standard).

In general, the minimum wage is the amount established by law (federal or regional):

- below which labor duties performed in full cannot be paid;

- participating in the calculation of the amount of benefits for temporary disability and for other purposes of compulsory social insurance.

The minimum wage is not a constant value. According to Art. 1 of the Law “On the Minimum Wage” of June 19, 2000 No. 82-FZ, starting from 01/01/2019 and thereafter annually from January 1 of the corresponding year, the minimum wage is set in the amount of the subsistence minimum of the working population as a whole in the Russian Federation for the second quarter of the previous year. The cost of living for the 2nd quarter of 2019 is 12,130 rubles. Thus, from 01/01/2020 the minimum wage is 12,130 rubles.

For the dynamics of changes in the minimum wage in recent years (until 01/01/2020), see the figure:

Find out more about the minimum wage from this material.

Any doubts left? Ask on our forum! For example, here forum members share their experience of how additional payments to the minimum wage should be calculated in practice.

Calculation of surcharge

Additional payment before actual earnings or any other type of additional payment of temporary disability benefits can be accrued in the month falling within the billing period when determining average earnings for certain cases. Let's figure out whether the additional payment is included in the number of payments taken into account when calculating average earnings.

Average earnings for vacation and other cases provided for by the Labor Code. Let's turn to paragraphs. “b” clause 5 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922. It states that when calculating average earnings, time is excluded from the calculation period, as well as amounts accrued during this time, if the employee received temporary disability benefits or maternity benefits.

Consequently, the additional payment is not taken into account when calculating average earnings in cases of its preservation provided for by labor legislation.

Average earnings for benefits. According to Part 2 of Art. 14 of Law N 255-FZ, the average earnings, on the basis of which benefits for temporary disability, maternity, and monthly child care benefits are calculated, include all types of payments and other remunerations in favor of the employee, which are taken into account in the base for calculating insurance premiums in the FSS of the Russian Federation in accordance with Law N 212-FZ.

Now let's turn to clause 1 of Art. 8 of Law No. 212-FZ. It talks about what payments are included in the base for calculating insurance premiums. Among them are all payments and rewards in favor of an individual, except for the amounts specified in Art. 9 of Law No. 212-FZ. If you study the mentioned article, the additional payment is not named in it. Thus, the additional payment as a payment in favor of the employee is included in the base for calculating insurance premiums.

It would be natural to assume that on this basis it should be included in the list of payments taken into account when calculating average earnings for calculating benefits. However, time spent on sick leave is excluded when determining the number of calendar days of the billing period. This is stated in paragraphs. “b” clause 5 of the Regulations on the specifics of the procedure for calculating the average salary (approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922).

Consequently, the additional payment accrued for the excluded period of incapacity for work is not taken into account in the future when calculating benefits.

Summarizing the above, we provide a table containing data on the taxation of surcharges.

Table

| Taxes, contributions, average earnings, benefits | Surcharge established | |

| labor (collective) agreement (provision referred to in the employment contract) | only by order of the director (one-time payment) | |

| Income tax | Reduces the taxable base | Does not reduce the taxable base |

| Personal income tax | Taxable | |

| Insurance premiums | ||

| Contributions in case of injury | ||

| Average earnings according to the Labor Code of the Russian Federation | Not taken into account | |

| Benefits |

I.A.Gavrikova

Senior Scientific Editor

magazine “Salary”

/ condition / The employee was on sick leave from May 20 to May 27, 2013 (8 calendar days). The employee's hourly wage rate is 250 rubles. at one o'clock.

The amount of his daily sick leave benefit is 1,335.62 rubles. ((463,000 rub. 512,000 rub.) / 730 x 100%).

According to the production calendar, the period from May 20 to May 27 has 6 working days. The employee's working day is 8 hours.

/ solution / Determine the amount of additional payment to salary during illness:

(250 rubles x 8 hours x 6 working days) – (1335.62 rubles x 8 calendar days) = 12,000 rubles. – 10,684.96 rub. = 1315.04 rub.

* If the period of illness falls on different months, then the amount of salary lost due to illness must be calculated separately for each month and added up, and then the benefit must be subtracted from the amount received.

/ condition / The employee was on sick leave from May 20 to May 27, 2013 (8 calendar days). The employee's salary is 42,000 rubles. per month.

The amount of his daily sick leave benefit is 1,335.62 rubles. (100% x (463,000 rub. 512,000 rub.) / 730).

According to the production calendar in May 2013, there are 18 working days; the period from May 20 to May 27 accounts for 6 working days.

/ solution / Determine the amount of additional payment to salary during illness:

(42,000 rubles / 18 working days x 6 working days) – (1335.62 rubles x 8 calendar days) = 14,000 rubles. – 10,684.96 rub. = 3315.04 rub.

The calculation of the additional payment in this case depends on which salary calculation option is used in the organization.

OPTION 1. Salaried employees are paid based on the average monthly number of working hours for the year or the average monthly number of working hours for the accounting period.

/ condition / Let's use the conditions of the previous example, changing them like this.

The standard working hours according to the production calendar for 2013 is 1970 hours. According to the work schedule, the employee had to work 48 hours from May 20 to May 27, 2013.

/ solution / Determine the amount of additional payment to salary during illness:

(42,000 rubles x 12 months / 1970 hours x 48 hours) – (1335.62 rubles x 8 calendar days) = 12,280.20 rubles. – 10,684.96 rub. = 1595.24 rub.

OPTION 2. Salaried employees are paid based on the standard working hours per month.

/ condition / Let's use the previous example, but with the condition that the standard working hours according to the production calendar in May 2013 is 143 hours.

/ solution / Determine the amount of additional payment to salary during illness:

(42,000 rubles / 143 hours x 48 hours) – (1335.62 rubles x 8 calendar days) = 14,097.90 rubles. – 10,684.96 rub. = 3412.94 rub.

To take into account the additional payment up to the employee’s earnings during illness in “profitable” expenses, do not forget to include it in a local regulation, collective or employment agreement with the employee. 25 Art. 255, sub. 6 clause 1, clause 2 art. 346.16 Tax Code of the Russian Federation. Personal income tax must be withheld from the additional payment amount. 209, paragraph 1, art. 210 of the Tax Code of the Russian Federation and charge contributions to it, including “for injuries”, part. 1 tbsp. 7, part 1 art. 8, art.

9 of the Law of July 24, 2009 No. 212-FZ; pp. 1, 2 tbsp. 20.1 of the Law of July 24, 1998 No. 125-FZ. At the same time, additional payment up to the employee’s earnings during illness is not wages, therefore, personal income tax must be withheld from it at the time of payment. 2 tbsp. 223 Tax Code of the Russian Federation. This additional payment must be included in expenses in the month of accrual. 25 Art. 255, paragraph 1, art. 272 of the Tax Code of the Russian Federation. In the same month, you must pay a contribution on it. 3 tbsp. 15 of the Law of July 24, 2009 No. 212-FZ.

To calculate the amount of the surcharge, you need to determine the amount of sickness benefit that the employer must pay without fail. In this case, one should be guided by the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 N 375, as well as Art. 14 of Law No. 255-FZ.

The amount of mandatory benefits is usually calculated based on the employee’s average earnings. First, the amount of accruals made in his favor for the billing period is determined. Typically this is the two years preceding the year in which the temporary disability began.

Only the accruals that are taken into account when determining average earnings are added up. And these are the amounts that are included in payments and other remuneration in favor of the employee, for which insurance contributions to the Federal Social Insurance Fund of the Russian Federation are calculated in accordance with Federal Law No. 212-FZ of July 24, 2009 (hereinafter referred to as Law No. 212-FZ).

Accruals are added up separately for each year of the billing period. If this time period has not been fully worked out or there is no certificate of earnings from other employers, then the actual amount available is taken into account.

The maximum benefit limit is then determined. That is, the amounts received for each year are compared with the maximum permissible value. Namely, with the maximum value of the base for calculating insurance contributions to the Federal Social Insurance Fund of the Russian Federation. In further calculations, a smaller indicator is used.

Next, the resulting amount is divided by 730, which gives the average daily earnings. It is multiplied by the insurance period coefficient, then by the number of calendar days of incapacity.

Finally, they determine how much the employee could actually earn if he worked and was not sick. The amount of compulsory benefits is subtracted from the resulting value. The result is a surcharge.

Example 1. Cashier of Magic LLC O.V. Vasilyeva was on sick leave from November 18 to November 26, 2013.

Her insurance experience is five years and two months. Earnings for 2011 amounted to 470,000 rubles, for 2012 – 530,000 rubles. The salary is 45,000 rubles.

The employment contract provides for the employer’s obligation to pay extra in case of incapacity to actual earnings.

The accountant of Magic LLC made the following calculations.

https://www.youtube.com/watch{q}v=xgRvy3K_VMk

First, he determined the average earnings to determine the benefit established by law.

(463,000 rub. 512,000 rub.) : 730 days. = 1335.62 rub.

RUB 1,335.62 x 80% x 9 days = 9616.46 rub.

45,000 rub. : 20 days x 9 days = 20,250 rub.

20,250 – 9616.46 = 10,633.54 rubles.

When to pay extra to the minimum wage and how to pay extra correctly

If the salary (wage) lags behind the minimum wage, the employer must pay the difference to the employee. Check the ratio and, if necessary, calculate the amount of additional payment (D):

If salary < minimum wage → D = minimum wage – salary

Salary ≥ minimum wage → D = 0

ATTENTION! You need to compare the fixed part of the salary (salary, tariff rate) with the minimum wage. Additional payments and allowances of a compensatory nature should not be included in this comparison. They must be paid in excess of the minimum wage, the Constitutional Court believes (Resolution of the Constitutional Court of the Russian Federation of April 11, 2019 No. 17-P).

Let us recall that before the release of the resolution of the Constitutional Court of the Russian Federation No. 17-P, the additional payment was determined taking into account allowances and additional payments according to the formula:

D = minimum wage – (FROT + CV + SV),

Where:

FROT is a fixed amount of remuneration (tariff rate, salary);

KV and SV are compensation and incentive payments, respectively.

As of April 11, 2019, doing so is risky.

For more information about the components of salary (allowances, additional payments and incentives), see this publication.

Sources of such additional payment:

- funds from the federal, regional or local budget (for budgetary organizations);

- employer funds (for other organizations).

If it turns out that your employees do not receive additional payment up to the minimum wage, having worked the full working hours for the month, both the company and the manager may be subject to a fine provided for in Article 5.27 of the Code of Administrative Offences.

We will tell you below what needs to be formalized at the enterprise in order for the additional payment to be calculated and paid to employees on time.

When recording working hours in total

Additional payment up to the minimum wage for cumulative accounting of work time begins with the determination of the standard time. It is taken according to the production calendar of a 5-day working week (Order of the Ministry of Health and Social Development No. 588n dated 08/13/09). An accounting period is established, usually a year.

This is important to know: Regions of the Russian Federation with preferential length of service

Summarized working time recording is used for employees who may be overworked in one month and underworked in another.

If the security guard’s salary is set (in violation of labor legislation!) at 1.0 times the rate of 10,000.00 rubles, 1⁄2 times the rate is equivalent to a payment of 5,000.00 rubles, and the “minimum wage” is equal to (11280/2) 5,640, rubles. The additional payment is RUB 640.00.

When paid hourly, the employee is paid for the actual time worked each month. The rate itself must be calculated taking into account the minimum wage and order No. 588n. Recycling must be paid for.

Deficiencies are paid based on the provisions of Art. 155 Labor Code of the Russian Federation:

- absenteeism and tardiness are not paid;

- an error on the part of the employer is paid based on average earnings, comparing it with the actual accrued payment for hours worked;

- force majeure, there is no fault of both parties - payment in the amount of 2/3 of the rate.

Let us consider in more detail how to calculate the minimum wage and additional payment for a work schedule that involves shifts, as well as for an incomplete month worked.

How can an employer organize additional payment?

In order to fulfill the requirements of Art. 133 of the Labor Code of the Russian Federation, each employer must organize:

- conducting a monthly comparison of the accrued salary of each employee with the current minimum wage;

- calculation of additional payment up to the minimum wage (if the salary turned out to be lower);

- payment of the calculated amount of additional payment to employees.

To achieve this goal, the employer has several ways:

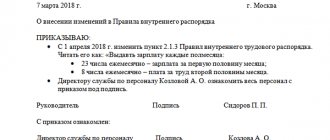

- monthly, based on accounting calculations, issue an order for additional payment up to the minimum wage, indicating specific employees and the amount of additional payment due to them;

- issue a one-time order (order) providing for mandatory monthly procedures for payroll payers: comparing the accrued salary with the minimum wage and determining the amount of additional payment;

- include a section on additional payment up to the minimum wage in an internal local act (in a collective agreement, regulations on wages, etc.)

We will tell you further how to issue an order for additional payment up to the minimum wage.

Responsibilities of the employer during business trips

A business trip , as defined by the Labor Code of the Russian Federation (Article 166 of the Labor Code of the Russian Federation), means a trip by an employee by order of the organization’s management to perform any work related to his direct duties. Such trips have a clearly defined period specified in the order for a business trip. The beginning is considered to be the date and time of departure from the place of work, and the end is the day of return, according to travel documents or waybills.

The rights of people sent on business trips are protected by Articles 167-169 of the Labor Code of the Russian Federation. According to these regulations, a business traveler has the right to:

- Maintaining a workplace (position) while on a business trip (Articles 167, 169 of the Labor Code of the Russian Federation);

- Maintaining the average salary (Article 167 of the Labor Code of the Russian Federation);

- Reimbursement of travel expenses (Article 167 of the Labor Code of the Russian Federation);

- Reimbursement of living expenses (renting housing), intercity travel and at the location of the business trip, expenses associated with living away from home (per diems), and caused by official (production) needs (Articles 168 and 169 of the Labor Code of the Russian Federation).

Since average and actual earnings are unequal values and depend on many factors, the organization can make an additional payment up to the monthly salary. Such an act on the part of the employer is one of the types of incentives for employees who perform their work functions while being in not very comfortable conditions (outside the home, away from family).

How to issue an order to establish an additional payment

Let's look at an example that explains how to issue an order for an additional payment up to the minimum wage and how to pay the additional amount correctly.

Kvanta LLC has 5 employees. Everyone works under employment contracts on a full-time basis. Employment contracts with managers establish a fixed salary and define the condition for receiving monthly bonuses: their percentage depends on the number of new contracts concluded with potential buyers during the month.

When calculating salaries, the company draws up a calculation table. Below is a table for January 2020:

In order not to waste extra time on additional calculations and their execution, the chief accountant put the necessary data and formulas into an Excel table and enters monthly only the bonus amounts (the variable part of the salary). To compare the accrued salary with the minimum wage and calculate the additional payment, a separate column 6 is provided. It shows that two employees need to be paid additionally (R.G. Perov and A.N. Surin). The calculation takes into account the current minimum wage in January 2020, equal to 12,130 rubles.

A sample order for additional payment up to the minimum wage can be downloaded here.

When an employee is entitled to the average salary for a lower-paid job

| Cases of performing lower-paid work | Decor | The period during which average earnings are maintained |

| Temporary transfer to prevent or eliminate the consequences of emergency circumstances (in particular, man-made and natural disasters, industrial accidents, industrial accidents | Manager's order for transfer (you can use a unified form or | The entire transfer time, which cannot exceed 1 month |

| Temporary transfer due to downtime, the need to prevent destruction or damage to property or to replace a temporarily absent employee if caused by emergency circumstances |

| |

| But when transferring an employee to a lower-paid job by agreement of the parties (for example, to replace a sick employee in the absence of emergency circumstances), there is no obligation to maintain his average earnings. Therefore, the employer can pay the employee a salary based on the work performed | ||

| Transfer to another job due to suspension of activities or temporary prohibition of activities due to violation of state regulatory requirements for labor protection through no fault of the employee |

| All translation time |

| Transfer to another job due to health reasons |

| During the first month from the date of transfer |

| Transfer to another job due to a work injury, occupational disease or other work-related health damage until recovery or disability is established |

| All translation time |

| By the way, reducing the working time for the same job (for example, if there is a medical certificate about the need to transfer to another job) is not a transfer to another lower-paid job. This is the establishment of part-time work at the request of the employee. And such work should be paid according to the time actually worked or work performed | ||

| Reduced production standards and service standards at the request of pregnant women |

| All the time the production standards (service standards) are decreasing |

| Transfer of pregnant women to another job that excludes exposure to unfavorable production factors |

| All translation time |

| Transfer of women with children under the age of one and a half years, upon their request, to another job due to the impossibility of performing the previous job (for example, if the work is incompatible with feeding the child and properly caring for him |

| |

Results

The employer is obliged to pay an employee additionally if the salary accrued to him for the month (taking into account all compensation and incentive payments) turns out to be below the minimum wage and at the same time the employee worked the standard working hours and fulfilled his job duties. To pay such an additional payment, an order or other administrative document is drawn up.

Sources:

- labor Code

- Law “On the minimum wage” dated June 19, 2000 No. 82-FZ

- Code of Administrative Offenses

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Supplement to average for business trip

: Kdn1 * Kotr1 * D )= 4,893.45 rub.

- D - number of calendar days of vacation.

- M is the number of fully worked months in the billing period;

- Kdn1 - the number of calendar days in months not fully worked;

- Kotr1 - the number of calendar days in “incomplete” months falling on the time worked.

Payment for business trips - reimbursement of expenses Compensation for expenses incurred by a person in connection with his stay on a business trip is also regulated by the local regulations of the legal entity, but is limited by the need to pay personal income tax.