The goods are shipped to the buyer on account of the advance transaction

Sales of goods can take place according to some scenarios, the most common is the following:

- The buyer selects the product.

- An invoice is issued to the customer for payment.

- The buyer transfers money.

- The shipment takes place, a goods and tax invoice is issued, and acts of acceptance and transfer of goods are often signed.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 51 | 62.02 | Reflection of prepayment | Advance payment amount | Payment order or bank statement confirming payment |

| 76.AB | 68.02 | VAT accrual on prepayment amount | VAT amount | Payment order, Sales book, Invoice |

| 90.02 | 43 | Finished products have been shipped. The amount of cost will depend on the method of estimating the output of the state enterprise | Cost of GP | Consignment note in the form TORG-12 |

| 62.01 | 90.01 | Reflection of total sales revenue including VAT | Sales price of GP including VAT | Consignment note in form TORG-12 and invoice |

| 90.03 | 68.02 | Accrual of VAT on the price of sold GP | VAT amount | Consignment note in form TORG-12 and invoice |

| 62.02 | 62.01 | Crediting of previously transferred prepayment for shipped products | Advance payment amount | Accounting certificate-calculation |

| 68.02 | 76.AB | Accounting for VAT amount from pre-paid payment | VAT amount | Purchase book, invoice |

The expenses that form the cost of finished products may include materials spent, part of the services provided by third parties, labor costs and the transfer of insurance premiums in favor of personnel directly involved in production. Goods are understood as material assets purchased by an enterprise for the purpose of further sale.

This means that employers who pay their employees at the minimum wage must raise their wages from May 1. {amp}lt; ... Holidays 2018: in May and June we work on an atypical schedule. Next week there are only four working days. In connection with the celebration of Victory Day, Wednesday May 9 has been declared a day off. {amp}lt;

… Home → Accounting consultations → Accounting Current as of: January 31, 2020 The sale of goods and services is the transfer on a paid basis of ownership of goods and the provision of services for a fee by one person to another person. We will tell you about standard accounting entries for the sale of goods and services in our consultation.

Info

Kt 44 - the amount of distribution costs of sold products is written off as selling expenses. The second account assignment is feasible only if this is established at the enterprise. A more typical and generally applicable method of writing off distribution costs is the first entry. Sales of goods: retail transactions Direct sales of products to consumers are most often carried out using cash payments, but bank cards, settlement checks, commission agreements or installment payments can also be used.

Cash registers, which are mandatory for use in enterprises working with the public, help track the volume of revenue at the cash desk. The machine’s performance at the end of the day forms the amount of money brought in by the sale of goods.

- Postings reflecting the sale of goods under a supply agreement

- Postings reflecting the purchase of goods under a supply agreement

Postings reflecting the sale of goods under a supply agreement. The supply agreement determines the transfer of ownership at the time of payment for the goods. The accounting entries of this business transaction reflect the situation when the transfer of ownership of goods from the supplier to the buyer occurs at the time of payment (determined by the terms of the contract).

Finished products or goods have been shipped. The amount of the cost depends on the method of assessing the output Cost of finished products Invoice 62.01 90.01 Reflection of revenue through the sale price of the goods including VAT Sales value of the goods including VAT Invoice, invoice 90.03 68.2 Amount of VAT from the shipment of goods VAT size Invoice, invoice, Sales book 51 62 .

01 Reflection of repayment of debt for shipped goods Sales value of goods Payment order or bank statement How the shipment of goods is reflected when the buyer makes an advance payment Account Dt Account Kt Description of the posting Posting amount Document basis 51 62.02 Reflection of the crediting of an advance payment for a future shipment of goods Prepayment amount Payment order or bank statement 76 .АВ 68.02 Accrual of VAT on the prepayment amount VAT amount Invoice, Sales Book, payment order 90.2 43, 41 Posting for shipment of goods or products.

The accountant calculated the VAT tax base on the date of sale of goods as follows: – RUB 157,750. ($5,000 × 50% × RUB 31/USD; USD 5,000 × 45% × RUB 32/USD; USD 5,000 × 5% × RUB 33/USD). The amount of VAT on sales proceeds amounted to RUB 28,395. (RUB 157,750 × 18%).

Debit 90-3 Credit 68 subaccount “VAT calculations” – 28,395 rubles. – VAT is charged on proceeds from the sale of goods; Debit 62 subaccount “Settlements on advances received” Credit 62 subaccount “Settlements on goods sold” – 176,410 rubles. (RUB 91,450 RUB 84,960) – the advance received is offset against payment under the contract;

USA) – payment has been received for goods sold. Methods for writing off the cost of goods Regardless of how the moment of transfer of ownership of goods is determined, the following methods are used to write off the cost of goods in accounting:

- at average cost;

- at unit cost.

Such rules are provided for in paragraph 16 of PBU 5/01. An organization can use different valuation methods for different types (groups) of goods. Fix the decision made in the accounting policy. This follows from paragraph 21 of PBU 5/01.

Sales expenses Accounting for sales expenses is maintained on account 44 “Sales expenses” (Instructions for the chart of accounts).

Sales of goods and finished products are as common as purchases. The event takes place in accordance with the signed supply agreement, and the reflection of the operation itself is similar to the acquisition of valuables.

The task of accounting when shipping goods is to show the transfer of ownership from the seller to the buyer. It is at the moment of transfer of the goods, that is, its shipment, that the owner changes. Sales, just like purchases, can be made in two ways:

- shipment of the goods is the first event, and after it payment is made within the period specified in the contract;

- shipment of goods follows prepayment, that is, the buyer first transfers money for the goods, and only then picks it up. In this case, the moment of payment may occur much earlier than the shipment itself, because of this the supplier develops receivables.

In the second case, the manufacturer of the goods will be able to repay his debt only by transferring the goods, unlike the first, where, on the contrary, accounts payable arise and the buyer must repay them.

The accounting entries of this business transaction reflect the situation when the transfer of ownership of goods from the supplier to the buyer occurs at the time of transfer of goods.

Depending on the moment of settlement (payment) by the buyer for the goods received, there are two options for generating accounting entries. The first version of the postings reflects the SALES of goods, in which the moment of PAYMENT occurs AFTER the moment of TRANSFER of the goods. Moreover, the moment of payment for goods may occur significantly later than the moment of transfer, which will lead to the emergence of unpaid receivables from the supplier.

The second version of the postings reflects the SALES of goods, in which the moment of PAYMENT occurs BEFORE the moment of TRANSFER of the goods. In this situation, the supplier has an account payable to the buyer, which he repays by transferring the goods.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 1. Sale of goods with payment after shipment (transfer) | ||||

| 90.2 | 41 | The disposal of goods is reflected. The amount depends on the methodology for estimating the value of goods upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of goods | Consignment note according to form No. TORG-12 |

| 62.01 | 90.1 | Revenue is reflected in the sales price of goods including VAT. | Sales value of goods (amount including VAT) | Consignment note (form No. TORG-12) Invoice |

| 90.3 | 68.2 | The VAT amount is reflected | VAT amount | Consignment note (form No. TORG-12) Invoice Sales book |

| 51 | 62.01 | The fact of repayment of debt for previously shipped goods is reflected. The payment date cannot be earlier than the shipment date. | Sales value of goods | Bank statement Payment order |

| 2. Sale of goods (shipment) with prepayment | ||||

| 51 | 62.02 | The buyer's prepayment for goods is reflected | Advance payment amount | Bank statement Payment order |

| 76.AB | 68.2 | VAT is charged on advance payment | VAT amount | Payment order Invoice Sales book |

| 90.2 | 41 | The disposal of goods is reflected. The amount depends on the methodology for estimating the value of assets upon disposal (at the cost of each unit, at the average cost, using the FIFO method) | Cost of goods | Consignment note (form No. TORG-12) |

| 62.01 | 90.1 | Revenue is reflected in the sales price of goods including VAT. | Sales price (amount including VAT) | Consignment note (form No. TORG-12) Invoice |

| 90.3 | 68.2 | VAT is charged on goods sold | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 62.01 | 62.02 | The previously received prepayment is offset against the debt for the transferred goods. | Advance payment amount | Accounting certificate-calculation |

| 68.2 | 76.AB | VAT is credited from the prepaid payment | VAT amount | Invoice Purchase book |

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 1. | ||||

What is shipment of finished products?

The actual transfer of goods from the manufacturer to the customer means that finished products have been shipped, and the posting records this in accounting. The release of goods is accompanied by documents that record the nomenclature, quantity of goods, unit price and total cost, place of shipment, and customer details. Completed transactions are confirmed by the signatures of the parties.

If at the time of shipment, under the terms of the contract, ownership of the goods is transferred, then we are talking about sale. In this case, material assets may not be paid for. Payment terms can be considered in the following options:

- The goods are transferred to the buyer after making an advance payment.

- The order is paid after delivery of the finished product within the agreed period.

Sales of finished products in accounting at light industry enterprises

Postings for accounting for the purchase of goods with payment to the supplier after receipt

4160.01 The receipt of goods from the supplier is reflected. The cost of goods without VAT. Invoice (form No. TORG-12) 19.360.01 The amount of VAT related to the values received is reflected. The posting is made if there is a supplier invoice Amount VAT Invoice Purchase book Bill of lading (form No. TORG-12) 60.0151 Reflects the fact of repayment of accounts payable for previously received valuables Purchase cost of goods Bank statement Payment order 2. Postings for accounting for the purchase of goods on an advance payment basis 60.0251 Reflects the prepayment to the supplier under the supply agreement Amount of advance payment Bank statement Payment order 4160.01 Reflects the receipt of goods from the supplier Cost of goods without VAT Consignment note (form No. TORG-12) 19.360.01 Reflects the amount of VAT related to the values received Amount of VAT arry waybill (form No. TORG-12)68.219.3 The amount of VAT refers to reimbursement from the budget. The posting is made if there is a supplier invoice Amount of VAT invoice Purchase book Bill of lading (form No. TORG-12) 60.0160.02 The previously transferred prepayment is counted towards repayment of the debt for the valuables received Amount of advance payment Accounting reference-calculation| Name of accounts | Initial balance | Revolutions | Final balance | |||

| Debit | Credit | Debit | Credit | Debit | Credit | |

| Total | ||||||

The goods are shipped to the buyer, wiring Ukraine

How is the shipment of goods reflected if payment is made later?

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 90.02 | 43, 41 | Finished products or goods have been shipped. The amount of cost depends on the method of estimating output | Cost of finished products | Sales Invoice |

| 62.01 | 90.01 | Reflection of revenue through the sale price of goods including VAT | Sales price of goods including VAT | Invoice, invoice |

| 90.03 | 68.2 | Volume of VAT on goods shipment | VAT amount | Invoice, invoice, Sales book |

| 51 | 62.01 | Reflection of debt repayment for shipped goods | Sales price of goods | Payment order or bank statement |

How is the shipment of goods reflected when the buyer prepays

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 51 | 62.02 | Reflection of crediting of prepayment for future shipment of goods | Prepayment amount | Payment order or bank statement |

| 76.AB | 68.02 | VAT accrual on prepayment amount | VAT amount | Invoice, Sales Book, Payment Order |

| 90.2 | 43, 41 | Posting for shipment of goods or products. Cost is calculated depending on the method of estimating production output | Product cost | Sales Invoice |

| 62.01 | 90.1 | Reflection of revenue through the sale price of goods including VAT | Sales price of finished goods including VAT | Invoice, invoice |

| 90.3 | 68.2 | Calculation of VAT amount on the volume of shipped goods | VAT amount | Invoice, invoice |

| 62.02 | 62.01 | Crediting advance payment against shipment | Prepayment amount | Accounting certificate-invoice |

| 68.02 | 76.AB | The amount of VAT is credited from the previously made prepayment | VAT amount | Invoice, Sales Book |

When shipping the goods, the seller must provide the buyer with a complete package of documents for correct acceptance of the values.

View more:

- Article 126 of the Tax Code of the Russian Federation Is it often punished under paragraph 1 of Art. 126 Tax Code of the Russian Federation?P. 1 tbsp. 126 Tax Code of the Russian Federation...

- OKVED rental of premises Transactions with real estate for a fee or on a contractual basisSubclass 68.3 contains two groups of codes: ...

- Double taxation in Russia Double taxation Double taxation is the simultaneous imposition of the same taxes on income in different countries. Double taxation is caused by...

- Tax Code Article 88 Article 88. Desk tax audit1. A desk tax audit is carried out at the location of the tax authority on…

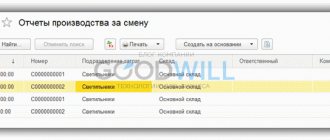

1. An agreement is concluded with the buyer for the supply of products (type of agreement - With the buyer);

2. The buyer is issued an invoice (document Invoice for payment to the buyer);

3. When payment is received from the buyer based on the invoice (or by filling out the invoice without using the based entry mode), enter the incoming cash or bank document into the system. Moreover, payment is possible in installments, using various payment methods, etc.

4. The products are transferred to the buyer, the document Sales of goods and services is filled out, which reflects the sale of finished products in accounting.

5. Sales operations, like many other operations, require special actions regarding VAT accounting. In particular, when issuing an invoice to a buyer, you need to create an invoice (for example, using the appropriate link in the Sales of goods and services document), and at the end of the month you should create a Sales Book. We will talk more about VAT accounting in one of the following lectures.

Let's fill out the document Invoice for payment to the buyer (Sale {amp}gt; Invoice), fig. 152.

Rice. 152. Document Invoice for payment to the buyer

Filling out the details of the document header is quite standard; in the Products tabular section, we indicate the Shelf element from the Nomenclature directory, which belongs to the Products group, fill in the Quantity field, and if the selling price is not specified in the system, enter it yourself; if it is specified, it will be entered automatically. The remaining fields of the document are filled in automatically.

- the product is delivered to the buyer by the seller;

- delivery of valuables to the buyer is carried out by a third-party carrier;

- The transfer of products by the manufacturer is made to the seller directly.

The fact of sale is accompanied by documents (contracts, invoices, acceptance certificates). It is not prohibited by law to use in a contract the moment of changing ownership of the commodity mass upon its receipt or during a certain period, including after making partial payment, immediately at the time of transfer of the product to the buyer’s warehouse. But any condition must necessarily be reflected in the agreement of the parties to the transaction.

Payment for the commodity mass is made by the buyer at the time of receipt or within a certain period agreed upon by the parties. After making the payment, the recipient of the product becomes its full owner.

If money for the delivered product is not transferred within the time period previously agreed upon by the parties, the goods must be returned to the seller. If the payment deadline is missed, the seller has the right to demand the return of the product or payment for it.

For your information! Such conditions are indicated in the agreement of the parties, as well as the criteria for changing the copyright holder of the subject of the contract or the right of disposal by the acquirer before the end of the settlement procedure.

The moment of receipt of revenue (payment) is recorded by the seller upon shipment of the product with the transfer of ownership of the subject of the transaction. For companies using a simplified taxation system, revenue is recorded after actual payment for the product.

At the time of recognition of revenue, expenses associated with the manufacture and sale of the product are subject to accounting (PBU 10/99; Order of the Ministry of Finance of the Russian Federation No. 119n, December 28, 2001).

When transferring ownership of a product after final settlement and determining the VAT base after shipment of the subject of the transaction, accounting transactions look like this:

- Debit account 45 / Credit account 41 (shipment of the product based on its actual cost).

- Debit account 45 / Credit account 44 (writing off other expenses incurred on shipment).

- Debit account 90 / Credit account 45 (recognition of the fact of sale after payment).

- Debit account 45 / Credit account 68 (VAT accrual on shipped products).

When ownership changes and its transfer to the acquirer, a sale takes place, and accordingly, receipts and expenses are subject to accounting on the account. 90 based on primary documents (Federal Law No. 402, December 6, 2011).

When selling products for cash, the following posting is made in accounting: Debit account. 50 / Credit account 90.1, for non-cash payments: Debit account. 62 / Credit account 90.1.

For your information! The actual cost of sales must be written off in a manner that takes into account the method of registration of finished goods by the enterprise (at actual or standard cost).

The cost of products to be written off as expenses is determined in one of the following ways:

- at cost (inventory units);

- using the FIFO method;

- at average cost.

The choice of valuation method must be enshrined in the accounting policy of the enterprise (order of the Ministry of Finance of the Russian Federation No. 119, December 28, 2001; letter of the Ministry of Finance of the Russian Federation No. 07-05-14/298, November 16, 2004; PBU 5/01).

If the return of the defective material occurred in one tax period, the seller makes adjustments to sales (account 90); if the return occurred in the next calendar year, then the cost of the returned object is included in the accounts of non-operating costs as a loss of the past period, which was determined in the reporting period. year (count 91):

- Debit account 91 / Credit account 62 (loss of the past period discovered in the reporting period);

- Debit account 43 / Credit account 91 (restoration of the cost of returned goods, previously written off);

- Debit account 68 / Credit account. 91 (profit of previous years calculated in the reporting year in the amount of VAT paid).

Defects identified before the end of production are accounted for in the main production: Debit account. 28 (manufacturing defect) / Credit account. 20, and defects detected upon completion of production - in finished products: Debit account. 28 / Credit account 43.

For your information! When returning goods, the seller has the right to deduct the VAT amount (Article 171 of the Tax Code of the Russian Federation). A deduction is allowed no later than 12 months from the date of return and in full after reflecting adjustment entries for the return (rejection) of the product.

The amount of VAT sent by the seller to the budget upon sale is deducted for the period in which there are adjustment entries due to returns. In this case, when sending a replacement to the buyer, the seller issues an invoice to him.

If the defect returned in the next tax period, then the profit tax base is subject to recalculation for the period when the goods were sold, or the costs of the cost of the returned product can be attributed to expenses in the form of damage from the defect (Article 264 of the Tax Code of the Russian Federation; letter from the Ministry of Finance RF No. 03-03-05/47, 04/29/2008).

If a defective product can be used in production, perform the following operations:

- Debit account 28 (marriage) / Credit account. 43 (reflection of the cost of marriage);

- Debit account 10 (materials) / Credit account. 28 (posting of the product at the price of possible use);

- Debit account 20 (production) / Credit account. 28.

Therefore, damage from defects will be reduced by the price of a spoiled product suitable for use.

- 20 - used to account for costs when selling services and performing work.

- 41 - is used when reflecting the cost of goods purchased for further resale.

- 42 - for writing off mark-ups on goods (when goods are reflected at sales prices).

- 43 - used to reflect finished products created at the enterprise.

- 44 - to account for sales expenses for goods sold.

- 45 – this account shows products that have been shipped to the seller, but have not yet been received or paid for by him.

- 46 - used when performing work step by step.

- 50 - when used in payments for sold services, works, goods, cash payments.

- 51 - when using non-cash payments in payments for sold services, works, goods.

- 52 - when the buyers are foreign persons transferring payment in foreign currency.

- 57 - when payment for sold services, works, goods is made by bank cards.

- 62 - is used when making payments to suppliers and contractors for services, works, and goods sold to them.

- 68/VAT - used to calculate VAT on the sale of services, work, goods.

- 76 - when carrying out sales of goods, works, services under one-time transactions.

- 90/1 - used when reflecting revenue from the sale of services, works, and goods in accounting.

- 90/2 - used to account for the cost of services, works, and goods sold.

- 90/3 - the account reflects information about VAT included in the price of sold services, works, goods (when the organization works with VAT).

- 90/4 - if the goods sold are subject to excise taxes.

- 90/1 “Revenue”;

- 90/2 “Cost of sales”;

- 90/3 “VAT”;

- 90/4 “Excise duties”;

- 90/9 “Profit/loss from sales”.

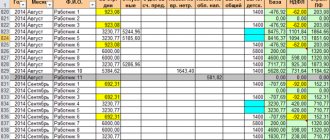

- The initial debit balance of all accounts is equal to the initial credit balance of all accounts. Equality follows from the equality of assets and liabilities of the initial balance sheet;

- The debit turnover of all accounts is equal to the credit turnover of all accounts. Equality follows from the method of double entry in accounts;

- the final balance on the debit of all accounts is equal to the final balance on the credit of all accounts. Equality reflects the new state of the organization’s property and liabilities and follows from the first two equalities.

Accounting statements: features of accounting for the cost of finished products

The value of the balances of finished products listed in the warehouse as of the reporting date in the balance sheet is included in the amount reflected in line 1210 “Inventories”. That is, finished products are an integral part of inventories, the total value of which consists of (clause 20 of PBU 4/99, approved by order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n):

- raw materials and supplies;

- costs in work in progress;

- finished products, goods and goods shipped;

- expenses of future periods.

To learn about what sections the balance sheet consists of and how to fill it out correctly, read the article “Balance sheet (assets and liabilities, sections, types)” .

Being an integral part of inventories (clause 2 of PBU 5/01, approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n), finished products must be taken into account at actual cost (clause 5 of PBU 5/01). Upon disposal, it is assessed in accordance with one of the methods chosen for this (clause 22 of PBU 5/01), i.e. based on the cost:

- each unit;

- average;

- first acquisitions.

Both of these valuation procedures (input and output) affect the cost at which the balance of available finished products will be reflected in the balance sheet (clause 24 of PBU 5/01).

The actual cost of the finished product is determined based on the actual costs incurred for its production (clause 7 of PBU 5/01). Finished products, as they are manufactured, are accepted for accounting in the warehouse, which is reflected by posting to the debit of account 43, intended for accounting for these products. However, due to the fact that at the time of receipt the actual cost has not yet been formed (the month is not closed), the receipt is registered at the accounting price (clause 204 of the Methodological Recommendations for Inventory Accounting, approved by Order of the Ministry of Finance dated December 28, 2001 No. 119n), selected by the taxpayer independently from several possible options. At the end of the month, when the actual cost of creating each type of finished product becomes clear, the accounting value is adjusted to the actual value.

Sales of services: postings

A peculiarity of accounting for sales in retail trade is that proceeds from sales are not transferred to the current account, but mainly to the cash register.

Due to the fact that buyers are a fairly wide range of consumers, settlements with them are carried out without using account 62, but directly to the revenue account. In addition, the cost of goods sold usually also includes the costs of selling them.

| Debit | Credit | Operation designation |

| 50 | 90/1 | Proceeds from the sale of goods are transferred to the cash register |

| 57 | 90/1 | Payment accepted via credit card |

| 51 | 57 | Money received under the acquiring agreement has been credited to the current account |

| 90/2 | 57 | The commission under the acquiring agreement is reflected |

| 90/2 | 41 | Cost of goods sold written off |

| 90/2 reversal | 42 reversal | The markup on goods sold is written off (if goods are reflected at sales prices) |

| 90/3 | 68 | VAT determined for goods sold |

| 90/2 | 44 | Selling costs included |

When an advance payment is established in a sales or delivery agreement, it implies that the buyer must pay for the goods in whole or in part before it is shipped.

Attention! When selling goods on an advance payment basis, the supplier has an obligation to charge and pay VAT to the budget on the advance amount, and when material assets are shipped, an offset is required. In this regard, to account for payments to the buyer, it is necessary to use two subaccounts with

bills 62

- general for payments and one for advances received.

| Debit | Credit | Operation designation |

| 51, 52 | 62/2 | An advance was received from the buyer for products, goods |

| 76/VAT | 68 | VAT has been determined on the advance received from the buyer |

| 62 | 90/1 | Indicates revenue from the sale of goods, finished products |

| 90/2 | 41, 43 | The cost of goods sold and finished products is written off |

| 90/2 reversal | 42 reversal | The markup on goods sold is written off (if goods are reflected at sales prices) |

| 90/3 | 68 | VAT is reflected on goods and products sold |

| 62/2 | 62 | The previously received advance has been offset |

| 51, 52 | 62 | The final payment for the goods has been made (if the advance payment was made partially). |

| 68 | 76/VAT | The previously paid VAT from the advance was offset |

When accounting for the sale of goods by shipment, payment is made at the time of shipment or after it. It also matters at what point the transfer of title to the shipped goods will occur from the supplier to the buyer (at the supplier’s warehouse, at the buyer’s warehouse, or somewhere in between).

Since the goods will no longer be in the warehouse, but the supplier will also not be able to write off its cost for goods sold, account 45 should be used. In this case, there is no obligation to determine and pay VAT on the advance payment (due to the absence of one).

Attention! Under the simplified tax system, it is necessary to make the same entries, with the exception of VAT calculation, since the fact of payment is important only when determining the company’s income for tax purposes.

| Debit | Credit | Operation designation |

| 62 | 90/1 | Revenue accrued for shipped products |

| 45 | 41,43 | Goods shipped, finished products to the buyer |

| 90/2 | 45 | The cost of goods sold and finished products is written off (when the goods become the property of the buyer) |

| 90/3 | 68 | VAT is reflected on goods and products sold |

| 51, 52 | 62 | Received payment for delivered goods and products |

Sales of services

The provision of services in accounting is carried out similarly to the sale of goods. But since they do not have a material embodiment, all costs are collected on one of the production accounts (20, 25, etc.), after which they are written off at the time of sale to account 90/2. Accounts 41, 43 are not used.

| Debit | Credit | Operation designation |

| 62 | 90/1 | Revenue from services performed is shown |

| 90/2 | 20 | The cost of services performed is written off |

| 90/3 | 68 | VAT on services provided is reflected |

| 51, 52 | 62 | Received payment for services |

The concept of finished products and their accounting

Finished product (FG) is a completed product that has been released as a result of production.

It must meet the requirements of GOSTs or technical specifications, undergo quality control, be assembled into a complete set and sent for storage to the warehouse of the enterprise or customer.

GPs are classified into several types:

- Gross is the product produced by an enterprise over a certain period of time. Expressed in monetary terms and includes intermediate, completed and final products.

- Gross turnover is the totality of gross output for all workshops of the enterprise, including production work and the internal turnover of the organization for a certain period of time.

- Comparable products are products that the company produced previously.

- Incomparable products – manufactured for the first time in the current reporting period

After production, finished products come under the control of the warehouse employee under financial responsibility. Receipts are recorded in quantitative terms, if necessary, divided into categories of goods. For accounting, a card or cardless method is used. GP warehouse balances are regularly checked by inventory.