Any financial and economic transaction in the activities of the company is reflected in the accounting accounts. All accounts are interconnected. The principle of their interaction is described by the double entry method. The chart of accounts itself is a list in which the number corresponds to a name that reflects the essence of the business transaction. It was approved by Order No. 94n as amended on November 8, 2010.

A product is any purchased or produced valuable item intended for subsequent sale. If an organization produces a product for internal use, it is not a product. Let's look at the basic entries for goods and services in accounting.

The goods accounting account is 41.01, usually it is maintained in both total and quantitative versions. If the company incurred additional expenses directly when purchasing the goods, these expenses are usually also taken into account in account 41.01. There is an alternative option - accounting for costs separately, on account 44.01.

Let's look at the main examples of accounting entries for goods on 41 accounting accounts.

Accounting for goods and materials

Goods and materials are often combined into one accounting group and given a general name - inventory assets, abbreviated as goods and materials.

Inventory materials in finished form intended for further sale are goods. And materials are goods and materials that are purchased for use in the manufacture of the company’s products, or for their own needs that affect the overall production process, provision of services or performance of work.

Inventory and materials are taken into account at the actual cost, which consists of the amounts of funds transferred or paid (in cash) to the supplier and other expenses associated with transportation, commission costs, etc.

Accounting entries for account 41

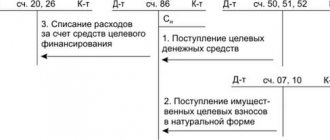

In accordance with Order No. 94n dated October 31, 2000, correspondence from account 41 is carried out by debit for the receipt of goods from suppliers (Account 60), accountable persons (Account 71), as contributions from founders (Account 75), and others counterparties (account 76). Write-off of goods is carried out on account credit. 41 in correspondence with accounts - (during sales), (when used for commercial purposes), 20, , (when spent on personal needs), (in the process of transferring from goods to materials), 41 - during internal movements, etc.

How goods are accepted for accounting

Goods are accepted for accounting in the same way as materials, at actual cost. For accounting purposes, account 41 and subaccounts opened to it are used. When carrying out retail trade, you also need account 42 “Trade margin”. If you keep records at accounting prices to reflect the difference between them and actual prices, then accounts 15 and 16 will be needed.

Products are sold wholesale and retail. In this case, accounting is influenced by the organization’s taxation system, and the methods enshrined in the accounting policy, and automation, or its absence at the point of sale, and the presence of intermediaries. When concluding a supply agreement, it is necessary to clearly state all the conditions that relate to prepayment, full payment and shipment, since the write-off of costs and the moment of sale of goods depend on this.

Wholesale trade can be carried out on the following terms:

- Prepayment and subsequent shipment.

- Shipment and then payment for the goods.

- Payment in foreign currency and then shipment. And vice versa.

- Sale of goods with their transportation to the buyer.

There are also many nuances in retail trade:

- Sale of goods at an automated point of sale (ATP) at sales prices in cash and non-cash.

- Sale of goods at a manual point of sale (NTP) at sales prices in cash and non-cash.

- Sale of goods at purchase prices.

Video lesson. Receipt of goods in 1C Accounting: step-by-step instructions

Practical video lesson on accounting for receipt of goods in 1C Accounting 8.3. Hosted by site expert Olga Likina: “Accounting for Dummies”, payroll accountant at M.Video Management LLC. The lesson provides step-by-step instructions for recording the receipt of goods.

https://youtu.be/6bo392E6ZS8

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Example of postings for 41 accounts

The Alpha organization carries out wholesale and retail trade. The goods were shipped to Omega after receiving full payment in the amount of RUB 274,520. (VAT RUB 41,876). Three days later the goods were shipped to the buyer.

Cost of goods sold RUB 129,347. In retail, daily revenue amounted to 17,542 rubles. (VAT 2676 rub.). The sale was carried out using ATT. To account for the trade margin, account 42 was used. The amount of the margin was 6,549 rubles.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 51 | 62.02 | Money has been deposited into the bank account from Omega | 274 520 | Bank statement |

| 76.AB | 68.02 | An advance invoice has been issued | 41 876 | Outgoing invoice |

| 62.01 | 90.01.1 | Revenue from sales of goods is taken into account | 274 520 | Packing list |

| 90.02 | 68.02 | VAT charged on sales | 41 876 | Packing list |

| 90.02.1 | 41.01 | Sold goods written off | 129 347 | Packing list |

| 62.02 | 62.01 | Advance credited | 274 520 | Packing list |

| An invoice for sales has been issued | 274 520 | Invoice | ||

| 68.02 | 76.AB | VAT deduction on advance payment | 41 876 | Book of purchases |

| 50.01 | 90.01.1 | Retail revenue taken into account | 17 542 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.03 | 68.02 | VAT charged | 2676 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.02.1 | 41.11 | Write-off of goods at sales price | 17 452 | Certificate-report of the cashier of the operator based on the retail sales report |

| 90.02.1 | 42 | Accounting for mark-ups on goods | -6549 | Help for calculating the write-off of trade margins on goods sold |

Translation of goods into materials

In production and trading organizations, goods are often transferred to the category of materials. Such a movement is documented with the TORG-13 consignment note.

Example

Alpha purchased 920 meters of cable for sale in the amount of RUB 179,412. (VAT RUB 27,383). To carry out electrical installation work, 120 meters of cable were needed, so this amount of goods was converted into materials.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 41.01 | 60.01 | Goods have arrived | 152 029 | Packing list |

| 19.03 | 60.01 | VAT included | 27 383 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 27 383 | Invoice |

| 10.01 | 41.01 | Products translated into materials | 19 830 | Internal movement invoice |

Methods of accounting for goods in a warehouse

Methods for accounting for goods must comply with the provisions of the Methodological Guidelines for Accounting of Inventory Production Plants (approved by Order of the Ministry of Finance of the Russian Federation No. 119n dated December 28, 2001). There are 2 main methods: varietal and lot accounting. Each of them has its own advantages and disadvantages.

Varietal accounting method

The varietal method involves storing goods by grade and name. The initial price of the MPZ does not matter. Newly received batches are added to existing units and written off as needed.

When selling goods, there are 3 methods for their valuation:

- The FIFO method means that the write-off price is used in the order of receipt of inventory items, that is, the prices of those batches that arrived earlier are initially taken into account;

- by average cost - with this method, the price of a unit of goods is determined by dividing the total cost by the total quantity;

- at the cost of each unit of goods - this method is justified if each product is unique, has special properties and cannot be replaced by another homogeneous asset.

For each item of goods, a warehouse accounting card is created in form M-17, which contains information about the inventory: name, item number, discount price, storage warehouse, and others.

Batch accounting method

The specific features of a number of goods require batch accounting. This method involves storing incoming batches separately. The warehouse number is assigned to the entire batch at once, and it is also used when materials are disposed of.

The receipt of goods is reflected in the MX-10 batch card, which records the entire movement of the incoming group of goods: date of acceptance, quantity of goods, disposal until complete consumption. Batch accounting is suitable for goods with a limited shelf life and is often used in catering establishments.

For trade organizations, account 41 is the main one. Account transactions determine the cost of sales and allow you to assess the profitability of the transaction.

https://youtu.be/3EzzHy2Qno4

Write-off of goods from 41 accounts for the needs of the organization

An organization may need the goods it sells for general business needs. Write-offs can be made by converting goods into materials or bypassing this operation, based on an order.

Example situation:

The organization purchased 87 packs of paper for retail sale for a total amount of 7,905 rubles. (VAT 1206 rub.) For office needs, 5 packs were needed.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 41.01 | 60.01 | Goods have arrived | 6699 | Packing list |

| 19.03 | 60.01 | VAT included | 1206 | Packing list |

| 68.02 | 19.03 | VAT is accepted for deduction | 1206 | Invoice |

| 41.11 | 41.01 | The goods were moved from the wholesale warehouse to the retail warehouse | 6699 | Invoice for internal movement (TORG-13) |

| 41.11 | 42 | Take into account the trade margin | 2609 | Invoice for internal movement (TORG-13) |

| 26 | 41.11 | Products written off for office needs | 604 | Request-invoice |

| 26 | 42 | Adjusting the cost of goods for office needs | 219 | Accounting information |

Typical operations for accounting for goods

- Reflection of additional costs for goods - for example, delivery or storage of goods.

- Return of goods from the buyer - return receipt of goods from the buyer.

- Write-off of goods is a reflection in accounting of damage or loss of goods.

Categories for articles on product accounting:

- Accounting for goods in accounting: postings, examples, laws

- Revaluation of goods in accounting

- Movement of goods through warehouses: postings, rules, examples

- Resale of goods between the commission agent and the principal in accounting

- Reflection of goods in storage in accounting entries

- Expenses for selling goods - postings and examples

- Examples of warehouse postings

- Accounting entries for the transfer of goods free of charge

- Accounting entries for payment for goods and services

- Accounting for goods in transit

- Consignment goods: the relationship between the consignor and the commission agent

- Carrying out an inventory: receipt of surpluses and write-off of shortages

- How does the shipment of goods occur from an accounting point of view?

- Postings for the purchase of goods and services

- Postings for the sale of goods and services

- Returning goods to the supplier: reasons, postings, examples

- Postings for receipt of goods to the warehouse

- How to reflect the return of goods from a buyer in accounting

- Write-off of goods in case of shortage or damage in accounting entries

- Postings according to additional costs for delivery of goods

A short video on how to reflect the sale of a product in 1C 8.3:

https://youtu.be/WGVlSbkFCc4

Analysis of account 41 and card

Before you begin accounting for a commercial enterprise, you need to find out whether the account is 41 active or passive. Since it aggregates information about the property, cash and assets of the enterprise, therefore, it is an active account. At the account 41 the balance is only debit (positive), it cannot result in a negative balance. Debit account 41 reflects the receipt of goods, containers, materials or resources at the warehouse or store of the enterprise. Credit account 41 reflects the disposal of goods, a decrease in their value in accounting, due to sale, transfer to other needs, return to the supplier, write-off of defects or inventory shortages.

Account card 41

The card for account 41 is similar in content to a balance sheet and is used in accounting to verify the correct entry of data into the software. When this report is displayed, it becomes easy to track the appearance of information on the account, as well as verify the turnover and balance of the account. 41. The report can be generated by the program for any period, up to its generation for one shift.

Note! The count should not be confused. 41 in accounting and accounts. 41, opened at the Federal Treasury. The latter is required only for making payments under some government programs for which the company is the executor. Opening such a personal account is not mandatory for all enterprises, but is required only for some tender participants.

Thus, accounting for products intended for further resale must be carried out to correctly reflect changes in the assets of the enterprise. After all, information about it, as well as trade margins on it, have a direct impact on the formation of the enterprise’s profit.

https://youtu.be/enPNNAytRJY