Video help “Accounting for account 94”: basic transactions, accounting

This video briefly describes accounting for account 94 “Shortages and losses from damage to valuables”, explains the basic transactions and accounting examples. The teacher of the site “Accounting and Tax Accounting for Dummies”, chief accountant N.V. Gandeva, runs the website. ⇓

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

https://youtu.be/AsEh_s-QKIY

Accounting 94 in accounting infographic. Typical wiring

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

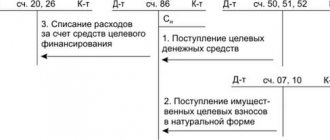

The figure below shows accounting account 94 “Shortages and losses from damage to valuables” and typical entries for their accounting. To enlarge the picture, click on it.

Accounting account 94 and main entries

Account 94 in accounting: reflection of shortages and damage

Deficiencies in account 94 should be reflected in cases identified by:

- conducting an inventory;

- receipt of goods and materials from the supplier, within the limits specified in the supply agreement (natural loss)

On the debit of account 94, shortages are recorded in the following amounts:

- actual cost, if inventory items are completely damaged or missing

- residual value - for fixed assets that have completely fallen into disrepair or are missing

- actual losses if inventory items are partially lost

Basic postings of accruals on account 94:

| Operations | Check |

| Write-off of the residual value of a fixed asset in the event of its complete disrepair or absence (theft, shortage) | 01 |

| Missing or damaged materials | 10 |

| Shortage or damage of goods in the warehouse | 41 |

| Missing or damaged equipment | 07 |

| Lack of cash in the cash register | 50 |

| Shortages identified in production | 20 (23, 29) |

| Shortages identified upon acceptance of goods and materials from the supplier | 60 |

| Lack of investments in non-current assets | 08 |

What should an employer do if it is discovered during an inventory?

When the inventory commission completes its work, it draws up and approves the following documents:

- comparison statement (the act of comparing the audit results with accounting data);

- act of identified discrepancies (shortages, surpluses);

- final act confirming the results of the inventory.

Registration of the above papers is considered the basis for proper reflection of the results of the audit performed in the relevant accounting registers.

If the results of the OS inventory reveal some discrepancies, both positive and negative, the entities officially responsible for the safety of specific property are required to provide management with written explanations of the reasons for the identified discrepancies.

In other words, the responsible person must justify both shortages and surpluses of fixed assets that are identified by the inventory.

Based on facts of shortage of fixed assets, a write-off act is drawn up in the prescribed form. This act is supplemented by the corresponding accounting certificate.

These documents reflect the following information:

- reason (ground) for disposal of an asset;

- the amount of accrued depreciation on the disposed object;

- residual value of property, the actual absence of which is confirmed by an audit;

- the amount of revaluation of the object (subject to its revaluation).

If the entity responsible for the detected shortage is identified, the following information must be documented:

- personal data (full name, position) of the subject;

- the total amount of the shortage caused;

- a list of documentary evidence confirming the deficiency and guilt of the person;

- a sum of money subject to monthly deduction from the earnings of the guilty subject.

If the culprit of the shortage refuses to pay the damage, the head of the organization has the right to file a statement of claim in court containing a demand for compensation (compensation) for material damage.

Repayment of the cost of the shortfall caused will be carried out by the guilty entity under the following circumstances:

- there is documentary evidence of the guilt of the subject;

- the employee admitted his own guilt (in writing);

- the inventory commission made an official decision (verdict) on the guilt of the subject;

- the manager issued an administrative act ordering the amount of the detected shortage to be withheld from the earnings of the guilty employee.

What entries need to be reflected in accounting?

Accounting for missing assets comes down to proper write-off of their cost.

There are two fundamental options for reflecting the shortage of such objects in accounting:

- Write-off of the cost of missing fixed assets to reduce the company’s financial result.

- Attribution of the detected shortage to the persons responsible for its occurrence. This measure is taken by decision of management.

The cost of missing fixed assets is written off using the following accounting entries:

| Operation | Account debit | Account credit |

| Primary cost is written off | 01 (according to the disposal subaccount) | 01 (according to the subaccount of objects in use) |

| Write-off of depreciation | 02 (“Depreciation”) | 01 (according to the disposal subaccount) |

| Residual value is written off | 94 ("Shortages") | 01 (according to the disposal subaccount) |

| Write-off of additional valuation of an object | 83 (“Additional capital”) | 94 ("Shortages") |

| Attribution of OS shortage to other costs (if the culprits are not identified) | 91 | 94 |

| Attribution of the shortage of fixed assets to future income (if the damage is recovered from the identified culprits) | 73 (according to the damage compensation subaccount) | 98 (“Future Earnings”) |

Example

Initial data:

For example, before preparing annual reports, the company conducted an inventory of fixed assets, as a result of which the following shortcomings were discovered:

- Woodworking machine (primary cost - 42,000 rubles, depreciation - 14,000 rubles, residual value - 28,000 rubles). The culprits have not been identified.

- Personal computer (primary cost - 52,000 rubles, depreciation - 16,000 rubles, residual value - 36,000 rubles). The culprit has been identified - the responsible employee.

Accounting for the cost of a missing woodworking machine is carried out as follows:

| Operation | Amount, rubles | Account debit | Account credit |

| Primary cost is written off | 42 000 | 01 (according to the disposal subaccount) | 01 (according to the subaccount of objects in use) |

| Write-off of depreciation | 14 000 | 02 | 01 (according to the disposal subaccount) |

| Residual value is written off | 28 000 | 94 | 01 (according to the disposal subaccount) |

| Attributing the shortage to a loss | 28 000 | 91 | 94 |

Accounting for the cost of a lost personal computer is carried out as follows:

| Operation | Amount, rubles | Account debit | Account credit |

| Primary cost is written off | 52 000 | 01 (according to the disposal subaccount) | 01 (according to the subaccount of objects in use) |

| Write-off of depreciation | 16 000 | 02 | 01 (according to the disposal subaccount) |

| Residual value is written off | 36 000 | 94 | 01 (according to the disposal subaccount) |

| Attributing the shortage to the culprit | 36 000 | 73 | 94 |

| Attribution of the difference between market price and residual value | 16 000 | 73 | 98 |

| Withholding damage from the culprit's earnings | 52 000 | 70 | 73 |

Account 94: writing off shortages

For the loan, 94 accounts reflect the write-off of shortfalls, that is, their attribution to expenses . Shortages can be written off as other expenses (Debit 91.2 Credit 94). This operation is carried out if the norms of natural loss are exceeded. If a guilty person is found, then such deficiency is recovered (Debit 73.2 Credit 94). Shortages within the limits of natural loss norms (for specific goods and materials) are written off at the expense of cost (Debit 20 (44) Credit 94).

If a shortage is identified upon acceptance of material assets from the supplier, then the terms of the contract must be followed. It should indicate the maximum amounts of shortages, which are subsequently reflected in account 94. Above-limit amounts must be carried out on the 76th account.

There are situations when a shortage is discovered several years after the actual damage or loss of inventory items. However, this fact is not reflected in the inventories carried out. In this case, you can make an entry Debit 94 Credit 98.3 if the guilty person is found and the amount of damage will be recovered from him. After the shortfall from account 98 is paid off, it is written off as other expenses. If an employee refuses to admit his guilt, then before the court makes a decision, it is impossible to make an entry on account 94.

Write-offs of damage and shortages that occurred due to emergency events are written off according to the act to account 99: Debit 99 Credit 94 .

If stolen inventory items are written off, then the VAT previously accepted for deduction on them must be restored.

Redemption of shortfalls: postings

The deficiency can be repaid in different ways. As a rule, a certain financially responsible person is responsible for the missing assets. When guilt is established, the deficiency is recovered from him. For example, if there is a shortage of money in the cash register, the cashier is the culprit. What kind of posting is used to make up the cashier’s repayment of the shortage, and how does the further closure of the account take place? 94, the reader can find out in our consultation.

On the credit account 94, the write-off of shortfalls is recorded:

- within the limits of natural loss, which is calculated by multiplying the quantity (weight) of the missing product by the established standard - by production accounts;

- in excess of the norms of natural loss and if it is impossible to find the culprit for the shortage - as part of other expenses;

- at the expense of the guilty person - withholding from wages. For losses that occurred several years ago, their value as they are collected is reflected on the account. 98, then - to the count. 73, then - to account. 91;

- at the expense of profits if losses were incurred due to force majeure.

Write-off of damage in accounting for shortages and losses from damage to valuables is formalized as follows:

| Operations | D/t | K/t |

| The identified shortage was written off: | ||

| At the expense of the guilty party | 73 | 94 |

| According to the norms of natural loss (EU) | 20,23,25 | 94 |

| Above EU standards | 91/2 | 94 |

| At the expense of profit under force majeure circumstances | 99 | 94 |

| For inventory items lost outside the reporting tax period: | ||

| – the amount of the shortage is reflected (the difference between the book value and the market value) | 94 | 98 |

| - recovered from the guilty person | 73 | 98 |

| - transferred to other income of the current period | 98 | 91 |

Norms of natural loss. Calculation formula

Shortages and spoilage within the limits of natural loss norms depend on many factors (type of goods and materials, method of transportation, storage methods and periods, etc.). This indicator is calculated in each specific situation:

- To establish standards for natural loss during the transportation (delivery) of inventory items, it is necessary to take into account either the cost of each product or the total weight of inventory items. Shortages or damage are identified upon acceptance, then they are documented (notes in accompanying documents, acts).

- To establish norms of natural loss during the storage or sale of inventory items, it is necessary to apply the calculation formula:

| EU = T x Well x 100% where: T – mass or cost of goods and materials; Well, there is a regulated rate of loss for a specific inventory item (the legislation provides reference books and classifiers of various inventory items with their rates of natural loss). |

- To establish norms of natural loss for the storage of goods, norms are calculated for the balances of goods, for their receipts and disposals during inter-inventory periods

Account 94: example of accounting entries

During the inventory, shortages of inventory items were identified in the organization:

- Materials in stock in the amount of RUB 17,894.

- Products in the retail department worth RUB 9,542.

- Lack of funds in the cash register in the amount of 541 rubles.

Also, when accepting a new batch of goods worth 221,500 rubles. a shortage of materials was identified from the supplier in the amount of 12,443 rubles. According to the terms of the contract, the natural loss of goods and materials during transportation can be 2% of the cost.

The following entries must be made in accounting:

- Debit 94 Credit 10 | 17894 – a shortage of materials is reflected.

- Debit 94 Credit 41 | 9542 – a shortage of goods is reflected.

- Debit 94 Credit 50 | 541 – a shortage of funds in the cash register is reflected.

- Debit 91.2 Credit 94 | 17894 – losses from shortage of materials were written off as expenses (the perpetrators were not identified).

- Debit 73.2 Credit 94 | 10083 – the cost of shortage of goods and funds was collected from the seller.

- Debit 50 Credit 73.2 – funds contributed to repay the shortfall.

- Debit 10 Credit 60 | 209057 – materials received from the supplier in their actual quantity were capitalized.

- Debit 94 Credit 60 | 4430 – the shortage is reflected within the limits of natural loss norms established under the contract.

- Debit 76 Credit 60 | 8013 – a shortage in excess of the norms of natural loss is reflected.

- Debit 20 Credit 94 | 4430 – the shortage within the limits of the norms of natural loss established by the contract is written off at cost.

We prepare and carry out inventory

The obligation to conduct an annual inventory of property and financial obligations is established by the Regulations on accounting, approved by the Ministry of Finance on July 29, 1998. No. 34n. The rules and procedure for carrying out this procedure are established by the Methodological Instructions (Order of the Ministry of Finance No. 49 of June 13, 1995), they list the composition of property and liabilities subject to audit, and the forms of documents that can be used to document the results.

The main stages of inventory are shown in the table:

| Stage | Document | Explanation |

| Preparation | Manager's order to conduct an inventory | The order indicates: the timing of the inventory, the reason for the inventory, the list of inventory property, the list of financially responsible persons and the composition of the commission |

| Carrying out | Inventory list | Members of the commission maintain an inventory (count) of property and its condition |

| Data Mapping | Collation statement | Reconciliation of the data presented in the inventory with the data in accounting. Drawing up comparison sheets to identify discrepancies. |

| Registration and approval of results | Accounting certificate | Bringing accounting data into correspondence with actual availability. Write-off of shortages or capitalization of surpluses |

Reasons for conducting an inventory, in addition to the annual obligation, may be:

- Change of financially responsible person;

- Fact of theft or damage;

- Disaster;

- Organizational reasons (change of manager, reorganization, etc.):

The results of the inventory can be:

To carry out an inventory at the enterprise, a commission consisting of at least three people is formed. Based on the results of the inventory, the commission draws up matching statements, inventory lists, acts: