Re-invoicing of electricity under an agency wiring agreement

In the header of the document we indicate the organization “Tenant” and select an agreement with the type “With the principal (principal)”.

On the “Goods and Services” tab, use the “Fill” button (fill in with those purchased under the contract). We also fill out the “Reward” tab. In addition to the postings, the document will generate two invoices: an invoice for agency fees and an invoice for electricity services reissued by the agent to the principal. Moreover, in the re-issued invoice, the organization “Energosbyt” is indicated in the seller column.

Payment for electricity wiring

Help:wow::wow: Be wiser and wiser)))). D 76 (tenant) K 60 - when re-invoicing the tenant! The amount that the tenant owes you. Including VAT. At 76.5 you should have the amount “hanging” - 105019.18 Until they pay.

Then, in order for the landlord to reimburse me for the expenses, I must submit an act for compensation of electricity, that is, the act must pass either on account 91 or 90. I think so Dt. 76.5 (tenant) Kt 91 105019.88 rubles re-invoiced electricity Dt. 51 Kt 76.5 105019.88 rubles they paid it to us

How to correctly recharge utilities to tenants

However, there is an important nuance here. If a company has included reimbursement amounts in income and expenses as part of tax accounting, it is necessary to record a permanent tax liability (PNO), as well as a permanent tax asset (PNA), in accounting. This is confirmed by PBU 18/02 “Accounting for income tax calculations”. PNA and PNO are formed due to constant differences between accounting and tax accounting.

PNO and PNA are recognized by the company in the reporting period in which they are formed. Constant liabilities are equal to the value that is the product of the constant difference of the reporting period and the income tax rate. This refers to the rate established by law and current as of the reporting date (clause 7 of PBU 18/02).

Accounting for VAT when rebilling expenses

At the same time, the Russian Ministry of Finance believes that VAT listed as part of the reimbursement of utility costs does not reduce taxable profit. And even in cases where the lessor does not allocate VAT in the amount of compensation. But this conclusion can be challenged. If VAT is not highlighted in the invoice, the lessor does not issue an invoice, and the contract does not indicate that compensation will be reimbursed with VAT, the tenant has the right to assume that he will compensate for the costs of electricity without VAT. In this case, the costs can be considered economically justified for the lessee and can be recognized for profit tax purposes.

Taking into account this position of the financial department, the tenant may have tax risks regarding income tax when including the amount of VAT in expenses that reduce taxable profit (if he applies the general taxation system), including if the amount of compensation in the documents issued by the lessor is indicated without VAT.

Topic: re-charging of electricity

Our enterprise has concluded a power supply agreement with CJSC Gorelektroset. The enterprise has a transformer substation on its balance sheet, through which other enterprises are connected. Having received an invoice from JSC Gorelektroset, we re-bille for electricity based on meter readings (meter data is taken by the chief power engineer) to all enterprises connected through us. Questions: 1. Do we have the right to re-invoice electricity? 2. What type of agreement should be concluded between our enterprise and enterprises supplied with electricity through our transformer station? 3.What kind of transactions should we use to reflect these transactions? 4. If we do not have the right to re-invoice electricity, then what ways out of this situation exist.

I have a suspicion that having a transformer station makes you a sub-supplier. Accordingly, with other enterprises you should. energy supply agreement agreed with Gorelektroset. Reflect how I buy and sell. For general provisions on this topic, see Art. 545 Civil Code. I advise you to look for something else specific in the legal framework.

Procedure for re-invoicing

No, this is unfounded.

The law does not regulate the procedure for re-invoicing. However, the legal requirements for the application of tariffs approved by the state apply only to energy supply contracts. There is no such condition for re-invoicing.

The tenant in this case acts as a third party (Article 313 of the Civil Code of the Russian Federation). Relations between the debtor and a third party are governed by agreement of the parties. Therefore, if the contract does not contain a provision for increased payment, then the scope of the tenant’s obligations is equal to the scope of the debtor’s (lessor’s) obligations.

The rationale for this position is given below in the materials of the Lawyer System.

Recommendation. Does it make sense for the landlord to include in the contract a condition that the tenant is obliged to enter into an agreement with utility services and pay for utility bills independently?

Re-invoicing of services, postings, which is our income and expense

With such, albeit incomprehensible, formulations, it should follow that the intermediary must be a subscriber

from the energy supply organization, and you are

a sub-subscriber

. Although you don’t need an agreement with the e-organization for this. To do this, an agreement is drawn up between the e-organization and the intermediary as a subscriber, and in this agreement the sub-subscriber is determined. Deal with this because this is the essence of VAT. With this determination, the intermediary subscriber must issue you a s/f.

We recommend reading: System of benefits and benefits for young families and professionals

The picture is as follows: A contract for electricity consumption has been concluded with an energy company, but the meter is ours, and energy metering goes through an intermediary company. issues electricity bills to us, we pay them directly to the Energy Company, sometimes we pay. We cannot receive bills directly from the Energy Company, because this substation belongs to the “Intermediary” and accounting must go through it.

Presentation of electricity to the subcontractor

The main argument of the tax authorities in substantiating their claims is, as a rule, a reference to the inconsistency of the agreement concluded between the parties with the provisions of civil law. In particular, the impossibility of the lessor to provide electricity, communications, etc. services. without appropriate permits and approvals. Therefore, the invoices available to the tenant, issued for these services by the landlord, do not comply with the requirements of Art. 169 of the Tax Code of the Russian Federation, since the taxpayer’s counterparty did not have the right to expose them.

We recommend reading: Are days off on sick leave included in pay?

Often, contracts for the supply of goods do not contain any separate remuneration for the seller for the services of delivering goods to buyers. Accordingly, the seller does not have a tax base for VAT. At the same time, the inspection authorities note that the funds received from the buyer to reimburse the costs of delivering the goods are associated with payment for the goods, as a result of which the supplier must include them in the VAT tax base. Judicial practice is developing in favor of intermediary companies. After all, in fact, the seller does not provide product delivery services, but only reimburses his costs.

Rebilling expenses from another organization

When considering situations related to the re-issuance of invoices, the courts indicate that the named circumstances themselves do not affect the taxpayer’s right to apply a tax deduction and Chapter 21 of the Tax Code of the Russian Federation does not provide for the refusal of a deduction for invoices re-issued to a Russian organization that is a VAT payer . In order to accept VAT for deduction, the taxpayer must register the work (services) (resolution of the Federal Antimonopoly Service of the Moscow District dated June 24, 2014 No. F05-5989/2014 in case No. A40-137020/13, the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2009 No. 12664/08 on case No. A76-24215/2007-42-106, FAS of the Ural District dated May 25, 2009 No. F09-3324/09-C3 in case No. A60-34244/2008-C10).

- such filling out of the invoice could give rise to claims from the tax authorities, for example, if the tax authority sent a request to the seller indicated in the invoice, who did not confirm the existence of an economic relationship with the final buyer, in whose interests the intermediary purchased goods (work, services);

Registration and taxation of overbilled expenses

Official structures believe that the landlord does not issue invoices to the tenant. This is due to the fact that re-listing does not imply the sale of services. That is, when receiving funds as reimbursement of the lessor's expenses, VAT is not subject to VAT. The basis is numerous letters from the Ministry of Finance.

Letter of the Ministry of Finance of Russia dated 02/07/2011 N 03-07-09/04). It should be noted that in order for the customer to accept for deduction of VAT, in addition to the available invoices issued by the supplier in the name of the customer (buyer), and copies of invoices, issued by a transport company in the name of the supplier, the remaining conditions for accepting VAT for deduction must be met, namely: - purchased goods (work, services) must be registered with the customer; - purchased goods (work, services) must be used in the customer’s taxable activities VAT. It should also be noted that due to the ambiguous position of the regulatory authorities on this issue, the risk of claims from the tax authorities cannot be completely excluded.

Representatives of the Ministry of Finance believe that VAT amounts on utility bills are not reimbursed and are not taken into account as expenses when establishing the income tax base. Basis - letter of the Ministry of Finance No. 03-03-06/1/895 dated December 27, 2007. Should the contractor (performer) pay VAT on compensation for additional costs associated with the execution of the main contract?

Rebilling utility bills to the tenant: accounting and taxes

In the ruling of the Supreme Arbitration Court of the Russian Federation dated January 29, 2008 N 18186/07, the judges stated that the amount of compensation for payment of utility bills received from the tenant is not the income of the lessor, since in this case the costs of maintaining and using the leased premises are compensated, but the costs of Payments for utilities related to the operation of the leased premises are not expenses of the owner, since they do not lead to a decrease in its economic benefits since they are compensated by the tenant.

At the same time, more recent court decisions represent the opposite opinion. Thus, the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2009 N 12664/08 states that without providing non-residential premises with electricity, water, heat, and other types of utilities, the tenant cannot exercise the right to use the rented premises necessary for him to carry out his activities. Consequently, this service is inextricably linked with the provision of rental services, and the procedure for settlements between the tenant (in this case, the company) and the landlord for these services does not matter. The deduction of VAT from the cost of utilities compensated to the landlord is legal provided that the conditions for applying tax deductions provided for by the legislation on taxes and fees are observed (see also resolutions of the Federal Antimonopoly Service of the North-Western District dated 08/24/2010 N A56-44025/2009, the Federal Antimonopoly Service of the West Siberian District dated 04/28/2010 N A45-8185/2009).

We recommend reading: Income Tax for Parents with Many Children 2019

Reimbursement of electricity costs

Thus, the money received by an entrepreneur in 2008 from the company for the provided utilities is his income from the rental of property, which is subject to reflection in tax accounting and inclusion in the object of taxation.

We recommend reading: Temporary disability benefit maximum per day in Crimea

Pathfinder, Jumped..You need to install a meter and enter into an agreement with the energy company. Which accepts payments for electricity. And pay them. But not zaku. And so your question NR Art. III clause 11. Expenses for improvement and maintenance of construction sites

Re-invoicing of reimbursable costs: how not to lose VAT deductions from end customers

Invoices received by the intermediary from the seller are registered by the intermediary in part 2 of the accounting journal, and invoices issued to subsidiaries - the final buyers of services are registered in part 1 of the invoice journal. In this case, the invoice data is not reflected in the intermediary’s purchase book and sales book (subclause “d” of clause 19 of the Rules for maintaining a purchase book used in calculations for value added tax (hereinafter referred to as the Rules for maintaining a purchase book) and clause 3 Rules for maintaining a sales book used in calculations of value added tax, approved by Resolution No. 1137).

- Section 10 of the declaration - in the case of issuing invoices when carrying out business activities in the interests of another person, in particular, on the basis of commission agreements, agency agreements or on the basis of transport expedition agreements;

How to re-invoice the services of another organization

Consequently, not 1.53 million rubles are paid to the budget, but 460 thousand rubles.

This can be a simplification, imputation or unified agricultural tax. Typically, the choice in favor of one of the preferential regimes without VAT is due to the desire to reduce the tax burden and time costs for maintaining accounting records.

Thus, the income tax rate is 20%, while the single tax under the simplified tax system is calculated at a rate of 6 or 15%, and in some regions there is a reduced rate.

Working without VAT is especially justified for small organizations, the main circle of clients of which are individuals.

These are, for example, representatives of the retail trade sector or organizations providing personal services to the population (for example, hairdressers or apartment renovations).

What are the disadvantages for the counterparty?

On the one hand, when purchasing goods from a company under a special regime, an organization using OSNO can take into account the entire amount of costs when calculating income tax.

VAT when re-invoicing expenses (Misnikovich L.)

Rebilling of utility costs by the landlord According to Art. 606 of the Civil Code, under a lease agreement, the lessor undertakes to provide the tenant with property for a fee for temporary possession and use or for temporary use.

The tenant is obliged to maintain the property in good condition, carry out routine repairs at his own expense and bear the costs of maintaining the property, unless otherwise provided by law or the lease agreement (Clause 2 of Article 616 of the Civil Code of the Russian Federation). The costs of maintaining the rented premises include, in particular, electricity costs. Based on paragraph.

1 tbsp.

539 of the Civil Code, under an energy supply agreement, the energy supplying organization undertakes to supply energy to the subscriber (consumer) through the connected network, and the subscriber undertakes to pay for the received energy, as well as to comply with the regime of its consumption stipulated in the agreement, to ensure the safe operation of the energy networks under its control and the serviceability of the devices it uses and equipment related to energy consumption.

Rebilling expenses from another organization

I receive posting 62.01/7609.

SF is included in the accounting journal. There are no sales in the book. ?6.09 closes A should B at 60. C should A at 62. In principle, there is no need to even redo anything.

Maybe you see some pitfalls in this scheme - if you have a similar principle implemented? The only caveat is that in the Federation Council from A to B they want to see the participation of organization B in some form.

Otherwise, there is no sign that this is a re-invoicing of someone else’s services, and not the provision of one’s own. Your company gives out some kind of extra.

Re-invoicing of reimbursable costs: how not to lose VAT deductions from end customers

At the same time, the parent company does not reflect these invoices in the books of purchases and sales and does not accept VAT for deduction and does not charge VAT to the budget, while subsidiaries reflect such invoices in the purchase book and accept VAT for deduction.

Starting from Q1 2020, tax authorities are conducting global electronic reconciliation of all invoices and all counterparties. If discrepancies are detected, the parties will be sent a request for clarification, and buyers may lose their VAT deduction.

The rules for filling out an invoice used in VAT calculations (hereinafter referred to as the Rules for filling out an invoice), approved (hereinafter referred to as Resolution No. 1137), provide for the procedure for issuing invoices within the framework of intermediary agreements (commission, agency).

According to this procedure, in the case of purchasing goods (work, services) on his own behalf, the commission agent (agent), when issuing invoices to the principal (principal), reflects in them the indicators of the invoices that were issued to him by the sellers of these goods (works, services) (subclause

Registration and taxation of overbilled expenses

Please also note that in this situation, your organization may have problems with deducting VAT on overbilled expenses. In accordance with paragraph 1 of Art. 171 of the Tax Code of the Russian Federation has the right to reduce the total amount of tax by established tax deductions. The procedure for applying tax deductions is established in Art.

172 of the Tax Code of the Russian Federation. Tax amounts are subject to deductions if three conditions are met: - goods (work, services) must be accepted for accounting (clause 1 of Article 172 of the Tax Code of the Russian Federation), which must be confirmed by relevant documents; - goods (work, services) must be used in activities subject to VAT or are intended for resale (clause

2 tbsp. 171 Tax Code of the Russian Federation); — the taxpayer must receive an invoice from the supplier (clause 2 of article 169, clause 1 of article 172 of the Tax Code of the Russian Federation). Thus, the organization has the right to claim VAT for deduction in the period in which all the conditions provided for in Art.

171, art. 172 of the Tax Code of the Russian Federation.

We record the invoices received from the carrier organization in the journal of received and issued invoices (clause

1, sub. "a" clause 11 section. II adj.

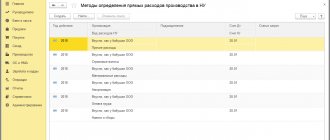

Rebilling of utilities from the landlord in 1C: Accounting 8

After completion, the document will generate postings: DT 62.01 CT 90.01.1 – amount 500 rubles. Accounting for agency fees DT 90.03 CT 68.02 – amount 76.27 rubles. VAT has been charged on the agency fee. In addition to the postings, the document will generate two invoices: an invoice for the agency fee and an invoice for electricity services reissued by the agent to the principal. Moreover, in the re-issued invoice, the organization “Energosbyt” is indicated in the seller column.

One of the options for the tenant to pay for utilities is to enter into an intermediary agreement for the landlord to purchase utilities, communication services, as well as security and cleaning services. In this case, the landlord re-issues invoices from utility organizations to the tenant, highlighting VAT amounts. In order to accept “input” VAT amounts for deduction, the landlord, acting as an intermediary between the tenant and utilities, must issue invoices on his behalf for the amount of utility payments. In addition, in accordance with the provisions of the Civil Code, the landlord is entitled to remuneration for intermediary services. Let's consider an example of registration of agency (version 2.0), accounting with the lessor.

Rebilling of utilities: tax accounting

Selections from magazines for an accountant Details Category: Selections from magazines for an accountant Published: 12/11/2014 00:00 Source: Glavbukh magazine For clarity, let’s consider the problem using a practical situation.

Rebilling of utility costs by the landlord According to Art.

The contractor entered into two agreements with the general contractor: for the provision of construction equipment and an agency agreement for the provision of electricity. The contractor then signed a subcontract agreement. And now the subcontractor uses this equipment and electricity. There are no problems with technology: the organization undertakes to provide it to the subcontractor for a fee under an agency agreement.

What about electricity?

Is it possible to draw up an agency agreement or should it be a subagency agreement? And how to arrange for rebilling of utilities?

What to follow Note that for real estate rental the same

The procedure for rebilling transportation costs to the buyer

We issue an invoice for the amount indicated in the delivery note: the cost of the goods, increased by the cost of transport services. We record it in the sales book. If the cost of transport services included in the price of the goods changes, we generate an adjustment invoice for the amount of the increase (decrease) in transport costs (paragraph 3, clause 1, article 169 of the Tax Code of the Russian Federation). There is no need to correct the old invoice.

For intermediary services, we present to the buyer a report from the intermediary indicating the amount of his remuneration (Article 999 of the Civil Code of the Russian Federation). We develop the report form independently with its mandatory approval in the accounting policy.

Repair costs

Under the simplified system, expenses include the costs of repairing both own and leased fixed assets (clause 3, clause 1, article 346.16 of the Tax Code of the Russian Federation). It turns out that after paying the corresponding expenses for repairs and their implementation, tenants can reduce the tax base under the simplified tax system (clause 2 of article 346.17 of the Tax Code of the Russian Federation) by the cost of repairs. However, there are some nuances here too.

Advice! Before making major repairs to the leased property at your own expense, and even more so before recognizing its cost as an expense, read the lease agreement once again. If it does not indicate that the responsibility for carrying out major repairs lies with the tenant, it will be very difficult to prove the validity of the costs incurred in order to take them into account under the simplified tax system.

Current and major repairs: who is responsible for what? Civil legislation clearly distinguishes between current and major repairs, therefore, the validity of accounting for its cost in expenses depends on the type of repair performed and contractual terms. So, according to Art. 616 of the Civil Code of the Russian Federation, expenses for current repairs are borne by the tenant, and for capital repairs - by the lessor, unless otherwise provided by law or agreement. Consequently, the parties themselves can determine in the lease agreement who is involved in routine repairs and who is involved in major repairs.

The Russian Ministry of Finance also agrees (Letter dated May 12, 2009 N 03-11-06/2/84) that the tenant has the right to take into account expenses incurred only if the obligation to carry out repairs is assigned to him by law or by the lease agreement. Thus, if the contract does not define the obligations of the parties to repair the leased property, the tenant has the right to reflect in expenses only the cost of current repairs, since in accordance with civil legislation the lessor must take care of major repairs (clause 1 of Article 616 of the Civil Code of the Russian Federation).

Will there be difficulties in accounting for expenses if the tenant has made major repairs instead of the landlord? Note that if the landlord does not carry out the necessary major repairs, the tenant can carry it out at his own expense and recover the cost of repairs from the landlord or offset it against the rent (clause 1 of Article 616 of the Civil Code of the Russian Federation). In this case, even if the obligation to carry out major repairs lies with the lessor, the tenant will be able to include in expenses the amount spent on repairs, since he acted in accordance with the law. However, the tenant will need to prove the economic justification of the costs incurred. We can recommend the following.

Firstly, the tenant must confirm the need for major repairs, and secondly, prove that the landlord was informed about the emergency condition of the premises (that is, it was impossible to conduct business in the rented premises without major repairs), but refused to repair it.

Note. Accounting for expenses in such a situation, as well as the procedure for reflecting inseparable improvements to rental property will be discussed in detail in one of the following issues.

Regardless of whether the cost of repairs is taken into account in expenses or not, the amount reimbursed by the lessor must be reflected by the tenant in non-operating income taken into account in the tax base under the simplified tax system (clause 1 of Article 346.15 and clause 3 of Article 250 of the Tax Code of the Russian Federation).

The parties may agree that the cost of major repairs made and paid by the tenant will reduce the rent. Then such a condition must be stated in the lease agreement (or in an additional agreement to it). Since in this case we are talking about a reduction in the contract price, rent is included in expenses under the simplified tax system only in the amount actually transferred to the lessor (that is, minus repair costs, which, if all necessary conditions are met, will be taken into account as a separate line). There is no taxable income under this option (unlike the situation when the tenant’s costs for major repairs are reimbursed by the landlord).

Advice! When using the simplified tax system with the object “income,” you should avoid a situation in which the tenant bears expenses and the landlord reimburses them. This is extremely unprofitable, since you will have to pay additional tax (on the amount of non-operating income generated).

Example 1. Phoenix LLC, which uses the simplified tax system with the object of taxation “income minus expenses,” rents premises for a warehouse for storing goods from Chryzolit LLC, which is not a VAT payer. The lease agreement specifies the following terms:

- rent in the amount of 125,000 rubles. transferred no later than the 12th day of the current month;

- the responsibility for carrying out routine repairs of the premises lies with the tenant;

- The responsibility for carrying out major repairs lies with the lessor.

The rent for December 2010, equal to 125,000 rubles, was transferred on December 6.

At the beginning of January 2011, the roof of the warehouse leaked, as a result of which the goods stored there were damaged. The expert commission called confirmed that the roof was in disrepair and required major repairs. The society informed the landlord about the need for major repairs, but he refused to take any action, asking Phoenix LLC to solve this problem on its own. As a result, the roof was repaired by a third party contracted by Phoenix LLC. The cost of the work was 118,000 rubles. (including VAT - 18,000 rubles). The repairs were paid for on January 11, and a certificate of completion was signed on the same day.

Chryzolit LLC decided to reduce the rent for January 2011 for the cost of major repairs of the premises carried out by the tenant, and an additional agreement to the contract was signed. Accordingly, the rent for January 2011 was transferred on January 12 in the amount of 7,000 rubles. (RUB 125,000 - RUB 118,000). We will reflect the completed business transactions in the tax accounting of Phoenix LLC.

Under the simplified system, expenses are recognized after payment and implementation (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). This means that Phoenix LLC has the right to include December rent in the amount of 125,000 rubles in expenses on December 31, 2010. Rent for January was transferred on January 12, 2011; it can be taken into account in expenses only on the last day of the month - January 31. In this case, the tax base can be reduced only by the amount actually transferred to the landlord (minus repair costs), that is, by 7,000 rubles.

Now about expenses in the form of the cost of major repairs. According to paragraphs. 3 p. 1 art. 346.16 of the Tax Code of the Russian Federation, the simplified tax system recognizes the costs of any type of repair of fixed assets, including leased ones. In this case, all expenses must be justified (clause 2 of Article 346.16 and clause 1 of Article 252 of the Tax Code of the Russian Federation). According to the lease agreement, Phoenix LLC is obliged to carry out only routine repairs at its own expense. However, there was a need for a major renovation of the premises, but the landlord refused to carry it out on his own. Since, due to the emergency condition of the roof, Phoenix LLC could not continue to store goods in the rented premises, the company had to carry out major repairs to avoid further losses. For these reasons, the costs of major repairs are justified for the tenant. And after payment and signing of the work completion certificate, that is, on January 11, Phoenix LLC has the right to take into account the cost of repairs without VAT in the tax base - 100,000 rubles. (118,000 rubles - 18,000 rubles) and a separate line for “input” VAT - 18,000 rubles.

Note. VAT, included in the cost of goods, materials, works and services, is reflected in expenses separately in accordance with paragraphs. 8 clause 1 art. 346.16 Tax Code of the Russian Federation.

Please note that in order to confirm the validity of the expenses, the company must have the conclusion of the expert commission on the emergency condition of the roof of the premises, as well as documents indicating that Chrysolite LLC was informed, but refused to carry out major repairs.

Situation. If the tenant personally pays utilities

Sometimes tenants pay for utilities themselves, transferring funds to the accounts of service companies. In paragraphs 5 p. 1 art. 346.16 of the Tax Code of the Russian Federation indicates material costs, the composition of which is determined in accordance with Art. 254 of the Tax Code of the Russian Federation (clause 2 of Article 346.16 of the Tax Code of the Russian Federation). In paragraphs 5 p. 1 art. 254 of the Tax Code of the Russian Federation mentions the costs of heating the building, as well as the purchase of fuel, water and all types of energy used for technological purposes. This means that utility bills can be included in expenses.

However, we should not forget that under the simplified tax system only justified and documented costs are recognized (clause 2 of article 346.16 and clause 1 of article 252 of the Tax Code of the Russian Federation). Therefore, the tenant who transfers utility payments to service companies must enter into appropriate agreements with them and ensure that the bills are issued in his name. Otherwise, it is impossible to reduce the tax base for these expenses, since the necessary supporting documents are missing.

If the relevant agreements have been concluded with the landlord and it is impossible to re-issue the documents, we advise tenants not to take risks and transfer utility payments to the landlord using one of the methods discussed in the article.

Re-wiring Electricity

2 tbsp. 539 of the Civil Code of the Russian Federation). As a rule, the tenant is not the owner of the heating and power networks, and he does not have the appropriate equipment to obtain energy, fuel, and water. The likelihood of signing an agreement with the tenant is low.

The procedure for accounting and taxation of the tenant's utility expenses depends on how exactly payment for these services is made. In practice, a tenant can pay for utilities in different ways:

We recommend reading: Allowance for moving to a clean zone

How to re-invoice costs incurred for another organization

And there are so many forms of this reporting that it’s not surprising to get confused in them.

To help respondents, Rosstat has developed a special service. using which you can determine what statistical reporting needs to be submitted to a specific respondent. However, unfortunately, this service does not always work correctly.

The Federal Tax Service has approved a new procedure for obtaining a deferment (installment plan) for payments to the budget.

- Polukhina Marina | Head of the Department of Methodology and Consulting of CJSC “Delovoy Profile”, full member of the Chamber of Tax Consultants of Russia and the IPB of the Moscow region, Doctor of Economics.

In practice, companies that have entered into a lease agreement constantly have questions about the payment procedure, as well as tax and accounting for utility payments.

Moreover, the issue is acute for both the landlord and the tenant in tax and accounting. According to the terms of the contracts, the delivery of goods is carried out by the supplier, but at the expense of the buyer.

The supplier does not have his own transport and uses the services of transport companies.

Re-billing of transport services

Rebilling of services is a methodologically and legally complex issue, since the legislation does not directly use such terminology. This issue becomes even more complicated when a VAT tax base arises. At the moment, 1C:UPP 1.3 does not implement accounting for agency services.

If they do not find this in the taxpayer’s records, they will definitely charge additional VAT on the cost of the transport tariff. The inspectors will most likely not take into account the amount of tax due for deduction, since the right to apply a tax deduction is granted to the taxpayer (clause 1 of Article 171 of the Tax Code of the Russian Federation). But he didn’t use it at that time.

How to re-bille services are recognized as income

Rules for filling out an invoice when purchasing services by an intermediary on its own behalf and re-issuing invoices to the final buyer of services; in line 2 of the invoice, the full or abbreviated name of the seller of services, and not the intermediary, is indicated. But keep in mind that the simplest option, which is recommended by many, is to record all services with VAT with the document “Receipt of goods and services” (recorded in the purchase book), then enter “Sales of goods and services” with VAT (recorded in the sales book) and do “Debt adjustment” is not entirely correct. More precisely, it is true for the organization itself, but the counterparty to whom “Sale of goods and services” is issued may have problems, since they purchase services from an organization that does not have the right to sell services, for example, utilities. The type of activity the organization has is not the same. In this case, the counterparty does not have the right to submit VAT on the purchased service for reimbursement.

VAT is imposed on transactions involving the sale of goods (work, services) on the territory of Russia (Clause 1, Article 146 of the Tax Code of the Russian Federation). At the same time, the tax base increases by all amounts associated with payment for goods, works, and services sold (subclause 2, clause 1, article 162 of the Tax Code of the Russian Federation). In this regard, compensation for additional costs (for example, travel or transportation expenses) incurred during the execution of the contract, which the customer pays to the contractor, should be included in the VAT tax base. As a rule, the contract stipulates the tenant’s obligation to compensate for the services of the landlord. That is, the person must deduct funds in excess of the established rent.

Re-billing for electricity payments

If there is no agreement between the network and the developer, then the developer will not receive permission to build, much less to put the house into operation. And he will wait for the Network Company to build this substation and provide a connection point there.

I can "describe". The developer does not rent out the networks. But electricity is supplied by the electricity supply organization. They “only” need to fulfill the requirements of the network company, expressed in the terms of connection, and hand over the networks. After which they will be happy and will not need to compensate for losses.

Utility Accounting and Taxation

The lessor is a subscriber of the resource supplying organization; he does not produce utilities, but purchases them. Transferring part of the expenses to the tenant in the form of compensation is not the sale of services, and, therefore, such an operation is not subject to VAT taxation.

- the tenant has no right to a deduction (for example, Resolution of the Federal Antimonopoly Service of the East Siberian District dated October 30, 2008 No. A10-845/08-F02-5264/08)

- the tenant can use his right to deduction based on an invoice from the lessor (for example, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated February 25, 2009 No. 12664/08)

Reflection in 1C Electricity Payment Accounting

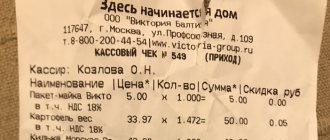

The document is generated in the menu section, which contains all documents related to banking and cash transactions. To enter a debit based on a bank statement, click the button of the same name and select the type of transaction such as payment to the supplier. Next, you need to fill out the document taking into account the following notes:

The usual procedure for paying energy company bills is prepayment, which is usually provided for in the contract. The supplier submits a payment request, the buyer of electricity accepts it, and notifies the bank where the service is served. After this, the bank debits the required amount from the buyer’s current account and transfers it to the supplier’s details specified in the payment request.