Order to transfer property to another organization

5. Establish that the preferential sale of state-owned shares of the Company to employees of the Organization and persons equivalent to them is carried out in accordance with the legislation of the Republic of Belarus within 5 months from the date of state registration of shares, but no more than 8 months from the date of the constituent meeting to create the Company. transfer of state property to the authorized capital of an open joint-stock company created in the process of privatization of republican property __________________________________________ (name of the organization being transformed) with the participation of a founder(s) other than the state ___________________________ (name of another(them), __________________________________________ other than the state, founder( her) In turn, the official website also contains the specified information about the notification by the bailiff body of the Federation of a certain region.

From the date of transfer of the seized property, its complete sale must be carried out within two months. Selected legal entities and individuals, through auctions in the relevant region, can purchase the property of the debtor. The order to transfer the defaulter's property for sale, which is issued by the bailiff in court, is the main factor allowing the commencement of proceedings for the sale of confiscated property. According to the resolution, before the start of the sale of property that was confiscated from the debtor, a special expert assessment is carried out.

For this purpose, both public and private property experts can be used. Property assessment is mandatory.

if its role is played by securities that are not subject to sale on a securities exchange, any real estate, jewelry and metals, foreign and national currency, collectibles, property rights, antiques of historical or artistic importance, any property the value of which may exceed thirty thousand rubles.

Why is transfer of cases necessary?

Transferring cases under the act to a successor is a good way to distinguish between time periods when responsibility for the correct completion of documentation and safety of assets lies with the person being dismissed, and when with the newly hired person.

Before drawing up the act, the commission carries out an inspection and inventory. Their results are reflected in the final document, which makes it possible to accurately identify the amount of work performed by the employee.

To start the process of transferring job functions from a dismissed employee to his successor, the head of the enterprise issues an order on the transfer of affairs upon dismissal. This document confirms the fact that the leaving specialist transferred documentation and material assets; the company has no claims against him. We list the essential elements of the order:

Articles on the topic (click to view)

- What to do and where to go if you are not paid upon dismissal

- What to do if you are laid off at work

- What to do if the employer does not want to fire at his own request

- What to do if the date of the dismissal order is later than the date of dismissal

- What to do if the employer does not give the work book after dismissal

- What to do if you didn’t work officially, you were fired, you didn’t get paid

- What is the employer obliged to give the employee on the day of dismissal?

- Date of preparation;

- place of publication;

- registration number of the form;

- listing of positions and full names. responsible persons;

- the essence of the order, the motives for initiating the inspection;

- director's signature and company seal.

The procedure for transferring cases allows you to solve the following problems:

- ensuring continuity of work in all segments;

- checking for the presence of all necessary documentation;

- analysis of the quality of work activity of the dismissed employee;

- assessment of the volume of upcoming work of a newly hired specialist.

Order accepting transfer of property

Contents > Accounting > Non-current assets > Fixed assets > Disposal > How to correctly document the movement of fixed assets within an organization - sample documents for internal transfer Fixed assets represent some part of the organization’s property that is used in the process of work. They have a certain period of use, cost and others characteristics. At an enterprise, situations may arise in which the movement of funds within the organization occurs. The internal transfer of fixed assets requires compliance with special rules and appropriate documentation. The decision on the need for internal movement of fixed assets within one owner can only be made by the management of the enterprise.

In turn, the management of the department into which the funds fall has the right to distribute them within the association. The following circumstances can be considered the main reasons for the internal movement of operating systems:

- the need for repairs, reconstruction or modernization;

- the need to transfer OS objects to another department.

- the need to transfer fixed assets to a subsidiary (branch), for which a separate balance sheet is allocated;

A financially responsible person is considered to be a working citizen whose professional activity involves interaction with the company’s property. The employee is responsible for its safety, damage and condition, and in case of problems, compensates the employer for the damage caused. In order to transfer the property under the responsibility of another financially responsible person a person needs to carry out several actions. First of all, you need to take an inventory. In this case, there are several of them - about changing the materially responsible

Order on gratuitous transfer of property sample

Contents Based on whether the organization receives or donates an asset, a different algorithm for carrying out such operations is assumed.

The results of the procedure are properly documented. During the event, the exact quantity of fixed assets and their main characteristics, including condition, are determined. Next comes the execution of contracts.

A budget-type organization has its own nuances for accounting for fixed assets transferred free of charge to another organization, and commercial-type institutions have their own. Be sure to check that the following conditions are met:

- Use in an area whose task is to generate economic profit.

- Long term of use - from 365 days or more.

- The recovered asset is not going to be resold within the next year.

The process of transferring OS free of charge to another organization includes the following steps:

- Reflection of necessary entries in accounting.

- Drawing up a transfer and acceptance certificate.

- Signing an agreement on gratuitous transfer (donation).

- Entering information into the OS inventory card.

- Creation of a commission.

When transferring a fixed asset item free of charge to another organization, you need to start by drawing up primary accounting documentation containing the required details.

Yes, the gratuitous transfer of a fixed asset is not prohibited, but if gratuitous property has been received, you should first make sure that this object can actually be capitalized as a fixed asset.

The basis on which the act is drawn up is technical documents for fixed assets, as well as accounting information (for example, thanks to turnover in account 02 “Depreciation of fixed assets”, it is possible to fill in information about the amount of accumulated depreciation). The execution of the transfer and acceptance certificate must include two copies - one of them must be received by the receiving party.

When drawing up an act, you need to leave free the column about information about fixed assets on the day of acceptance for accounting.

This section is filled out by the recipient in his document. Each copy of the document must be signed and approved by both the donor and the donee. The act must consist of:

- The number and day on which the document was drawn up.

Sample order for transfer of fixed assets to another institution

» Tax law Fixed assets represent some part of the organization’s property that is used in the course of work.

They have a certain period of use, cost and other characteristics. At an enterprise, situations may arise in which funds are moved within the organization. Performing internal transfer of OS objects requires compliance with special rules and appropriate documentation.

The decision on the need for internal movement of fixed assets within one owner can only be made by the management of the enterprise.

Important! Funds can move between structural divisions, workshops, areas, etc. In turn, the management of the department into which the funds fall has the right to distribute them within the association.

The following circumstances can be considered the main reasons for the internal movement of operating systems:

- the need to transfer fixed assets to a subsidiary (branch), for which a separate balance sheet is allocated;

- the need to transfer OS objects to another department.

- the need for repairs, reconstruction or modernization;

A financially responsible person is considered to be a working citizen whose professional activity involves interaction with company property.

The employee is responsible for its safety, damage and condition, and in case of problems, he compensates the employer for the damage caused.

In order to transfer property under the responsibility of another financially responsible person, it is necessary to carry out several actions. First of all, you need to take an inventory. The results of the procedure are properly documented.

During the event, the exact quantity of fixed assets and their main characteristics, including condition, are determined.

Both material persons—current and future—as well as members of a specially created commission take part in the inventory. Next comes the execution of contracts.

Documentation of inventory of fixed assets

In general, the inventory procedure is as follows:

- approval of the inventory commission, deadline, basis for inventory (documentation - order of the manager);

- determining the availability of OS (including identifying the names of OS, their quantity, numbers, cost, possibility of using for their intended purpose). In the process of inventorying fixed assets, an inventory of INV-1 is compiled;

- reconciliation of information obtained as a result of the above actions with accounting data (documentary execution - statement INV-18).

If during the reconciliation discrepancies were identified in accounting (in amounts, number of fixed assets, etc.), they must be eliminated.

The inventory should reflect correct data about the fixed assets, regardless of how exactly these data were reflected in accounting.

If, as a result of the inventory, a fixed asset is identified that was not taken into account earlier, then it should also be included in the inventory.

When assessing fixed assets, you should be guided by market prices.

If OSs are identified that cannot be used for their intended purpose, their own inventory is drawn up to record them, indicating the commission’s conclusions about their unsuitability.

Rented operating systems are also subject to inventory. Its results are recorded in a separate inventory. The issuance of a separate order for the inventory of leased fixed assets is not required, because such an inventory is carried out simultaneously with a check of all operating systems in the organization.

Before proceeding with the reconciliation of the property present in the company or individual entrepreneur (fixed assets, inventory, intangible assets or inventories) and the data recorded in its accounting database, an appropriate order should be generated.

IMPORTANT! If you use a self-developed form, it is recommended to reflect in it all the same indicators that the unified form contains, including: the personal composition of the inventory commission, the content, volume, procedure and timing of the inventory.

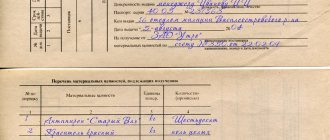

When changing the person in charge, in addition to the inventory act, it is necessary to draw up an act of acceptance and transfer of property.

This document contains a list of all valuables under the responsibility of the rotating employee, their accounting quantity, purchase price and market value. In addition, the act must display the details of the acceptance and delivery of the registered property and the date when the presence of the valuables was confirmed.

The transfer and acceptance certificate can be drawn up on the basis of inventory documents. There is no legally defined form for this document, so it is drawn up freely, taking into account the above nuances.

This document releases the responsible person from his current position, followed by the conclusion of an agreement with another employee.

An important nuance: the procedure for accepting and transferring recorded values should be completed before the dismissal or appointment of the previous responsible person to another position, since this is the only way to resolve any disagreements that arise immediately, without lengthy proceedings.

Thus, changing the financially responsible person is a process that is possible only after an inventory has been taken, the procedure for which is defined at the legislative level. Based on the results of the inspection, an act of acceptance and transfer of property is drawn up, dismissing the materially responsible person from office.

We invite you to familiarize yourself with: Sample order to change working conditions

Only after this the manager has the right to conclude an agreement with another employee, issuing an Order to change the materially responsible person according to the standard form of administrative documentation.

An inventory order (2020 sample) is usually drawn up by order of the manager on a scheduled or unscheduled basis. The person responsible for this is the chief accountant or another accounting employee, and if he is ill or absent, a person authorized to maintain accounting records.

Inventory is required in several cases (clause 27 of the Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n):

- before preparing annual reports;

- when changing financially responsible persons, including those associated with the transfer of property to third parties;

- after emergency situations - fires, floods, other disasters;

- upon detection of theft or damage to property.

Migration rights

Order to transfer property to another organization

Sample order to change the financially responsible person

- 3.1 Transfer of fixed assets from one pier to another order sample

- 2.1 Certificate of acceptance and transfer of material assets

- 1.1 How to transfer to another financially responsible person within the same owner?

The process of collecting shortages of property

If, based on the results of the inventory, it is discovered that some material assets are missing, the shortage may be recovered from the person responsible for their safety. In general, this procedure is performed in the following order:

- First of all, an order is issued to conduct an inventory of a specific area. In this case, an inspection commission must be formed.

- Then the inventory procedure itself is implemented, in which the financially responsible person also takes part.

- If discrepancies are identified, written explanations are taken from the relevant employee about the reasons for the shortage. If he refuses to do this, then a corresponding act is prepared.

- An internal investigation is being conducted into the absence of the required volume of inventory items. A special commission is being created for this purpose. During this procedure, the perpetrators whose unlawful actions led to the shortage are identified.

- The final stage is the issuance of an official order from the manager to recover damages caused by the fault of the financially responsible person. This must be done within a month from the moment the full amount of damage caused is determined.

The culprit must be familiarized with the order against signature. The established amount can be withheld from the employee’s salary (if it does not exceed the average monthly salary) or paid to him separately.

When implementing the procedure for collecting shortfalls, the employer should remember the rules prescribed in Art. 248 Labor Code of the Russian Federation. Otherwise, the employee will be able to appeal this decision in court.

Thus, the fact of transfer of inventory items in connection with the dismissal of a financially responsible person must be carried out on the basis of an order from the head of the organization. There is no single sample of such a document. Each business entity develops its standard form independently.

Order on transfer of fixed assets

» News Formation of an order to change the financially responsible person is necessary in cases where the organization needs to shift financial responsibility for the property of the enterprise from one employee to another. FILESDownload a blank form for an order to change the materially responsible person .doc order to change the materially responsible person .doc Materially responsible can be company employees occupying completely different positions in the staffing table.

These include:

- storekeepers, etc.

- accountants;

- caretakers;

- drivers;

In other words, all those who work with the financial flows of the enterprise, have at their disposal and use in their work inventory assets that are the property of the organization, become financially responsible persons. Financial responsibility does not automatically pass to employees: to assign it, as well as to transfer it from one employee to another, appropriate orders are issued.

Any employee of the enterprise can be appointed as a responsible person from a financial point of view, with the exception of those who have previously been convicted of crimes related to robbery, theft, embezzlement and official abuse. The reason for changing the financially responsible person can be a variety of circumstances:

- other unfavorable factors.

- employee going on long-term sick leave;

- dismissal;

- improper handling of entrusted property, its damage, damage, premature wear;

- going on a business trip or vacation;

The standard form of an order to change a financially responsible employee is not currently established at the legislative level.

That is, enterprise employees can write a document based on their own ideas about it and guided by the needs of the organization.

The only thing that is important to consider is that the structure, composition and style of the order comply with the norms of administrative documentation.

Accounting and registration of an order to change the materially responsible person

Administrative acts issued by enterprises, which include an order to change the financially responsible person, are subject to mandatory accounting.

To do this, information about their publication must be recorded in a special document - a journal (as a rule, it is kept either by the secretary or another responsible employee). Here it is enough to enter the name and number of the order, the date of its issue. If necessary, this data will help not only prove the fact that the order was created, but also quickly and easily find it

Sample order for the transfer of fixed assets free of charge to another institution

» Banking law The only thing that is important to take into account is that the structure, composition and style of the order comply with the norms of administrative documentation.

In addition, if the company has its own document template, developed and approved by management, then when creating all other orders, you need to focus on it. If necessary, it is photocopied and all additional copies are properly certified and transferred to the destination (for example, to the heads of the structural divisions of the enterprise).

All orders issued within the organization always come on behalf of the highest official - the director (or an employee temporarily performing his functions). The act of acceptance and transfer of fixed assets, form No. OS-1 (approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7) is used primarily for registration and accounting of transactions of acceptance and transfer of fixed assets between organizations or acceptance (commissioning) operations. created fixed asset object.

When changing the MOL, the object is not disposed of from the fixed assets or is re-included in the fixed assets and put into operation. If you follow the Guidelines for the use of unified forms, strictly speaking, it is also not correct to use the Invoice for the internal movement of fixed assets, form OS-2, since this document is intended for registration and accounting of the movement of fixed assets within an organization from one structural unit to another, and when changing the MOL, the property itself does not move anywhere, it remains in the same departments, areas, etc.

2. When transferring OS to government and local governments, state and municipal institutions, state and municipal unitary enterprises.

If the assets were not received from institutions of the budget system, then you should pay attention to whether they came as a donation or under a gift agreement.

Because in accordance with sub. 1 item 2 art. Termination (consolidation) of the right to operational management of material reserves upon their transfer (receipt) 0 401 20 241 0 105 xx 440 0 105 xx 340 0 401 10 180 0 210 06 660 Autonomous institutions Deregistration (acceptance for accounting) of an object of fixed assets as previously generated value received (transferred) from state (municipal) institutions: - on the book value of the fixed asset; 0 401 20 241 0 101 xx 000 0 101 xx 000 0 401 10 180 - for the amount of accrued depreciation 0 104 xx 000 0 401 20 241 0 401 10 180 0 104 xx 000 Termination (assignment) of the right to operational management of inventories ami when transferring them ( receiving) 0 401 20 241 0 105 xx 000 0 105 xx 000 0 401 10 180 Example 1.

Drawing up an order to change the materially responsible person

As for the design, the drafters of the order are also free to choose: make it handwritten or printed. Only in the second case the order must be printed. For printing, both a simple sheet of paper and a form with the details and company logo printed on it are suitable.

The order is made in one original copy . If necessary, it is photocopied and all additional copies are properly certified and transferred to the destination (for example, to the heads of the structural divisions of the enterprise).

Order to transfer fixed assets to another legal entity

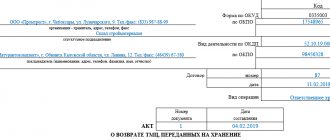

» Criminal procedural law STATE UNITARY ENTERPRISE on the transfer and acceptance of material assets in connection with vacation from “___”______________2009 No. ___ In connection with the departure of the storekeeper T.I. Solnyshkina on another vacation, 1.

By 06/09/2009, transfer to the storekeeper T.I. Solnyshkina, personnel number 4019, and to the head of the administrative and economic department S.Yu. Olkhovich, personnel number 5006, to accept the inventory items listed in the report of the storekeeper T. Solnyshkina. AND. Create a commission for the acceptance and transfer of material assets, consisting of: Anna Nikolaevna Logvinova – OMTO engineer; Bychkov Mikhail Andreevich – accountant. 3. The acceptance certificate must be submitted to me for approval on June 09, 2009.

| Quantity 3 | Average score 3 Carry out the transfer of warehouse documentation and inventory items from storekeeper I.P. Smirnov. warehouse manager V.I. Kornilov 3. To carry out the acceptance and transfer of documentation and conduct an inventory of inventory items, create a commission consisting of: chairman - commercial director V.A. Orlov.

members of the commission: warehouse manager V.I. Kornilov storekeeper Smirnov I.P. storekeeper Voronin A.N. accountant Valyaeva N.S. 4. The results of the acceptance and transfer of accounting warehouse documentation and inventory of inventory items should be formalized in an act with an inventory list attached and submitted for signature to the General Director on February 16, 2006.

General Director SIGNATURE A.A. Khmelevsky You can also report violation of labor discipline. At the same time, an educational institution can act not only as a receiving party, but also as a transmitting party. How is the transfer and acceptance process carried out?

What documents should be used to document these transactions? How to reflect the receipt and transfer of property in accounting?

How to calculate depreciation on an incoming fixed asset? You will find answers to these and other questions in our article.

Legality of transfer of property Sample order to change the financially responsible person Transfer of affairs when changing the chief accountant What to do if your chief accountant quits or, for example, goes on maternity leave?

Cases of transfer of responsibility when changing employees' positions

The employer requires the transfer of material assets from one employee to another, if this is provided for by their positions. Positions that may be held by employees from whom this procedure is required:

- Director.

- Chief Accountant.

- HR department employee.

- Department head.

- An employee who bears financial responsibility (for example, chief cashier, warehouse manager).

The reason for changing the financially responsible person may be:

- Dismissal.

- Long-term sick leave care.

- Going on a business trip or going on vacation.

- The previous employee failed in his duties.

The act of acceptance and transfer of affairs allows you to remove the responsibility of the new employee for the actions of his predecessor. The head of the organization must organize the inspection and create conditions for its conduct. The procedure takes place after the order is issued. The act is drawn up by its parties. The procedure and form of the act are not regulated by law. The document is drawn up in any form on an A4 sheet. Usually it takes the form of an accounting inventory of documents.

Data indicated in the document:

- Date and place of compilation.

- Details of the order on the basis of which cases are transferred.

- Name of company.

- Full name and position of the parties to the procedure.

- List of transferred cases.

- Detected errors in accounting and reporting.

- Information about trial witnesses.

An order establishing the procedure for changing a person to whom the employer imposes measures of financial responsibility for the safety of the property entrusted to him is issued in the following situations:

- in case of termination of employment relations with an employee who bears property liability (regardless of the reasons for dismissal);

- when the employee is undergoing long-term treatment;

- when a materially responsible person exercises his right to legal rest of a specified duration (the order is drawn up before the employee goes on vacation);

- when an employee goes on a business trip;

- in case of improper handling of entrusted property (usually when it comes to premature wear, damage, deterioration or loss).

The determining factor is that the employee cannot perform functions related to ensuring the safety of material assets.