Balance sheet form 1 – form 2020

The current balance sheet form, Form 1, was approved in Order of the Ministry of Finance No. 66n dated 07/02/10. Data on the assets and liabilities of the enterprise as of the reporting dates of the current period and the two previous ones are entered into this form. You can download the current 2020 balance sheet form in Word or Excel format (with or without codes).

If you analyze Form 1 of the financial statements, it becomes clear that all assets and liabilities in the balance sheet are divided into short-term and long-term. In this case, the first ones include those objects whose repayment period (circulation) does not exceed 12 months, the second ones – those exceeding 12 months. This requirement for data reflection is the same for all organizations, regardless of legal form and field of activity.

How to fill out your balance

When filling out form No. 1, you should be guided by section 4 of the order of the Ministry of Finance of the Russian Federation dated 07/06/1999 No. 43n (as amended on 11/08/2010). Let's define the key rules for filling out the reporting document:

- fill out the report indicators in accordance with the actual account balances as of the reporting date, formed taking into account the requirements of PBU and the company’s accounting policies;

- reflect the indicators in monetary terms in the currency of the Russian Federation - in rubles, in thousands of rubles or in millions of rubles;

- Transactions made in foreign currency are recalculated at the exchange rate established on the day of the transaction;

- if a company has a branch network, then at the end of the year a single balance sheet should be formed (parent company plus branches);

- include indicators that exist for no more than 12 months as short-term assets and liabilities, and indicators that exist for more than one year as long-term assets;

- property and fixed assets should be reflected at “net” value, that is, taking into account depreciation and other costs provided for by PBU.

We offer a simple cheat sheet for filling out form No. 1.

Accounting statements - form

Many accountants are concerned about the question: Is a new Form 1 balance sheet expected in 2020 or not? The concern is quite understandable, because in the near future legal entities need to report for 2020. The general deadline for filing financial statements is set until March 31st; filing a document for 2020 is required until 04/01/2019 inclusive.

We hasten to reassure you: the forms of financial statements have not been adjusted since 2011. Since the entry into force of Order No. 66n, no changes to these forms have been made. This means that in 2018 you can use the balance sheet form with or without line codes as amended in 2011. The organization has the right to determine the order of detailing the indicators independently, taking into account the degree of materiality of the information. The encoding is given according to gr. 3 in accordance with the requirements of Appendix No. 4 to Order No. 66n.

Note! SE entities (small businesses) have the right to draw up simplified Form 1 based on accounting data. The corresponding form in Word for the balance sheet is approved in Appendix No. 5 to Order No. 66n.

When and where to submit reports

For 2020, financial statements in Form No. 1 must be submitted to several organizations at once: the Federal Tax Service and Rosstat - for all organizations and individual entrepreneurs, to the Ministry of Justice and (or) to the Ministry of Finance of Russia - for non-profit organizations and public sector employees. Upon additional request, accounting records can be requested by the founder or owners of the company.

The balance sheet must be submitted to the Tax Inspectorate and Rosstat for 2020 no later than 90 calendar days from the first day of the year following the reporting period. That is, no later than 03/31/2019. However, in 2019, March 31st falls on a weekend, therefore, the transfer rule applies. This means that the deadline for submitting the balance sheet for 2020 is 04/01/2019.

For public sector organizations, other reporting deadlines may be set earlier. This information is communicated to institutions in the prescribed manner.

Regulations for filling out a balance sheet form with line codes

Regulatory rules for entering data are defined in Order of the Ministry of Finance of the Russian Federation No. 43n dated 07/06/99 (as amended on 01/29/18). Here are the general requirements for filling out accounting reports, the composition of accounting reports and the rules for creating a balance sheet. When reflecting data in Form 1, remember that:

- Reporting is completed based on reliable information.

- Accounting forms must reflect information about the enterprise as a whole, including separate divisions.

- Data should be entered sequentially, that is, according to the accepted methodology from the first period to subsequent ones.

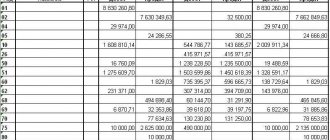

- Digital indicators must be indicated for the current reporting date and the two previous ones. If necessary, adjustments are made.

- The indicators are detailed taking into account the degree of significance of the information for users. Rows with missing data are crossed out or not included.

- The reporting year is a calendar year – from January 1 to December 31. Reporting date – the last day (calendar) of the reporting year.

- For newly registered companies, the first reporting year is the period from the date of establishment of the company to December 31st. If the company is officially registered after 01.10, until December 31 of the next calendar year.

- Accounting forms are filled out in Russian, only in domestic currency, that is, in rubles (thousands or millions), and signed by the director and chief accountant of the legal entity.

- The balance sheet of any enterprise includes 2 sections - assets and liabilities, the sum of the results of each must be equal to each other.

- The asset (sections 1, 2) reflects accounting information on the residual value of the organization's fixed assets, profitable and financial investments, inventories, VAT, receivables and cash in hand, on settlement and foreign currency accounts, as well as other data.

- The liability (sections 3-5) reflects accounting information on authorized, reserve and additional capital, financial results, borrowed obligations, accounts payable, deferred income, future reserves, etc.

- Information in the balance sheet is entered from the company's general ledger.

- Some lines of the balance sheet reflect information from several accounts at once. In this case, additional explanations are provided separately.

- The title of the form indicates the name of the subject, its legal form, TIN, OKPO, OKVED codes, and the unit of measurement used (million rubles or thousand rubles).

- If the enterprise is small, it has the right to fill out accounting forms in a simplified form. At the same time, there is no detailing of articles; indicators are combined by aggregated elements.

Accounting statements - adjustments after the reporting date

Balance Sheet Structure

The balance sheet (F-1) consists of assets and liabilities, including sections, in each of which there are lines containing data on certain types of property or liabilities.

The asset includes 2 sections:

I. Non-current assets

It contains information about fixed assets, intangible assets, R&D, long-term financial investments, i.e., about property that cannot be sold quickly.

II. Current assets

These are the so-called short-term (easily realizable) assets: inventories, accounts receivable with a maturity of up to 1 year, short-term financial investments, cash.

The passive has 3 sections:

III. Capital and reserves

It reflects information about the organization’s capital (authorized, reserve, additional) and retained earnings (uncovered loss).

IV. long term duties

These are obligations with a maturity of more than 12 months (borrowed, assessed, deferred).

V. Current liabilities

This section provides information on liabilities with a maturity of less than a year, including borrowed funds, accounts payable, estimated and other liabilities.

For more information about some of the nuances that require consideration when filling out individual balance lines, read this material.

Other forms of accounting

In addition to the balance sheet form, Form 2 is filled out based on the financial results for the reporting period. Previously, in accounting, Form 2 was called the “Profit and Loss Statement.” Then the name changed, but the general essence remained the same.

Form 2 of financial statements - form

The current form of Form 2 is approved in Appendix No. 1 to Order No. 66n. Here you enter data on the enterprise’s revenue, cost, administrative and commercial expenses, other income and expenses, interest payable and received, the company’s income from participation in other business, as well as profit. Information about profit is provided by its type - gross, from sales, before tax, as well as net. The information is filled in as of 2 dates – for the current year and the previous one.

Form 5 of financial statements - form

Along with the balance sheet and financial results report, legal entities are required to draw up other financial reporting forms. All forms are approved in Order No. 66n. If the company is a small business, it is allowed to submit only f. to the control authorities. 1 and 2. Otherwise, you will have to prepare all the required reports.

Form 5 is currently not included in accounting. Previously, this form meant an explanatory note. Out of habit, even today, some accountants call this the explanations for the balance sheet and financial results report. This document reflects accounting data on fixed assets, intangible assets, and material resources of the enterprise; on financial investments; accounts payable and receivable; on production costs; volume of state aid; the company's estimated obligations and to secure obligations.

Conclusion - in this article we figured out where in Word the balance sheet, form 1. In 2020, a report is in force according to Order of the Ministry of Finance No. 66n dated 07/02/10. The same regulatory act approves other forms of accounting - such as a report on financial results, cash flows, changes in capital, etc.

How to submit a company's balance sheet

In order to submit reports correctly, it is necessary to draw up a balance sheet according to certain requirements. Form 1 answers them in the official version. The balance sheet in Form 1 is filled out by all organizations submitting reports.

Some organizations may improve this form to suit their needs, but the general requirements must be met, including maintaining the encoding of this document. It must be accompanied by explanations in the general reporting manner.

The OKUD form 0710001 was approved by the relevant order of the Ministry of Finance No. 66n as the main example for drawing up a balance sheet. It consists of two parts - which reflect all the basic information about the financial activities of the business entity.

Form 1, when filled out, has the following requirements:

- Correctness and reliability of the information entered.

- No errors or fixes.

- Availability of all necessary details when filling out the title part.

OKUD 071001 can be filled in with amounts in thousands or millions. In the case when the company’s turnover is very large, which provokes the appearance of a large number of zeros on the balance sheet, the company can choose a convenient amount reduction for itself and include an explanation for it in the accompanying documents.

Full instructions on how to create a balance can be seen in this video:

Deadlines for “special” cases

Please note that for newly formed, liquidated and reorganized enterprises the deadlines are somewhat different. Let's look at the reporting deadlines for the following companies:

- Creation. An organization that was formed before 09/30/2018 is required to report according to generally accepted rules, that is, before 04/01/2019. But those companies that were formed after September 30, 2018 must report not in 2020, but in 2020. That is, for the reporting period of 2019 plus the period of existence in 2020.

- Reorganization. The company is required to report three months after making the latest changes to the Unified State Register of Legal Entities. This rule is established not only for companies that continued their activities, but also for “merged” companies that completed their activities.

- Liquidation. An institution that has officially completed its activities is required to provide reporting no later than three calendar months from the date of making the relevant entries in the Unified State Register of Legal Entities.

Balance due dates

The rules establish that the balance sheet report Form 1 must be sent in the general reporting package for the previous year before March 31 of the year following the reporting year.

Moreover, this deadline is mandatory both when transferring the balance to the tax service and for statistics.

Under certain conditions, an audit report must be submitted to statistics along with the financial statements. This must be done within 10 days, but no later than December 31 of the year following the reporting year.

For some organizations, due to the type of activity they perform or other criteria, they are required not only to prepare and submit reports to government agencies, but also to publish them. For example, companies acting as tour operators must submit documents to Rostrud within 3 months after approval of the reports.

Attention! The law also defines separate reporting deadlines for organizations that registered after September 30 of the year. Due to the fact that the calendar year for such companies will be calculated differently, they will be required to submit reports for the first time before March 31 of the second year following registration.

For example, Imperia LLC was included in the Unified State Register of Legal Entities on October 20, 2020. For the first time, the company will need to prepare a package of financial statements by March 31, 2020.

As a rule, the balance sheet is drawn up based on the company’s performance for the year. However, it is allowed to compile it not only every quarter, but also, for example, monthly. In this case, these documents will be called intermediate. This kind of documentation is usually necessary for banking organizations when assessing solvency, company owners, etc.