From January 1, 2020, all legal entities are required to provide financial statements in electronic form (with the exception of SMEs).

The updated balance sheet form must be filled out and submitted for the first time when submitting reports for 2020. In 2020, key amendments were made to fill out and submit annual financial reporting forms to the Federal Tax Service of Russia. The changes came into force on January 1, 2020.

Main amendments:

- new forms of financial statements were introduced on 01/01/2020;

- the legal deposit report and the auditor's report thereon are provided only in electronic form through EDI operators.

It is necessary to conclude an agreement in advance with a licensed center and issue a qualified digital signature for the company’s management (full list of electronic document management operators). Note from the author! This amendment does not affect the small business segment: they are provided with a one-year deferment, during which they can submit the report electronically or on paper at their discretion. - All powers to collect reports and audit opinions related to them have been removed from state statistics bodies: only archives for the period from 2014 to 2020 remain in the department of the body, which will be provided to interested parties upon request.

Starting from 2020, the Federal Tax Service of Russia will introduce a state information resource for financial statements. Starting in May, it is planned to launch a free Internet service for interested users, which will allow them to obtain information about the reporting of any company. - The following are exempt from reporting:

- public sector enterprises; - TSB RF; — religious organizations; — companies submitting reports on the results of their activities to the Central Bank of the Russian Federation; — enterprises whose annual report contains information classified as state secret in accordance with current legislation; — other enterprises in situations determined by the Government of the Russian Federation.

In accordance with the Federal Law, individual entrepreneurs and persons engaged in private practice are exempt from accounting - financial statements are not required to be generated and submitted in accordance with the established forms.

Note! The exemption for individual entrepreneurs only applies when they keep operational records of income and expenses and provide information to regulatory authorities in other formats.

and reporting:

| Name | Relevance of the version | Regulatory document |

| Balance sheet | 2020 | Order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n (as amended on April 19, 2020) |

| Income statement | ||

| Statement of changes in equity | ||

| Report on the intended use of funds |

https://youtu.be/FfRR1hyJv94

Funds from the budget for capital expenditures are reflected in a new way

Since 2020, changes made to PBU 13/2000 “Accounting for State Aid” by order of the Ministry of Finance of Russia dated December 4, 2018 No. 248n are in effect.

Now, as a separate article in Sect. IV “Long-term liabilities” of the balance sheet can reflect deferred income recognized in accordance with paragraph. 2 clause 9 of PBU 13/2000 in connection with the receipt of budget funds to finance capital costs (subclause “a” of clause 21 of PBU 13/2000).

Information on such future income in line 1450 “Other liabilities” is not provided, even if their value is insignificant.

We note that the procedure adopted by the organization for presenting information about these incomes must be disclosed in the explanations to the financial statements (clause 22 of PBU 13/2000).

A new composition of balance sheet indicators has also been introduced, disclosing information about received government assistance. Here, in separate articles, taking into account materiality, they reflect:

• unused balance of provided budget funds as part of targeted financing; • accounts receivable for budget funds accepted for accounting; • accounts payable for the return of budget funds recognized in accounting; • deferred income, which the organization recognized as part of short-term liabilities when receiving government assistance for current expenses.

Let us note that until 2020, the organization showed the balance of provided budget funds under the item “Deferred income” or separately in the section “Short-term liabilities”.

On the balance sheet, deferred income recognized upon receipt of funds to finance capital expenditures can be reflected in one of two ways. How:

- a separate item as part of long-term liabilities;

- a regulatory value that reduces the book value of non-current assets.

What has changed

Key amendments were made by Order of the Ministry of Finance No. 61n dated April 19, 2019, while changes in the balance sheet must be taken into account when preparing and submitting reports based on the results of 2020. Changes in the financial results statement will need to be applied when preparing reports for 2020 (organizations have the right to use the updated form now if they wish).

- Amendments to the balance sheet form occurred in the header part:

- instead of OKVED, OKVED 2 is used; — code 385 and million rubles are excluded. From January 1, 2020, filling out financial statements is provided only in thousands of rubles; — a line about mandatory audit has appeared: for companies whose activities are subject to audit, it is necessary to enter basic information about the auditor. - Changes in the income statement form:

- instead of OKVED, OKVED 2 is used - code 385 and million rubles are excluded. — the disclosure lines about the company’s income tax are adjusted— reporting is supplemented with a line with information about income tax from transactions not included in the company’s net profit (loss)

- Amendments to the header of the report on the intended use of funds:

- OKVED 2 is used instead of OKVED - code 385 and million rubles are excluded. — OKUD form code 0710006 replaced by 0710003

How to fill out the balance form

Where to begin

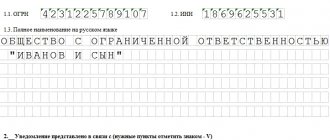

A balance sheet, an example of filling out, which can be given for any organization, is not difficult for a specialist. Filling out the balance sheet begins with the “header”. The Taxpayer Identification Number (TIN) and KPP are indicated at the top, and the balance sheet date is indicated just below. Next, write down the name of the organization, its type of activity according to the OKVED classifier, its individual OKPO code.

The next line is the form of ownership according to OKFS (private - code 16). Below is the code for OKOPF, which represents its legal form (for the balance sheet of an LLC, code 65). The next code is OKEI for numerical records (thousand or million rubles), code 384 or 385 is written. Next, it is indicated how many pages the balance sheet form occupies, and the number of pages of attachments.

At the bottom left, the 2014 balance sheet form has a subsection where the data of the head of the company or an authorized representative, the chief accountant is entered, and the name of the document certifying the rights of the representative is indicated.

Then detailed information about the legal address of the company is entered.

Next, the data is entered line by line.

About non-current assets of the balance sheet:

- 1110 - intangible assets (data 1120 are not taken into account);

- 1120 – information on R&D (results of research and development);

- (1130 – 1140) – reports on the search and exploration of mineral deposits and the equipment used;

- 1150 – fixed assets (their residual value);

- 1160 – the cost of material assets and profitable investments accounted for in account 03.

- 1170 - financial investments of the enterprise for a period of more than 12 months (debit of account 58 and 55 subaccount “deposits”);

- 1180- account balance 09 (related tax assets);

- 1190 – other non-current resources not shown above;

- 1100 – the final amount of all funds on lines 1110-1190.

Small Business Report

Small businesses, non-profit companies and participants in the Skolkovo project are allowed to fill out simplified financial statements (if desired, the company can prepare and submit the full form). For small businesses, amendments to the Law “On Accounting” provide for a deferment and in 2020 companies can provide financial statements, both electronically and in person, or via mail of their choice.

Topic: Criteria for classification as small enterprises.

When to submit and responsibility for violating deadlines

In 2020, the deadlines for submitting reports to regulatory authorities have not changed: financial statements must be submitted to the Federal Tax Service of Russia within three months from the end of the reporting period, that is, no later than March 31, 2020. If the company's activities are subject to mandatory audit, then the conclusion is submitted simultaneously with the reporting or within 10 working days following the date of the conclusion (no later than December 31 of the following reporting year).

Note from the author! The date of submission of forms in electronic form is considered to be the date on the receipt of receipt of the document.

For violation of the deadlines for submitting financial statements based on the results of the year to the tax inspectorate of the Tax Code of the Russian Federation, penalties are provided: 200 rubles for each reporting form not provided (submitted in violation of the deadlines).

Article

You can download Form 1 of the balance sheet in Word directly from this article. And our recommendations will help explain to the director where the profits and losses are in the annual balance sheet, what this or that amount means.

Form 1 balance sheet Word form

Where to see if the balance sheet has tallied in 2020

The balance sheet consists of two parts: assets and liabilities. An asset is the company's property. The liability side includes the sources through which she received this property.

The balance is correct when the indicators in the asset and liability coincide. This total is also called the balance sheet currency. Whether it is in thousands or millions depends on your accounting policy.

Look at the sample below. This is the classic balance sheet structure. All data in the balance sheet is as of December 31. And over the last three years. In the balance sheet, which the accounting department submits in March 2017, you see data for 2020, 2020 and 2014.

balance sheet in 2020 in Word

Based on the balance sheet currency, you will understand what is happening to the company

A decrease in balance sheet currency over three years is not a good sign. He says that the value of the enterprise - its capitalization - is falling. But a sharp jump in the balance sheet currency does not indicate success. This is often a sign of a company's risky credit policy.

It happens that the balance sheet currency does not change from year to year. This means the company is standing still. In a stable economy this is bad, because the goal of any company is to make a profit. But during a crisis, such stagnation indicates that the company manages to maintain stability.

Table 1. Property in the asset balance sheet

IndicatorLine codeThe value of which property is included in the indicator

| Fixed assets | ||

| Intangible assets and research results | 1110, 1120 | Trademarks, know-how, exclusive rights to inventions, etc. |

| Fixed assets | 1150 | Real estate, equipment, cars, cash register equipment, etc. |

| Profitable investments in material assets | 1160 | Fixed assets that the company leases or rents |

| Financial investments | 1170 | Loans issued for a period of more than a year, contributions to the authorized capital of other companies |

| Deferred tax assets | 1180 | These are contingent assets. They arise due to differences between tax and accounting. For example, if in accounting the value of property was taken into account gradually, but in tax accounting immediately |

| Current assets | ||

| Reserves | 1210 | Goods, own products, materials, work in progress |

| Accounts receivable | 1230 | Debts of contractors for delivered products (goods, works, services), issued to employees accountable, advances issued to suppliers, interest-free loans, overpayments of taxes and contributions |

| Financial investments | 1240 | Loans issued for a period of no more than a year |

| Cash and cash equivalents | 1250 | Money in accounts and in the cash register |

| Other current assets | 1260 | Shortages, completed stages of unfinished work, etc. |

How to find out the liquidity of assets from the balance sheet

We explained what Form 1 of the balance sheet is (the Word form can be downloaded from the link above). Now let's talk about asset liquidity.

The assets on the balance sheet are divided into two large groups.

Non-current assets are property that should initially generate income for the company for more than one year. For example, buildings, production equipment, transport.

Current assets are property that immediately goes into circulation and should generate income within a year. These are materials, goods, products, receivables, deposits, etc.

In the asset balance sheet, assets are located depending on liquidity. That is, on how quickly you can turn it into money. The higher the line, the longer it takes to sell the asset.

The lower, the less.

Balance sheet for 2020: form, sample filling

What does a balance sheet asset tell you?

See if and how the composition of assets has changed over three years. Let’s say that there are more low-liquidity ones every year.

This suggests that the company is actively investing in its own infrastructure, purchasing new equipment or upgrading old equipment.

If this is the case, it is necessary to further evaluate through what sources this occurs - own or borrowed ones. Borrowing too much is dangerous. The company risks not paying off its debts.

Important! The higher the asset is on the balance sheet, the longer it takes to sell it

If, on the contrary, there are more highly liquid assets, then demand is growing. And the company does not need to borrow money to purchase goods or materials. Or you can use funds for new projects or for the same modernization of production.

A consistently high indicator in the Cash and Cash Equivalents line may indicate the stability of the company.

But it’s not necessary, because money may need to be transferred to the budget or to the account of another company at any time.

That is, this indicator must be assessed together with the company’s accounts payable.

In a regular balance sheet, receivables are shown on a separate line over time. When its amount decreases from year to year, this is a good sign.

An increase in accounts receivable compared to previous periods may indicate problems with the solvency of buyers.

In the simplified form of the balance sheet, receivables are included in the indicator “Financial and other current assets”. You can ask an accountant to separate out the receivables from a simplified form and draw up a certificate for three years.

What a balance sheet asset for 2020 might look like and what conclusions can be drawn from it is in the sample below.

Click on the sample to enlarge it.

Fragment of Form 1 balance sheet Word form

What liabilities of the company does the balance sheet liability contain?

The sources from which the company received assets are located in liabilities according to the degree of urgency of the return of funds. The higher the line, the more stable the source of funds. For example, while the company is operating, it does not have to return their shares in the authorized capital to the founders.

This is a very stable source of funding. The lower the line, the faster the funds must be returned to counterparties and other creditors. For example, the last lines of liabilities contain short-term loans received by the company with a repayment period of up to a year.

Passives are conventionally divided into two groups:

- own sources;

- borrowed sources: long-term - more than a year and short-term - up to a year inclusive.

What indicators to look for in the balance lines can be seen in Table 2.

Table 2. What is included in the liability side of the balance sheet

IndicatorLine codeThe value of which property is included in the indicator

| Capital and reserves | ||

| Authorized capital | 1310 | The amount of authorized capital from the company's constituent documents |

| retained earnings | 1370 | Profit after paying income tax and dividends, that is, net profit |

| long term duties | ||

| Borrowed funds | 1410 | Loans received and credits with a repayment period of more than a year |

| Deferred tax liabilities | 1420 | These are conditional liabilities. They arise due to differences between tax and accounting. For example, if in accounting the value of property was taken into account immediately, and in tax accounting gradually |

| Estimated liabilities | 1430 | Company reserves. For example, for a future major overhaul, which will begin no earlier than in a year |

| Short-term liabilities | ||

| Borrowed funds | 1510 | Received loans and credits with a repayment period of no more than a year |

| Accounts payable | 1520 | Debts to contractors, the budget or employees that must be repaid within a year |

| Estimated liabilities | 1540 | The company's reserves for expenses of the coming year. For example, for vacation pay |

What do the balance sheet liability indicators tell you?

If own sources prevail over borrowed ones, this indicates a stable financial position of the company. This is also evidenced by the large share of long-term debt obligations compared to short-term ones.

But a significant amount of short-term debt, and especially its growth over three years, is already a reason to think about the financial position of the company.

These obligations include, for example, debts for wages to employees, and for taxes and contributions. Delay in these payments entails additional financial losses.

Such as compensation for delayed wages, tax penalties and fines.

Ultimately, this can lead the company to bankruptcy. In such cases, the director is obliged to declare bankruptcy (information from the Federal Tax Service of Russia dated January 12, 2020).

What a balance sheet liability for 2020 might look like and what conclusions can be drawn from it is in the sample below.C

Fragment of Form 1 balance sheet Word form

Form 1 balance sheet form Word download

To have Form 1 of the balance sheet in Word on your computer, follow the link.

https://www.glavbukh.ru/art/88666-qqqm3y17-buhgalterskiy-balans-v-2017-go…

Source: https://www.asvsoft.ru/article/buhgalterskiy-balans-v-2017-godu-blank-i-obrazec-zapolneniya