Using the form

The notification in form P15001 consists of 3 sheets and 6 pages, each of which has its own purpose:

- title (or page 001 ) indicates the name of the enterprise and the reason for liquidation,

- Sheet A (or pages 002 and 003 ) is completed only when a liquidator is appointed,

- Sheet B (or pages 004, 005, 006 ) records information about the applicant.

If a liquidator is appointed, the appropriate box is ticked:

Please note: clauses 2.1. and 2.2. can be noted simultaneously - if the decision on liquidation has been made and a liquidation commission has already been appointed.

The main difference between the supernova form P15001 is the ability to cancel a previously launched liquidation process. For this purpose, clause 2.4 is provided. on the title page.

Decision to revoke the decision

Filling Features

Form P15001 can be filled out electronically. To do this, open the file in Excel, make sure the font is Courier New, 18, and start typing. If necessary, you can fill out the application with a black ballpoint pen. In this case, all words are written in block letters. In both cases, there must be only one character per field. If the end of a word comes at the end of a line, the next one must begin with a space. Fields that do not need to be filled in - for example, information about the applicant-legal entity, if the applicant is an individual - remain empty, without dashes.

Only those pages that are of actual importance should be completed. So, if the reason is the preparation of an interim liquidation balance sheet, sheet A does not need to be filled out. Accordingly, Sheet B page 1 will be numbered 002 (second after the title page).

The name of the enterprise must be complete and correspond to what is indicated in the State Register of Legal Entities.

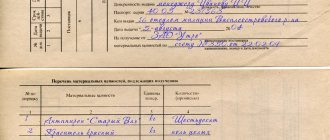

An identification document must be indicated on sheets A and B. Often this is a passport of a citizen of the Russian Federation, which means the digital code of the document is 21. In this case, the order is as follows: indicate the passport series, put a space, indicate the document number.

Entering passport data

- 10 — foreigner’s passport,

- 12 — residence permit.

We fill out the “Issued by” field exactly as indicated in the document. Sometimes the full name of the authorized body is given there and should be repeated in P15001.

Entering information about place of residence

If the notification is related to the emergence of a liquidation commission, then the details of its head are entered into sheet A, and when submitted, the decision on the appointment of the commission is attached to the form itself.

https://youtu.be/vxYM1hv5tUA

Notification of enterprise creditors

The creditor must also be notified of this during the closure of the business. You can write the corresponding document in any form. The management of the enterprise also determines the time for submitting the form independently. However, it is obvious that it is best to do this as early as possible - approximately two months before the first physical stage of liquidation begins.

Liquidation of an enterprise with debt must occur in a certain way. This is due to the fact that notification of the business closure process should not only come to creditors. The Federal Pension Fund and the Tax Inspectorate should also receive relevant information.

A company in debt, among other things, must make an inventory of all letters sent.

Deadlines and features for submitting the completed form P15001

According to the law, both the founder and the liquidator (representative of the liquidation commission) can submit P15001. The notification, as well as the minutes of the meeting where the final decision was made, must reach the Federal Tax Service no later than 3 business days after the decision on liquidation is made. This date is recorded on the title page.

Unlike other forms that notify the IRS of the termination of activity, 15001 can be submitted several times. So, it can be used to fix the liquidation balance. In this case, it is necessary to attach the balance itself to the notification. This re-filing usually occurs 2 weeks after the publication of the winding up decision.

P15001 can be submitted not only electronically or in person, but also by mail. In the same way, you can obtain documents from the Federal Tax Service.

Liquidation commission

After the decision to terminate the activities of the organization , the founders (participants) appoint a liquidation commission (liquidator) and establish the procedure and timing for carrying out the necessary measures in this regard. (Clause 3, Article 62 of the Civil Code of the Russian Federation). From this moment on, the powers to manage the company’s affairs are transferred to the liquidation commission. (clause 4 of article 62 of the Civil Code of the Russian Federation).

The next step is the publication of a notice about the liquidation of the company, the procedure and deadline for filing creditor claims in the journal “Bulletin of State Registration”. The period for submitting claims by creditors cannot be less than two months from the date of publication of the notice of liquidation (Clause 1, Article 63 of the Civil Code of the Russian Federation). After the deadline for submitting claims by creditors, the company's employees must fill out a special form of financial statements - an interim liquidation balance sheet.

Where is the notification provided?

One copy of this document is sent to:

- To everyone who participated in various legal relations that took place while the organization was functioning properly.

- To certain government bodies that at one time registered this company. There they get acquainted with all the information contained in the notification and make an entry in the Unified State Register of Legal Entities that the company is in the process of terminating its activities.

- Another copy should be sent to the Federal Tax Service department, which is in charge of the territory where the organization is located. Based on this application, the tax service closes all accounts that are registered with the company and identifies possible debts.

- Next, you need to send a notification to various funds with which the company collaborated during its activities. As a rule, there are no more than three. This:

- Lastly, you should notify the persons who provided loans to the company and all counterparties who collaborated with the organization. This step should be taken with special attention, since the above-mentioned persons can challenge the start of the liquidation process in court if they deem it necessary.

To be sure, it is necessary to publish information about the curtailment of the company’s work in specially created media. Before preparing such a publication, you need to know that not all media outlets have the legal right to post such information in the public domain. Today, only a journal called “Bulletin of State Registration” has this right.

Notice of liquidation of a legal entity form P15001

Until July 2013, for each listed action, a separate document had to be filled out and submitted to the registration service of the Federal Tax Service:

- Р15001 (notification of a decision to liquidate a legal entity),

- R15002 (notification of the formation of a liquidation commission, the appointment of a liquidator (bankruptcy trustee)),

- R15003 (on the preparation of an interim liquidation balance sheet).

However, today each of the three actions is accompanied by filling out and submitting to the registration authority only one form P15001 “Notice of liquidation of a legal entity.”

Who needs to be notified

Notice of liquidation of a legal entity is sent primarily to four different entities. They are:

- tax service;

- personnel of the enterprise itself;

- creditors who provide money to the company, or a supplier;

- Employment Center.

Notification of the liquidation of an LLC must be provided to the registration authority, creditors and company employees. It is not always worth notifying the employment center about the closure of an enterprise. Notice of liquidation only needs to be given if more than 15 employees are unemployed after the cessation of the business.

Notice of liquidation of a legal entity before 2020 had to be submitted to two more important entities, such as:

- Pension Fund of the Russian Federation;

- Federal Compulsory Health Insurance Fund (MHIF).

Currently, in accordance with current legislation, the tax authority independently reports information about the closure of the business of the Pension Fund of the Russian Federation and the Compulsory Medical Insurance Fund.

Requirements for filling out form P15001: step-by-step filling

Since forms P15001 and P16001 are the main ones for registering liquidation, we will consider the basic requirements for filling them out, which are established by Order of the Federal Tax Service of Russia N ММВ-7-6/ [email protected] . General requirements for filling out both forms are contained in Section I of a document such as “General requirements for the preparation of submitted documents.” In the same appendix to the order of the Federal Tax Service of the Russian Federation there is a sample of filling out forms P15001 and P16001 line by line.

So, when filling out these forms, legal entities must:

- You should use black ink both when filling in manually and when printing on a printer);

- it is necessary to write only in capital letters in Courier New font 18 points high, each of which, as well as quotation marks, dashes, hyphens and numbers are placed in a separate cell;

- do not allow corrections or additions, as they are prohibited;

- do not allow hyphens, the word that does not fit must be continued to be written on the next line (if it ends in the last cell of the first line), the next line begins with an empty cell (space between words);

- do not print or attach blank sheets to notifications;

- When printing an application on a printer, changing the location of fields and sizes of characters is not allowed;

- Do not use double-sided printing of completed forms, as it is prohibited.

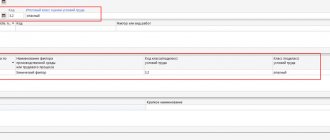

Fill out section 2 of form P15001

In this sheet, you should put a “tick” (“V” sign) in the relevant points in connection with which a notification is being submitted:

- if a decision has been made to liquidate a legal entity, then put a tick in clause 2.1, this field also indicates the date of its adoption;

- if a commission has been formed and a liquidator has been appointed, then put a tick in clause 2.2.;

- if an interim liquidation balance sheet has been drawn up, then check the box in clause 2.3;

- if a decision is made to cancel a previously made decision to terminate activities, then put a tick in clause 2.4.

The requirements do not contain a ban on filling out several items at the same time. Therefore, you can, for example, check two boxes: about making a decision to terminate work (clause 2.1.) and forming a liquidation commission (clause 2.2.).

If a decision is made to continue the work of the company (clause 2.4.), then the decision to cancel the decision to liquidate the legal entity must be attached to the notification.

The section “For official marks of the registering authority” is not filled out.

Staff warning

Company closure is a process that results in notice of liquidation to employees. That is why, according to the law, they must be warned about this 2 months before the corresponding procedure takes place. The corresponding norm is prescribed in Part 2 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation.

If a business is forced to cease operations but its management does not provide notice of liquidation within the statutory period, it should be prepared to receive a fine. The size of the latter can be different - from 1000 to 5000 rubles. If the fine is imposed on a legal entity and not on the manager, then its volume increases to 30,000-50,000 rubles. In this way, the rights of the company’s employees are protected.

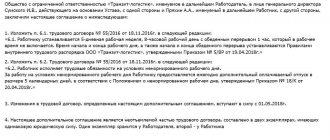

Fill out sheet B

The first page and sheet B are filled out if clauses 2.1 (decision on liquidation), 2.3 (interim liquidation balance sheet) or 2.4 are noted in the application. (decision to cancel the liquidation decision). The first page, sheets A and B should be drawn up when appointing a commission (clause 2.2).

What do we fill out in sheet A “Information on the formation of the liquidation commission/appointment of a liquidator”? In section 1, “1” is entered if a commission is appointed, and “2” if a liquidator is appointed. Section 2 indicates the date of formation of the liquidation commission or appointment of a liquidator. Section 3 in Russian indicates the last name, first name and patronymic (if any) of the head of the liquidation commission or the liquidator. If he has a TIN, we indicate it in section 4. Section 5 indicates the date and place of birth of the liquidator, the telephone number by which he can be contacted.

Fill out sheet B

In sheet B “Information about the applicant” in section 1, we indicate with a number who the applicant is:

- “1” - for the founder (participant) - an individual;

- “2” - for the founder (participant) - a legal entity;

- “3” - for the body that made the decision on liquidation;

- “4” - for the head of the liquidation commission.

It is important to correctly determine in what cases and which of the entities listed above can act as an applicant. As the Federal Tax Service of Russia explains in a letter dated October 15, 2014 N SA-4-14/ [email protected] , when submitting form P15001 to the registration authority in connection with a decision to liquidate a legal entity, the applicants are the founders (participants) of the legal entity or the body that adopted decision to liquidate the organization. If the document is sent in connection with the decision to liquidate the company and the formation of a liquidation commission (appointment of a liquidator), as well as in connection with the preparation of an interim liquidation balance sheet, then the applicant is the founders (participants) of the organization or the body itself that made the corresponding decision. The head of the liquidation commission (liquidator) can also act as an applicant.

Sections 2-5 should be completed depending on who the applicant is. Section 6 must be completed by hand in the presence of a notary. Next, you should indicate the most acceptable way to obtain a document confirming the fact of making an entry in the Unified State Register of Legal Entities, or a decision to refuse state registration (the document must be delivered personally to the applicant, a person acting on the basis of a power of attorney, or by mail). Section 7 is filled out by the notary, indicating his status and TIN. You can download the form p15001 2020 for free, a sample of how to fill it out, at the end of the article.

Notification from the tax service

Notification of the liquidation of an enterprise must be sent to the tax service. Without notice of liquidation, it is impossible to close a business.

An application must be submitted to the tax service within three business days from the moment the manager decides to liquidate the enterprise. To transmit information, it is necessary to use a form specially approved by the government of the country. Notification of liquidation of a legal entity R15001 within 5 working days, the registration authority must make a corresponding entry in the Unified State Register of Legal Entities. It contains information about the beginning of the business closure procedure.

If the form is submitted to the tax service at the wrong time, the head of the company responsible for this must pay a fine of 5,000 rubles. This is due to part 3 of article 14.25 of the Code of Administrative Offenses of the Russian Federation.

Requirements for filling out form P16001

Form P16001 is submitted when the liquidation balance sheet is compiled. The requirements for filling out the P16001 form are contained in section X of the Requirements. This is a simpler form, consisting of one page and Sheet A for the applicant (four pages).

On the first page, information about the liquidated organization is entered according to data from the Unified State Register of Legal Entities. Section 2 indicates the date of publication of the notice of the decision on liquidation in the press. In sheet A we put the number corresponding to the applicant. Information about it is filled out according to rules similar to those indicated above for form P15001. Section 3 is completed by hand in black ink and in the presence of a notary.

Correctly filling out notifications P15001 and P16001 will significantly shorten the period for registering the liquidation of an organization. The ability to fill out such forms yourself will naturally reduce the financial costs of the organization. Careful reading of the material presented and the documents linked to it will help resolve both of these difficulties. You can download form P15001 2020 for free and a sample of filling out its lines at the end of this material. This is Appendix No. 20 to the order of the Federal Tax Service of Russia dated January 25, 2012 N ММВ-7-6/ [email protected] “On approval of forms and requirements for the execution of documents submitted to the registration authority for state registration of legal entities, individual entrepreneurs and peasant (farmer) farms" (registered with the Ministry of Justice of Russia on May 14, 2012 N 24139).