Who and where should take 4-FSS?

The 4-FSS report must be submitted by all employers (organizations and individual entrepreneurs) who make payments to employees that are subject to social insurance contributions. The report is submitted to the territorial offices of the FSS.

Please note that individual entrepreneurs who do not have employees do not have to submit this report to the Social Insurance Fund, since they do not pay wages or transfer social insurance contributions for employees.

Policyholders who do not have separate divisions must submit 4-FSS to the territorial office of the FSS at the place of their registration.

If the policyholder has separate units that have their own bank account and which independently calculate and pay salaries to employees, then 4-FSS is submitted to the territorial offices of the FSS at the place of registration of these separate units.

Responsibility for late submission of a report on Form 4-FSS

Any violations of the rules for preparing and submitting mandatory 4-FSS reports result in sanctions against the business entity that committed them. The amount of the fine varies from 5% to 30% of the amount of contributions accrued for the reporting quarter. The minimum penalty is set at 1 thousand rubles.

The specified fine is imposed for each month of delay - full or incomplete. Therefore, if any violations are identified, it is advisable to eliminate the comments as quickly as possible and submit an updated calculation of insurance premiums in Form 4-FSS.

Deadlines for submitting 4-FSS in 2019-2020

The reporting periods in this case are quarter, six months, nine months and a year.

Depending on the average number of employees, reporting is submitted within the following deadlines:

If the average number of employees is up to 25 people, the deadline for submitting the report is the 20th day of the month following the reporting period. In this case, the policyholder has the right to submit reports both on paper and electronically.

If the average number of employees is more than 25 people, the deadline for submitting the report is the 25th day of the month following the reporting period. In this case, reporting must be submitted exclusively in electronic form.

The deadlines for submitting 4-FSS in 2020 are as follows:

| Reporting period | Average number of employees up to 25 people | The average number of employees is more than 25 people |

| For 2020 | 20.01.2019 | 25.01.2019 |

| For the 1st quarter of 2020 | 20.04.2019 | 25.04.2019 |

| For the first half of 2020 | 20.07.2019 | 25.07.2019 |

| For nine months of 2020 | 20.10.2019 | 25.10.2019 |

The deadlines for submitting 4-FSS in 2020 are as follows:

| Reporting period | Average number of employees up to 25 people | The average number of employees is more than 25 people |

| For 2020 | 20.01.2020 | 25.01.2020 |

| For the 1st quarter of 2020 | 20.04.2020 | 25.04.2020 |

| For the first half of 2020 | 20.07.2020 | 25.07.2020 |

| For nine months of 2020 | 20.10.2020 | 25.10.2020 |

Zero FSS report, what to count there

If during the reporting period the organization did not pay wages and did not pay insurance premiums for injuries, there will be nothing to reflect in the 4th Social Insurance Fund report, unless, of course, there were no debts at the beginning of the period. The zero report must still be submitted. It will include the title page, the first, second and fifth. The title page will show the basic data of the company, its type of activity, INN, KPP, OGRN. In the same way as the completed report, we submit it to the fund, if the organization has up to 25 people, you can submit it manually, receiving a mark on your copy that it has been accepted by a specialist.

Form 4-FSS 2019-2020

This form consists of six sheets, the first of which contains fields for entering the details of the policyholder and brief information about the insured workers. The next five sheets contain six tables with the following meaning:

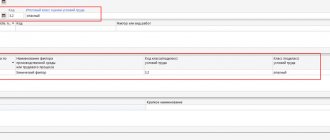

- Table 1 represents the calculation of the base for accrued and paid insurance contributions for compulsory social insurance.

- Table 1.1 serves to indicate the information required for calculating insurance premiums by those policyholders specified in clause 2.1 of Art. 22 Federal Law No. 125-FZ. This legislative norm refers to those insurers who temporarily send their employees to work in other organizations under the agreement “On the provision of labor for employees.”

- Table 2 is a calculation of the base for compulsory social insurance.

- Table 3 provides information on the costs of paying all types of benefits provided for by the compulsory social insurance system.

- Table 4 is necessary to indicate the number of injured people, dividing them into victims of accidents and occupational diseases.

- Table 5 serves to enter information on the results of assessing working conditions and medical examinations of workers.

All policyholders must fill out the details on the first sheet, as well as tables 1, 2 and 5. Tables 1.1, 3 and 4 are filled out only in cases where the relevant events occurred during the reporting period.

What sections does the 4 FSS report consist of?

| Sections | Short description |

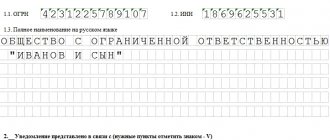

| Title page | The registration number of the enterprise in the social insurance fund is indicated, then the adjustment number, if the report is submitted for the first time, it will be 0, with subsequent changes the numbers are in order, then follows the period for which we submit 4 FSS, as well as the main OKVED code for the type of activity. TIN of the organization, full name, checkpoint and OGRN and postal address. Here we can fill in the number of employees and of them disabled |

| Table 1 | Includes the amount of accrued and paid contributions from the beginning of the year, and then for each month separately, as well as the size of the insurance tariff, thus the tax base for tax calculation is reflected here |

| table 2 | Line 1 contains the amount of debt at the beginning of the period, line 2 the amount of accrued contributions in general and for each month, lines 3 and 4 are intended to reflect additional accruals for desk audits, and the fifth line is for independent additional accruals, in case of errors, the seventh line is necessary for the amounts refund from the Social Insurance Fund for overpaid payments. Line 8 contains the control sum of the indicators of lines 1 to 7. Lines 9 – 11 reflect the amount of debt owed by the division of the Federal Social Insurance Fund of the Russian Federation at the end of the period - 09/30/2020, namely: – line 9 – total amount; – line 10 – incl. due to excess costs; – line 11 – incl. due to overpayment. Lines 12 -14 reflect the amount of debt owed by the division of the Federal Social Insurance Fund of the Russian Federation at the beginning of the period - 01/01/2020, namely: – line 12 – the total amount, its indicator must correspond to line 9 of the report for 2020; – line 13 – incl. due to excess costs; – line 14 – incl. due to overpayment. |

| Table 5 | Contains information about medical examinations carried out for employees: Column 3 is required for the total number of employees, column 4 for the number who underwent a labor assessment, columns 5 and 6 for hazardous working conditions. Second line for medical examinations |

Important! These sections are filled out by all employers, and tables 1.1., 3 and 4 by certain policyholders.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Rules for filling out 4-FSS 2019-2020

This report is completed in accordance with the procedure put into effect by Appendix No. 2 of FSS Order No. 381.

Paper reporting can be completed on a computer or by hand in block letters using a black or blue pen.

Monetary amounts in 4-FSS reporting are not rounded. They must be reflected in rubles and kopecks. If the indicator is zero, then a dash is placed in the corresponding field of the table.

On each page of the report, the policyholder must sign and date it, as well as indicate his registration number and subordination code. This number and code are contained in the notification that the policyholder receives after registration with the Social Insurance Fund.

The report sheets are numbered and their quantity is indicated in the corresponding field of the report title page.

At the top of the title page of 4-FSS there is a field for indicating the report correction number. If the document is submitted for the first time during the reporting quarter, the value “000” is indicated. In the case of submission of updated reports, for such documents the value “001” is entered in this field if the updated report is submitted for the first time, “002” if this is the second updated report, etc.

To the right of the “adjustment number” field there is a field for indicating the reporting period. As stated above, the following reporting periods apply to this form:

- The first quarter is designated by the number “03”.

- Six months - indicated by the number “06”.

- Nine months - indicated by the number "09".

- The year is indicated by the number “12”.

Also, the title page of the report indicates the full name of the legal entity or individual entrepreneur, as well as all registration and contact information: TIN, KPP, OGRN, main OKVED code, telephone number and address.

Immediately below the field for indicating the address there is a field for entering information about the average number of employees. Below is the number of working disabled people and the number of employees working in dangerous and/or harmful working conditions.

What has changed in the calculation of 4-FSS since the 3rd quarter of 2020

From the Information of the Social Insurance Fund of the Russian Federation “On the application of the Order of the Social Insurance Fund of the Russian Federation dated 06/07/2017 No. 275” it follows that the changes made by this Order to the Calculation Form 4-FSS are applied starting with reporting for 9 months of 2020.

By order of the Social Insurance Fund of the Russian Federation dated June 7. 2020 No. 275 in the calculation of 4-FSS for contributions from NS and PZ, changes were made to Table 2 and the title page, which entered into force on July 9, 2020. The following new lines appeared in Table 2 of the 4-FSS calculation:

- Line 1.1: “Debt owed by the reorganized policyholder and/or deregistered separate division of the organization”;

- Line 14.1: “Debt from the territorial body of the Fund to the policyholder and/or to a separate division of a legal entity that has been deregistered.”

In addition, the title page of the 4-FSS calculation

supplemented with a new field for identifying the policyholder as a budgetary organization, which is such in accordance with the source of funding.

Otherwise, the calculation remained unchanged and almost completely coincides with Section II of the previously valid form, approved by Order No. 59 of the Social Insurance Fund dated February 26, 2015. The changes are mainly of a technical or clarifying nature. From the previously presented calculation, only the part devoted to contributions from NS and PP has been preserved.

Let me remind you that it is mandatory to fill out in the 4-FSS calculation

are:

- title page,

- table 1 “Calculation of the base for calculating insurance premiums”,

- table 2 “Calculation of the base for compulsory social insurance against accidents at work and occupational diseases”,

- table 5 “Information on the results of a special assessment of working conditions (on the results of certification of workplaces for working conditions) and mandatory preliminary and periodic medical examinations of workers at the beginning of the year.”

The remaining tables are filled out and included in the calculation only as needed, that is, if the data reflected in them is available.

Separately, I note that mandatory table 5 of the 4-FSS calculation provides information on conducting a special assessment of working conditions. All data is entered into this table as of January 1, 2017. And, if medical examinations were carried out during 2020, the data on them is not reflected in this table.

Also note that the title page of the 4-FSS calculation indicates the average number of employees. In this case, the number is always determined on the last day of the reporting quarter (clause 5.14 of the Procedure approved by Order of the Federal Social Insurance Fund of the Russian Federation dated September 26, 2016 No. 381). To calculate 4-FSS for 9 months, this indicator must be calculated as of September 30 as follows: the number of employees for January - September is added up, and the result is divided by 9 months (clauses 81.6, 81.7 of the Instructions approved by Rosstat Order No. 498 dated October 26, 2020).

At the same time, on the title page of the calculation the code of the organization’s main activity according to the OKVED-2 classifier is given, even if last year’s OKVED was indicated in the previously submitted calculations.

And be sure to check that table 1 of the calculation should contain the rate of contributions for injuries that the Federal Social Insurance Fund of the Russian Federation has established for your organization for 2020. If you previously submitted a calculation indicating last year’s tariff, and this year the tariff has changed, then do not mistakenly transfer outdated data from the previous calculation, since this will lead to the fact that the inspectors from the Federal Tax Service of the Russian Federation will not agree on the control ratios, and they will require appropriate explanations.

When and how is 4-FSS surrendered?

Date of submission of calculation 4-FSS

hasn't changed. As before, paper payments are due by the 20th day of the month following the reporting period. And the electronic calculation format is submitted no later than the 25th day of the month, inclusive of the first month after the reporting quarter.

Accordingly, for 9 months of 2020, form 4-FSS must be submitted on paper no later than October 20, 2020, and in electronic form no later than October 25, 2020.

As for the methods of submitting reports to the Social Insurance Fund of the Russian Federation, the requirements for them remain the same as before. It all depends on the average number of individuals in whose favor payments and other remuneration are made. Those insurers whose average number of individuals in whose favor payments and other remunerations are made for the previous billing period exceed 25 people are required to report only in electronic format, and not on paper.

Of course, all policyholders have the right to report electronically. There are no prohibitions on this. Regulatory authorities even welcome such actions. After all, electronic document management optimizes the work process on both sides.

To submit reports electronically, an organization must purchase an electronic signature certificate from an accredited Certification Center, for example, in.

And a few words about what the Order of the Social Insurance Fund of the Russian Federation of 03/09/2017 No. 83 introduced. The document defined control ratios for calculating contributions for injuries, updated the Technology for receiving 4-FSS calculations

. The Order provides comparable indicators of 4-FSS and the procedure for their comparison. To check the correctness of the data reflected in the calculation, you need to compare the amount of payments in favor of working disabled people and the final base for calculating insurance premiums. The first value must be less than or equal to the final base. Otherwise, the calculation will be considered incorrect.

Nuances of filling out the form

Before understanding the procedure for filling out the 4-FSS report for the quarter of 2020, let’s consider the general formalities that need to be completed when drawing up the document:

- The form consists of a title page and five pages.

- Basic information about the organization is filled out on the title page.

- Tables 1, 2 and 5 must always be completed, even if the contributions they report did not occur in a given period. Other tables are filled in as needed. If there were no reasons for paying the contribution, these tables can be omitted from the report.

- The document can only be filled out using a pen with black or blue ink. Other colors are not acceptable.

- One cell – one indicator. No data - put a dash.

- If we submit it electronically, we must certify it with an electronic digital signature.

- Don't forget to number the report pages at the top of the sheet.