Features and differences

The director is an employee, like all other employees of the company. The difference from them lies in the special procedure and his appointment/removal from office, as well as in his job responsibilities. The director, like everyone else, has the right to receive a bonus based on the results of his work.

The director is an employer in relation to other employees, but is not an employer for himself. For him, the employer is society. Only a meeting of participants can make a decision on bonuses to the director (Article 40 No. 14-FZ).

The main difference between bonuses for a director and a worker is that the director has the right to assign additional remuneration to an ordinary employee, but not to himself.

https://youtu.be/eOBDyd5L-I4

Social guarantees

Letters from the Federal Social Insurance Fund of the Russian Federation dated December 21, 2009 No. 02-09/07-2598P and the Ministry of Labor of Russia dated May 5, 2014 No. 17-3/OOG-330, as well as by order of the Ministry of Health and Social Development of Russia dated June 8, 2010 No. 428n explained, that if the relationship between an organization and its manager, who is the sole founder, is formalized by an employment contract, then the manager is one of the persons subject to compulsory social insurance in case of temporary disability and in connection with maternity, and accordingly has the right to receive benefits in connection with maternity. In addition, the letter of the Ministry of Labor of Russia (dated May 5, 2014 No. 17-3/OOG-330) emphasizes that the head of the organization has the right to other labor guarantees and benefits.

And from January 1, 2012 in p.p. 1 clause 1 art. 2 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity” it is clearly stated that the list of persons subject to compulsory insurance includes heads of organizations who are the only participants (founders) , members of organizations, owners of their property (as amended by Federal Law dated December 3, 2011 No. 379-FZ).

However, judicial practice shows that fund specialists refuse to reimburse benefits for temporary disability, arguing that the founder cannot be in an employment relationship with the organization.

Considering such cases, the courts come to the conclusion that labor relations that arise as a result of election and appointment to a position are characterized as labor relations on the basis of an employment contract (Article 16 of the Labor Code of the Russian Federation). And, therefore, such an employee, who is in a labor relationship with the company, has the right to compulsory social insurance provided for by the Labor Code of the Russian Federation and Federal Law of July 16, 1999 No. 165-FZ “On the Basics of Compulsory Social Insurance.”

In this situation, the founder is simultaneously both the policyholder and the insured (resolutions of the Thirteenth Arbitration Court of Appeal dated March 4, 2013 No. A21-8666/2012, FAS Volga-Vyatka District dated January 17, 2011 No. A29-679/2010 FAS West -Siberian District dated 05.28.10, No. A45-23350/2009, FAS Far Eastern District dated 08.5.09, No. F03-3639/2009).

The decisions made by the courts are based on the position of the Supreme Arbitration Court of the Russian Federation (Determination dated September 23, 2009 No. VAS-11691/09). Thus, considering the dispute about the legality of payment of maternity benefits, the senior arbitrators noted that the provisions of Art. 255, 256 of the Labor Code of the Russian Federation do not limit the rights of women managers to maternity leave with the payment of benefits under state social insurance. Article 16 of the Labor Code of the Russian Federation provides that labor relations that arise as a result of election and appointment to a position are characterized as labor relations on the basis of an employment contract. At the same time, the fact that the sole participant of the company fulfilled his labor duties was confirmed by personnel documents. Therefore, such an employee has the right to receive compulsory social insurance benefits.

Criteria for evaluation

The answer for what a director can receive a bonus is found in the Regulations on bonuses for employees of the company, a collective agreement or other local act. There is no need to decipher them in the contract, you just need to provide a link to the internal document (letters of the Ministry of Finance of Russia dated February 26, 2010 No. 03-03-06/1/92, dated February 5, 2008 No. 03-03-06/1/ 81). The director may be assigned the following types of bonuses based on:

- minutes of the general meeting of shareholders of the organization;

- decisions of the board of directors or supervisory board;

- decisions of the sole shareholder of the organization.

Bonuses for the director: how to arrange everything correctly

The organization has a CEO and a founder. These are different faces. How to reward the CEO? Is the founder's approval required? How to format this correctly? Published in the magazine “Accounting News” No. 5 dated February 9, 2010 Director (General Director) in accordance with Art. 40 of the Federal Law “On Limited Liability Companies” is elected by the general meeting of company participants and is the sole executive body. An employment contract between the company and the general director is signed on behalf of the company by the chairman of the meeting at which the general director was elected or by a company participant authorized by a decision of the general meeting of company participants (Article 275 of the Labor Code of the Russian Federation).

The payment of the bonus is provided for in the employment contract. The bonus may also be provided for by a collective agreement and other local acts. But at the same time, the employment contract must contain a reference to one or another document.2. The bonus must be awarded for labor performance. In accordance with paragraphs. Art.

Ways to encourage

One-time

This type of remuneration to a director can be assigned only on the basis of the minutes of the general meeting of shareholders of the company. A one-time payment is a bonus payment that a director can receive in connection with certain events (the completion of a project that is significant for the company, the company’s anniversary, the director’s birthday).

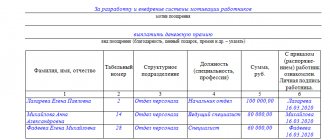

When all the documentation necessary to assign a bonus to a manager is ready, it is transferred to the accounting department for accrual. The appointment order specifies the timing of the transfer of remuneration to the director . If payment is untimely, then responsibility rests with the employee whose fault it was.

If there are no such deadlines, then the payment of a one-time remuneration is made together with the payment of wages. The bonus can be handed over to the director or transferred to his salary card.

The procedure for awarding bonuses to a director can be specified in the bonus regulations that apply in the organization, as well as in the director’s employment agreement. To pay, you need to draw up the minutes of the general meeting of shareholders and the decision of the sole founder, and then an order for bonuses is issued.

Permanent

A permanent bonus is awarded to the director on the basis of accounting and static reporting , as well as operational accounting data. A permanent bonus is issued by order, which indicates the name of the recipient, the type, size and grounds for payment of the remuneration. The bonus order is announced to the director against signature. This type of bonus is assigned based on the results of work for the reporting period.

Administrative liability for violation of labor and labor protection laws

Persons carrying out entrepreneurial activities without forming a legal entity

Administrative fine – from 1000 to 5000 rubles.

Administrative fine – from 1000 to 5000 rubles. or suspension of activities for up to 90 days

Administrative fine – from 30,000 to 50,000 rubles. or suspension of activities for up to 90 days

3. The absence of an employment contract with the director entails a loss of personal income tax for the budget in the amount of 13%.

4. Lack of social guarantees for the director himself (payment of benefits for temporary disability, maternity benefits, annual paid leave, etc.).

Recognition of wages in tax accounting

One of the main problems in the relationship between the organization and the director, the sole founder of the organization, is the impossibility of recognizing accrued wages as expenses.

In this case, the employer’s obligation is to pay wages in full and on time (Article 22 of the Labor Code of the Russian Federation). And exceptions for situations where the same individual acts on behalf of the employer and employee, in Art. 22 of the Labor Code of the Russian Federation no. Since the director works in the organization, he is paid a salary.

It would seem that all the conditions for recognizing accrued wages as tax expenses have been met. And if you have properly executed documents, accrued wages can be included in tax expenses on the basis of Art. 255 and paragraph 6 of Art. 346.16 of the Tax Code of the Russian Federation (for organizations using the simplified tax system).

However, recently the Ministry of Finance of Russia (letter No. 03-11-06/2/7790 dated February 19, 2015) concluded that it is impossible to take into account the director’s salary as part of “simplified” tax expenses.

The reason for the prohibition of recording wages in a “simplified” base lies in the same impossibility of concluding an employment contract between a director and himself. According to the Ministry of Finance of Russia, since the head of an organization, who is its sole founder and member of the organization, cannot accrue and pay wages to himself, then such wages do not reduce taxable profit (clause 21 of Article 270 of the Tax Code of the Russian Federation).

This position of the Russian Ministry of Finance is not new. Previously, such clarifications were addressed to a taxpayer applying the Unified Agricultural Tax (letter of the Ministry of Finance of Russia dated October 17, 2014 No. 03-11-11/52558) and an individual entrepreneur applying the simplified tax system with the object of taxation “income reduced by the amount of expenses” (letter of the Ministry of Finance of Russia dated 01/16/15 No. 03-11-11/665).

It should be noted that representatives of the financial department expressed a position regarding special regimes, but, taking into account the above logic of reasoning, it can be assumed that a similar position will be extended to taxpayers applying the general taxation system.

Basic papers

Petition

A petition from a legal point of view means a request that is sent by government bodies that have the authority to consider and resolve it.

Important! The regulations for the preparation of documentation on the appointment of a bonus to a director must be approved by the local regulatory act of the company or regulated at the regional level.

The form of this document is free, but there are a number of rules that must be followed.

The application for a bonus must contain references to legislation or internal acts of the company that serve as the basis for issuing the reward. When drawing up an application, you must provide the following information:

- title of the document “Application for Bonus”;

- date of preparation of the document and its serial number;

- information about the director: full name, position title, name of the structural unit to which he is assigned;

- type of award;

- amount due and method of calculation of remuneration;

- reasons for bonuses;

- signature of the person who prepared the petition.

Position

When compiling this document, the following information is indicated:

- reasons for bonuses;

- payment terms;

- remuneration amounts.

The position serves to increase material interest in improving the quality of job duties, tasks and functions performed.

Solution

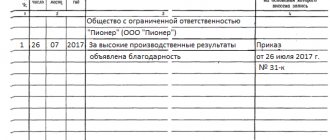

A director can be awarded a bonus only by decision of the organization's shareholders. A similar decision is made at the meeting and included in the minutes.

A decision is a document drawn up on company letterhead. The secretary records the following information in it:

- the total number of persons present, indicating the powers or incompetence of the meeting, the full name, position and passport details of the meeting chairman and secretary are also indicated;

- agenda: indicate the appointment of a bonus to the director;

- an indication of the amount of remuneration and the period for its receipt;

- signatures of the founders, the secretary of the meeting.

Reference! All minutes of the meeting are sent to an authorized person for storage.

Order

The order to assign remuneration is issued on the basis of a decision made by the shareholders. Then it is signed by the director himself. The order includes the following information:

- FULL NAME. and the position held by the person to whom the remuneration is due;

- The reason why the decision was made to award the employee a bonus;

- grounds for assigning remuneration;

- the amount and terms of payment of the bonus.

After drawing up the order, it is printed on the company’s letterhead. For convenience, the legislator suggests using form T-11. It was approved by the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 “On approval of unified forms.”

Protocol

This document can be formatted in different ways:

- it can be signed by all members of the meeting;

- The presiding officer and the secretary can sign the protocol.

Each of the above methods must be enshrined in the local act of the company. When compiling a duct, the following data is used:

- type of general meeting;

- form of conduct;

- location;

- time spending;

- total number of participants with their full names;

- agenda;

- Names of the persons who heard and decided;

- signature of the chairman and secretary of the meeting.

Putting it under control

The display of bonuses in accounting is compiled taking into account the sources from which the remuneration is paid:

- due to expenses for ordinary activities;

- at the expense of other expenses.

USN and OSNO

Firms that pay a single tax on the difference between expenses and income can include remuneration as part of the costs that reduce the tax base for the single tax.

This is enshrined in sub. 6 clause 1, clause 2 art. 346.16 of the Tax Code of the Russian Federation.

But this is possible if two conditions are simultaneously met:

- remuneration is provided for in the employment agreement;

- payments are made for performance indicators.

The amount of the premium is included in expenses at the time of its payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

UTII

When a company uses a general taxation system and pays UTII, the director will have to keep separate records of bonuses for different types of activities. Rewards that are awarded for achieving certain indicators should be classified as expenses for the type of activity to which they relate. When a bonus is awarded for the overall results of a company’s work, it is distributed (clause 9 of article 274, clause 7 of article 346.26 of the Tax Code of the Russian Federation).

Income tax

Various types of remuneration for production indicators, which are provided for in the employment agreement, must be taken into account when calculating income tax as part of expenses for remuneration of labor activities - clause 2 of Art. 255, paragraph 21 art. 270 of the Tax Code of the Russian Federation (for details on whether a bonus is subject to personal income tax, and also when it is not withheld from wages, read our material).

All bonuses that were accrued to the director cannot be taken into account for taxation (clause 21, article 270 of the Tax Code of the Russian Federation). Remunerations that are not related to the director’s performance of his job duties (for example, an anniversary, a holiday) also do not reduce the tax base for income tax.

Attention! The bonus to the manager is an indirect expense, and not a production indicator of the manager's incentives. When a company calculates income tax using the accrual method, these costs are fully attributed to the expenses of the current period (clause 2 of Article 318 of the Tax Code of the Russian Federation).

We talked more about the specifics of taxation of funds allocated for employee bonuses here.

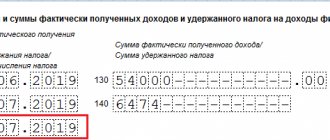

Personal income tax

It doesn’t matter what taxation system is used by the organization, with a bonus the boss must calculate personal income tax - clause 1 of Art. 210 of the Tax Code of the Russian Federation (read about the procedure for calculating and paying personal income tax on bonuses for individuals here, and from this article you will learn how to reflect the bonus in 6-personal income tax separately from salary). The amount of remuneration is affected by contributions for insurance against accidents and occupational diseases (Article 20.1 No. 125-FZ). also influence the amount of the premium.

In this case, the cost of goods (works, services) includes the corresponding amount of value added tax, and for excisable goods, the corresponding amount of excise taxes.

This rule applies regardless of whether remuneration is provided for in the employment agreement or not. Not only employees of the organization, but also its director can receive the bonus. Only the shareholders of the organization can assign it to him. The director has the right to independently issue his own remuneration only if he is both a founder and a manager.

Reflection in accounting

The source of bonuses, indicated in the documents regulating the payment to the manager, determines the correspondence of the accounts. The bonus associated with production efficiency is included in the costs of ordinary activities: Dt 44, 26 Kt 70 (PBU 10/99 clause 5.8). Non-production bonuses, for example, for a professional holiday, are included in other expenses: Dt 91/2 Kt 70 (ibid., clause 11). Bonuses from net profit, annual, are reflected by posting Dt 84 Kt 70.

- the bonus from net profit is subject to income tax, but is not taken into account as expenses (Articles 270-1, 208-6 of the Tax Code of the Russian Federation);

- bonuses during the year are not included in NU expenses unless they are mentioned in the agreement with the manager (Article 270-21 of the Tax Code of the Russian Federation) and were calculated for indicators not related to work activity (Article 255-2 of the Tax Code of the Russian Federation);

- bonuses due to special financing, target amounts are also not reflected in expenses (Article 270-22 of the Tax Code of the Russian Federation).

Results and conclusions

Giving bonuses to the CEO without the knowledge of the founders is illegal. Permanent bonus payments to management must be included in the employment contract, LNA of the company. One-time bonuses are related to the decision of the meeting of participants. The director, being the only participant in the company, does not have the right to receive bonuses on the basis of his own order. The decision of a single participant is required.

In accounting, the bonus is reflected in connection with the source of its payment, on the credit of account 70. In NU, the bonus cannot be reflected in expenses if it is not fixed in the employment agreement with the director. A bonus from net profit does not increase expenses; similarly, bonuses from targeted revenues.

The reasons for bonuses to the director must be indicated in the organization’s internal legal act on bonuses. In the employment agreement, it is enough to indicate a reference to this act, but decoding is not necessary.

A one-time bonus is issued based on the results of a year, half a year or quarter, when the results of work allow additional payments to be issued. They are accrued and issued on the basis of a decision of the highest executive authorities of the organization.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.