About bonuses for employees

The terms of remuneration (including the size of the employee's tariff rate or salary, additional payments, allowances and incentive payments) must be reflected in the employment contract with the employee (Part 2 of Article 57 of the Labor Code of the Russian Federation). However, this does not mean that all employers must provide bonuses. Specific terms of remuneration are the result of an agreement between the employer and the employee. And they may include, for example, solely paying the employee a salary. If the terms of remuneration also provide for the payment of bonuses to the employee, then only in this case information about this should be included in the employment contract. In this case, the procedure and conditions for paying bonuses can be specified in detail in the employment contract itself. For example, “the employee is given a monthly bonus in the amount of 30% of the official salary.” Or the payment of the bonus may be made dependent on the presence or absence of disciplinary sanctions, but the size of the bonus is also clearly defined.

Or you can indicate in the employment contract that the bonus is accrued and paid to the employee on the terms and in the manner prescribed by local regulations. Such a local act will be the Regulation on Bonuses. And its approval with such wording in the employment contract is mandatory.

Please note that a document disclosing the procedure for paying bonuses to employees may be part of a general local regulatory act. For example, the Regulations on remuneration and bonuses for workers. Or it could be an independent document devoted exclusively to issues of bonuses for employees. An example of the Regulations on bonuses for employees (sample 2019) is given below.

Sample employment contract with incentive payment in the amount of a fixed amount

It is also a violation of the employee’s rights if more than 15 calendar days pass between the advance payment and the final payment.

- The form of remuneration is incorrectly indicated. An error will be considered a situation when the employer pays part of the salary with a product, and this is either not fixed in any way in the contract, or the maximum share of the total payment is not limited. In the Labor Code of the Russian Federation, this figure is 20% of the monthly salary. Moreover, the employee's written consent is required. If wages are indicated in foreign currency, then such a document will not be valid in the territory of our state. Regardless of what currencies the organization works with, the amount of payment in the employment contract is specified only in rubles.

- Illegal penalties are prescribed. In order to further stimulate employees and preserve their own funds, employers indicate various fines in the contract.

Labor legislation does not require specific amounts of additional payments, allowances and incentive payments to be indicated in the employment contract. However, it is necessary (if available) to indicate at least general information about all additional payments and allowances of a compensatory nature and incentive payments in accordance with the current remuneration systems of this employer (paragraph 5, part 2, article 57 of the Labor Code of the Russian Federation).

Thus, additional payments, allowances and incentive payments can be directly indicated in the employment contract, or it can make reference to the relevant local regulation, collective agreement, agreement, which provides the grounds and conditions for their payment. In the latter case, the employee must be familiarized with their contents against signature (Part 3 of Art.

68 Labor Code of the Russian Federation, Letters of Rostrud NN 395-6-1, 428-6-1).

The terms of remuneration stipulate the size of the salary or tariff rate established for a given position, as well as various types of additional payments, incentive payments and allowances. They are an integral part of the remuneration system and belong to the category of mandatory conditions to be included in the employment contract, in accordance with the provisions of Art. 57 and parts 1 art. 135

Attention

The procedure for paying bonuses can be fixed:

- in local acts;

- collective agreements;

- agreements;

- employment contracts.

If there is no bonus system in the organization, the head of the organization has the right to pay bonuses arbitrarily, at his own will. However, he is not responsible for making payments.

The legislation does not provide for types of bonuses for ordinary categories of employees. In practice, bonuses are paid:

- For labor performance.

- For the lack of penalties for employees.

- For holidays, anniversaries, vacations.

- After certain time periods have passed: month, quarter, year.

We suggest you read: They are required to resign or transfer after a miscarriage, what to do.

Monthly bonus to salary in the employment contract The employment contract may stipulate the procedure for bonuses for a specific employee.

It must be strictly observed.

The wording of the employment contract in this part may be as follows: “The employee may be paid a bonus in the amount of up to 100% of the salary, subject to the conditions and procedure established by the bonus regulations (reference to the regulation)” or “The employer establishes additional payments, allowances and incentive payments.

The amounts and conditions of such additional payments, allowances and incentive payments are determined in the provision on bonuses for the employee (reference to the provision), with which the employee is familiarized with signature when signing the employment contract" or "The employee may be paid additional payments, allowances, bonuses for high qualifications and personal contribution to results of the employer’s activities, length of service, additional payments for an increased volume of work, high quality in accordance with the regulations on remuneration (reference to the regulations), which the employee must be familiar with upon signature.”

What is the salary for part-time workers? If the salary for a part-time position is, say, 6,000 rubles, then in this case the employment contract states that “this contract establishes a salary for the Employee in the amount of 3,000 (Three thousand) rubles,” since the number of hours per day for work part-time employees should not exceed 4.

If a five-day work week is established, then we get 20 workers, which is 0.5 of the rate. Therefore, the salary is indicated in full, and the salary is indicated depending on the employee’s rate.

Thus, when drawing up an employment contract, the employer must be careful, read the laws, use the above information, so that in the future there will be no misunderstandings or problems with various authorities.

If the collective or labor agreement does not specify the procedure for remuneration in kind, then appropriate changes can be made to the labor or collective agreement. The terms of an employment contract can only be changed by agreement of the parties by signing an additional agreement (Article 72

Labor Code of the Russian Federation). The terms of a collective agreement can be changed in the manner established by the Labor Code of the Russian Federation for its conclusion, or in the manner provided for by the collective agreement (Article 44 of the Labor Code of the Russian Federation). If the form, procedure and place of payment of wages are determined by a collective agreement, then in the employment contract with the employee it is enough to make a reference to it.

As a general rule, wages are paid in cash in the currency of the Russian Federation (in rubles). However, an employment or collective agreement may establish that, at the written request of the employee, partial remuneration (no more than 20% of the accrued monthly salary) is made in non-monetary form (Article 131

Labor Code of the Russian Federation, paragraph 54 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation”).

An employment or collective agreement must determine how wages are paid: - in cash at the place of work; — by bank transfer by transferring funds to the credit institution specified in the employee’s application; - in non-monetary (in particular, in kind) form at the place of work or other place (Art.

Art. 131, 136 Labor Code of the Russian Federation). Question: How to correctly indicate the condition of remuneration in an employment contract? Answer: In the employment contract with the employee, it is necessary to indicate the specific amount of the tariff rate or official salary.

Additional payments, allowances and incentive payments may be directly indicated in the employment contract, or it may make reference to the relevant local regulation or collective agreement, agreement, which provides the grounds and conditions for their payment.

We invite you to read: Calculation of vacation without errors, taking into account weekends and holidays

An employment contract does not have to indicate a specific date for payment of wages; it is enough to make a reference to internal labor regulations or a collective agreement.

Rationale: Wages (wages) are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed, as well as compensation payments and incentive payments (Art.

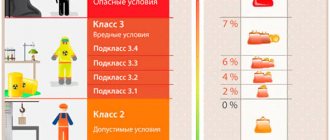

Additional payments, allowances and incentive payments in the employment contract Additional payments and allowances of a compensatory nature (for performing work with harmful and (or) dangerous working conditions, for working in areas with special climatic conditions, for working at night, for overtime work, other payments) relate to compensation payments, and additional payments and incentive allowances, bonuses and other incentive payments (remunerations based on the results of work for the year, for length of service, other payments) refer to incentive payments.

Remuneration systems, including tariff rates, salaries (official salaries), additional payments and compensatory allowances, systems of additional payments and incentive allowances and bonus systems, are established by collective agreements, agreements, and local regulations. The employee’s salary is established by the employment contract in accordance with the current employer’s remuneration systems (Article 135

Labor Code of the Russian Federation). Therefore, the terms of remuneration must be included in the employment contract. In this case, it is necessary to indicate the size of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments (para.

5 hours 2 tbsp. 57 Labor Code of the Russian Federation). However, the legislation of the Russian Federation does not contain clearer requirements on how to indicate the terms of remuneration in an employment contract. The essence of a personal allowance An employee can receive not only a “bare” salary, but also additional payments, including those assigned in addition to wages.

The Labor Code does not have a precise definition of a bonus. The bonus included in the salary, reflected in the employment contract or additional agreement thereto, is common to all personnel upon the occurrence of certain conditions, for example, for work in certain climatic zones, for shift work, etc.

Such allowances are not considered personal. If the employer is not obliged to assign a bonus, but he does it for individual employees on an individual basis, reflecting the conditions of appointment in a special Regulation, collective agreement or other local act, such a payment will be a personal bonus.

The right to assign such payments by the employer is granted by Art. 135 Labor Code of the Russian Federation.

The wording may be as follows: In this case, the employment contract cannot use the wording “Payment according to the staffing table” or “The official salary of the employee is established in accordance with the staffing table.” If the employer does not indicate a specific salary amount, this will violate the requirements of paragraph 5 of Part 2 of Art. 57 Labor Code of the Russian Federation.

Thus, referring to the staffing table instead of indicating the specific amount of the employee’s salary is a violation of the requirements of labor legislation, for which the employer may be brought to administrative liability under Part 1 of Art. 5.27 of the Code of the Russian Federation on Administrative Offenses (CAO RF).

Therefore, when paying time-based labor, the employment contract must indicate the specific amount of the tariff rate or official salary of the employee, as well as additional payments, allowances and incentive payments.

At the same time, the law does not require the specific amount of additional payments, allowances and incentive payments to be indicated in the employment contract.

We are developing Regulations on bonuses for employees

The structure and content of the Regulations on bonuses and material incentives for employees is determined by the employer independently. At the same time, it is in the interests of both the employer and the employee to detail in the Regulations all types of production bonuses paid by the organization, the grounds for their accrual, as well as the amount of bonuses. After all, the likelihood of claims arising both from employees and from regulatory authorities will depend on how transparently such aspects are spelled out in the Regulations. Let us recall, by the way, that bonuses that are not provided for either by an employment or collective agreement with an employee or by a local regulatory act of the employer cannot be taken into account in tax expenses (Letter of the Ministry of Finance dated September 22, 2010 No. 03-03-06/1/606).

It is necessary to familiarize employees with the approved Regulations on bonuses upon signature upon their employment (Part 3 of Article 68 of the Labor Code of the Russian Federation).

An example of the Regulations on bonuses for employees of an enterprise is given below.

Articles on the topic

Bonuses are often part of the salary. Organizations, especially recently, prefer to combine wages from salary and such incentive additional payment. Under current conditions, this is quite reasonable, since it allows you to reduce the amount of premiums if there are objective grounds. But here it is important to formulate the conditions for material incentives both in the local act of the organization and in the employment contract.

From this article you will learn:

- when payment of a bonus is an obligation and not a right of the organization;

- how an employer can avoid making the bonus mandatory;

- how to formulate the conditions for granting bonuses in an employment contract;

- Is it possible not to pay premiums or pay them in a smaller amount?

My own lawyer

Now, even if the amount of the bonus is fixed in the contract, the employer has a chance to prove why the employee is not entitled to it. If the employer intends to change the entire bonus system as a whole, then he will have to change the terms of the TD.

If the bonus is part of the salary, that is, it is specified in the employment contract, then any adjustments to the local act will require changing the TD.

This can be done either through the procedure under Art. 74 of the Labor Code of the Russian Federation, or by agreement of the parties. The procedure for changing the terms of the contract is cumbersome and often contestable.

In such cases, the employer needs to come up with reasons why this had to be done (organizational or technological changes). Therefore, it is best for the employer to enter into an agreement with the employee. By law, it can be achieved at any time. As already mentioned, often the employer does not stipulate a specific bonus amount in the employment contract.

If it is not assigned to the TD

In what situations does an organization have no right to refuse to pay a bonus?

Bonuses are incentive payments. Moreover, the order in which they are made, the conditions for bonuses, and the amount of such incentives can be established by the employer himself. For this purpose, most often, a special local act is developed and approved - the Regulations on Bonuses. It is in this document that all the necessary information on the issues of incentive additional payments in the organization is prescribed.

If the company has a primary trade union organization, this local act will need to be agreed upon with it. This condition is provided for by part 4 of article 135 of the Labor Code of the Russian Federation. But if there is no trade union in the organization, approval of such a Regulation will only require an order from the manager.

When developing the Regulations on bonuses, you must be very careful about the wording. After all, the mandatory nature of payments will depend on how you specify the conditions for calculating incentive bonuses in the local act. So, for example, if a local act states that the employer is obliged to pay bonuses, or the employer pays incentives (without indicating the right), the payment becomes mandatory. In this case, the company makes the incentive additional payment an indispensable part of the salary and it will have to be made regardless of the financial situation of the organization and the decision of the manager.

How to specify the payment of bonuses in an employment contract

Issues related to wage conditions must be included in the text of the employment contract. All personnel officers know this rule; it is established by part 2 of article 57 of the Labor Code of the Russian Federation. In this case, it is imperative to indicate the size of the salary; it must correspond to the indicator that is in the staffing table.

The amount of the incentive, the conditions and procedure for its payment may not be clearly stated in the employment contract. But it is necessary to make a reference to the local act on bonuses. For example, the wording may be as follows: “The employer has the right to pay bonuses to the employee in the amount, in the manner and under the conditions established by the Regulations on bonuses of the organization.” If the rules for payment of remuneration are enshrined in the employment contract in this form, the employee must be familiarized with the Regulations on Bonuses upon signature. So, if a new employee is hired, he should be given this provision to read before signing the employment contract. If the Regulations on bonuses are adopted or changed during the work process, all employees must also be familiarized with it.

There may be a situation where, for one reason or another, the organization does not have a bonus provision. And if material bonuses are expected to be paid, all necessary conditions must be specified directly in the text of the employment contract. So the contract will need to indicate:

- bonus amount;

- frequency of payments (once a month, quarterly, year-end, etc.);

- conditions for calculating such additional payment;

- conditions under which the bonus is not paid or the payment is made in a smaller amount.

Order for a bonus

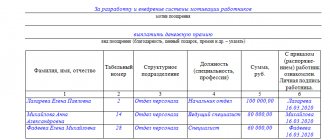

The manager's order is drawn up according to unified forms approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1: Form T-11 or Form T-11A (for bonuses to a group of employees).

The Instructions for Application and Completion of Forms state that Form T-11 and Form T-11A:

- used to formalize and record incentives for success in work;

- are compiled on the basis of a proposal from the head of the structural unit of the organization in which the employee works;

- signed by the manager or authorized person;

- are announced to the employee against signature.

Based on the order, an entry is made in the employee’s personal card (Form T-2 or Form T-2GS (MS)) and his work book.

When registering all types of incentives, except for monetary rewards (bonuses), it is allowed to exclude from Form T-11 the requisite “in the amount of ______ rubles. _____ cop.”

When filling out Form T-11, the full name, structural unit, and type of incentive (gratitude, valuable gift, bonus, etc.) are indicated. If we are talking about material assistance and valuable gifts as elements of bonuses, then, according to clause 28 of Art. 217 of the Tax Code of the Russian Federation, personal income tax is not calculated if material assistance does not reach 4,000 rubles.

Arbitration practice shows that a gift is not money, but a thing. However, sometimes the tax authorities regard money as a gift. Therefore, you need to be prepared for an ambiguous approach from the tax authorities to such situations.

How not to make a bonus a mandatory payment

In order for the bonus not to have the status of a mandatory additional payment, it is necessary to indicate in the local act the employer’s right to make such accruals. The payment condition may look like this: “The employer has the right to make monthly bonuses to employees depending on the results of work and the financial situation of the organization.”

more about the employment contract: types

Wording indicating the company's right in matters of financial incentives helps to prove the legality of the manager's decision not to pay incentives.

In addition, be sure to indicate all bonus conditions in the local act. Thus, the possibility of paying such a special incentive or its size may be made dependent on the employees fulfilling their job duties, observing labor discipline, and achieving certain production indicators. And if the established indicators are not achieved or the conditions are met, the employer will have every right not to provide financial incentives to employees.

You also need to be careful when determining the amount of financial incentives. It is not at all necessary to indicate a fixed payment amount in the local act. As an example, an employer may set a bonus as a percentage of salary. In this case, the condition on the amount of payment can be stated as follows: “The bonus is paid in the amount of 10 to 70 percent of the employee’s salary.” Or it can be established that the employee can be paid a bonus of up to 50,000 rubles.

How to correctly spell out the terms of remuneration

Yulia Zhizherina, business consultant on personnel management and labor law, tells how to prepare salary documents to avoid fines.

Employers often make mistakes when describing wage conditions, which can lead to unpleasant consequences.

For incorrectly indicating the terms of remuneration in an employment contract, the employer may face administrative liability under Part 4 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation in the form of a fine on officials in the amount of 5,000 to 10,000 rubles; for legal entities - from 50,000 to 100,000 rubles.

If the employer incorrectly prescribed wage standards in local regulations, he may be held liable under Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation in the form of a fine on officials in the amount of 1,000 to 5,000 rubles; for legal entities - from 30,000 to 50,000 rubles.

If working conditions are incorrectly reflected in the employment contract or local regulations, there is also a risk of a dispute with the employee, who, to protect his rights, can appeal to both supervisory authorities and the court.

If an employee contacts supervisory authorities, the employer will in any case face an inspection. If the employee goes to court, then if a decision is made in his favor, he can also recover moral damages from the employer.

To avoid these risks, spell out the terms of remuneration correctly in all documents.

In local regulations

Labor laws governing wages are few in number. Art.

135 of the Labor Code of the Russian Federation states that wages are established by an employment contract in accordance with the current employer’s remuneration systems, described in local regulations.

Thus, local regulations are the main documents regulating wages. Based on these documents, the terms of remuneration are reflected in the employment contract.

The only requirement for local regulations is that they do not worsen the situation of workers in comparison with the legislation.

In the internal labor regulations

According to current practice, the internal labor regulations must necessarily reflect the timing of payment of wages (Article 136 of the Labor Code of the Russian Federation). In this case, specific dates should be specified.

To avoid errors in determining payment dates, keep in mind that wages must be paid at least every half month, and no later than 16 days after the end of the period for which they were accrued (ILO Recommendation No. 85):

“The official salary is paid to the Employee every half month for the time actually worked based on the time sheet: for the first half of the month - on the 16th day, for the second half - on the 1st day of the next month.”

As for the amount of wages for the first part of the month (the so-called advance), the rules need to stipulate that it is paid according to the time actually worked (Resolution of the Council of Ministers of the USSR dated May 23, 1957 No. 566; Letter of Rostrud dated 09/08/2006 No. 1557- 6) in accordance with the report card. Setting the first part of the salary at a specific amount, for example 40%, is illegal.

In the terms of remuneration, it will be illegal to establish that the employee is obliged to receive wages from a certain bank, for example, as part of a salary project (Article 136 of the Labor Code of the Russian Federation).

Please note that to change the bank, the employee must inform in writing about the change in the details for the transfer of wages no later than five working days before the day of payment of wages. This condition can be fixed in a local act.

The employer has the right to establish a special procedure for an employee to submit an application to change a credit institution.

According to Art. 134 of the Labor Code of the Russian Federation, the company must establish conditions for wage indexation (see also Determination of the Constitutional Court of the Russian Federation dated June 17, 2010 No. 913-О-О). The provisions of the current labor legislation do not directly indicate the frequency of wage indexation; it is determined by the employer. This is usually done once a year:

“The Employer indexes the wages of employees, as a rule, by 3% annually in the second quarter of the current year based on the financial capabilities of the Employer and the approved budget.”

Write down all the guarantees and compensations provided to employees by law (allowances, additional payments, compensation), and also secure other payments established by the employer (for example, the possibility of bonuses).

In the wage regulations

Be sure to establish a wage system, a system of additional payments and allowances, and a bonus system (Article 135 of the Labor Code of the Russian Federation). If different categories of employees have different remuneration systems, the remuneration regulations must describe them all.

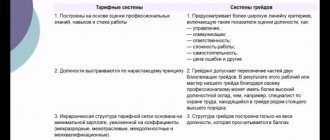

The section on the remuneration system or systems describes its elements: time-based, time-based-bonus, piece-rate, piece-rate-bonus, commission, etc. If the system includes salaries, you can specify how they are set. If the company has a grading system, it can be included in the salary regulations as an appendix.

In light of the requirements of Art. 133 of the Labor Code of the Russian Federation indicate that wages cannot be lower than the minimum wage established by law.

To discipline employees, state that “wages are calculated based on the working time worked by the employee according to the working time sheet. The employee’s absence from the workplace without good reason is not paid.”

The amount of additional payments for combining duties, performing the duties of an absent employee, or expanding the scope of work can be stated as a specific percentage of the salary or it can be indicated that their amount is provided for by agreement of the parties.

Indicate the procedure and terms for paying wages, whether wages are paid in cash through the organization’s cash desk or transferred to bank accounts, in what parts wages are paid, on what dates. This section also specifies the guarantees provided for by the Labor Code of the Russian Federation (payment of vacation no later than 3 days in advance, payment of wages when the payment day coincides with a weekend or holiday, etc.).

If the company employs employees who work in the Far North, indicate that the company pays percentage bonuses and regional coefficients and their size (Article 135 of the Labor Code of the Russian Federation):

"3.1.3. To the actual accrued wages, including bonuses related to the performance of labor duties, a regional coefficient of 30% is applied to wages for work in areas equated to the regions of the Far North.

3.1.4. To the actual accrued wages, including bonuses related to the performance of labor duties, a percentage increase of 50% is applied to wages for work in areas equated to the regions of the Far North.”

The employer also needs to provide guarantees and compensation for employees working in harmful and/or dangerous working conditions, compensation or allowances for the traveling nature of the work, for working on a rotational basis.

Describe what allowances and additional payments are due to certain categories of employees. For example, the wage regulations stipulate guarantees of increased payment to employees for overtime work and work on days off and non-working holidays.

A whole section of the remuneration regulations can be devoted to a description of the terms of bonuses.

When compiling this section, you can specify the conditions for bonuses in detail, down to KPI, or you can limit yourself to the phrase: “Employees for effective work and conscientious work, by decision of the manager, may be paid a bonus.”

At the request of the employer, the terms of bonuses can be formalized in a separate local regulatory act, for example, by approving the regulations on bonuses.

In the bonus regulations

Providing bonuses to employees is a right, not an obligation, of the employer. If the employer decides to approve the bonus provision, this document can reflect:

- bonus indicators;

- bonus conditions;

- circle of employees receiving bonuses;

- amounts of bonus payments;

- procedure for calculating bonuses;

- frequency of bonuses;

- sources of bonuses;

- a list of circumstances in the presence of which the bonus is paid less than the base amount or is not paid at all;

- list of payments for which the bonus is calculated.

When drafting the text of the bonus regulations, do not allow a situation where the bonus may be considered mandatory.

Non-payment of premium

We have already said above that all conditions for the payment of material bonuses must be reflected in the local act of the organization or directly in the employment contract. Particular attention should be paid to those provisions that will determine the procedure for non-payment of bonuses or determine the conditions under which the amount of the incentive is reduced. Most often, employers reduce the amount of additional payments or do not pay them at all when:

- the employee commits a disciplinary offense;

- presence of disciplinary action;

- violation of internal labor regulations:

- failure to complete a certain amount of work;

- presence of defects in work;

- failure to achieve certain indicators.

It is important to establish all these conditions so that there are no subsequent disputes regarding the issue of reducing the amount of the incentive or non-payment of such a bonus. After all, if these provisions are not included in the local act, the employer will have to pay the employee bonuses even if the work result is unsatisfactory.

Therefore, if you carefully formulate all the necessary conditions, it will be quite simple for the manager to justify to the employee the reason for reducing the size of the bonus or non-payment of the bonus. And this, in turn, will help avoid a legal dispute. Accordingly, when developing bonus provisions, as well as drawing up an employment contract, be careful about the wording.

25.07.2018

By Sergey Mashkov / 30th May, 2020 / Business law / No Comments

The head of an organization, who is its sole founder and member of the organization, cannot calculate and pay wages to himself. Therefore, the amount of wages is not taken into account in expenses (letters of Rostrud dated March 6, 2013 N 1776-1, Ministry of Finance of Russia dated February 19, 2020 N 03-11-06/2/7790). However, in Art.

Bonuses for the head of the organization

- or on the basis of the minutes of the general meeting of participants (shareholders);

- or based on a decision of the board of directors or supervisory board;

- or based on the decision of the sole participant (shareholder who owns all voting shares) of the organization.

An example of how to draw up the minutes of a general meeting of participants on the payment of a bonus to the general director. For the fulfillment of the established bonus indicators, the participants of Torgovaya LLC approved a quarterly bonus to the general director A.V. Lvov. This decision was documented in the minutes of the general meeting. Attention: a hired director does not have the right to sign an order to accrue a one-time bonus to himself.

A manager cannot assign a bonus to himself

Attention

The accrual of non-production bonuses in the accounting accounts is reflected in the following entry: Debit 91 subaccount “other expenses” Credit 70 - a non-production bonus was accrued to the director of the organization. Personal income tax must be calculated and withheld from the manager’s bonus in accordance with the requirements of clause 1 of Art. 210 of the Tax Code of the Russian Federation. At the same time, this must be done regardless of what taxation system the organization uses. In accordance with Art.

20.1 of the Federal Law of July 24, 1998 N 125-FZ, contributions for insurance against accidents and occupational diseases are calculated on the amount of the premium. Also, regardless of the taxation system used, contributions for compulsory pension, medical and social insurance must be calculated on the amount of the premium.

However, this is possible if two conditions are simultaneously met:

- bonuses are provided for in the labor (collective) agreement;

- bonuses were paid for labor performance.

Include the amount of bonuses in expenses at the time of their payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation). An example of taxation of a quarterly bonus accrued for production results. The organization applies a simplified tax system; it pays a single tax on the difference between income and expenses. Alpha LLC uses a simplified tax system. The single tax is paid on the difference between income and expenses.

In April, Alpha General Director A.V. Lvov received a bonus based on the results of the first quarter.

Important

The source of remuneration is the profit remaining at the disposal of Aurora LLC after taxation. The size of the bonus depends on the length of service of the General Director in his position at Aurora LLC: - up to 2 years - in the amount of 15% of the official salary; - from 2 to 5 children - in the amount of 30% of the official salary; - over 5 years - in the amount of 50% of the official salary. Remuneration at the end of the year is paid if there is a free balance of profit, taking into account the time actually worked. 5.4.

The decision on bonuses to the General Director and payment of remuneration to him at the end of the year is made by the sole founder. How to include bonuses for the director of a government institution in an employment contract

Info

How to draw up a regulation on bonuses for the general director? Bonuses for the general director must be carried out according to the rules established by the legislator. However, the regulations do not cover this issue in detail, so the employer needs to develop a local act that will include a provision on bonuses for the general director (the provision can be either an independent document or be part of the salary regulation).

Important changes: employment contract, wages and bonuses

Important changes in labor legislation: employment contract, remuneration and bonuses in 2020

An employment contract is the main document regulating labor relations. When hiring, it must be drawn up in writing in two copies (Part 1 of Article 67 of the Labor Code of the Russian Federation). If the employment contract is not drawn up properly, the organization faces a fine of up to 100,000 rubles (Part 3 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation). When hiring a new employee, it is not enough to simply conclude an employment contract with him (although some employers ignore even this key condition, clearly stated in the Labor Code of the Russian Federation), you also need to check the correctness of its preparation: the document must contain all mandatory information (facts that have legal meaning) and terms (obligations that the parties agree on). The procedure for concluding an employment contract, this is the algorithm according to which an employment contract must be drawn up, is clearly stated in Chapter 11 of the Labor Code of the Russian Federation, in particular in Article 65, and the employer is obliged to adhere to it:

1) first, the future employee must be familiarized with local acts that are directly related to his work activity at the new place of work: a collective agreement (if there is one at the enterprise), internal labor regulations, job descriptions, etc.;

2) only after familiarization with the local documentation, an employment contract is concluded, the terms of which (including main job responsibilities, place of work, social guarantees, etc.) are agreed upon in advance with the employee; the document is drawn up in two copies, in writing, with each party signing both copies; one copy is given to the employee, about which a corresponding mark is made on the copy remaining with the employer;

Salary reduction: registration procedure

In accordance with Art. 74 of the Labor Code of the Russian Federation in the case when, for reasons related to changes in organizational or technological working conditions (changes in equipment or production technology, structural reorganization of production, other reasons), the terms of the employment contract determined by the parties cannot be preserved, they can be changed at the initiative of the employer , with the exception of changes in labor function.

In this case, the employer must comply with a number of conditions:

A real change in organizational or technological working conditions, resulting in a change in wage conditions.

It is clear that in a financial crisis, a number of employers may try to use this norm to cover up the real reasons for reducing wages - the lack of necessary funds.

It should be borne in mind that lack of funding is not a basis for changing the terms of remuneration in accordance with Art. 74 Labor Code of the Russian Federation.

Resolution of the Plenum of the Supreme Court of the Russian Federation dated March 17, 2004 N 2 “On the application by the courts of the Russian Federation of the Labor Code of the Russian Federation” in paragraph 21 provides that the courts, when resolving cases on declaring illegal changes to the terms of the employment contract determined by the parties when the employee continues to work without changing the labor function are required to check the evidence provided by the employer confirming that the change in the terms of the employment contract determined by the parties was a consequence of changes in organizational or technological working conditions.

The Supreme Court provides an approximate list of such reasons:

• changes in equipment and production technology, • improvement of jobs based on their certification, • structural reorganization of production.

According to the Supreme Court, in the absence of such evidence, a change in the terms of the employment contract determined by the parties cannot be recognized as legal.

Compliance with a certain procedure prior to the introduction of new wage conditions.

The employer is obliged to notify the employee in writing no later than two months in advance about upcoming changes in the terms of the employment contract (in this case, changes in the terms of remuneration), as well as about the reasons that necessitated the need for such changes. This can be done in the form of a written familiarization of the employee with the order (instruction) of the employer on the changes being introduced, or by sending a written notice to the employee.

If the employee does not agree to work under the new conditions, the employer is obliged to offer him in writing another available job (both a vacant position or work corresponding to the employee’s qualifications, and a vacant lower position or lower paid job), which the employee can perform taking into account his health condition . At the same time, the employer is obliged to offer the employee vacancies available in the given locality; the employer has the right to offer vacancies in other localities only if this is provided for in a collective or labor agreement.

Changes in the terms of the employment contract determined by the parties should not worsen the employee’s position in comparison with those established by the collective agreement and agreements.

Thus, if the organization has a collective agreement that fixes the level of remuneration for certain categories of workers, the changes introduced should not worsen these provisions.

If there is no work that the employer is obliged to offer to the employee, or if the employee refuses the offered work, the employment contract is terminated in accordance with clause 7, part 1, art. 77 Labor Code of the Russian Federation.

It should be taken into account that failure by the employer to comply with the above conditions may lead to negative consequences for the employer. An employee may file a claim in court for reinstatement at work, or for the recognition of illegal changes in wage conditions.

In addition, it should be taken into account that a change in the terms of remuneration may concern not only a change in its size, but also the payment procedure. So, for example, an employer cannot forcibly transfer an employee to pay wages by bank transfer if the condition for this was not initially provided for in the employment contract. In accordance with Art. 136 of the Labor Code of the Russian Federation, wages are paid at the place where work is performed, or are transferred to the bank account specified by the employee under the conditions determined by the collective or labor agreement.

Question: How to correctly indicate the condition of remuneration in an employment contract? Answer: In the employment contract with the employee, it is necessary to indicate the specific amount of the tariff rate or official salary. Additional payments, allowances and incentive payments may be directly indicated in the employment contract, or it may make reference to the relevant local regulation or collective agreement, agreement, which provides the grounds and conditions for their payment. An employment contract does not have to indicate a specific date for payment of wages; it is enough to make a reference to internal labor regulations or a collective agreement. Rationale: Wages (wages) are remuneration for work depending on the qualifications of the employee, complexity, quantity, quality and conditions of the work performed, as well as compensation payments and incentive payments (Article 129 of the Labor Code of the Russian Federation).