Chess sheet - what is it and when is it used?

The statement fully reflects its name and is a table:

- vertically and horizontally – a list of used accounting accounts (statements);

- each operation - correspondence between two books/accounts - is entered in a cell at the intersection of the row and column of accounts from the correspondence;

- totals – sums by rows and columns – final debit and credit turnover of accounting accounts.

This “chessboard” arrangement of transactions in the statement allows you to control the correctness of accounting: the principle of double entry is observed here by itself, and errors are quite easily identified.

Small businesses can keep accounting records in a simplified form. One of the methods recommended by the Ministry of Finance for small businesses is accounting using registers. It uses “checkerboard” as a summary register.

Checking indicators when filling out

The posting of indicators is based on the chess principle, which provides convenient visual control. A number of other turnover sheets are built on the chess principle. One example is the principle of constructing entries in registers using the journal-order form of accounting.

Correctly carried out posting eliminates errors, which is confirmed by the same totals vertically and horizontally on the statement. When creating a statement, the accountant can immediately see the occurrence of non-standard transactions. A number of accounts cannot have correspondence with each other.

Chess sheet: example of filling according to accounting data

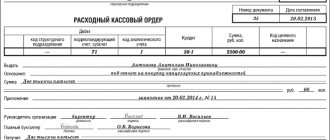

Let's look at filling out form No. B-9 using the example of operations for the receipt of materials and payment of debts to suppliers.

Example

In April, Alta LLC received 40 tons of cement from the supplier Kalina LLC at a price of 5 rubles/kg; from Omega LLC - 1000 liters of acrylic primer at a price of 79 rubles/liter.

All received primer 1000 liters at 79 rubles/l, as well as cement (including warehouse stocks) 44.2 tons at 5 rubles/kg, were transferred to production.

Payments have been made to suppliers for April deliveries.

Entries in form No. B-7 “Statement of settlements with suppliers” - the debt is reflected in correspondence with the debit of account 10:

Entries in form No. B-4 “Statement of cash and funds for account N51” in correspondence with the debit of account 60:

Entries in form No. B-2 “Inventory Accounting Statement” in correspondence with the debit of account 20:

The consolidated register - the chess sheet - contains the total turnover of statements for the month in the context of corresponding accounts.

After posting all the amounts, all debit and credit turnovers are calculated (amounts in the columns and rows of the checkerboard) and the total is verified.

Chess sheet

- a rather large-scale document, which is sometimes included in an extensive package of financial statements of enterprises and organizations. Sometimes this is because not all companies resort to registration. It is compiled based on the results of the annual period and includes summarized information from primary accounting documents.

FILES

Sources of data generation

The principle of constructing chess sheet data can be seen in the example of posting a number of operations. The sample does not contain 90 accounts that are mandatory for recording the results of activities. An example of compiling a statement for specified operations is presented below.

When maintaining records, the company recorded the following transactions:

- The following components received from the supplier were accepted for registration: Dt 10 Kt 60 – 20,000 rubles;

- Payment has been made for the supply of components: Dt 60 Kt 51 – 20,000 rubles;

- The components have been transferred to production: Dt 20 Kt 10 – 20,000 rubles;

- Wages accrued to workers: Dt 20 Kt 70 - 25,000 rubles;

- Salaries paid to the card: Dt 70 Kt 51 – 25,000 rubles. Conclusion: the total amount for credit and debit coincided, the transactions were carried out correctly.

| Credit | Bottom line | |||||

| Debit | ||||||

| 20 000 | 20 000 | |||||

| 20 000 | 25 000 | 45 000 | ||||

| 20 000 | 20 000 | |||||

| 25 000 | 25 000 | |||||

| Bottom line | 20 000 | 45 000 | 20 000 | 25 000 | 110 000 |

Who is required to draw up a chess sheet?

Filling out a chess sheet is the responsibility of accountants of many commercial structures, but not all of them. The exception is

those who:

- uses simplified accounting and reporting for taxes and accounting,

- memorial order form,

- consider this type of analytical accounting to be outdated.

In addition, the chess sheet is rarely used by large companies, since their activities use too many different types of accounts and the formation of this rather cumbersome document from the point of view of filling out is simply too complex and ineffective.

Chess sheet form and example of how to fill it out

There is no official form of chess sheet. After all, this is an accounting register, therefore it can be developed by the organization independently (Part 5 of Article 10 of the Federal Law of December 6, 2011 No. 402-FZ). However, based on its name, the type of chess statement is usually the same: it shows accounting accounts horizontally and vertically, and also indicates the turnover between them.

An example of a chess statement is contained in Appendix 11 to the Standard Recommendations for organizing accounting for small businesses (approved by Order of the Ministry of Finance dated December 21, 1998 No. 64n).

Sample chess sheet.

Let's give an example of filling out a chess sheet using conventional digital data.

Rules for registering

The very name “chess” already speaks about the structure of the sheet. It is more complex than a regular sheet and its table form is similar to a chessboard. It uses double entry for accounts, that is, correspondence from both debit and credit accounts is simultaneously recorded in one cell.

Important nuance:

the number of rows and columns in each specific case is individual and is directly dependent on the number of accounting accounts used in the enterprise; accordingly, the more there are, the more labor-intensive the process of creating a checkerboard will be.

Information in the document is entered on the basis of the transaction log, in which all accounting entries are recorded.

The chess sheet can be compiled in one or several copies, depending on the needs of the enterprise. If there are several copies, then each of them must be certified by the signature of the employee who filled it out, and then submitted to the chief accountant for verification. Today, the manual method of document preparation is rarely used; everything is automated and easily done using computer programs. Nevertheless, it is simply necessary for any accountant to know the principles of compiling a chess sheet.

Statement for small businesses

In the turnover of small enterprises, characterized by a limited number of accounting accounts and a small number of transactions, a chess sheet of sample No. B-9 is used. The document is compiled monthly, with the document opened at the beginning of the month. The peculiarity of the form is that the accounting accounts are arranged vertically and statements horizontally. Numbering and data are arranged in ascending order.

At the end of the month, debit turnover on accounts and credit statements is calculated.

The data on the debit turnover of statements is subject to reconciliation with the debit and account turnover. The amount received must match the credit turnover. Based on the results of the statement, the ending balance is determined for transferring data to a new monthly reporting period. The chess sheet is convenient due to its detail and allows you to eliminate counting errors.

Example of drawing up a statement

In this case, a simple example of filling out a chess sheet is given, which is quite suitable for use by a small enterprise with low turnover. The form of the document here is simple and understandable, and having studied it as a basis, in the future you can learn how to manually compile more complex chess sheets.

- At the beginning of the document, the “header” is filled in: the full name of the enterprise is entered, as well as the period for which the document is being drawn up.

- Next, you need to pay attention to the method of entering information into the statement table. Data generation occurs in two directions:

- loan

turnover is entered in horizontal lines,

by debit

- in vertical columns. - loan

- In the last line of the “Total” document, at the very bottom of the table, all amounts entered in each column are calculated and the final result for each column separately for credit accounts is indicated. The result for debit accounts is calculated in the same way in all rows, but the data is entered in the last vertical column.

The amount that is posted to both of these accounts and placed at the intersection of the corresponding line and column.

Checking the correctness of the chess sheet is elementary: if everything is correct, then the indicators from the last row and the last column will be equivalent

. If the results do not match, then you will have to check all the numbers entered in the document to find out where exactly the error crept in.

In conclusion, the statement is signed by the person who was entrusted with its preparation, indicating the position and deciphering the signature. Today it is not necessary to certify a chess sheet with a seal, since legal entities are exempt from the need to stamp their reporting papers.

Express accounting check

An express check of accounting in the 1C Accounting 8 program helps to obtain summary or detailed information about the state of the information base data at any time.

https://youtu.be/Zmbm6ehA5qI

An express check is a set of checks grouped by accounting sections. Each check ensures that there are no errors in the infobase data. Control may consist in compliance of credentials with certain provisions of the law or in compliance of data with internal algorithms embedded in the program.

As a result of the express check, a report is generated that shows the total number of checks performed and the number of checks during which errors were detected. The report can be printed or saved to a file.

The results of the express check can be displayed with details up to the accounting section or before each check. The report can show comments for each check performed:

- subject of control - what exactly the current inspection checks;

- the result of the check - whether errors were found during the check;

- possible causes of errors;

- recommendations for troubleshooting.

The list of checks performed can be limited ( Show/hide settings ). To prevent a check or check section from being performed, you need to uncheck the box.

After compiling the chess sheet

After the document is completed, checked and signed, it is transferred to the tax service specialists as part of the annual balance sheet. In this case, it is advisable to leave one copy at the enterprise, handing it over to the enterprise archive, where it will be stored, like any other accounting documents, for the next five years.

Reverse and checkerboard sheets

The turnover sheet is a way of summarizing account indicators; it records the turnover and balances of all operating accounts.

2 type of turnover sheets

: according to synthetic accounts, according to analytical accounting accounts.

Synthetic accounting

is generalized, carried out as a whole for expenses and income for a given account.

Analytical accounting

- is carried out within the framework of the account for each of the objects (each building, employee, etc.).

the sum of all values for analytical accounts must be equal to the total amount for the specified account. This addition has a control (verification) meaning.

Turnover sheet for synthetic accounts:

| A chess back sheet is a back sheet drawn up in a chess form. The chess sheet contains the correspondence of the accounts. The chess sheet is quite complex and cumbersome in construction. Let's consider the turnover of the balance sheet in the form of a checkerboard sheet: The following forms of accounting are distinguished:

With a memorial order form accounting on the basis of primary or cumulative documents, memorial orders are made. A memorial order is an accounting document. It reflects the accounting entry. Memorial orders are drawn up on special forms and signed by the chief accountant or his deputy; supporting documents are attached to the orders. Each memorial order is assigned a serial number. Memorial orders drawn up for similar transactions must have the same numbers from month to month. For example, memorial orders for cash transactions have No. 1, for a current account - No. 2. This makes it easier to find the necessary documents and draw up various certificates. The number of orders drawn up per month is determined by the chief accountant. The memorial order looks like this: MEMORIAL JOURNAL No. 1 write down for______200_g. (month) The total of all amounts in the registration journal should be equal to the sum of all debit and the sum of all credit turnovers for the month for all synthetic accounts. Based on memorial orders, entries are made in synthetic accounting accounts in the general ledger. It opens for a year. One synthetic account corresponds to one unfolded sheet of the book. main book When using the “Journal-Main” accounting form, the registration journal is not used. Data from memorial orders are recorded in the “Journal-Main” book, which is a chronological and systematic record register. The book “Journal-Main” keeps synthetic records. At the end of each month, this book calculates the turnover of the accounts and the total in the column “Amount of turnover by item.” This total should be equal to the sum of debit and the sum of credit turnover for all accounts. At the same time, the book displays the balances of the accounts that are used to compile the balance sheet. The total of debit balances must equal the total of credit balances for all accounts. Analytical accounting is kept in books or cards. For analytical accounting accounts, revolving statements are compiled, the results of which are compared with the data of the corresponding synthetic accounting accounts in the “Journal-Main” book. Magazine-home This form of accounting is used in organizations with a small number of business transactions. With a journal-order form To record business transactions, order journals are used, in which entries are made on a credit basis. Usually, chronological recording, synthetic and analytical accounting are combined in one register. Books (cards) of analytical accounting are maintained as an exception for some objects, fixed assets, calculations of wages, and materials. With a journal-order system, auxiliary (cumulative) statements, development tables and the general ledger are also used. The auxiliary statement is an accounting register. It is intended for systematization (accumulation) of data contained in primary documents. These data are recorded as a total of the accounting accounts. Auxiliary statements are often also analytical accounting registers. Auxiliary are, for example:

The general ledger is an accounting register intended for synthetic accounting. It is designed to keep records throughout the year. All synthetic accounting accounts used by the organization are opened in it. The balance as of January 1 is recorded on the accounts and the total data of the order journals is recorded monthly, the turnover for the month and the balance at the end of the reporting month are displayed. In the general ledger for each account, credit turnover is reflected in one amount, and debit turnover is reflected in correspondence with the accounts being credited. The amounts of debit and credit turnover for all accounts must be equal. A balance sheet is prepared based on the general ledger data. In the general ledger, each synthetic account has a separate sheet (on the double page). This is what the ledger sheet looks like: When using a journal-order form of accounting, all primary documents should indicate the register numbers in which they are recorded and the record (line) numbers. Documents are grouped in relation to order journals and accumulative statements. There is a separate monthly folder for each group of documents. Order journals and statements are stored separately from primary documents. Automated accounting system involves the use of a computer program for accounting. An organization can develop or purchase a licensed program itself. The choice of program depends on the size of the organization, the volume of business transactions, the need for separate accounting, etc. With an automated form of accounting, as well as with manual forms, the accountant’s job is to process primary source documents and accounting certificates Each document corresponding to a business transaction , recorded by machine using accounting entries. Many primary documents are generated directly in the program, and accounting records are created on their basis. The output forms are traditional accounting registers. Based on these registers, accounting and tax reporting is generated programmatically. | |||||||

| Account name | Balance at the beginning of the month | Monthly turnover | Balance at the end of the month | ||||

| Fixed assets | |||||||

| Current accounts | |||||||

| Authorized capital | |||||||

| Calculations for short-term loans and borrowings | |||||||

| Settlements with suppliers and contractors | |||||||

| Payments to personnel regarding wages | |||||||

| Calculations with accountable persons | |||||||

The rows of this table indicate all the accounts working at the enterprise with their turnover and balance values. All movements of funds are presented quite clearly.

Turnover sheet for analytical accounts (to the account “Settlements with suppliers and contractors”):

| Account (vendor) name | Balance at the beginning of the month | Monthly turnover | Balance at the end of the month | ||||

| LLC "Uyut" | |||||||

| Zarya LLC | |||||||

| LLC "Rassvet" | |||||||

The main feature of this statement is that the total totals of turnovers and balances of each are equal to the turnovers and balances of the synthetic account combining them in the turnover sheet for synthetic accounts.

Current statements of analytical accounts have great informational and control value: they allow you to monitor the presence and movement of specific types of economic assets and the sources of their formation, contribute to the safety of property, and serve as the basis for checking the correctness of entries in synthetic accounts.

Advantages of the turnover sheet

— convenient organization of accounting information on accounts, so it is easy to transfer already verified data from it to a monthly or quarterly balance sheet.

In practice, balance sheets have become widespread. They contain only account balances as of the first of each month and are maintained throughout the year.

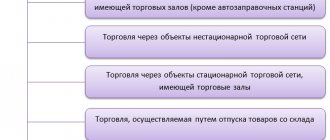

Chess form (sheet)

— contains the General Ledger and the turnover sheet.

A form

is a procedure for recording data from primary documents for the purpose of summarizing and obtaining reporting on it, that is, it is a system for recording and processing data.

Credit turnovers are arranged in rows, debits - in columns. This form is recommended for small businesses.

Principles for compiling statements

Turnover sheet for synthetic accounts

Compiled based on closed synthetic accounts for the month. In the columns “Balance at the beginning of the month” and “Balance at the end of the month” only one amount is always indicated - either by debit (if the account is active) or by credit (if the account is passive). Monthly turnover (the sum of all transactions separately for debit and credit accounts) is entered in the columns for both debit and credit.

After filling out the entire statement, the totals for each column (by columns) are calculated. main feature

correctly compiled and calculated turnover sheet - pairwise equality of the column totals, that is,

the total of the initial debit balances should be equal to the total of the initial credit balances

(as a balance sheet asset is equal to its liability),

the total of the debit turnover for the month is equal to the total of the credit turnover

(according to the principle double entry of transactions on accounting accounts),

the total of the final debit balances is equal to the total of the final credit balances

.

In the first and last pairs of columns (beginning and ending balances or balances

) there is either an amount in debit or an amount in credit (this determines the type of account). The middle pair of columns should indicate both turnovers - debit and credit; if the turnover was zero, 0 is entered.

Turnover sheet for analytical accounts

It is compiled according to the same principle, but for each group of analytical accounts opened to one synthetic account. There are 2 different systems for recording values in accounts: sum

(in monetary terms) and

quantitative-amount

(in physical and monetary terms). The first is used in settlements with suppliers, debtors, creditors and accountable persons, the second - when accounting for material assets in warehouses and in production.

The total for the analytical group of one synthetic account must correspond to the line of this synthetic account in the turnover sheet.

Economic funds and sources form the assets and liabilities of the enterprise. Assets

- the value of property

.

Liabilities are a set of debts and obligations of an enterprise

.

An asset is equalized with a liability by adding own funds to the liability.

To summarize information in accounting, the balance sheet method is used. The assets of the balance sheet reflect the state, placement and use of economic assets (property) of the enterprise, the liabilities - a set of indicators that track the intended purpose and ownership of economic assets, that is, economic assets are grouped by sources of formation.

Each organization in the course of its activities has the obligation to provide data on its financial condition to the tax authorities. Distortion of indicators threatens the imposition of penalties and blocking of transactions in the bank, which, in turn, will lead to a decrease in net profit. In this regard, the most important operation before preparing reports and closing the month is to control the correct filling of accounting registers. One of the forms of control is the formation and review of the balance sheet for the analyzed period. But when considering it, you also need to be able to read the indicators from it.

The balance sheet is a report on the main performance indicators of the company. It generates data on movements in the enterprise, grouped by accounting accounts and sub-accounts for any arbitrarily selected period. As a rule, a complete accounting statement is created before closing the year to form a balance sheet.

Purpose and main goals of creating a balance sheet

- Analysis of the financial and economic activities of the enterprise for making timely management decisions.

- Checking the double entry method (all transactions in accounting are reflected in the debit of one account and the credit of another in the same amount). Example: Payment of VAT is reflected in debit 68 of account and credit 51.

- Identifying arithmetic errors and inaccuracies.

- Control over the correct distribution of amounts between accounting accounts.

Attention! When compiling SALT in 1c, the ability to automatically switch to the analysis of a specific account has been developed.

Create a chess turnover sheet

The elements of accounting are system of accounts and double entry.

Definition 1

We suggest you read Complaint about Sberbank where to call

A system of accounts is a certain way of grouping economic values that reflect the current state and changes in assets and liabilities, as well as business processes and their results in digital terms.

There are separate accounts for each group of funds and their sources, business processes and results of activities. On a certain account, the initial balance of the object to be accounted for and its subsequent changes determined by business transactions are recorded.

Definition 2

For the operational management of the results of the enterprise’s economic activities, as well as checking the recording of all operations on synthetic and analytical accounts and summarizing data for the reporting period, turnover sheets are drawn up.

The turnover sheet is a table that reflects the balance and turnover of accounting accounts. Turnover statements are also called balance sheets.

This is due to the fact that they are compiled on the basis of account data on turnover for the period and account balances at the beginning and end of the period.

The balance sheet is compiled on the basis of the journal of business transactions and the initial balance sheet.

The turnover sheet is a table in which a separate line is allocated for each account.

Can not understand anything?

Try asking your teachers for help

There are three types of turnover sheets:

- on synthetic accounts, which includes all accounts,

- for analytical accounts, which is maintained separately for each account,

- chess (blind), reflecting exclusively account turnover.

The turnover sheet for synthetic accounts has the following components (Fig. 1):

- account name;

- opening balance of debit or credit;

- turnover for the month by debit and/or credit;

- balance at the end of the period by debit or credit.

In such a statement, all synthetic accounts that are used in the economic activities of the enterprise are reflected in ascending order.

The total of the turnover sheet for synthetic accounts should be represented by three equalities:

- the balance at the beginning of the reporting period on the debit side of the accounts is equal to the balance on the credit side of the accounts;

- the turnover for the period in the debit of accounts is equal to the turnover in the credit of accounts;

- the debit balance at the end of the reporting period is equal to the credit balance of the accounts.

https://youtu.be/oKxj1Fhnjg4

Three pairs of total columns of the turnover sheet for synthetic accounting accounts contain debit and credit totals equal to each other. This is because the first two columns contain the asset and liability amounts of the balance sheet at the beginning of the month, and the second two include transactions for the period recorded through double entry. The third pair of columns is essentially a new balance.

Note 1

Please note that in the columns “Balance at the beginning of the month” and “Balance at the end of the month” only one amount can always be entered. By debit if the account is active or by credit if the account is passive.

Picture 1.

We can say that the turnover sheet for synthetic accounting accounts is a summary of turnover and balances for all synthetic accounts, which is intended to control accounts, draw up a new balance and allows you to determine the status and changes in funds as a result of economic activity.

The turnover sheet is the main document when drawing up a balance sheet. The final balance on the debit side of the accounts in the turnover sheet is data for the asset side of the balance sheet, and the final balance on the credit side of the accounts is transferred to the liability side of the balance sheet. The main advantage of the balance sheet is one register for all accounts.

Figure 2.

Turnover statements for analytical accounting accounts represent a summary of turnover and balances for all analytical accounting accounts opened to a specific synthetic account (Fig. 2).

To identify technical errors in the accounts, the results of the turnover sheets for analytical accounting accounts are compared with the data of the corresponding synthetic account in the turnover sheet for synthetic accounts.

We invite you to familiarize yourself with the Land Easement Agreement - a sample of how to draw it up

The total amounts of turnover in the analytical accounting accounts must be equal to the total amounts in the synthetic account.

If records of business transactions in analytical accounts were reflected in monetary terms, then the total form of the statement is used. If the records of business transactions on analytical accounting accounts were reflected using natural and monetary or labor and monetary values, then the quantitative-total form of the statement is used.

The chess turnover sheet summarizes the data on turnover on the accounts and reveals their content. It serves to check the correctness of invoice correspondence.

The chess sheet clearly shows the correspondence of accounts, i.e. it is easy to trace where the values came from and where they were sent.

The sum of the debit turnovers of all accounts in the checkerboard turnover sheet is equal to the sum of the credit turnovers, which is achieved through the principle of double entry in the accounts.

Note 2

Today there is no need to fill out balance sheets manually. This process is automated and implemented in accounting software products. But understanding the principle of drawing up a turnover sheet and the ability to analyze the data reflected in it help to quickly respond to management requests and track errors when entering primary data.

Reverse chess sheet

The turnover sheet is a way of summarizing the indicators of accounts; it records the turnover and balances of all working accounts.

2 types of turnover sheets: for synthetic accounts, for analytical accounting accounts.

Synthetic accounting is generalized, carried out as a whole for expenses and receipts for a given account.

Analytical accounting - carried out within the framework of the account for each of the objects (each building, employee, etc.).

the sum of all values for analytical accounts must be equal to the total amount for the specified account. This addition has a control (verification) meaning.

| No. | Account name | Balance at the beginning of the month | Turnover per month | Balance at the end of the month | |||

| Debit | Credit | Debit | Credit | Debit | Credit | ||

| 1 | Fixed assets | 40 000 | – | – | – | 40000 | |

| 2 | Goods | 23 300 | – | 41600 | 34 800 | 30100 | – |

| 3 | Cash register | 50 | – | 1000 | 950 | 100 | – |

| 4 | Current accounts | 3000 | – | – | 1000 | 2000 | – |

| 5 | Authorized capital | – | 56 650 | – | – | – | 56 650 |

| 6 | Calculations for short-term loans and borrowings | – | 4000 | – | 3000 | – | 7000 |

| 7 | Settlements with suppliers and contractors | – | 6000 | 3000 | 8 300 | – | 11300 |

| 8 | Payments to personnel regarding wages | – | 1500 | 950 | – | – | 550 |

| 9 | Calculations with accountable persons | 1800 | – | 5 500 | 4000 | 3 300 | – |

| Total: | 68 150 | 68 150 | 52 050 | 52050 | 75 500 | 75500 |

The rows of this table indicate all accounts operating at the enterprise with their turnover and balance values. All movements of funds are presented quite clearly.

In order to create a balance sheet, you need to draw up a TSA (turnover balance sheet).

It is a form that contains the balances at the beginning and end of the period for calculating the balance; it also includes data on debit and credit for this period for each subaccount.

There are different types of statements: analytical, synthetic and chess. SALT can be done only after making entries in the accounts: writing off costs, calculating depreciation, calculating all forms of profit.

Varieties of WWS

Many companies use complex 1C software products to set up accounting. In it, the following forms of displaying the balance sheet can be distinguished:

Drawing up a table of synthetic accounts (code 0250) is a classic analysis of activity on synthetic accounts using the calculation method. The balance at the beginning of the period increases or decreases by turns and shows the balance at the end. The main method of checking: triple equality (for debit and credit, the initial and final balances, as well as turnover - the principle of double entry).

You can also make a statement broken down by subaccounts. For example, account 68 contains data on personal income tax, VAT, income tax and others.

Attention! A statement with code 0250 is often asked to be provided to the tax office upon request for documents in the event of a desk audit.

The principle of document preparation in an enterprise

The form has a strict breakdown of debit (vertical) and credit (horizontal) accounts. The total indicator is recorded in the intersection cell. These statements can be expanded - used simultaneously taking into account the balance at the beginning of the period and displaying the balance. The document is called a checkerboard balance sheet and is analogous to a general ledger. How to fill out the form:

| Action | Explanations |

| The amount is recorded once, at the intersection of correspondence accounts | When posting, the debits and credits of the transaction account are taken into account |

| The debit and credit data of active-passive accounts are indicated separately | When maintaining records, the expanded account balance is used |

| The balance is displayed for each credit and debit | Credit and debit amounts are displayed vertically and horizontally separately |

| The result is summed up | The total of the amounts indicated in the lower right corner, vertically and horizontally, must match. |

When entering indicators manually, the order corresponding to the double entry rule is followed. The debit account, the amount and credit correspondence are determined. The loan posting is formed unconditionally and does not require additional control.

Filling example

- Sales of goods to the buyer (D62 K41) - 15000

- Wages transferred to employees (D70 K51) - 5000

Analytics analysis - SALT for a separately selected account. Allows you to more deeply study movements in certain operations, for example, wages.

Form of balance sheet for account 70:

Attention! When analyzing analytical accounts, equality between turnovers is not necessary.

A chess sheet is a type of synthetic accounting, filled out according to the business transactions log. Checkerboard is a table that displays debited accounts vertically and credited ones horizontally. After filling out the statement, you need to calculate the total amount, which must be the same for any calculation.

Analysis of OCB indicators

- In accounting, all accounts are divided into three categories:

- active;

- passive;

- active-passive.

Important! Each account has certain rules for filling in when displaying business transactions. Thus, active accounts cannot have a credit balance at the beginning and end of the period.OSV in this case allows you to check the wiring, see possible errors and make corrections.

- You need to know the rules for closing months in accounting when preparing quarterly and annual reports:

- At the end of each month, accounts for accounting expenses for farming and production (with the exception of work in progress) must be closed.

- Accounts 90 “Sales” and 91 “Other income and expenses” are not closed according to subaccounts, but in general should not have a balance. 1c automatically closes the month, and SALT, in turn, makes it possible to identify unclosed accounts, which leads to distortion of information about the real financial position of the enterprise.

- When preparing annual reports, summary data on the company's work is entered into the balance sheet. The balance sheet displays the final balance of all accounts, which saves time on preparing a balance sheet.

- Drawing up the SALT allows you to compare data with a certificate of calculations from the tax inspectorate and timely determine existing debts on basic taxes (VAT, profit, etc.).

- SALT allows you to calculate the profit of an enterprise: account 90 contains data on sales revenue, cost and VAT; all other income and expenses are reflected here, which in 1C can be automatically sorted by accounting and tax accounting and allocated amounts not subject to income tax. In addition, SALT contains totals for retained earnings.

- SALT serves as an additional check for VAT deductions. When goods and services are received with VAT, suppliers issue invoices and when they are entered into 1C, the turnover on account 19 is closed. However, there are situations when an invoice has not been entered or delivery documents have not been submitted. The unclosed balance at the end of the VAT period makes it possible to see shortcomings.

Account Analysis

The “Account Analysis” report is designed to present data on turnover between the selected account and all other accounts for a certain period.

In terms of the content of the information displayed, the report is similar to the Account Turnover report. The difference lies in the form of presentation of information.

The report can be generated with detail by subaccounts or by analytical accounting objects (subaccounts).

Data can be displayed with an additional breakdown by time periods: month, year, etc.

You can display the expanded balance in the report. In this case, the expanded balance is calculated for each grouping level and for the account as a whole.