In general terms, operating expenses are the costs of an enterprise that are not directly related to its core activities. The current edition of PBU 10/99 does not contain a precise definition of the terms operating income and expenses due to the change in classification according to Order No. 116n dated September 18, 2006. The legislation now proposes a simplified gradation for other expenses/income, as well as expenses/income for ordinary activities . How to determine what costs belong to what, how to calculate net operating income - we will explain in detail below.

What are operating expenses?

Operating expenses according to the Tax Code of the Russian Federation

Operating expenses are costs of a business that are not related to the production of goods or provision of services. They are necessary for the functioning of the enterprise.

PBU 10/99 does not clearly define the term and does not delimit losses as a result of changes in classification in accordance with Order No. 116n. As is known, until 2006, other expenses were divided into non-operating, operating and emergency. According to today's standards, a simplified version of the gradation of expenses / income has been adopted for enterprises operating in any industry.

Similar to expenses, there are other operating incomes - these are financial receipts not related to the sale of the main product. If there is no evidence of indirect profitability, it is necessary to indicate the profit in subaccount 90 as income from core activities.

Other sources of income

Profitability is classified as “Other” if the income is not related to the ordinary activities of the institution. If the income comes from the main activities of the enterprise, it must be reflected in account 90 “Sales”.

Other operating income includes the following income:

- paid provision of assets for limited use;

- paid provision of rights to patents of various types of intellectual property;

- from participation in the authorized capitals (AC) of other institutions;

- from participation in simple partnership agreements;

- from the sale of property, assets, products;

- interest on loans and borrowings;

- penalties accrued for violation of the terms of the contract;

- profit of previous periods;

- compensation for losses of the organization, etc.

The full list of profitability is presented in paragraph 7 of PBU 9/99.

Net operating income is the difference between the actual value of gross income (IG) and fixed costs, such as insurance premiums, taxes and other costs.

CHOD = VD – OR.

The calculation of this indicator illustrates the amount of net profit that the enterprise will receive from the use of property, contributions to the capital company and other types of profitability for the current period.

Composition of operating expenses

Classification of expenses

If you imagine the complex of expenses existing in an enterprise, you can immediately understand which expenses are basic and ensure the production of the enterprise, and which of them are necessary to support its functioning, and these are the operating expenses of the enterprise.

The list of indirect costs is regulated by PBU 10/99 clause 11, chapter 3. According to the document, operating expenses include:

- leased assets or received in other ways for temporary use on a reimbursable basis;

- leased rights to intellectual products;

- founders' investments into the process of other enterprises;

- any form of alienation of one’s own property – sale, lease, etc.;

- creation of funds to reserve money;

- payment of commissions and interest on bank accounts.

Important: expenses can be classified as operating expenses only if these expenses were not used to create a new product or provide services.

There is also a list of operating costs classified as other:

- repayment of penalties provided for by various contractual obligations;

- payment of losses caused by the company’s actions to third parties;

- losses on financial obligations that are impossible to recover;

- the size of the difference in currency fluctuations, due to which the company incurs losses when the cost of purchasing raw materials increases;

- losses from the write-off of assets that are out of order and, according to the conclusion of the commission, are unsuitable for restoration or partial sale;

- terminal expenses associated with the movement of cargo and business trips through the use of various land, air or road transport.

Operating income includes the same items that only benefit the enterprise, for example, rental of premises and other assets of the enterprise, income from representative activities, interest received on loans or the return of accounts payable that have expired.

The operating costs incurred by an enterprise can be much higher, it all depends on the type of its activity, for example, for a store such costs are the repair of the premises and cash register equipment, payment of salaries and contributions to extra-budgetary funds.

What income should be considered operating income?

From clause 5 of PBU 9/99 it follows that the income received by an organization from the provision for a fee for temporary use (temporary possession and use) of its assets, rights arising from patents for inventions, industrial designs and other types of intellectual property, and from participation in the authorized capital of other organizations, when this is not the subject of the organization’s activities, are classified as operating income. Operating income also includes: - receipts associated with the provision for a fee for temporary use (temporary possession and use) of the organization's assets, provided that they are not income from ordinary activities; - profit received by the organization as a result of joint activities (under a simple partnership agreement). According to Articles 1041 - 1043, 1046 and 1048 of the Civil Code of the Russian Federation, Instructions for reflecting in accounting transactions related to the implementation of a simple partnership agreement, approved by Order of the Ministry of Finance of Russia dated December 24, 1998 N 68n, profit received by partners as a result of their joint activities , is distributed in proportion to the value of the partners’ contributions to the common cause, unless otherwise provided by the simple partnership agreement or other agreement of the partners. Profit from joint activities is accounted for in the debit of account 74 “Settlements on property allocated to a separate balance sheet”, subaccount “Settlements under a simple partnership agreement”, and in the credit of account 80 “Profits and losses”. When the partners receive funds determined in accordance with the simple partnership agreement, the debt is written off from account 74, subaccount “Settlements under the simple partnership agreement”, in correspondence with the debit of cash accounts (50 “Cash”, 51 “Cash account”, 52 “ Foreign currency account"); — proceeds from the sale of fixed assets and other assets other than cash (except foreign currency) and products. The excess of turnover on the credit of account 47 “Sales and other disposal of fixed assets” over the turnover on the debit is credited to account 80 “Profits and losses” (on the debit of account 47 and the credit of account 80). The sale of other assets is reflected in account 48 “Sale of other assets”. The credit (income) balance on account 48 “Sale of other assets” is written off to account 80 “Profits and losses”; — interest received for providing the organization’s funds for use, as well as interest for the bank’s use of funds located directly in the organization’s account. V.I. Makarieva State Advisor to the Tax Service, 2nd rank Signed for publication on July 23, 1999 “Tax Bulletin”, 1999, No. 8

What income will be considered non-operating income? »

Accounting consultations »

Accounting and management of operating expenses

How expenses are accounted for

All operating expenses must be taken into account and, if necessary, reduced without losing the quality of the enterprise. In addition, they must be planned in advance for such cases as downtime of the enterprise, due to holidays or lack of activity, for the period of occurrence of circumstances independent of the enterprise, for example, fire, force majeure and others.

Among the popular methods for optimizing costs is reducing the wage fund by reducing the number of employees, but such a decision can negatively affect the quality and quantity of products produced.

As a result, there are delays in the delivery of products, and as a result, losses occur for the company.

How to correctly calculate operating income and expenses

Loss from previous years identified in the reporting year (insignificant error)

260 0002.7. Damage caused to the organization (in the absence of perpetrators) 600 0002.8. Other miscellaneous expenses 465 1942.9. Analytical account for accounting for VAT on income from the sale of non-current assets 270 0002.10. Analytical account for accounting for VAT on rent 126 000Fragment of the Financial Results Report for 2013

Option 1. The organization shows other income and expenses in detail in the Statement of Financial Results.

| Explanations | Indicator name | Code | For 2013 | For 2012 |

| 1 | 2 | 3 | 4 | 5 |

| Other income | 2340 | 3955 | 1960 |

Option 2. The organization shows other income and expenses collapsed in the Income Statement.

| Explanations | Indicator name | Code | For 2013 | For 2012 |

| 1 | 2 | 3 | 4 | 5 |

| Other income | 2340 | 1553 | 987 |

Solution

Option 1. The organization shows other income and expenses in detail in the Statement of Financial Results.

The amount of other income minus VAT for the reporting period is 4112 thousand rubles. (RUB 4,508,120 - RUB 270,000 - RUB 126,000).

A fragment of the Income Statement in Example 6.10 will look like this.

| Explanations | Indicator name | Code | For 2014 | For 2013 |

| Other income |

Option 2. The organization shows other income and expenses collapsed in the Income Statement.

Step one.

Let's determine the balance of income and expenses, which are shown collapsed in the Statement of Financial Results:

- income (net of VAT) and expenses from renting out property - 150,000 rubles. (RUB 826,000 - RUB 126,000 - RUB 550,000);

- income (net of VAT) and expenses associated with the sale of non-current assets - 250,000 rubles. (RUB 1,770,000 - RUB 270,000 - RUB 1,250,000);

- positive and negative exchange rate differences - (-65,485 rub.) (280,635 rub. - 346,120 rub.);

- the amount of created valuation reserves (including adjustments) - (-900,000 rub.) (900,000 rub. - 1,800,000 rub.).

Step two.

Let's determine the indicator for the line “Other income”.

The amount of other income for the reporting period is 1131 thousand rubles. (RUB 250,000 + RUB 150,000 + RUB 250,000 + RUB 150,000 + RUB 300,000 + RUB 31,485).

A fragment of the Income Statement in Example 6.10 will look like this.

| Explanations | Indicator name | Code | For 2014 | For 2013 |

| Other income |

3.2.11. Line 2350 “Other expenses”

This line reflects information about other expenses of the organization not mentioned above (clause 21 of PBU 10/99).

Reflection of operating expenses in accounting

Account reflection 91

After finding out which company expenses are not core, you need to understand the peculiarities of their accounting. In accounting, they are accounted for in account 91, while income goes in subaccount 91.1, and expenses go in subaccount 91.2.

Important: entries are made to open accounts cumulatively, and at the end of the billing period, the difference between costs and other income is calculated and entered into subaccount 91.9, showing losses as a debit and profits as a credit.

Accounting is carried out in such a way that it is easy to conduct analytics for each previously performed operation.

Rebus Company

Income other than income from ordinary activities is considered other income. Line 090 reflects the following types of other income (clause 7 of PBU 9/99):· receipts related to the provision for temporary use of the organization’s assets, including intellectual property, for a fee (if this is not the main activity of the organization);

· proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products and goods. For example, proceeds from the sale of accounts receivable, securities (if such income is not reflected in the section “Income and expenses from ordinary activities” of form No. 0710002);

· income related to participation in the authorized capital of other organizations, including interest and other income on securities (if such income is not reflected in the section “Income and expenses from ordinary activities” of form No. 0710002);

· profit received by the organization through joint activities (under a simple partnership agreement);

· interest received for the provision of the organization’s funds for use, as well as interest for the bank’s use of funds located in the organization’s bank account;

· fines, penalties, penalties due to the organization for violation of the terms of business contracts;

· proceeds to compensate for losses caused to the organization;

· assets received free of charge, including under a gift agreement;

· profit of previous years identified in the reporting year;

· amounts of accounts payable and depositors for which the statute of limitations has expired;

positive exchange rate differences;

· the amount of revaluation of assets;

· Other income.

Other income is also income arising as a consequence of emergency circumstances of economic activity (natural disaster, fire, accident, nationalization, etc.). Such income, in particular, includes the cost of material assets remaining from the write-off of assets unsuitable for restoration and further use, etc.

According to the norms of PBU 9/99, fines, penalties, penalties for violation of the terms of business contracts, as well as compensation for losses caused to the organization, are recognized in the reporting period in which the court made a decision to collect them or they were recognized as a debtor.

The value of assets received free of charge, as well as the value of assets acquired from budget funds, is reflected in accounting under the credit of account 98 “Deferred income”. It is included in other income when these assets are transferred into production as depreciation is calculated on fixed assets or at the time of their disposal. In the line, such income is reflected in the amount that in the reporting period was written off from the debit of account 98 to the credit of account 91, subaccount 1 “Other income”.

The profit of previous years, identified in the reporting year, may be, for example, expenses that were erroneously included earlier in the cost price, or income that was not taken into account in previous years in accounting. These amounts are reflected in the line “Other income”.

Accounts payable and depositors are included in other income after the expiration of the limitation period. It is three years after the end of the obligation (Article 200 of the Civil Code of the Russian Federation). According to Article 203 of the Civil Code of the Russian Federation, the limitation period may be interrupted if the creditor filed a claim in the prescribed manner, as well as if the debtor organization took actions indicating recognition of the debt. This may be a written notification to the debtor about the recognition of the debt or an act of reconciliation of accounts signed by the debtor. After the break, the limitation period begins again. The time elapsed before the break does not count towards the new deadline.

Cash, receivables or payables in foreign currency in accounting and reporting are reflected in ruble valuation. Therefore, the balances of funds in foreign currency accounts (except for the balances of advances received or issued in foreign currency), amounts of debt in foreign currency should be recalculated into rubles at the Bank of Russia exchange rate established for the corresponding currency on the date of reporting. In this case, positive or negative exchange rate differences are formed.

The amounts of positive exchange rate differences are reflected on line 090 of form No. 0710002. They are formed if the exchange rate of the corresponding currency, established by the Bank of Russia on the reporting date, has increased compared to the rate on the date of receipt of funds into the foreign exchange account. And also if the rate at the reporting date turned out to be lower than the rate established on the date the accounts payable arose.

Other income is accounted for as a credit to account 91 “Other income and expenses,” subaccount 1 “Other income” in correspondence with the debit of account 62 “Settlements with buyers and customers” and account 76 “Settlements with various debtors and creditors.” In line No. 0710002, these incomes are reflected minus value added tax, excise taxes, and export duties accrued upon sale (DEBIT 91-2 CREDIT 68).

In the line of other income, it is allowed to show the amount of other income reduced by the amount of the corresponding other expenses. In this case, these expenses are not reflected in the “Other expenses” line of form No. 0710002. But only income and expenses arising as a result of the same (or similar in nature) fact of economic activity can be offset in this way, and only on the condition that they are not significant for characterizing the financial position of the organization.

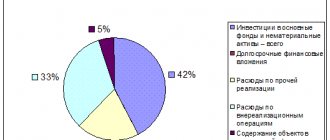

Calculation of the efficiency of operating expenses

Efficiency calculation

The efficiency index for incurred operating expenses is established by the management body for each regulated company. One of the methods used is the efficiency of investment capital or indexation of established tariffs to optimize their level.

Investments raised to reduce costs are taken into account, and their impact on the level of costs at the stage of development and implementation of the application plan is studied.

Important: if, thanks to the implemented investment program, expenses can be reduced by 5%, then the efficiency index is applied at a 5% value.

At the same time, for enterprises:

- for thermal energy production, an index of 1%, maximum 5% is applied;

- for enterprises transmitting energy, the index obtained by applying the following formula IORj = max (IORj inv; IOR jcomp) , but not more than 5%.

After establishing the method, the management team monitors the activities of enterprises every 5 years and analyzes their activities through comparison. As a result, after comparative activities, an index of the efficiency of the companies' work process is determined.

Such a calculation of the efficiency index and comparative analysis are necessary to determine the level of costs and find ways to optimize them. So that the cost of production can be reduced if it turns out to be too high. The coefficient gives a clear idea of what percentage goes to maintaining the company's activities.

By drawing up graphical dynamics of activity using a coefficient, you can increase the company’s productivity by completely eliminating costs.

Factors Affecting Operating Expense Ratio

Main factors influencing the profitability of an enterprise

In order to operate efficiently, it is necessary to optimize non-operating expenses - this is the main goal of the management team. When they decrease, the rate of development of productivity and profitability of the enterprise is observed. There are several factors influencing the level of costs, and they are divided into internal and external.

External factors

External factors influencing the amount of operating expenses do not depend on the will and activity of the company and include:

- Inflation. The higher its level, the more companies incur additional expenses - this includes paying salaries and bonuses, interest on loans to banks, transportation or services of third-party companies;

- Increase in tax rates for extra-budgetary expenses. Deductions take up a significant percentage of the company's expenses and an increase in their rates significantly affects the growth of expenses.

Internal factors

Internal ones include:

- Volume of production and sales of finished goods. Despite the fact that increasing production capacity requires additional expenses, production costs can be significantly reduced due to the constant number of service personnel. For example, a mechanic was servicing one machine, when there were 3 of them, and the mechanic’s salary was the same, three machines were already being serviced, and there were more products, which meant their cost was lower.

- Duration of the production cycle. With its reduction, the level of investment costs, cash transactions, costs of storing products is reduced, the costs of accounts receivable, and the costs of paying employees and managers are reduced.

- Labor productivity indicator per one workplace. The higher this value, the lower the amount for operational settlements with employees.

- Technical condition of fixed assets at the enterprise. The more worn out the equipment is, the more money is required for depreciation. As a result, the question arises about the effectiveness of purchasing new machines.

- The amount of own working capital. The higher the percentage of equity capital used in the company's activities, the less the need for borrowed capital, which means there is a decrease in servicing loans and borrowings.

Operating income is:

> receipts associated with the provision for a fee for temporary use (temporary possession and use) of the organization’s assets;

> revenues related to the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

> proceeds from the sale of fixed assets and other assets other than cash (except foreign currency), products, goods;

> and others.

Operating expenses are:

> expenses associated with the provision of temporary use (temporary possession and use) of the organization’s assets for a fee;

> costs associated with the provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property;

> expenses associated with participation in the authorized capitals of other organizations;

> interest paid by an organization for providing it with funds (credits, borrowings) for use;

> other operating expenses.

7. Lines 060 “Interest receivable” and 070 “Interest payable” reflect the amounts of income and expenses due in accordance with agreements to be received or paid, not related to participation in the management capital of other organizations.

These report lines reflect:

> dividends (interest) on bonds;

> interest on deposits;

> amounts due from credit institutions for the use of balances in the organization’s accounts;

> interest on borrowed funds raised to finance current production activities.

8. An organization that has financial investments in securities of other organizations reflects the income to be received on shares for a period in accordance with the constituent documents under the article “Income from participation in other organizations” (line 080).

The article “Income from participation in other organizations” (line 080) also reflects income to be received from participation in joint activities without forming a legal entity (under a simple partnership agreement).

9. Lines 090 “Other operating income” and 100 “Other operating expenses” reflect data on transactions related to the movement of the organization’s property (fixed assets, cash, securities, etc.). These include: sale of fixed assets and other property, write-off of fixed assets from the balance sheet due to obsolescence, leasing of property, maintenance of mothballed production facilities and facilities, cancellation of production orders (contracts), termination of production that did not produce products. At the same time, income due from these operations and costs associated with obtaining these income are shown on lines 090 and 100 expanded (not balanced). In the case of compensation for the costs of maintaining mothballed production capacities and facilities for canceled production orders (contracts), discontinued production that did not produce products, the corresponding amounts are shown under the item “Other operating income”. In case of disposal of depreciable property, line 100 reflects its residual value, as well as expenses associated with the disposal of property.

Operating income and expenses also include: The results of revaluation of property and liabilities, the value of which is expressed in foreign currency (exchange differences) (PBU 3/2000);

> expenses associated with servicing securities (payment for consulting and intermediary services, depository services, etc.);

> the amount due for payment of certain types of taxes and fees at the expense of financial results in accordance with the legislation of the Russian Federation.

Data on operating income is shown minus the amounts of VAT and other similar mandatory payments reflected in accounts 47, 48, 80.

Section III. Non-operating income and expenses Non-operating income is:

> fines, penalties, penalties for violation of contract terms;

> assets received free of charge, including under a gift agreement;

> proceeds to compensate for losses caused to the organization;

> profits from previous years identified in the reporting year;

> exchange rate differences;

> the amount of revaluation of assets;

> other non-operating income. Non-operating expenses are:

> fines, penalties, penalties for violation of contract terms;

> compensation for losses caused by the organization;

> losses of previous years recognized in the reporting year;

> the amount of receivables for which the statute of limitations has expired, and other debts that are unrealistic for collection;

> exchange rate differences;

> amount of asset depreciation;

> other non-operating expenses.

10. Lines 120 “Other non-operating income” and 130 “Other non-operating expenses”.

The line “Other non-operating income” reflects accounts payable and depositors for which the statute of limitations has expired; amounts received in repayment of receivables written off in previous years at a loss as uncollectible; fines, penalties, penalties and other types of sanctions awarded or recognized by the debtor for violation of contracts, as well as amounts due in compensation for losses caused in connection with violation of contracts; profit of previous years identified in the reporting year; crediting to the balance sheet property that is in surplus as a result of inventory, etc.

The line “Other non-operating expenses” shows the amounts of markdown of inventories, finished products and goods in accordance with the established procedures; loss from writing off receivables for which the statute of limitations has expired; debts that are unrealistic to collect; fines, penalties, penalties and other types of sanctions awarded or recognized by the organization for violation of contracts, as well as for compensation for losses caused; losses from operations of previous years identified in the reporting year; losses from theft of material and other assets, legal costs, etc.

11. “Profit (loss) before tax” (line 140). The amount of profit (loss) before tax is determined as

the balance of all income and expenses for ordinary activities, as well as operating and non-operating income and expenses.

12. The line “Profit tax and other similar mandatory payments” (line 150) shows the amount of profit tax reflected in the accounting records, calculated by the organization in accordance with the legislation of the Russian Federation, subject to transfer to the budget at the expense of profits in the order of its distribution and taken into account on account 81 “Use of profits”, as well as other payments to the budget at the expense of profits remaining at the disposal of the organization (penalties to the budget, state extra-budgetary funds, etc.)

13. The amount in line 160 “Profit (loss) from ordinary activities” is determined as the difference between the amount of “Profit (loss) before tax” (line 140) and the amount of income tax (line 150).

Section IV. Extraordinary income and expenses.

14. “Extraordinary income” (line 170) is considered to be income arising as a consequence of emergency circumstances of economic activity (natural disaster, fire, accident, nationalization, etc.): insurance compensation, the cost of material assets remaining from the write-off of unsuitable for restoration and further use of assets, etc.

15. Extraordinary expenses (line 180) reflect expenses arising as a consequence of emergency circumstances of economic activity (natural disaster, fire, accident, nationalization of property, etc.)

16. Line 190 “Net profit (retained profit (loss) of the reporting period)” reflects the final financial result of the organization’s activities for the reporting period, including all types of income and expenses.

Data on line 190 “Net profit” is determined by adding to the profit from ordinary activities (line 160) the amount of extraordinary income (line 170), reduced by the amount of extraordinary expenses (line 180) for the reporting period.

Form No. 2 contains additional information in the form of “Explanation of individual profits and losses”: lines 210-270 provide an explanation of individual types of non-operating income and expenses for the reporting period and the period of the previous year.

(Form No. 2)

Gains and losses report

| Indicator name | Line code | For the reporting year | For the same period of the previous year | ||||

| 1 | 2 | 3 | 4 | ||||

| 1. Income and expenses from ordinary activities Revenue (net) from the sale of goods, products, works, services (less VAT, excise taxes and similar mandatory payments) | 010 | 106969 | 99017 | ||||

| Including from sales of: products | 011 | 88988 | 80504 | ||||

| Products | 020 | 12533 | 70203 | ||||

| industrial services | 013 | 5448 | 3861 | ||||

| Cost of goods, products, works, services sold | 020 | 69744 | 60254 | ||||

| Including sold: Products | 021 | 59470 | 60254 | ||||

| Products | 022 | 6893 | 7305 | ||||

| industrial services | 023 | 3381 | 2644 | ||||

| Gross profit | 029 | 37225 | 28814 | ||||

| Business expenses | 030 | 5562 | 594 | ||||

| Administrative expenses | 040 | 3102 | 198 | ||||

| Profit (loss) from sales (lines 010-020-030-040) | 050 | 28561 | 28022 | ||||

| Indicator name | Line code | For the reporting year | For the same period of the previous year | ||||

| 2. Operating income and expenses Interest receivable | 060 | 1610 | 4654 | ||||

| Percentage to be paid | 070 | 3102 | 4188 | ||||

| Income from participation in other organizations | 080 | 4814 | 1064 | ||||

| Other operating income | 090 | 749 | 600 | ||||

| Other operating expenses | 100 | 11344 | 3584 | ||||

| 3. Non-operating income and expenses Non-operating income | 120 | 1604 | 495 | ||||

| Non-operating expenses | 130 | 642 | 1715 | ||||

| Profit (loss) before tax (lines 050+060-070+080+090-100+120-130) | 140 | 22250 | 25348 | ||||

| Income tax and other similar mandatory payments | 150 | 6675 | 8872 | ||||

| Profit (loss) from ordinary activities | 160 | 15575 | 16476 | ||||

| 4. Extraordinary income and expenses Extraordinary Income | 170 | ||||||

| Extraordinary Expenses | 180 | — | — | ||||

| Net profit (retained profit (loss) of the reporting period) (lines 160+170-180) | 190 | 15575 | 16476 | ||||

| FOR REFERENCE Dividends per share: preferred | 201 | ||||||

| according to the usual | 202 | — | — | ||||

| Estimated dividend amounts per share for the next reporting year: for preferred | 230 | ||||||

| according to the usual | 204 | — | — | ||||

| Decoding individual profits and losses | |||||||

| Indicator name | Line code | During the reporting period | For the same period of the previous year | ||||

| profit | lesion | profit | lesion | ||||

| 1 | 2 | 3 | 4 | 5 | 6 | ||

| Fines, penalties and penalties recognized or for which court (arbitration court) decisions on their collection have been received | 210 | — | — | — | — | ||

| Profit (loss) of previous years | 220 | — | — | — | — | ||

| Compensation for losses caused by failure to fulfill obligations | 230 | — | — | — | — | ||

| Exchange differences on transactions in foreign currency | 240 | 1604 | 642 | — | — | ||

| Reduction in the cost of inventories at the end of the reporting period | 250 | — | — | — | — | ||

| Write-off of receivables and payables for which the statute of limitations has expired | 260 | — | — | — | — | ||

| 270 | |||||||