Having a car in a company or individual entrepreneur – representatives of small businesses – is not that uncommon. Indeed, in many cases, mobility provided by automobiles can only contribute to the successful development of an enterprise. A special situation when a car is required directly as part of a commercial activity - when transporting passengers or goods. And, of course, the presence of a car presupposes the reflection of some transactions related to it in accounting and tax accounting.

Car as a main means

First, let's look at how the fact of purchasing a car is reflected in the accounting records. Since this is an expensive purchase, in this case we will be talking about a fixed asset, the acquisition of which must be documented. An inventory card in the OS-6 form, an acceptance certificate (OS-1) and an order for commissioning are drawn up for the facility.

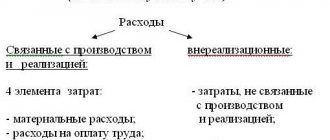

The acquisition cost of a fixed asset is written off using depreciation. For the simplified tax system “income minus expenses”, depreciation of fixed assets in tax accounting is accrued until the end of the calendar year in which the object was acquired and put into operation, in equal quarterly installments. Thus, if you have documents, and also if such a purchase is economically justified, that is, due to the specifics of the activity, the use of a car is necessary, due to its cost, you can seriously reduce the annual tax base. This rule applies primarily to legal entities that purchase a car, as they say, in their own name. In addition to tax accounting, companies are also required to maintain accounting records. In it, the cost of the car is written off over several years, in accordance with its useful life. Thus, depreciation in tax and accounting of organizations will not coincide.

With individual entrepreneurs, the situation in this matter is somewhat easier and more complicated at the same time. On the one hand, individual entrepreneurs do not keep accounting records, therefore, for them the only question is how to reflect the car as part of fixed assets for tax accounting. However, in this situation, it must be taken into account that a private businessman purchases a car in his own name one way or another, that is, such a purchase can be interpreted as personal. In this regard, in order for the cost of a fixed asset to be taken into account when calculating tax, it is necessary to confirm that the car will be used specifically in commercial activities.

Thus, the argument that the car is needed for traveling on general business issues will most likely not be taken into account by the controllers. And, conversely, there will be no problems for individual entrepreneurs who are engaged, for example, in passenger or freight transportation. In this case, the paid and put into operation OS will be written off in tax accounting in the manner described above, and additional costs for transport services with a simplified tax system of 15% can be taken into account in the tax base. And, by the way, about commissioning: the car must be registered with the traffic police. It is this date of registration that will be considered the date of commencement of use of the fixed asset.

If a car, recorded as a fixed asset, is sold on behalf of an LLC or individual entrepreneur, another interesting situation will arise. Firstly, of course, the amount that will be paid by the buyer will need to be included in the income for the simplified tax system of the current period. At the same time, if it turns out that the fixed assets were sold within 3 years after the year of its acquisition and its cost was taken into account in expenses (for fixed assets with a useful life of over 15 years - before the expiration of 10 years from the date of their acquisition), then the taxpayer will have to recalculate tax base, applying the general rules of Chapter 25 of the Tax Code to the procedure for reflecting expenses for the purchase of fixed assets.

The procedure for reflecting when the sale of transport occurred under the simplified tax system “income minus expenses” is as follows in this case. First you need to determine the day when the costs of purchasing the OS were taken into account. In this case, this is the day the car is registered with the traffic police. Next, you need to calculate depreciation for the fixed asset being sold in accordance with the norms of Chapter 25 of the Tax Code for the entire period of use of this property.

This means that depreciation for such an object will need to be determined from the 1st day of the month following the month in which it was put into operation until the month of its sale inclusive. Further, the recorded expenses in the form of the cost of the acquired fixed asset are excluded from the “simplified” tax base. In the same period, as well as subsequent years, the corresponding amounts of depreciation calculated according to general depreciation rules are included in the base. The specified sequence of actions will lead to the fact that for past periods the simplifier will need to file adjustment returns, pay additional tax and penalties.

Accounting for the cost of fuel and lubricants under the simplified tax system

Document

What is it needed for

How to register

A waybill is a key document that confirms the validity and necessity of traveling by car. It must be issued for each car separately. The validity period of the travel document can be from one day to one month

In the waybill, it is better for the company and entrepreneur to indicate the specific route of each trip and the corresponding fuel consumption of the car

Invoices, gas station receipts, account statements

Primary payment documents will confirm that the costs for fuel and lubricants were actually paid

The list of documents that the fuel and lubricants seller will issue to the “simplified” driver depends on how the fuel is purchased. If the driver pays at the gas station in cash, he will be given a cash receipt. Non-cash purchases with fuel cards will be confirmed by seller reports, account statements and monthly invoices

An advance report is required if fuel was purchased through an accountable entity. The employee attaches payment documents to the report

Expenses paid by the reporting person are considered paid by the employer on the date of approval of the advance report. Provided that there is no debt to the employee

Director's order on the procedure for accounting for expenses for fuel and lubricants

The document will be needed to establish how the “simplified” method determines the amount of expenses for fuel and lubricants in tax and accounting under the simplified tax system

Compose the order in any form. The document must provide standards for fuels and lubricants or indicate that you are writing off the costs of fuels and lubricants in full.

Please note: expenses can be normalized both in tax and accounting. But you don’t have to normalize it. In accounting, expenses for fuel and lubricants are allowed to be written off in the amount of actual costs incurred, that is, without standardization (clause 5 of PBU 5/01). In tax accounting, there are also no mandatory standardization requirements. Actual fuel consumption is confirmed by the waybill

Transport tax under the simplified tax system “income minus expenses”

The presence of a car on the balance sheet of an organization requires the company to pay transport tax. The company calculates its amount independently based on the technical data of the car. The date from which the organization becomes the payer of this payment is the date the car is registered with the traffic police. The tax return is submitted at the end of the year by February 1 of the year following the reporting year. According to general rules, the tax itself must be paid within the same period.

The Tax Code also provides for the payment of advance payments for transport tax. The amount of the advance payment is ¼ of the tax calculated for the year (clause 2.1 of Article 362 of the Tax Code of the Russian Federation). The amount of transport tax payable at the end of the year is determined as the difference between the amount indicated in the tax return and the advances transferred during the billing period. The advance procedure for settlements with the budget in this case is provided for by the Tax Code, however, the timing of the transfer of advances is established by regional authorities. Also at the local level, advances on transport tax may be completely abolished. In this case, the company will have to pay the entire tax amount at the end of the year.

Individual entrepreneurs pay transport tax in the usual manner, like an individual. Paragraph 1 of Article 362 of the Tax Code provides for independent calculation of transport tax only in relation to organizations. Individual entrepreneurs, like individuals, pay tax on the basis of a notification received from the Federal Tax Service. (Clause 3 of Article 363 of the Tax Code of the Russian Federation). The Federal Tax Service Inspectorate independently receives data for calculations from the State Traffic Safety Inspectorate through interdepartmental interaction.

A reasonable question that arises when you pay transport tax. Is it included in expenses under the simplified tax system or not?

As a general rule and on the basis of subparagraph 22 of paragraph 1 of Article 346.16 of the Tax Code, transport tax is accepted as an expense under the simplified tax system, subject, of course, to the application of a rate of 15%, since it is a fee paid in accordance with tax legislation. However, again, we should not forget about the economic feasibility of any expenses taken to reduce the tax. Thus, since the presence of a car on the organization’s balance sheet in itself presupposes its use in commercial activities, problems with taking into account the paid transport tax as part of the company’s expenses for the simplified tax system will not arise. The question of whether to include transport tax in the expenses of the simplified tax system for individual entrepreneurs again depends on the fact of using the car in commercial activities. If we are talking about a tax for a car that does not generate income, that is, it is used by an individual rather than a businessman, then it is impossible to take into account the transport payment in reducing the “simplified” tax base. But if a car is directly related to generating income in business, it is clear that transport tax, the inclusion of which in the simplified tax system expenses is impossible “for personal purposes,” is justified and permitted in this case. This is in particular confirmed by employees of the Ministry of Finance in their letter dated July 4, 2013 No. 03-11-11/25784.

Rationing costs for fuel and lubricants

The Tax Code does not provide for fuel rationing for motor vehicles. But at the same time, any fuel expenses must be confirmed by waybills. You can develop travel forms yourself. All mandatory details are contained in Order No. 152 of the Ministry of Transport of Russia dated September 18, 2008. Be sure to include information about medical examinations in them. And add there such details as “trips”.

- See also the cost standards for fuel and lubricants

Therefore, firms and entrepreneurs decide on their own whether or not to normalize costs for fuels and lubricants. If the option in favor of rationing is chosen, then to account for costs you can use, firstly, independently developed standards, and secondly, data from the car manufacturer. And thirdly, the standards approved by the order of the Ministry of Transport of Russia dated March 14, 2008 No. AM-23-r. The latter are mandatory only for motor transport companies. Ordinary companies and entrepreneurs can use them at will.

Accounting for fuel and lubricants in tax and accounting under the simplified tax system

Question

Answer

Is it possible not to standardize the costs of fuel and lubricants, but to write them off in full?

Can. Neither accounting nor tax legislation imposes mandatory requirements for rationing the cost of fuels and lubricants. At the same time, if you do not apply the standards, be prepared to justify the amount of fuel written off in tax accounting. It is advisable to establish the same approach to accounting for costs of fuel and lubricants in accounting and tax accounting. That is, either apply the rules here and there, or not apply them

What methods of rationing exist?

The “Simpler” can choose one of three options.

The first is to apply the standards developed by the Ministry of Transport. The second is to take fuel and lubricants into account within the limits established by the manufacturer.

The third option for cost accounting is to use standards developed independently. These standards will be confirmed by reports of a vehicle control drive under specified conditions.

This is interesting: Housing standards per person 2020

Is it a violation to revise fuel standards in the middle of the year?

This is allowed if the change in fuel and lubricants standards is justified. For example, it turned out that a new car consumes more fuel than originally installed. Only economically justified costs that are supported by documents are written off as expenses of the simplified tax system. Indicate the reason for the changes in the order of the company director on new fuel consumption standards

Is it possible to develop different fuel consumption rates for winter and summer?

Yes, you can, the law does not prohibit it. In the director's order, reflect which periods are considered winter and summer. Specify winter and summer fuel consumption rates

Is it possible to deduct excess fuel consumption from the driver’s salary?

It is possible if the overspending is the driver’s fault. And this can be established by a commission consisting of the director and other specialists (Article 247 of the Labor Code of the Russian Federation). You should definitely ask the employee to explain the overspending. The director has the right to issue a deduction order only within a month after calculating the damage to the company. And in an amount not exceeding one average monthly salary (Article 248 of the Labor Code of the Russian Federation). If the monthly deadline is missed or the amount of damage is greater, then the funds can only be recovered from the employee through the court.

Accounting for expenses for the purchase and write-off of fuel and lubricants

Purchased fuels and lubricants are included in the organization's inventories and are taken into account at actual cost (paragraph 2, paragraph 2, paragraph 5, paragraph 3, paragraph 6 of the Accounting Regulations “Accounting for inventories” PBU 5/01 , approved by Order of the Ministry of Finance of Russia dated 06/09/2001 N 44n).

Fuel and lubricants purchased by an accountable person for a car are accepted for accounting as the debit of account 10 “Materials”, subaccount 10-3 “Fuel”,

The cost of consumed fuels and lubricants is included in expenses for ordinary activities or as part of other expenses (clause 4, paragraph 2, clause 5, paragraph 2, clause 11 of the Accounting Regulations “Organization Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated 05/06/1999 N 33n).

The write-off of fuel and lubricants is carried out on the basis of the data reflected in the waybill (Letter of Rosstat dated 03.02.2005 N ИУ-09-22/257).

Document forms for accounting for fuel and lubricant expenses on the simplified tax system:

- Form No. 3. Passenger car waybill

- Passenger car waybill (simplified form)

- An example of filling out a waybill for a passenger car (form No. 3)

- An example of filling out a waybill for a special vehicle

- Form No. 4-C. Truck waybill

- Form No. 6. Bus waybill

- Form No. 4. Passenger taxi waybill

- An example of filling out a waybill for a truck (form No. 4-P)

- An example of filling out a waybill for a construction vehicle (form No. ESM-2)

- Form No. 4-P. Truck waybill

- Form No. 3 special Waybill for a special vehicle

- Form No. 412-APK. Tractor waybill

- Form No. 4. Truck waybill

- Form No. 6 (special). Waybill for a non-public bus

- Passenger car waybill

- Form No. 8. Journal of the movement of waybills

- Form No. ESM-2. Construction vehicle waybill

- An example of filling out a waybill for a non-public bus (form No. 6 special)

- An example of filling out a truck waybill (form No. 4-C)

Answers to common questions about fuel and lubricants accounting rules

Question #1:

How to write off gasoline based on its consumption if it is impossible to understand how much fuel is left in the tank of a filled car?

Answer:

As a rule, for these purposes, actual fuel consumption is determined as the number of kilometers on the speedometer multiplied by the standard adopted by the company.

Question #2:

The company applies fuel consumption standards established by the Ministry of Transport for tax accounting purposes. Is it possible to apply similar standards in accounting?

Answer:

Yes. The same limit value (according to the standards of the Ministry of Transport or independently developed standards) can be used when calculating the gasoline consumed and when reducing the tax base.

Consumption rates

There are approved standards recommended by the Ministry of Transport, but they are designed for average conditions. In reality, fuel consumption can be affected by the presence/absence of precipitation, road condition, highway congestion and many other factors.

So, if freight vehicles move almost off-road, fuel consumption can increase by 35–40% with cargo and by 15–20% without it. It is also necessary to take into account the season and the specifics of road trips in specific localities.

Rules for accounting for fuels and lubricants - standards

Companies have the right to approve their own fuel consumption limit:

- borrow information about the consumption of fuel and lubricants from the technical documentation for the machine;

- They collect a commission and take measurements.

Gasoline consumption is measured according to the following scheme (separately for an empty and loaded vehicle, for summer and winter trips, for idle time with the engine running, etc.):

- Gasoline is poured into an empty tank and its volume is recorded.

- The car drives until the gas tank is completely empty.

- The speedometer determines how many kilometers the car has traveled before the tank is empty.

- It is determined how much fuel is required to travel 1 kilometer (the number of liters divided by the number of kilometers).

- An act of the commission is drawn up with the signatures of all its members.

Important!

Periodically, it is necessary to reconcile the data reflected in the accounting records with the actual balances. As for determining the standard for gasoline consumption, it is allowed to set a basic standard and increasing coefficients for trips on congested highways, for trips in winter, etc.

Rules for accounting for fuels and lubricants have been updated

By order of the Ministry of Transport dated 04/06/2020 No. NA-51-r, methodological recommendations on fuel and lubricant consumption standards for certain brands of cars produced in 2008 and later were updated. It is recommended to use consumption standards not only when making calculations, but also when writing off the costs of fuels and lubricants (but this is a right, not an obligation of enterprises).

The updates affected the following sections:

- “Domestic and CIS vans manufactured since 2008”;

- “Domestic and CIS passenger cars produced since 2008” (for Lada Granta, Lada Priora, Lada Kalina, Lada Vesta, etc.);

- “Domestic and CIS flatbed trucks produced since 2008”;

- “Domestic and CIS buses since 2008.”

The maximum values of winter surcharges to fuel consumption standards in Sevastopol and Crimea were also approved. These indicators are necessary for calculating the cost of transportation and other types of transport work, making payments to vehicle drivers and users, and planning the needs of companies for the provision of fuel and lubricants.

Rules for accounting for fuels and lubricants: postings

Accounting for purchased fuels and lubricants will depend on how they were purchased:

| Operation | DEBIT | CREDIT |

| Purchase of fuel and lubricants using fuel cards and coupons | ||

| Reflection of funds transferred for cards/coupons as an advance issued | 60, subaccount “advances issued” | 51 |

| Acceptance for deduction of VAT on advance payments issued | 68, subaccount “VAT calculations” | 76 |

| Acceptance for accounting of fuels and lubricants issued using coupons or cards (based on a report from the company issuing coupons or cards, or coupon stubs from drivers). | 10 | 60 |

| Reflection of VAT on fuel and lubricants | 19 | 60 |

| Acceptance for deduction of VAT on fuel and lubricants | 68, subaccount “VAT calculations” | 19 |

| Restoration of VAT accepted for deduction from the transferred advance payment | 76 | 68, subaccount “VAT calculations” |

| Purchase of fuel and lubricants for cash | ||

| Issuance of money against a report for the purchase of fuels and lubricants | 71 | 50 |

| Capitalization of fuel and lubricants based on an advance report from the driver | 10 | 71 |

| Reflection of VAT on purchased fuels and lubricants | 19 | 71 |

| Acceptance for deduction of “input” VAT on fuel and lubricants | 68, subaccount “VAT calculations” | 19 |

The cost of fuel and lubricants consumed per month is calculated using waybills or reports from mileage and fuel consumption monitoring systems. Write-offs are made to expenses on the last day of the month:

| Operation | DEBIT | CREDIT |

| Including the cost of fuel and lubricants in costs (only if there is a seller’s invoice) | 20 (26, 44) | 10 |