Entrepreneurs who want to use the simplified tax regime must decide for themselves an important question: what rate is beneficial for their business? Let's consider the main aspects of decision-making in this case.

This service can greatly facilitate accounting on the simplified tax system, as well as tax and personnel records, try it to minimize risks and save time.

STS - the most popular special mode

Simplified language is indeed very popular among entrepreneurs. It’s easy to fit into the basic conditions:

- Income for the year is limited (in 2020 this limit will be 150 million rubles);

- The annual number of employees also has a limit - no more than 100 people in average terms;

- The remaining amount of fixed assets is not more than 150 million rubles;

- Participation in the authorized capital of other companies should be no more than 25%;

- It is prohibited to have branches, only representative offices of the company.

Most individual entrepreneurs and many small LLCs meet these requirements. Of course, there are exceptions by type of activity, but, in principle, you can fit into the simplification without much effort.

For individual entrepreneurs and LLCs under the simplified regime, in fact, there is only one difference - the deadline for filing reports and transferring taxes. For LLCs this deadline is set at the end of March, and for individual entrepreneurs at the end of April.

https://youtu.be/9jgbjPtWVW0

How to choose an object of taxation under the simplified tax system

The simplified taxation system (STS) is a special regime chosen by small enterprises with an annual turnover of no more than 150 million rubles.

This system has two types of taxation objects:

- “income” with a rate generally of 6%;

- “income minus expenses” at a rate of 15%.

Which is better - simplified tax system 6 or 15% depends on many factors: the presence of hired employees, type of activity, volume of documented costs, amount of income, region of business, etc.

The choice of object should be approached as responsibly as possible, because the tax burden for the entire next year depends on it, since moving from one object to another during the calendar year is prohibited.

How to choose simplified tax system 6 or 15%? To answer this question, it is necessary to find out how USN-6 differs from USN-15.

How do rates differ?

To simplify things, there are two betting options:

- 6% from the amount of income;

- 15% of profits (“income minus expenses”).

Please note that in the first option, regions can reduce the rate to 1% for certain categories of taxpayers, and in the second option, the rate can be regulated by regional authorities within the range of 5 to 15%. Once you choose a rate, you will not be able to change it until the end of the year, so your choice must be informed and balanced. Let's look at the features of each option.

conclusions

In general, it is most profitable to pay UTII. But not all types of activities can use this mode. Between OSNO and simplified tax system, 15% choose the simplified version.

If a company's costs are 60% less than its income, it is more profitable for it to choose a rate of 15%, and if it is 60% more - 6%. In addition to the low simplified tax rate of 6%, compared to the simplified tax system of 15%, its advantage is that you do not need to keep track of expenses. This means that accounting costs become much lower. Tax risks that are associated with incorrect interpretation of costs and the need to prove the legality of each expense made are also reduced.

Based on the article, we can draw the following conclusion: you can determine what rate will be beneficial for your organization only by taking into account the specifics of your activity and assessing the profitability of the business.

To make the best choice, it is best to contact a consulting organization. Specialists with extensive experience in this matter will help you make the right choice and provide the most profitable option, clearly justifying your position.

Similar articles

- Can an LLC choose a simplified taxation system?

- How to reduce the simplified tax system on insurance premiums?

- USN: rates

- Calculation of transport tax (accounting entries)

- Rules for calculating the minimum tax under the simplified tax system

Option #1: 15%

Tax calculation is done based on the difference between income and expenses. You can choose this option only when the cost is constant or can be easily predicted. In order for the expenses you incurred to be taken into account when calculating the amount to be transferred to the state treasury, they must meet several criteria:

- Be necessary for your business;

- Comply with the list approved by the Tax Code of the Russian Federation;

- Be paid and documented with appropriate documents;

- The goods or services you have paid for must be received by you. This fact is also documented.

If you choose a rate of 15%, you will have to calculate the amount of the minimum tax. The mechanism in general looks like this:

- Calculate tax as usual;

- Consider the minimum tax, it is equal to 1% of income for the year;

- Compare two numbers;

- Pay into the budget the one that is larger.

You will need to pay the minimum wage even when you have a loss and the tax according to the general calculation is zero. In the future, this amount can be included in the expenses of subsequent periods.

We also note that paying the minimum tax and the presence of losses attracts the attention of the tax inspectorate.

What is the difference between simplified tax system 6 and 15%

Here are the main differences between the simplified tax system-15 and the simplified tax system 6% in a comparative table:

| Index | simplified tax system 6% | simplified tax system 15% | Note |

| Tax rate | From 1% to 6% | From 5% to 15% | Depending on the region |

| The tax base | Income | Profit (difference between income and costs) | Accounting for income and expenses is carried out using the cash method |

| Minimum tax | No | 1% of income | |

| Nuances | The amount of calculated tax can be reduced by the amount of insurance premiums paid (benefits paid at the expense of the employer, contributions for voluntary insurance, trade tax), but not more than 50% | Insurance premiums are taken into account in costs and reduce the tax base | Individual entrepreneurs on the simplified tax system of 6% without hired employees have the right to reduce the payment to 0 |

Let us consider the algorithm for calculating the simplified tax system for each taxable object in more detail.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

The amount of simplified tax payable is calculated according to the formula:

simplified tax system income = D × St - St,

Where:

D - income for the year;

St - tax rate;

St - the amount of insurance premiums paid, etc., but not more than ½ of the amount of calculated tax (for employers).

simplified tax system income - costs = (D - R) × St,

Where:

Subscribe to our newsletter

Read us on Yandex.Zen Read us on Telegram

D - income;

R - expenses;

Important! Costs that are accepted for tax accounting under the simplified tax system “income minus costs” must be included in the closed list given in Art. 346.16 Tax Code of the Russian Federation. All expenses must be supported by correctly completed documents and economically justified.

St - tax rate.

Read even more about calculating the simplified tax system in our article “How to calculate the simplified tax system: formula and calculation example.”

If a loss is incurred during the tax period, the taxpayer, using the simplified tax system of 15%, is obliged to pay a minimum tax, which is equal to 1% of the amount of income received. The minimum tax is also paid if the amount of tax calculated in the standard way is less than the amount calculated based on the 1% rate.

That is, the “income” object is more profitable to use when the amount of costs is minimal. If the amount of costs exceeds 60%, it is more profitable to use the simplified tax system of 15%.

Visual comparison of the simplified tax system with 6 or 15%

Illustrative examples help to better understand the difference and make a choice of the simplified tax system option. Initial data: the annual income of the individual entrepreneur was 150 thousand rubles, the payroll was 75 thousand rubles.

| Example #1 | Tax at the rate of 6%: 150,000 * 6% = 9000 (rubles). The amount received can be reduced by tax payments and contributions (except personal income tax) within 50%, i.e. maximum up to 4500 rubles (9000 * 50%). Calculation of taxes and contributions that reduce the tax base of individual entrepreneurs (conditional rates):

Total: 6000 4500 900 = 11,400 (rubles). The tax payable will be 4,500 rubles, since the payment of contributions (11,400 rubles) exceeded the calculated amount. |

| Example No. 2 | The individual entrepreneur paid 33,000 rubles for office rent. Personal income tax: 75,000 * 13% = 9,750 (rubles). Expenses: 150,000 – 75,000 – 33,000 – 9,750 – 11,400 = 129,150 (rubles). Tax calculation at a 15% rate: (150,000 – 129,150) * 15% = 3,127.5 (rubles). As you can see, the expenses of an individual entrepreneur exceed 60% of its revenue. In this case, it is more profitable for him to use the simplified tax system of 15% (tax 3,127.5 rubles) than 6% (tax amount 4,500 rubles). |

Thus, we can conclude that the choice of the simplified tax rate depends mainly on the size of the company’s expenses for carrying out its economic activities. If expenses are high, it is more profitable to use the simplified tax system of 15%, which implies a reduction in the tax base by the amount of expenses.

60% rule for “simplification”

Just remember:

If expenses make up 60 percent or more of income, then it is more profitable for you to pay 15% on an income minus expenses basis; if less, then 6% only from income, and expenses are not taken into account at all.

This task, it should be noted, is at the fifth grade level. To solve it, you need to build a table in Excel and look at it. This is done in 5 minutes and the following is obtained (the results are given for rates of 6% and 15%).

In the table, do not look at the first two columns: income and expenses are presented there in some conventional units (these are not dollars; the units are not important at all). The amount here has absolutely no meaning - the meaning is in percentage. As you can see from the third column, in each subsequent row the amount of expense (and its share of income) increases. The fourth and fifth columns show the amount of tax.

This simple calculation confirms that the higher the share of expenses from income, the less profitable over time (with an increase in expenses for the same income) the “income” tax base becomes (USN 6%). Column 4 shows that the 6% simplified tax system is beneficial for those cases when the share of expenses is in the range from 0 to 50% inclusive (highlighted in green). The simplified tax system of 15% (“income minus expenses”), on the contrary, becomes profitable in the range of 70% (highlighted in green in the last column).

But I highlighted the border in yellow. There expenses make up 60% of income. In essence, this is a “transitional territory” and it is not very clear what exactly is more profitable. So the “60% rule” shown above, which, it should be noted, is very well known, I would paraphrase a little differently:

When to choose simplified tax system

If your expenses are clearly less than 60% of your income, then choose the simplified tax system of 6%; if it is clearly more, the simplified tax system is 15%. If you are in the “transition zone”, then you should think about it some more.

The point here is that all such calculations when choosing a tax base for a new company are approximate. Who knows what might change in the future, once you've already started operating? Personally, if I am in the yellow zone of the schedule, I would choose the simplified tax system of 15%, since in reality the costs are usually higher than you think. Is it worth the risk trying to save an extra 5 cents? However, cases are different and here everyone must think for himself (the key word is “think”, and for a long time).

It’s a completely different matter if the company has been operating for some time and you know exactly the ratio of income and expenses. At the initial stage, you have to make approximate calculations, so, in my opinion, there is nothing wrong with making a choice based on the assumption that costs may increase beyond estimates if a controversial situation arises (yellow bar in the table).

For greater clarity, I will provide a graph based on the created table. The vertical red stripe delineates the areas of effective application of the tax base “income” and “income-expenses” for simplicity.

If you want to look at the table and graph values for tax rates other than 6% and 15%, then download the Excel file at the bottom of the article, on the basis of which all this was calculated, and experiment yourself.

Choosing the correct tax base for the simplified tax system

If you read carefully and did not spin the wheel on your mouse, you should have already understood that the choice between the simplified tax system of 6% (income) and the simplified tax system of 15% (income minus expenses) depends on the amount of your expenses, or rather on the ratio of expenses and income. If it’s clear, then open Excel and figure out for yourself what’s more profitable for you. If you're lazy, then read on. By the way, I will present all calculations here specifically for standard rates of 6% and 15%; if you need others, then count them yourself - it’s simple.

Firstly, even without any calculations it is obvious that the smaller the share of expenses from income, the more profitable it is to apply the simplified tax system of 6%. Below I will provide calculations showing exactly what share of expenses should be in order to make the right decision. Now let’s look a little at the question: in which types of activities the costs are the least.

The first thing that comes to mind is consulting services, as well as any non-production services in general. Costs here come down to advertising, salaries and rent (all sorts of little things can be ignored for now). On the contrary, in trade, the purchase of goods is added to the expenses, which, with a small trade margin, makes the expenses significant and cannot be ignored. Production stands apart - here it’s even more difficult to make a decision right away.

At the end of the article, after all the calculations and graphs, I will look at examples of choosing the simplified tax system base for different types of business, and now let’s see how to accurately calculate which tax base will be more profitable when simplified: “income” or “income minus expenses.”

Accounting services

To do this, you should contact a professional who will calculate all the pros and cons, specifically for your business.

Make it ahead of time and here's why. According to the Tax Code, you can change the tax regime only once a year, and you must inform the tax office in advance, no later than December 31, on an approved form. An inappropriate approach to choosing a tax rate can become a rope around the neck of your business.

ORDER IN FINANCES IS ORDER IN EVERYTHING!

| WHY US? | WHY YOU? | ||

| We do not violate deadlines - everything is clear and on time | Do you like ALL INCLUSIVE? | ||

| We have an excellent reputation | Don't like hidden commissions in the price list? | ||

| We are not being replaced by competitors | payment upon delivery of the report for you? | ||

| Fair price list | We don’t just listen, we hear the client |

| NUMBER OF DOCUMENTS | PERIOD | PRICE | |

| up to 50 operations | month | 6000-00 | |

| up to 100 operations | month | 10 000-00 | |

| up to 150 operations | month | 13 000-00 | |

| up to 200 operations | month | 16 000-00 | |

| up to 250 operations | month | 20 000-00 | |

| up to 280 operations | month | 25 000-00 | |

| up to 300 operations | month | 30 000-00 |

| NUMBER OF DOCUMENTS | PERIOD | PRICE | |

| up to 50 operations | month | 8000-00 | |

| up to 100 operations | month | 12 000-00 | |

| up to 150 operations | month | 15 000-00 | |

| up to 200 operations | month | 18 000-00 | |

| up to 200 operations | month | 22 000-00 | |

| up to 280 operations | month | 27 000-00 | |

| up to 300 operations | month | 32 000-00 |

TAX RATES FOR USN

| 6 % | 15 % |

| INCOME | INCOME minus EXPENSES |

| All income received to the current account or cash desk of the enterprise is taken into account. | All income received to the current account or cash desk of the enterprise is taken into account, minus expenses |

TAX CALCULATION IS MADE ACCORDING TO THIS FORMULA

| TAX AMOUNT | = | TAX RATE | X | THE TAX BASE |

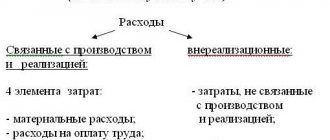

For a taxpayer who has chosen the INCOME taxation system, the tax base consists of all receipts of revenue to the current account or cash register of the enterprise, minus only contributions paid to the pension fund and social insurance fund. For taxpayers of the simplified tax system who have chosen INCOME minus EXPENSES, the tax base consists of all receipts of revenue to the current account or cash desk of the enterprise, minus the expenses defined in Article 346.16 “Procedure for determining expenses.” THE MOST IMPORTANT INDICATOR WHEN SELECTING THE TAX BASE IS EXPENSES Expenses for acquisition, construction and production of fixed assets, as well as for the completion, retrofitting, reconstruction, modernization and technical re-equipment of fixed assets.

Expenses for the acquisition of intangible assets; Expenses for repairs of fixed assets Rent payments for leased property; Material costs; Expenses for wages, payment of benefits for temporary disability in accordance with the legislation of the Russian Federation - salary, sick leave; Expenses for all types of compulsory insurance of employees, property and liability, including insurance contributions for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases produced by in accordance with the legislation of the Russian Federation - contributions to the insurance funds of the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, and the Federal Compulsory Medical Insurance Fund; Interest paid for the provision of funds (credits, borrowings) for use; Expenses for ensuring fire safety of the taxpayer in accordance with the legislation of the Russian Federation, expenses for services for the protection of property, maintenance of fire alarm systems, expenses for the purchase of fire protection services and other security services; Amounts of customs duties paid when importing goods into the territory of the Russian Federation Expenses for the maintenance of official transport; Travel expenses; Payment to a public and (or) private notary for notarization of documents. Moreover, such expenses are accepted within the limits of tariffs approved in accordance with the established procedure; Expenses for accounting, auditing and legal services; Expenses for the publication of financial statements, as well as for publication and other disclosure of other information, if the legislation of the Russian Federation imposes on the taxpayer the obligation to publish (disclose) them; Expenses for office supplies; Expenses for postal, telephone, telegraph and other similar services, expenses for payment of communication services; Costs associated with acquiring the right to use computer programs; Expenses for advertising of manufactured (purchased) and (or) sold goods (work, services), trademark and service mark; Expenses for the preparation and development of new production facilities, workshops and units; Costs for provision of warranty repair and maintenance services;

If your expenses do not exceed 60%, it is better for you to choose an INCOME rate of 6%

Consider employee costs

If the business involves hiring employees, then in the “Income” object you can make a tax deduction for the amount of insurance premiums for employees and the amount of sick leave benefits paid at the expense of the employer. In this case, the tax amount can be reduced by no more than 50%. We gave examples of the use of tax deductions in the article on calculating the tax on the simplified tax system of 6%.

In the “Revenues minus expenses” object, you can take into account employee salaries, insurance premiums and sick leave benefits as expenses. This will reduce the tax base and, accordingly, the amount of tax payable.

What is more economically profitable: simplified taxation system 6% or 15%

It's easier to answer this question with an example:

Option 1.

Income - 100,000 rubles

Expense - 70,000 rubles

The tax amount will be:

2. simplified tax system 15% =0) * 15% = 4,500 rubles

Conclusion: simplified tax system 15% is more profitable to use.

Option 2.

Income - 100,000 rubles

Expense - 50,000 rubles

The tax amount will be:

1. STS 6% = 100,000 * 6% = 6,000 rubles

2. simplified tax system 15% =0) * 15% = 7,500 rubles

Conclusion: simplified tax system 6% is more profitable to use.

Thus, if the amount of expenses is less than 60% of the amount of income, then it is more profitable to use the simplified tax system of 6%.

When switching to the simplified tax system, the business owner must decide which object of taxation will be more profitable for his activities - “Income” or “Income minus expenses”. We will tell you what points you need to pay attention to.

There is a simple way to approximately determine a more profitable tax object. You need to understand what percentage your expenses are in relation to your income. If expenses are more than 60% of the amount of income, then it is better to select the “Income minus expenses” object. But, of course, the most correct thing is to make accurate calculations based on a business plan or the results of real activities.