- Regulated personnel records and office work

- Staffing table

- Accounting for personnel movement

- Accounting for personal data

- Time tracking

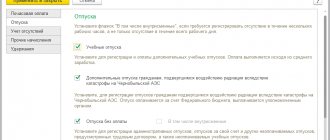

- Vacation accounting and calculation of unused vacation balances

- Military registration

- Salary and reporting

- Calculations of accruals and deductions

- Payroll calculation procedure

- Reflection of accruals in regulated accounting

- Payment of wages

- Transfer of salaries to personal accounts of employees

- Personal income tax and wage contributions

- Personalized accounting

- Support for the FSS pilot project

- Statistical reporting

Regulated personnel records and office work

HR records are mandatory for any company. Every year it is increasingly regulated by law, so the ability to automate it is important for many companies, especially those with a large staff of employees.

"1C: Salary and HR Management 8" allows you to:

- Company management

: reduce the time spent on HR work - receive reliable information in a timely manner

- analyze information about staffing, the use of working time and the wage fund to make management decisions.

:

- maintain personnel document flow in accordance with legal requirements

- Carry out, in strict accordance with the law, automatic calculation of wages, payment of absences and other charges

- synchronize data with the 1C: Accounting 8 program, edition 3.0.

- receive a payslip by email.

1C:Enterprise 8. Salaries and personnel management ed. 3.1. Level 1. Personnel records

1C:Enterprise 8. Salary and personnel management v.3.1. Level 1. Personnel records

02/38/01 Economics and accounting (by industry)

This content is available to authorized users only. Please log in to the site or register.

Login Registration

This course meets the requirements of the professional standard “Accountant” (approved by order of the Ministry of Labor and Social Protection of the Russian Federation dated February 21, 2019 No. 103n).

Any company, regardless of the type of activity, is required to maintain personnel records. If you want to systematize and organize automated, qualified personnel records, with the ability to draw up regulated personnel documents and generate reports based on employee data, take the course “1C: Enterprise 8. Salaries and personnel management ed. 3.1. Level 1. Personnel records.”

Purpose of the course: to learn how to maintain automated personnel records using standard program documents in the new edition of 1C Salary and personnel management

taking into account the latest changes. The course is built on solving a cross-cutting problem, including all possible aspects of maintaining personnel records at an enterprise, from hiring to reporting.

During the training process, practical examples are used to examine the maintenance of personnel records in the program, starting with the settings of the organization’s personnel policy, drawing up work schedules and staffing, and ending with setting up your own reporting options. Great attention is paid to the competent formation of personnel orders (hiring, dismissal, transfers, vacations, etc.). The course also discusses the possibilities of the program related to changes in the requirements for recording work books (registration of employee applications for work activities). We remind you that Federal Laws No. 436-FZ and No. 439-FZ of December 16, 2019 came into force, which introduce the mandatory generation of information about labor activity in electronic form (“electronic” work book), which will gradually replace the classic work book. Changes come into force on January 1, 2020

and affect both employers and employees.

The course is based on a cross-cutting example. The situation of starting accounting from “scratch” is considered, that is, starting from filling out the initial information about the organization and drawing up the staffing table and ending with the generation of reporting on employees and military records. Throughout the course, typical situations of maintaining personnel records are considered (drawing up and changing the staffing table, orders for hiring, dismissal and personnel transfers, sick leave, vacation schedules, orders for vacations and transfers of vacations, business trips, etc.).

The course is intended for

specialists who maintain personnel records of the organization, technical specialists who implement and maintain software products of the 1C:Enterprise 8 system. The course will also be useful to managers of organizations who want to maintain automated document flow for the purpose of personnel records. The course will be of interest to users who want to learn about the differences between the new edition of this software product.

Helpful information. Setting up a shift work schedule

•

» Watch a free webinar on using the E-Staff program in personnel selection

Staffing table

- Maintaining staffing in the program is optional

. If the enterprise is small and there is no need to maintain a staffing table in the program, then you can keep records without a staffing table. In this case, when hiring and transferring employees, it will be necessary to fully describe the place and conditions of their work. If the organization subsequently decides to draw up a staffing table in the program, it will be generated automatically based on the available information about employees. The only thing that may be required is to make some adjustments to it (for example, indicate vacant positions). - Monitoring of personnel documents for their compliance with the staffing table

can be established or abandoned. - The mode of approving the staffing table with special documents

allows you to store the history of changes in the staffing table, which makes it possible to obtain the staffing table for any past date. In addition, you can analyze the unapproved (planned) staffing table.

Accounting for personnel movement

- registration of employees with whom employment contracts are concluded, and execution of fixed-term and open-ended employment contracts, including for remote work, in a standard form

- registration of employment and execution of orders for hiring an employee or list of employees (forms No. T-1 or No. T-1a)

- registration of an employee’s transfer to another place of work, change of type of employment (internal and external part-time work and main place of work); changing the terms of the contract and issuing orders for the transfer of an employee or a list of employees (forms No. T-5 or No. T-5a)

- registration of employee dismissals (forms No. T-8 or No. T-8a)

- registration of civil law contracts: work contracts, paid services contracts, author's orders.

Based on traffic recording data, you can obtain the following information:

- current lists of employees for a specific date with a customizable set of details;

- data on the movement of workers for the selected period;

- statistical information on the number of employees of various categories (number of employees at the main place, internal and/or external part-time);

- average and average number of employees.

This information allows the manager to analyze the personnel dynamics of the company and individual departments (number of moves, dismissals), track changes in personnel, and promptly identify problems in personnel management.

Benefits of implementation

What do the currently existing office automation and document flow systems allow us to do?

They solve a number of important problems: they eliminate the “forgetting” of individual employees, missing deadlines, violating the norms of the Labor Code of the Russian Federation, and establish interaction between the HR department and other structural divisions of the organization. But the main thing is to save the HR manager’s time and the employer’s money by:

- optimization by the program of personnel selection planning processes, control over staff turnover, visual representation of processes in the field of personnel management in numbers, graphs and charts;

- saving in the database forms established by the legislation of the Russian Federation or local regulations of the employer, which are filled out automatically. The HR employee only needs to correctly enter information about the employee and workplace into the program and print the required document;

- facilitating the formation of personal files of employees in accordance with the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), archival legislation, and other regulations;

- reminders to the HR specialist about the approach of a certain period with which the Labor Code of the Russian Federation or other regulatory legal act associates the emergence, change or termination of rights and obligations (for example, warning periods about the termination of a fixed-term employment contract or about an upcoming layoff, the deadline for familiarizing yourself with the order for granting leave , on the application of disciplinary measures, the deadline for approving the vacation schedule for the next calendar year, etc.);

- optimization of employee certification processes, their training and development;

- automatic calculation of the number of days of unused vacation, average earnings for a certain period, the amount of benefits, data for filling out reports (average and average number of employees) and others;

- automatic recording of working hours based on entered work schedules and orders for leave, reduction of working hours, provision of part-time work, information on payment of sick leave, etc.;

- indications of incorrectly entered data, checking SNILS, TIN for authenticity;

- consolidation of data entered by various users and maintenance of a single, transparent database for various interconnected departments (HR department, accounting and others), which allows getting rid of the transfer of paper documents;

- electronic management of interaction processes within the enterprise, simplification of the approval of draft local regulations and other documents that require compliance with certain approval procedures in accordance with the requirements of the employer, subsequent storage of electronic documents in the employer’s database both in order to ensure their safety and for the purposes of using them to optimize procedures for adaptation and training of personnel, facilitating entry into positions and teams, and many others.

Accounting for personal data

“1C: Salary and HR Management 8” stores all the basic information about employees necessary for personnel work, payroll calculation, personal income tax and insurance contributions:

- personal information about the employee (full name, date of birth, gender, etc.);

- ID card details (passport details);

- TIN;

- PFR insurance certificate number;

- contact information (phone numbers, email addresses, etc.);

- information about citizenship, insurance and tax status;

- data on tax deductions;

- information about disability;

- information about education;

- information about previous work activities;

- family composition;

- military registration information;

- information about awards, academic degrees and titles.

In addition to those provided in the program, the user can create additional details and information (for example, height, weight, clothing size, etc.), as well as attach a photograph of the employee, scanned copies of any documents, such as a resume.

The functionality of “1C: Salaries and HR Management 8” allows you to meet the requirements of the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data”. For this purpose, registration of database access events has been implemented for selected data areas (PD processing, personal data, addresses and telephone numbers, disability, income data, property data).

Time tracking

"1C: Salary and HR Management 8" provides tracking of employee working time. This data can be used:

- to prepare the necessary personnel records;

- for subsequent analysis of statistics on the time and reasons for the employee’s absence from the workplace;

- for accruals and payments in accordance with actual time worked.

Time tracking schemes

. “1C: Salary and Personnel Management 8” provides tracking of employees’ working hours both according to standard schemes (five days) and specific ones, for example “every three days”. Typical options for filling out work schedules can be used to create an automatic schedule. It is possible to create individual work schedules for specific employees.

Production calendars

. To fill out work schedules, a regulated federal or regional production calendar is used. You can create multiple production calendars. They may be needed if the organization’s branches are located in regions where their own holidays are established.

In this way, the company can easily keep track of working hours in accordance with all work options that exist at the enterprise (in shifts, taking into account weekends and holidays, part-time work, staggered schedules, etc.).

Classifier of types of working time

. In “1C: Salary and Personnel Management 8” there is a classifier of types of working time (appearance, shift, holiday, etc.), which the company can expand and supplement at its own discretion. Remuneration depends on the type of working time. During the working day, an employee can be busy at work of different types of hours.

Types of no-shows

. Based on typical types of absences, the personnel service can register the absence of an employee for various reasons and automatically generate the necessary personnel records documents.

Types of processing

. Information about work outside the established work schedule is collected from the following documents:

- about overtime with cumulative time tracking;

- orders to work on weekends and holidays;

- registration of overtime work.

When registering overtime, overtime, and work on weekends and holidays, you have the opportunity to choose the method of compensation: time off or increased pay. Time off can be registered as a separate order or added to vacation. Remaining days off and vacations are taken into account.

Time sheet

. Based on the results of the accumulated data in “1C: Salary and Personnel Management 8”, you can generate a “Working Time Sheet” (unified form T-13).

Analytical reports

. The program allows you to analyze the causes of lost working time, obtain information on the number of employees who were absent for various reasons over a certain period (for example, data on how many employees are on vacation, how many are on a business trip, etc.).

The program implements the following HR accounting functions:

- Maintaining a list of individuals of the enterprise with detailed personal information including: addresses (in accordance with “KLADR”), identification documents, marital status, education, advanced training, disability, VHI policy, etc. If the program is used to maintain records of several organizations, it is possible to copy data of an individual from one organization to another. The program implements historicization of changes in the employee’s full name (the full name is changed by the appropriate order from a specific date, the changes are taken into account when generating personnel documents).

- Formation of orders for core activities: changing the organizational and staffing structure (creation, deletion, renaming, reassignment of units), approval/change of the staffing table. For a staffing position, the norms for additional leave, official allowances, analytical groups, and analytical amount are determined. The program allows you to create several staffing projects.

- Formation of orders for personnel composition. The program implements not only the basic ones, but also many others that are encountered in practice (currently 27 orders).

- Accounting for absences: vacation, business trips, sick leave, time off, absenteeism. Taking into account the requirements for archival storage of personnel documents, two types of orders for sending on business trips and two types for granting leave were implemented. When applying for a vacation or business trip, you can indicate that this position in the staffing table is temporarily free. In this case, an employee may be hired for this position during the absence of the main employee.

- Formation of a vacation schedule for the year. It is possible to create an addition to the schedule. In addition to the standard printed form, several analytical reports are available, including in chart form. Using the vacation schedule when creating orders, generating notifications to employees about the start of vacation.

- Accounting for an unlimited number of types of vacation with automatic calculation of balances. In one document you can register several types of leave for different working periods. Control of balances, working periods and additional leaves. Vacation rates are determined for each employee. You can also define additional leave for a staffing position. The vacation shift rule can also be configured.

- Accounting for an unlimited number of types of work experience. The type of length of service can be associated with the employee’s personal allowance. Experience calculator.

- Maintaining military records (including standard reporting)

- Maintaining personal files of employees. A personal file is a list of electronic copies of documents related to an employee. Moreover, if an employee appears in personnel orders, the corresponding information record is automatically added to his personal file and it is possible to attach an electronic copy of the signed document to it. In manual mode, you can add copies of any documents. An inventory is formed on the personal file.

- Automatic generation of a working time sheet taking into account the working time schedule or shift schedule and absences. The program allows you to define an unlimited number of operating modes. The mode can be single-shift or multi-shift. According to the rules defined in the operating mode, a working time schedule (for single-shift mode) or a shift schedule (for multi-shift mode) is automatically created.

- The basic package includes a large number of analytical reports; in addition, all accumulated information on employees can be used to build a variety of analytical reports using the report designer.

A complete list of functional modes of the program can be found in the “Specification” section.

Vacation accounting and calculation of unused vacation balances

Accounting for vacation rights

. “1C: Salary and Personnel Management 8” implements accounting of rights to annual basic and additional leaves. These include vacations provided to employees both in accordance with the law and under the terms of employment contracts.

Accounting for balances

. If the enterprise is not new, then at the beginning of working with the program it is necessary to fill out information about vacation balances (previously used vacations). This can be done even if some time has passed since the start of using the program and the information base already contains information about current vacations. Moreover, data on vacations used can be entered by working years.

“1C: Salary and HR Management 8” supports keeping records of the balances of annual basic and additional leaves, the right to which is registered in the program. The balance of unused vacations is calculated on the basis of the employees’ rights to annual vacations and vacations taken into account. The calculation results for any employee can be displayed in the form of a certificate for any date. You can generate such a certificate, for example, from the “Vacation” document.

Vacation planning

. “1C: Salary and HR Management 8” allows you not only to create a vacation schedule in T-7 format, but also to draw up actual vacations and vacation transfers from the “Schedule” document. “1C: Salary and HR Management 8″ provides the ability to create vacation lists: by department and position; by group of employees, for example by management. An analysis of the implementation of the vacation schedule is available.

Vacation pay calculation

. In the “Vacation” document “1C: Salaries and HR Management 8”, along with vacation pay, you can also accrue wages for the days of the month preceding the vacation, as well as financial assistance for the vacation.

The “Vacation” document calculates personal income tax and other permanent deductions established for the employee (for example, professional contributions or alimony), by the amount of which the payment will be reduced. The tax register records the dates of payment of vacation pay and transfer of personal income tax.

Vacation pay

. You can pay vacation pay in “1C: Salary and Personnel Management 8” together with wages, with an advance payment, or during the interpayment period. During the inter-payment period, payment can be made directly from the “Vacation” document.

1C:ZIK and 1C:ZUP

The 1C personnel program on the 7.7 platform made it possible to organize records of personnel and employees of the enterprise, control internal movements of personnel, and calculate the company’s salaries in accordance with current legislation. The program could implement any form of required reporting. ZUP has become a worthy successor to the glorious traditions of accounting, but also received expanded functionality:

- Work in budgetary organizations and self-supporting companies;

- Comprehensive comprehensive automation of various processes of personnel movement, control of personnel movement;

- Analysis of the quality of working employees, personnel qualifications;

- Analysis of employee workload;

- Calculation of personnel requirements, personnel reserve;

- Analysis of personnel costs, preparation of planned personnel budgets, analysis of budget execution;

- Drawing up a personnel plan, accumulating information about candidates, generating personnel training plans and analyzing the obtained training results;

- Payroll calculation, vacation calculation and planning;

- Calculation of necessary taxes to government agencies and funds;

- Generation of complete and comprehensive reporting with various analytics, details and sections for submission to government agencies, as well as for managers of the company and departments.

Fig.1 Program interface

Options for automation systems based on platform 8:

- Salaries and personnel of government agencies (for state-owned enterprises), CORP version, basic version.

- 1C: ZUP 8 version of KORP (comprehensive professional management at enterprises with geographically distributed branches, to evaluate employees from all sides at a professional level), ZUP PROF (for small firms and large companies with structural divisions), Basic version (for accounting in small company with the possibility of working in a one-employee program).

Implementation of 1C:ZUP

Implementation for the company’s business model: personnel accounting, payroll calculation, personnel management and analysis

from RUB 3,700.

To learn more

Automation based on 1C:ZUP

Possibilities for managing HR processes: personnel planning, KPI calculation, HR analytics with one button!

To learn more

Note that the more complex the accounting system at the customer’s enterprise, the higher the likelihood that certain modifications to the ZUP will be needed, despite the widest functionality and tools for work available in the standard configuration. Our company specializes in all types of work with this solution and will help develop and implement any complex accounting scheme based on it.

Military registration

"1C: Salary and HR Management 8" allows you to:

- keep records of all categories of employees: subject to military registration

- in reserve

- those on special military registration, reserved for state authorities, local self-government or organizations for the period of mobilization, martial law or wartime

Program interface 1C:ZUP 8

When you run the program, its view opens. Depending on the information base in the system, the interface may differ.

Work in the 1C: Salaries and Personnel Management 8 program is built through the sections panel. An individual user selects what he needs: Salary, Personnel or Settings. Then it goes into the functions of the desired section.

By the way, specific functions in the section are also formed according to the information base.

You can customize the 1C:ZUP 8 interface for yourself, taking into account the sections you need, as well as the roles that are open to you.

For example, if you are an accountant, then you will need a completely different set of options and functions to work than an HR employee.

Salary and reporting

The program automates:

- payroll preparation

- setting up various motivation schemes

- accounting for balances of the main (extended main) leave and additional leaves

- planning and approval of staffing

- analysis of the reasons for overexpenditure/savings of payroll

- calculation of personal income tax and insurance premiums, generation and sending of reports to regulatory authorities

- reflection of accrued wages, personal income tax and insurance contributions in the company’s expenses, synchronization with the 1C: Accounting 8 program

- management of settlements with personnel, including salary projects, transfers to the account, payments through the cash register and through the distributor, depositing

- personnel accounting and personnel analysis

- personnel records management

- accounting of working time and analysis of the effectiveness of its use.

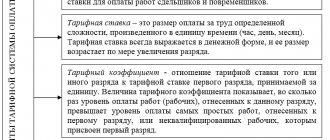

“1C: Salary and Personnel Management 8” implements all forms of remuneration:

- time-based (using monthly, daily and several hourly tariff rates)

- piecework

- using a bonus system.

The following time-based and piece-rate accruals correspond to these forms of remuneration:

- salary payment

- payment by salary (hourly)

- hourly rate

- piecework earnings.

In accordance with the local regulations of the organization, the following bonus options can be specified in the program:

- one-time bonus in amount or percentage

- monthly bonus amount

- monthly bonus as a percentage of the employee’s earnings: the current month

- last month

- when calculating the month in which the percentage or amount is entered

You can set up any accrual and deduction: a fixed amount or an arbitrary formula. As a result, in the information system, for each accrual and deduction, all the characteristics necessary for calculating wages, calculating personal income tax and contributions are established. This allows all calculations to be carried out in accordance with the accounting policies of the organization.

Salary and personnel in 1C:Accounting

Purpose of the lecture

: become familiar with the features of organizing personnel and payroll accounting in 1C: Accounting.

8.1. General provisions

Personnel accounting and payroll accounting are an important part of office work in any organization. Personnel accounting itself is somewhat apart from accounting, but in some issues (for example, in matters relating to the amount of employee salaries) it is very closely related to it.

1C:Accounting allows you to automate personnel accounting and payroll transactions, however, the program, not being a specialized system aimed at personnel and “salary” accounting, does not have sufficiently broad capabilities in this area. We can say that 1C:Accounting implements a set of operations that allows you to correctly reflect wages in accounting, reflect wage accounting by individual employees, but more complex operations are not provided for in the program. Of course, if the program does not provide for the automation of any actions, they can always be done manually, however, if you are faced with the task of complex automation of personnel and salary accounting in an enterprise, it would be better if you use, for example, a solution from 1C (1C: Salary and personnel management) focused specifically on these operations.

The subsystem for personnel accounting, payroll calculation and related operations in 1C: Accounting is suitable only for those organizations that maintain fairly simple personnel records and have a small number of employees.

In particular, 1C:Accounting allows you to perform the following actions:

- Personnel accounting;

- Payroll accounting;

- Payroll accounting;

- Accounting for salary deposits;

- Accounting for personal income tax payments;

- Reporting;

First, let's look at the issues of personnel accounting in 1C: Accounting.

8.2. Organization of personnel records

Personnel accounting in 1C:Accounting involves performing the following operations:

- Recruitment;

- Dismissal from work;

- Personnel movements;

- Generating HR reports;

Recruitment

After an employment contract has been concluded with a new employee, it can be drawn up in 1C: Accounting using the Hiring

(

Personnel > Hiring to the organization

).

This document, in addition to registering a new employee in the database, saves the parameters of the regulated accounting of his wages, allows you to generate printed form No. T-1 - Order (instruction) on hiring an employee or, for a group of employees, form No. T-1a .

Before creating this document, it is advisable to complete the following preparatory steps for new employees.

First, you need to add them to the Individuals

(

HR > Individuals

). Above, when preparing information about the responsible persons of the organization, we have already filled out this directory. Data about an individual (Fig. 8.1) is quite detailed.

Rice.

8.1. Filling out information about an individual

In our case, data about Sergei Petrovich Vasiliev, who is included in the directory Responsible Persons

as the head of the organization.

Let us remind you that when you click on the personal income tax

in the command panel of the above window, a window opens to configure some parameters that affect the calculation of personal income tax. In particular, this is information about wages at previous places of work and information about tax deductions applied to a given individual.

Directory Individuals

stores information about individuals who may or may not be employees of the organization.

In order to “transform” an ordinary individual into an employee of an organization, you need to fill in the element of the Organization Employees

(

HR > Employees of the organization

).

It is most convenient to fill out the directory Employees of an organization

based on the data in the directory

Individuals

.

In our case, in order to create a directory element Organization Employees

, just select the individual

Vasilyev Sergey Petrovich

in the directory

Individuals

, right-click on it, select the item

Based on

Employees of the organization

in the menu that appears after selecting the command . This is what we got after executing this command (Fig. 8.2).

Rice.

8.2. Filling out information about an organization employee

As you can see, information from the individual data form was copied into the employee information form.

You may notice that the directory element Employees of Organizations

contains less information than the directory element

Individuals

. For example, there is no information about personal income tax, employee address, etc.

Also pay attention to how you can create elements of this directory. If you previously entered data about an individual, you can transfer them to the Employees of Organizations

by selecting the

Create a new employee option, selecting him from the directory of individuals

and clicking on the appropriate button.

If you have not previously entered data about the individual you need, you will have to leave the Create a new employee option selected and enter his personal data in the directory of individuals

- you will have to fill out the directory element

Employees of Organizations

, the data from which will also be transferred to the directory

Individuals persons

, and in the latest directory you may need to supplement the data.

Automatic completion of the directory element Employees of organizations

we are satisfied, so click

OK

. This is what the list form of this directory looks like (Fig. 8.3).

Rice.

8.3. Directory list form Employees of the organization

Pay attention to the Status

.

Here, opposite the entry Sergey Petrovich Vasiliev

, there is the inscription

Not accepted

.

The fact that we have added an individual to the list of employees does not mean that we have registered him in the system as an employee. Now it’s the turn of the document Hiring to an organization

.

It can be created by entering based on the Employees of Organizations

(the

Enter based button > Hiring to an organization

or the corresponding context menu element).

Let's create a new document Hiring to an organization

using the entry procedure based on. This is what we got (Fig. 8.4)

Rice.

8.4. Document Hiring to an organization, Employees tab

The document is drawn up for one of the organizations for which records are kept in the database (the Organization

), it has two tabs.

Workers tab

contains a list of employees (from the directory

Employees of Organizations

), whose hiring we are going to register using a document. There is a table field here that indicates the employee’s personnel number, his full name, date of admission, department to which he is hired and position.

Set the date for hiring the employee 01.01.2009

, division -

Administration

, position -

Director

.

Previously, we entered data for the fields Division

and

Position

, so now we just need to select them from the corresponding lists.

In the table field of the Employees

may contain information about several employees, but in this example we will limit ourselves to one.

Now let's look at the Accruals

(Fig. 8.5).

Rice.

8.5. Document Hiring to an organization, Accruals tab

It contains information about how the employee will be paid. In the table section field Employee

you need to enter an employee of the organization from the directory

Employees of Organizations

(in our case, this is the same employee whom we hire with this document).

Calculation Type

field contains details about the employee's salary.

In particular, in this field you need to select an element of the plan of calculation types Organization accruals

.

By default, in this plan of calculation types there is only one element - it is called Salary by day

. You can add other elements to the calculation types plan. This must be done if you want to specially configure the reflection of an employee’s salary in accounting and the parameters of its taxation.

In the above fig. 8.5 you can see the open form of the element of the plan of calculation types Accrual of the organization: Salary by day

. Here you can configure the following parameters:

- Reflection in accounting

. Click on the button with three dots - a directory window will appear

Methods

reflection of wages in regulated accounting (Fig. 8.6).Rice.

8.6. Setting up the reflection of accrued wages in accounting This directory contains templates for postings by which wages are reflected in regulated accounting. Only corresponding accounts (or sub-accounts) are indicated here, and information on analytical accounting sections is not provided. When the system processes this template, the necessary data will be inserted into it for the correct organization of analytical accounting.In our case, it can be noted that the method preset in the system, Reflection of default accruals, was selected as a method for reflecting wages in regulated accounting .

.

Here you can see that when calculating wages, an accounting entry of the type D26 K70

, that is, the wage costs of this employee are charged to general business expenses. This posting is quite satisfactory for us - after all, we are currently drawing up the parameters of the director’s remuneration, and the expenses for the salaries of management personnel are usually attributed to account 26.If we need to indicate methods of accounting for wages for some other employee, for example, those employed in the main production (expenses for which are recorded in account 20 “Main production”

), the correct order of work would be, firstly, to create a new element in terms of types of calculation

Accruals of the organization

, secondly, to appropriately configure the reflection of wages in accounting, and, thirdly, to configure other parameters of the element of the plan of types of calculation. - Personal income tax

.

Here you need to select the income code suitable for this type of accrual to organize accounting for the calculation and deduction of personal income tax. When you click on the button with three dots, a list of personal income tax codes appears (from the personal income tax directory Incomes), from which you need to select the code corresponding to the accrued income. In our case, this is code 2000 - Remuneration for the performance of labor or other duties

. - UST. Here you should indicate the procedure for taxing accrued income with the Unified Social Tax (UST). When installing this element, we actually select the directory element UST income

(Methods of reflecting income in accounting for unified social tax) (Fig. 8.7).Rice.

8.7. Methods of reflecting income in accounting for UST The Unified Social Tax has a complex structure, not all payments to employees of an organization are subject to UST, the directory provides various options for taxation of UST income, in our case the element selected by default is suitable -

Taxed in full

. - FSS (Insurance accidents)

.

This field contains information about the taxation of contributions to the Social Insurance Fund of the Russian Federation. We are happy with the Taxed

. - Type of accrual under Art. 255 Tax Code of the Russian Federation

. Article 255 of the Tax Code of the Russian Federation “Labour costs” refers to Ch. 25 of the Tax Code of the Russian Federation “Organizational profit tax”. This article of the tax code contains a list of labor costs that can be accepted for tax accounting purposes. In our case, expenses refer to paragraphs. 1 tbsp. 255 Tax Code of the Russian Federation. This sub-clause reads as follows:Labor costs for the purposes of this chapter include, in particular

:

- amounts accrued at tariff rates, official salaries, piece rates or as a percentage of revenue in accordance with the forms and systems of remuneration accepted by the taxpayer

Having completed all of the above steps, saving and posting the document, we can, if necessary, print out the order form and see the movements of the document by registers ( Go > Document movements by registers

).

When carried out, the document generates movements according to the information register Employees of organizations

, into which information about the employee is entered, as well as according to the information register

Planned accruals for employees of organizations

(Fig. 8.8).

Rice.

8.8. Document movements across registers

After we have completed the hiring process, we will hire another employee - Galina Vladimirovna Petrova

for the position of cashier. We accept her with the same parameters that were in place when hiring the director, we will set the salary at 15,000 rubles, and the hiring date will be January 2, 2009.

Please note that from the directory form Employees of the organization

You can, by pressing the key combination

Alt+F12

or by selecting the toolbar command

Go > Employee Data

, open a processing window in which all personnel and “salary” information about the employee is grouped (Fig. 8.9)

Rice.

8.9. Detailed information about the employee

It is convenient to use this processing if you need to quickly view or edit some data about an employee. In fact, we have before us an alternative interface for performing many HR tasks.

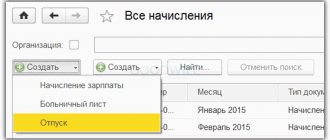

Calculations of accruals and deductions

“1C: Salary and Personnel Management 8” implements all forms of remuneration:

- time-based (using monthly, daily and several hourly tariff rates);

- piecework;

- using a bonus system.

The following time-based and piece-rate accruals correspond to these forms of remuneration:

- salary payment;

- payment by salary (hourly);

- payment at an hourly rate;

- piecework earnings.

The sizes of all tariff rates are set in rubles with the accuracy specified during the initial setup of the program.

Rates can be determined by tariff scales in accordance with the categories of employees. In this case, the grids can be described in the staffing table, and in the program their changes can be reflected in special documents for indexing earnings.

Several tariff rates can be applied simultaneously to one employee.

A cumulative tariff rate can be applied to set up charges. By default, the employee’s tariff rate during recalculation is the rate of his “basic” (time-based) accrual, for example, salary by day. The total tariff rate takes into account not only the employee’s salary, but also any other charges, such as percentage or bonus amount.

During initial setup, you can specify the options for the bonus system adopted in the organization:

- one-time bonus in amount or percentage;

- monthly bonus amount;

- monthly bonus as a percentage of the employee’s earnings: the current month;

- last month;

- when calculating the month in which the percentage or amount is entered;

Each accrual in the information system is described by a number of properties:

- Purpose of accrual

- Calculation frequency

- Method for calculating the result, which can be selected from the options

- The degree of dependence of this accrual on other accruals

- The procedure for recording working time

- The ratio of accrual to social benefits or vacations, to the calculation of average earnings

- Classification of accrual for calculating personal income tax

- Accrual classification for calculated insurance premiums

- Method of reflecting accruals in accounting

- List of crowding out accruals (for example, an employee cannot be sick and work at the same time).

"1C: Salary and HR Management 8" allows you to calculate deductions:

- By appointment

- Monthly or only when the indicator value is entered

- The following methods of calculating the result: a fixed amount;

- a formula based on a combination of any data available in regulated calculation methods, as well as based on the values of one’s own calculation indicators using various formulas, including the mathematical functions max and min.

As a result, in the information system for each accrual and deduction, all the characteristics necessary for its use in calculating wages, calculating personal income tax and contributions are recorded and stored. This allows all calculations to be carried out in accordance with the accounting policies of the organization.

Payroll and personnel accounting 2020 + 1C ZUP 8.3

This course meets the requirements of the professional standard “Accountant”, approved by order of the Ministry of Labor and Social Protection of the Russian Federation dated February 21, 2019 No. 103n!

Labor and salary accounting is one of the main areas of accounting. During the classes you will learn what systems, types and forms of remuneration there are and how to take into account working hours. The training is based on practical examples.

Practice proves that 20% of the mistakes accountants make relate to calculating employee salaries.

During the course, you will learn about the most important changes that will occur in 2019-2020 in settlements with the organization’s personnel. New things in salary calculation, changes in the payment of insurance premiums, features of personal income tax withholding, complex issues of calculating benefits. Obtaining a fundamental theoretical basis for further work as a payroll accountant.

In recent years, the payroll calculation procedure has undergone major changes. This applies to insurance premiums, methods for calculating personal income tax and average wages, keeping records of travel expenses, business needs, and more. All these changes in effect in 2020 are fully reflected in the course program. During the classes, you will learn in a simple and accessible form how to make payments to personnel for wages and insurance premiums, and complete practical tasks based on real data.

You will learn how to organize accounting of personnel and working hours, learn to take into account worked and unworked time, receive algorithms for calculating wages on various bases, deductions and deductions from wages, calculation of sick leave, and become familiar with the new rules for calculating insurance premiums.

In the course, you will become familiar with the rules of accounting and tax accounting for salary expenses and insurance contributions. You will learn how to update your accounting policies in the “Labor and Payroll Accounting” section.

The course is intended for specialists who have accounting skills and want to work in the payroll area: practicing or aspiring accountants, accountants planning to resume their professional activities after a long break, senior students of specialized universities.

The course will also be extremely useful for heads and managers of commercial enterprises, individual entrepreneurs and business owners, heads of financial, economic and administrative departments (services).

Upon completion of the course, a novice accountant or practicing accountant will be able to independently manage the “Salaries” section in the accounting department of an enterprise. The course will also be of interest to personnel workers and lawyers.

Upon completion of the course you will be able to:

- carry out salary and bonus calculations;

- calculate personal income tax and other deductions and deductions for wages;

- keep records of personnel and working hours, use of codes in primary documentation;

- apply algorithms for calculating wages on various grounds, deductions and deductions from wages;

- take into account worked and unworked time (get algorithms for calculating wages on various grounds, deductions and deductions from wages, calculation of sick leave, get acquainted with the new rules for calculating insurance premiums in 2019);

- make calculations of average earnings: based on sick leave, vacation, business trips;

- apply new calculations and concepts for insurance premiums;

- draw up other settlements with staff.

At the end of the course you will know:

- rules for calculating wages and incentive payments according to different systems;

- rules for maintaining time sheets;

- how to organize personnel and working time records;

- rules for accounting and tax accounting of salary expenses and insurance premiums in 2020;

- how to update the Accounting Policy in the “Labor Accounting and Salary” section.

Specialists with this knowledge and skills are currently in great demand. Most of our course graduates go on to successful careers and are respected by employers.

Payroll calculation procedure

“1C: Salaries and HR Management 8” gives the accountant a flexible tool for calculating salaries in accordance with the company’s accounting policies and the specifics of its work.

Salary calculation

. "1C: Salary and HR Management 8" allows you to fully automate the payroll process. Formulas for calculations are entered into the system only once. To perform each subsequent calculation, the user must monthly monitor personnel information, time tracking and indicate only the most general parameters: salary month, organization, etc. All other actions - filling out the tabular part of the document and the calculation itself - the system will perform automatically.

Calculation of deductions

. The system automatically calculates all deductions: personal income tax, amounts of loans for which the repayment period has come, alimony, etc.

The calculated deductions will be reflected on the corresponding tabs in the tabular part of the document.

Calculation of contributions

. Simultaneously with the calculation of accruals and deductions, the calculation of insurance contributions to extra-budgetary funds is displayed on a separate tab.

Manual adjustment of calculations

. If necessary, calculations can be adjusted manually. The corrected results will be used in further calculations.

Possibility of recalculations

. “1C: Salary and HR Management 8” allows you to automatically make recalculations in situations where the primary information for calculations is adjusted. For example, if an employee fails to appear for an unknown reason, wages for the period of absence will not be accrued. If he later brings in sick leave for this period, then at the next payroll he will be paid sick leave for sick days. The system also allows you to enter accruals relating to previous months for recalculation.

Reflection of accruals in regulated accounting

“1C: Salaries and HR Management 8” allows you to prepare data to reflect wages, taxes and contributions in accounting and tax accounting.

The data synchronization mechanism combines data from the programs “1C: Salaries and Personnel Management 8” and “1C: Accounting 8” edition 3.0 into a single information space.

The chief accountant works in 1C: Accounting 8, while the accountant maintains personnel records and payroll calculations in the 1C: Salaries and Personnel Management 8 program.

Synchronizing the data of these two programs allows you to minimize the need for double entry of information, reduce the time spent on entering transactions based on calculation results, and also avoid typos when manually transferring calculation results.

Synchronization can be performed automatically according to a schedule. But regardless of the schedule, you can synchronize at any time by pressing the button of the same name. The entire exchange process is recorded in the Data Sending Event Log. It is important that during synchronization only relevant information gets into 1C:Accounting 8. When synchronizing “1C: Salaries and HR 8” and “1C: Accounting 8”, the data from reference books and documents is synchronized. Not all directory elements are synchronized, but only those that are used in the synchronized documents. List of synchronized elements:

- Regulated reporting.

- Documents: reflection of salaries in accounting;

- documents on payment and transfer of salaries.

The program warns about unaccepted uploaded documents, unfilled details, data conflicts and unaccepted data based on the download ban date.

The prohibition date for downloading data can be set either uniformly for all information databases or for each database.

Overview of 1C capabilities: Human Resources Management

The functions of the program largely depend on its version:

- Basic. Suitable for a small company and allows you to automate personnel records at one workplace. The list of options includes calculation of wages, taxes and insurance premiums, and preparation of reports.

- Professional. Suitable for maintaining personnel records in medium and large companies, including those with separate divisions. This version has all the functions of the basic program and several additional ones, including the ability to work with multiple organizations and a distributed information base.

- Corporate. This is the optimal solution for medium and large companies for which effective personnel management is the basis for success. The corporate version of the program has the largest list of options. These include recruiting personnel with an online search for applicants, working with KPIs, training, adaptation and development of personnel, forming a personnel reserve, working with labor protection, permits, medical examinations, briefings, etc.

The program has other functions that we did not mention above, for example, preparation of notices, cards and reports for the military commissariat, personnel transfer, including from part-time work to the main job and vice versa, etc.

Payment of wages

"1C: Salary and HR Management 8" automates and documents the entire labor-intensive process of paying salaries.

Salary can be paid:

- Advance:

- During the inter-settlement period:

- Based on the results of work for the month.

The program allows you to prepare salary slips - automatically fill out lists of employees and generate appropriate printed forms or files.

You can pay amounts in the following ways:

- by crediting to a card opened as part of the salary project;

- transfer to a bank account;

- through the cash register (there may be several cash desks);

- through a distributor (a person authorized to transfer money).

For the convenience of preparing statements, you can configure the method, place of issue and authorized person in the program:

- for the entire organization;

- for a division of an organization;

- for an employee.

The program generates in printed and electronic form the documents necessary for processing payments to employees in various ways. For each payment method (place) there is a corresponding statement:

- statement to the bank (transfer to cards as part of the salary project);

- statement of transfers to accounts (transfers to arbitrary accounts specified by employees);

- statement to the cash register;

- disbursement statement through the distributor.

If an employee has incurred a debt to the organization (for example, a large amount was accrued by mistake) and the employee repaid it on his own, this can be reflected in the document “Repayment of Debt by an Employee.” The debt amount in this document is filled in automatically.

The program has the ability to:

- salary deposits;

- payment of deposited wages,

- writing off deposited wages.

For each of these cases, a corresponding document is provided. You can generate an accounting book, a list of depositors and an analytical report on deposited amounts.

Transfer of salaries to personal accounts of employees

“1C: Salary and HR Management 8” automates and documents the entire process of paying accruals.

The program offers the following payment methods:

- by crediting to a card opened as part of the salary project;

- transfer to a bank account;

- through the cash register;

- through the distributor.

Bank accounts for employees can be opened centrally – as part of the so-called salary project. Moreover, an organization can open several salary projects at the same time.

The employee can also indicate a personal bank account for salary transfers.

Registers indicating amounts and applications for opening personal accounts are transferred to the bank, as a rule, in electronic form. In this case, the file can be sent to the bank via special communication channels, for example through Client-Bank, or transferred on physical media (flash card, disk). Some banks accept registers and applications exclusively on paper - the program allows you to generate these documents.

The format (structure) of transferred files may vary among banks. Together with Sberbank, a standard for the exchange of electronic information based on XML technology was developed, which was also supported by other banks. File generation in the 1C: Salary and Personnel Management 8 program is implemented according to this universal standard, which allows you to organize an exchange with banks that support this standard without additional settings.

Possibilities of electronic exchange in the program "1C: Salaries and personnel management 8":

- generating an electronic application to the bank to open/close personal accounts for one or more employees and downloading the bank’s confirmation of the opening of these accounts;

- generating an electronic statement to the bank for crediting amounts to employee accounts and downloading the bank’s confirmation of the crediting of these amounts.

To complete all the work, the program has a special workplace - “Exchange with banks for salary projects.” It allows:

- upload the statements that need to be paid to a file (for transferring it to the bank);

- create a printed form - a list of transfers (to transfer it to the bank);

- download confirmation from the bank about the crediting or non-crediting of amounts on this statement to the employees’ accounts;

- if the amounts were not credited to all employees, then create a new statement for the uncredited amounts;

- prepare applications for opening personal accounts and upload them to a file for transfer to the bank, work on these applications;

- download confirmation from the bank about the results of opening personal accounts;

- manually enter personal account numbers (for example, when filling out for the first time, if you are already working with the bank, and the program is just starting to be used);

- prepare applications for closing personal accounts of dismissed employees and upload them to a file for transfer to the bank.

During the work process, special documents are automatically created, which can be viewed and edited in the appropriate lists if necessary:

- Confirmation of salary payment;

- Application for opening personal accounts;

- Confirmation of opening personal accounts;

- Application for closing personal accounts.

Personal income tax and wage contributions

The calculation of personal income tax and insurance contributions in the 1C: Salaries and Personnel Management 8 program is fully automated. If necessary, the results of automatic calculations of personal income tax and contributions can be adjusted manually.

For each type of calculation, the description of the accrual type contains information for the calculation.

In the document “Calculation of salaries to employees,” personal income tax to be withheld is calculated automatically for each employee, taking into account information about his tax deductions and tax status.

The calculation results are displayed in the tabular part of the document on the Personal Income Tax tab.

The transfer of personal income tax to the budget is registered automatically when documents are paid or transferred money to employees - in accordance with the amount calculated for withholding.

You can specify the amounts and dates of personal income tax transfer to the budget yourself.

Insurance premiums are calculated automatically when calculating salaries on a separate tab of the document “Calculation of salaries to employees”, taking into account the insurance status of employees.

Mutual settlements with funds are taken into account including penalties and fines.

“1C: Salary and HR Management 8” generates all the necessary reporting for the Social Insurance Fund, the Pension Fund of the Russian Federation, and the Federal Tax Service in electronic and paper form in accordance with legal requirements.

Specialized workplaces for preparing reports for the Pension Fund and the Federal Tax Service provide the entire process of sending reports:

- automatic generation of documents that make up the reporting set;

- checking information using built-in and external verification programs;

- sending to regulatory authorities.

“1C: Salary and HR Management 8” allows you to send electronic reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat directly from the program. For this purpose, it includes a convenient 1C-Reporting service, which ensures the exchange of documents between the taxpayer and regulatory authorities in electronic form via telecommunication channels using an electronic signature. Users who have entered into a 1C:ITS PROF level agreement can submit reports from one legal entity or individual entrepreneur without additional payment.

Personalized accounting

Generating information for the Pension Fund. “1C: Salaries and HR Management 8” allows you to generate the following information for the Pension Fund:

- ADV-1 – personal data of employees who do not have an insurance certificate;

- ADV-2 in case of changes in personal data (for example, when changing your last name);

- ADV-3 if an employee loses an insurance certificate;

- information about length of service, including special types of work experience that give the right to early accrual of a pension;

- form RSV-1 PFR - calculation of insurance premiums, which includes SZV-6-4 - information on payments, contributions and length of service of insured persons;

- SZV-6-1, SZV-6-2 – information on contributions and length of service of insured persons (forms are presented according to data from 2010–2012);

- form SPV-1 with information about the length of service and earnings since the beginning of the year for employees who have reached retirement age.

To prepare the listed documents, the “Quarterly reporting to the Pension Fund” workplace is provided.

Sending electronic reports to regulatory authorities. “1C: Salary and HR Management 8” allows you to send electronic reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat directly from the program. For this purpose, it includes a convenient 1C-Reporting service, which ensures the exchange of documents between the taxpayer and regulatory authorities in electronic form via telecommunication channels using an electronic signature. Users who have entered into a 1C:ITS PROF level agreement can submit reports from one legal entity or individual entrepreneur without additional payment.

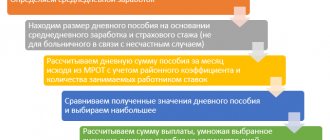

Support for the FSS pilot project

A new system for paying benefits to employees - directly from the Social Insurance Fund of the Russian Federation - was launched back in 2011. Then the Nizhny Novgorod region and the Karachay-Cherkess Republic joined it. In 2012, six more regions became participants in the pilot project: Astrakhan, Kurgan, Novgorod, Novosibirsk, Tambov regions and Khabarovsk Territory. In 2020, the project covered even more regions. Already in January of this year, the Republic of Crimea and the city of Sevastopol joined the pilot project. From July 1, the Republic of Tatarstan, Belgorod, Rostov and Samara regions joined (Resolution of the Government of the Russian Federation of December 25, 2014 No. 1484).

The tools of the 1C: Salary and Personnel Management 8 program allow you to keep track of accruals and benefits for participants in the pilot project.

The document “Sick Leave” provides for filling out additional information to be included in the register for transfer to the Social Insurance Fund as part of the pilot project.

An employee’s application to the Social Insurance Fund for payment of benefits is generated automatically.

“1C: Salary and Personnel Management 8” provides a specialized workplace “Benefits at the expense of the Social Insurance Fund”, where you can create registers of applications, upload them to a file and immediately send them via electronic communication channels to the Social Insurance Fund.

1C: Salaries and personnel of budgetary institutions 8

Price 1C: Salaries and personnel of a budgetary institution 8

- 1C: Salaries and personnel of a budgetary institution 8 RUB 28,100 Buy

- 1C: Salaries and personnel of a budgetary institution 8 (USB) RUB 25,500 Buy

We present to you one of the most popular developments from the 1C company - the program “1C: Salaries and personnel of a budgetary institution 8”, designed for calculating wages in budgetary institutions. It is based on the 1C: Enterprise 8 configuration.

- Functionality

- Advantages compared to version 7.7

- Advantages of using the 1C:Enterprise 8 platform

Every day, the accounting departments of government organizations carry out hundreds of operations to generate various kinds of reports for inspection authorities, and keep records of funds from the payroll fund. Programs specially written for this industry can make their work easier. Our company center-comptech.ru is a representative of 1C and is engaged not only in the implementation of its software products, but also serves users of configurations purchased on our company’s website.

Statistical reporting

“1C: Salaries and Personnel Management 8” automatically generates statistical reports that can be sent to Rosstat electronically directly from the program via electronic communication channels using 1C-Reporting, or printed:

- information about overdue wages (3-F);

- information on the number and remuneration of labor by categories of personnel of workers in the field of healthcare (ZP-health), culture (ZP-culture), education (ZP-education), social services (ZP-social) and organizations carrying out scientific research (ZP-science) ;

- information on the main performance indicators of a microenterprise (MP-micro), small enterprise (SM);

- information on the number, wages and movement of workers (P-4);

- information on underemployment and movement of workers (P-4 NZ).

GRADUM managers will be happy to answer all questions by phone. +7(495)74-146-74. You can also write to us via the feedback form.