Objects subject to tax based on cadastral value

From January 1, 2020, the constituent entities of the Russian Federation were given the opportunity to additionally determine other types of real estate for which the tax must be calculated at the cadastral value.

These included:

- House;

- apartment, room;

- garage, parking place;

- single real estate complex;

- unfinished construction project;

- other buildings, structures, premises.

The amount of cadastral value required for calculation

The cadastral value is a mathematical value; its calculation occurs according to certain rules. They are approved by the internal regulations of Rosreestr, according to which revaluation must be carried out every 5 years.

The frequency of revaluation is due to the fact that over such a period of time the average price of a particular object may change, as well as the infrastructure around the site.

What is usually taken into account in the calculation is listed in the table below:

| Name | Description |

| Value of 1 sq. meters | for different cities and regions - different |

| Year of construction | it determines the level of physical wear and tear |

| Location in space | For an apartment, not only the geographical location matters, but also the floor on which it is located |

| Area of the room or area | the amount is calculated from the area |

All specified parameters are assessed and the cost of the object is formed using the method of mathematical calculation.

The value is approximate and often differs from the market price, because does not take into account individual characteristics (the architecture of the building in which the apartment is located, or the internal layout of the home).

Who is the payer

The procedure for calculating property tax for organizations is established in Chapter. 30 Tax Code of the Russian Federation. In addition, constituent entities of the Russian Federation can also adopt their own regulations regulating individual elements of the tax.

According to Art. 373 of the Tax Code of the Russian Federation, such tax should be paid by enterprises that own property that is considered an object of taxation. There are no fiscal obligations for companies using special regimes. However, if such companies have property that is taxed based on cadastral value, then they will still have to pay tax (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

The object of property taxation is real estate, which is taken into account by the enterprise as a fixed asset (clause 1 of Article 374 of the Tax Code of the Russian Federation). In some cases, property that is not included on the balance sheet as a fixed asset may be subject to taxation if the value of such property has a cadastral valuation, such as, for example, residential real estate (clause 2 of Article 374 of the Tax Code of the Russian Federation).

In addition to the above, foreign companies may also be required to pay property tax if a Russian permanent representative office is established for their activities in the Russian Federation. It should be remembered that in this case the tax will be calculated not only on the value of the organization’s own fixed assets, but also on the value of the property that the company received under the concession agreement.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

However, some property of enterprises is not considered subject to taxation at all due to clause 4 of Art. 374 Tax Code of the Russian Federation. These are, in particular:

- land;

- cultural objects considered to be in the public domain (for example, historical monuments);

- Russian ships, icebreakers, as well as ships with nuclear reactors;

- space industry objects;

- others from the list given in this article.

In addition, from 01/01/2019, in accordance with the changes that were introduced by the Law “On Amendments to the Tax Code of the Russian Federation” dated 08/03/2018 No. 302-FZ, movable property is not considered an object of taxation.

Determination of the tax base

In accordance with paragraph 2 of Art. 375 of the Tax Code of the Russian Federation, tax base for property tax of legal entities. persons in relation to individual real estate objects is determined as their cadastral value in accordance with Article 378.2 of the Tax Code of the Russian Federation in relation to 5 types of real estate:

- administrative and management complexes;

- commercial buildings;

- non-residential premises used for offices, catering or consumer services;

- real estate of foreign enterprises operating in the Russian Federation without representative offices;

- non-balance living premises (service housing, for example).

Tax base for property tax in 2020

| Type of property | Base |

| administrative, business and shopping centers or complexes, as well as individual premises in them | cadastral value |

| non-residential premises, which, according to technical documentation, are intended to accommodate offices, retail facilities, catering or consumer services, as well as premises that are actually used for these purposes | cadastral value |

| any real estate objects of foreign organizations that do not have permanent representative offices in Russia | cadastral value |

| any real estate objects of foreign organizations that are not used in the activities of permanent missions in Russia | cadastral value |

| residential premises, garages and parking spaces, garden houses, residential and commercial buildings or structures that the organization has placed on land plots intended for personal farming, vegetable gardening, horticulture or individual housing construction, unfinished construction projects | cadastral value |

| other property for which cadastral value is not applied | Average annual cost |

Step-by-step instructions for calculating property tax from cadastral value

In accordance with Chapter 32 of the Tax Code of the Russian Federation, Moscow City Law No. 51 dated November 19, 2014 “On the property tax of individuals”, from 01/01/2015 on the territory of Moscow, a new procedure was introduced for the calculation by tax authorities of property tax for individuals based on cadastral value.

Property included in the common property of an apartment building is not subject to taxation (clause 3 of Article 401 of the Code).

When calculating tax, deductions are provided in the following amount:

- 10 sq. m. for a room;

- 20 sq. m. for an apartment;

- 50 sq. m. for home;

- 1 million rub. for a single real estate complex.

Tax calculation under the new scheme is carried out using the formula: N = (N1*SK – N2*SI) *K + N2*SI, where:

- N – total payment amount;

- N1 – cadastral valuation of real estate;

- SC – cadastre rate;

- H2 – inventory value;

- SI – inventory tax rate;

- K – coefficient.

Reduction factors:

- 2016 – 0,2;

- 2017 – 0,4;

- 2018 – 0,6;

- 2019 – 0,8.

Owners are required to pay 100% of the cadastre without reduction by 2020, after which the payment is calculated as the cadastral value multiplied by the rate minus the tax deduction.

Calculation example

Calculation algorithm:

- Determine the amount of tax from the cadastre.

- Calculate the inventory payment.

- Determine the difference between these indicators.

- Multiply the resulting result by the reduction factor.

- Add inventory tax to the total.

For example, a citizen owns 2 apartments:

- 1 - 54 sq. m and cadastral value of 2,322,000 rubles;

- 2 - 30 sq. m costing 1,800,000 rubles.

The first was purchased in July 2020, the second on October 16, 2019.

When calculating property tax in 2020 for 2020, the deduction will be applied only for the 1st object of the payer’s choice.

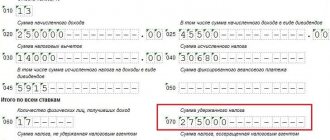

Calculation:

- Let's calculate the cost of 1 sq. m: 2,322,000 rub. / 54 sq. m = 43,000 rub./sq. m.

- Let's apply tax deduction: 54 sq. m. - 20 sq. m = 34 sq. m.

- Let's find the cost of the taxable area: 34 sq. m × 43,000 rub./sq. m = 1,462,000 rub.

- Let's apply the tax rate: RUB 1,462,000. × 0.1% = 1,462 rubles.

For the 2nd apartment, no deduction is applied, but it is taken into account that it was owned for only 2 months. Then:

RUB 1,800,000 × 0.1% / 12 months × 2 months = 300 rubles.

As a result, the property tax for 2 apartments is:

RUB 1,462 + 300 rub. = 1,762 rubles.

This amount must be paid to the tax office no later than December 1 of the current year.

Rules for legal entities and physical persons

Since 2020, rules have been provided for the use of cadastral value as the tax base for the property of individuals. Taken into account when determining the tax base from the date of entering information into the Unified State Register of Real Estate:

- change in the cadastral value of a taxable object, reversal of qualitative and (or) quantitative characteristics;

- in the event of a change in the value of a taxable object based on the establishment of its market value by a decision of the commission for the consideration of disputes on the results of determining the cadastral value or a court decision on information about the cadastral value.

Organizations (legal entities):

- using OSN - starting from 2014;

- those using the simplified tax system - starting from 2020;

- paying UTII - starting from July 1, 2014

An object is subject to property tax based on its cadastral value if 4 conditions are simultaneously met:

- the object belongs to the organization by right of ownership;

- according to the accounting rules, it is recorded on the balance sheet as part of fixed assets (in account 01 “Fixed assets” or 03 “Income-generating investments in tangible assets”);

- the object is included in the list of real estate objects for which the tax base is determined as the cadastral value;

- The cadastral value of the object itself or the building in which the object (premises) is located is determined as of January 1 of the current year.

The cadastral value of an object as of January 1 can be found out by sending a request to the territorial body of Rosreestr to provide a cadastral extract about the object or a cadastral certificate.

Possible rates

Tax rates are established by regulatory legal acts of representative bodies of municipalities (laws of the federal cities of Moscow, St. Petersburg and Sevastopol).

In the constituent entities of the Russian Federation that apply the procedure for determining the tax base based on the cadastral value of real estate, rates are set in amounts not exceeding the values prescribed in the table:

| Interest rate, % | Description of objects |

| 0,1 | For residential buildings and parts thereof, apartments, parts of apartments, rooms, garages and parking spaces. Outbuildings or structures, the area of each of which does not exceed 50 square meters. m and which are located on land plots provided for personal subsidiary plots, dacha farming, vegetable gardening, horticulture or other activities. housing construction. |

| 2 | Included in the list determined in accordance with paragraph 7 of Article 378.2, paragraph 10 of Art. 378.2 of the Code. The cadastral value of each of them exceeds 300 million rubles. |

| 0,5 | Other. |

For objects that fall under a base rate of 0.1% of the cadastral value, tax rates can be reduced to zero or increased, but a maximum of three times, by regulatory legal acts of representative bodies of municipalities (laws of federal cities).

For example, in Moscow, property tax rates for individuals (apartment, room, residential building) are differentiated depending on the cadastral value:

- 0.1% - up to 10 million rubles;

- 0.15% - from 10 to 20 million rubles;

- 0.2% - from 20 to 50 million rubles;

- 0.3% - from 50 to 300 million rubles.

For any real estate with a cadastral value of more than 300 million rubles. a tax rate of 2% applies.

The interest rate depends not only on the region, but also on what property the interest is paid on.

Calculation of tax payment

The most accurate calculation will be on the calculator of the official website of the Federal Tax Service, where the cadastral value will be provided by the service.

The tax amount for the year is determined by the formula:

TnI = Tax base × Tax rate

If your region has established reporting periods and payment of advance payments, the payment for the reporting period (for example, for the 1st quarter) must be calculated based on 1/4 of the cadastral value (share of cost) of the object (subclause 1, clause 12, article 378.2 of the Tax Code ):

AP = Tax base × 1/4 × Tax rate

In this case, the amount of tax payable at the end of the year will be equal to the difference between the calculated tax amount for the year and the amount of advance payments.

Calculation example

For example, let's calculate the tax if the cadastral value of real estate = 10 million rubles. The tax rate is 1.5%. Then:

- the annual tax amount will be 150 thousand rubles. (10 million × 1.5%);

- advance payments based on the results of the 1st quarter, half a year and 9 months will be equal to 37,500 rubles. (10 million × 1/4 × 1.5%);

- the amount of tax payable at the end of the year is RUB 37,500. (150 thousand – 3 × 37,500).

If ownership of a real estate item arose or ceased during the reporting period, then the amount of tax for the tax period and advance payment for the reporting period is determined based on the number of full months of ownership.

Formulas for calculation:

- advance payments: AP = Tax base × 1/4 × Tax rate × Number of full months of ownership of the property in the reporting period/3;

- full tax amount for the year: NnI = Tax base × Tax rate / Number of full months of ownership of the property in a year / 12.

Table of changes in property tax in 2020

| What changed | How to use | From what date is it valid, basis |

| We expanded the list of real estate objects that are taxed at cadastral value | For all objects that are subject to property tax for individuals, it is necessary to pay corporate property tax at the cadastral value. | From January 1, 2020, paragraph 70 of Art. 2 of the Law of September 29, 2019 No. 325-FZ |

| Ownership of real estate has ceased to be a condition for paying tax at the cadastral value | Organizations that manage real estate under the right of operational management or have received real estate under a concession agreement must pay tax at the cadastral value. | From January 1, 2020 sub. “a” clause 69 art. 2 of the Law of September 29, 2019 No. 325-FZ |

| There is no longer a need to prepare and submit advance payment calculations | Organizations do not have to submit advance property tax calculations. The last time calculations are submitted is for nine months or the third quarter of 2020. Starting with reporting for 2020, organizations must submit only tax returns. | From January 1, 2020, paragraph 20 of Art. 1 of the Law of April 15, 2019 No. 63-FZ |

| The procedure for applying tax rates has been clarified | 1. The maximum tax rate for “cadastral” real estate cannot exceed 2 percent in all regions. Previously, different restrictions were in force for Moscow and other regions. 2. Restrictions on tax rates for main pipelines, energy transmission lines and structures that relate to these objects as integral technological parts were abolished. 3. The period for which the increase in tax rates in Crimea and Sevastopol was frozen has expired. Now regional authorities have the right to set the maximum rates provided for by the Tax Code | From January 1, 2020, paragraph 71 of Art. 2 of the Law of September 29, 2019 No. 325-FZ |

| The declaration for 2020 must be submitted on new forms | Organizations that report property taxes after January 1, 2020 must prepare declarations using the new form. | From January 1, 2020. Order of the Federal Tax Service dated August 14, 2019 No. SA-7-21/405 |

| Tax returns can be submitted centrally | We legalized the centralized procedure for filing tax reports. Under certain conditions, organizations have the right to submit uniform declarations to the Federal Tax Service of their choice. | From the reporting for 2020, paragraph 20 of Art. 1 of the Law of April 15, 2019 No. 63-FZ |

Tax benefits

If you are entitled to a benefit, then you have the opportunity not to pay this tax, or to reduce its amount. Documents confirming this right must be submitted to the Federal Tax Service.

Federal benefits

Article 407 of the Tax Code defines the circle of persons who are completely exempt from property payments. On the list of beneficiaries:

- veterans of all categories;

- disabled people of groups 1 and 2;

- disabled children;

- citizens affected by radiation after various accidents at civilian facilities;

- persons who took part in thermonuclear tests of special risk;

- liquidators of nuclear accidents at military facilities;

- family members of military personnel killed in service;

- pensioners;

- representatives of creative professions in relation to objects used directly in such activities;

- physical persons - for outbuildings up to 50 square meters, located on garden plots, under individual housing construction.

The state suppresses attempts to re-register real estate to a beneficiary. Therefore, exceptions are provided for 1 object of each type of real estate at the choice of the owner. If he does not do this, the Federal Tax Service will help make a decision, but not in favor of the beneficiary.

Local benefits

The list of benefits established in a particular region can be found in the legal act that approved the procedure for calculating property taxes in a given region.

Additional local benefits may include, for example, tax exemptions for:

- low-income citizens;

- orphans;

- children left without parental care;

- large families;

- etc.

Preferential benefits are provided only after submitting an application and consideration of the candidacy. You can submit an application for benefits to the Federal Tax Service at your place of residence.

To confirm the right to claim tax exemption, you will need to provide a certain list of documentation.

Tax calculation

Legal entities and individual entrepreneurs calculate property tax independently by applying the appropriate tax rate to the tax base.

Tax authorities calculate property taxes for individuals before July 1 of the year following the tax period by applying the appropriate tax rate to the tax base.

If the object of taxation was under ownership for less than a year, then the tax is calculated for the period of actual ownership.

Is it possible to challenge the cadastral value of a property?

You can challenge only the value of the property that was established at the time of application.

The cadastral value can be revised for 2 reasons:

- inaccurate information was used to determine the cost;

- the cadastral value of the property exceeds the market value of the property (at the time the cadastral value is established).

The challenge procedure in the Rosreestr commission is considered simpler and faster. If it fails and the commission refuses to revise the cadastral value, you can go to court and challenge the commission’s decision.

To pay real estate tax at cadastral value, it is not necessary to calculate it first. The tax office will calculate everything itself, and the notification will already indicate the total amount. The main thing is to pay the tax within the required time frame to avoid penalties and fines.

Paying tax

Legal entities and individual entrepreneurs (with the exception of individual entrepreneurs on the SNR) pay current property tax payments throughout the year: in equal installments on February 25, May 25, August 25, November 25.

The final payment of property tax is carried out according to the declaration no later than 10 calendar days after its submission.

Individual entrepreneurs using the SNR pay property tax 10 calendar days after submitting the declaration.

Individuals pay property tax by October 1 of the year following the tax period.