Home / Real estate / Land / Taxes / Cost and calculation

Back

Published: 05/09/2017

Reading time: 10 min

0

267

Fulfillment of tax obligations is the responsibility of each entity in respect of which they are established, regardless of its type or category. In particular, various groups of persons owning land plots are obligatory payers of the corresponding land tax. The features of its calculation, as well as the main methods that are used, and specific examples will be discussed further in more detail.

- Basic calculation methods Manual

- Using an online calculator

- Standard settlement terms

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

Land tax in 2020 for legal entities

Payers of land tax in 2020 are recognized, first of all, as legal entities, as well as entrepreneurs and citizens who own land plots:

- owned;

- in permanent (perpetual) use;

- in lifelong inheritable possession.

Legal entities with benefits for paying land tax in 2018:

- religious organizations;

- companies related to the Federal Penitentiary Service of the Russian Federation;

- public organizations working with disabled people, provided that 80 percent or more of the total number of company representatives are disabled;

- organizations that own areas with publicly accessible highways.

The object of land tax is land plots located within the municipality (in Moscow and St. Petersburg - within the city), on the territory of which the tax is introduced.

Legal entities may not pay land tax:

- If these are lands that are withdrawn from circulation in accordance with the legislation of the Russian Federation. According to paragraph 4 of Article 27 of the Land Code, such lands include areas under federal property.

- If these are land plots that are limited in circulation by the legislation of the Russian Federation. They are listed in subparagraphs 2-5 of paragraph 3 of Article 389 of the Tax Code.

- If these are rented plots.

- If this is a land plot for free, fixed-term use.

Where to pay land tax to legal entities in 2020

Legal entities must pay land tax to the tax office located in the same municipality to which your land plot belongs.

In the case where an organization owns a plot belonging to several municipal districts at once, the tax is paid proportionally to the inspectorate of each municipality (read more about calculating land tax below).

Who has the right to enjoy benefits and does not pay land tax?

The duty is paid by enterprises or individuals who own a land plot for lifelong use or property acquired as an inheritance. Some companies have the right to enjoy certain benefits, but first you need to write an application:

- An organization of disabled people, where over 80% belongs to disabled people and authorized persons. Discounts are given for land used for core activities.

- Companies in which the authorized capital is made up of LLC contributions, the number of disabled people is over 50%. Discounts apply to those lands where goods are sold and produced.

- Handicraft companies. The exemption applies to those objects that are used for the production and sale of artistic products.

- Criminal authorities and structures of the Ministry of Justice. Exemption is given for areas used to carry out the main function of the organization.

In addition to the benefits established by federal authorities, there are local concessions in the form of:

- a certain amount that is not subject to fees;

- reduction of the duty;

- reduced tax rate.

There is a list of areas that are completely exempt by law from the obligation to pay payments:

- taken out of circulation, that is, territories under federal ownership;

- limited in circulation – territories of municipal or state bodies;

- objects that were transferred for lifelong use;

- territories used under a lease contract;

- forest areas;

- places located under residential multi-storey buildings.

This is interesting: How to change gears on a manual transmission - correctly, without jerking, diagram, down, smoothly, on a VAZ, quickly

Deadlines for payment of land tax in 2020 by legal entities

Land tax for legal entities is a local tax. This means that the deadline for its payment is set by the representative bodies of municipalities.

Local authorities may also require companies to pay land tax quarterly. In this case, quarterly payment deadlines must be specified in the regulations of the municipality to whose territory the land plot belongs.

Most often, quarterly payment deadlines fall on the last day of the month following the end of the quarter, but this is not required.

Deadlines for payment of land tax in 2020 by legal entities, example

Let's give an example of deadlines for paying land tax for the Moscow region in 2020. The payment terms are regulated by clauses 1 and 2 of Article 3 of Moscow Law No. 74 of November 24, 2004.

| Land tax payment period | Payment deadline for legal entities |

| 1st quarter 2018 | 03.05.2018 |

| 2nd quarter 2018 | 31.07.2018 |

| 3rd quarter 2018 | 31.10.2018 |

| For 2020 | 01.02.2019 |

Land tax for legal entities in 2020, tax rate

The land tax rate for legal entities in 2020, as well as the payment deadlines, is set by local authorities. An important rule in this case is that it cannot be higher than the federal one approved by the Tax Code of the Russian Federation.

The company has the right to reduce the land tax in the middle of the year if the cadastral value of the site has changed. But the period for which you have the right to recalculate the tax depends on the reason for which the value of the land has changed. Check whether you have grounds to reduce the tax and for what period it can be refunded. In any case, tax officials will be interested in the reasons for reducing advances, so prepare explanations in advance. Three samples in the article will help you save money and avoid mistakes>>>

If your region does not have its own land tax rate, pay according to the federal one; this does not affect the payment deadline.

| Land object | Tax rate |

| Agricultural land or land within agricultural use zones in populated areas and used for agricultural production; | 0,3% |

| Lands occupied by housing stock and engineering infrastructure facilities of the housing and communal services complex or acquired for housing construction; | 0,3% |

| Lands limited in circulation in accordance with the legislation of the Russian Federation, provided to ensure defense, security and customs needs (Article 27 of the Land Code of the Russian Federation); | 0,3% |

| Other lands | 1,5% |

Land tax rates

Article 394 of the Tax Code provides for specific tax rates for land plots - 0.3% or 1.5%. They apply unless other rates are established by local authorities (clause 3 of Article 394 of the Tax Code).

A rate of 0.3% applies to the following types of plots:

- officially limited in circulation due to use for customs, security, and defense needs;

- used for the purposes of personal subsidiary or dacha farming, including livestock farming, vegetable gardening, gardening;

- used for placement (construction) of housing facilities and engineering infrastructure;

- legally used for agricultural purposes.

For other plots not classified as the types of plots listed above, a rate of 1.5% is applied.

How not to miss the deadline for paying land taxes in 2020

In order not to miss the deadline for paying land tax in 2020, a legal entity must first calculate it correctly.

Land tax is calculated based on the cadastral value of the land. The amount is taken as of 01/01/2018.

Land tax on a plot located on the territories of several municipalities is calculated separately in relation to the area of the land plot located on the territory of each municipality.

The amount of land tax is determined by the formula:

If the region has a quarterly tax payment system, then calculate the advance (quarterly) payment as follows:

And the annual payment for legal entities under the advance system will be equal to the amount of tax minus the amount of quarterly payments.

If the company did not become the owner of the land from the beginning of the reporting period, then it has the right to apply a special coefficient when calculating the amount of tax. That is, the resulting amount of land tax will need to be multiplied by a coefficient. It can be calculated as follows:

When determining the coefficient, if you took ownership of the land before the 15th of a month, then it is counted as a whole month, if after the 15th, then this month is not included in the calculation.

We recommend making calculations in advance, since failure to pay land tax on time for legal entities entails serious fines.

www.rnk.ru

Where to pay land tax to legal entities and citizens?

Land tax is local, so local authorities determine:

- tax rates;

- payment terms;

- mandatory advance tax payments;

- tax benefits.

The income from it goes to replenish the treasury of municipalities, and it must be paid to the budget of the municipality on whose territory the land plot is located.

What to do if the site is located on the land of several municipalities at once? In this case, payment must be made to the local budgets of all municipalities in whose territory it is located.

Such clarifications were given by the Russian Ministry of Finance, in particular, in Letter No. 03-06-02-02/59 dated May 5, 2006 (clause 6). The tax base for each municipality is determined in this case as a share of the cadastral value of the land plot in proportion to the part of the plot falling on the corresponding municipality. Payment of the tax must be made in the manner and within the time limits established in the territory of each municipality. To obtain information about the size of the share attributable to a specific municipal entity, the Ministry of Finance recommended contacting the territorial bodies of Rosnedvizhimost (this service has been abolished, its functions have been transferred to Rosreestr) and local government.

Features of land reporting

The tax period for land tax is equal to a year (clause 1 of Article 393 of the Tax Code of the Russian Federation). Until the tax period 2020 inclusive, legal entities are required to submit an annual declaration to the Federal Tax Service (clause 1 of Article 398 of the Tax Code of the Russian Federation). No other (interim) reports are provided for this tax. The deadline for filing a declaration for 2020 is 02/03/2020 (postponed from Saturday, February 1). The declaration form for land tax for 2020 was approved by order of the Federal Tax Service of Russia dated August 30, 2018 No. ММВ-7-21/ [email protected]

The tax period is divided into reporting periods (clause 2 of Article 393 of the Tax Code of the Russian Federation), equal to a quarter, upon completion of which the payment of advances (clause 6 of Article 396 of the Tax Code of the Russian Federation), if the region did not exercise its right not to introduce such a division (clause 3 of Article 393, clause 2 of Article 397 of the Tax Code of the Russian Federation).

Each quarterly advance payment is calculated in the same manner as the tax itself, but the amount paid to the budget will be ¼ of the calculated amount (clause 6 of Article 396 of the Tax Code of the Russian Federation). Advances paid for 2020 are reflected in the tax return and are taken into account when determining the total amount payable or refunded for the year.

Starting with land tax for 2020, filing a declaration is cancelled. In this case, the legal entity will receive a tax message with the calculated amount. However, this does not mean that they will no longer need to calculate the tax themselves. This responsibility will remain with organizations in the future. After all, they must know the amount in order to make advance payments throughout the year (if such are established by local authorities).

The land declaration includes all the main components of the calculation:

- the tax base;

- coefficient reflecting the share of land rights;

- category of land and the corresponding tax rate;

- coefficient taking into account the number of months of ownership with an incomplete period;

- circumstances influencing an increase in the amount of calculated tax;

- tax benefits that are reflected both in the volume of the base and in the amount of the tax itself.

For each plot of land that is an object of taxation, you will have to fill out a separate sheet in section 2. Moreover, it will be possible to further fragment the data on it due to assignment to different OKTMO or KBK.

How to correctly fill out the land tax return for 2019, see this material.

Land tax: payment deadlines for legal entities

Organizations must independently calculate the tax after the end of the calendar year (tax period). Next, they must pay the tax within the deadlines set by local authorities. Moreover, such a period cannot be earlier than February 1 of the year following the expired one. This follows from paragraph 1 of Article 397 and paragraph 3 of Article 398. For example, based on the results of 2020, the payment deadline cannot be set earlier than 02/01/2017.

Taking into account this rule, municipalities determine the deadlines for paying land tax in their territories. For example, in Moscow, organizations must pay land tax for 2020 no later than 02/01/2017. In St. Petersburg, tax for 2020 must be paid by a legal entity no later than 02/10/2017.

In addition, local authorities (authorities of St. Petersburg, Sevastopol, Moscow) have the right to determine the frequency of payment of advance tax. However, local authorities may provide in their regulations that advance payments are not made.

In Moscow and St. Petersburg, advance tax payments must be made before 30.04, 31.07, 31.10 inclusive. That is, 1 calendar month is given to pay the advance after the corresponding reporting period.

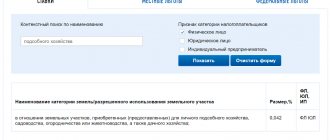

You can find out about tax payment deadlines on the Federal Tax Service website. This service provides information on almost any region and municipality. To get the information you need, you need to fill out an intuitive search form, after which the service will display data for the relevant territory.

Who calculates the base and tax amount

Legal entities independently calculate the base and amount of land tax according to the Unified State Register of Real Estate. These calculations are made for each taxable asset. These requirements are established in paragraph 3 of Art. 391 Tax Code and paragraph 2 of Art. 396 NK. The tax is paid by the legal entity at the end of each reporting period (in advance payments) and each tax period (finally).

For individual taxpayers, the base and amount of land tax are calculated by the divisions of the Federal Tax Service according to the Unified State Register of Real Estate information provided by Rosreestr authorities. The citizen receives a notification from the tax service about the transfer of the fee. Such conditions are provided for in paragraph 4 of Article 391 of the Tax Code and paragraph 3 of Article 396 of the Tax Code.

Deadline for payment of land tax for individuals

Individuals, including entrepreneurs, do not have to calculate tax on their own, and therefore they do not have to submit tax returns. Payment of land tax is carried out on the basis of a notification received from the tax authorities, which must be sent out no later than 30 days (working days) before the payment deadline. Land tax for individuals must be paid before December 1 (inclusive) of the year following the previous one. December 1 is the deadline for paying both land tax and other property taxes for citizens, valid throughout the country.

As for advance payments, unlike organizations, individuals do not pay an advance, and local authorities do not have the right to establish it.

glavkniga.ru

Land tax is local and is regulated by the legislation of municipalities, and in cities of federal significance - Moscow, St. Petersburg and Sevastopol - by the laws of these cities. Within the framework of the Tax Code, municipalities are defined within the framework of:

- tax rates;

- procedure and deadlines for tax payment;

- tax benefits, including the amount of tax-free amounts for certain categories of taxpayers.

Which organizations pay land tax?

Taxpayers for land tax are organizations that own land plots that are recognized as an object of taxation in accordance with Article 389 of the Tax Code. The land must belong to the organization on the right of ownership, the right of permanent (perpetual) use or the right of lifelong inheritable possession.

Organizations do not report and do not pay taxes on land plots that they have the right to use free of charge or transferred under a lease agreement.

If the land plot belongs to the property constituting a mutual investment fund, the management company is recognized as the taxpayer. The tax is paid on the property that makes up the mutual fund.

Object of taxation for land tax

The object of taxation is land plots located within the municipality on whose territory the tax has been introduced. Also not recognized as an object of taxation:

- land plots withdrawn from circulation in accordance with the law;

- land plots limited in circulation, which are occupied by particularly valuable cultural heritage sites, sites included in the World Heritage List, historical and cultural reserves, archaeological heritage sites, museum reserves;

- land plots from the forest fund lands;

- land plots limited in circulation, occupied by state-owned water bodies;

- land plots included in the common property of an apartment building.

Tax base for land tax

The tax base is determined separately for each land plot and is equal to its cadastral value as of January 1 of the year for which the tax is calculated. If the land plot appeared during the tax period, then to determine the tax base, the cadastral value is taken as of the date the land plot was registered with the state cadastral register.

Changes in the cadastral value of a land plot during a tax period are not taken into account when determining the tax base in this and previous tax periods. There are exceptions to this rule:

- if the cadastral value of a land plot has changed after correcting a technical error made by a government agency when registering a plot or maintaining a real estate cadastre: in this case, the correction is taken into account in calculating the tax base starting from the period in which the error was made;

- if the cadastral value of the land plot has changed by decision of the court or dispute resolution commission: in this case, the changed cadastral value is valid starting from the period in which the application for revision of the cadastral value was submitted. But not earlier than the date of entry into the cadastre of the initial (disputed) cadastral value.

If a land plot is located on the territories of several municipalities, for each of them the tax base is determined separately and is equal to the share of the cadastral value of the entire land plot, proportional to the share of part of the plot.

How to determine the tax base for a land plot that is in common ownership

For land plots that are in common shared ownership, the tax base is determined separately for each taxpayer-owner of the plot in proportion to his share in the common property.

Often, when purchasing real estate, the buyer receives title to a portion of the land that is occupied by the property and necessary for its use. The tax base for this plot for the specified person is determined in proportion to his share in the ownership of the land plot.

If several persons buy real estate, the tax base for each is determined in proportion to the share of ownership (in area) of the specified real estate.

Tax and reporting period for land tax

The tax period for land tax is a calendar year. Reporting periods for taxpayer organizations are the first quarter, second quarter and third quarter of the calendar year. Legislative bodies of a municipality may not establish a reporting period.

Tax rate for land tax

Tax rates are established by regulatory legal acts of municipalities and laws of federal cities of Moscow, St. Petersburg and Sevastopol.

Bids cannot exceed:

— 0,3 %

- for agricultural lands and lands used for agricultural production;

- for lands occupied by housing stock and engineering infrastructure facilities of the housing and communal services complex;

- for plots acquired for personal subsidiary farming, gardening, truck farming, livestock farming, dacha farming;

- for areas provided for defense, security and customs needs.

— 1.5% for other land plots.

Taxation is carried out at the same rates if tax rates are not determined by the regulatory legal regulations of the municipality.

A municipality can establish differentiated tax rates depending, for example, on the category of land or the location of the object of taxation of the site in the municipality.

Tax benefits for land tax

The following are exempt from taxation:

- organizations and institutions of the penal system of the Ministry of Justice in relation to land plots that are used to directly perform the functions assigned to these organizations;

- organizations - in relation to land plots occupied by public state highways;

- religious organizations - in relation to sites on which buildings for religious and charitable purposes are located;

- all-Russian public organizations of disabled people;

- "Skolkovo residents".

See the full list here.

The procedure for calculating land tax and advance payments for it

The tax amount is calculated after the end of the tax period and is equal to the product of the tax rate and the tax base. If a company has acquired a land plot for the purpose of housing construction, the tax and advance payments on it are calculated with the coefficient:

- coefficient = 2 is applied for 3 years from the date of state registration of rights to a land plot and until state registration of rights to a constructed property;

- if construction and state registration of rights occurred before the expiration of three years, then the overpaid amount of tax is offset or returned to the taxpayer in the general manner;

- if housing construction has exceeded the 3-year period, over the next 4 years and until the state registration of rights to the constructed object, a coefficient = 4 is applied.

Taxpayer organizations for which quarterly reporting periods are established independently calculate land tax and advance payments thereon after the end of the first, second and third quarters.

Quarterly advance payment = ¼ * tax rate * cadastral value of the land plot as of January 1 of the tax period.

Municipalities may allow certain categories of taxpayers not to calculate or transfer advance payments.

At the end of the tax period, organizations transfer to the budget the difference between the calculated tax amount and advance payments paid during the tax period.

Incomplete tax period or incomplete benefit period

If a taxpayer has acquired or lost ownership of a land plot during the tax period, the time of ownership of the plot must be taken into account when calculating tax and advance payments. To do this, a coefficient is calculated: the number of full months of ownership of the plot is divided by the number of calendar months in the tax (reporting) period.

The number of full months of ownership of a plot is calculated as follows:

- if the ownership of a land plot or its share occurred before the 15th day (inclusive) or the termination of the right occurred after the 15th day, the month of emergence (termination) of the specified right is taken as a full month;

- if ownership of a land plot or its share occurred after the 15th day or termination of the right occurred before the 15th day (inclusive), this month is not considered the month of ownership of the plot.

Taxpayers who are entitled to tax benefits must provide supporting documents to the Federal Tax Service at the location of the land plot. If a taxpayer received or lost the right to a land tax benefit during the tax period, when calculating the tax and advance payments, the period of absence of this benefit must be taken into account. The month of emergence and termination of the right to a tax benefit is taken as a full month.

When to submit a land tax return

Taxpayer organizations no later than February 1 of the year following the expired tax period submit a tax return to the tax authority at the location of the land plot. The largest taxpayers submit declarations to the tax authority at the place of registration as the largest taxpayers.

Deadline for payment of land tax and advance payments

Organizations pay advance payments and land tax to the budget at the location of the land plots within the time limits established by the regulations of municipalities. The tax payment deadline cannot be earlier than the deadline for submitting the land tax return - currently it is February 1.

Do you want to easily pay taxes and submit returns? Work in the cloud service Kontur.Accounting: keep records, pay salaries and send reports online. The service will remind you to pay tax, help you calculate it and automatically generate reports. The first month of operation is free for all new users.

www.b-kontur.ru

Land tax benefits

From 01/01/2018 (valid from 01/01/2017) the following has been established for pensioners:

- land tax benefit by amending Article 391 of the Tax Code;

- the procedure for applying this benefit, according to which:

- Notification of the selected land plot in respect of which a tax deduction for land tax is applied (notification form approved by Order of the Federal Tax Service of Russia dated March 26, 2018 No. ММВ-7-21/[email protected]). It is submitted to the tax authority before July 1.

From May 13, 2020, a new notification form is used (introduced by letter dated May 13, 2020 No. BS-4-21/ [email protected] )

- A taxpayer who has submitted a notification to the tax authority about the selected land plot does not have the right, after July 1, 2020, to submit an updated notification with a change in the land plot in respect of which a tax deduction is applied in the specified tax period.

- If a taxpayer entitled to apply a tax deduction for the 2020 tax period fails to provide notification of the selected land plot, the tax deduction is provided in respect of one land plot with the maximum calculated tax amount.

By letter dated January 17, 2018 No. BS-4-21/ [email protected] “On the grounds for applying a tax deduction for land tax,” the Federal Tax Service of Russia explained the following:

- the taxpayer has the right, but is not obliged, to send a notification to the tax authority about the selected land plot to receive a tax deduction for land tax;

- when calculating land tax, a tax deduction in the amount of the cadastral value of 6 acres of land area is applied to one plot of land at the choice of the taxpayer entitled to a tax benefit;

- the notification is sent to the tax authority only at the will of the taxpayer;

- in the absence of notification, a tax deduction will be provided in respect of the land plot with the maximum calculated amount of land tax;

- there is no additional requirement to submit an application for a tax benefit if the tax authority has the relevant information (if, for example, tax benefits for land tax were previously applied).

Also, from 01/01/2018, the procedure for providing benefits for the property tax of individuals, as well as for transport and land taxes for individuals, is changing.

Article 395 of the Tax Code establishes a list of preferential categories of taxpayers at the federal level. According to this article, the following are exempt from taxation:

- Organizations and institutions of the penal system of the Ministry of Justice of the Russian Federation - in relation to land plots provided for the direct performance of the functions assigned to these organizations and institutions;

- Organizations - in relation to land plots occupied by public state highways;

- Religious organizations - in relation to land plots owned by them on which buildings, structures and structures for religious and charitable purposes are located;

- All-Russian public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80% - in relation to land plots used by them to carry out their statutory activities;

organizations whose authorized capital consists entirely of contributions from the specified all-Russian public organizations of disabled people, if the average number of disabled people among their employees is at least 50%, and their share in the wage fund is at least 25% - in relation to land plots used by them for production and (or) sale of goods (except for excisable goods, mineral raw materials and other minerals, as well as other goods according to the list approved by the Government of the Russian Federation in agreement with all-Russian public organizations of disabled people), works and services (except for brokerage and other intermediary services);

institutions, the only owners of whose property are the specified all-Russian public organizations of disabled people - in relation to land plots used by them to achieve educational, cultural, medical and recreational, physical education and sports, scientific, information and other purposes of social protection and rehabilitation of disabled people, as well as for providing legal and other assistance to people with disabilities, disabled children and their parents;

- Organizations of folk artistic crafts - in relation to land plots located in places of traditional existence of folk artistic crafts and used for the production and sale of folk artistic crafts;

- Individuals belonging to the indigenous peoples of the North, Siberia and the Far East of the Russian Federation, as well as communities of such peoples - in relation to land plots used to preserve and develop their traditional way of life, farming and crafts;

- Organizations - residents of a special economic zone, with the exception of organizations specified in paragraph 11 of this article - in relation to land plots located on the territory of the special economic zone, for a period of five years from the month of the emergence of ownership of each land plot;

- Organizations recognized as management companies in accordance with the Federal Law “On Innovation” - in relation to land plots that are part of the territory of innovation and provided (acquired) for the direct performance of the functions assigned to these organizations in accordance with the specified Federal Law;

- Shipbuilding organizations that have the status of a resident of an industrial-production special economic zone - in relation to land plots occupied by buildings, structures, and industrial structures owned by them and used for the construction and repair of ships, from the date of registration of such organizations as a resident of a special economic zone economic zone for a period of ten years.

Federal Law No. 286-FZ of September 30, 2017, supplemented Article 396 of the Tax Code of the Russian Federation with paragraph 3, according to which, from January 1, 2018, confirmation of the taxpayer’s right to a tax benefit for land tax is carried out in a manner similar to the procedure provided for in paragraph 3 of Article 361.1 of the Tax Code.

Article 391. Procedure for determining the tax base

(as of 10/15/2019)

- The tax base is determined in relation to each land plot as its cadastral value entered in the Unified State Register of Real Estate and subject to application from January 1 of the year, which is the tax period, taking into account the features provided for in this article.

In relation to a land plot formed during a tax period, the tax base in a given tax period is determined as its cadastral value on the day of entering information into the Unified State Register of Real Estate that is the basis for determining the cadastral value of such a land plot.

The tax base for a land plot located on the territories of several municipalities (in the territories of the municipality and federal cities of Moscow, St. Petersburg or Sevastopol) is determined for each municipal entity (federal cities of Moscow, St. Petersburg and Sevastopol). In this case, the tax base in relation to the share of a land plot located within the boundaries of the corresponding municipal entity (federal cities of Moscow, St. Petersburg and Sevastopol) is determined as a share of the cadastral value of the entire land plot, proportional to the specified share of the land plot.

- The tax base is determined separately in relation to shares in the common ownership of a land plot, in respect of which different persons are recognized as taxpayers or different tax rates are established.

- Taxpayer organizations determine the tax base independently on the basis of information from the Unified State Register of Real Estate about each plot of land owned by them or the right of permanent (perpetual) use.

- For taxpayers - individuals, the tax base is determined by the tax authorities on the basis of information that is submitted to the tax authorities by the authorities carrying out state cadastral registration and state registration of rights to real estate.

- The tax base is reduced by the cadastral value of 600 square meters of land area owned, permanent (perpetual) use or lifetime inheritable possession of taxpayers belonging to one of the following categories: (clause 5 as amended by Federal Law of December 28, 2017 N 436 -FZ)

1) Heroes of the Soviet Union, Heroes of the Russian Federation, full holders of the Order of Glory;

2) disabled people of disability groups I and II;

3) disabled people since childhood, disabled children;

4) veterans and disabled people of the Great Patriotic War, as well as veterans and disabled people of combat operations;

5) individuals entitled to receive social support in accordance with the Law of the Russian Federation “On social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant” (as amended by the Law of the Russian Federation of June 18, 1992 N 3061-1), in in accordance with the Federal Law of November 26, 1998 N 175-FZ “On the social protection of citizens of the Russian Federation exposed to radiation as a result of the accident in 1957 at the Mayak production association and the discharge of radioactive waste into the Techa River” and in accordance with the Federal Law dated January 10, 2002 N 2-FZ “On social guarantees for citizens exposed to radiation as a result of nuclear tests at the Semipalatinsk test site”;

6) individuals who, as part of special risk units, took direct part in testing nuclear and thermonuclear weapons, eliminating accidents at nuclear installations at weapons and military facilities;

7) individuals who received or suffered radiation sickness or became disabled as a result of tests, exercises and other work related to any types of nuclear installations, including nuclear weapons and space technology;

pensioners receiving pensions assigned in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who, in accordance with the legislation of the Russian Federation, are paid a monthly lifelong allowance. (subparagraph 8 was introduced by Federal Law No. 436-FZ of December 28, 2017 and applies to legal relations that arose from January 1, 2017)

pensioners receiving pensions assigned in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who, in accordance with the legislation of the Russian Federation, are paid a monthly lifelong allowance. (subparagraph 8 was introduced by Federal Law No. 436-FZ of December 28, 2017 and applies to legal relations that arose from January 1, 2017) 9) individuals who meet the conditions necessary for the assignment of a pension in accordance with the legislation of the Russian Federation in force as of December 31, 2020. (clause 9 introduced by Federal Law No. 378-FZ dated October 30, 2018)

Commentary to paragraphs. 9 p. 5

10) individuals with three or more minor children. (Clause 10 introduced by Law dated April 15, 2019 No. 63-FZ)

- Reduction of the tax base by the tax-free amount established by paragraph 5 of this article is carried out on the basis of documents confirming the right to reduce the tax base, submitted by the taxpayer to the tax authority of his choice. (from January 1, 2020, Federal Law No. 286-FZ dated September 30, 2017, paragraph 6 is repealed).

6.1. The reduction of the tax base in accordance with paragraph 5 of this article (tax deduction) is carried out in relation to one land plot at the choice of the taxpayer.

A notification about the selected land plot in respect of which a tax deduction is applied is submitted by the taxpayer to the tax authority of his choice before November 1 to December 31 of the year, which is the tax period from which the tax deduction is applied in respect of the specified land plot.

A notification about the selected land plot can be submitted to the tax authority through a multifunctional center for the provision of state or municipal services. (as amended by Law No. 325-FZ dated September 29, 2019)

If a taxpayer entitled to apply a tax deduction fails to provide notice of the selected land plot, the tax deduction is provided in respect of one land plot with the maximum calculated amount of tax.

The form of the notification is approved by the federal executive body authorized for control and supervision in the field of taxes and fees. (clause 6.1 was introduced by Federal Law No. 436-FZ of December 28, 2017 and applies to legal relations that arose from January 1, 2017)

- If, when applying a tax deduction in accordance with this article, the tax base takes a negative value, for the purpose of calculating tax, such tax base is taken equal to zero. (clause 7 as amended by Federal Law dated December 28, 2017 N 436-FZ)

- Until January 1 of the year following the year of approval in the territories of the Republic of Crimea and the federal city of Sevastopol of the results of mass cadastral valuation of land plots, the tax base in relation to land plots located on the territories of these constituent entities of the Russian Federation is determined on the basis of the standard price of land established on 1 January of the corresponding tax period by the executive authorities of the Republic of Crimea and the federal city of Sevastopol.

1.1. Changes in the cadastral value of a land plot during a tax period are not taken into account when determining the tax base in this and previous tax periods, unless otherwise provided by this paragraph.

Changes in the cadastral value of a land plot due to changes in the qualitative and (or) quantitative characteristics of the land plot are taken into account when determining the tax base from the date of entry into the Unified State Register of Real Estate information that is the basis for determining the cadastral value.

In the event of a change in the cadastral value of a land plot due to the correction of a technical error in the information of the Unified State Register of Real Estate on the value of the cadastral value, as well as in the case of a decrease in the cadastral value due to the correction of errors made in determining the cadastral value, revision of the cadastral value by decision of the dispute resolution commission on the results of determining the cadastral value or a court decision in the event of unreliability of the information used in determining the cadastral value, information on the changed cadastral value entered in the Unified State Register of Real Estate is taken into account when determining the tax base starting from the date of application for tax purposes of information on the changed cadastral value .

In the event of a change in the cadastral value of a land plot based on the establishment of its market value by decision of the commission for the consideration of disputes on the results of determining the cadastral value or a court decision, information on the cadastral value established by the decision of the said commission or a court decision, entered into the Unified State Register of Real Estate, is taken into account when determining tax base starting from the date of commencement of application for taxation purposes of the cadastral value that is the subject of the dispute.

The article was written and posted on August 31, 2013. Added - 09/05/2015, 11/24/2015, 07/22/2016, 02/16/2017, 10/03/2017, 12/21/2017, 01/17/2018, 05/29/2018, 04/21/2019, 10/14/2019

ATTENTION!

Copying the article without providing a direct link is prohibited. Changes to the article are possible only with the permission of the author.

Who is the taxpayer?

According to Article 388 of the Tax Code, the payers of this tax are citizens and enterprises that have land at their disposal that is included in the category of taxable objects.

In this case, these persons must have one of the following rights to the site:

- ownership, including joint and shared;

- right of perpetual use;

- right of lifelong inheritable ownership.

Persons exploiting leased land or plots transferred to them for free use are not required to pay tax.

The tax is imposed on all land territories, with the exception of:

- withdrawn from circulation or those whose circulation is limited;

- allocated for logging;

- related to cultural heritage;

- included in the water fund and in state ownership;

- used for the construction of apartment buildings.

Right to benefits

The legislation provides for a benefit that provides for a reduction in the tax base by 10 thousand rubles for the following citizens:

- Heroes of the USSR and Russia;

- disabled people of group I, as well as group II, if it was assigned earlier than 2004; disabled children;

- combat veterans;

- exposed to radiation.

Full exemption from land tax is provided exclusively for representatives of indigenous peoples of the Far East, Far North and Siberia.

The following legal entities receive a 100% benefit:

- religious organizations;

- institutions of the penal system;

- road organizations;

- associations engaged in artistic crafts;

- public organizations whose members are disabled people;

- management companies in innovation;

- residents of open and free economic zones.

The legislative framework

Land tax belongs to the category of local fees, the payment details of which may have certain differences in individual regions.

The basic nuances regarding this tax are spelled out in Chapter 31 of the Tax Code; in addition, local legislative acts are adopted at the regional level, which:

- establish tax rates within the limits provided for by the Tax Code;

- determine the procedure and timing of tax transfers in accordance with the restrictions introduced by federal legislation;

- introduce additional benefits for various categories of citizens.

Procedure for paying land tax

The Tax Code spells out all the main points regarding the payment of land tax. Specific nuances regarding the amount of deductions, benefits and terms of transfer are contained in local legislative acts.

Individuals

Payment of land tax by citizens occurs in accordance with the notification sent to them by the authorities responsible for collecting taxes.

When the plot is in joint shared ownership, each owner pays an amount proportional to his share in the common property.

The calculation of land tax is based on the cadastral value of land, which is determined annually by the cadastral service. The advantage of individuals is that they do not need to do their own calculations, since representatives of the tax authorities do this for them.

Citizens must transfer the specified amount to the local budget before December 1 of the year following the reporting year.

Legal entities

Companies and organizations, unlike individuals, in 2019 have to calculate the tax amount independently. To do this, they must monitor what cadastral value is established for the land plots they own at the beginning of each year.

For legal entities, local authorities may establish advance payments. In this case, enterprises will have to pay tax quarterly in the amount of ¼ of the annual amount.

All legal entities obligated to pay land tax must promptly submit a completed declaration to the tax service.

Pensioners

In standard cases, land tax is paid by pensioners on the same basis as for individuals. Federal legislation does not provide for any special uniform benefits for retired citizens, but they can be assigned by local authorities in individual cities and regions.

Detailed information about them can be found in the Federal Tax Service office at your place of residence.

Site placement

To a greater extent, the amount of tax is influenced not by the territorial location of the site, but by its category and purpose.

In SNT

REFERENCE! The fee is not paid by those who own land under a lease agreement or the right of gratuitous temporary use.

When you are a member of the Sadovniche Non-Profit Partnership, land tax is included in the amount of membership fees. The fee here is calculated using the usual formula, and the rate is usually 0.3%, it can be changed by the local municipal department, but cannot be higher than 1.5%.

In cities

Owners of living space in an apartment building do not pay this tax.

If your lands are privately owned, then the fee in respect of them is calculated according to the basic formula or the formula for individuals, taking into account benefits and the rate established by the municipality.

Outside the city

The amount of this fee is often determined by the tax service and set by the municipality. Thus, the calculation is made according to accepted formulas depending on the established rate and other factors described above.

Plot with house

Such land falls under residential development and by law must be taxed at a rate of 0.3%, but the local government can increase it, but not higher than 1.5%. Everything else is calculated according to the generally accepted formula.

Size

The tax base for determining the amount of tax on a land plot is its cadastral value. It is determined annually by cadastral service specialists at the beginning of the reporting period, taking into account the current market price for similar objects.

The specific tax rate used to calculate the exact amount is determined by the municipal government.

Legal entities have to calculate the amount payable on their own, while individuals, including individual entrepreneurs, should not do this, since they receive notifications with specific figures from the tax service.

The Federal Tax Service uses information provided by the authorities responsible for registered real estate.

Tax rate

The responsibility for setting the land tax rate lies with municipalities, which must be based on the figures prescribed in Article 394 of the Tax Code.

The maximum tax amount cannot be more than 0.3% of the cadastral value of such lands:

- agricultural;

- used for the construction of residential buildings and arrangement of related infrastructure;

- located under gardens/vegetable gardens and subsidiary plots;

- special lands, the turnover of which is limited.

In all other cases, the upper tax rate is 1.5% of the cadastral value of the land.

What does the amount depend on?

For legal entities

The amount of the fee for legal entities is calculated using a general formula without benefits, taking into account the tax rate for a given category of land.

N = KSt x P

The rate can be 0.3% and 1.5%.

- 0.3% – for agricultural areas and land for residential development.

- 1.5% – for all other categories.

REFERENCE! Regional authorities have the right to lower or raise your interest rate.

For individuals

For individuals, the general formula applies:

N = (KSt – L) x P

The amount of calculation depends on the tax rate, which may vary depending on the category and purpose of the site, and the availability of benefits for the person paying the tax.

Also, to calculate the case of incomplete ownership of land, the formula is used:

N = (KSt x D - L) x R x Kv,

Where

- D – share of ownership of property.

- Kv – land ownership coefficient. It is defined as the ratio of the number of months in which a person owned the land to the twelve months of the tax period.

Deposit methods

Individuals can pay land tax in the following ways:

- at a bank branch or through a payment terminal (according to the document index or barcode specified in the notification received from the tax service);

- online through the Federal Tax Service web resource or specialized services;

- using online banking functions.

Legal entities have the opportunity to pay land tax exclusively through bank branches using payment orders.

Deadlines

The procedure and deadlines for paying land tax differ for individuals and legal entities. The Tax Code establishes that the deadline for organizations to transfer this payment to the budget cannot be earlier than February 1 of the following reporting year. At the same time, local authorities have the right to set their own dates, but only later ones.

The same applies to individuals, but for them the starting point is December 1 of the year following the reporting year.

Thus, land tax has its own specifics of calculation and payment, which all taxpayers must take into account.

realtyurist.ru

The procedure for paying land tax for legal entities

The general procedure and deadlines for paying land tax are defined in Art. 396–397 Tax Code of the Russian Federation. There are no changes in them for 2020 compared to 2020.

Specific deadlines for payment of advance payments (if there is a decision to pay them) and the land tax itself are established by representative municipal bodies by adopting relevant regulations. For example, in Moscow this is the last day of the month following the reporting quarter (Clause 2, Article 3 of the Moscow Law “On Land Tax” dated November 24, 2004 No. 74).

Taxpayers-legal entities independently calculate the amounts of advance payments and taxes based on the rates and rules adopted in the region. Municipal authorities have the right to approve tax rates for certain categories of land plots, without violating the maximum values established in Art. 394 Tax Code of the Russian Federation.

See “Land tax rate in 2017-2018”.

Read about the expected changes in land tax rates in the material “[DRAFT] New scale of land tax rates.”

Also, local authorities may establish an obligation for taxpayer organizations to pay tax in the form of advance payments. If it is determined, then the legal entity must pay quarterly ¼ of the amount equal to the product of the rate established in the region multiplied by the cadastral value of the land.

The tax at the end of the year is paid as the remaining unpaid tax amount (i.e., minus advances). It must be included in the local budget within the deadline established in the region.

For an example of calculating land tax, see the material “How to calculate land tax in 2020 (example)?”

About algorithms for calculating tax when cadastral value changes, read the material “Calculation of land tax when cadastral value changes.”

How to calculate land tax in 2020?

Now you need to find out the basic rules and regulations for calculating land tax for the year, as well as what formulas can be used to calculate it.

Calculation order

Finally, we come to the main question of the article: how to calculate land tax in 2020.

It is worth noting that the tax period is one year, that is, land tax is payable annually.

The tax base

From 2020, the amount of land tax is calculated taking into account the cadastral value of the land plot.

Previously, until 2020, land tax was calculated through the book value of the plot, which was noticeably less burdensome for owners.

Thus, from 2020, the tax base for land tax is the cadastral value of the plot, determined taking into account the requirements of the Land Code of the Russian Federation.

Data on the cadastral value of land can be found on the Rosreestr website.

Interest rate

In addition to the tax base, the interest rate also affects the amount of land tax.

It is determined by municipal government agencies and cannot be more than 0.3% and 1.5%, depending on what category the land belongs to.

A tax rate of three tenths of a percent is used to calculate land tax:

- classified as agricultural lands;

- occupied by the housing stock and objects of communal systems of the housing complex or received for residential construction;

- purchased for running a subsidiary plot (note – in SNT, which is a legal entity, you have to pay a land tax on plots in the amount of 0.3%);

- limited in circulation, as well as presented for defensive purposes, security and customs needs;

- other plots of land that do not fall under this list are taxed at a rate of 1.5%.

Basic formula

The basic formula for calculating land tax for individuals is as follows:

S = (KSt – L) * P, where

- S – total tax amount;

- Kst – cadastral value of land;

- L – benefits equal to 10,000 rubles, if provided;

- P – interest rate equal to the maximum value of 0.3% for individuals.

The basic formula for calculating tax for legal entities is similar to the formula for individuals, with the exception of the deduction of RUB 10,000. benefits and an interest rate of 0.3%, which for legal entities is 1.5%.

This is due to the fact that legal entities can own any land plots, while individuals can own only those for which the rate is set at 0.3%.

In total, the formula for legal entities is:

S = KSt * P, where

- S – total tax amount;

- Kst – cadastral value of the land plot;

- P – interest rate equal to the maximum value of 1.5% for legal entities.

Who determines the amount?

Legal entities determine the tax amount independently; individuals receive ready-made receipts from the Federal Tax Service.

Calculation using an example

Let's calculate land tax using several examples.

For legal entities

Rosa LLC owns a plot of land in the Moscow region acquired for the construction of a garment factory. The cadastral value of the plot is 67,700,567 rubles. The tax rate in the Moscow region for this type of land plot is 1.5%.

The tax calculation will be as follows: 67 700 567*1,5 = 1 015 508,505

For individuals

The price for a land plot of 260 sq.m is 2.3 million rubles. Tax rate - 0.2%.

Land tax is calculated as follows: 2,300,000*0.2/100=4,600 rubles.

According to cadastral value

The cost of the territory is 1 million rubles. From this monetary value it is required to calculate 0.3%, which is the collection rate: 1,000,000*0.3=3,300 rubles.

This amount must be paid annually.

In Moscow

Citizen D. owns a plot of land in Moscow, which he acquired for housing construction. The cadastral value of the site is estimated at 8,567,089 rubles. Citizen D. is a disabled person of group 1, received disability in 2003. The tax rate in Moscow for this type of land plot is 0.1%.

The tax calculation will be as follows: (8 567 089 – 10 000) *0,1 = 25 671,267.

Total - 25,671,267 rubles. – the amount payable by citizen D.

Advance payments

Advance payments are the amount that is paid quarterly to the local budget by legal entities (clause 6 of Article 396 of the Tax Code of the Russian Federation).

Tax calculation of advance payments for land tax is calculated based on the results of each of the first 3 quarters of the current year. Then, based on the total amount of advances throughout the year, the final payment is calculated.

From Article 396 of the Tax Code of the Russian Federation it is possible to derive a general formula for calculating the quarterly advance payment:

A=Kst*P*1/4, where

- Kst – cadastral value of the land plot;

- P – interest rate

In less than a month

Clause 7 of Article 396 of the Tax Code of the Russian Federation provides an answer to the question of calculation if the enterprise owned the land for an incomplete quarter.

They look at two circumstances - the date of registration of ownership of the plot and the date of termination of ownership:

- registration before the fifteenth day - the month is counted;

- registration after the fifteenth day - the month is not counted;

- termination of possession before the fifteenth day - the month is not counted;

- termination of possession after the fifteenth - a month is counted.

In total, to calculate the payment for an incomplete period, a formula is taken and the result is multiplied by the number of months of land ownership, divided by three.

Methods and deadlines for paying taxes

Municipal bodies, by adopting regulations, establish specific deadlines for the payment of advance payments. Legal entities independently calculate the amount of payments.

At the end of the tax period, the amount of tax remaining unpaid after advance payments is paid.

For legal entities:

- The payment period is from February 1 of the year following the reporting year until the date determined by local regulations.

- Payment method – transfer of funds through a bank using a payment order.

Individual entrepreneurs and individuals pay tax on the basis of notifications received from the Federal Tax Service.

Tax is paid in different ways, be it through a terminal, be it through the Federal Tax Service mobile application or in other ways. Thus, the procedure for individuals is much simpler than for legal entities.

Regarding deadlines, payment dates are set every year in each region.

In 2020, for example, in Moscow, individuals are required to pay tax by December 1, 2017.

Find out from our article how to calculate personal income tax. What does the 13th salary consist of? Information is here.

What percentage of the salary must the advance be according to law? Read here.

How to pay land tax

Payment of land tax in 2017–2018 by individuals can be carried out in various ways:

- through a bank or through a payment terminal - by barcode or document index specified in the tax notice;

- online - through the tax transfer service on the Federal Tax Service website;

- from a mobile phone or from an electronic wallet;

- online through the services oplatagosuslug.ru or the municipal service “Pay taxes”;

- using Internet banking connected by the bank servicing the individual’s personal account;

- by another person for the taxpayer.

Legal entities can transfer money through a bank using a payment order, or other persons can pay tax for it.

For the procedure for filling out a payment order and an example of its execution for paying land tax in Moscow, see here .

When is land tax paid?

The deadline for paying land tax at the end of the year for legal entities is from February 1 of the year following the reporting year until the date established by local regulations.

The deadline for transferring advance payments is established by the regulations of the constituent entities of the Russian Federation. For example, in Moscow they are paid before the end of the month that follows the reporting quarter. Thus, the advance payment for land tax in 2020 in Moscow is paid by legal entities:

- 04/30/2018 - for the 1st quarter;

- 07/31/2018 - for the 2nd quarter;

- 10.31.2018 - for the 3rd quarter.

The tax payment deadline for individuals was set until December 1 of the year following the reporting year. For example, for 2020 the land tax must be paid no later than 12/01/2018, and for 2018 - no later than 12/03/2019 (taking into account the postponement of the deadline 12/01/2018 (Saturday) to the next working day).

A similar procedure and payment deadline applies to individual entrepreneurs.

Are there specific deadlines for paying taxes?

The federal authorities have decided that advances must be transferred once per quarter; the main tax for 12 months will not be paid until February 1.

A part of the finances received from paying the tax on land area remains in the regional authorities. They form the basis for creating the budget for the next year. Therefore, the legislation places the responsibility for collecting duties and setting deadlines on local authorities and tax authorities.

Article 397 of the Tax Code of the Russian Federation in paragraph 1 states that the total tax period for paying the duty for the object will not be added up before submitting the declaration to the tax authorities, that is, it is submitted before February 1. Regional structures have the right to set their own deadlines and periods for submitting reports. Then, in addition to the annual payment, firms must pay a fee every quarter.

The deadlines for paying duties in all areas are different. Specific data are indicated in the acts of municipal authorities. They contain payment periods for funds. You can also contact your local tax office for information. You can view it on the official website of the Federal Tax Service. There you can use a service that will help you get acquainted with the tax conditions anywhere in Russia and the deadlines for depositing money. The deadlines for paying advance payments for land tax in 2020 are also written there.

In Moscow, authorities declare the tax payment deadline for individuals to be February 10.

Duty payment period in 2020 for enterprises

For companies, individual entrepreneurs, firms, a different deadline for payment of land advance has been formed. They are required to deposit the money by December 1 of the year following the previous one. The fee for the reporting period is paid until December 2020. Advance payments for legal entities are not provided. Sample documents are posted on the website.

How to pay land tax to individuals

Since 2020, a unified procedure for paying land tax has been in force for individuals and individual entrepreneurs (clause 4 of Article 397 of the Tax Code of the Russian Federation). They pay taxes based on notifications received from the Federal Tax Service. In this case, the fiscal authority cannot send a notification for a period exceeding 3 tax periods.

If the notification is not received on time, citizens who own land must submit the relevant information about the land plot in their ownership (permanent use) to the territorial Federal Tax Service. This obligation for taxpayers is established in paragraph 2.1 of Art. 23 Tax Code. Such information should be transmitted using a specially designed form, which can be downloaded here .

Control over the payment of land tax is carried out by the Federal Tax Service at the location of the land plot. If the site is located on the territory of several Federal Tax Service Inspectors, then the responsibility to monitor the calculation and payment of land tax falls on each of them.

If the land plot was received by an individual by inheritance, then the tax is calculated from the date of inheritance. For plots allocated for development, during the first 3 years, when calculating land tax, an increasing coefficient of 2 is used. It is applied until the completed housing project is put into operation, and then the overpaid amounts of land tax (since upon receipt of ownership rights to the property before the expiration After the 3-year period, the coefficient 1) is returned to the taxpayer.

For details, see the material “Land tax coefficient in 2017” .

If the land plot became the property of the taxpayer before the 15th day, then for calculating the tax this partial month is taken into account as a full one. And if after the 15th day, then the tax begins to be calculated from the next month. Similar rules apply when a plot is disposed of from ownership: if this event occurred before the 15th day of the month, then this month is not taken into account when calculating the tax, and if after the 15th, the month is included in the calculation.

Land tax for individuals

An individual individual is required to make a payment for land ownership in one amount at the end of the reporting year.

The tax service sends a notice of the need to pay land tax indicating the accrued amount. However, the landowner can check the accuracy of the calculation. To do this, he must know about the presence or absence of legislation approved at the local level.

The individual specifies the following data

:

- can the landowner take advantage of possible benefits when paying land tax;

- the value of land subject to taxation;

- tax rate for a specific category of land.

There are various benefit systems for individuals in the regions.

The territorial Tax Service can provide information upon the specific request of an individual land owner. If he has the opportunity to use the benefit, he needs to write an application to the tax service, attaching a document on land ownership. The tax service provides a document confirming the right to the benefit. In its absence, the taxpayer makes a recalculation based on the cadastral value of the land in his possession. After clarifying the interest rate, you can proceed with the calculation and make sure that the tax authorities have calculated it correctly.

Citizens should be aware that the Tax Code of the Russian Federation prohibits exceeding the interest rates established by it depending on the category of land:

- 0.3% – for agricultural land and summer cottages;

- 1.5% – for other categories.

The basic formula for recalculating the type of payment under consideration:

Land tax = cadastral value? interest rate

If there is a benefit, the following formula is used:

Preferential land tax = (cadastral value – non-taxable amount) ? interest rate

To calculate the amount of payment for ownership of a land plot, full months are taken into account, the calculation is made according to the same principle as for legal entities.

Sample calculation

payment for land ownership for an individual:

Petrov I.V. owned the dacha plot from the beginning of 2020; on September 17, he sold it.

The price according to the cadastre is 850,000 rubles.

Rate – 0.3%.

There is no benefit.

Advance – no.

Number of months possessions – 9.

Tax on dacha plot = 850,000? 0.3% ? (9 / 12) = 1,912 rubles.

Features of land taxation

Article 388 of the Tax Code of the Russian Federation sets out the basis for the mandatory payment of a fee for the use of land that is owned without a term of right of use or through inheritance for life.

If there are changes in the value of the land cadastre during the current year, they will be taken into account only in the next year.

If a technical error is made, the local Federal Tax Service makes corrections and the payment amount for the current year is recalculated.

Changes in the value of a plot according to the cadastre may be associated with a decision of the commission considering disputes or a court decision. According to clause 1 of Article 391 of the Tax Code of the Russian Federation, such changes are made in the year in which the price revision was announced, but not before the value that was the cause of the land dispute is entered into the cadastre.

In case of shared land ownership, payment is calculated in proportion to the share of each individual owner.

In case of joint ownership without determining shares, taxation is calculated in equal parts (clauses 1-2 of Article 392 of the Tax Code of the Russian Federation).

Deadlines for paying taxes by individuals

Payment must be made by December 1 of the year following the tax period.

For example, the tax for 2020 must be paid before December 1, 2020. The Tax Service must send a notification 30 days before the deadline (clause 2 of article 52, clause 1, 3 of article 363, clause 4 of art. 397, paragraph 1, 2 of Article 409 of the Tax Code of the Russian Federation; Letter of the Federal Tax Service of the Russian Federation dated January 11, 2016 N BS-4-11/48).

Results

The procedure and deadlines for paying land taxes are established by local legislators. At the same time, local laws cannot contradict the Tax Code. Organizations calculate the tax amount independently. They pay the tax quarterly and at the end of the year, but not earlier than February 1 of the year following the reporting year, unless other deadlines are established at the regional level.

Individuals and individual entrepreneurs receive a tax notice from the Federal Tax Service and pay tax at the end of the year no later than December 1 of the year following the reporting year.

nalog-nalog.ru

Basis for calculating land tax

The starting point for calculating the amount of payment for land property is the value according to the cadastre; its size is fixed at the regional level and is listed in the state register.

You can easily find out this information using the official website of the main registration authority. Sequence of the procedure for determining the amount of tax

:

- Make sure whether there is a local authority requirement to make an advance payment or not.

- Find out about the availability of benefits.

- Check current information on the latest tax rate for the category of land owned by the organization.

- Find out what the value of the land plot is according to the cadastre.

The basic formula by which land tax is calculated looks like this:

Land tax = cadastral value x interest rate

The calculated value obtained after assessing the land at the state level in accordance with the classification of its purpose is taken as of the date when the land plot was registered.

The Tax Code of the Russian Federation is the legislative basis. This document regulates the limits of the rate: from 0.3% for the categories presented in paragraph 3 of Article 394, for the rest - up to 1.5%.

According to the statutory documents, the category of the land plot, which is the property of the enterprise, is specified.

If local authorities have not made a decision on setting the interest rate, the maximum payment amount established by the Tax Code of the Russian Federation is taken as a basis.

When transferring land tax quarterly, advance payments must be made. At the end of the year, the total amount of tax is calculated, from which advance contributions paid are deducted.

Advance payment of land tax is determined by the following formula:

Advance payment = cadastral value x interest rate / 4

You can see how to use the official website of the fiscal service to automatically calculate the tax on a land plot in the video presented.

pensioners receiving pensions assigned in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who, in accordance with the legislation of the Russian Federation, are paid a monthly lifelong allowance. (subparagraph 8 was introduced by Federal Law No. 436-FZ of December 28, 2017 and applies to legal relations that arose from January 1, 2017)

pensioners receiving pensions assigned in the manner established by pension legislation, as well as persons who have reached the ages of 60 and 55 years (men and women, respectively), who, in accordance with the legislation of the Russian Federation, are paid a monthly lifelong allowance. (subparagraph 8 was introduced by Federal Law No. 436-FZ of December 28, 2017 and applies to legal relations that arose from January 1, 2017)