Territories of the trade tax

The trade tax in Russia was first introduced on July 1, 2020. In accordance with Art. 15 of the Tax Code of the Russian Federation, it belongs to the category of local taxes and fees. According to Art. 410 of the Tax Code of the Russian Federation, municipal authorities of three federal cities - Moscow, St. Petersburg, Sevastopol - have the right to introduce it on their territory.

However, at the moment, the trade tax has been introduced exclusively in the territory of the city of Moscow, in accordance with Moscow City Law No. 62 of December 17, 2014. The rest of the federal cities are still engaged in preparatory work. In the city of Moscow, the trade tax continues in 2020.

Let us draw your attention to the fact that an individual entrepreneur or LLC may be registered in another subject of the Russian Federation as an entrepreneur, but if the object of his trade is located in the territory in which the trade tax has been introduced, then he will be the payer of the trade tax.

Before starting activities, he needs to submit a notification to the Federal Tax Service at the location of this facility.

How to calculate trading fee

To pay the vehicle, you need to calculate its amount for the quarter yourself. Collection rates are established by district and territory; for Moscow the rates are contained in Article 2 of Law No. 62. The amount of the fee depends on the number of retail facilities and their area. This is a physical indicator.

Vehicle amount = Rate (Article 2 of Moscow Law No. 62) × FP

Income from trading does not affect the amount of the fee. Let us note once again: even if you traded at the facility at least one day per quarter, you will have to pay the fee in full. Therefore, it is not at all profitable to start an activity at the end of the tax quarter, as well as to finish it at the beginning.

Calculation example. IP Demidov sells farm products in Moscow. It has a shopping pavilion with an area of 60 sq.m. in the Tverskoy district, two kiosks in Cheryomushki and one van.

The vehicle rate in the Tver region for an object over 50 sq.m. is 1080 rubles for each sq.m. within 50 sq.m. and 60 rubles for each full and incomplete sq.m. over 50 sq.m. In Cheryomushki, the cost of one kiosk will be 40.5 thousand rubles. The fee for the van is 40.5 thousand rubles. Let's calculate the total trading fee:

50 × 1080 + (60 − 50) × 60 = 54,600 rubles - fee for a trade pavilion 40,500 × 2 = 81,000 rubles - fee for two kiosks 54,600 + 81,000 + 40,500 = 176,100 rubles - total trade fee

Demidov will pay a trading fee of 176,100 rubles per quarter.

Do not forget that the amount of the fee depends on the area of the sales floor; when calculating it, do not take into account warehouses and utility rooms. We recommend that you separately highlight retail space in the plan or lease agreement so that inspectors do not impose fines.

Trade tax payment deadlines in 2020

Entrepreneurs are required to calculate the amount of the trading fee and pay it quarterly. Report on payment of the trade fee, in accordance with Art. 414 of the Tax Code of the Russian Federation, not necessary.

The deadline for payment of the trade tax is the 25th day of the month following the taxable quarter. Namely:

- IV quarter of 2020 - January 27, 2020;

- Q1 2020 – April 27, 2020;

- Q2 2020 – July 27, 2020;

- III quarter of 2020 - October 26, 2020;

- IV quarter of 2020 - January 25, 2021.

Liability for non-payment

In conclusion, let us remind you that if an organization or individual entrepreneur is subject to payment of the trade tax in Moscow, but does not register as a tax payer, then this will be regarded as conducting business without registration. And for this violation a fine may be issued in the amount of 10 percent of the income received as a result of such activity, but not less than 40,000 rubles (Clause 2 of Article 116 of the Tax Code of the Russian Federation). Fines are also possible for the very fact of failure to submit a notification (see “Tax officials have announced the amounts of fines for late submission of a notification of registration as a trade tax payer”). In addition, if you do not submit a notice of registration as a trade tax payer, the organization or individual entrepreneur (on OSNO or USN) will lose the right to reduce taxes by the amount of the fee.

For non-payment or incomplete payment of the trade fee, which occurred as a result of incorrect calculation of the fee or other unlawful actions (inaction) of the payer, a fine of 20% of the unpaid amount is provided. And if it is proven that the act was committed intentionally, the fine will be 40% of the unpaid fee (Article 122 of the Tax Code of the Russian Federation). In addition, in case of late payment, you will need to pay a penalty (Article 75 of the Tax Code of the Russian Federation). Thus, correct completion of the payment order and, as a result, timely receipt of the trade fee to the budget will protect the organization or individual entrepreneur from various negative consequences.

Note that when filling out payment slips for the payment of trade fees, those who generate payment slips using web services feel most comfortable. There, current forms of payment orders with all the necessary codes and details are installed automatically, without user participation.

Fresh materials

- KBK transport tax Features of KBK when paying transport tax Transport tax is paid by all owners of vehicles: legal entities, organizations and…

- Picking berries and mushrooms New law: Picking mushrooms and berries will become a profitable business The State Duma passed the law passed to the Federation Council…

- KBK penalties for personal income tax Some clarifications on the KBK for income tax personal income tax are calculated by subtracting from the amount of income of individuals documented...

- KBK 18210501021010000110 what tax Code 18210501011010000110 KBK: decoding and explanation To understand what payment a particular KBK is intended for, you need...

Payment order for payment of trade fee

According to paragraph 7 of Art. 416 of the Tax Code of the Russian Federation, the payment order must include the details of the Federal Tax Service branch where the trade tax payer is registered.

The rules for filling out a payment order are regulated by Bank of Russia Regulation No. 383-P and Appendices 1 and 2 to Order No. 107n of the Ministry of Finance of the Russian Federation.

If the trade fee is paid for a property, then the payment order indicates the details of the Federal Tax Service at the place of registration of the individual entrepreneur (organization) as the payer of the trade fee. In this case, the OKTMO code is indicated at the place of trade.

If the trade fee is paid at the place of residence of the individual entrepreneur (location of the organization), then the payment order indicates the details of the Federal Tax Service, in which the individual entrepreneur (organization) is the payer of the trade fee. In this case, the OKTMO code is indicated at the place of trade indicated in the notification of registration as a payer of the trade tax.

The BCC for the trade fee in 2020 is indicated in field 104 of the payment order. In case of payment of fines and penalties associated with the trade fee, other BCCs are indicated.

We bring to your attention the current BCCs for payment of trade tax in 2020:

- KBK for payment of trade tax in 2020: 182 1 0500 110

- KBK for payment of penalties: 182 1 05 05010 02 2100 110

- KBC to pay the fine: 182 1 05 05010 02 3000 110

Who pays and who doesn't pay this fee?

This is a new payment for entrepreneurs, introduced into use in the 3rd quarter of 2020 (Chapter 33 of the Tax Code of the Russian Federation) so far only in Moscow. The capital will be the first to “test” all the nuances of the new tax collection, St. Petersburg is next in line, and then other regions of Russia. The dates for widespread innovations have not yet been specified.

The fee is a fixed quarterly payment; the calculation takes into account the commercial component of the activity and the criteria for retail locations. The rate is calculated at the municipal level or by a city of federal significance; it is allowed to reduce it even to 0%.

Who should pay it

Moscow entrepreneurs who receive income from sales of any goods need to get used to this fee. The sales volume and number of transactions do not matter for the calculation of this fee.

IMPORTANT! Entrepreneurs on UTII cannot combine this tax regime with a trade tax; they will have to switch to another type of taxation.

Who will not be affected by the fee?

Some sellers may not have to worry about trading fees for now. Amendment to Sec. 33 of the Tax Code does not currently apply to:

- Internet entrepreneurs who do not use personal contact with consumers (even courier delivery);

- suppliers of goods from the warehouse;

- patent IP;

- Unified Agricultural Tax payers.

By special order the following are exempt from the trade tax:

- owners of vending machines;

- traders at fairs that are open only for a few days;

- ticket sellers in theaters, cinemas, museums, etc.;

- press hawkers;

- sellers of religious objects in temples, church shops, etc.

How to pay

The merchant must register with the tax office as a payer of trade tax. He himself calculates the collection amount quarterly and transfers it by the 25th of the next month. The tax office has the right to independently “identify” a payer who is not in a hurry to register and issue him a requirement to pay a fee.

In order for the transferred fee to go to the correct account, correctly indicate in the KBK payment order:

- for payment of the principal amount : 182 1 05 05010 02 1000 110;

- for payment of penalties in case of delay in quarterly payment: 182 1 0500 110

- to transfer fines accrued for non-payment of trade fees: 182 1 0500 110.

This might also be useful:

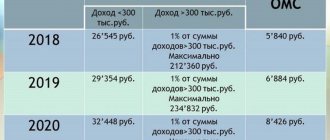

- Changes in the field of insurance premiums in 2020

- Deadline for submitting 2-NDFL in 2020 for 2020

- Fixed payments for individual entrepreneurs in 2020 for themselves

- Tax calendar for 2020

- How much taxes does an individual entrepreneur pay in 2020?

- Tax system: what to choose?

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Payers

According to paragraph 1 of Art. 411 ch. 33 Tax Code of the Russian Federation Federal Law No. 117 dated 08/05/2000 (as amended on 12/25/2018), the sales duty is paid by entrepreneurs and companies that trade through stationary retail outlets in federal cities. Thus, the obligation to pay the duty falls on enterprises and individual entrepreneurs selling:

- at stationary facilities with trading floors. For example, a department in a shopping center (small retail facilities in the center of the shopping center hall);

- at separate points. For example, trays in park areas, trade from trucks without warehouses, mobile coffee shops, etc.;

- market management companies.

It is the direct responsibility of the individual entrepreneur or company to pay the sales tax, and failure to pay is punishable by a fine. To become a payer, you need to register with the tax office in accordance with Art. 416 ch. 33 Tax Code of the Russian Federation.

Budget classification codes for 2020: KBK for tax fines

| Purpose | Fines |

| VAT | |

| from sales in Russia | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 |

| Personal income tax | |

| paid by tax agent | 182 1 0100 110 |

| paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code) | 182 1 0100 110 |

| paid by the resident independently, including from income from the sale of personal property | 182 1 0100 110 |

| in the form of fixed advance payments from the income of foreigners who work on the basis of a patent | – |

| Income tax | |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 |

| from interest on bonds of Russian organizations | 1 0100 110 |

| from the profits of controlled foreign companies | 182 1 0100 110 |

| Water tax | |

| Water tax | 182 1 0700 110 |

| Unified agricultural tax | |

| Unified agricultural tax | 182 1 0500 110 |

| simplified tax system | |

| from income (6%) | 182 1 0500 110 |

| from income minus expenses (15%), including minimum tax | 182 1 0500 110 |

| UTII | |

| UTII | 182 1 0500 110 |

| Patent | |

| tax to the budgets of city districts | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 |

| Transport tax | |

| from organizations | 182 1 0600 110 |

| Organizational property tax | |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 |

| Land tax | |

| within the borders of Moscow, St. Petersburg and Sevastopol | 182 1 0600 110 |

| within the boundaries of urban districts | 182 1 0600 110 |

| within the boundaries of urban districts with intracity division | 182 1 0600 110 |

| within the boundaries of intracity districts | 182 1 0600 110 |

| within the boundaries of inter-settlement territories | 182 1 0600 110 |

| within the boundaries of rural settlements | 182 1 0600 110 |

| within the boundaries of urban settlements | 182 1 0600 110 |

| Trade fee | |

| Trade tax paid in the territories of federal cities | 182 1 0500 110 |

Trading fee: KBK 2020

When paying tax, you must indicate the correct budget classification code. For this purpose, field “104” is provided in the payment order. It is worth considering that if funds are transferred incompletely or incorrectly, the taxpayer will be fined and will also be charged a penalty for each day of delay. Even if the tax was transferred on time and in full, but the budget classification code was incorrectly indicated, the company will be required to pay a fine. To avoid this, you need to clarify the purpose of the payment. That is, correct the incorrect BCC in the payment slip.

KBK 2020 “Trade fee”

| Purpose of payment | KBK |

| Mandatory fee | 182 1 0500 110 |

| Fine | 182 1 0500 110 |

| Penalty | 182 1 0500 110 |

The recipient of the funds is the Federal Tax Service. Its code is "182". The differences in the BCC for transferring the main fee, penalties and fines will be in 14-17 characters. Therefore, you need to be careful when filling out a payment order to indicate the correct budget classification code.

Trade fee reporting

So far, they have not submitted a declaration for the trade tax. However, merchants have obligations to record retail facilities. In addition, organizations that pay the trade tax, like all legal entities, are required to keep accounting records.

article will tell you what entries to make when calculating the trading fee .

The trade tax is compatible with taxation systems such as the OSN and the simplified tax system.

Is it possible for a simplifier to take into account the collection amount in expenses, read our article .

For Moscow payers of the trade tax on special taxation tax, the law allows them to reduce their income tax by the amount of the fee.

But what about entrepreneurs, since they calculate personal income tax from business activities according to rules similar to the calculation of income tax for organizations?

The trade tax can be taken into account in the personal income tax return. This is provided for in the declaration form - read about it in the material “The new 3-NDFL is ready .

Despite the fact that there is no trade tax declaration yet, you will still have to report to the INFS.

In what cases - read our article .

Trade tax is a new payment for businessmen, so it raises many questions. Officials will still finalize the rules for calculating and paying this tax. The main thing that taxpayers across the country are now interested in is: will a trade tax be introduced in their region? Trade Tax section - we will keep you up to date with the latest changes in trade tax legislation

Budget classification codes for 2020: KBK of the main tax payment

| Purpose | Mandatory payment |

| VAT | |

| from sales in Russia | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 |

| Personal income tax | |

| paid by tax agent | 182 1 0100 110 |

| paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code) | 182 1 0100 110 |

| paid by the resident independently, including from income from the sale of personal property | 182 1 0100 110 |

| in the form of fixed advance payments from the income of foreigners who work on the basis of a patent | 182 1 0100 110 |

| Income tax | |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 |

| from interest on bonds of Russian organizations | 182 1 0100 110 |

| from the profits of controlled foreign companies | 182 1 0100 110 |

| Water tax | |

| Water tax | 182 1 0700 110 |

| Unified agricultural tax | |

| Unified agricultural tax | 182 1 0500 110 |

| simplified tax system | |

| from income (6%) | 182 1 0500 110 |

| from income minus expenses (15%), including minimum tax | 182 1 0500 110 |

| UTII | |

| UTII | 182 1 0500 110 |

| Patent | |

| tax to the budgets of city districts | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 |

| Transport tax | |

| from organizations | 182 1 0600 110 |

| Organizational property tax | |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 |

| Land tax | |

| within the borders of Moscow, St. Petersburg and Sevastopol | 182 1 0600 110 |

| within the boundaries of urban districts | 182 1 0600 110 |

| within the boundaries of urban districts with intracity division | 182 1 0600 110 |

| within the boundaries of intracity districts | 182 1 0600 110 |

| within the boundaries of inter-settlement territories | 182 1 0600 110 |

| within the boundaries of rural settlements | 182 1 0600 110 |

| within the boundaries of urban settlements | 182 1 0600 110 |

| Trade fee | |

| Trade tax paid in the territories of federal cities | 182 1 0500 110 |

Trade tax fines

Sanctions in the form of fines are applied not only to registered tax defaulters, but also to entrepreneurs who do not register on time.

- Late registration may result in a fine of 10 thousand rubles.

- For trading without registration, the fine will be 10% of the income received during this time, but not less than 40 thousand rubles. The director is charged a separate fine of up to 3,000 rubles in accordance with the Code of Administrative Offenses of the Russian Federation.

- For untimely notification of changes in the characteristics of a taxable object - a fine of 200 rubles for each document submitted late.

- In case of non-payment of the fee or part thereof, the fine will be 20% of the unpaid amount, if the non-payment is intentional - 40%.

When paying a fine, generate a payment order and indicate the appropriate budget classification code in line 104. Do not forget about the need to pay penalties for late payment of the fee.

Author of the article: Elizaveta Kobrina

The cloud service Kontur.Accounting will help you generate a payment order without errors. Keep records, send reports online and consult with our experts. The first month of using the service is available to new users for free.

Budget classification codes for 2020: BCC for tax penalties

| Purpose | Penalty |

| VAT | |

| from sales in Russia | 182 1 0300 110 |

| when importing goods from countries participating in the Customs Union - through the tax office | 182 1 0400 110 |

| when importing goods - at customs | 153 1 0400 110 |

| Personal income tax | |

| paid by tax agent | 182 1 0100 110 |

| paid by entrepreneurs and persons engaged in private practice, including notaries and lawyers (Article 227 of the Tax Code) | 182 1 0100 110 |

| paid by the resident independently, including from income from the sale of personal property | 182 1 0100 110 |

| in the form of fixed advance payments from the income of foreigners who work on the basis of a patent | – |

| Income tax | |

| to the federal budget (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (except for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the federal budget (for consolidated groups of taxpayers) | 182 1 0100 110 |

| to the budgets of the constituent entities of the Russian Federation (for consolidated groups of taxpayers) | 182 1 0100 110 |

| when implementing production sharing agreements concluded before October 21, 2011 (before the Law of December 30, 1995 No. 225-FZ came into force) | 182 1 0100 110 |

| from the income of foreign organizations not related to activities in Russia through a permanent representative office | 182 1 0100 110 |

| from the income of Russian organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from the income of foreign organizations in the form of dividends from Russian organizations | 182 1 0100 110 |

| from dividends from foreign organizations | 182 1 0100 110 |

| from interest on state and municipal securities | 182 1 0100 110 |

| from interest on bonds of Russian organizations | 1 0100 110 |

| from the profits of controlled foreign companies | 182 1 0100 110 |

| Water tax | |

| Water tax | 182 1 0700 110 |

| Unified agricultural tax | |

| Unified agricultural tax | 182 1 0500 110 |

| simplified tax system | |

| from income (6%) | 182 1 0500 110 |

| from income minus expenses (15%), including minimum tax | 182 1 0500 110 |

| UTII | |

| UTII | 182 1 0500 110 |

| Patent | |

| tax to the budgets of city districts | 182 1 0500 110 |

| tax to the budgets of municipal districts | 182 1 0500 110 |

| tax to the budgets of Moscow, St. Petersburg and Sevastopol | 182 1 0500 110 |

| tax to the budgets of urban districts with intracity division | 182 1 0500 110 |

| to the budgets of intracity districts | 182 1 0500 110 |

| Transport tax | |

| from organizations | 182 1 0600 110 |

| Organizational property tax | |

| for property not included in the Unified Gas Supply System | 182 1 0600 110 |

| for property included in the Unified Gas Supply System | 182 1 0600 110 |

| Land tax | |

| within the borders of Moscow, St. Petersburg and Sevastopol | 182 1 0600 110 |

| within the boundaries of urban districts | 182 1 0600 110 |

| within the boundaries of urban districts with intracity division | 182 1 0600 110 |

| within the boundaries of intracity districts | 182 1 0600 110 |

| within the boundaries of inter-settlement territories | 182 1 0600 110 |

| within the boundaries of rural settlements | 182 1 0600 110 |

| within the boundaries of urban settlements | 182 1 0600 110 |

| Trade fee | |

| Trade tax paid in the territories of federal cities | 182 1 0500 110 |

Solution

The court of first instance satisfied the entrepreneur's demands. This decision was confirmed by the cassation instance (resolution of the Federal Arbitration Court of the East Siberian District dated June 26, 2003 NА33-15760/02-С3н-Ф02-1877/03-С1).

The judges justified their decision as follows. In the above-mentioned Model Provisions (Recommendations) on certain types of local taxes and fees, a permanent outlet refers to shops, canteens, cafes, kiosks, etc. Consequently, a warehouse is not a permanent outlet. Due to the fact that the entrepreneur did not trade “in permanent retail outlets,” he did not have to pay a fee for the right to trade.