Object of taxation

^Back to top of page

Legal entities

https://www.youtube.com/watch?v=ytaboutru

There is no sale of goods not related to retail trade (sale of excisable goods, goods subject to mandatory marking with identification means, including control (identification) marks).

Individual entrepreneurs

For more details see Art. 346.26 Tax Code of the Russian Federation.

Order dated December 11, 2012 No. ММВ-7-6/ [email protected] “On approval of forms and formats for submitting applications for registration and deregistration with tax authorities of organizations and individual entrepreneurs as taxpayers of the single tax on imputed income for certain types activities, as well as the procedure for filling out these forms”

To work on a simplified basis, entrepreneurs must comply with three conditions:

- In terms of income - no more than 150 million rubles per year.

- The number of employees is no more than 100 people. Full-time employees and those working under civil contracts are taken into account.

- By field of activity. Individual entrepreneurs who sell minerals, engage in advocacy or produce excisable goods, such as alcohol or perfumes, cannot work on a simplified basis. All restrictions are specified in the tax code.

The simplified tax must be calculated on an accrual basis and paid in installments four times a year:

- For the first quarter - no later than April 25.

- For half a year - no later than July 25.

- For 9 months - no later than October 25.

- For a year - no later than April 30 of the following year.

The first three payments are advance payments. For the fourth, they calculate the total amount of tax at the end of the year and subtract advance payments from it.

If the final date falls on a weekend, the payment deadline is extended to the next business day.

Customize the tax and reporting calendar for yourself to pay taxes on time and avoid fines

Individual entrepreneurs can legally reduce the tax on the amount of insurance premiums.

Individual entrepreneurs without employees - for the entire amount of insurance premiums. This includes fixed and additional contributions.

Under the simplified tax system “Income”, contributions reduce the amount of tax itself, and under the simplified tax system “Income minus expenses” they are added to total expenses.

For example, an individual entrepreneur using the simplified tax system “Income” earned 100,000 RUR in the first quarter. The advance payment will be 6,000 RUR: 6% × 100,000 RUR.

In the same quarter, he paid part of the insurance premiums for himself - 6,000 RUR. This means that he can deduct them from the amount of the advance payment. It turns out that you don’t need to pay tax for the first quarter.

One more example. Income of individual entrepreneurs on the simplified tax system 15% in the first quarter - 100,000 RUB, expenses - 20,000 RUB. Advance payment - 12,000 RUB: 15% × (100,000 RUB - 20,000 RUB).

Individual entrepreneurs with employees can reduce the tax on insurance premiums for themselves and their employees. In this case, it is possible to reduce the tax for the simplified tax system “Income” by only half of the contributions, and individual entrepreneurs using the simplified tax system “Income minus expenses” can include the entire amount in the calculation.

Simplified individual entrepreneurs are not required to keep accounting records. They fill out a book of income and expenses (KUDiR) and submit a tax return once a year.

Accounting for income and expenses. All simplified entrepreneurs are required to keep a ledger of income and expenses. It records income and expenses that affect tax. Individual entrepreneurs using the simplified tax system “Income” should only record expenses that can reduce tax: insurance premiums for themselves and employees, if any.

You can maintain KUDiR in printed or electronic form. The e-book is printed and bound at the end of the year. There is no need to submit and certify the KUDiR to the tax office. The book may only be needed for verification. If the book is not bound and numbered, the individual entrepreneur may receive a fine. For example, if a book is missing for more than two years, they may be fined RUB 30,000.

Reporting for employees. If an individual entrepreneur hires employees, then he is obliged to pay taxes, fees and prepare reports for them.

Entrepreneurs who process payments from individuals must also install an online cash register.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

Additional reporting. In some cases, entrepreneurs need to pay other taxes and report to the tax authorities. For example, when owning land, you pay a land tax, and when using water from a river for irrigation, you pay a water tax.

Other entrepreneurs can switch to the simplified tax system only from the beginning of next year. In this case, notification must be submitted no later than December 31.

The only exception is the transition from UTII if the individual entrepreneur stopped working in the assigned type of activity and did not do anything else. In this case, you can switch to the simplified tax system with your new business from the beginning of any month. The tax office must be notified no later than 30 calendar days from the date of termination of work on UTII.

An example of filling out a notice of transition to the simplified tax system

^Back to top of page

Employees{amp}lt;100 people

Income {amp}lt; 150 million rubles

Residual value {amp}lt;150 million rubles.

Separate conditions for organizations:

- The share of participation of other organizations in it cannot exceed 25%

- Prohibition of the use of the simplified tax system for organizations that have branches

- An organization has the right to switch to the simplified tax system if, based on the results of nine months of the year in which the organization submits a notice of transition, its income did not exceed 112.5 million rubles (Article 346.12 of the Tax Code of the Russian Federation)

^Back to top of page

Within the framework of the simplified tax system, you can choose the object of taxation: income or income reduced by the amount of expenses incurred (sometimes they say “income minus expenses”, Article 346.14 of the Tax Code of the Russian Federation).

It is possible to change the object of taxation only starting next year by notifying the tax authority in writing before December 31.

^Back to top of page

Legal entities

How much does an individual entrepreneur pay for employees?

If an individual entrepreneur has employees, he must pay personal income tax in the amount of 13% of wages and insurance premiums defined in Chapter 34 of the Tax Code of the Russian Federation .

Check out the amounts of fixed insurance premiums for employees in 2020:

| Type of contribution | Bid |

| Mandatory pension insurance | 22 % |

| Compulsory social insurance | 2,9 % |

| Compulsory health insurance | 5,1 % |

The rates indicated in the table apply to all entrepreneurs with employees and do not depend on the specifics of the business and working conditions. But one column in the tax burden for an entrepreneur can still vary - these are contributions for injuries.

The FSS (Social Insurance Fund) determines contributions for injuries separately for each employer. The tariff varies depending on the type of activity, and the entrepreneur must confirm it once a year. Do you want to “forget” about it? Then you may be assigned a maximum rate corresponding to the types of activities that were specified when registering.

In 2020, injury rates are proportional to the occupational risk class . The higher the likelihood of being injured on the job, the higher the rate. Organizations with hazardous production will also have to pay more, which is quite logical. Today the minimum rate is 0.2%, and the maximum is 8.5%.

Thus, for individual entrepreneurs you will have to pay insurance premiums - at least 30.2% of wages, plus do not forget to withhold income tax in the amount of 13% and transfer it to the budget. Total - from 43% for each employee .

Example: an individual entrepreneur has one employee - Anna Ivanova. Her salary under the employment contract is 30,000 rubles. The professional risk of injury is minimal. Let's try to figure out what an entrepreneur needs to pay - well, of course, in addition to salary:

- Personal income tax: 30 000 * 0,13 = 3 900 ₽.

- Contributions to compulsory pension insurance: 30 000 * 0,22 = 6 600 ₽.

- Contributions for compulsory health insurance: 30 000 * 0,051 = 1 530 ₽.

- Contributions to compulsory social insurance: 30 000 * 0,029 = 870 ₽.

- Accident insurance premiums: 30 000 * 0,002 = 60 ₽.

- Salary to the employee “in hand”: 30 000 — 3 900 = 26 100 ₽.

Thus, an individual entrepreneur will pay 9,060 rubles in insurance premiums to the funds for one employee. The entrepreneur must also withhold income tax in the amount of 3,900 rubles from his salary and transfer it to the budget. What will the employee receive? Only 26,100 ₽.

This is simple arithmetic, from which it becomes clear how difficult it is to have employees and pay them high salaries. Therefore, many businessmen are looking for workarounds - they give part of their earnings “in an envelope” or do not officially arrange for people under the Labor Code at all.

Today, such options are doomed to failure - the deception will definitely be discovered, and the consequences will be extremely unpleasant: large fines or even criminal liability .

Today, some individual entrepreneurs believe that it is more profitable to work with the self-employed. It would seem that there is no need to pay insurance premiums and personal income tax, a complete benefit. However, this option is legal only if the entrepreneur orders specific services from a self-employed person or buys any goods. Moreover, for each transaction you need to receive a check from the self-employed.

If you want to work with a self-employed person without formalizing an employment relationship, be prepared to answer before the law under Art. 419 Labor Code of the Russian Federation .

Article on the topic: How to become self-employed and start working in a new status

Types of simplification

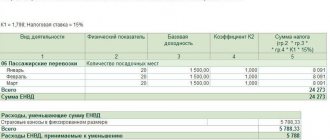

Each tax regime has its own reporting period. That is, the entrepreneur is obliged to pay taxes to the state treasury on time and submit all necessary reports. Similar rules exist for those businessmen who have chosen the Single Tax. They need to make payments every quarter. It is advisable to carry out this procedure before the 25th day of the month following the reporting quarter.

On the one hand, it is very convenient that payments do not need to be made every month, but this is not a payment once or twice a year, as with PSN.

In this case, the estimated revenue of the entrepreneur and all kinds of increasing and decreasing coefficients are taken into account. From all this, 15 percent is calculated, that is, the size of the fixed rate. This is how the amount of the single tax for individual entrepreneurs comes out, which must be paid by the businessman to the state treasury every quarter.

In this case, a flat tax is both a plus and a minus. Of course, it is very convenient when a businessman does not have to take time off from his main occupation, that is, making a profit, in order to calculate taxes and prepare numerous reports. However, if a businessman does not receive income for a certain period of time, he cannot be exempt from paying taxes.

This is the most significant disadvantage of UTII. For example, on OSNO, a businessman has the opportunity, in case of business downtime, to simply submit a zero report and avoid paying fees to the state treasury for the time when there was no profit or the business was operating in the red. This will not work with a single tax. Here, in any case, you will have to make payments in full, which was established for the individual entrepreneur upon registration.

Some businessmen are not satisfied with the amount of tax they have to pay on UTII. It’s all about the basic profitability, which is determined taking into account various additional nuances. For example, in the service sector, the number of service personnel plays a large role. If we are talking about a car service, then the size of the premises used for work is taken into account. In passenger transportation, it is important how many cars are in the individual entrepreneur’s fleet.

https://www.youtube.com/watch?v=upload

After calculating the basic yield, 15 percent is deducted from this amount at the single tax rate. But that’s not all, since in the case when the individual entrepreneur’s profit exceeds 300 thousand rubles during the reporting period, the businessman will have to pay an additional one percent of the income received in excess of the established limit.

Entrepreneurs can choose one of two simplified work options.

STS "Income". When calculating tax, only income is taken into account. It is beneficial for individual entrepreneurs who provide services. For example, editors, developers, marketers. They have virtually no expenses.

USN “Income minus expenses”. Tax must be paid on the difference between income and expenses. Suitable if expenses exceed 60% of turnover.

The entrepreneur himself chooses the option that suits him and indicates it in the notification to the tax office.

How to save, spend less and earn more

We tell you in our free newsletter. Subscribe to receive the best stories in your inbox twice a week

The main advantage of the simplified tax system is the ability to choose how to pay tax: only on income or on the difference between income and expenses. Here are other advantages:

- Can be combined with UTII and a patent.

- An entrepreneur pays only one tax.

- Simple tax reporting: return once a year.

- Tax is calculated based on actual income. Therefore, if they are not listed on the simplified tax system “Income”, then you do not need to pay tax.

And the disadvantages are:

- Not all expenses can be taken into account when calculating tax.

- Even if expenses are greater than income, you will have to pay a minimum tax on the simplified tax system “Income minus expenses”.

- Companies that pay VAT are reluctant to work with individual entrepreneurs on a simplified basis.

Important

Contact an experienced accountant. Do not solve complex issues and do not calculate taxes based on items from the Internet. Laws change, articles become outdated, and because of this there may later be problems with the tax authorities.

Is it possible to close with outstanding financial obligations?

The procedure for liquidating an individual entrepreneur with debt is the same as without it. The entrepreneur draws up an application, pays the state fee and submits these documents to the local branch of the Federal Tax Service.

The tax authority does not have the right to refuse to liquidate an individual entrepreneur if there are outstanding financial or property obligations.

An individual can first liquidate an individual entrepreneur in the prescribed manner, and only then pay off all existing debt.

However, it is worth doing this, being confident in the financial ability to repay your debts. Otherwise, accounts payable may be collected from the former individual entrepreneur through civil proceedings.

If a businessman is not confident in his financial solvency, it is worth filing a petition in court to declare the individual entrepreneur bankrupt. To pay off obligations, they can launch a procedure for selling property at public auction.

If, as a result of the sale of property, the debt is only partially repaid, an enforcement procedure will be launched in accordance with the procedure established by current legislation.

Liquidation of a sole proprietorship is a fairly simple procedure and, with some attention to detail, can be completed within one business week.

You only need to provide 2 documents to the tax office - an application in form P2601 and a receipt for payment of the state duty. Additionally, you need to take a passport and a certificate of state registration of individual entrepreneurs.

During liquidation, it is also necessary to notify extra-budgetary funds such as the Social Insurance Fund and the Pension Fund. The applicant can use a convenient electronic service and submit all documents without leaving his own home.

Find out where to submit an application to close an individual entrepreneur in the article: application for liquidation of an individual entrepreneur. Features of the liquidation of an OJSC are discussed here.

Read about the timing of LLC liquidation in this article.

Replaces taxes

^Back to top of page

For legal entities:

- Corporate income tax In relation to profits received from business activities subject to a single tax

- Organizational property tax

In relation to property used for business activities, subject to a single tax (with the exception of real estate objects, the tax base for which is determined as their cadastral value in accordance with this Code) - Value added tax

In relation to transactions recognized as objects of taxation in accordance with Chapter 21 of the Tax Code of the Russian Federation, carried out within the framework of business activities subject to a single tax).

For individual entrepreneurs:

- Personal income tax In relation to income received from business activities subject to a single tax

- Property tax for individuals

In relation to property used for business activities subject to a single tax - Value added tax

In relation to transactions recognized as objects of taxation in accordance with Chapter 21 of the Tax Code of the Russian Federation, carried out within the framework of business activities subject to a single tax)

^Back to top of page

^Back to top of page

- corporate income tax, with the exception of tax paid on income from dividends and certain types of debt obligations;

- property tax for organizations, however, from January 1, 2020, organizations using the simplified tax system are required to pay property tax in relation to real estate, the tax base for which is determined as their cadastral value (clause 2 of article 346.11 of the Tax Code of the Russian Federation, p. 1 Article 2, Part 4 Article 7 of the Federal Law of 04/02/2014 No. 52-FZ);

- value added tax.

- personal income tax in relation to income from business activities;

- property tax for individuals on property used in business activities. however, from January 1, 2020, for individual entrepreneurs using the simplified tax system, an obligation has been established to pay property tax in respect of real estate objects that are included in the list determined in accordance with paragraph 7 of Art. 378.2 of the Tax Code of the Russian Federation (clause 3 of article 346.11 of the Tax Code of the Russian Federation, clause 23 of article 2, part 1 of article 4 of the Federal Law of November 29, 2014 No. 382-FZ)";

- value added tax, with the exception of VAT paid when importing goods at customs, as well as when executing a simple partnership agreement or a property trust management agreement).

The use of the simplified tax system does not exempt you from performing the functions of calculating, withholding and transferring personal income tax from employee salaries.

How to apply for registration online

To submit an application online, you will have to issue a qualified electronic signature - CEP. It is multifunctional - you can sign contracts with contractors and participate in tenders. You can issue a CEP at a certification center or at a bank.

After the CEP has been received, you can register the individual entrepreneur.

Go to the individual entrepreneur registration website and select “Register a person as an individual entrepreneur” in the left column

Rates and payment procedure

^Back to top of page

UTII = (Tax base * Tax rate) - Insurance Contributions

^Back to top of page

Tax amount=Tax rate*Tax base

For a simplified taxation system, tax rates depend on the object of taxation chosen by the entrepreneur or organization.

For the object of taxation “income” the rate is 6%.

According to the laws of the constituent entities of the Russian Federation, the rate can be reduced to 1%. Tax is paid on the amount of income.

When calculating the payment for the 1st quarter, income for the quarter is taken, for the half-year - income for the half-year, etc.

If the object of taxation is “income minus expenses”, the rate is 15%.

At the same time, regional laws may establish differentiated tax rates according to the simplified tax system in the range from 5 to 15 percent. The reduced rate may apply to all taxpayers or be established for certain categories. In this case, to calculate the tax, income is taken, reduced by the amount of expense.

For entrepreneurs who have chosen the “income minus expenses” object, the minimum tax rule applies: if at the end of the year the amount of calculated tax is less than 1% of the income received for the year, a minimum tax is paid in the amount of 1% of the income received.

When applying a simplified taxation system, the tax base depends on the selected object of taxation: income or income reduced by the amount of expenses:

- The tax base under the simplified tax system with the object “income” is the monetary value of all income of the entrepreneur.

- On the simplified tax system with the object “income minus expenses,” the base is the difference between income and expenses. The more expenses, the smaller the size of the base and, accordingly, the tax amount will be. However, reducing the tax base under the simplified tax system with the object “income minus expenses” is possible not for all expenses, but only for those listed in Art. 346.16 Tax Code of the Russian Federation.

Income and expenses are determined on an accrual basis from the beginning of the year. For taxpayers who have chosen the “income minus expenses” object, the minimum tax rule applies: if for the tax period the amount of tax calculated in the general procedure is less than the amount of the calculated minimum tax, then a minimum tax is paid in the amount of 1% of the actual income received.

An example of calculating the amount of an advance payment for an object “income minus expenses”

During the tax period, the entrepreneur received income in the amount of 25,000,000 rubles, and his expenses amounted to 24,000,000 rubles.

- We determine the tax base of

25,000,000 rubles. – 24,000,000 rub. = 1,000,000 rub. - We determine the amount of tax

1,000,000 rubles. * 15% = 150,000 rub. - We calculate the minimum tax of

25,000,000 rubles. * 1% = 250,000 rub.

You need to pay exactly this amount, and not the amount of tax calculated in the general manner.

The laws of the constituent entities of the Russian Federation may establish a tax rate of 0% for two years for individual entrepreneurs registered for the first time and carrying out activities in the production, social and (or) scientific spheres, as well as in the field of consumer services to the population. From September 29, 2020, services for providing places for temporary residence have been added to this list (clause 4 of Article 346.20 of the Tax Code of the Russian Federation).

The validity period of these tax holidays is until 2020.

For some newly created individual entrepreneurs, tax holidays may apply. This means that entrepreneurs are not required to pay tax at all for some time.

You can check the tax rate and the possibility of tax holidays in your region on the tax website. Let's look at it with an example.

An entrepreneur from Petropavlovsk-Kamchatsky is opening a bakery and plans to work on the simplified tax system “Income”. On the tax website, he selects his region and goes to the page about the simplified tax system.

First, select the desired region - for us it is the Kamchatka Territory

The simplified tax rate for bakeries is 3%. This is what needs to be taken into account when calculating tax.

Some entrepreneurs may not pay tax at all for the first two years, because tax holidays apply to their areas of activity. For example, in the Kamchatka Territory, the benefit applies to agricultural and construction businesses.

In addition to areas of activity, there are other conditions for tax holidays for entrepreneurs in the Kamchatka Territory: the number of employees cannot exceed 10 people

USN “Income”: Rate × Income

STS “Income minus expenses”: Rate × (Income - Expenses)

Let’s say that an entrepreneur’s income for the year is 900,000 RUR, and expenses are 850,000 RUR. If we calculate according to the formula, it turns out that he must pay 7,500 RUR: 15% × (900,000 RUR − 850,000 RUR). But 1% of his income is 9000 RUR, so the individual entrepreneur will have to pay this amount.

The minimum tax will have to be paid even if the individual entrepreneur is at a loss or has zero income.

^Back to top of page

What is place of residence

Place of residence is a living space, for example, a house, apartment, dormitory, office housing.

But places such as a hotel, boarding house, holiday home, camp site, hospital or other similar institutions are called a place of stay. Individual entrepreneurs cannot be registered with them. Just as this cannot be done in non-residential premises (office, warehouse, workshop). When registering an individual entrepreneur in form P21001, the residential address is indicated, which is documented. If the applicant has a permanent residence permit, then the data from the passport is entered. If there is no registration, but there is temporary registration, then an individual entrepreneur is opened at this address, but only for the period of its validity.

Of course, an entrepreneur usually conducts a real business not at home, but in some non-residential premises. However, his official address is still his residence. Information from the Federal Tax Service and other government bodies will be sent to your registration address.

If the entrepreneur does not actually live at the place of registration or temporary registration, it is necessary to ensure the receipt of this correspondence. For example, agree with apartment residents or neighbors to ensure that letters or postal notices are sent to him in a timely manner.

In any case, letters from the Federal Tax Service are considered delivered on the sixth day after sending, even if the addressee has not signed for their receipt. But this correspondence may contain demands to provide clarification on reporting or to pay arrears on taxes. Therefore, in order not to create unnecessary problems for yourself, you need to maintain contact with the official registration address of the individual entrepreneur, even if you do not live there.

A big plus for individuals doing business is the opportunity to conduct activities throughout Russia, regardless of the place of registration of the individual entrepreneur. Moreover, unlike an LLC, an individual entrepreneur does not need to register a separate division.

But there is one feature in the tax accounting of individuals registered as individual entrepreneurs. Payers of imputed income tax (UTII) and entrepreneurs with a patent (PSN) must be registered at the place of real activity.

For example, an individual entrepreneur whose registration is in the Tver region opens a store on PSN in Kirov. To do this, he submits an application for a patent to the Kirov Federal Tax Service, and pays tax here.

But in the simplified taxation system and OSNO modes, it does not matter at what address in reality the individual entrepreneur does business. Additionally, you do not need to register with the inspectorate at your place of business. The entrepreneur will file returns and pay taxes at the Federal Tax Service where he is registered.

The procedure for switching to the simplified tax system

^Back to top of page

Legal entities

^Back to top of page

From January 1, 2013, the transition to paying a single tax is carried out voluntarily through filing an application for registration of an organization (IP) as a UTII taxpayer with the tax authority at the place of business, at the location of the organization (place of residence of an individual entrepreneur) when implementing 3 types of activities:

- delivery or peddling retail trade;

- advertising on vehicles;

- provision of motor transport services for the transportation of passengers and goods.

Deregistration as a UTII payer is carried out on the basis of an application submitted to the tax authority.

Taxpayers have the right to switch to a different taxation regime from the beginning of the calendar year (Article 346.28 of the Tax Code of the Russian Federation).

^Back to top of page

1Transition to the simplified tax system simultaneously with the registration of individual entrepreneurs and organizations. The notification can be submitted along with a package of documents for registration. If you have not done this, then you have another 30 days to think about it (

clause 2 art. 346.13 Tax Code of the Russian Federation

)

2Transition to the simplified tax system from other taxation regimes. The transition to the simplified tax system is possible only from the next calendar year. Notification must be submitted no later than December 31 (

clause 1 art. 346.13 Tax Code of the Russian Federation

)

Transition to the simplified tax system with UTII from the beginning of the month in which their obligation to pay the single tax on imputed income was terminated (clause 2 of article 346.13 of the Tax Code)

In this case, the taxpayer must notify the tax authority about the transition to the simplified tax system no later than 30 calendar days from the date of termination of the obligation to pay UTII.

The notification can be submitted in any form or in the form recommended by the Federal Tax Service of Russia.

^Back to top of page

Legal entities

^Back to top of page

What documents are needed

To liquidate an individual entrepreneur, it is necessary to prepare the following package of documents for the tax office:

- applicant's passport;

- application in form P26001;

- receipt of payment of state duty;

- certificate of state registration of individual entrepreneurs.

In FSS:

- report;

- calculation of 4-FSS.

To the Pension Fund:

- extract from the Unified State Register of Individual Entrepreneurs;

- SNILS;

- TIN;

- certificate of state registration of individual entrepreneurs.

Accounting procedure

^Back to top of page

Separate accounting of indicators is carried out: for each type of activity subject to UTII;

in relation to activities subject to UTII and activities taxed under other taxation regimes.

Mandatory accounting of indicators: for taxes calculated as tax agents;

for other taxes and fees.

The obligation to comply with the procedure for conducting cash transactions.

The obligation to maintain accounting records for legal entities does not apply to individual entrepreneurs. (Law dated December 6, 2011 No. 402 “On Accounting”)

The obligation to provide information on the average number of employees (paragraph 3, paragraph 3, article 80 of the Tax Code of the Russian Federation).

^Back to top of page

How does the IP address change?

Changing the legal address of an LLC is a rather complicated process, especially if the organization moves to another city. But for an entrepreneur, changing his address is much easier, even without his direct participation.

The entrepreneur does not need to independently report his new place of residence to the Federal Tax Service. The tax office receives information about the address at which the individual entrepreneur is now located from the Migration Service.

Within ten working days after the change of registration, the Federal Migration Service transmits the new address of the entrepreneur to the inspectorate. Even if the deadline for making a new entry in the Unified State Register of Individual Entrepreneurs is violated, the individual entrepreneur is not responsible for this.

Changing the address of an organization is a rather complicated process that can take a whole month. If an LLC changes its city of location, then it is necessary to amend the charter and pay a state fee of 800 rubles. To change the address of an organization, it is necessary to gather participants at a general meeting, approve the corresponding decision and notarize the form P14001 or P13001.

Individual entrepreneurs do not have such a procedure. The tax inspectorate will learn about a change in registration of an individual registered as an individual entrepreneur through interdepartmental interaction channels.

Next, the Federal Tax Service Inspectorate independently makes changes to the state register at the new address of the entrepreneur. Just in case, we advise you to check 15-20 days after changing your registration whether the corresponding entry has been made in the Unified State Register of Individual Entrepreneurs. You should find information similar to this on your statement.

If there is no information about a change of address in the register, we advise you to contact the tax office for clarification. After all, when you change your place of residence, the Federal Tax Service may change where the entrepreneur is registered.

The taxpayer’s case is transferred there, and insurance premiums and taxes are paid to the details of this inspection. If the register does not reflect information about a change of address in a timely manner, problems may arise with accounting for these payments, and this is unnecessary paperwork. It is better to prevent possible problems in advance, especially since the individual entrepreneur is not responsible for the untimely change of address in the register.

Tax payment and reporting

^Back to top of page

https://www.youtube.com/watch?v=ytcopyrightru

Taxpayers using the simplified taxation system do not have the right to switch to a different taxation regime before the end of the tax period.

Reporting period

Quarter

Half year

9 months

Procedure

Organizations pay tax and advance payments at their location, and individual entrepreneurs - at their place of residence.

1We pay tax in advance no later than 25 calendar days from the end of the reporting period. Advance payments paid are counted against tax based on the results of the tax (reporting) period (year) (

clause 5 art. 346.21 Tax Code of the Russian Federation

)

2Fill out and submit a declaration according to the simplified tax system

- Organizations - no later than March 31 of the year following the expired tax period

- Individual entrepreneurs - no later than April 30 of the year following the expired tax period

3We pay tax at the end of the year

- Organizations - no later than March 31 of the year following the expired tax period

- Individual entrepreneurs - no later than April 30 of the year following the expired tax period

If the last day of the tax payment (advance payment) deadline falls on a weekend or non-working holiday, the payer must remit the tax on the next working day.

Filing a declaration

Procedure and deadlines for submitting a tax return

The tax return is submitted at the location of the organization or the place of residence of the individual entrepreneur.

- Organizations - no later than March 31 of the year following the expired tax period

- Individual entrepreneurs - no later than April 30 of the year following the expired tax period

Order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected] “On approval of the tax return form for the tax paid in connection with the application of the simplified taxation system, the procedure for filling it out, as well as the format for submitting the tax return for the tax paid In connection with the use of a simplified taxation system, the tax return form and the procedure for filling it out were approved in electronic form (registered with the Ministry of Justice of Russia on March 25, 2016 No. 41552).

Control ratios for the purpose of self-checking the declaration approved by order of the Federal Tax Service of Russia dated February 26, 2016 No. ММВ-7-3/ [email protected] for the correctness of its completion were sent by letter of the Federal Tax Service of Russia dated May 30, 2016 No. SD-4-3/ [email protected]

Go to Tax returns valid in previous periods and periods of application are posted on the page

“Presentation of tax and accounting reporting” in the section “Presentation on paper” in the subsection “Tax return form templates”

Calendar with quarters for OSNO

Advance payments under the simplified tax system for individual entrepreneurs - what are they and are they required?

Some entrepreneurs, due to certain circumstances, can only work under the basic tax regime. This may be their type of activity that does not allow them to switch to a simplified approach, revenue that exceeds the allowable amount, or their personal choice.

OSNO is distinguished by a large number of reports and the complexity of filling them out. Therefore, individual entrepreneurs usually prefer a simplified regime. The main reports on OSNO are VAT and 3-NDFL declarations. Individual entrepreneurs submit quarterly reports on the same dates from year to year.

| Term | Action |

| May 02, 2020 | 3-NDFL for 2020 |

| April 30, 2020 | 4-NDFL, advance payments must be paid on July 15, 2018 and October 15, 2018. |

| April 25, July 25, October 25, 2020; January 25, 2020 | VAT returns for the 1st, 2nd, 3rd and 4th quarters of 2020 |

| July 1, 2020 | Payment of contributions to the Pension Fund for excess income of 300 thousand rubles. for 2018 |

| December 31, 2020 | Payment of fixed contributions of individual entrepreneurs to the Pension Fund for 2020. |

| July 1, 2020 | Payment of contributions to the Pension Fund for excess income of 300 thousand rubles. for 2019 |

Annual reports are prepared in March

Responsibility for tax violations

^Back to top of page

| Conducting activities without registration | 10% of income, but not less than 40 thousand rubles |

| Late submission of application for registration | 10 thousand rubles |

| Late submission of the declaration | 5% of the tax amount, not less than 1 thousand rubles |

| Non-payment (late payment) of tax | 20% of the tax amount, intentionally – 40% of the tax amount |

| Evasion of the appearance of a person called as a witness | 1 thousand rubles |

| Refusal of a witness to testify | 3 thousand rubles |

You must submit reports and pay taxes on time, otherwise the tax office may impose fines and penalties.

For example, an individual entrepreneur was supposed to submit reports by April 30, but forgot about it. If he submits it before May 30 inclusive, he will receive a fine of 5% of the amount of unpaid tax. If he delivers before June 30, he will pay another 5% - and so on. Every month he will be assessed a new fine.

The maximum fine is 30% if you forget about the declaration for six months or more.

The tax office may also suspend operations on the individual entrepreneur’s account. This happens if the declaration is delayed for more than 10 working days.

For late payment. If you miss the payment deadline, the tax office may charge a penalty. Its size is calculated using a special formula; the penalty depends on the number of days of delay, the key rate and the amount of tax.

For non-payment of tax. If you don’t pay the tax at all - partially or completely - you can receive a fine:

- 20% of the tax amount if the error in the calculations was unintentional;

- 40% of the tax amount if the violation was committed intentionally. For example, they did not pay insurance premiums, but deliberately reduced the tax on them.

To avoid making mistakes in calculations, especially using the simplified tax system “Income minus expenses,” contact an accountant.

^Back to top of page

If the filing of a declaration is delayed for more than 10 working days, operations on the account may be suspended (account freezing

Article 76 of the Tax Code of the Russian Federation

).

from 5% to 30%

the amount of unpaid tax for each full or partial month of delay, but not less than 1000 rubles. (

Late payment may result in penalties. The amount of the penalty is calculated as a percentage, which is equal to 1/300 of the refinancing rate, from the amount of the contribution or tax not transferred in full or in part for each day of delay (Article 75 of the Tax Code of the Russian Federation).

For non-payment of tax there is a fine of

from 20% to 40%

amount of unpaid tax (

^Back to top of page

Signs of entrepreneurial activity

Activities are aimed at systematically generating profit.

This can be proven:

- bank statements of the suspect;

- purchase of goods and materials, rental agreements for premises;

- acts of transfer of goods, performance of work or provision of services;

- advertisements in which a citizen advertises his activities.

And if the dumplings do not bring Zhenya profit, he will still be responsible for not registering an individual entrepreneur. Because profit is the goal of entrepreneurial activity, but not its guaranteed result.

Purpose and use of property acquired by a citizen.

You will have to answer if it is proven in court that the property was used for systematic profit-making.

This is evidenced by the following facts:

- a citizen has manufactured or acquired property with the aim of making a profit from its use or sale;

- maintains business records of transactions;

- all transactions are interrelated within a certain period of time;

- There are stable connections between citizens and contractors and buyers.

The tax office will also be alert if an individual buys property that has an entrepreneurial purpose. Therefore, it is important to pay attention to the characteristics of the object if you are actually buying it for personal purposes.

FAQ

^Back to top of page

How is registration as a UTII taxpayer carried out when carrying out activities in the territories of municipalities in which several tax inspectorates operate?

Registration of such persons as UTII payers is carried out with the tax authority on whose territory the place of conducting the “imputed” activity is located, indicated first in the application for registration (

para. 4 paragraphs 2 art. 346.28 Tax Code of the Russian Federation

).

Transition procedure

The procedure for deregistration upon termination of conducting “imputed” activities

The Tax Code of the Russian Federation provides for a declarative procedure for deregistration as a taxpayer of UTII (

para. 3 p. 3 art. 346.28 Tax Code of the Russian Federation

). Therefore, when terminating the “imputed” activity, it is necessary to submit a corresponding application to the tax authority. This must be done no later than five working days from the date of termination of activities subject to UTII (

clause 6 art. 6.1

,

para. 3 p. 3 art. 346.28 Tax Code of the Russian Federation

). The day of completion of the activity is indicated in the application and is considered the date of deregistration (

para. 3 p. 3 art. 346.28 Tax Code of the Russian Federation

).

Is it possible to switch from UTII to another taxation regime during a calendar year?

You can voluntarily switch from UTII to OSN, simplified tax system and other taxation systems only from the next calendar year (

para. 3 p. 1 art. 346.28 Tax Code of the Russian Federation

). This means that the transition day will be January 1 of the next year.

Is it possible to switch from UTII to simplified tax system during the calendar year?

Organizations and individual entrepreneurs who have ceased to be UTII taxpayers have the right, on the basis of a notification, to switch to the simplified tax system from the beginning of the month in which their obligation to pay UTII was terminated.

Accounting procedure

Are organizations that pay UTII required to keep accounting records?

Are individual entrepreneurs who pay UTII required to keep accounting records?

^Back to top of page

Accounting procedure

^Back to top of page

What are the deadlines for a taxpayer to submit a tax return and pay tax when applying the simplified tax system in the event that the taxpayer ceases the activity in respect of which he applied the simplified tax system?

The taxpayer submits a tax return no later than the 25th day of the month following the month in which, according to the notification submitted by him to the tax authority in accordance with

clause 8 art. 346.13 Tax Code of the Russian Federation

, business activity in respect of which the simplified taxation system was applied by this taxpayer was terminated. In this case, the tax is paid no later than the deadlines established for filing a tax return.

Art. 346.23 Tax Code of the Russian Federation

. That is, the tax is paid no later than the 25th day of the month following the month in which the taxpayer stopped using the simplified tax system. (

clause 7 art. 346.21

,

clause 2 art. 346.23 Tax Code of the Russian Federation

)

What is the procedure for notifying the tax authority about the taxpayer’s transition to a different taxation regime due to the loss of the right to use the simplified tax system?

https://www.youtube.com/watch?v=ytadvertiseru

What is the procedure for notifying the tax authority about the desire of a taxpayer using the simplified tax system to switch to a different taxation regime?

Calendar with quarters for the simplified tax system (simplified)

“My Tax” for self-employed citizens - how to use, instructions

Entrepreneurs under the simplified taxation system differ in several respects. Firstly, the tax base can be different: it is either income (6%) or income minus expenses (15%). The number of reports does not depend on this, but different sections will need to be filled out in the declaration, and the calculation of the tax paid will be different.

Secondly, do the individual entrepreneurs have employees? In case there are no employees, but the businessman needs to submit one declaration at the end of the year and pay advance payments quarterly.

| Term | Action |

| April 30, 2020 | Filing a tax return for the simplified tax system for 2020. |

| April 30, 2020 | Payment of the simplified tax system for 2020 |

| July 1, 2020 | Payment of contributions to the Pension Fund for excess income of 300 thousand rubles. for 2018 |

| April 25, July 25, October 25, 2020 | Payment of advance payments of the simplified tax system quarterly |

| December 31, 2020 | Payment of fixed contributions of individual entrepreneurs to the Pension Fund for 2020. |

| April 30, 2020 | Filing a tax return for the simplified tax system for 2020. |

| April 30, 2020 | Payment of the simplified tax system for 2020 |

| July 1, 2020 | Payment of contributions to the Pension Fund for excess income of 300 thousand rubles. for 2019 |

Need to keep track of deadlines

Application of the IP general taxation system (OSN)

When closing an individual entrepreneur, a businessman who uses the regular taxation system (OSN) submits a declaration to the Federal Tax Service of the Russian Federation in form 3-NDFL. In it, he indicates information about the income that he received in the period between the date of drawing up and submitting an application for state registration of the completion of business activities and the date of exclusion from the Unified State Register of Individual Entrepreneurs.

Then, within 15 calendar days from the date of filing 3-NDFL with the regulatory authority, the businessman pays the required amount of tax to the budget.

Also, when closing a business, an individual entrepreneur indicates a tax period code of 50 in the declaration document.

Individual entrepreneurs put down a similar code name when closing their office.

Code 50 means that the taxpayer provides information for the last calendar year.

Termination of the activities of an entrepreneur in the UTII regime

The UTII declaration, including the liquidation declaration, is submitted in the official form, approved. By order of the Federal Tax Service of the Russian Federation dated July 4, 2014 No. ММВ–7–3/ [email protected] Please note that at the end of 2020, by order of the Federal Tax Service dated October 19, 2016, changes were made to the declaration form. Therefore, in 2017, the declaration must be submitted using this amended form.

The deadline for filing a liquidation declaration when closing an individual entrepreneur is determined by Art. 346.32 Tax Code of the Russian Federation. It must be submitted before the 20th day of the month following the quarter in which the termination of the entrepreneur’s activities was recorded in the Unified State Register of Entrepreneurs. The declaration is filled out according to the general rules.

glavkniga.ru

Closing an individual entrepreneur - tax return for UTII

When conducting business activities using a special imputed regime, the main form of reporting for an individual becomes a single tax declaration, UTII. Deregistration of the payer's imputation in the middle of the quarter gives businessmen the legal opportunity to calculate tax not for the entire quarter, but for the calendar days actually worked in the reporting months. Since the tax period for UTII is not a year, but a quarter, when closing an individual entrepreneur it is necessary to report to the Federal Tax Service by filing a declaration under the imputed regime.

The report must be submitted by the 20th. The form was approved in Order of the Federal Tax Service No. ММВ-7-3/353 dated 07/04/14, which lists the rules for drawing up the document. When filling out, you need to pay attention to the correctness of the codes on the title page. In particular, if an individual entrepreneur is being liquidated, code “0” should be reflected in the reorganization/liquidation code field. And along the line of the period code a special digital indicator is given:

- 51 – for 1 sq.

- 54 – for 2 sq.

- 55 – for 3 sq.

- 56 – for 4 sq.

The deadlines for paying the single tax when closing an individual entrepreneur correspond to the general ones according to stat. 346.32. The deadline for transferring amounts for the quarter is the 25th. Therefore, the general deadlines for submitting the report (paying tax) for 2020 will be as follows:

- For 4 sq. 2020 – until 01/22/18 (submission) / until 01/25/18 (payment).

- For 1 sq. 2020 – until 04/20/18 / until 04/25/18

- For 2 sq. 2020 – until 07.20.18 / until 07.25.18

- For 3 sq. 2020 – until 10.22.18 / until 10.25.18

- For 4 sq. 2020 – until 01/21/19 / until 01/25/19

Note! When working for UTII, an entrepreneur has the status of not only an individual entrepreneur, but also a tax payer. Therefore, you will probably need to additionally deregister as a UTII payer; it is better to clarify the nuances of this procedure with your inspection.

How to fill out a zero declaration of an individual entrepreneur at closing

When business activity ceases, filing zeros is required if the citizen does not have income and expenditure indicators. However, this statement does not apply to UTII, since the calculation of tax during imputation is based on the estimated profitability. It is also not allowed to submit blank declarations under the Unified Agricultural Tax, except for those entrepreneurs who have been doing business for the first year.

If the individual entrepreneur does not have indicators on OSNO, zero declarations should be drawn up according to f. 3-NDFL and VAT. Filling out such reports is no different from generating regular forms. The only difference is that all lines with digital indicators will be crossed out. It is recommended to promptly fulfill taxpayer obligations when closing a business, so as not to be responsible for debts to the state in the future.

Liquidation declaration when closing an individual entrepreneur on the simplified tax system - download a sample here.

www.zakonrf.info

Use of the Unified Agricultural Tax (USAT) by an entrepreneur

Businessmen - taxpayers of the Unified Agricultural Tax, upon completion of business activities as agricultural producers, submit a declaration by the 25th day of the month, which follows the month of closure of the individual entrepreneur company.

If the day of submission of the declaration to the regulatory authority falls on a Saturday, Sunday or holiday, then the merchant submits it during business hours.

According to Appendix No. 1 to the Procedure for entering data into the declaration document for Unified Agricultural Tax, approved by order of the Federal Tax Service of the Russian Federation dated July 28, 2014, a businessman who is a taxpayer of Unified Agricultural Tax when liquidating an agricultural enterprise indicates the following codes:

- Code value 50 - designation of the last tax period of the individual entrepreneur;

- Code 34 - designation of the calendar year;

- Code name 96 - designation of the last calendar year at the end of the business activities of the individual entrepreneur who applied the Unified Agricultural Tax.

Also in accordance with Appendix No. 2 to the Procedure for entering data into the Unified Agricultural Tax declaration. established by the Federal Tax Service of the Russian Federation, the entrepreneur indicates the following company liquidation codes:

- 1 - when transforming a company;

- 2 - when merging companies;

- 3 - when dividing an organization;

- 5 - when one company merges with another;

- 6 - upon division and simultaneous merger of one company with another;

- 0 - upon liquidation of the company.