In 2020, the legislation of the Russian Federation introduced the concept of tax holidays, which give the right to individual entrepreneurs (registered for the first time) not to pay taxes. For individual entrepreneurs, a rate of 0% is set for certain types of activities.

In our material today, we will look at in what areas tax holidays are being introduced for individual entrepreneurs in 2020 and other forms of small and medium-sized businesses, what benefits are provided for small businesses and what features tax holidays have in Moscow, as well as in other regions of Russia in 2020 .

Features of tax holidays in 2020

The application of tax holidays in a particular region of the Russian Federation depends on the decision of local authorities. They are the ones who establish the types of activities (according to OKUN and OKVED) that are subject to tax holidays. Thus, the law on tax holidays will not apply in all regions.

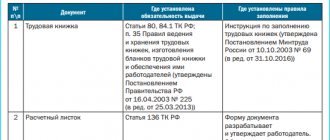

It should be noted that the essence of the law is that for individual entrepreneurs who work on the patent and simplified tax system, the rate is 0%. At the same time, insurance contributions to the Social Insurance Fund and the Pension Fund for oneself and for employees, tax reporting and personal income tax in 2020 remain unchanged.

conclusions

Not all entrepreneurs can take advantage of the right to use the tax code, and accordingly the zero tax rate on the simplified tax system or a patent. For this:

- they must be registered for the first time since the entry into force of the regional holiday law;

- they must apply a simplified taxation system or a patent;

- entrepreneurs must carry out their activities in a certain area.

Each subject of the federation has the right to independently decide whether to introduce the right to use tax codes in its region and adopt appropriate laws regulating this right.

Conditions for tax holidays for individual entrepreneurs

Tax holidays will be valid in the constituent entities of the Russian Federation from 2015 to 2020 and can be applied under the following conditions:

1. Only individual entrepreneurs who registered for the first time can use the benefit. Tax holidays do not apply to existing individual entrepreneurs. Even if an individual entrepreneur has de-registered and registered again as an individual entrepreneur, he is not subject to the law on tax holidays.

2. Entrepreneurs who have switched to the PSN or simplified tax system within two years (from the date of state registration) can apply a preferential rate. The benefit does not apply to other tax regimes.

3. The right to apply the benefit (0% rate) is valid only for the first two years of the individual entrepreneur’s activity.

4. Tax holidays for individual entrepreneurs in 2020 apply only to those entrepreneurs who operate in the following areas:

- social;

- scientific;

- production.

At the same time, the share of the individual entrepreneur’s income in the above types of activities cannot be less than 70% of the entrepreneur’s total income.

5. The authorities of the constituent entities of the Russian Federation may introduce additional restrictions at their own discretion (this may be a limit on the maximum income from the sale of goods, services or products, or a limit on the average number of employees).

Who can go on vacation

From January 1, 2020, constituent entities of the Russian Federation received the right to establish a zero tax rate for individual entrepreneurs registered for the first time. Corresponding amendments to the Tax Code of the Russian Federation were introduced by Federal Law No. 477-FZ dated December 29, 2014 (see “Tax holidays for individual entrepreneurs: who can avoid paying taxes”).

ATTENTION. Tax holidays have been introduced only for individual entrepreneurs. Organizations are not entitled to receive tax exemption.

According to the provisions of the Tax Code of the Russian Federation, tax holidays can be used by individual entrepreneurs who comply with the following requirements:

- the entrepreneur registered for the first time after the regional law on tax holidays came into force;

- The individual entrepreneur works on “simplified” or PSN;

- an entrepreneur conducts business in the production, social or scientific sphere or provides personal services to the population (specific preferential types of activities are determined by the authorities of the constituent entities of the Russian Federation in accordance with OKVED);

- income from activities transferred to the simplified tax system constitutes at least 70% of all income of individual entrepreneurs (no such restriction has been established for the simplified tax system).

Maintain separate accounting when combining simplified taxation system and PSN and prepare reports

Regions also have the right to set their own requirements. The laws of constituent entities of the Russian Federation on the introduction of tax holidays may provide for:

- restrictions on the average number of employees of an entrepreneur;

- maximum income from “preferential” types of activities.

If an individual entrepreneur violates any of the listed restrictions, then taxes under the simplified tax system and PSN will need to be recalculated for the entire tax period (calendar year) at regular tax rates.

IMPORTANT. Tax holidays apply to taxes paid under the simplified tax system and special tax system. They do not exempt entrepreneurs from paying other taxes (excise taxes, land, transport taxes, etc.) or from paying insurance contributions to extra-budgetary funds. In addition, entrepreneurs using the simplified tax system are required to submit tax reports with zero indicators.

Keep records and submit zero reports according to the simplified tax system (for new individual entrepreneurs - a year free of charge)

Tax holidays for persons using PSN

It should be taken into account that PSN can be used by self-employed citizens. Thus, an individual who does not have hired employees has the right to apply PSN without registering with the tax office as an individual entrepreneur.

This category of taxpayers can count on obtaining a patent to conduct business in a simplified manner.

For all persons working on PSN, the tax payment deadline has been extended. That is, if the patent was received for the period:

- up to 6 months - payment of the tax in full must be made no later than the expiration of the patent;

- from 6 to 12 months - 1/3 of the tax amount is payable 90 days after the patent begins to be valid. The remaining 2/3 of the tax amount will need to be paid no later than the expiration of the patent (no later than 30 days before the expiration of the patent).

Tax holidays for small businesses in 2020

In accordance with Decree No. 98-r dated January 27, 2015, the following measures are provided to support small and medium-sized businesses in 2020:

1. For individual entrepreneurs using the simplified tax system: granting the right to local authorities of the constituent entities of the Russian Federation to lower the tax rate from 6% to 1% (for individual entrepreneurs with the object of taxation “income”).

2. For individual entrepreneurs on PSN:

- the list of permitted activities has been expanded;

- granting the right to constituent entities of the Russian Federation to reduce the maximum amount of potential income per year for individual entrepreneurs (from 1 million rubles to 500,000 rubles).

3. For individual entrepreneurs on UTII: granting the right to local authorities of constituent entities of the Russian Federation to lower the tax rate from 15% to 7.5%.

4. Increasing the maximum values of revenue from the sale of goods and services for classifying business entities as small and medium-sized businesses by 2 times:

- for micro-enterprises - from 60 to 12 million rubles;

- for small enterprises - from 400 to 800 million rubles;

- for medium-sized enterprises - from 1 to 2 billion rubles.

Registration of tax holiday benefits for individual entrepreneurs in 2020

In order to apply for benefits, you must complete the following steps:

1. After registering an individual entrepreneur, submit an application for transition to the Simplified taxation system within one month.

2. During the tax holiday, it is necessary to submit reports with a tax rate of 0%.

3. If a patent is purchased, then its zero value must be indicated in the reports.

Please note that in each region where the 2020 small business tax holiday is available, there are certain conditions that are subject to adjustment by the federal authorities.

For example, in St. Petersburg, tax holidays for individual entrepreneurs using the simplified tax system came into force in 2020. In the Altai Territory, a zero tax rate is provided only for persons who work for PSN. In the Vologda region, a zero tax rate is provided only for persons who work for PSN.

Which entrepreneurs can apply 0% rates under the simplified tax system and special tax system?

First of all, in the region where the entrepreneur is registered, a law must be passed to reduce the rate in accordance with Federal Law 477-FZ. At the time of writing this article, laws have been adopted in 57 regions. But some laws will come into force only in 2016 (for example, in St. Petersburg, Irkutsk, Nizhny Novgorod regions and the Republic of Kalmykia). And in some regions, laws relate to only one taxation system - in St. Petersburg, the Volgograd region and the Krasnodar Territory only the simplified tax system, in the Altai Territory only the PSN.