An error is the incorrect reflection of the facts of economic activity in accounting and reporting. They also evaluate the situation when transactions were not recorded in accounting at all. Simply put, if, through your own fault, you made incorrect entries or did not reflect the transaction at all, or filled out the reports incorrectly, this is a mistake. This is indicated in paragraph 2 of PBU 22/2010.

But in this same paragraph of the PBU there is an important caveat. Inaccuracies and omissions in the recording of business transactions identified when receiving new information are not an error. For example, if a counterparty notifies you that he previously provided you with a primary report with incorrect data, but you have already reflected the operation in accounting, this will not be recognized as an error. After all, this was not your fault. You won't have to correct the records either.

Types of errors

The procedure for correcting errors in accounting and reporting depends on the nature of the error made and on the period in which it was made and discovered.

You may discover an error at one of the following moments.

| The moment when an error can be detected | |||||

| Until the end of the calendar year | Last year’s reporting was prepared | Last year’s reports were signed | Last year's reporting is presented to external users | Last year's reporting approved | Subsequent years |

| Year the error occurred | The year following the one in which the error occurred | ||||

Errors are divided into significant and insignificant. You will have to determine the materiality threshold yourself. After all, there are no limit values provided for in the legislation.

In this case, one must proceed from both the magnitude and the nature of a particular item or group of items in the financial statements. Specify the thresholds for the materiality of an error in the accounting policy (clause 7 of PBU 1/2008, clause 3 of PBU 22/2010).

For example, you can write down the materiality threshold as follows: “An error is considered significant if the ratio of its amount to the balance sheet currency for the reporting year is at least 5 percent.”

https://youtu.be/RIiW1pctywI

What is a material accounting error?

The main regulatory act regulating the procedure for correcting errors in accounting is PBU 22/2010 “Correcting errors in accounting and reporting” (approved by Order of the Ministry of Finance dated October 28, 2010 No. 63n). According to PBU, an error cannot be an inaccuracy in accounting or reporting that arises due to the appearance of information after the fact of economic activity has been entered into accounting.

PBU 22/2010 divides accounting errors into significant and insignificant. A significant error is one that, by itself or in combination with other errors for the reporting period, can affect the economic decisions of users made on the basis of accounting records for this reporting period.

The legislation does not establish a fixed amount of a significant error - the taxpayer must identify it independently in absolute or percentage terms. The level above which the error becomes significant must be specified in the accounting policy.

Officials in some regulations recommend setting the level of materiality equal to 5% of the indicator of a reporting item or the total amount of an asset or liability (clause 1 of Order of the Ministry of Finance dated May 11, 2010 No. 41n, clause 88 of Order of the Ministry of Finance dated December 28, 2001 No. 119n). We propose to establish simultaneously both an absolute and a relative indicator for determining a significant error. The firm can set the absolute indicator at any size.

Example of an accounting policy statement:

An error is considered significant if the amount of distortions exceeds ... thousand rubles. or the magnitude of the error is 5% of the total amount of the asset (liability), the value of the financial reporting indicator.

Read about what you need to be guided by when drawing up your accounting policies in the material “PBU 1/2008 “Accounting Policies of an Organization” (nuances).”

If an individual error is not significant, according to the established criterion, but there are many similar errors in the reporting period - for example, an accountant incorrectly takes into account personal protective equipment - then these errors must be considered in their entirety, since in total they can be considered significant.

For significant errors in accounting, separate correction rules have been established.

Error correction

Identified errors and their consequences must be corrected (clause 4 of PBU 22/2010).

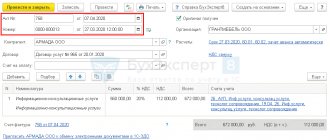

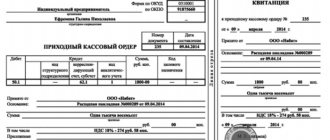

Make accounting corrections based on primary documents. Also draw up accounting statements, indicating the rationale for the corrections. This follows from the general rule that each fact of economic activity must be documented in a primary accounting document. This is directly stated in Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

Having determined the significance of the error and taking into account the moment when it was discovered, make corrections in the accounting. How exactly – the table below will help you with this.

| When and what error was discovered? | How to fix | Base |

| An error was made this year. The significance of the error does not matter | In the month in which the error was discovered, make corrections to the accounting. When generating reports, take into account already corrected indicators | Clause 5 PBU 22/2010 |

| The error occurred last year. The reporting for this period has not yet been signed by the head. The significance of the error does not matter | Make corrections in December of last year. Regenerate reporting | Clause 6 PBU 22/2010 |

| A significant error from last year was identified this year. Reporting for the past period is ready and signed, but not presented to external users | Make the necessary adjustments in December of last year. Rework the statements and re-certify them with the manager | Clause 7 PBU 22/2010 |

| A significant mistake was made last year. The reporting for this period has already been generated and signed by the manager. Reporting is presented to external users. But not approved | Correct the error in December last year. Generate the reporting again. Get it verified by your manager and present it to external users again | Clause 8 PBU 22/2010 |

| A significant error was identified in subsequent years. Reporting for the period when the error occurred was prepared, signed by the manager, presented to external users and approved | Make corrections in the period in which the error was identified. There is no need to update the reporting for the period in which the error was made. All changes related to previous periods should be reflected in the reporting of the current period. In the explanations to the annual reporting of the current period, indicate the nature of the corrected error, as well as the amount of adjustments for each item | Clause 39 of the Accounting and Reporting Regulations and clauses 10 and 15 of PBU 22/2010 |

| A minor error was identified for any prior year | Make adjustments in the period in which the error was identified There is no need to submit information about corrections of immaterial errors from previous periods in current reporting. Making changes to submitted reports is also | Clause 14 PBU 22/2010 |

What determines the order in which errors are corrected?

The procedure for correcting errors depends

on the following factors: 1. The level of significance of the error.

According to the level of significance, errors are of two types:

- Significant mistake

- Minor error.

In accordance with paragraph 3 of PBU 22/2010, an error is considered significant if it, individually or in combination with other errors for the same reporting period, can affect the economic decisions of users made on the basis of the financial statements prepared for this reporting period period.