Greetings, friends!

When choosing dividend stocks, we always look at the dividend yield; the higher it is, the more attractive the stock. But it is always important to know not the amount that the company will pay in dividends, but the amount that we will receive in our hands. The difference between the payout amount and the amount we receive is the dividend tax.

The tax on dividends from individuals is 13%, the same for legal entities. persons if they own the company for less than a year or their ownership share is below 50%.

Or, in more detail:

A 0% rate is applied to dividends of the parent company if, on the day the decision to pay dividends is made, it owns at least 50% of the organization’s authorized capital and for at least 365 consecutive days (subclause 1, clause 3, article 284 of the Tax Code of the Russian Federation).

A rate of 13% is levied on dividends from Russian and foreign organizations if the conditions before receiving a zero rate are not met. A rate of 13% is also levied on dividends received on shares, the rights to which are certified by depositary receipts (subclause 2, clause 3, article 284 of the Tax Code of the Russian Federation).

The 15% rate is intended for income in the form of dividends received by a foreign company on shares of a Russian organization, as well as dividends from participation in the capital of an organization in another form (subclause 3, clause 3, article 284 of the Tax Code of the Russian Federation).

But practice shows that the actual tax on dividends for individuals. persons is not always 13%, sometimes it is less, now let’s try to figure out what this is connected with.

Let's look at a few examples:

Lukoil

Lukoil's final dividends for 2020 amounted to 155 rubles per share

It is not difficult to estimate in theory what tax we will pay:

Tax = 155 * 0.13 = 20.15 rubles.

Let's calculate how much tax should be withheld if 3 shares were purchased from us:

Tax = 20.15 * 3 = 60.45 rubles

In theory, everything seems clear, but in practice, a different amount is withheld as tax:

The tax was only 55 rubles, instead of the estimated 60.45 rubles.

This is a very interesting point, the tax turned out to be less than it should be, and our income, accordingly, is greater.

Or, if in percentage terms:

Withholding tax (%) = 55 / 465 = 11.83% instead of 13%

https://youtu.be/BK3108JrNGY

Taxation of dividends

When paying dividends to the founders, the JSC or LLC must calculate, withhold and transfer the appropriate taxes to the budget. The company performs the duties of a tax agent, regardless of the taxation regime it applies (OSNO, USN, UTII, or Unified Agricultural Tax), and the taxpayer is the recipient of dividends.

The founders of the company can be both organizations and citizens - individuals. For dividends paid, taxation in 2017 includes: income tax withheld for legal entities and personal income tax withheld for individuals. The tax rate will depend on whether the founder is a resident or non-resident, Russian or foreign organization.

MTS

The portfolio contained 400 MTS shares, the dividend for 2020 was 19.98 rubles:

Net income (NI) is income after payment of tax on dividends.

ND per share = 19.98 * 0.87 = 17.38 rubles.

BH = 19.98 * 0.87 * 400 = 6953 rub.

In fact, the amount received after tax withholding:

Tax withheld (%) = (19.98 * 400 – 7034)/(19.98 * 400)*100 = 11.99% (again below 13%).

Concept of dividends

In taxation, dividends mean the income that the owner of a legal entity receives when distributing the resulting profit. For example, in a joint-stock company dividends are paid to participants, and in an LLC, profits are usually distributed among the founders according to the available shares. Profit is paid to both individuals and legal entities. But now they have the obligation to pay taxes: for individuals - personal income tax, and for legal entities - income tax.

Tax rates on dividends of legal entities and individuals

| Participant | Income tax | Personal income tax |

| Russian organizations that have a share of 50% or more in the authorized capital of an LLC paying dividends for a period of at least 365 calendar days before the decision to pay dividends is made | 0% | — |

| All other Russian organizations | 13% | — |

| Foreign organizations | 15% or the rate provided for by international agreements | — |

| Residents of the Russian Federation | — | 13% |

| Non-residents of the Russian Federation | — | 15% |

AFK System

The most striking example of this “tax maneuver” is AFK Sistema. The approved dividend should be 0.11 rubles per share:

There were 12,000 shares in the portfolio. After simple calculations, we get the amount of dividends that we should receive after paying tax:

BH = 12,000 * 0.11 * 0.87 = 1148.4 rubles.

But it wasn’t exactly the same amount, but again a larger one:

Let's calculate how much the tax was in this case:

Withholding tax (%)= (12,000 * 0.11 – 1320) / (12,000 * 0.11) = 0%

Oh, how, the tax on dividends was not withheld at all...

This indicates that the company received dividends from other legal entities, the ownership share of which does not exceed 50% or the holding period of which is less than 365 days. In other words, legal entities that paid dividends to the System were required to withhold tax on the dividends paid. But Sistema is paid dividends by MTS, Detsky Mir, Etalon Group and non-public subsidiaries, and their ownership share exceeds 50% and the period exceeds 365 days; according to tax law, dividends from these companies must be taxed at a zero rate for the System.

And if AFK Sistema receives dividends from its subsidiaries without paying taxes (paying at a zero rate), then they should take 13% from us, but they don’t take it... In general, it’s not a question, it’s a problem...

Let's try to figure it out, look in detail at the ownership structure of MTS:

It turns out that MTS AFK Sistema directly owns only 44.36%, the rest is owned through its subsidiaries (in total Sistema's share is 50.01%).

And here, it would seem, it is extremely illogical to own MTS indirectly with a share of 50+%, because have to pay tax on dividends received. MTS is an asset that provides the bulk of System's income, paying it about 25-26 billion rubles per year in dividends. But the fact remains that, just in case, I decided to clarify this issue in the AFK System, because... According to reporting, taxes are not described in detail, and this is what they told me:

It's nice when people communicate with you on behalf of the company; you feel like a real shareholder).

Thus, even if the System distributes in the form of dividends the entire amount it receives from MTS, tax will not be withheld from them (put a plus sign in front of the System ;)).

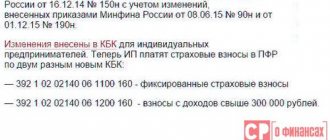

What does the tax code tell us about this?

Tax on dividends

Let's turn to the tax code and try to understand the current situation, why the tax office takes less from us than it should in theory.

Let's take a look first at the dividend tax calculation algorithm:

We have already figured out that when receiving dividends from a company that itself receives dividends from other companies and pays a tax on them other than 0%, we do not pay the 13% tax again, in order to avoid double taxation. From the formula above, dividends from other companies are exactly D2. This is the case when knowledge of the laws exempts you from responsibility ))) joke.

Let's look at this formula with an example of how it works:

Company A received 1,000,000 rubles in dividends from company B with a tax rate other than 0%. Company A also decided to distribute 2,000,000 rubles as dividends. At the same time, company A has 2 owners (for simplicity), Ivanov I. with a share of 30% and Petrov P. with a share of 70%.

The question is, what amount of tax will Ivanov I. pay on the amount of dividends?

So, according to our formula we get:

Tax from Ivanov I. = 30% *(2,000,000 – 1,000,000)*13% = 39,000 rub.

If company A did not receive dividends from company B, from which tax was already withheld, or received them at a 0% rate, then the tax would be:

Tax from Ivanov I. = 30% * 2,000,000 * 13% = 78,000 rub.

Here are some interesting facts.

How to report taxes on dividends

It is important for a tax agent not only to correctly calculate taxes on dividends, but also to report them to the Federal Tax Service.

Income tax on dividends paid to domestic companies is reflected in the usual “profit” declaration:

- The tax calculation itself is in section A of sheet 03;

- breakdown of dividend recipients - in section B of sheet 03;

- amounts payable - in subsection 1.3 of section 1.

For information on the rules for entering data on dividends into the income tax return, read the material “How to correctly fill out the income tax return when paying dividends.”

For the tax on dividends of foreign companies, a tax calculation (information) is provided on the amounts of income paid to foreign organizations and taxes withheld. Its form was approved by order of the Federal Tax Service of Russia dated March 2, 2016 No. ММВ-7-3/ [email protected]

The deadlines for submitting a profit declaration and tax calculations coincide (clause 4 of Article 310 of the Tax Code of the Russian Federation). Their last date is defined as the 28th calendar day from the end of the reporting period (clause 3 of Article 289, clause 2 of Article 285 of the Tax Code of the Russian Federation), and for the annual report - as March 28 of the next year (clause 4 of Article 289, Clause 4 of Article 310 of the Tax Code of the Russian Federation).

For more information about the deadlines for reporting profits, read the article “What are the deadlines for filing income tax returns?” .

Dividends paid to individuals are reflected in 2-NDFL certificates, annually submitted to the Federal Tax Service and handed over to the individual (clauses 2, 4 of Article 230 of the Tax Code of the Russian Federation). If information on the payment of income is submitted by a tax agent recognized as such under Art. 226.1 of the Tax Code of the Russian Federation (transactions with securities, derivative financial instruments, payments on securities of Russian issuers), and this agent submitted to the Federal Tax Service data on payments made as part of the profit declaration submitted by him (in Appendix 2 to it), then certificates 2- He does not need to submit personal income tax to the Federal Tax Service (clause 4 of Article 230 of the Tax Code of the Russian Federation, letter of the Federal Tax Service of Russia dated 02.02.2015 No. BS-4-11 / [email protected] ).

Regarding reporting in Form 2-NDFL, see the article “What is the reporting period for personal income tax? When should I submit my reports? .

And about how dividends will be reflected in the 6-NDFL form, read the material “How to correctly reflect dividends in the 6-NDFL form?”

“Was there a boy” (c)?

Let's use the example of MTS and its reporting for 2020 to try to trace what happened with dividends and whether this theory works in practice.

So, for the 1st half of 2020, the dividend payment was 2.6 rubles per share, the portfolio included 350 shares.

BH (theoretical) = 2.6 * 0.87 * 350 = 791.7 rubles.

But theory again diverges from practice, and in fact it came:

Withholding tax (%) = (2.6 * 350 – 809) / (2.6 * 350) = 11% (instead of 13%).

Once again we see that fewer taxes have been withdrawn, this is nice).

Let’s try to calculate the difference, how much the tax office “lost,” but more precisely, it received this money, just not from us.

The number of MTS shares in circulation is 1,998,381,575 .

My profit from tax for the 1st half of 2020:

Profit (per 1 share) = (2.6 * 350 * 0.87 – 809)/350 = 0.05 rubles (rounded)

Similarly, the profit per share from dividends for 2020, as you remember (there was an example at the very beginning of the article), the calculated dividend should have been 6953 rubles, but it was 7034 rubles, only there were already 400 shares in the portfolio.

My tax profit for 2020:

Profit (per 1 share) = (7034 – 6953) / 400 = 0.2 rubles (rounded).

The total profit for the year was thus: 0.2 + 0.05 = 0.25 rubles.

Let's now try to restore the amount on which tax should have been withheld when receiving dividends from MTS itself.

1,998,381,575 * 0.25 / 0.13 = 3,843 million rubles. (rounded)

Or, in other words, MTS companies had to pay dividends in the amount of 3,843 million rubles, moreover, from a company that MTS itself owns less than 50%.

Open the DDS report and find there the line “Dividends received”

Yes, indeed, there were dividends, and our calculated figure turned out to be very close to the real value, 3,726 million rubles against 3,843 million rubles. (I simply rounded the numbers up when making calculations). The company can also take into account dividends received in previous tax periods, which may also be why there is a small difference, but these are nuances.

Next, we look at what kind of ownership structure MTS has, which subsidiaries are included in it, and select those whose participation share is less than 50% (for the above reasons):

We see a subsidiary in the structure, which is accounted for using the equity method of MTS Belarus; we find in the reporting information about dividends received from it:

Those. the bulk of the dividends received by MTS (from subsidiaries that are not consolidated) comes from MTS Belarus - RUB 3,691 million versus RUB 3,726 million.

Well, I think the idea is clear, I won’t bore you with calculations anymore).

Payment of personal income tax on dividends in 2020

Article 43 of the Tax Code of the Russian Federation “Dividends and Interest” recognizes as dividends any income (even from sources outside Russia) that was received by a shareholder or participant in the distribution of the organization’s profit after taxation.

This is important to know: Personal income tax payment for July 2020

Federal Law No. 424-FZ of November 27, 2018 introduced a paragraph into Article 250, paragraph 1 of the Tax Code of the Russian Federation, which established that from January 1, 2020, dividends also include income in the form of property received by a participant upon leaving the organization or upon its liquidation.

In accordance with the current legislation of the Russian Federation, individuals must pay income tax on dividends received. Paying personal income tax on dividends differs from paying personal income tax on income received in the form of wages. From this article, the reader will learn about the personal income tax rate on dividends, on which BCCs and within what time frame to pay income tax in 2020.

Lifehack

The easiest way is to make some kind of reminder about the size of the divs that should come to the account for those shares that are already in the portfolio. To keep an eye on those companies who are giving away a little more money than we planned to receive (no, I’m not talking about Gazprom).

This can be controlled simply, as we have already discussed above, just create a column with the formula:

Expected dividend amount = Number of shares owned * expected dividend (per 1 share) * 0.87

From now on, everything will be calculated automatically for all shares. When declaring divs, you only need to enter them in the appropriate column, for me it is “Dividend 2019”, for convenience, I also enter the cut-off date.

And when receiving dividends, before entering them in the required column, we compare whether they meet expectations or not. If the amount received is greater than the calculated amount, then we are happy, you now already know the reasons.