Car leasing. What is this?

Car leasing means receiving a car under a leasing agreement concluded with a leasing company for temporary possession and use with the possibility of subsequent purchase of the vehicle.

As a result, the vehicle can become the property of the entrepreneur - this is a key difference from classic rental. After signing the leasing agreement, the business owner begins to use the car, but does not become its owner. Until the amount under the lease agreement is paid, the company acts as a lessee. An important point is that if the individual entrepreneur cannot continue paying, then the leasing organization seizes the car.

Leasing for individual entrepreneurs: basic conditions

Leasing companies impose a number of conditions on individual entrepreneurs that must be met in order to take advantage of the benefits of this agreement:

- The business must have at least three months of successful operation.

- The total operating experience of the business is at least six months.

- It is necessary to provide documents confirming the status of an individual entrepreneur.

- The lessee must be at least 21 years old.

- If the subject of the contract is a car, then you will need to make a down payment - about 20 percent of the cost of the car itself.

Differences between leasing and lending

There are several key differences that can help you decide which service to choose.

| Leasing | Credit | |

| Participants in the operation |

|

|

| Ownership | Until the debt is fully repaid, the vehicle is the property of the leasing organization | The vehicle becomes the property of the loan recipient, but there are restrictions on use |

| Application processing time | 1-5 days | 15-60 days |

| Package of documents | Minimum package, since the vehicle remains the property of the lessor, thereby minimizing its own risks | Large package, including confirmation of financial status, income stability, guarantee |

| Additional expenses | Any financial expenses: insurance, state registration, maintenance are offered by lease. company with discounts up to 10%. All expenses can be included in the monthly payment under the contract | All costs are borne by the loan recipient |

| Contract term | From 1 to 5 years | From 1 to 3 years |

| Pledge | Not required | The car itself acts as collateral |

Who provides car leasing

Lessors can be state or private companies . Almost every credit institution offers leasing services. Insurance companies offer favorable offers for car rentals.

Attention! Differences may be in the terms of the agreement and requirements for the client.

The down payment may also differ, ranging from 10 to 30% . The service can be provided in different currencies. Companies lure customers with flexible payment schedules. The leased object is movable and immovable property.

How does leasing work?

- First, the client selects the desired car from the seller;

- The client sends a request to the leasing organization for a preliminary calculation of the leasing transaction;

- The client provides the leasing organization with a package of documents;

- The organization evaluates the financial condition of the individual entrepreneur;

- If the decision is positive, the parties sign a leasing agreement;

- An individual entrepreneur transfers an advance payment under the agreement;

- The organization purchases vehicles and transfers them to the client for possession and use;

- The individual entrepreneur makes monthly payments under the concluded agreement;

- Upon completion of payments, the businessman can buy the car or return it back to the company.

What special equipment can be purchased on lease?

Road

It is used for construction, repair and restoration of road surfaces. This work involves the use of a whole complex of specialized equipment that was developed and intended for road construction:

- earth cultivators;

- excavators;

- bush cutters;

- cutters;

- asphalt pavers;

- skating rinks;

- other types of road special equipment.

Special equipment for construction

This is a wide group of equipment and machines, the direct purpose of which is the construction and destruction of buildings and various types of structures. Specialized equipment can be on tracks for movement in difficult conditions or on wheels. This class includes:

- bulldozers;

- pile driving machines;

- concrete mixers;

- dump trucks;

- mechanisms for installing electrical communications, etc.

Municipal special equipment for housing and communal services

The main task of these machines is to clean city yards and streets and quickly eliminate the consequences of accidents and natural disasters in residential areas. This category includes:

- street sweepers and snow removal machines;

- sewage disposal equipment;

- sludge pumping machines;

- garbage trucks, etc.

Production special equipment

A large group of equipment that is involved in the extraction of mineral resources, as well as in the production process at enterprises in the mining and production sectors:

- loaders of various types;

- logging equipment;

- machines for working in quarries;

- drilling rigs;

- mobile technology.

Special cargo transport

A wide category of specialized vehicles designed for transportation and towing of various types of cargo on roads and off-roads, on water and in the sky. These include:

- tractor units;

- trucks;

- tugs;

- air transport for cargo transportation;

- tankers of various tonnage, barges, etc.

Lifting technology

These mechanisms and equipment are designed for lifting and lowering various loads. The category includes:

- forklifts;

- cranes on wheels, tracks, rails;

- manipulators.

- bridge structures, etc.

Agricultural special equipment

It is used for work in the fields, in poultry farming, livestock farming, and is indispensable for harvesting and processing crops, and transporting agricultural products. This category includes:

- seeders, mowers;

- elevators, etc.

The best manufacturers of special equipment

The domestic market for special equipment includes brands of Russian and foreign manufacturers, which differ in technical characteristics and cost. Before choosing special equipment to lease, you need to thoroughly study the offers on the market.

We offer a list of the largest foreign suppliers of specialized equipment: Hyundai, Hitachi, Komatsu, Volvo, Caterpillar, Zoomlion, Terex, Liebherr, etc. American, Japanese and Chinese equipment manufacturers are rightfully considered the leaders.

The equipment of Russian companies is actively used only in the Russian Federation and the CIS. The largest and most popular brands today are KAMAZ, Gorky Automobile Plant GAZ, Chelyabinsk Tractor Plant, Combine.

Equipment selection parameters

When choosing equipment to perform various production tasks and increase the financial efficiency of a business, you need to pay attention to the following parameters:

- Dimensions and weight of cars.

- Efficiency.

- Fuel consumption.

- Maintainability and availability of spare parts.

High-quality equipment from the industry’s flagships is developed using innovation, so with equal sizes it will be many times more effective than cheaper and “simplified” analogues.

As you can see, leasing is a simple and affordable form of financing that does not require special efforts or large expenses from the lessee at the beginning of the transaction. Through leasing, you can expand and update your production base and fixed assets, which will increase financial efficiency and business returns. And you can make regular lease payments from the profit generated by special equipment purchased on lease.

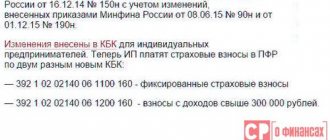

Car leasing for merchants on a simplified taxation system

The differences for this type of individual entrepreneur lie in the documentation. Due to simplified taxation, it is impossible to confirm the financial condition in the form required by the leasing organization. In addition, businessmen using the simplified tax system submit reports once a year, and it is also impossible to provide, for example, reports for a quarter or half a year. Therefore, the company financing the purchase of a car through leasing insures itself by increasing the amount of the advance payment.

Positive aspects of car leasing for individual entrepreneurs:

- Down payment from 10%;

- Prompt receipt of a vehicle for use;

- There are fewer documents compared to car loans;

- The contract is drawn up for a longer period (up to 60 months), which reduces the amount of monthly payments.

Negative sides

- The car is not the property of the entrepreneur until the lease agreement is executed and the car is purchased by him.

Design features

You can conclude an agreement with any leasing company or bank that provides such services. The deal has similarities with loan and lease agreements. For individual entrepreneurs, the registration process is somewhat different due to the specific legal status. Car leasing for individual entrepreneurs can be arranged without a down payment.

https://youtu.be/L8LGZv4tY3g

Required documents

The list may differ depending on the lessor company and the financial status of the individual entrepreneur. The general list of documents is as follows:

- passport (valid, original);

- certificates of registration and entry of data into the Unified State Register of Individual Entrepreneurs;

- declarations marked by the Federal Tax Service;

- certificate of movement of funds in the account from the bank;

- accounting reporting.

Some organizations may request documents on the credit obligations of an individual (client) and the availability of property. The nuance is that the individual entrepreneur is liable for debts with all his property, so it is important for the lessor to make sure of the financial stability of the applicant. Additional documents may be the conclusion of an audit firm, data on current contracts, and contractors of the entrepreneur.

Conclusion of an agreement

The transaction is completed in several stages. First you need to decide on the leased object. It is important to consider that the selected equipment may not meet the company's requirements. For example, many rental companies have a list of vehicles that are recommended for transportation work. These include KAMAZ trucks, GAZelles, and middle-class taxi models.

Main stages of concluding a contract:

- Collection of documents;

- Submitting an application;

- Review of conditions, checking the client’s solvency;

- If the decision is positive, a date is agreed upon and the contract is approved by both parties (one copy for each participant with “living” seals and signatures of individual entrepreneurs and directors);

- The leased object is purchased from the seller;

- The property is transferred into the possession of the tenant, and a transfer and acceptance certificate is signed.

The final stage of the transaction is the re-registration of the item into the ownership of the recipient (for example, registration with the traffic police if a car is purchased on lease for an individual entrepreneur).

Attention! It is necessary to make payments on time according to the developed schedule. If the terms of the contract are violated, the lessor has the right to withdraw the object and terminate the agreement.

How are payments made under the contract?

A leasing agreement, as a rule, provides for 4 types of payments (although this division is rather arbitrary):

- Advance payment;

- Commission;

- Monthly payments;

- Redemption payment.

Payment schemes:

- Annuity – the same amount of monthly payment throughout the entire term of the contract;

- Differentiated - a different amount of monthly payment during the term of the contract (by reducing interest on the amount of the principal debt).

Advantages of finance lease

Financial organizations that provide leasing services for special equipment cooperate with equipment suppliers, which guarantees more favorable conditions for its purchase. Manufacturers offer discounts, thanks to which the increase in the cost of the transaction is reduced to zero.

Due to the refund of value added tax for special equipment, the lessee has the opportunity to save 20%. Accounting for leasing payments as an expense item reduces the tax base.

You can purchase the necessary equipment quickly and without withdrawing large sums from circulation. The application is processed within 3–7 days, and in some companies within 1 day. After which the equipment is purchased by the leasing company and delivered directly to the lessee.

Application for leasing

Fill out the form online and we will select a profitable and suitable leasing program

Submit your application

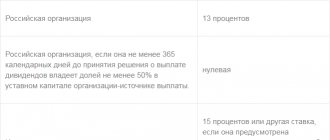

VAT compensation

- For individual entrepreneurs that operate under the general tax system (OSN), leasing is very profitable. The cost of the leased item under the contract includes VAT, but the entrepreneur can receive a tax deduction of 20%;

- Entrepreneurs working under the simplified tax system “INCOME-EXPENSES” take into account leasing payments including VAT in their expenses, as a result of which the tax is reduced;

- Entrepreneurs working on the simplified tax system “INCOME” make payments for leasing from the company’s revenue, so these payments do not affect the amount of tax.

Differences between car leasing and car loan

Our clients have at their disposal passenger cars of domestic and foreign production with a maximum permissible weight of up to 800 kg or 8 passengers.

With the help of our company, you can lease either one unit of equipment or fully equip your fleet. We present cars of such famous brands as Nissan, BMW, Audi, Mercedes-Benz, Land Rover, KIA, Ford, Renault, Volkswagen, GAZ, VAZ (Lada), UAZ and others.

Insurance in the OSAGO and CASCO systems is one of the most important conditions for the purchase of passenger vehicles. The insurance contract must cover the entire rental period, and the insured amount must cover the cost of the leased object.

There are different types of leasing. If the subject of the contract is a vehicle, the term “car leasing” is used. This type, in turn, is divided into leasing of cars, trucks, etc. Car leasing is a special form of relationship between the lessor and the lessee. It combines the concepts of credit and lease. The scheme for car leasing for individual entrepreneurs is as follows:

- The lessee (in this case, the individual entrepreneur) selects the vehicle he needs.

- The lessor buys this vehicle from the dealer and provides it for use by the individual entrepreneur.

- After transferring the vehicle for use to the individual entrepreneur, the latter pays a certain amount of funds every month, which, being a rental payment, simultaneously repays the lessor’s costs for purchasing the car.

- After the expiration of the period specified in the contract, the individual entrepreneur has the right to purchase the property or can extend the validity of the document.

This is what the provision of a vehicle to an individual entrepreneur under leasing terms looks like in general terms. Today, such a service is provided by banking organizations and specialized companies (in most cases they are intermediaries between financial institutions and lessees).

Typically, the lessee is required to make a down payment, which is equal to a certain percentage of the cost of the car. But not all companies operate under such conditions. In any case, leasing a car for an individual entrepreneur is an opportunity to get the necessary vehicle without significant one-time expenses. The funds that would be used to buy a car can be used to expand the business.

- With a car loan, a citizen receives money for use; with leasing, he receives movable property.

- Leasing involves the signing of contracts by three parties: the dealer who provided the car, the lessor and the lessee. When applying for a car loan, the parties to the agreement are a financial institution and an individual entrepreneur.

- Long-term lease with the right to purchase is not accompanied by the accrual of additional commissions, which is often practiced by banking organizations.

- The standard term of a car loan is about 3 years. In the case of leasing – up to 5 years.

- When purchasing a vehicle, an individual entrepreneur can pay for its insurance by making a one-time payment or spreading payments over a long period. Banking organizations do not provide their clients with such a choice.

- When leasing, an individual entrepreneur has a choice after the expiration of the contract: buy the vehicle (often at a symbolic cost) or return it and conclude a new contract regarding another vehicle.

Since a car loan involves the provision of funds, and not a vehicle, the borrower needs to repay not only the loan body, but also the accrued interest rate. In the case of leasing, interest is not charged. However, the individual entrepreneur will have to pay for the fact that the company purchased a car for him. Instead of an interest rate, leasing organizations take advantage of the rise in price of the leased object.

- the opportunity to obtain equipment for short-term use if, after a certain period of time, it becomes unnecessary;

- in order to obtain transport you need to provide fewer documents than to apply for a loan;

- in the case of a rental relationship, the car does not become the property of the lessee and, accordingly, is not listed on the balance sheet of the enterprise. This circumstance affects the amount of taxes collected from individual entrepreneurs;

- In the event of damage to the vehicle, proceedings with the insurer are carried out by the lessor, and not by the individual entrepreneur.

Despite the obvious advantages, leasing also has certain disadvantages. The following should be noted:

- although leasing is not a form of lending, an individual entrepreneur still overpays for the vehicle;

- Since the car belongs to the lessor, he has the right to impose certain restrictions on its use. For example, it is possible to limit the maximum annual mileage;

- the lessor may terminate the contract with the individual entrepreneur without returning the funds paid by the individual entrepreneur. This can be done without going to court.

Thus, today it is possible to lease a car for an individual entrepreneur. The pros and cons of this method given above will allow you to evaluate the advantages and disadvantages of car leasing. If an individual entrepreneur decides to use leasing, he can contact a subsidiary of one of the Russian banks or use the services of specialized companies. Some vehicle manufacturers have their own leasing companies (for example, KamAZ).

The number and list of documents that are required to buy a prestigious car or truck on lease are almost the same:

- An official application, which is signed on behalf of the legal entity by its director;

- A special questionnaire indicating the car model, wishes and requirements of the enterprise;

- A copy of the statutory documents;

- Copies of orders on the appointment of a manager;

- Copies of his personal documents (passport);

- A copy of the certificate confirming the chosen taxation system;

- Balance sheet or other financial documents (upon request);

- Certificates from the bank about existing existing accounts.

The leasing company may require other documentation at its discretion: certificates from credit institutions, a letter of guarantee or justification for the need to purchase a new unit for the fleet. This is due to the instability of the last period and the desire of the lessor to protect itself from a failed transaction. Providing a complete package will speed up the review of your application and help you receive a positive response.

In order to lease a car, you need to choose a company with the most acceptable program conditions. After that, you visit the organization’s website and fill out an online application. The following information must be reflected in electronic form: Full name. (or company name - for legal entities), date of birth, contact details, your location, the leased item (for example, a car), its cost and the amount of the advance payment.

After filling out, you submit the application for consideration and wait for feedback from a company representative. The manager will agree on some issues and, if everything is in order, will invite you to the office to conclude the deal. In some organizations, it is possible for an employee to travel to a client. Next, you need to prepare a package of documents, on the basis of which the company decides to purchase a vehicle from a dealer or refuse to lease you.

If the decision is approved, you agree on the terms of the transaction, sign the contract and make an advance payment. The leasing company buys a vehicle that you can take back for your use.

Almost any commercial activity is not complete without the use of vehicles - cars, trucks, special equipment, etc. A car can be bought or rented. At the same time, leasing for legal entities. persons - the optimal solution for buying a car.

The company has the opportunity to use transport in its activities without incurring significant expenses, and also receives certain tax preferences. Purchased cars are on the balance sheet of the leasing company during the entire period of the contract. Standard leasing schemes allow you to profitably purchase not only new models, but also used cars, i.e. used cars or trucks.

Car leasing allows enterprises to conduct business as quickly as possible. All necessary documents and transactions are carried out, as a rule, within 2 - 3 days.

You can lease a new car, truck or used car, but under certain conditions. Vehicles are purchased only in good condition; their service life should not exceed 5 - 7 years.

Leasing or car loan

What is more profitable – a car loan or leasing? To make it easier to find the answer to this question, we present the main characteristics of these financial transactions in the table.

| Characteristic | Leasing | Car loan |

| An initial fee | Usually 20-30% | Most Russian banks require 10-20% |

| Depreciation expenses | Possibility of accelerated depreciation calculation. This ensures savings on income taxes | Depreciation is calculated according to the standard scheme |

| Property tax | Paid by the lessor while the car is on its balance sheet | Since the borrower is the owner of the car, he pays this tax |

| Fees for maintaining, opening and servicing an account | Most lessors do not charge | As a rule, there are |

| Attribution of debt repayment expenses to the costs of the borrowing organization | The entire volume of leasing payments is included in expenses | The cost category includes only interest payments on the loan. |

| On the balance sheet of which company is the purchased car located? | Until the individual entrepreneur repays the debt, the car is on the balance sheet of the lessor | Balance holder – individual entrepreneur |

| Payment schedule | Adapts to the financial capabilities of the individual entrepreneur | Hard |

| VAT | Subject to reimbursement after each payment under the leasing agreement | Paid when buying a car on credit in a lump sum |

Thus, if the amount of the advance payment is acceptable for an individual entrepreneur, leasing becomes an excellent alternative to a car loan. This topic is covered in more detail in the publication “Car Loan or Leasing.”

Who can be a lessor

- State leasing, “VTB-leasing”, “Web-leasing”, etc.);

- Private leasing organizations (“Europlan”, “Baltic Leasing”, “Reso-leasing”).

There are usually three parties involved in a leasing agreement:

- Seller – the party who sells the property;

- Leasing company – the party acquiring the property;

- The recipient is an individual to whom the leasing company leases the property for use with the option of redemption.

The seller and the leasing company can act as one legal entity.

As a rule, a car is not provided for long-term lease without guarantees of solvency and reliability of the Recipient. Therefore, those wishing to lease a car are subject to a number of requirements:

- Russian citizenship;

- age from 20 to 60 years;

- driver's license;

- confirmed regular income.

If all the requirements are met, we move on to choosing a leasing company.

Long-term financial lease programs may be included in the list of products not only of specialized leasing companies, but also of banking organizations. Let’s start with the latter with a brief overview of the options available in 2020.

VTB 24

VTB 24, which is part of the unified structure "System Leasing 24", deals with the sale of cars on lease. Businessmen can take advantage of the following offers:

- “Express leasing”.

- “Operational leasing”.

- “Universal leasing”.

- “Used cars and equipment.”

- “Leasing a used car.”

- “Cars for driving schools.”

- “UAZ for leasing.”

- “KAMAZ for leasing”.

You can familiarize yourself with the conditions of these programs in detail by studying the article “Leasing at VTB”.

Sberbank

was founded in 1993. Individual entrepreneurs are offered 4 long-term financial lease programs:

- "Vehicle leasing" The duration of the contract is from 1 year to 48 months. The maximum amount of financing is 24 million rubles.

- "Leasing of commercial vehicles." The parameters of this program are the same, except for the contract duration – 36 months. But according to its terms, the individual entrepreneur will not be able to take the car onto the balance sheet of his organization.

- "Leasing of special equipment." The maximum contract period is 36 months. In relation to the balance holder, the conditions are similar to the previous program.

- "Leasing of freight transport." Under the terms of this product, an individual entrepreneur can lease trucks from not only domestic, but also foreign manufacturers.

You will get more relevant information from the publication “Leasing in Sberbank”.

"Europlan"

Europlan finances the purchase of vehicles on lease and helps clients use them comfortably. The car leasing company offers small business representatives the following products:

- "Cars for sale";

- "Cars";

- "Special equipment";

- "Trucks".

We draw your attention to the special offers currently available at Europlan. They are covered in the article “Leasing in Europlan”.