Which organizations pay transport tax?

Do you want to easily pay and report taxes?

Use the cloud service Kontur.Accounting! The service will remind you to pay taxes, carry out calculations and automatically generate a declaration. Get free access for 14 days

Transport tax is paid by organizations to which vehicles recognized as an object of taxation are registered. Transport tax is not paid by FIFA and its subsidiaries, national football associations, the Organizing Committee "Russia 2018" and other companies specified in the Federal Law "On the preparation and holding in the Russian Federation of the 2018 FIFA World Cup, the 2020 FIFA Confederations Cup " Vehicles must be owned by the organization and used for the preparation and holding of the championship.

Increase in transport tax on expensive cars

Attention! From January 1, 2014, coefficients have been established for expensive PASSENGER cars that increase the amount of tax payable to the budget. They are listed in paragraph 2 of Article 362 of the Tax Code. For such cars, the tax amount calculated based on the car engine power multiplied by the tax rate must be multiplied by an increasing factor. As a result, you will receive the amount of transport tax payable.

The coefficients are set in the following sizes:

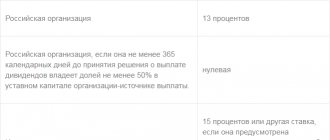

| Average cost of a car | The size of the coefficient that increases the tax amount |

| 1,1 |

| 1,3 |

| 1,5 |

| 2 |

| 3 |

| 3 |

The procedure for calculating the average cost of passenger cars is established by the Ministry of Industry and Trade of the Russian Federation (Ministry of Industry and Trade of Russia). A list of passenger cars with an average cost of 3 million rubles is posted annually no later than March 1 on the official website of the Ministry of Industry and Trade of Russia in the “Documents” section.

https://youtu.be/qHB-gaHy6Gc

Which vehicles are taxed?

The objects of taxation are cars, motorcycles, scooters, buses, airplanes, helicopters, ships, yachts and other machines and mechanisms. The following are not subject to taxation:

- rowing and motor boats with engines up to 5 horsepower;

- passenger cars equipped for use by disabled people;

- tractors, self-propelled combines, special agricultural vehicles used for the production of agricultural products;

- vehicles of federal executive authorities, where military or equivalent service is legally provided for;

- vehicles that are wanted, if the theft is documented by an authorized body.

Full list here.

Calculation example for a passenger car

In order to calculate the transport tax for a passenger car, use the following formula:

The established tax rate x the vehicle capacity x the period during which the taxpayer owns the vehicle.

For example, you can take a Russian-made passenger car, purchased by the owner in March 2013 and deregistered in September of the same year.

It turns out that the citizen was the owner of the vehicle for only seven months. The vehicle's power rating is set at eighty-nine horsepower.

The tax rate established in the region of registration of the taxpayer is thirteen rubles. From the above data you can calculate the transport tax:

13 rubles x 89 horsepower x 7/12 months = 674.9 rubles

Today, every car owner will be able to calculate the tax on a vehicle using numerous online calculators.

In addition to such sites, vehicle owners will be able to see the amount of duty on the vehicle using the official portal of the Federal Tax Service.

Knowing all the information and performance of the car, the owner will be able to calculate the duty independently. The only information that needs to be obtained when calculating is the regional tax rate.

Indeed, depending on the region in which the vehicle was registered, a certain tax rate is established when calculating the transport duty.

The increasing coefficient for transport tax in 2020 is described in the article: increasing coefficient for transport tax in 2020. Do disabled people of group 1 pay transport tax, read here.

When to report and pay transport tax

Do you want to easily pay and report taxes? Use the cloud service Kontur.Accounting! The service will remind you to pay taxes, carry out calculations and automatically generate a declaration. Get free access for 14 days

For organizations, the tax period is a calendar year, the reporting period is the first, second quarter and third quarter. The legislative bodies of the constituent entities of the Russian Federation may not establish reporting periods, but leave only annual reporting.

The deadlines for paying taxes and advance payments are also set by the regions. The deadline for paying the tax cannot be earlier than the deadline for filing the declaration, which is specified in paragraph 3 of Art. 363.1 of the Tax Code. Now it is February 1 of the year following the expired tax period.

Organizations submit a transport tax return to the tax authority at the location of the vehicles. The largest taxpayers submit declarations to the tax authority at the place of registration as the largest taxpayers.

Transport tax and advance payments are transferred to the budget at the location of the vehicles.

The location of the vehicle is recognized as:

- for water vehicles (except for small boats) - the place of state registration of the vehicle;

- for air vehicles - the location of the organization to which the vehicle is registered;

- for other vehicles - the location of the organization or its separate division under which the vehicle is registered.

What is transport tax

Transport tax is an annual fee, varying depending on the region of Russia, paid by each citizen of the Russian Federation or organization that owns a vehicle registered with the State Traffic Inspectorate.

The amount of tax directly depends on several factors:

- An increase in the power of the power unit on manufactured vehicles directly proportionally increases the cost of the rate that forms the basis of the calculation. Thus, if the power characteristics of the vehicle engine are less than 100 hp. pp., then the tax rate is either not applied to them at all, or is extremely low - 5 - 15 rubles per horse. If the car owner is an admirer of iron horses with powerful power units with a capacity of 250 horsepower or more, then he will have to fork out 50 - 150 rubles for each unit of power.

- Depending on the region of registration of the car, there are also differences in the tax base, since some subjects of the federation have a high level of urbanization, a developed network of public transport in the form of buses, trams or metro, while others are completely deprived of all amenities, which obliges the population use personal transport to survive and ensure your own movement. Thus, the tax rate is lower, the less developed the transport infrastructure in the region.

On a note! The second factor influencing this indicator is the standard of living in the region and GDP per capita, which either allows taxes to be subsidized for citizens, or, conversely, budget expenditures are so high that the rate has to be increased.

Thus, in the Magadan region the minimum tax rate is 6 rubles, in Moscow it is already 12, and in the Perm region it is even 25.

- The next factor is the increasing coefficient, expressed in the number of months per year during which the vehicle is in the possession of one owner according to the title. This indicator is taken into account only for the first year of ownership, and for subsequent years it is always equal to 1 until the car is sold to another owner, which requires paying the tax in full.

- Several years ago, a new increasing coefficient began to operate in the country, the value of which is influenced by the cost of an extremely expensive car and the year of its manufacture. If a wealthy person purchases a new business-class car that costs more than 3 million rubles, he will pay another 10 percent of his total tax on top of the base rate. If a rare, sophisticated connoisseur purchases an exclusive limousine for more than 15 million rubles, then the tax payment for him will be three times higher than the base calculation amount.

Every year, responsible tax officials, substituting these indicators, accepted according to tables, in the Tax Code of the Russian Federation, approved by tax legislation, into a special formula, calculate and assign annual penalties to drivers in the form of transport tax.

Engine over 250 hp. With.

Tax base and tax rates

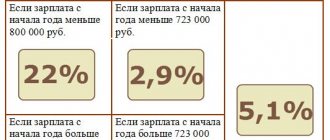

The tax base is determined separately for each vehicle. Tax rates are set in the region and depend on the characteristics of the vehicle specified in the technical documentation:

- for vehicles with engines - from the engine power in horsepower,

- for air vehicles with jet engines - from the total nameplate static thrust of the jet engine at takeoff in terrestrial conditions in kilograms of force,

- for non-self-propelled water vehicles - based on gross tonnage.

For other water and air vehicles, the unit for calculating the tax is the vehicle itself. The tax base for them is determined separately. Subjects of the Russian Federation can increase or decrease federal tax rates, but no more than ten times. For passenger cars with engine power up to 150 hp. You can reduce rates without taking into account this limitation.

Transport tax rates by region and year are given here.

It is allowed to establish differentiated tax rates for each category of vehicles, taking into account the “age” of the vehicles and their environmental class. The age of a vehicle is the number of completed years between January 1 of the year following the year of manufacture and January 1 of the current year.

If tax rates are not determined by the laws of the constituent entities of the Russian Federation, the rates specified in paragraph 1 of Art. 361 Tax Code.

How to pay transport tax

Previously, there was only one way to pay transport fees. It was necessary to come to the tax office at your place of residence and fill out declarations. Then transfer a certain amount to state details and enter a certificate of payment into the tax office.

Now you can make payments online, saving time and nerves. To do this, follow the link egov.kz/cms/ru/services/epay024_nal and click on the button shown in the figure below.

Once in the payment section, you need to fill out several forms:

- type of vehicle;

- tax office at your place of residence;

- the period for which the fee is paid;

- VIN code of the car (for cars - body number; for trucks - chassis number);

- indicate the tax amount;

- choose one of the available payment methods.

Next, confirm that the information entered is correct and fill in the payment details (card number, CV code (if required)). The payment has been processed, but how do I receive the receipt?

It's simple. Go to the “Service payment history” section and find the required statement. It can be printed and, if necessary, presented to the tax service.

A little about the tax itself and those who pay it

Before you figure out how transport tax is calculated on a car, you need to remember what it is and how it is implemented in our country. Transport tax in the Russian Federation is property tax, that is, the need to pay it appears only when there is certain property, in our case, a vehicle. Only after purchasing a car, the car tax is calculated at the rates accepted in the state. It should be understood that we will talk exclusively about individuals, and not organizations or enterprises, companies and firms that may own a car.

Need to know

In addition to the fact that transport tax is calculated only if you have a car, you should also understand that all funds collected go to regional budgets. Thus, this tax can be called regional, because the rates on it can vary significantly, as well as the categories of beneficiaries who are offered discounts and concessions, depending on the reasons for their purpose.

About taxpayers

You should always begin to wonder why, in what amount and how the tax on a car is calculated from the legislative base.

- Article 357 of the Tax Code of the Russian Federation states that the owner of a motor vehicle registered in his name is considered as a taxpayer, in accordance with the laws of the Russian Federation.

- According to Article 186 of the Civil Code of the Russian Federation, the payer is also the person who received the vehicle by proxy, but not later than 2002. However, you should know that according to the same law, the term of a power of attorney cannot exceed three full years. At this time, the deadlines for such powers of attorney have long expired, and the previous owners are recognized as the owners of the cars, therefore, taxpayers.

- According to the article, number 362 of the Tax Code of the Russian Federation, all available information on the registration of motor vehicles will be transferred to the tax service by the registration authorities themselves.

That is, any person who bought a car and registered it in their name will immediately and automatically be considered by the Federal Tax Service as a transport tax payer.

Objects of taxation

To complete the picture, it will be necessary to clearly distinguish all vehicles into those that are objects of taxation and those that are not. Let's start with the first ones: cars, motorcycles, yachts, airplanes and helicopters, scooters and buses, together with a variety of mechanical vehicles on caterpillar and pneumatic tracks, self-propelled vehicles and snowmobiles, jet skis and similar vehicles, are recognized as taxable, provided that they are not were included in the second list, which we will now provide.

So, there are categories of vehicles that are not subject to taxation. Agree, this is quite reasonable, otherwise you would have to pay even for a children’s bicycle.

- Passenger vehicles equipped specifically for people with disabilities, and also equipped with engines with a power of no more than one hundred horsepower, which is equal to 73.55 kW. This also includes all vehicles that were purchased through intervention and with funds provided by social security and protection authorities.

- Row-powered boats, as well as those equipped with engines of no more than five horsepower.

- Sea and river commercial fishing vessels, as well as those owned by anyone, but operating in the system for transporting passengers or various cargoes.

- Special machines, including milk tankers, livestock trucks, tractors, combines and others that are used in growing, harvesting and transporting products.

- Any vehicles that are located unknown where at the time of tax assessment or are listed as stolen, about which there is special confirmation from the Ministry of Internal Affairs.

- Airplanes, as well as helicopters that are assigned to medical services, as well as drilling platforms and installations.

Thus, it will not be difficult to distinguish a vehicle that is subject to taxation, especially since the law has clear instructions regarding this.