Rules for calculating insurance premiums from vacation payments

The employee's annual leave period (standard - 28 days) is paid in full based on the average daily earnings for the last 12 calendar months.

From each accrual, the employer makes contributions to various authorities. Income tax on vacation pay is withheld directly from labor remuneration and transferred to the Federal Tax Service. All other contributions are paid from the company’s funds in the following proportions of income:

- for the formation of pension provision – 22%;

- for social insurance – 2.9%;

- for compulsory health insurance – 5.1%;

- insurance for injuries and occupational diseases – from 0.2%.

In addition to annual paid leave, other types of leave are also subject to payment of contributions. But there are exceptions.

Payment and accrual of vacation pay

Every person who intends to exercise his right to rest as defined in the Labor Code is entitled to payment for days of “absenteeism.” It must be issued no later than three days before the start of the holidays - this is often what explains the reluctant change to the agreed and approved vacation schedule. Below we will talk about whether vacation pay is subject to insurance premiums, but now we will look at what and how these payments themselves consist of.

Accruals are made based on:

- billing period;

- duration of rest;

- average earnings.

The billing period generally means 12 calendar months preceding the vacation. In this case, only the days worked on which full earnings were paid are important.

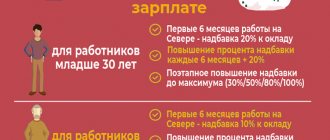

The average salary is calculated based on the value for one day, and the resulting amount is multiplied by each day of vacation. In this case, all bonuses and coefficients are taken into account: for length of service, for titles, for scientific works, and the like. Bonuses will also be taken into account if they are part of the company’s remuneration system. But all additional payments will be taken into account only once - when calculating the average amount, when calculating the actual vacation pay, no additional allowances or coefficients will be added.

When is it necessary to pay personal income tax on vacation pay?

In 6-NDFL, this tax must be included in full for the month in which the payment was made. Example of deduction Example conditions: The employee is entitled to regular leave from March 27 to April 15, 2020 inclusive (20 calendar days).

Articles on the topic (click to view)

- Fine for late payment of vacation pay

- What to do with unused vacation

- What to do if your employer does not pay vacation pay

- How long after employment is vacation allowed?

- Is maternity leave taken into account when calculating pensions?

- Accounting for compensation for unused vacation

- Dismissal while on maternity leave

- Date of actual receipt of income - .

- Personal income tax withholding date - .

- The transfer deadline is (since the last day of March is Saturday).

Useful video About the deadlines for paying personal income tax and insurance contributions from vacation pay, see the video: Conclusions The employer is required to withhold 13 percent of the tax from accrued vacation pay and pay it to the tax office.

Basic rules for calculating personal income tax

The object of taxation is the totality of all vacation payments. According to the provisions of Letter No. 8-306 of the Ministry of Finance, these funds cannot be considered as a component of salary. For this reason, personal income tax on vacation pay is calculated separately from payroll tax.

When to make tax payments?

Vacation pay is issued to the employee three days before his vacation. At the same time, income tax is withheld on the basis of Article 226 of the Tax Code of the Russian Federation. The timing of tax transfer to the treasury depends on how vacation pay is calculated:

- Cash - on the day the funds are issued or the next day

. For example, if the money was issued on Friday, the tax is paid on the same day or Monday. - When withdrawing cash from an organization's account - on the same day

. Payment of personal income tax must be carried out on the date of withdrawal of vacation funds from the organization’s account, regardless of when the money will be transferred to the employee. - Transfer to a bank card or account from a company card or account - on the day of accrual

.

IMPORTANT!

Some accountants transfer tax before the deadline for issuing vacation pay, when they are recorded in the payroll. This order is considered erroneous.

In 2020, an amendment was made regarding the tax calculation procedure. In particular, now the transfer can be made until the end of the month in which vacation pay was paid.

Let's look at an example

The employee goes on vacation on September 16, 2020. The funds are issued to him in 3 days, that is, on September 13. Personal income tax is transferred to the treasury on the day the money is actually issued. If the responsible persons did not have time to make all the necessary accruals, they can be made until September 30, 2020. The amendment has significantly simplified the work of tax agents. Now you can avoid making payments to employees, maintain accounting and tax records, and transfer personal income tax to the treasury on the same day.

When is tax paid on compensation for unused vacation?

An employee must be granted leave after 6 months of work at the enterprise. If he quits without using his right to leave, compensation is due. It is also considered employee income and therefore subject to tax.

Compensation is issued on the day of dismissal. At the same time, tax is calculated. Funds are transferred to the country's budget on the last day of the month. The compensation paid must be indicated in the 2-NDFL certificate.

What are the fees?

Are vacation pay taxable? Since vacation pay is part of earnings, the employer must include it in the calculation base and when calculating insurance premiums . If he evades this duty, he will be subject to penalties.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

The amount of vacation pay will be: 1365.2 rubles. x 14 = 38225.6 rub. 13% of this amount is 4969.3 rubles, which must be transferred to pay personal income tax.

You will learn about the deadlines for personal income tax payment in the following video:

Contributions to the Pension Fund, FFOMS and Social Insurance Fund

Is the holiday subject to insurance contributions?

Along with income tax, the employer is required to pay insurance contributions to the following organizations:

- Pension Fund.

- Social Insurance Fund.

- Compulsory health insurance fund.

Funds must be paid by the 15th of the following month . If the vacation is taken out in August, contributions from vacation pay are transferred until mid-September.

How are insurance premiums calculated from vacation pay?

At the legislative level, regulation of the mechanism for calculating and subsequent payment of insurance premiums is carried out in chapters. 34 NK.

In accordance with paragraph 1 of stat.

420 taxable objects include various types of payments to individuals within the framework of existing labor and civil law relationships. Vacation pay is subject to insurance contributions in the general manner, since it is provided to personnel under the terms of concluded employment contracts.

Amounts not subject to insurance premiums

Insurance premiums are required to be calculated on the following types of vacation pay:

- Annual basic rest - this type of leave is entitled to all employees without exception. The total duration is 28 days (calendar) per year, the right to rest for newly hired specialists arises after six months of employment with the employer (stat. 115, 122 of the Labor Code).

- Additional basic rest - such periods are issued and paid to the employee for employment in certain working conditions. For example, for working in harmful or dangerous production, at irregular hours, etc. (stat. 116, 321 TC).

- Other vacations - the employer, at its discretion, has the right to establish other types of vacation for employees that are not specified in labor legislation. The exact regulations should be approved by the company’s LNA.

This is important to know: Sample application for leave followed by dismissal

There is no requirement to charge insurance premiums on the following types of vacation pay:

- Medical leave for referral to sanatorium-resort institutions - such leave is granted to employees who have a work-related injury or occupational disease (Clause 1, Article 8 of Law No. 125-FZ).

Insurance premiums for vacation pay and compensation - examples of calculations

Let's look at how the above regulatory rules work in practice. Let’s assume that the manager of a trading company, S.V. Krivonosov, goes on annual leave with a total duration of 28 days (calendar) from April 2 to April 29, 2020. Let’s calculate the amount of vacation payments and accrued contributions by type of insurance:

- For the billing period, the accountant will take the period from 04/01/17 to 03/31/18. The period was worked by the employee in full, there are no excluded days.

- The total amount of earnings during this time is RUB 570,000.00.

- Let's determine the employee's earnings for one day - SDZ = 570,000.00 / 12 / 29.3 = 1621.16 rubles.

- Let's calculate the amount of vacation payments - OTP = 1621.16 rubles. x 28 days = 45,392.48 rub.

We will calculate insurance premiums taking into account the fact that the company applies general (not preferential) rates. The calculation of deductions was carried out in terms of pension, social and medical insurance, as well as “injuries”. Wiring – typical:

- Contributions from vacation payments to OPS were accrued - 45,392.48 rubles. x 22% = 9986.35 rubles, wiring - D 44 K 69.2.

- Contributions from vacation payments to OSS were accrued - 45,392.48 rubles. x 2.9% = 1316.38 rubles, wiring - D 44 K 69.1.

- Contributions from vacation payments for compulsory medical insurance were accrued - 45,392.48 rubles. x 5.1% = 2315.02 rubles, wiring - D 44 K 69.3.

- Contributions to NS and PZ from vacation pay were accrued - 45,392.48 rubles. x 0.2% (tariff assigned by the territorial branch of the Fund) = 90.78 rubles, posting - D 44 K 69.11.

How to calculate compensation if the employee did not take the leave required by the Labor Code? Let us assume that S.V. Krivonosov did not have time to use his vacation and quits on April 2. According to the norms of stat. 127 of the Labor Code, he is entitled to compensation payments for all unused days, that is, for 2020 and January-March 2020. In our example, this is 35 days. (28 days + 3 months x 2.33 days) The calculation is carried out according to the general rules for calculating vacation payments:

- Compensation amount = 35 days. x 1621.16 rub. (average daily earnings) = 56,740.60 rubles.

Note! When working less than 15 days. such a month is not taken into account, over 15 is taken into account. Insurance premiums are determined using the algorithm above.

Other deductions from vacation pay

In addition to income tax, contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund are subject to accrual on vacation pay amounts. Insurance premiums from vacation pay are calculated in the month in which vacation pay is calculated and are payable no later than the 15th day of the month following the month of their accrual. For example, if an employee goes on vacation from May 1 and vacation pay is accrued in April, contributions must be paid no later than May 15. The amounts of insurance contributions to the Social Insurance Fund regarding insurance against accidents at work are subject to transfer simultaneously with the payment of wages in the month in which vacation pay is accrued. Insurance premiums from vacation pay in 2020 are calculated at the following rates (with the exception of preferential and increased rates):

General rules for issuing vacation pay

Vacation pay represents financial support during vacation. Rely on employees who have worked for the company for at least six months. If an employee does not exercise his right to leave and resigns, he is entitled to compensation. The amount of vacation pay depends on the following factors:

- Duration of vacation.

- Average employee salary.

- The period for which the calculation is performed.

The amount of the employee's salary is used to calculate the tax. This amount includes bonuses and various compensations issued for the year preceding the vacation.

IMPORTANT!

Both budgetary structures and commercial enterprises and individual entrepreneurs are required to provide annual paid leave to their employees. The amount of vacation pay is calculated based on the official salary.

Types of vacations not subject to insurance contributions

Vacation pay is not subject to insurance premiums in the following cases:

- additional rest for liquidators of the accident at the Chernobyl nuclear power plant or those affected by its consequences;

- leave for sanatorium-resort treatment in health institutions due to the consequences of injury or occupational disease;

- social leaves provided to women in connection with the birth of children - sick leave for pregnancy and childbirth (maternity leave) and time to care for a child up to one and a half or three years.

According to the provisions of Art. 422 of the Tax Code, accruals for the described periods are classified as social security payments. According to the legislation of the Russian Federation, in this case, contributions from vacation pay are not paid.

General provisions

It is very important for the employer to determine which compensation, social or incentive payments these payments are calculated for. Several points will be discussed here.

There are several types of vacation pay. According to the law, each of them requires its own calculation procedure.

An equally important question: is the premium subject to insurance contributions? By definition, this is an incentive payment for work. Therefore, the discussed deductions must be paid from it. However, there are exceptions, which we have already discussed.

Due dates for payment of contributions

The company is obliged to transfer contributions from the funds issued to the employee no later than the fifteenth day of the month following the one in which the employee was given the remuneration. This rule is spelled out in paragraph 7 of Art. 6.1 of the Tax Code of the Russian Federation.

Working conditions regulated by the Labor Code and Tax Code of the Russian Federation oblige employers to comply with the specified period. Responsibility for its violation is expressed in the form of a penalty for each day of delay and a fine equal to 20% of the amounts subject to deduction.

The company also faces liability if an accounting error was made that led to an incorrect calculation of the amounts payable. For such a violation, fines of 5-10 thousand rubles are provided. for the head of the enterprise and the chief accountant.

An example of calculating insurance contributions for vacation pay for an annual 28-day rest period in the amount of 30 thousand rubles:

IMPORTANT! Contributions must be made in separate payments to the appropriate funds within the period prescribed by law.

Are they charged according to law?

Every officially working citizen of Russia is supposed to be given annual paid leave.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

The Labor Code of the Russian Federation also enshrines the right to additional leave, which is given due to dangerous working conditions, irregular working hours or the special nature of the work.

Important! The Russian Tax Code states that insurance contributions are subject to vacations of any kind, including paid annual and additional ones.

An exception is maternity and child care leave; benefits paid on these grounds are not subject to contributions.

Insurance premiums must be transferred:

- for pensions at a rate of 22%;

- for social (disability and maternity) at a rate of 2.9%;

- in medical - 5.1%;

- for social protection from occupational diseases - from 0.2%.

The first three are accrued for payment to the Federal Tax Service, the last - to the Social Insurance Fund.

There are some exceptions in the form of non-taxable holiday periods.

The following holidays are not subject to contributions:

- To undergo medical treatment in resort organizations for workers who have work-related injuries or occupational diseases. Such vacation is considered paid. Moreover, the employer is obliged to reimburse the costs of travel and treatment. This is stated in Law No. 125-FZ, paragraph 1, article 8.

- Victims of radiation as a result of the Chernobyl disaster. Budget funds are used for such payments.

Due to the fact that such payments for the above types of paid vacation are made at the expense of social insurance, vacation pay contributions are not accrued.

We also recommend reading: Is vacation compensation subject to insurance contributions?

When to pay in 2020?

Almost all insurance contributions must be paid to the Federal Tax Service budget, except for injuries.

Important! The payment deadline, according to Article 431 of the Tax Code of the Russian Federation, is until the 15th day of the next month in which vacation pay is accrued.

If the 15th is a weekend or non-working day, then the deadline is considered to be the nearest working day. This procedure is established by clause 7 of Art. 6.1 Tax Code of the Russian Federation.

This is important to know: What to do with unused vacation

In 2020, the terms and conditions for paying contributions for injuries to the Social Insurance Fund are the same as to the tax office. The payment procedure is prescribed in clause 4 of article 22 of Federal Law No. 125 dated.

If you do not pay your dues on time, then the tax office will charge penalties. If arrears are identified during an audit, the organization is also imposed a fine of 20% of the debt amount.

Fixation of vacation pay in 2-NDFL

Vacation pay is subject to taxation. Therefore, they must appear in the 2-NDFL certificate as the employee’s income. Displayed in the month in which the funds were actually issued to the employee. For them you need to provide a separate line with code 2012.

Fixing compensation for unused vacation in 2-NDFL

When displaying compensation on a tax certificate, you must use the code. There is no special number for the payments in question. The following codes are allowed:

- 4800 (payment of compensation upon dismissal).

- 2000 (income related to wages).

- 2012 (vacation pay).

IMPORTANT!

According to the explanations of the Federal Tax Service, code 2012 should be used. However, the use of other numbers will not be considered a serious error.

Correct reflection of vacation pay in accounting and tax documentation allows you to avoid problems during audits.

Vacation pay (VA) is the same salary for a certain period of time, but received in advance. Therefore, these accruals are not exempt from paying social contributions (SC).

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how to solve your specific problem

— contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week

.

It's fast and FREE

!

However, there are exceptions; some types of leave are not subject to contributions:

- Rest periods provided for resort and sanatorium treatment of occupational diseases and work-related injuries.

- Additional leave for persons exposed to radiation during the Chernobyl accident.

In addition, financial assistance accrued along with vacation pay is not subject to deductions. All these payments are provided by social insurance and are exempt from the payment of social insurance.

Vacation pay for employees engaged in hazardous work is subject to additional tariff contributions

Additional tariffs for insurance contributions for compulsory pension insurance apply to payments and other remuneration in favor of individuals employed in the types of work specified in paragraphs 1 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”.

At the same time, the mentioned insurance premiums at additional tariffs, as well as insurance premiums at the main tariffs, are charged in the generally established manner on all payments and remunerations in favor of the employee, recognized as the object of taxation, with the exception of the amounts specified in Article 422 of the Tax Code.

An employee who holds a position in a job with harmful, difficult and dangerous working conditions, but is absent from work due to being on annual paid leave, educational leave, maternity leave, parental leave until the child reaches the age of 1, 5 years, due to temporary disability, etc., continues to be considered employed in the above jobs.

This is important to know: Is vacation available to an external part-time worker?

Thus, payments in favor of the above-mentioned employee holding a position at work with harmful, difficult and dangerous working conditions, accrued in the month the employee is on the mentioned vacations or during a period of temporary disability, are fully subject to insurance premiums in the generally established manner, including for OPS at additional rates.

Duration of rest

Labor legislation establishes a minimum, it is 28 days according to the calendar ().

However, employers have the right to provide their employees with longer vacations. This condition must be indicated in a collective or labor agreement, or in the internal charter of the enterprise.

There are also certain categories of workers who are entitled to extended vacations at the legislative level.

The duration of leave depends on the field of activity, working conditions, qualifications and is regulated by the Labor Code (Labor Code of the Russian Federation).

Procedure for provision

Every worker in our country has the right to rest. In most cases, vacation lasts 28 KD and is granted once per year worked, but the law does not prohibit it from being divided into several parts.

The only obligatory condition is that at least one part of it lasts at least fourteen AC.

Providing annual paid leave consists of several stages:

- Drawing up a vacation schedule for the coming year. It has to be adjusted periodically, adapting to the life circumstances of employees and the needs of production.

- Informing the employee about the upcoming vacation against signature no later than two weeks before the event itself.

- Writing an application for leave (from an employee to the manager).

- Drawing up an order to grant leave to an employee (Form N T-6a).

- taking into account taxation and SV.

- Drawing up a note - calculation for the provision of leave (Form T-60).

- Issuance of medical insurance into the hands of employee a (not later).

Having received vacation pay, the employee goes on vacation, the duration of which is indicated in the application. Holidays and sick days cannot be included in the duration of leave.

Payments

When calculating RH, three indicators play a decisive role:

- Settlement period (RP). As a rule, this is 12 months before the holiday. If an employee has been working for less than a year, then his length of service at this enterprise is in months before the start of his vacation. Are excluded from the billing period due to downtime and unpaid vacations.

- Duration of rest in calendar or working days.

- for RP. Taking into account bonuses and allowances, but excluding social payments: ballots, financial assistance, one-time cash rewards, compensation for food and travel, etc.

Based on these data, the employee’s average daily earnings (SDES) are calculated using the following formula: SDES = average earnings per RP / RP in months / 29.3.

Are they accrued?

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

Regardless of the chosen taxation system used at the enterprise, insurance contributions for compulsory medical, pension and social insurance are charged on the entire amount of vacation pay (Article 420 of the Tax Code of the Russian Federation).

In addition, deductions for accidents and occupational diseases are calculated on the amount issued (125-FZ of July 24, 1998).

The Tax Code indicates the need to tax any type of employee rest, with the exception of maternity leave, and rest accompanied by treatment in sanatorium-resort institutions. Payment under these circumstances is made from the funds of the Social Insurance Fund; contributions are not charged.

When and how to pay in 2019?

The transfer must be made no later than the 15th day of the month following the month of accrual of vacation pay (Article 431 of the Tax Code of the Russian Federation, clause 3).

If the payment day coincides with a weekend or holiday, the payment order should be issued on the next business day following the transfer deadline.

For this type of tax burden, the day of payment of vacation pay or the date the employee starts rest does not matter.

The payment procedure is influenced by which company accrues them. If a separate division independently calculates payments, then the transfer of insurance premiums is carried out at its own location. If all actions are carried out by the head office, then it pays this type of deductions (Article 431 of the Tax Code of the Russian Federation, clause 11).

How holiday pay is assessed - example

Initial data:

Employee Klekovkina M.A. Irregular working hours are established. The collective agreement gives her additional leave of 8 days.

Is it possible to pay insurance premiums from vacation pay earlier?

The employer calculates mandatory payments for contributions based on the results of each calendar month based on the amounts accrued in favor of the employee (Part 3, Article 15 of Law No. 212-FZ of July 24, 2009). And he pays them to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund no later than the 15th day of the month following the month of accrual (Part 5, Article 15 of the Law of July 24, 2009 N 212-FZ).

- payment for leave for sanatorium-resort treatment provided if an employee has an accident or receives an occupational disease (clause 1, part 1, article 9 of the Law of July 24, 2009 N 212-FZ, subclause 3, clause 1, article 8 Law of July 24, 1998 N 125-FZ, Letter of the Ministry of Labor dated October 27, 2015 N 17-3/B-524).

Legislative regulation

The procedure and features of accrual of vacation payments are provided for by current legislation.

When calculating taxes and contributions, you should rely on these documents:

- from 07/24/2009 "About insurance premiums."

- Article 20.1 of Federal Law No. 125 of July 24, 1998

- Letter of the Ministry of Labor 09/04/2015 No. 17-4/Vn-1316.

- Federal Law No. 113 dated 02/05/2015 On amendments to the Tax Code (Tax Code of the Russian Federation).

- Article No. 255 of the Tax Code of the Russian Federation.

- Chapter No. 19 of the Labor Code of the Russian Federation on vacations.

At these addresses, the accountant will find answers and clarifications on taxation and compulsory insurance in relation to vacation payments.

Is it possible to transfer insurance premiums in the middle of the month?

Withhold personal income tax on income paid in kind or in the form of material benefits from any monetary remuneration paid to an employee. That is, in this case, the date of payment of income and the date of tax withholding may differ. In this case, the withheld tax amount cannot exceed 50 percent of the amount of monetary remuneration.

The tax agent’s obligation to transfer personal income tax to the budget can be considered to have arisen if the following conditions are simultaneously met: – wages for the past month have been accrued (the management of the organization has approved the payroll for the payment of wages); – the amount of personal income tax subject to withholding from the income of each employee has been determined (accounting entries related to the withholding of personal income tax have been made, and accounts payable have been generated in account 68 subaccount “Personal Income Tax Payments”).