Home Insurance premiums Payment of insurance premiums from January 1, 2017.

( 1 ratings, average: 5.00 out of 5)

November 22, 2016

On January 1, 2020, the Federal Law of July 3, 2016 N 243-FZ “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the transfer to tax authorities of powers to administer insurance contributions for compulsory pension, social and health insurance” comes into force " Let us outline the main changes awaiting insurance premium payers.

Starting from 2020, the rules related to the payment of insurance premiums are returning to the Tax Code.

In the Tax Code of the Russian Federation, insurance premiums are understood as mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance provision for the corresponding type of compulsory social insurance. As follows from the Tax Code of the Russian Federation, insurance premiums also include contributions collected from organizations for the purpose of additional social security for certain categories of individuals.

Changes for payers of insurance premiums from January 1, 2017 according to the first part of the Tax Code of the Russian Federation.

Now the Tax Code of the Russian Federation establishes insurance premiums and the principles of taxation of insurance premiums.

However, the legislator draws attention to the fact that the Tax Code of the Russian Federation applies to relations regarding the establishment, introduction and collection of insurance premiums only in cases where this is directly provided for by the Tax Code of the Russian Federation.

From January 2020, the payer of contributions is provided with additional guarantees that were previously provided only for taxpayers and fee payers. Thus, acts of legislation on taxes and fees must be formulated in such a way that everyone knows exactly what insurance premiums, when and in what order they must pay. All irremovable doubts, contradictions and ambiguities in acts of legislation on taxes and fees are interpreted in favor of the payer of insurance premiums, the guarantees established by Article 3 of the Tax Code of the Russian Federation. Considering that the wording of acts of legislation on taxes and fees often allows for ambiguous interpretation, these norms will be very useful for contribution payers.

https://youtu.be/vneKRzWSGCY

Social contributions – changes for 2020

In order to reduce the administrative burden on taxpayers, optimize document flow and increase the level of collection of tax payments, starting from 2020, control functions for accepting reports and collecting contributions regarding the ESSS have been transferred to the Federal Tax Service of the Russian Federation. Reporting periods are: quarter, half-year, 9 months, year. Submission of reports RSV, 4-FSS has been replaced with a single form (approved in Order No. ММВ-7-11/551 dated 10.10.16).

Payers of social contributions are recognized as employers-enterprises/individual entrepreneurs, self-employed categories of persons. The rules for determining the base for calculating charges and tax objects have not changed globally. The deadline for submitting a single calculation is the 30th day of the calendar month following the reporting period. Amounts must be paid to the Federal Tax Service using new details, including KBK.

Important! The social authorities are left with the function of administering the following reports: FSS - “injuries”, Pension Fund of the Russian Federation - monthly reporting on f. SZV-M, SZV-Stazh.

General conditions for establishing insurance premiums.

The general conditions for establishing insurance premiums are formulated and the elements of taxation of contributions are determined, in the absence of which the contribution will not be considered established by Article 17, Article 18.2 of the Tax Code of the Russian Federation.

These elements include: the object of taxation of insurance premiums; basis for calculating insurance premiums; billing period; insurance premium rate; the procedure for calculating insurance premiums; procedure and terms for payment of insurance premiums.

But the legislator did not dare to describe all the elements of taxation in the Tax Code of the Russian Federation and in Chapter 34 of the Tax Code of the Russian Federation included reference norms to the Federal Laws “On compulsory health insurance in the Russian Federation”, “On compulsory social insurance in case of temporary disability and in connection with maternity” , “On compulsory pension insurance in the Russian Federation”, etc.

Innovations of the Tax Code of the Russian Federation.

Changes in connection with the transfer of the functions of administering insurance premiums to the tax authorities were made to both Part I and Part II of the Tax Code of the Russian Federation.

Part I of the Tax Code of the Russian Federation has been supplemented throughout the text, where necessary, with the words “insurance contributions”. Thus, all provisions of tax legislation apply to insurance premiums.

It is stipulated that the relations regarding the establishment and collection of insurance contributions for compulsory social insurance against accidents at work and occupational diseases (contributions from NS and PZ) and insurance contributions for compulsory medical insurance of the non-working population, as well as relations arising in the process of control for payment of the specified insurance premiums, appeals against acts, actions (inaction) of officials of the relevant

bodies of control and bringing to justice the perpetrators, the legislation on taxes and fees is not applied. Accordingly, contributions from NS and PP are regulated, as before, by a separate law (see below).

Part I of the Tax Code of the Russian Federation provides a definition of the concept of insurance premiums.

Changes in insurance premiums in 2020. Note:

Insurance contributions are understood as mandatory payments for compulsory pension insurance, compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, collected from organizations and individuals for the purpose of financial security for the implementation of the rights of insured persons to receive insurance coverage for the corresponding type of compulsory social insurance.

For the purposes of applying the Tax Code of the Russian Federation, insurance premiums also recognize contributions collected from organizations for the purpose of additional social security for certain categories of individuals.

Part I of the Tax Code of the Russian Federation has been supplemented by Ch. 2.1 “Insurance premiums in the Russian Federation”, which consists of two articles: Art. 18.1 “Insurance premiums” and 18.2 “General conditions for establishing insurance premiums”.

It has been determined that insurance premiums are established by the Tax Code of the Russian Federation, are federal and are obligatory for payment throughout the Russian Federation. The following elements have been introduced:

- object of taxation of insurance premiums;

- basis for calculating insurance premiums;

- billing period;

- insurance premium rate;

- the procedure for calculating insurance premiums;

- procedure and terms for payment of insurance premiums.

Article 23 “Responsibilities of Taxpayers (Payers of Fees)” of the Tax Code of the Russian Federation has been supplemented with clause 3.4, which spells out the obligations of payers of insurance premiums. Among the general obligations for the payment and accounting of insurance premiums, we highlight the obligation to ensure the safety of documents necessary for the calculation and payment of insurance premiums for six years. We would like to remind you that in relation to accounting and tax accounting data, a mandatory document retention period is set at four years.

The responsibilities of the tax authorities are supplemented by the norm on the transfer of data on tax registration of organizations and individual entrepreneurs to the territorial bodies of the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund (Article 32 of the Tax Code of the Russian Federation).

A new mechanism for sending a request for payment of insurance contributions to the Social Insurance Fund is being introduced (clause 2.1 of Article 70 of the Tax Code of the Russian Federation):

- The FSS makes a decision not to accept expenses for the payment of insurance coverage for offset based on the results of an audit of the validity of the declared expenses conducted by the fund;

- The FSS sends a request for payment of insurance premiums based on this decision to the tax authority;

- the specified requirement must be sent by the tax authority to the payer of insurance premiums within 10 days from the date of receipt by the tax authority of the relevant decision.

All types of tax sanctions also apply to insurance premium payers. In particular, this is responsibility in accordance with the following articles of the Tax Code of the Russian Federation:

- Article 119 “Failure to submit a tax return (calculation of the financial result of an investment partnership)”;

- Article 120 “Gross violation of the rules for accounting for income and expenses and objects of taxation”;

- Article 122 “Non-payment or incomplete payment of tax (fee) amounts”;

- Article 126 “Failure to provide the tax authority with information necessary for tax control.”

Part II of the Tax Code of the Russian Federation has been supplemented by section. XI “Insurance premiums in the Russian Federation”, which includes Chapter. 34 “Insurance premiums”.

Basic provisions of Ch. 34 of the Tax Code of the Russian Federation duplicate the well-known Federal Law No. 212-FZ, which has been repealed since 2020, but there are a number of differences. Let us note the most significant of them.

All significant norms remain the same: they relate to the object of taxation of insurance premiums, the basis for calculating insurance premiums, and the billing period. At the same time, for example, insurance premium rates are structured in comparison with Federal Law No. 212-FZ, in which they were specified in Chapter. 8 "Final provisions". From 2020, insurance premium rates will be regulated by the following articles of the Tax Code of the Russian Federation:

- Article 425 “Insurance premium rates”;

- Article 426 “Insurance premium rates in 2020 – 2018”;

- Article 427 “Reduced rates of insurance premiums”;

- Article 428 “Additional tariffs of insurance premiums for certain categories of payers”;

- Article 429 “Tariffs of insurance premiums for certain categories of payers for additional social security of flight crew members of civil aviation aircraft, as well as certain categories of employees of coal industry organizations.”

The rates of insurance premiums have not changed directly, but the conditions for their application have changed, which requires separate study. For example, for “simplified” people, we note that they can apply reduced tariffs when carrying out certain types of activities if their income for the tax period does not exceed 79 million rubles. This figure raises questions due to the fact that since 2017, the income limit under the simplified tax system has been increased to 120 million rubles.

For individual entrepreneurs, the procedure for calculating insurance premiums for themselves and the deadlines for their payment do not change.

At the same time, the procedure for calculating and paying insurance premiums by payers making payments and other remuneration to individuals, and the procedure for reimbursing amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, are regulated by Art. 431 of the Tax Code of the Russian Federation, change somewhat.

As before, during the billing period, at the end of each calendar month, payers calculate and pay insurance premiums based on the base for their accrual from the beginning of the billing period to the end of the corresponding calendar month and the rates of insurance premiums minus the amounts of insurance premiums calculated from the beginning of the billing period to the previous one. calendar month inclusive.

At the same time, the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity is reduced by payers by the amount of expenses incurred by them to pay insurance coverage for the specified type of compulsory social insurance in accordance with the legislation of the Russian Federation. This rule is valid until December 31, 2018 inclusive. It can be assumed that from 2020 the FSS will pay insurance compensation directly to the insured person: the FSS pilot project, carried out today in a number of regions, will be distributed throughout the Russian Federation.

The deadline for paying insurance premiums in 2020 does not change: no later than the 15th day of the next calendar month.

As today, payers are required to keep records of the amounts of accrued payments and other remunerations, the amounts of insurance premiums related to them, in relation to each individual in whose favor the payments were made.

The rule according to which the amount of insurance premiums to be transferred is calculated in rubles and kopecks, although taxes are calculated in full rubles (clause 6 of Article 52 of the Tax Code of the Russian Federation) remains unchanged.

There was also no single payment for insurance premiums: the amount of insurance premiums is calculated and paid separately in relation to insurance premiums for compulsory pension insurance, insurance premiums for compulsory social insurance in case of temporary disability and in connection with maternity, insurance premiums for compulsory health insurance.

But the reporting deadlines have changed: from 2020, insurance premium payers submit calculations for insurance premiums no later than the 30th day of the month following the billing (reporting) period to the tax authorities at the location of the organizations and the location of separate divisions of organizations that charge payments and other remuneration in favor of individuals, the place of residence of individuals making payments and other remuneration to individuals.

Today, reporting on insurance premiums is submitted:

a) to the Pension Fund:

- on paper – no later than the 15th day of the second calendar month following the reporting period;

- in the form of an electronic document – no later than the 20th day of the second calendar month following the reporting period;

b) in the FSS:

- on paper – no later than the 20th day of the calendar month following the reporting period;

- in the form of an electronic document – no later than the 25th day of the calendar month following the reporting period.

Thus, compared to the current procedure, the reporting deadlines will be reduced.

In addition, it is established that if in the calculation there is a discrepancy between the total amount of insurance contributions for compulsory pension insurance and the amount of insurance contributions for each insured person, then such a calculation will be considered unsubmitted, about which the payer will be notified no later than the day following the day the calculation is submitted a corresponding notification has been sent. Within five days from the date of receipt of this notification, the payer of insurance premiums is obliged to submit a calculation in which the specified discrepancy is eliminated. In this case, the date of submission of the calculation is considered to be the date of submission of the calculation recognized as initially not submitted.

As before, verification of the correctness of the declared expenses for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity will be carried out by the territorial bodies of the Social Insurance Fund. To do this, the calculation data will be sent by the tax authority no later than five days from the date of their receipt in electronic form and no later than 10 days from the date of their receipt on paper to the relevant territorial body of the Social Insurance Fund to verify the correctness of the payer's expenses for the payment of insurance coverage.

Copies of decisions on the allocation (refusal to allocate) funds for implementation (reimbursement) of the policyholder's expenses for the payment of insurance coverage, non-acceptance of expenses for the payment of insurance coverage, as well as information about the cancellation (change) of these decisions by a higher body of the territorial body of the Social Insurance Fund or the court will be sent by the territorial body of the Social Insurance Fund to the tax authority within three days from the date of adoption of the relevant decision.

You need to pay special attention to the next rule. If, at the end of the settlement (reporting) period, the amount of expenses incurred by the payer for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity (minus the funds allocated to the policyholder by the territorial body of the Social Insurance Fund in the settlement (reporting) period for the payment of insurance coverage) exceeds the total amount of calculated insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity, the resulting difference is subject to offset by the tax authority against upcoming payments for compulsory social insurance in case of temporary disability and in connection with maternity on the basis of the Social Insurance Fund received from the territorial body confirmation.

Since insurance premium payers, whose average number of individuals for whom they report exceeds 25 people, are already sending reports electronically, this practice will continue in the future.

The procedure for paying insurance premiums and submitting reports by organizations with separate divisions remains the same.

Entry into force of acts on insurance premiums.

Controversial issues regarding the entry into force of acts on insurance premiums have been resolved. Now, as a general rule, such acts of legislation on taxes and fees come into force no earlier than one month from the date of their official publication and no earlier than the 1st day of the next billing period (calendar year) for insurance premiums. Accordingly, the payer of insurance premiums is protected from unpredictable and rapid changes in the payment of insurance premiums. The issue of granting acts with retroactive force (the provisions of Article 5 of the Tax Code of the Russian Federation) has been resolved in favor of the contribution payer. Thus, if previously, in relation to acts that worsen the situation of taxpayers, one could be guided by Articles 54, 57 of the Constitution of the Russian Federation, then in relation to acts that improve the situation of taxpayers, there was no such legal certainty.

Deadlines for payment of insurance premiums for periods up to 2018.

Unpaid insurance premiums for periods before 2020 are considered debt, and therefore they must be transferred within the following deadlines:

- in case of an independently made decision - on the nearest date;

- when making a request from the tax office - no later than 8 days from the date of receipt of this document.

In the second case, the Federal Tax Service has the right to establish a longer debt repayment period, which is indicated in the request. This is stated in Art. 69 and 6.1 of the Tax Code of the Russian Federation.

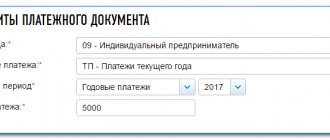

In the payment order for periods up to 2020, it is necessary to take into account the adopted changes, namely, indicate the details of the Federal Tax Service, taxpayer status (01) and tax period. If insurance premiums are transferred at the request of the tax office, then the payment slip must indicate the date and number of this document in columns 108 and 109.

As for the BCC, new budget classification codes are used in 2020 and 2020, different from earlier periods. You need to pay special attention to this, and to become fully familiar with the KBK, read the article: “KBK for insurance premiums in 2020.”

Administration of insurance premiums.

The administration of insurance premiums from the Pension Fund of Russia and the Social Insurance Fund has been transferred to the jurisdiction of the Federal Tax Service of the Russian Federation. For written clarification on the application of insurance premiums, it is now necessary to contact the Ministry of Finance of the Russian Federation.

Calculations for insurance premiums, documents necessary for their calculation and payment, in some cases, information about insured persons in the individual (personalized) accounting system is provided by the payer of contributions to the tax authority.

The tax authorities are entrusted with the responsibility for monitoring the payment of insurance premiums established in Chapter 14 of the Tax Code of the Russian Federation.

The right to verify the correctness of the declared expenses for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity is reserved by the territorial bodies of the Social Insurance Fund of the Russian Federation.

Individual entrepreneur insurance premiums 2020 for themselves: transfer deadlines

The fixed amount of insurance premiums for individual entrepreneurs for 2020 must be transferred before December 31 of the current year. They can be paid at one time, or they can be divided into several transfers, paying them at a convenient time. In this case, the amount can be any. The main thing is that the entire fixed payment is transferred in full before the last day of the year.

For incomes exceeding 300 thousand rubles, individual entrepreneurs must transfer insurance premiums to themselves for 2020 no later than 07/01/19.

For failure to pay the required payment, the entrepreneur may be subject to penalties from tax authorities:

- a fine of 20% of the unpaid amount (Article 122 of the Tax Code of the Russian Federation);

- a penalty in the amount of 1/300 of the refinancing rate of the Bank of Russia for each day of delay (Article 75 of the Tax Code of the Russian Federation).

Transfers for injuries are transferred to the territorial branch of the Social Insurance Fund. Its details can be found using the official website. For example, for St. Petersburg you can go to the website: https://rofss.spb.ru

Thus, there is no need to look for the PFR details for paying insurance premiums in 2018.

Registration as a payer of insurance premiums.

Registration as a payer of insurance premiums will be carried out by the tax authorities in accordance with the procedure existing for taxpayers. An obligation has been introduced for the payer of insurance premiums to notify the tax authority of the vesting of a separate division (including a branch, representative office) created on the territory of the Russian Federation with the authority to accrue payments and rewards in favor of individuals within one month from the date of vesting it with the corresponding powers.

The procedure for registering individuals who do not have a place of residence in the Russian Federation as insurance premium payers has been determined. Registration (deregistration) of an individual as a payer of insurance premiums is carried out by the tax authority at the place of residence of such person on the basis of his application for registration (deregistration) as a payer of insurance premiums, submitted to any tax authority of his choice .

Deadlines for paying basic taxes in 2020

| Type of tax | Payment period | Payment deadline |

| Income tax (if only quarterly advance payments are made) | For 2020 | No later than 30.03.2020 |

| For the first quarter of 2020 | No later than 04/28/2020 | |

| For the first half of 2020 | No later than July 28, 2020 | |

| For 9 months of 2020 | No later than October 28, 2020 | |

| For 2020 | No later than March 29, 2021 | |

| Income tax (when paying monthly advance payments with additional payment at the end of the quarter) | For 2020 | No later than 30.03.2020 |

| For January 2020 | No later than 01/28/2020 | |

| For February 2020 | No later than 02/28/2020 | |

| For March 2020 | No later than 30.03.2020 | |

| Additional payment for the first quarter of 2020 | No later than 04/28/2020 | |

| For April 2020 | No later than 04/28/2020 | |

| For May 2020 | No later than 05/28/2020 | |

| For June 2020 | No later than 06/29/2020 | |

| Additional payment for the first half of 2020 | No later than July 28, 2020 | |

| For July 2020 | No later than July 28, 2020 | |

| For August 2020 | No later than 08/28/2020 | |

| For September 2020 | No later than September 28, 2020 | |

| Additional payment for 9 months of 2020 | No later than October 28, 2020 | |

| For October 2020 | No later than October 28, 2020 | |

| For November 2020 | No later than November 30, 2020 | |

| For December 2020 | No later than 12/28/2020 | |

| For 2020 | No later than March 29, 2021 | |

| Income tax (for monthly payment of advances based on actual profit) | For 2020 | No later than 30.03.2020 |

| For January 2020 | No later than 02/28/2020 | |

| For February 2020 | No later than 30.03.2020 | |

| For March 2020 | No later than 04/28/2020 | |

| For April 2020 | No later than 05/28/2020 | |

| For May 2020 | No later than 06/29/2020 | |

| For June 2020 | No later than July 28, 2020 | |

| For July 2020 | No later than 08/28/2020 | |

| For August 2020 | No later than September 28, 2020 | |

| For September 2020 | No later than October 28, 2020 | |

| For October 2020 | No later than November 30, 2020 | |

| For November 2020 | No later than 12/28/2020 | |

| For 2020 | No later than March 29, 2021 | |

| VAT | 1st payment for the fourth quarter of 2020 | No later than 01/27/2020 |

| 2nd payment for the fourth quarter of 2020 | No later than 02/25/2020 | |

| 3rd payment for the fourth quarter of 2020 | No later than March 25, 2020 | |

| 1st payment for the first quarter of 2020 | No later than 04/27/2020 | |

| 2nd payment for the first quarter of 2020 | No later than 05/25/2020 | |

| 3rd payment for the first quarter of 2020 | No later than 06/25/2020 | |

| 1st payment for the second quarter of 2020 | No later than July 27, 2020 | |

| 2nd payment for the second quarter of 2020 | No later than 08/25/2020 | |

| 3rd payment for the second quarter of 2020 | No later than September 25, 2020 | |

| 1st payment for the third quarter of 2020 | No later than October 26, 2020 | |

| 2nd payment for the third quarter of 2020 | No later than November 25, 2020 | |

| 3rd payment for the third quarter of 2020 | No later than 12/25/2020 | |

| 1st payment for the fourth quarter of 2020 | No later than 01/25/2021 | |

| 2nd payment for the fourth quarter of 2020 | No later than 02/25/2021 | |

| 3rd payment for the fourth quarter of 2020 | No later than 03/25/2021 | |

| Tax under the simplified tax system (including advance payments) | For 2020 (only organizations pay) | No later than 03/31/2020 |

| For 2020 (only individual entrepreneurs pay) | No later than 04/30/2020 | |

| For the first quarter of 2020 | No later than 04/27/2020 | |

| For the first half of 2020 | No later than July 27, 2020 | |

| For 9 months of 2020 | No later than October 26, 2020 | |

| For 2020 (only organizations pay) | No later than 03/31/2021 | |

| For 2020 (only individual entrepreneurs pay) | No later than 04/30/2021 | |

| Personal income tax on vacation and sick leave benefits | For January 2020 | No later than 01/31/2020 |

| For February 2020 | No later than 03/02/2020 | |

| For March 2020 | No later than 03/31/2020 | |

| For April 2020 | No later than 04/30/2020 | |

| For May 2020 | No later than 06/01/2020 | |

| For June 2020 | No later than 06/30/2020 | |

| For July 2020 | No later than 07/31/2020 | |

| For August 2020 | No later than 08/31/2020 | |

| For September 2020 | No later than September 30, 2020 | |

| For October 2020 | No later than 02.11.2020 | |

| For November 2020 | No later than November 30, 2020 | |

| For December 2020 | No later than 12/31/2020 | |

| UTII | For the fourth quarter of 2020 | No later than 01/27/2020 |

| For the first quarter of 2020 | No later than 04/27/2020 | |

| For the second quarter of 2020 | No later than July 27, 2020 | |

| For the third quarter of 2020 | No later than October 26, 2020 | |

| For the fourth quarter of 2020 | No later than 01/25/2021 | |

| Unified agricultural tax | For 2020 | No later than 03/31/2020 |

| For the first half of 2020 | No later than July 27, 2020 | |

| For 2020 | No later than 03/31/2021 | |

| Trade tax on the territory of Moscow | For the fourth quarter of 2020 | No later than 01/27/2020 |

| For the first quarter of 2020 | No later than 04/27/2020 | |

| For the second quarter of 2020 | No later than July 27, 2020 | |

| For the third quarter of 2020 | No later than October 26, 2020 | |

| For the fourth quarter of 2020 | No later than 01/25/2021 | |

| Personal income tax (individual entrepreneur on OSN for himself, including advance payments) | For October – December 2020 | No later than 01/15/2020 |

| For 2020 | No later than 07/15/2020 | |

| For the first quarter of 2020 | No later than 04/27/2020 | |

| For the first half of 2020 | No later than July 27, 2020 | |

| For 9 months of 2020 | No later than October 26, 2020 | |

| For 2020 | No later than 07/15/2021 |

Fulfillment of obligations to pay insurance premiums.

The fulfillment of the obligation to pay insurance premiums is now carried out in accordance with Chapter 8 of the Tax Code of the Russian Federation according to the rules that were previously valid only for payers of taxes and fees, and have not undergone significant changes.

Up to 3000 rub. the threshold for debt to pay insurance premiums from an individual has increased. When such a threshold amount is reached, the tax authority must apply to the court for collection. Let us remind you that previously this amount was 500 rubles.

Contributions to funds in 2020 - table

3 deductions for social needs have been retained: pensions - to the Pension Fund, social for hospital expenses and maternity - to the Social Insurance Fund, medical - to the Compulsory Medical Insurance. Tariffs remained at the same level, the maximum limits for calculating amounts at reduced rates were increased.

Tariffs for contributions to the funds in 2020 – for general categories of employers:

| On OPS in the Pension Fund of the Russian Federation, in% | For social insurance (VNIM) in the Social Insurance Fund, in% | On compulsory medical insurance FFOMS, in% | ||

| Tariff for the taxable base within established limits | Tariff for the taxable base in excess of the established limits | Tariff for the taxable base within established limits | Tariff for the taxable base in excess of the established limits | |

| 22 | 10 | 2,9 | No charge | 5.1, limit not regulated |

The amount of contributions to the Pension Fund and the Social Insurance Fund depends on the size of the tax calculation base obtained on an accrual basis for the period. The limits were approved by the Government of Russia in Resolution No. 1255 of November 29, 2016. The procedure is applied by all taxpayers-employers paying wages to hired personnel.

Limits on the maximum amounts of the taxable base for funds:

| Type of contribution | 2016 – maximum base, in rubles. | 2017 – maximum base, in rubles. |

| OPS PFR | 796,000, amounts above are taxed at a rate of 10% | 876,000, amounts above are also taxed at a rate of 10% |

| VNiM FSS | 718000, amounts above are not taxed | 755,000, amounts above are also not taxed |

| Compulsory medical insurance FFOMS | No limit set | No limit set |

The amount of reduced tariffs applied in 2020 remained at the same level for all 13 categories of policyholders. Some beneficiaries have additional types of conditions for starting/terminating the use of reduced tariffs. Officials plan to increase rates from 2020 in terms of medical deductions (instead of 5.1%, an increase to 5.9% is expected).

Main categories of taxpayers entitled to reduced tariffs (detailed list in Article 427 of the Tax Code):

| Insured category | OKVED example | Tariff rate, % | ||

| OPS | FSS | Compulsory medical insurance | ||

| Simplified, applied preferential activities with income of at least 70% of total revenue. If the taxpayer’s annual income exceeds 79 million rubles, the benefit for reduced rates is lost | 13-16 codes | 20 | — | — |

| Pharmaceutical companies, including individual entrepreneurs, who have received a license | 47.73, 46.46.1, and also 46.18.1 | 20 | — | — |

| Individual entrepreneur on PSN, the benefit is applied in accordance with the types of activities of the entrepreneur | 96.02, 96.01, and also 74.20. 31.0, other codes | 20 | — | — |

| NPOs-simplified, except for the exceptions provided for by stat. 427 NK | 37, 86-88, 93 and other codes | 20 | — | — |

| Charitable Institutions - Simplified | 88.10, 64.9 | 20 | — | — |

| Information technology companies | Codes 63, 62 | 8 | 2 | 4 |

| Business entities/partnerships operating under the simplified tax system with the main activity of introducing intellectual products | 72 code | 8 | 2 | 4 |

| Companies that have an agreement with the management bodies of ecozones in the field of tourism, recreation, technology and innovation activities | 62.0, 63.11.1, as well as 65.20, 63.1, 94.99, 79.1 codes | 8 | 2 | 4 |

| Business entities paying wages to crews of international ships | 50 | — | — | — |

| Skolkovo participating entities | 72.1 (Law No. 244-FZ, stat. 10 h.  | 14 | — | — |

| Participants of the free economic zones SEZ Crimea and Sevastopol | All except 05-08, 71.12.3, 09.1 codes | 6 | 1,5 | 0,1 |

| Resident companies of special territories | Adjustable individually for each territory | 6 | 1,5 | 0,1 |

| Companies participating in the free economic zone SEZ Vladivostok | Any types, except those prohibited by law | 6 | 1,5 | 0,1 |

Providing a deferment (installment plan) for their payment.

The position of the payer of insurance premiums has improved in terms of providing a deferment (installment plan) for their payment. The period for granting installment plans (deferments) has been increased to three years. New grounds for its provision have emerged, for example, the threat of signs of insolvency (bankruptcy) of the interested party in the event of a one-time payment of contributions; and also if the property status of an individual excludes the possibility of a one-time payment of contributions. However, the legislator retained the rule that it is impossible to provide a deferment (installment plan) for the payment of insurance premiums in relation to amounts associated with the formation of funds to finance the funded part of the pension.

Basic requirements for the report form

The accountant needs to know the composition of payments to individuals, which are not subject to contribution. Such income includes:

- benefits from the labor exchange or other government agencies (for example, unemployment);

- compensation from the state : provision of housing, money for housing and communal services, purchase of food, fuel, payment of expenses for professional sports, personnel training and others;

- amounts of monetary assistance paid once for compensation of damage from a natural disaster and in some other cases;

- voluntary formation of the funded part of employee pensions and other payments reflected in Article 422 of the Tax Code of the Russian Federation.

There are certain requirements for filling out the calculation form:

- Columns and fields are filled in strictly in accordance with their purpose.

- Page numbering starts from zero (“001”, “020”).

- For kopecks, columns are provided next to the main amount in rubles.

- When filling out electronically, the Courier New font is set.

- Text fields are filled in from the first empty cell, starting from the left.

- Zeros are placed in the number boxes, and dashes are used if there is no data.

Refund of overpaid and overcharged insurance premiums.

The right of the payer of insurance premiums to return overpaid and excessively collected insurance premiums is limited. Thus, a refund is unacceptable if information about the amount of excessively collected insurance contributions for compulsory pension insurance is taken into account (posted) on the individual personal accounts of the insured persons. In this part, only offset is allowed (Articles 78, 79 of the Tax Code of the Russian Federation). Previously, the payer of insurance premiums could return such premiums if they were overcharged.

The concept of “calculation of insurance premiums”

Article 80 of the Tax Code of the Russian Federation introduced the concept of “calculation of insurance premiums”, defined as a written statement or application of the payer of insurance premiums, drawn up in electronic form and transmitted via telecommunication channels using an enhanced qualified electronic signature or through the taxpayer’s personal account, about the object of taxation by insurance contributions, the basis for calculating insurance premiums, the calculated amount of insurance premiums and other data serving as the basis for the calculation and payment of insurance premiums, unless otherwise provided by the Tax Code. This calculation must be submitted quarterly to the tax authority under Article 423 of the Tax Code of the Russian Federation, and Article 119 of the Tax Code provides for liability for failure to submit it.

Rules for conducting on-site and desk audits of insurance premium payers.

The rules for conducting on-site and desk audits of insurance premium payers are now regulated in detail by the norms of the Tax Code of the Russian Federation, which, of course, guarantees greater protection of the rights of premium payers than was previously the case. A negative for the payer is the fact that on-site inspections can be carried out more often. Previously, such inspections of the payer of insurance premiums were carried out by the body monitoring the payment of insurance premiums no more than once every three years. Now on-site tax audits can be carried out twice during the calendar year. In addition, such events are possible beyond the established schedule if the head of the Federal Tax Service of Russia decides on the need to conduct an additional on-site tax audit of the contribution payer.

Appeals against acts of tax authorities and actions or inactions of their officials will also be carried out according to the general rules enshrined in the Tax Code of the Russian Federation, which previously applied only to the taxpayer and payer of fees.

What's new for IP?

In general, the procedure for paying insurance premiums for individual entrepreneurs in 2020 remains the same, and does not depend on the applicable tax regime. As always, monthly, before the 15th, individual entrepreneurs must transfer insurance premiums at a general rate of 30% for employees (or less if they are entitled to a benefit), and also pay “injury” contributions, which remain under the jurisdiction of the Social Insurance Fund.

Individual entrepreneurs will also continue to transfer “for themselves” contributions to the Pension Fund (26%) and the Compulsory Medical Insurance Fund (5.1%). The fixed amount of insurance premiums for individual entrepreneurs in 2020 depends on the minimum wage, as before. For income amounts over 300,000 rubles, you need to transfer 1% of the additional contribution to the Pension Fund.

An important innovation is that insurance premiums will have to be transferred to the tax authorities, and not to the funds. This means there will be new BCCs for entrepreneurs to pay contributions to the Federal Tax Service.

Reporting on the new form will also be submitted to the Federal Tax Service starting from the 1st quarter of 2020. At the same time, individual employers must submit reporting on contributions for 2020 and “clarification” for periods before 2020, as before, to the funds, that is, to their branches of the Social Insurance Fund and the Pension Fund of the Russian Federation.

An updated 4-FSS report will be submitted to the Social Insurance Fund, but only for contributions for “injuries.” And to the Pension Fund of Russia you will have to submit the SZV-M form every month and once a year - a new report on the length of service of employees.