Deadlines and procedure for submitting a declaration for the 2nd quarter to the Federal Tax Service

The deadline for submitting the reviewed report is set at the 25th day of the month following the previous quarter. If the deadline for submitting the declaration falls on a weekend or holiday, then the deadline is shifted to the nearest working date (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). The deadline for submitting the VAT return for the 2nd quarter of 2020 is set at 07/25/2018 and will not be postponed.

The declaration is prepared only in electronic form and is sent to the Federal Tax Service via telecommunication channels with data from the purchase book and sales book attached. Tax agents who are exempt from the obligation to pay VAT, for example, in the case of renting municipal property, have the right to submit a paper version of the document.

Personal income tax on vacation and sick leave benefits

In general, personal income tax must be transferred from wages no later than the day following the date of payment. For example, the employer paid the salary for January 2020 on February 6, 2020. In this case, income was received on January 31. The tax must be withheld on February 6th. And the last date when personal income tax needs to be transferred to the budget is February 7, 2020.

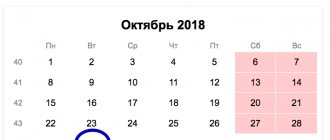

However, personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay must be transferred no later than the last day of the month in which the income was paid. For example, an employee goes on vacation from January 25 to February 15, 2020. Vacation pay was paid to him on January 20. In this case, consider the income received on the date of issuance of vacation pay - January 20. Tax must be withheld from the payment on the same day. And personal income tax must be transferred to the budget no later than January 31, 2018. Below is a table with the deadlines for paying personal income tax on vacation and sick leave benefits in 2020.

Deadlines for paying personal income tax on vacation and sick pay in 2018

| For January 2020 | No later than 01/31/2018 |

| For February 2020 | No later than 02/28/2018 |

| For March 2020 | No later than 04/02/2018 |

| For April 2020 | No later than 05/03/2018 |

| For May 2020 | No later than 05/31/2018 |

| For June 2020 | No later than 07/02/2018 |

| For July 2020 | No later than July 31, 2018 |

| For August 2020 | No later than 08/31/2018 |

| For September 2020 | No later than 01.10.2018 |

| For October 2020 | No later than 10/31/2018 |

| For November 2020 | No later than November 30, 2018 |

Who submits the VAT return and in what form?

The current legislation approves 3 forms of VAT declaration:

| KND form | Title of the declaration | Details of the Order of the Federal Tax Service that approved the form |

| 1151001 | VAT declaration | Order of the Federal Tax Service of the Russian Federation dated October 29, 2014 NMMV-7-3/558 |

| 1151088 | Declaration of indirect taxes | Order of the Federal Tax Service of the Russian Federation dated September 27, 2017 NCA-7-3/765 |

| 1151115 | VAT declaration for the provision of services by foreign organizations in electronic form | Order of the Federal Tax Service of the Russian Federation dated November 30, 2016 NMMV-7-3/646 |

Form KND 1151001 is submitted by:

- absolutely all taxpayers on the general system (OSNO), with the exception of those exempt (Articles 145 and 145.1 of the Tax Code of the Russian Federation);

- tax agents (TA);

- special regime officers who issued an invoice with allocated VAT.

Form KND 1151088 is submitted by importers of goods from neighboring countries that are members of the EAEU. It is issued only for the months when the imported goods were accepted for accounting. KND form 11511115 is issued by foreign companies that provided services electronically in the 2nd quarter of 2020.

In this article we will look at the algorithm for filling out the most frequently submitted declaration - KND 1151001 and analyze its nuances using an example.

What to consider when filling out a profit declaration for the second quarter of 2020

About reimbursable expenses

If you have been reimbursed for travel costs, check that you have accounted for them correctly

If the supplier carries out delivery on its own and the buyer pays additionally for it, then for profit tax purposes the supplier shows revenue from the sale of transport services and recognizes the corresponding costs for their provision <*>.

If the supplier purchases transport services from third parties, and the buyer reimburses them, then the supplier does not include the cost of such transport services as expenses taken into account for taxation, and the amount of compensation received from the buyer is not included in revenue, since he does not provide (does not sell) ) to the buyer transport services <*>.

If the subsubscriber has reimbursed expenses for electricity, include the reimbursement amounts in revenue

If an organization receives electricity from an energy supplying organization and transfers it to a sub-subscriber, then in the subscriber’s accounting, the receipt of reimbursement for the cost of electricity from the sub-subscriber is reflected through settlement accounts, and when taxing profits, the amount of reimbursement is included in revenue, and the cost of energy consumed by the sub-subscriber is included in expenses <*>.

If the employee reimbursed personal expenses, do not include them in the declaration

According to Letter N 2-2-10/00541, if a civil contract is not concluded between the employer and the employee, then when the employee reimburses any personal expenses, the specified amounts are not recognized as either revenue or non-operating income of the organization. Such expenses include payment for: personal telephone calls, vouchers for treatment and recreation, excursions and travel, classes in sections, clubs, clubs, visits to cultural, entertainment and physical education (sports) events, subscriptions to periodicals, goods (work, services) for personal consumption, etc.

Accordingly, compensation amounts received from employees are not included in either revenue or non-income, and amounts paid by the organization on behalf of or in the interests of a given employee are not included in either costs or non-expenses and are not reflected <*> .

Let us recall that earlier the Ministry of Taxes and Taxes explained that if, under the terms of an agreement for the provision of telecommunication services, an organization acts as a subscriber, and employees reimburse the cost of such services in terms of their use for personal purposes, then when calculating income tax, amounts received from employees are included in non-income to reimburse the cost of telephone calls. In this case, the cost of communication services is included in non-expenses within the limits of the amount of compensation received on the date of actual expenses, but not earlier than the date of receipt of compensation <*>.

If you reimbursed the commission agent for expenses, include these amounts in expenses

In the case of the sale of property through a commission agent, the amount of expenses reimbursed to him is included by the principal in the costs taken into account for taxation and is reflected in the calendar quarter to which it relates (accrual principle), regardless of the time (term) of payment (preliminary or subsequent) < *>.

If amounts received in excess of the contract price, include them in revenue

Funds received as part of the fulfillment of contractual obligations for the sale of goods (works, services), property rights that participate in the formation of the price (cost) or are received in excess of the price (cost) of the contract are recognized as revenue for income tax purposes <*>.

If the tenant has reimbursed amounts in excess of the rent, he can include them in costs

The lessor under a sublease agreement) includes all funds received within the framework of as non-income .

The tenant can take into account when taxing profits the amounts subject to reimbursement (real estate tax, land tax, utility bills, etc.) in excess of the rent only if the lessor makes such payments in accordance with the law or other agreements on the maintenance and servicing of the leased property.

Similarly, when taxing, reimbursed amounts of real estate tax, land tax (land rent) by members of the owners' association directly to the partnership are taken into account as expenses - in the part attributable to the property owned by them, and only if the owners' association makes such payments in in accordance with the law<*>.

On paying income tax from your own funds

In some cases (when using Internet resources in sales), an organization - a tax agent, if it is impossible to withhold income tax from its payer, pays it at its own expense <*>.

Expenses for paying income tax cannot be taken into account when taxing profits either as part of costs or as part of non-expenses. Even if the organization is exempt from administrative liability.

When do you need to pay tax?

Income tax for the second quarter must have been paid no later than July 23, 2020 (July 22, 2020 - Sunday) <*>.

If on the 23rd there is not enough money in the organization’s account to pay the tax, then you need to place a payment order in the bank for the entire amount necessary to pay off the tax debt. Then only a penalty will be charged. There will be no administrative violation due to incomplete payment of tax <*>.

It is also possible to repay unpaid taxes at the expense of debtors <*>. To do this, no later than 5 working days from the date the income tax debt arose, you need to submit a list of debtors to the tax office <*>. For failure to provide such information within the specified period or for providing false information, the official may be brought to administrative responsibility <*>.

Submitted an updated declaration - be prepared for verification

From January 1, 2020, a restrictive period for checking compliance with tax legislation was introduced <*>.

In general, an audit of the payer's compliance with tax legislation is carried out by the tax authority for a period not exceeding 5 calendar years preceding the year in which the decision to order the audit was made, and for the expired period of the current calendar year <*>.

But if, as a result of filing an updated income tax return, the loss increases (occurs) for more than 5 years, the period for which the organization submitted the updated return is checked <*>.

Latest clarifications from the Ministry of Finance on VAT

In order to correctly fill out the declaration, it is necessary to correctly calculate both the tax base and the VAT itself. Let's consider several explanations from officials issued in the 2nd quarter of 2020 that will help you in working on the report:

- If VAT is not indicated in the contract, but it follows from it that the contract price is indicated without VAT, charge the tax on top of this price and present it to the buyer. Otherwise, allocate VAT by calculation at the rate of 18/118 or 10/110 (letter of the Ministry of Finance dated April 20, 2018 No. 03-07-08/26658).

- If you decide to write off fixed assets without waiting for the end of depreciation (for example, due to wear and tear), then the VAT amounts accepted for deduction when purchasing fixed assets cannot be restored (letter of the Ministry of Finance dated April 16, 2018 No. SD-4-3/).

- If you do not have a supplier invoice, but the fact that the work was carried out is confirmed by the court, VAT deduction cannot be applied: the presence of a correctly executed incoming invoice is a prerequisite for VAT deduction (letter of the Ministry of Finance dated 04/05/2018 No. 03-07-11/22147 ).

What legislative innovations need to be taken into account when calculating income tax, and which not

Legislators regularly adjust tax legislation. Thus, in 2020, due to the coronavirus epidemic, the rules for paying advance payments were temporarily changed:

- the income limit has been increased to switch to quarterly advances without monthly payments;

- It is allowed to switch to paying advances on actual profits within a year.

If you take advantage of these innovations, the procedure for filling out the declaration will also change.

We also recommend taking into account the following recent changes in legislation:

- Check the waybills when writing off fuel and lubricants. Documents must be prepared taking into account the latest clarifications of the Ministry of Transport.

- Check that all airfare costs are supported by your boarding pass. It is risky to include electronic forms in costs .

- You can take into account the costs of advertising on the Internet in full. They are not limited.

- Check the primary costs, because Only a cash receipt does not confirm expenses.

- Record the investment deduction in your declaration. The current declaration form provides a special annex for it.

ConsultantPlus experts provided instructions on how to reflect investment deductions in the declaration:

You can view it by getting free trial access to the system.

Our special section will help you keep track of current tax news.

Penalties for late submission of declarations

For late submission or failure to submit a declaration, the company will face a fine of 5% of the amount for each month of delay, including partial months, but not more than 30% of the amount of arrears and not less than 1 thousand rubles. (clause 1 of article 119 of the Tax Code of the Russian Federation). In case of untimely submission of a zero declaration, the taxpayer will be presented with a minimum fine of 1 thousand rubles.

If the period of non-submission of the declaration exceeds 10 days, inspectors have the right to block the taxpayer’s current accounts (subclause 1, clause 3, article 76 of the Tax Code of the Russian Federation).

If a VAT return is submitted in an unspecified format (on paper instead of electronic), the report is not accepted by tax authorities and is considered not submitted (clause 5 of Article 174 of the Tax Code of the Russian Federation). Consequently, the taxpayer faces the same sanctions as for failure to submit.

Taxes when working abroad

When a Russian company cooperates with foreign organizations and purchases either work or services abroad, it is automatically considered a tax agent and is obliged to remit VAT to the State Treasury. In addition to directly paying the tax, the company pays for the work or services provided by the foreign entity.

Such rules are spelled out in paragraph 4 of Article 174 of the Tax Code of the Russian Federation. If goods are imported into the country, then the tax must be paid no later than the 20th day of each month occurring after 30 days during which it was accepted or payment was made under the leasing agreement. For example, if a product was brought into the territory of the Russian Federation and registered in March, tax must be paid for it on April 20.

Here are the deadlines for paying VAT in 2020. The table for legal entities and individual entrepreneurs is given in this article. Exact dates for paying VAT.