3. If the amount of fixed insurance premiums paid by an individual entrepreneur exceeds or is equal to the amount of tax on imputed income in the same tax period. This point can only be implemented for individual entrepreneurs who do not use hired labor.

However, even if the activity was not actually carried out, you will still have to pay a single tax if the taxpayer is registered.

Deadlines for paying UTII in 2020

The tax period for the Unified Tax on Imputed Income is a quarter. In accordance with the norms of the current Russian legislation (clause 1 of Article 346.32 of the Tax Code of the Russian Federation), UTII must be paid to the state budget no later than the 25th day of the month that follows the previous tax period, that is, quarter.

It is worth considering that if the date of payment of the single tax falls on a non-working day, then payment should be made no later than the first working day (after a holiday or weekend). This is stated in the Tax Code of the Russian Federation (clause 7 of Article 6.1).

We invite you to familiarize yourself with the deadlines for paying UTII in 2020 in the form of a table.

Table. Deadlines for payment of the Unified tax on imputed income in 2019

| Payment period | Payment deadline |

| for the 4th quarter of 2020 | until January 25, 2020 |

| for the 1st quarter of 2020 | until April 25, 2020 |

| for the 2nd quarter of 2020 | until July 25, 2020 |

| for the 3rd quarter of 2020 | until October 25, 2020 |

| for the 4th quarter of 2020 | until January 25, 2020 |

Filling out a payment order for payment of UTII

When filling out a payment order, please pay attention to the following:

- field “104” – indicate the BCC and check its correctness;

- field “105” – indicate OKTMO (this code corresponds to the type of “imputed” activity);

- field “110” – payment type – do not fill in this column (this information is contained in the KBK).

The following BCCs have been established for 2020:

- Single tax on imputed income 182 1 0500 110

- Penalty for UTII 182 1 0500 110

- Fine on UTII 182 1 0500 110

The payment order form for payment of UTII, current in 2019, can be found here:

UTII in 2020 must be paid according to the details of the Federal Tax Service, which has jurisdiction over the territory where activities are carried out on the “imputation”.

Responsibility for non-payment of UTII in 2020

For non-payment of UTII, taxpayers are subject to the following liability:

| Basis (Tax Code of the Russian Federation) | Type of responsibility |

| article 45 paragraph 2 | collection of arrears under the single tax on imputed income |

| Article 75 paragraph 1 and 3 | For late payment of tax, penalties are charged (for each day of late payment) |

| article 57 paragraph 2 | |

| Article 122 paragraph 1 | for non-payment of tax there is a fine of 20% of the UTII that was not paid (if the taxpayer did not pay unintentionally) |

| Article 122 paragraph 3 | for non-payment of tax there is a fine of 40% of the UTII that was not paid (if the taxpayer did not pay intentionally) |

Deadlines for filing a UTII declaration in 2020

In 2020, a tax return for UTII must be submitted to the Federal Tax Service:

- at the location of the organization or individual entrepreneur (if it is difficult to determine the specific place of business activity, as is the case with taxi services);

- at the place where the “imputed” activity is carried out.

Please note that there cannot be a zero declaration for UTII. This is due to the fact that even in the absence of actual activity, tax must be paid based on physical indicators, such as premises area, number of employees, etc.

Based on paragraph 3 of Article 346.32 of the Tax Code of the Russian Federation, it is necessary to submit a UTII declaration based on the results of the quarter, no later than the 20th day of the month that follows the reporting quarter.

The form on which you need to submit your UTII declaration in 2019 can be found here:

Table of deadlines for submitting UTII declarations in 2020

| Period for submitting the UTII declaration | Deadline for submitting the UTII declaration |

| for the 4th quarter of 2020 | until January 22, 2020 |

| for the 1st quarter of 2020 | until April 20, 2020 |

| for the 2nd quarter of 2020 | until July 20, 2020 |

| for the 3rd quarter of 2020 | until October 20, 2020 |

This might also be useful:

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free! You can also consult by phone: MSK - 74999385226. St. Petersburg - 78124673429. Regions - 78003502369 ext. 257

Source: https://tbis.ru/nalogi/sroki-envd

Declaration on UTII for the 3rd quarter of 2020: which form to use?

The Federal Tax Service of Russia, in a letter dated July 25, 2018 No. SD-4-3/, explained that for reporting for the 3rd quarter of 2020, you can use one of 2 UTII declaration forms:

- Currently in force (it was approved by order of the Federal Tax Service of Russia dated July 4, 2014 No. ММВ-7-3/) ─ it can be used as before by those companies and individual entrepreneurs that do not declare a cash register deduction in the reporting quarter.

- The form recommended by the Federal Tax Service (the form was approved by order dated June 26, 2018 No. ММВ-7-3/, which is being registered with the Ministry of Justice) ─ this form allows you to reflect the cash register deduction of an individual entrepreneur on UTII (clause 2.2 of Article 346.32 of the Tax Code of the Russian Federation).

The Federal Tax Service allows the taxpayer to choose a form for the report and instructs lower tax authorities to correctly select the template for a particular declaration during the reporting campaign.

Thus, if before the start of the reporting period the new declaration form is not officially approved, you can report both on the form familiar to taxpayers and on the one recommended by the Federal Tax Service. An individual entrepreneur on UTII declaring a deduction using CCP, it is better to use the recommended form.

On September 25, the new form was officially published

A new UTII declaration form has been officially published on the portal of regulatory legal acts.

The updated declaration form provides for the possibility for entrepreneurs to reduce the “imputed” tax by the amount of expenses for the purchase of an online cash register.

To implement this possibility, line 040 “Amount of expenses for the purchase of cash registers, reducing the amount of UTII” has been added to section 3 “Calculation of the amount of UTII for the tax period.”

In addition, a new section 4 appeared in the declaration, “Calculation of the amount of expenses for the acquisition of cash registers, which reduces the amount of the single tax on imputed income for the tax period.” For each copy of the cash register for which the entrepreneur wants to receive a “cash” deduction, you will need to fill out a separate section 4.

Let us remind you that an individual entrepreneur on UTII has the right to reduce the amount of tax on expenses associated with the purchase of cash register equipment, provided that the purchased cash register is registered with the Federal Tax Service in the period from 02/01/2017 to 07/01/2018 (for some individual entrepreneurs - until 07/01/2019) . The maximum amount of “cash” deduction is 18 thousand rubles. for one copy of CCT.

You can report using the new form for the 3rd quarter of 2020. After all, the Federal Tax Service previously recommended using this particular declaration form, even before it was officially published.

Changes to UTII from January 1, 2020 - declaration, calculation formula

The single tax on imputed income is a popular tax regime under which more than 2 million small businesses operate in Russia. For them, of course, it is important to know what changes to UTII will come into force in 2019, and how long this taxation system will be in effect.

When will UTII be cancelled?

Discussions about whether UTII will be abolished have been going on since 2011. What’s wrong with this tax, and why do they want to exclude it from the list of taxation systems operating in the Russian Federation?

The fact is that the procedure for calculating tax on imputed income differs significantly from the procedure for calculating other taxes. UTII is paid not from actually received income, but from imputed income, i.e. pre-established by the state.

In this case, the principle of linking tax payments with the economic indicators of an economic entity is violated. Simply put, UTII payers pay tax on income, which is often much lower than the real one.

Let's take the basic profitability per unit of freight transport as an example. This is only 6,000 rubles per month. But can a cargo transportation business that brings in such a meager income be called successful? And UTII payers pay tax according to a formula that is precisely based on such modest figures of basic profitability.

Federal Tax Service statistics show that in 2020, a tax in the amount of 133,648,484 thousand rubles was assessed on 2,044,154 organizations and individual entrepreneurs that work on imputation.

But considering that the accrued tax can be reduced by the amount of insurance premiums for employees and individual entrepreneurs for themselves, only 69,869,934 thousand rubles were due for payment to the budget.

This means that on average one UTII payer paid 34,180 rubles per year or 2,848 rubles per month to the budget.

But not only individual entrepreneurs without employees who provide household services work in this mode. These are quite large retail outlets, as well as catering establishments (the area limit for these facilities is limited to 150 sq. m). At the same time, there is no income limit on UTII, and the permitted number of employees is 100 people.

UTII was introduced in 2003 to reduce the fiscal burden, and its action was justified in the period when small businesses in Russia were just taking shape. But, for example, in Moscow UTII has already been abolished since 2011. And it was valid only for one type of activity - outdoor advertising using advertising structures.

And in other cities of federal significance - Sevastopol and St. Petersburg - city administrations have significantly reduced the list of activities permitted for UTII. The reason for this is clear - business revenues here far exceed revenues from similar activities in other regions.

So, the abolition of tax on imputed income has already become a reality, and from 2021, UTII will be terminated throughout Russia. But for now, those who work in this mode have two more years of activity ahead – 2020 and 2020.

2020 changes in the UTII calculation formula

The formula for calculating UTII includes not only the basic profitability, but also a physical indicator (number of employees, area in square meters, number of transport units, etc.). In addition, the final tax amount is affected by two coefficients - K1 and K2.

The K1 coefficient is established annually by order of the Ministry of Economic Development of the Russian Federation and is valid throughout the Russian Federation. K1 is called a multiplying factor because it reflects the increase in inflation. For 2020, K1 is set at 1.915. In the previous year it was 1.868, that is, the increase is quite insignificant.

The K2 coefficient is under the control of municipalities. Using K2, local authorities can significantly reduce the imputed tax payable. The K2 fork ranges from 0.005 to 1. Not all administrations of localities approve the reduction factor annually. In some cities, K2 remains at the same level for several years in a row.

Let's look at a specific example to see how much the UTII payable in 2020 will increase compared to 2020.

Individual entrepreneur store without employees in Kurgan with an area of 45 square meters. meters sells clothing and accessories. The Kurgan City Duma established that the K2 coefficient for this type of activity will have a maximum value, that is, “1”.

Moreover, the K2 coefficient has remained unchanged here for several years. This means that the city administration believes that retail trade in clothing is a profitable business, and a reduction in the tax burden is not required. For comparison, for children’s assortment and food stores, K2 is slightly lower (0.7 and 0.8, respectively).

Let's calculate the amount of tax on imputed income using these data using the formula (DB * FP * K1 * K2 * 15%):

- for 2020 – (1800 * 45 * 1.868 * 1) * 15% = 22,696 rubles per month or 68,088 rubles per quarter;

- for 2020 – (1800 * 45 * 1.915 * 1) * 15% = 23,267 rubles per month or 69,801 rubles per quarter.

As you can see, the accrued quarterly tax increased by only 1,713 rubles compared to 2018.

However, this amount can be reduced by insurance premiums that the individual entrepreneur pays for himself. Contributions include not only mandatory payments, but also an additional contribution from the amount of imputed income exceeding 300,000 rubles.

| Period | Mandatory contributions | Imputed income | Additional payment |

| 2018 | 32,385 rubles | 605,232 rubles | 6,052 rubles |

| 2019 | 36,238 rubles | 620,460 rubles | 6,205 rubles |

In total, the individual entrepreneur will pay contributions for himself in 2020 of 38,437 rubles, and in 2019 - 42,443 rubles. We reduce the quarterly tax calculated above by the contributions paid and get the amount of tax payable:

- 58,479 rubles in 2020;

- 59,190 rubles in 2020.

That is, the real tax increase for this individual entrepreneur turned out to be even less - only 711 rubles per quarter.

UTII and online cash registers

For a long time, UTII payers enjoyed another benefit - the opportunity to work without a cash register. Indeed, why do you need to report to the Federal Tax Service about real revenue if it is not taken into account for the tax base?

Instead of a cash receipt, the impostors issued a BSO when providing services or a sales receipt when selling at retail. But the situation began to change since July 2020. Then stores and catering outlets were required to install an online cash register if they have employees.

Moreover, organizations on UTII were automatically recognized as employers, so only individual entrepreneurs trading or catering independently, without employees, received a deferment in the use of the cash register.

But from July 1, 2020, this category of taxpayers also loses the right to work without a cash register. From the same date, UTII payers will no longer be able to issue printing BSOs when providing services to the public. Instead, you need to issue a cash receipt or BSO, which is generated by an automated system (a type of cash register equipment). Cash registers will also become mandatory when trading through automatic machines.

To compensate for the costs of installing cash registers, individual entrepreneurs were provided with a tax deduction on UTII. Individual entrepreneurs will be able to reduce the accrued tax by up to 18,000 rubles for each installed cash register. Organizations do not have such benefits.

New UTII declaration

In order for individual entrepreneurs to be able to reflect in their declaration a tax reduction on the amount of expenses for purchasing cash registers, tax authorities have developed a new reporting form.

From January 1, 2020, UTII payers must submit a declaration in the form approved by order of the Federal Tax Service dated June 26, 2020 N ММВ-7-3/ [email protected]

The new form now contains Section 4, which contains information about the purchased cash register: serial and registration number, model name, date of registration with the Federal Tax Service and the amount of purchase costs.

Due to this, the number of pages of the declaration increased from four to five.

The deadline for submitting the UTII declaration in 2020 remains the same - no later than the 20th day of the first month of the next tax period. This is January 20, April, July, October, respectively, for each quarter.

If this date falls on a weekend, it is postponed to the next working day. For example, the deadline for submitting the UTII declaration for the 4th quarter of 2020 is postponed to January 21, 2020, because January 20 is Sunday.

The deadline for paying quarterly taxes in 2020 has also not changed - the 25th day of the month following the reporting quarter. This is 5 days later than the deadline for submitting the declaration, i.e. January 25, April, July, October.

Source: https://www.regberry.ru/nalogooblozhenie/izmeneniya-po-envd-s-1-yanvarya-2019-goda

Sample of filling out the title page

Let's talk about the procedure for filling out the UTII declaration for the 3rd quarter of 2018 using an example.

Individual entrepreneur Nadezhda Arkadyevna Kuleshova provides hairdressing services (OKVED 96.02). In the hairdressing salon of N.A. Kuleshova. 4 employees work under employment contracts (total number ─ 5 people including individual entrepreneurs). In July 2020, she registered a cash register with the tax authorities. The cost of purchasing a new generation cash register (online cash register), setting it up and connecting it amounted to RUB 12,480.

To prepare a declaration for UTII Kuleshova N.A. I used the form recommended by the Federal Tax Service.

She filled out the main block of the title page as follows:

Filling out the title page of the updated UTII declaration form follows the usual rules - there have been no changes to it (except for the barcode). The sections are formatted according to the following scheme:

- First, the amount of UTII for the quarter is calculated (Section 2).

- Then the amount of expenses included in the cash register deduction is determined (Section 4).

- The amount of tax to be transferred to the budget is determined, taking into account the contributions paid and the amount of cash deduction (Section 3).

- The final data is transferred to Section 1.

You can also use another approach: first make all the necessary calculations (prepare the initial data), and then sequentially fill out all sections of the declaration with them.

Deadlines for paying UTII in 2020

The declaration of imputation includes 3 sections and a title page. The pages in the document are sequentially numbered and have three spaces to fill out - 001, 002 and so on.

We recommend that you start filling out the UTII declaration from Section 2, since it is there that detailed calculation data is written down, which can ultimately lead to filling out not one or two, but several sheets of this section at once.

The calculations from Section 2 are summarized in the next Section - 3. Having filled out this data, you can begin filling out Section 1.

It is not clear why the tax authorities placed the sections in this order, however, the sheets of the completed UTII declaration for the 4th quarter of 2020 are at the end folded in accordance with the Section numbers in order, and the sheets of the document are also numbered in order. The document must be carefully stapled so as not to damage the sheets.

It should be immediately clarified that tax authorities do not have strict requirements for certification of this document with the organization’s seal. Even if you have not abandoned the use of a round seal, which is now permitted by law, you do not have to put the stamp in the declaration.

Declaration of UTII for individual entrepreneurs (filling sample).

Declaration of UTII for organizations (filling sample).

- All indicators are recorded starting from the first (left) cell, and if any cells are left blank, dashes must be placed in them.

- If there is no data to fill out a field, a dash is placed in each cell.

- Physical indicators and values of cost indicators are indicated in whole units according to rounding rules (with the exception of the K2 coefficient, the value of which is rounded to the third decimal place).

- Text fields are filled in in capital block letters.

- When filling out the declaration, you must use black, purple or blue ink.

- When filling out a declaration on a computer, characters must be printed in Courier New font with a height of 16-18 points.

- All pages, starting from the title page, must be numbered (for example, the 1st page is “001”; the second is “020”, etc.).

- On the title page and pages of the first section, you must sign and date the declaration. At the same time, if there is a seal, then it should be placed only on the title page, where the M.P. is indicated. (place of printing).

- There is no need to stitch or staple the pages of the declaration.

- Double-sided printing of the declaration and correction of errors in it are not allowed.

- Fines and penalties are not reflected in the declaration.

- It is more convenient to fill out the second section first, then the third, and lastly the first section of the declaration.

When determining the latest reporting date, it is necessary to take into account that the 20th day of the first month following the 4th quarter of 2020 falls on a weekend. Therefore, you can report a little later than the legally established deadline - on the next working day (Clause 7, Article 6.1 of the Tax Code of the Russian Federation).

In January 2020, only the deadline for submitting the UTII declaration for the 4th quarter of 2020 is shifted; the deadline for payment in this period coincides with the legally established one.

Section 2 of the declaration

It must be filled out separately:

- for each type of activity,

- for each location of a specific type of business activity (for each OKTMO).

In our example, IP Kuleshova N.A. carries out only one type of activity in a single hairdressing salon, so she only needs to complete one Section 2.

Procedure for filling out this section:

| Section line number 2 | What to indicate? | Where to get the data? |

| 010 | Code of the type of activity performed (for households) | Appendix No. 5 to the Procedure for filling out the declaration |

| 020 | Full address of the hairdressing salon (place of business) | The code of the subject of the Russian Federation must be taken from Appendix No. 6 to the Procedure for filling out the declaration |

| 030 | OKTMO code of the place of activity | OK 033-2013 All-Russian classifier of municipal territories |

How to fill out the remaining lines of Section 2 according to the example data is shown in the example:

Column 3 (on pages 070-090) for this example does not contain numerical values (dashes are inserted), since individual entrepreneur N.A. Kuleshova was not registered/deregistered with the tax authority in the reporting quarter. If this happened in one of the months of the quarter, in column 3 we would indicate the number of calendar days from the date of registration to the end of the month in which the individual entrepreneur (or company) registered as a UTII payer. In this case, when calculating UTII, the number of calendar days of actual activity in the month the taxpayer is registered will be taken into account.

UTII reporting – online

Individual entrepreneurs and organizations must submit UTII declarations to the tax authority at the actual place of business.

When providing services such as:

- delivery or peddling retail trade;

- advertising on vehicles;

- provision of motor transport services for the transportation of passengers and cargo;

It is impossible to unambiguously determine the place of business, therefore, in such cases, individual entrepreneurs submit declarations to the Federal Tax Service at their place of residence, and organizations at their location (legal address).

Several points on UTII with one type of activity

If you have several points on UTII with the same activity in one municipality (with one OKTMO), then you need to submit one declaration, but at the same time summing up the physical indicators from each point in the 2nd section of the declaration.

If you have several points on UTII with the same activity in different municipalities (with different OKTMO), then you need to submit your own declaration to the tax office of each entity, while you do not need to summarize the physical indicators and fill out several sheets of the second section.

Several types of UTII activities

If you are engaged in several types of UTII activities in the territory under the jurisdiction of one Federal Tax Service, then you need to submit one declaration, but with several sheets of section 2 (filled out separately for each type of activity).

If you are engaged in several types of UTII activities in different municipalities, then you must submit your own declaration with the required number of sheets of section 2 to the tax office of each entity.

If an individual entrepreneur carries out his activities without using the labor of hired employees, then based on the results of the reporting periods, the individual entrepreneur is required to submit a UTII declaration to the local tax office.

This report was approved in 2014 by order of the Federal Tax Service, including its form, requirements for its completion and the format for submitting the declaration to the tax office in electronic form (Order of the Federal Tax Service dated July 4, 2014 No. ММВ-7-3 / [email protected]

Our tips will help you meet the 20-day deadline for preparing and submitting the UTII declaration:

- Check whether you have the right to apply UTII in the 1st quarter of 2019.

How the Federal Tax Service recommends calculating the maximum number of vehicles for UTII, see the publication.

Let us remind you once again that the form has recently changed.

- Before calculating the imputed tax, check whether the physical indicator involved in the tax calculation has changed.

How to determine retail space for UTII, read here.

Find out whether it is possible to submit a zero UTII declaration if there are no physical indicators from this article.

What else to pay attention to so that the UTII declaration reaches the tax inspectors in a timely manner, we will tell you further.

For electronic and paper UTII declarations, a single deadline has been established for submission (unlike, for example, the calculation of 4-FSS, the paper version of which is submitted 5 days earlier than the electronic one).

Find out more about the deadlines for 4-FSS here.

Therefore, no matter how you report, the deadline for submitting the UTII declaration for the 1st quarter of 2020 falls on 04/22/2019.

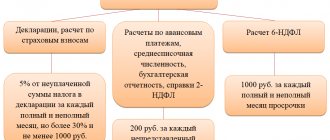

If you still fail to report on time, be prepared for sanctions from the tax authorities:

- 4-FSS (for a quarter, half a year, 9 months and a year);

- Calculation of insurance premiums;

- 2-NDFL;

- 6-NDFL;

- Information on the average number of employees (once a year);

- Confirmation of the main type of activity in the Social Insurance Fund;

- Annual financial statements to the Federal Tax Service and statistical authorities (organizations on UTII are required; individual entrepreneurs on UTII are not required to keep accounting records and generate appropriate reporting).

Individual entrepreneurs without employees submit only a UTII declaration.

If an organization or individual entrepreneur is engaged in several types of activities, some of which do not fall under UTII, then they need to submit reports under two tax regimes at once and keep separate records for the correct payment of taxes.

- In person or through a representative in paper form.

- By registered mail with a list of attachments.

- Via the Internet, for example, using our service (submitting a declaration in xml format, signed with an electronic signature).

Section 3 of the declaration

Here you need to combine the data from sections 2 and 4 to calculate the total amount of tax to be transferred to the budget. The tax must first be reduced by the insurance premiums paid (but not more than 50%), and then by the cash register deduction.

IP Kuleshova N.A. paid insurance premiums in the 3rd quarter of 11,500 rubles. This does not exceed 50% of the calculated UTII tax (25,218 rubles x 50% = 12,609 rubles), therefore the entire amount of contributions is included in page 020 of section 3. The remaining amount of tax in the amount of 13,718 rubles. (RUB 25,218 ─ RUB 11,500) can be reduced by CCP deduction:

RUB 13,718 ─ 12,480 rub. = 1,238 rub.

This amount must be indicated in Section 1 and transferred to the budget.

IMPORTANT!

The indicator p.050 can be zero, but cannot take a negative value. This means that if the CCP deduction exceeds the tax after deducting insurance premiums paid, nothing needs to be transferred to the budget at the end of the reporting quarter. And the balance of the cash register deduction can be transferred to the 4th quarter.

Let's explain with an example.

Expenses of IP Rodygina S.A. in the 3rd quarter for the purchase and connection of an online cash register amounted to RUB 20,180. And the calculated tax for this period (taking into account its reduction by the amount of insurance premiums) amounted to 12,780 rubles. In the declaration for the 3rd quarter of IP Rodygin S.A. will reflect:

- on page 050 of Section 4 ─ the amount of the cash register deduction is 18,000 rubles. (this is the maximum that is allowed under clause 2.2 of Article 346.32 of the Tax Code of the Russian Federation for a cash deduction);

- on page 050 of Section 3, a zero will be entered (RUB 12,780 ─ RUB 18,000 = – RUB 5,220 <0).

The balance of the cash register deduction is in the amount of 5,220 rubles. the entrepreneur will reflect in the declaration for the 4th quarter. In this case, the amount of the remaining deduction is determined not on the basis of the actual costs of CCP (20,180 rubles), but on the basis of the permissible maximum (18,000 rubles).

Delivery conditions

The tax return for UTII is submitted to the Federal Tax Service at the place of business of the entrepreneur or at his location (if it is impossible to accurately determine the specific place of activity - for example, for taxi services).

Since 2013, UTII, like the simplified tax system, has been a voluntary taxation system.

The tax declaration of individual entrepreneurs and organizations is completed based on the results of each quarter - no later than the 20th day of the month following the reporting quarter (clause 3 of Article 346.32 of the Tax Code of the Russian Federation).

There cannot be a zero declaration for UTII. Even if the taxpayer temporarily does not conduct business, he must pay tax based on physical indicators (area, number, etc.).

Section 4 of the declaration

Lines 010-050 of Section 4 must be completed for each copy of the cash register purchased for UTII activities and registered with the tax authorities within the established time frame.

Let's continue with our original example. According to its terms, IP Kuleshova N.A. On July 17, 2018, I registered a cash register with the tax authorities. The cost of purchasing a cash register and connecting it amounted to 12,480 rubles. In section 4, to receive a cash register deduction, the entrepreneur filled out one block of lines 010-050:

The amount of expenses for purchasing a cash register reduces the UTII tax and is reflected in section 2 of the declaration.

Zero UTII declaration

You cannot submit zero declarations for UTII.

The UTII tax is calculated not on the actual profit received, but on the income imputed by the state, so regardless of whether you are actually conducting business or not, you will have to pay taxes and submit a declaration in any case.

There were no physical indicators during the quarter

Even if you had no physical indicators for a good reason (there was a fire, an employee got sick) and you managed to submit a declaration with “zero” indicators, then by law this will be considered a violation and you will have to eliminate them by submitting an updated declaration with an additional amount of tax.

https://www.youtube.com/watch?v=https:tv.youtube.com

In general, the state’s position on “zero” UTII declarations is quite simple: if there is no activity, then write an application for deregistration, and if it is, then pay taxes and submit normal declarations.

How often do I need to report on UTII and pay tax?

In order not to receive claims from controllers, it is important for the taxpayer using UTII to remember two important calendar dates:

- The 20th day of the month following the expired quarter - no later than this date, submit to the tax authorities your UTII declaration for the expired quarter;

- The 25th day of the month following the end of the quarter - no later than the specified date, the tax reflected in the declaration must go to the budget.

If the deadline for submitting a declaration or paying a tax falls on a weekend (non-working) day, it is shifted to the next closest working date. Since October 20, 2020 is a Sunday, taxpayers have 1 additional day to prepare their return, because... The deadline has been moved to 10/21/2019.

Taking into account the quarterly frequency of reporting and payment of UTII, in the period from 01/01/2019 to 12/31/2019, the UTII taxpayer will need to submit 4 UTII declarations and pay the tax to the budget 4 times on time.

Read about the accounting rules for UTII here.

We will tell you what to take into account in the UTII declaration based on the results of the 3rd quarter in the next section.

How to fill out a declaration

The procedure for filling out the report fields is contained in Order No. ММВ-7-3/414. Some information is taken from its appendices. Which ones exactly will be noted in the text.

Title page

At the top, the entrepreneur’s TIN and page number are indicated in format 001. The legal entity also enters the checkpoint. This block is identical for all report sheets; only the page number will change.

In the following fields of the title of the UTII declaration of our individual entrepreneur for the 3rd quarter of 2019, you need to enter:

- adjustment number - 0, because the report for the specified period is submitted for the first time;

- tax period - 23, this is the code for the 3rd quarter from Appendix No. 1;

- reporting year - 2019;

- Mozhaisk tax inspectorate code - 5075, taken from registration documents;

- code for the place of registration from Appendix No. 3 - 320, since the individual entrepreneur is registered at the place of business;

- last name, first name and patronymic of the individual entrepreneur in printed capital letters on a separate line. The legal entity must indicate its full name here as in the charter or other document of establishment;

- contact phone number;

- number of sheets - 5, attached copies - 2. The individual entrepreneur must attach documents for the purchase of the cash register, for example, an invoice and a receipt (copies). They will serve as confirmation for the deduction.

The line dedicated to reorganization is filled out only by legal successors and companies in the process of liquidation. The reorganization code is in Appendix No. 2.

The lower part of the sheet is divided into 2 blocks, but only the left one needs to be filled out. Code 1 should be indicated in the top field if the signature on the report is signed by the entrepreneur or the director of the organization. If the individual entrepreneur signed it, but his representative submitted the declaration, then code 1 is still entered, and dashes are placed in the following fields. When filling out a report by an organization, you must indicate the full name of the director in these lines.

Code 2 should be entered only when the declaration is signed by an authorized person. Next, indicate his full name, and in the bottom two lines of the sheet - the parameters of the power of attorney. If the interests of the UTII payer are represented by an organization, its name must be indicated.

Section 2

The section is filled out for each “imputed” activity separately. It happens that only one type of business is registered, but work is carried out at several points that belong to different tax inspectorates. In this case, the declaration should include several sections 2 - according to the number of OKTMO codes.

In the report of entrepreneur Petrov there will be only one section 2, since he has one line of business, as well as the address of the place where services are provided. The upper part of the fields should be filled in as follows:

- 010 - activity code from Appendix No. 5. For vehicle repair and maintenance it is 03;

- 020 - code of the subject of the Russian Federation, index and address of the car service;

- 030 - OKTMO code.

The following lines include the profitability indicator and coefficients from Table 1. Lines 070-090 are filled out equally, since the individual entrepreneur had no changes in the number of employees during the quarter:

- column 2 - physical indicator - 3;

- Column 3 in our case is not filled in, since the individual entrepreneur was not registered or deregistered;

- Column 4 is the UTII base, which is calculated using the formula: Physical. indicator * Base. profitability * K1 * K2.

For individual entrepreneur Petrov, the base for calculating UTII for the month will be: 3 * 12,000 * 1,915 * 1 = 68,940 rubles. Base for the entire period: 68,940 * 3 = 206,820 rubles. This amount should be entered in line 100. In line 105 the rate is indicated - 15%, and in line 110 - the amount of UTII: 206,820 * 15% = 31,023 rubles.

Free tax consultation

Section 3

Here the previously calculated UTII is reduced by deductions. If an entrepreneur has employees, then the deduction from contributions can be no more than 50% of the UTII. The same rule applies to organizations. If there are no employees, the individual entrepreneur takes into account only his contributions. However, in this case the restriction does not apply, that is, the tax can be reduced at least to zero.

As for the cash deduction, its maximum amount is 18,000 rubles per 1 purchased copy of cash register. You can reduce UTII starting from the period in which the cash register was registered with the tax service. The deduction can be claimed for the entire amount at once or in parts over several periods.

Let's calculate the deductions:

- The individual entrepreneur transferred contributions for 60,000 rubles. But he is an employer, so he can only reduce his tax by half: 31,023 / 2 = 15,511.5. We will round this amount in favor of the Federal Tax Service so that there is no underpayment. As a result, after reducing contributions, the tax amount will be: 31,023 - 15,511 = 15,512 rubles.

- The amount received can be reduced to zero by deducting the cash register. It is this amount that must be indicated in line 040 of section 3 of the UTII declaration. For individual entrepreneurs, 2020 is the last year for which they can claim a cash deduction. Therefore, entrepreneur Petrov must declare the balance in the amount of 18,000 - 15,512 = 2,488 rubles in the report for the 4th quarter, otherwise it will be lost.

In section 3 of our IP report you should indicate:

- in line 005 - code 1, since it attracts workers;

- in line 010 - the amount of UTII from section 2 - 31,023;

- in line 020 - the amount of contributions that reduce the tax - 15 51;

- There are dashes in line 030 because the individual entrepreneur did not pay his own contributions in the 3rd quarter;

- in line 040 - the amount of cash deduction 15,512;

- in line 050 - UTII payable for the quarter: 31,023 - 15,511 - 15,512 = 0.

Section 4

Since the UTII declaration for the 3rd quarter of 2020 of entrepreneur Petrov contains a deduction for CCP, this section is filled out as follows:

- in lines 010 and 020 - information from the device passport - name and serial number;

- in line 030 - the registration number assigned to the device by the Federal Tax Service;

- in line 040 - the date of registration of the cash register;

- in line 050 - the amount of the cash deduction.

If the individual entrepreneur does not claim a deduction, dashes are entered in all fields. The organization does the same.

Section 1

This section reflects the results of the calculation of UTII. For individual entrepreneur S.P. Petrov fill in just two lines:

- 010 - OKTMO;

- 020 - the amount of tax payable for the quarter. In our example, the individual entrepreneur does not have to pay anything.

When the UTII declaration for the 3rd quarter of 2020 is ready, you need to put the date and sign in two places: at the bottom of the title page and section 1.

In conclusion, let us remind you that the imputation report must be submitted by all payers, including those who did not work during this period. There are no zero declarations, because the amount of tax depends on possible, and not on actual income. It is also important to remember that from January 1, 2021, UTII in Russia will be cancelled.

Who does not need to report on UTII in the 3rd quarter?

If companies or individual entrepreneurs carried out activities falling under the UTII regime in the 3rd quarter, this does not mean that they automatically become payers of this tax at the end of the quarter.

It must be taken into account that UTII is not available to some business entities. Taxpayers cannot apply this regime if:

- the average number is more than 100 people. and/or the share of other legal entities in the authorized capital exceeds 25%;

- UTII does not apply in the territory of their work;

- they are healthcare, educational or social welfare organizations (in terms of catering services) or provide rental services for gas stations and gas filling stations (gas filling stations);

- they belong to the category of the largest (the criteria for such entities are specified in the order of the Ministry of Taxes dated April 16, 2004 No. SAE-3-30 / [email protected] as amended by the order of the Federal Tax Service dated December 25, 2017 No. MMV-7-7 / [email protected] );

- The types of activities falling under UTII are carried out within the framework of agreements on joint activities or trust management of property;

- they carry out trading activities that are subject to UTII on the territory of the municipality (federal city), where the trade tax is established;

- they are taxpayers of the Unified Agricultural Tax and sell the agricultural products they produce within the framework of retail trade and public catering activities subject to UTII;

- they are institutions that have the status of a state or municipal governing body (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 22, 2010 No. 561/10).

Thus, these categories of taxpayers do not file a UTII declaration at the end of the 3rd quarter and do not pay tax. At the end of the reporting period, they have obligations for other taxes (VAT, income tax, etc.).

Who can apply UTII

Individual entrepreneurs and legal entities have the right to switch to UTII for certain types of activities. A complete list of activities is presented in Article 346.26 of the Tax Code of the Russian Federation, but this list is adjusted in each region.

The use of UTII is a voluntary decision of each taxpayer. This taxation system is applied at will to a certain type of activity, if it is on the approved list. UTII can be used simultaneously with other taxation systems, for example with the simplified tax system.

UTII is applied if the taxpayer carries out:

- Domestic services;

- Veterinary services;

- Motor transport services, namely passenger and freight transportation, repair and maintenance of vehicles, provision of parking spaces for vehicles, etc.;

- Retail trade, which is carried out through shops, pavilions, provided that the area of the sales floor does not exceed 150 square meters for each facility, as well as facilities of a stationary retail chain without a sales area and facilities of a non-stationary retail chain;

- Catering services through organizations whose service room area does not exceed 150 square meters for each facility, as well as if they do not have a customer service room;

- Advertising services that are placed on advertising structures, as well as advertising on both the internal and external surfaces of vehicles;

- Provision of temporary accommodation, the total area of which does not exceed 500 square meters

- Providing rental services - a retail outlet or a plot of land.

Also, in order to switch to UTII for certain types of activities, individual entrepreneurs and legal entities must meet certain conditions, namely:

- The number of employees should not exceed 100 people;

- The share of participation in the authorized capital of the enterprise of other enterprises is no more than 25%.