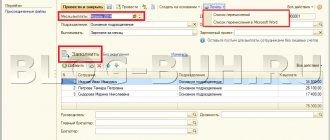

Select category 1. Business law (237) 1.1. Instructions for starting a business (26) 1.2. Opening an individual entrepreneur (27) 1.3. Changes in the Unified State Register of Individual Entrepreneurs (4) 1.4. Closing an individual entrepreneur (5) 1.5. LLC (39) 1.5.1. Opening an LLC (27) 1.5.2. Changes in LLC (6) 1.5.3. Liquidation of LLC (5) 1.6. OKVED (31) 1.7. Licensing of business activities (13) 1.8. Cash discipline and accounting (69) 1.8.1. Payroll calculation (3) 1.8.2. Maternity payments (7) 1.8.3. Temporary disability benefit (11) 1.8.4. General accounting issues (8) 1.8.5. Inventory (13) 1.8.6. Cash discipline (13) 1.9. Business checks (19) 10. Online cash registers (14) 2. Entrepreneurship and taxes (415) 2.1. General tax issues (27) 2.10. Tax on professional income (9) 2.2. USN (44) 2.3. UTII (46) 2.3.1. Coefficient K2 (2) 2.4. BASIC (36) 2.4.1. VAT (17) 2.4.2. Personal income tax (8) 2.5. Patent system (24) 2.6. Trading fees (8) 2.7. Insurance premiums (64) 2.7.1. Extra-budgetary funds (9) 2.8. Reporting (86) 2.9. Tax benefits (71) 3. Useful programs and services (40) 3.1. Taxpayer legal entity (9) 3.2. Services Tax Ru (12) 3.3. Pension reporting services (4) 3.4. Business Pack (1) 3.5. Online calculators (3) 3.6. Online inspection (1) 4. State support for small businesses (6) 5. PERSONNEL (104) 5.1. Vacation (7) 5.10 Salary (6) 5.2. Maternity benefits (2) 5.3. Sick leave (7) 5.4. Dismissal (11) 5.5. General (22) 5.6. Local acts and personnel documents (8) 5.7. Occupational safety (9) 5.8. Hiring (3) 5.9. Foreign personnel (1) 6. Contractual relations (34) 6.1. Bank of agreements (15) 6.2. Conclusion of an agreement (9) 6.3. Additional agreements to the contract (2) 6.4. Termination of the contract (5) 6.5. Claims (3) 7. Legislative framework (37) 7.1. Explanations of the Ministry of Finance of Russia and the Federal Tax Service of Russia (15) 7.1.1. Types of activities on UTII (1) 7.2. Laws and regulations (12) 7.3. GOSTs and technical regulations (10) 8. Forms of documents (82) 8.1. Primary documents (35) 8.2. Declarations (25) 8.3. Powers of attorney (5) 8.4. Application forms (12) 8.5. Decisions and protocols (2) 8.6. LLC charters (3) 9. Miscellaneous (25) 9.1. NEWS (5) 9.2. CRIMEA (5) 9.3. Lending (2) 9.4. Legal disputes (4) From July 1, 2020, changes will come into force that will affect a number of nuances in the interaction of companies with tax authorities. The list of taxpayers entitled to the application procedure for VAT refund is expanding - now it will also be available to companies whose obligation to pay taxes is secured by a guarantee.

Another change affected the invoice - a new electronic format is being introduced and new details are being added.

New line in the invoice from July 1, 2020

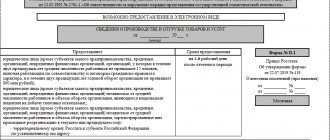

For all VAT payers, from July 1, 2020, one more line has been added to the regular and adjustment invoices.

It is necessary to indicate in it the identifier of the government contract for the performance of work, provision of services or supply of goods, as well as contracts or agreements on subsidies, investments from the budget, or contributions to the authorized capital. The identifier is indicated only if it is in the document. Line 8 has become new for the invoice, and line 5 for the adjustment document.

In essence, this means the introduction of additional control by the state over the relations of counterparties. At the same time, it will not matter whether the contracts fall within the scope of state control; the details must be indicated in each case of their availability.

What changes are being made?

The changes affected not only the initial filling of the document, but also the preparation of an adjustment invoice. Changes were also introduced to the UPD, which is represented by a document combining an invoice and a delivery note.

How to organize transport logistics? Read here.

This is due to the fact that in this documentation there are some columns dedicated directly to VAT. Information about the increased tax rate is indicated in column 7 of the table.

The main changes that come into force from the beginning of 2019 include:

- accountants must prepare to fill out this document in a new way;

- you must use the old form, which was used in 2018;

- the main changes concern column 7, which relates to the tax rate used;

- instead of the standard rate of 18%, a new rate of 20% is indicated;

- additionally, instead of 18/118, the value 20/120 is entered into the formula for determining the settlement rate, for example, such information must be indicated in the document if the company receives an advance payment from its counterparties for the future supply of goods or provision of services;

- It is necessary to use only the form approved by the Government, but companies can supplement this documentation with their own unique details;

- mandatory elements cannot be excluded from the invoice, since otherwise the document will not be accepted by Federal Tax Service employees, so the company will not be able to count on receiving a tax deduction for this tax;

- if there is no need to fill in any lines, then a dash is added rather than the entire column being completely deleted.

Adding VAT to the invoice.

Photo 1-sys.ru If the basic rules for this documentation are violated, the company may face a refusal from the Federal Tax Service employees to provide a tax refund.

Requirements for filling

In order for an accountant to fill out an invoice correctly in 2020, some requirements must be taken into account.

These include:

- basic information about the rules for filling out documentation is contained in PP No. 1137;

- line 1 is intended to indicate the document number, as well as the date of its preparation;

- it is allowed to use any numbering, but these rules are fixed in the internal accounting policies of the company;

- You can only use ascending and continuous numbering;

- line 2 is intended for entering information about the seller, therefore the name of the company is indicated based on the content of the constituent documents;

- line 2a is used to reflect the registration address of the company on the basis of the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs;

- lines 3 and 4 are used to enter information about the consignor and consignee, and these columns are filled in only on the condition that the company sells different goods;

- line 5 is used if goods are sold against a previously transferred prepayment;

- line 6 is intended to reflect information about the buyer, for which the name of the counterparty is entered, which must match the data from the constituent documents;

- line 6a contains information about the counterparty's address;

- Column 7 is intended for the code and name of the currency that is used for settlements between the two parties to the transaction;

- line 8 is used to enter information about the identifier of the government contract or agreement on the basis of which the enterprise receives subsidies, contributions to the authorized capital or investments from the state;

- The table includes the name of goods or services performed, units of measurement, prices or tariffs, the amount of excise tax paid and the total quantity of goods shipped or work performed.

Filling out the invoice.

Photo buhguru.ru If imported goods are sold, then the table additionally indicates what their country of origin is, and also provides data from the customs declaration if the company sells goods imported from other countries.

New invoice format from July 1, 2020

As for the electronic form of the invoice, we are talking about canceling one of the options that could be used.

If previously it was possible to choose any of those approved by orders of the Federal Tax Service of the Russian Federation No. ММВ-7-6/93 dated 03/04/2015 and No. ММВ-7-15/155 dated 03/24/2016, then from July 1, 2020 only the latter remains in force. Likewise, electronic adjustment documents can only be transmitted in the formats introduced by Order of the Federal Tax Service dated April 13, 2016 No. ММВ-7-15/189.

The main part of the document remains the same. However, it will be possible to indicate additional data, including primary details. That is, the format from Order No. MMV-7-15/155 is suitable not only for an invoice, but also for a universal transfer document (UTD), as well as a shipping document.

The new format will reduce discrepancies between the invoice and primary documents, as well as reduce the volume and facilitate the settings of electronic document management.

The right to apply for VAT refund

The declarative procedure for VAT refund implies that the refund of the amount declared in the tax return is made before the completion of a desk tax audit based on this declaration.

This is a simplified procedure that allows companies to quickly and easily return funds. Starting from July of this year, there will be significantly more companies that have the right to this procedure. These will be added to those who have a guarantee from another company to secure the obligation to pay taxes.

However, the state also insures its own interests - a number of requirements have been established for the guarantor that guarantee its solvency:

- the guarantor must be a Russian company;

- he must not have debts on taxes, fees, penalties and fines;

- insolvency proceedings should not be initiated against him;

- it cannot be in the process of reorganization or liquidation;

- the amount of VAT, excise taxes, corporate income tax and mineral extraction tax paid by the guarantor for 3 years must be at least 7 billion rubles;

- the amount of obligations under existing guarantee agreements should not exceed 20% of the value of its net assets.

All these requirements are aimed at protecting the interests of the tax authorities, since it is the guarantor in the event of difficulties that will become the subject to whom financial claims will be sent.

From October 1, 2020, a new invoice form comes into force. Changes were made not only to the form, but also to the filling procedure. Look at the detailed analysis with samples of filling out, what exactly will change, and how to fill out invoices.

What changes have occurred in invoices since 10/01/2017

It's not just the form that has changed. Serious amendments were also made to the filling procedure. First, we’ll deal with the amendments to the form, and then we’ll figure out how to fill out the new document.

Change #1. Added column 1a “Product type code”

The new form has been supplemented with a new column 1a “Product type code”. This column is intended for sellers who export goods to the EAEU countries.

The code must be selected according to the nomenclature of the Commodity Nomenclature of Foreign Economic Activity. If you do not have data for this column, put a dash. In the example below we showed what kind of graph this is.

What has changed in the procedure for filling out the invoice form since 10/01/2017

Now let’s figure out what has changed in the order of filling out the new form.

Change #1. New rules for freight forwarders

New rules for drawing up invoices have been established for freight forwarders. Now companies that do not transport goods themselves, but engage third-party companies, will be able to draw up consolidated invoices and indicate in them information from invoices that they received from hired carriers.

Please note that from October 1, forwarders who make purchases at the expense of the customer, but on their own behalf, fill out consolidated invoices as follows:

- line 1 – date and number of the “consolidated” invoice according to the chronology of the forwarder;

- line 2 – full or abbreviated name of the seller (forwarder), full name of the entrepreneur (forwarder);

- line 2a – forwarder’s address;

- line 2b – INN and KPP of the seller (forwarder);

- line 5 – details (number and date of preparation) of payment and settlement documents indicating that the forwarder transferred money to the sellers, and the client to the forwarder – through the sign “;”;

- Column 1 – names of goods (works, services) in separate positions for each seller;

- columns 2–10 – for each seller, data from the invoices they issued to the forwarder.

As it was There were no separate rules.

Therefore, when drawing up invoices, forwarders were guided by the rules for commission agents. This is what the Ministry of Finance advised to do (letters dated January 10, 2013 No. 03-07-09/01, dated November 1, 2012 No. 03-07-09/148). Change #2. Since October 1, the procedure for filling out invoices when determining the price by calculation method has been prescribed. In some cases, the price of goods (work or services) is determined by calculation method. To do this, the amount of VAT is deducted from the purchase price including VAT. Then the question arises, how to fill out column 4? From October 1, taking into account the changes, the accountant indicates in the new invoice form the difference between column 9 “Cost of goods (work, services), property rights with tax - total” and column 8 “Amount of tax presented to the buyer.” Use this procedure for filling out an invoice when selling: property accounted for VAT upon purchase (clause 3 of Article 154 of the Tax Code of the Russian Federation); agricultural products purchased from a “physicist” (clause 4 of article 154 of the Tax Code of the Russian Federation); a car purchased from a “physicist” (clause 5.1 of Article 154 of the Tax Code of the Russian Federation); property rights (clauses 1–4 of Article 155 of the Tax Code of the Russian Federation). Change #3. We updated the form of the adjustment invoice. The form of the adjustment invoice will also have a column for the product type code - 1b. The filling procedure is similar to column 1a in a regular invoice. Where is this column, look at the sample. In addition, you can now add your own lines and columns to the new adjustment invoice form. The main requirement is that the basic form of the document should not change.

An adjustment document will be needed if the shipping cost has changed. In this case, the seller prepares a document with the corrected value. For example, when the price, quantity or volume of delivery changes.

Change #4. From October 1, the rules for storing invoices will change

From October 2020, there will be strict rules for storing invoices. This procedure has not been described in such detail before.

So, accountants will keep invoices in chronological order as the company issues, corrects, or receives the document.

Shelf life - 4 years. This applies to both regular and adjustment ones. The same amount of time will need to be stored:

- invoice journal;

- book of purchases and sales;

- certified copies of paper invoices received from intermediaries;

- customs declarations or their copies, certified by the head and chief accountant of the organization (IP);

- payment and other documents confirming the payment of VAT in relation to goods imported into the territory of the Russian Federation or imported from the EAEU, etc.

There are also requirements for storing copies of invoices from intermediaries. From October 1, they must be certified by the signatures of the intermediary. This may be a principal, a principal, a developer or a forwarder.

Changes in filling out the invoice

In addition to the presented form, some amendments have been made to the procedure for filling out the document. Such changes are quite enough to cause difficulties for the person in charge.

Let's look at the most important of them in more detail.

- The seller’s address should be entered in accordance with the entry that is available in the Unified State Register of Legal Entities or in the Unified State Register of Individual Entrepreneurs. From the beginning of October, lines 2a should be filled out in a new way. Today, this line contains information about the location of the seller in accordance with the information specified in the constituent documentation or the residential address of the entrepreneur. Starting from October 1, 2017, this detail will need to be indicated in accordance with what information is registered in the Unified State Register of Individual Entrepreneurs or the Unified State Register of Legal Entities. Additionally, it is necessary to enter the postal code for both the seller and the buyer.

- New rules for freight forwarders were adopted. The new invoice is supplemented with attachments that the forwarder or developer will be required to fill out. Previously, there were no such rules, so freight forwarders must familiarize themselves with the current rules in detail and fill out invoices. The order of registration line by line is as follows:

- “1” – date and number of the form;

- “2” – name of the company or forwarder (full and abbreviated);

- “2a” – registration address of the seller;

- “2b” – details of the forwarder (TIN, KPP);

- “5” – data on the transfer of funds to the forwarder;

- “Column 1” – product name for each seller separately;

- “columns 2–10” – data on issued invoices for each seller separately.

3. The price will be determined by calculation. For this, column 4 is filled in as the difference between columns 9 and 8.

From October 1, 2020, a new invoice form will be used. What has changed in the form? Why did you need to make adjustments? Have the changes affected the form of adjustment invoices? Is it true that new rules for filling out and storing invoices are starting to apply? We'll tell you what new fields have been added to the invoice and provide a sample of how to fill it out. You can also download a new form (including amendments).

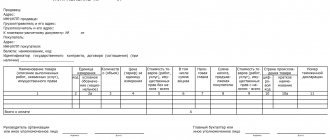

New invoice form: sample filling

You have two ways to prepare a document: on paper or electronically. The document can be prepared on paper:

- using a computer;

- by hand;

- combined.

The second option is an electronic invoice. In order to use this option, the consent of the other party is required, as well as the compatibility of electronic means of communication.

You can enter details into the form that the organization considers necessary (letter of the Federal Tax Service of Russia dated July 18, 2012 No. ED-4-3/11915). You can insert your own columns and lines, but do not violate the sequence of columns that are approved by the resolution.

All columns and lines that need to be filled out are listed in paragraphs 5 and 6 of Article 169 of the Tax Code of the Russian Federation.

Let's take a closer look at the procedure for filling out an invoice.

Number and date

First, indicate the number and date of the document. Write down the numbering order in the accounting policy. Numbering should be continuous and ascending.

The invoice must be issued within five calendar days from the date of shipment of goods, provision of services, performance of work or transfer of property rights.

Shipper and consignee

Fill in the information about the shipper and consignee. The line is filled in when goods are sold. If the invoice is for services or work, put dashes in these lines.

Payment order

Indicate the payment order number if there was an advance payment. If you are issuing an invoice for shipment, put a dash in the field.

Seller information

Provide seller information. Information is filled in by analogy with information about the buyer.

Currency

Enter the name of the currency. According to paragraph 7 of Article 169 of the Tax Code of the Russian Federation, issue an invoice in foreign currency only if prices and payments under the contract are expressed in it. Examples:

Government contract ID

Specify the details: government contract ID. This detail must be filled in if the organization is working under a government contract.

Sample of filling out the tabular part of the invoice from 10/01/2017

In the tabular part of the invoice, indicate:

- name of goods or description of work performed, services provided and transferred property rights, units of measurement;

- quantity of goods, works, services, if this can be determined. Otherwise, put a dash;

- price per unit of measurement, if possible, excluding tax and the cost of goods, work performed, services rendered, transferred property rights without tax.

- excise tax amount. Fill out this column only when selling excisable goods. If there is no indicator in the column, indicate the words “Without excise tax.”

Fill in the tax rate and tax amount. Reflect the tax amount on the invoice in rubles and kopecks without rounding.

The last column for imported goods: country of origin and registration number of the customs declaration.

The document must be signed by the head and chief accountant of the organization or other employees who are vested with these powers.

I significantly changed my appearance and the rules for filling out the form. The changes affected many aspects, and now before filling out sellers and organizations should carefully read the innovations in order to avoid mistakes.

The new rules are already in effect. The form already has additional fields to fill out, so entrepreneurs are advised to download new forms taking into account the amendments.

2% surcharge to VAT

You have a good relationship with the buyer, and after receiving the advance payment, you agreed with him that he will pay another 2%, and you will not lose anything on the sale.

There are two options for further developments: the additional payment was made before the rate increase and after. Let's look at both.

- Payment until 01/01/2019. Since in 2020 the rate is 18%, this 2% is considered as an additional payment - you decided that you want to pay more than the cost of the product/service, and, accordingly, tax must be charged on it. After receiving the 2% prepayment, you issue an adjustment invoice, which reflects the change in cost, but, accordingly, at the same rate of 18/118 (Table 1).

Table 1. Change in cost including VAT when paid before January 1, 2020