In what cases is it not necessary to pay VAT on advances?

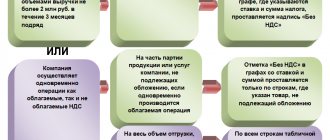

The VAT payer is not obliged to calculate VAT on the advance payment if (clause 1 of Article 154 of the Tax Code of the Russian Federation):

- applies exemption from VAT (Article 145 of the Tax Code of the Russian Federation);

- sells goods that are subject to VAT at the export rate of 0% (clause 1 of Article 164 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance dated October 15, 2012 No. 03-07-08/293);

- sells goods for which the duration of the production cycle is more than 6 months (clause 13 of article 167 of the Tax Code of the Russian Federation). The list of such goods is approved by the Government of the Russian Federation (List, approved by Government Resolution No. 468 of July 28, 2006). In this case, the seller-manufacturer must have a document confirming the cycle duration, issued by the Ministry of Industry and Trade of Russia;

- sells goods that are not subject to VAT (Article 149 of the Tax Code of the Russian Federation). Then VAT will not have to be charged when shipping the goods;

- the place of sale of goods for which an advance was received is not the territory of the Russian Federation (Articles 147, 148 of the Tax Code of the Russian Federation). In such a situation, there is no object of VAT taxation (clause 1, clause 1, article 146 of the Tax Code of the Russian Federation).

We issue an invoice for the advance received in 2020

If the last day, from the one allocated in Art. 168 of the Tax Code of the Russian Federation, the 5-day period falls on a weekend or non-working holiday, then an invoice can be issued on the first working day after the holiday. This will not constitute a violation.

- The production cycle of prepaid products exceeds six months.

- Prepaid goods are subject to VAT at a rate of 0%, in accordance with the norms of the Tax Code of the Russian Federation.

- The seller does not apply the main tax regime, but applies a special one. That is, he does not calculate VAT and does not pay it to the budget.

https://youtu.be/9GjcU47Ict8

https://youtu.be/j7UwaNN1B80

When an advance invoice is not issued

What actions must the parties to the transaction take if the buyer makes an advance payment to the supplier? Chapter 21 of the Tax Code provides the following algorithm.

Transfer of advance payment

Having received an advance payment (advance payment), the supplier issues an advance invoice to the buyer within 5 calendar days with the allocated amount of VAT (clause 3 of Article 168 of the Tax Code of the Russian Federation). The supplier records the invoice in the sales ledger, and the buyer records the invoice in the purchase ledger.

Carry out automatic reconciliation of invoices with your counterparties

The supplier is obliged to transfer the VAT allocated in the “advance” invoice to the budget, and the buyer has the right to submit it for deduction (clause 9 of article 172 of the Tax Code of the Russian Federation).

At the time of shipment, the parties to the transaction once again register an “advance” invoice. This time, the supplier makes an entry in the purchase ledger and the buyer makes an entry in the sales ledger.

The VAT allocated in the “advance” invoice can be deducted by the supplier (clause 6 of Article 172 of the Tax Code of the Russian Federation). The buyer, in turn, is obliged to restore the previously accepted deduction (subclause 3, clause 3, article 170 of the Tax Code of the Russian Federation) and pay tax to the budget.

There are cases when the above algorithm does not work. Thus, an “advance” invoice is not issued if the shipment took place no later than 5 calendar days from the date of receipt of the advance payment. This opinion was expressed by the Russian Ministry of Finance in letter dated January 18, 2017 No. 03-07-09/1695 (see “If shipment is due within five days after receiving the advance payment, then there is no need to issue an invoice for the advance payment”).

In addition, you can do without an “advance” invoice if the buyer is not a VAT payer or is exempt from paying this tax. This is directly stated in subparagraph 1 of paragraph 3 of Article 169 of the Tax Code of the Russian Federation. Experts from the Ministry of Finance confirmed that this norm applies to “simplified” buyers (letter dated March 16.

15 No. 03-07-09/1380; see “When receiving advance payments from an organization using the simplified tax system, invoices do not need to be drawn up”). On our own behalf, we would like to add that this standard also includes “imputed workers”, entrepreneurs on the PSN, payers of the unified agricultural tax and those who have received an exemption under Article 145 of the Tax Code of the Russian Federation.

Finally, an “advance” invoice is not issued when exporting goods that are taxed at a zero rate. The fact is that, according to paragraph 1 of Article 154 of the Tax Code of the Russian Federation, prepayment for goods that are taxed at a zero rate is not included in the tax base. Consequently, an “advance” invoice is not needed here (letter from the Ministry of Finance of Russia 10.01.

Submit a VAT return online with documents confirming export Submit for free

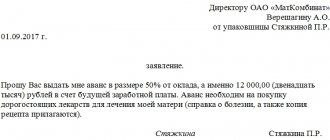

Order

When are advance invoices issued? Within 5 days from receipt of money. The invoice is drawn up in two copies. If errors were made when issuing the document, the Federal Tax Service may refuse to deduct VAT to the buyer. But such sanctions do not apply to the seller. He must charge tax twice: upon receipt of funds and at the time of sale.

Invoices can be issued electronically or in paper form. In the second case, both parties to the transaction must have technical equipment.

An invoice is issued only if the advance payment and sale took place in different tax periods. The amount of VAT payable is calculated based on the results of the month. If payment and shipments occurred in the same period, then the tax base will not be distorted.

Calculation of VAT on advance payment

The choice of rate depends on what kind of goods you are selling and what rate applies to operations for their sale. If you received an advance payment for goods taxed at a rate of 10%, then VAT must be calculated at a rate of 10/110. Such goods are named in clause 2 of Art. 164 Tax Code of the Russian Federation. In other cases, when calculating advance VAT in 2020, the rate of 20/120 is applied.

We invite you to familiarize yourself with: Sample delivery agreement with prepayment

If the advance was received for the supply of goods taxed at different tax rates (some of them at 10%, the other at 20%), then VAT is calculated at 20/120.

Results

https://youtu.be/it6IIesGtzk

When prepayment is received, the supplier must issue an advance invoice on the form used for shipping invoices. This document serves to calculate tax from the seller and deduct VAT from the buyer. The peculiarity of issuing an advance invoice is that it indicates the estimated tax rate, and some indicators inherent in a shipment invoice may be missing. Increased attention is required when preparing invoices when receiving advances for goods, works, and services taxed at different tax rates.

Details of the “advance” invoice

An invoice for prepayment is drawn up in the same way as a “regular” invoice (rules for filling out are given in the article “Instructions for filling out invoices”). But there are some features that need to be taken into account when filling out individual fields of the “advance” invoice (see Table 1).

Table 1

Rules for filling out individual lines of an “advance” invoice

| Number | Name | Content |

| Invoice header | ||

| line 1 | INVOICE No.___ dated_______________ | “Advance” invoices are numbered in general chronological order along with regular invoices. There is no special numbering procedure for prepayment invoices (letter of the Ministry of Finance of Russia dated October 16, 2012 No. 03-07-11/427). |

| line 3 | Shipper and his address | There is always a dash (letter of the Ministry of Finance of Russia dated December 19, 2017 No. 03-07-05/84934.) |

| line 4 | Consignee and his address | There is always a dash (letter of the Ministry of Finance of Russia dated December 19, 2017 No. 03-07-05/84934) |

| line 5 | To payment and settlement document No. ___ dated _______________ | Enter the number and date of the payment document or cash receipt for prepayment. It is permissible to indicate only the last three digits in the payment order number (letter of the Ministry of Finance of Russia dated September 19, 2014 No. 03-07-09/46986) For non-cash payments, line 5 is not filled in |

| Invoice table | ||

| column 2 | Unit code | There is always a dash |

| column 2a | Unit symbol (national) | There is always a dash |

| column 3 | Quantity (volume) | There is always a dash |

| column 4 | Price (tariff) per unit of measurement | There is always a dash |

| column 5 | Cost of goods (works, services), property rights without tax - total | There is always a dash |

| column 6 | Including the amount of excise tax | There is always a dash |

| column 7 | Tax rate | The calculated rate is indicated: 10/110 or 18/118 (clause 4 of article 164 of the Tax Code of the Russian Federation) |

| column 9 | Cost of goods (works, services), property rights with tax - total | The entire prepayment amount including VAT is indicated. |

| column 10 | Country of origin of goods digital code | There is always a dash |

| column 10a | Country of origin of goods short title | There is always a dash |

| column 11 | Number of customs declaration | There is always a dash |

Generate invoices and invoices in the web service for accounting and reporting

The seller has the right to include additional details in the advance invoice to simplify his work. For example, you can mark “advance payment” using a special stamp.

Advice. You can enter additional data into the invoice, but you cannot delete existing columns and lines.

Kontur service expert. SKB Kontur company standard

Elena Rogacheva

Purpose of advance invoices

An invoice is a source that serves as a legal basis for the company purchasing a product (work, service) to accept the amount of VAT included in the structure of the selling price as a deduction provided for by law. The legislator in paragraph 3 of Art. 168 of the Tax Code of the Russian Federation directly instructs the seller to send this document to the buyer upon receipt of advance payment for the delivered goods (work or service), as well as when the supplier actually fulfills its obligations.

Having an advance invoice in hand, the purchasing organization can, as if it had a shipping document, exercise the right to deduct VAT (clause 12 of Article 171 of the Tax Code of the Russian Federation).

Thus, advance and shipping documents have the same legal significance. The legislator has established the form in which they must be drawn up - its structure is given in Appendix 1 to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

You can download the invoice form on our website.

In turn, a special form is also established for the adjustment invoice - in Appendix 2 to Resolution No. 1137.

You can download the adjustment invoice form on our website.

There are 2 main criteria for distinguishing between advance and shipping invoices:

- moment of preparation (an advance document is drawn up upon receipt of an advance payment by the seller, a shipping document upon the fact of the sale of goods or completion of work);

- completeness of filling out (information in some of the points of the advance invoice cannot always be entered for objective reasons - and the legislator takes this into account).

Let us study the specifics of both of these criteria in more detail.

Registration in the purchase book and sales book

When transferring an advance payment, entries in the sales book from the supplier and in the purchase book from the buyer are made in the period when the “advance” invoice is issued.

When shipping goods on account of prepayment, an entry in the supplier's purchase book is made during the shipment period. An entry in the buyer's sales book is also made in the period of shipment, and not in the period of transfer of the advance payment.

We invite you to read: Deprivation of rights for non-payment of alimony

A prepayment invoice is recorded in the purchase ledger and in the sales ledger in the same way as a “regular” invoice. But there are features that need to be taken into account when filling out individual fields (see Table 2 and Table 3; for examples of filling, see the article “How to correctly fill out a purchase book and a sales book in case of prepayment, as well as when issuing an adjustment invoice” ).

table 2

Rules for filling out individual fields of the purchase book when registering an “advance” invoice

| Number | Name | Content |

| What entries does the buyer make when transferring the advance payment? | ||

| column 2 | Operation type code | 02 |

| What entries does the seller make when shipping goods and deducting previously accrued VAT? | ||

| column 2 | Operation type code | 22 |

| column 9 | Seller's name | data from line 2 of the “advance” invoice |

Table 3

Rules for filling out individual fields of the sales book when registering an “advance” invoice

| Number | Name | Content |

| What notes does the seller make when receiving an advance? | ||

| column 2 | Operation type code | 02 |

| What entries does the buyer make when shipping the goods and restoring the previously accepted deduction? | ||

| column 2 | Operation type code | 21 |

| column 7 | Buyer's name | data from line 6 of the “advance” invoice |

| column 8 | Buyer's INN/KPP | data from line 6b of the “advance” invoice |

Maintain purchase books and sales books for free in an accounting web service

VAT on advance payment from the buyer

Having received an advance invoice from the seller, the buyer can accept it for deduction. But later, when he receives the goods and receives a “shipping” invoice, the buyer must restore VAT from the advance received earlier by the seller, and after that deduct VAT on the shipment (clause 3, clause 3, article 170 of the Tax Code RF, Letter of the Ministry of Finance dated November 28, 2014 No. 03-07-11/60891).

It is also necessary to recover VAT from the advance if, due to a change in the terms of the contract or its termination, the advance was returned to the buyer. This must be done during the refund period.

We talked about what accounting entries for VAT on advances are made by the seller and buyer here.

https://youtu.be/y8b-7Jfhbko

Exceptions

Is it necessary to issue an invoice for the advance payment? No. No invoice will be issued if:

- the period of production of goods exceeds six months;

- goods are not subject to VAT or the rate is zero.

How long does it take for an advance invoice to be issued? No later than 5 days from the date of receipt of the advance. If payment and shipment are made in the same quarter, then an invoice may not be issued, since payment is not recognized in advance. This interpretation of the FAS causes controversy among the Federal Tax Service. According to Art. 168 of the Tax Code of the Russian Federation, an advance invoice is issued regardless of the time of shipment of goods. Since the interpretation of decisions is not the same, disputes on this issue are most often resolved through the courts.