Personal income tax benefits are certain amounts not subject to income tax, by which the income of individuals can be reduced when calculating the tax payable. The use of benefits allows you to reduce the size of the base for calculating personal income tax, which entails a tax reduction.

In relation to personal income tax, benefits take the form of standard deductions that are applied to certain categories of working citizens. The responsibility for calculating tax, deducting it from salary and transferring it to the budget falls on the shoulders of the employer. The employee himself does not need to take any independent actions regarding income in the form of wages.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Benefits for children

The most popular deduction among the available standard ones is provided to persons providing care and maintenance of children of a certain age:

- No more than 18 years of age in general;

- No more than 24 years of age with full-time study (it does not matter whether the study is paid or free).

The amounts of the “children’s” benefit are prescribed in the Tax Code of the Russian Federation (clause 4p.1 art. 218) and are provided for each existing child of a suitable age . The amount of the benefit depends on a number of factors:

- number of children available;

- the child has a disability;

- family composition;

- person caring for the child.

| On whom | To whom is it provided? | |||||

| Parents | Unity parent, adoptive parent | One of the parents, if the other refused the deduction | Guardian, trustee, adoptive parent, foster parent | Unity guardian, foster parent | One of the adoptive parents, if the second one refuses the deduction | |

| 1st child | 1400 | 2800 | 2800 | 1400 | 2800 | 2800 |

| 2nd child | ||||||

| 3rd and subsequent children | 3000 | 6000 | 6000 | 3000 | 6000 | 6000 |

| Disabled person | 12000 | 24000 | 24000 | 6000 | 12000 | 12000 |

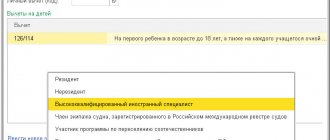

An officially employed person who has income on which it is necessary to withhold personal income tax in the amount of 13% and falls into one of the following categories can count on the benefit:

- Father;

- Mother;

- The new husband of the mother (adoptive parent, guardian, trustee), and the new husband must participate in raising the child or paying alimony for him;

- The new wife of the father (adoptive parent, guardian, trustee) must meet the same conditions as in the previous paragraph;

- Adoptive parents;

- Guardians;

- Trustees.

To determine the amount of the child benefit, you need to take into account all existing children, without paying attention to their actual age on the current day. For example, if a worker has 4 children: 30, 26, 15 and 7 years old, then the amount of the required deduction is 6,000 rubles. (for 15 and 7 year olds, 3,000 rubles each due to the fact that these are the 3rd and 4th children in the family, respectively).

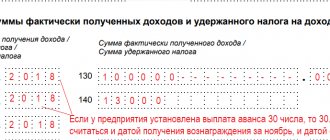

The benefit for children is provided only until the moment when the total salary from the beginning of the current year does not reach the limit value established for 2020. at around 350,000 rubles. For income exceeding the specified value, no deduction is provided.

When determining the total salary on the calculation date, it is necessary to add up the salary accrued for each month of the current year (from January to the billing month inclusive), as well as vacation pay, bonuses, allowances, sick leave, financial assistance paid in the current calendar year.

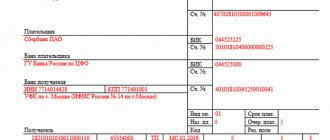

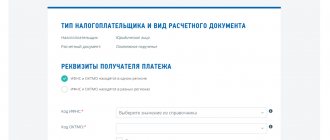

How to apply for tax benefits

Obtaining a tax benefit is of a declarative nature. The applicant must contact the Federal Tax Service with a request for a discount or privilege. The list of documents includes:

- Confirmation of the applicant's identity;

- Declaration in form 3 - income tax of an individual;

- Certificate of income;

- A document confirming the citizen’s right to receive benefits;

- Individual taxpayer number;

- Statement.

Required Documentation

A worker with minor children must inform the employer about the benefits entitled to him in writing.

Documentation required to be provided includes:

- A personal statement outlining a request to take into account the required deduction;

- Certificate confirming the presence of the child and his age;

- Certificates for all children, if there are more than two of them (even for those for whom benefits are no longer provided);

- A certificate from the educational institution confirming full-time study (submitted every year until the 24th birthday or graduation);

- 2-NDFL for the current year from a new employee hired not since January of the current year (to take into account his taxable income from earlier jobs when determining the total salary for the year to compare it with the maximum value);

- A document indicating that the child has a disability of group 1 or 2.

If the child’s natural parents are not claiming the deduction:

- For adoptive parents - an appropriate certificate and an agreement that states the fact of accepting the child into the family;

- For adoptive parents - a certificate or certificate confirming the fact of adoption;

- For a guardian – a decision to establish guardianship (extract from it);

- For the trustee – a decision to establish guardianship.

Divorced parents will additionally need the following documents:

- One must provide paper indicating that the child lives with this parent at the same address;

- The second is documentation confirming the maintenance of the child, for example, payment of alimony for him;

- For a new husband or wife - a passport with a marriage mark or a corresponding certificate. These persons are also required to confirm their participation in ensuring the life of the child.

To receive a double benefit, in addition to the above papers, you will need other documentation:

- If the basis is the refusal of the 2nd parent in favor of the 1st, then the 2nd parent writes a statement that he transfers the right to the benefit to the husband (wife). The fact that the employer of the 2nd parent does not take into account the deduction must be documented through 2-NDFL, this certificate must be provided every month;

- If the reason is being raised alone, then an appropriate supporting document is required.

Application example:

The application must be personal in nature and certified by the signature of the person who is applying for personal income tax benefits.

The text should indicate a request from the first person to take into account the required deduction on a monthly basis, indicating the year and the justifying article of the Tax Code of the Russian Federation. In this situation, clause 4, clause 1, article 218 applies.

You should also provide information about each minor son or daughter for whom the applicant wishes to receive a standard deduction, indicating his full name, date of birth and the amount of the benefit itself. To substantiate the right to these benefits, all attached documentation is listed in the appendix.

The compiled document is addressed to a representative of the organization, usually its head. The stated information of an application nature is certified by the applicant for the deduction himself, indicating the current date of writing.

Example

Application for standard deduction for children

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

...and not standard

The standard personal income tax deductions described above are a kind of income tax benefits that are calculated simply based on the fact that individuals receive income on a regular basis, and this is done by the employer, the source of income. Some deductions are provided on other grounds, which of course does not eliminate the need to have income subject to personal income tax to receive them.

Thus, Article 219 of the Tax Code describes the so-called social tax deductions for personal income tax. They are provided, in particular, for the costs of training at various universities, technical schools and colleges, etc., if the latter have the appropriate license or other document that confirms the right of the educational institution to provide the relevant educational services. We are talking about money spent on one’s own education, as well as on the education of children: relatives under the age of 24 and those under the taxpayer’s care – up to 18 years.

Another social deduction can be obtained in connection with the expenses incurred for treatment - for yourself and your immediate relatives (spouse, parents and minor children). also, as in the case of educational institutions, treatment must take place in medical centers or individual entrepreneurs that have the appropriate license and carry out medical activities in accordance with the list of medical services approved by the Government of the Russian Federation.

Individuals who pay pension contributions under non-state pension agreements or insurance contributions under voluntary pension insurance agreements can also count on personal income tax benefits.

The total amount of all social deductions by which the personal income tax tax base can be reduced also has its own limit - 120,000 rubles per year (unless we are talking about a number of cases during treatment). If during one calendar year a person paid, for example, for both education and treatment, and the total amount of expenses exceeded the limit, then he himself has the right to choose which specific expenses and in what amount to take into account within the given amount.

The same citizens who purchased an apartment or built a house during the reporting period have the right to a property deduction (Article 220 of the Tax Code of the Russian Federation). Property deductions also apply when selling real estate, as well as other property. Their application depends on the transaction amount, as well as on the time during which the object being sold was owned by the seller.

Individual entrepreneurs on the general taxation system, as well as persons working under civil contracts, can take advantage of the so-called professional deduction for personal income tax (Article 221 of the Tax Code of the Russian Federation).

Personal income tax benefits for disabled people

Working disabled people with confirmed disability of group I or II can apply for benefits according to paragraph 2, paragraph 1, article 218 of the Tax Code of the Russian Federation. The benefit has the form of a standard deduction for personal income tax, by the amount of which the taxable income of a disabled person can be reduced.

The amount of the benefit is 500 rubles . The essence of its application is that the monthly salary of a disabled worker when calculating income tax is reduced by 500 rubles. The employer needs to take into account the deduction in question in each month of the year, and does not need to count income from January of the year to the calculation date and compare it with the limit value, as is done for the “children’s” deduction.

If a disability of group I, II or III was acquired during the performance of combat missions in military service in defense of the USSR or the Russian Federation (this also includes disabled people of the Second World War), then an increased deduction of 3,000 rubles is provided. , which should be used instead of the above.

What documents are needed:

- Personal statement;

- A document of the established form on disability - a certificate from a medical and social examination;

- If disability was received during combat, then an appropriate certificate and a certificate of disability indicating the reason (wound, illness caused by military service).

Application example

Application for a standard tax deduction

Levels of application of tax incentives

Any benefits vary in level of validity. Depending on the object of taxation, all benefits apply to federal taxes, taxes of federal subjects and local governments.

| Federal | Regional | Local |

| They are established at the federal level and apply throughout Russia. The rate of each tax is determined by the legislative body, tax rates in the field of natural resources are the competence of the government of the Russian Federation | When distributing funds, funds from the budget of the constituent entity of the Russian Federation are used. Benefits are established at the regional level. To approve rates, the executive body of the subject has the right to independently make a decision without coordination with the federation | Established by local self-government authorities and are valid only on the territory of the municipality in which the payer’s property is located |

Personal income tax benefits for veterans

Combat veterans may qualify for the following types of income tax benefits:

- Standard deduction 500 rub. – provided for each month, regardless of annual income;

- Exemption from personal income tax for received gifts of various types, financial support (within 10,000 rubles per year);

- Exemption from personal income tax for payments that are assigned to a veteran to receive monthly.

What documents are needed to receive a deduction of 500 rubles:

- Personal Statement;

- Veteran's ID.

Tax benefits: concept and forms

A tax benefit is understood as an advantage provided by state authorities and local governments to certain categories of tax payers.

Providing benefits is an important part of the state policy to increase budget revenues. The tax advantage provided can be expressed in the following forms:

- Tax deductions. A striking example is the tax deduction for the acquisition of real estate, which is valid only once;

- Reduced rate taken into account for tax purposes. This mainly applies to value added tax. There are 10% discounts on medical and children's products. Many regions have reduced rates on income taxes;

- Exemption of certain categories of persons from paying tax, for example pensioners;

- Tax reduction.

Benefits for personal income tax for other categories

In addition to the above categories, personal income tax benefits are also available to the following persons:

- 3000 rub. – “Chernobyl victims”, liquidators of radiation accidents, participants in nuclear tests and other persons from the list of paragraph 1, paragraph 1, article 218;

- 500 rub. – Heroes of the USSR and the Russian Federation, participants of the Second World War, concentration camp prisoners who suffered from radiation sickness, medical staff with increased radiation doses and other persons from paragraph 2, paragraph 1, article 218.

If the same person is entitled to two deductions of 3000 and 500 at the same time, then the larger of them is taken for calculation.

Exemption from personal income tax

Finally, another income tax benefit is the complete exclusion of certain types of income from the tax base. Their complete and exhaustive list is given in Article 217 of the Tax Code.

For example, maternity benefits are not subject to personal income tax (clause 1 of Article 217 of the Tax Code of the Russian Federation), some types of compensation payments established by law, for example, severance pay paid to an employee upon dismissal and earnings for the period of employment (clause 3 of Article 217 Tax Code of the Russian Federation), material assistance within the limits determined by the Tax Code depending on the situation, limits, payment for professional training, retraining of an employee in Russian educational institutions (clause 21 of Article 217 of the Tax Code of the Russian Federation), gifts received by the employee from the employer both in cash and and in material form within the range of 4,000 rubles per year, or compensation of employee expenses for paying interest on loans for the purchase or construction of housing (clause 40 of Article 217 of the Tax Code of the Russian Federation), income tax is not paid on pensions and scholarships. The list of personal income tax benefits is long, and you can read it in full in Art. 217 Tax Code of the Russian Federation.