The determination of the financial result of the company’s activities is carried out not only before the reformation of the balance sheet, but also at the end of the reporting period - the calendar month. In this article we will tell you which accounts are closed at the end of the reporting month and calendar year.

First of all, let's define the concept. Thus, in accounting, account closure (ACC) is recognized as an accounting operation of attributing the final balance of the accounting account to special CACs, which determine the financial results of the company.

Which accounts are closed at the end of the year?

Before starting to prepare the annual financial statements, that is, before reforming the balance sheet, the accountant is required to generate the final entries for the reporting period. In accounting, the reporting period is a calendar month (clause 48 of PBU 4/99). Consequently, before closing the financial year, the accountant will need to draw up the final monthly turnover.

Which accounts are closed at the end of the month or year? Such BSCh can be tentatively divided into three groups:

- Cash balances that cannot have balances at the end of the reporting (financial) period. These include counting. 25 “General production expenses” and 26 “General operating expenses”.

- BSCs that may have a remainder, but which can be completely closed. These include counting. 20 “Main production”, 23 “Auxiliary production”, 29 “Service facilities and production”.

- BSCs that cannot have a general balance, but have a balance in open subaccounts. These are 90 “Sales” and 91 “Other income and expenses”.

Next, we will look at how accounts are closed at the end of the year; the entries are also suitable for generating final entries at the end of the month. We will determine the procedure for generating final accounting entries separately for each account, which directly affect the financial results of the company.

Closing the year in accounting. 5 tips from experts

It is easier to correct them this year than to correct them next year. Correct minor errors as soon as they are discovered.

With essentials things are different. If such an error is found in the reports that have already been compiled, you will have to draw up a new one, print it out and give it to the manager for signature.

It is up to the company to decide whether to revalue the property or not.

If a company has once carried out a revaluation of fixed assets, then in the future it should be carried out regularly, but not more than once a year. In accordance with clause 27 of the Regulations on accounting (approved by order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n), assets can be recorded in the period from October 1 to December 31 of the reporting year.

And the inventory of obligations is as of December 31 inclusive, since the reporting period in this case is a calendar year (see Part 1 of Article 15 of Law No. 402-FZ and the recommendations of the Ministry of Finance of Russia in letter dated January 09, 2013 No. 07-02-18 /01).

It is formed once - when the organization is created - and is applied consistently from year to year. It is not at all necessary to form annually. But this is necessary if the legislation of the Russian Federation has changed.

But it changed in 2020. It is important that the accounting policy establishes the procedure for the formation of reserves.

As of December 31, it is necessary to take an inventory of reserves and draw up an estimate of contributions to the reserve in 2020. Balance sheet reformation is the final entry that determines net profit or net loss.

This entry is made with entries dated December 31, after all transactions of financial and economic activities are reflected in the accounting records.

We write off general production costs

The BSC is closed monthly, and all accumulated overhead costs must be written off to the accounts of the relevant production facilities. In other words, costs are written off to the accounts of those production facilities that were serviced.

Typical accounting entries:

| Operation | Debit | Credit |

| ODA written off in favor of core production | 20 | 25 |

| ODA included in the costs of servicing auxiliary production facilities and workshops | 23 | 25 |

| ODA aimed at maintaining service farms is written off to the appropriate accounts | 29 | 25 |

Writing off costs to expense accounts

Write-off of expenses on account 26 “General business expenses”

The procedure for closing account 26 depends on the chosen accounting policy, or more precisely, the method of forming the cost of production.

The cost price can be formed: 1) at the full production cost; or 2) at reduced production costs.

Note: For small businesses, the second option is more convenient.

When choosing the accounting policy “at full production cost,” costs can be written off monthly by the following entries: Debit 20 “Main production” Credit 26 Debit 23 “Auxiliary production” Credit 26 Debit 29 “Servicing production and facilities” Credit 26

When choosing an accounting policy “at reduced production cost”, general business expenses can be fully attributed to cost:

D 90.2 “Cost of sales” Credit 26.

Write-off of expenses on account 25 “General production expenses”

Account 25 is closed monthly by debiting the amount of expenses from the account using the following transactions:

Debit 20 “Main production” Credit 25

Debit 23 “Auxiliary production” Credit 25

Debit 29 “Service production and facilities” Credit 25

depending on the activity with which these costs are associated.

Writing off costs from account 44 “Sales expenses”

Costs are written off from account 44 “Sales expenses” monthly in whole or in part by posting:

Debit 90.2 “Cost of sales” Credit 44 – sales expenses are written off.

Closing account 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”

At the end of the month, accounts 20,23,29 can be closed with the following entries: Debit 90.2 “Cost of sales” Credit 20 Debit 90.2 “Cost of sales” Credit 23 Debit 90.2 “Cost of sales” Credit 29

Service organizations can close these accounts completely (without leaving unfinished production on the account balance).

to menu

Write-off of general business expenses

The procedure for concluding an account. 26 depends on the method of forming the cost of finished products (sold services, work), which must be enshrined in the accounting policy of an economic entity. So, there are two key ways:

- At full production cost, the following standard transactions are generated monthly:

| Operation | Debit | Credit |

| OCR written off for main production | 20 | 26 |

| OCR included in the costs of auxiliary production | 23 | |

| OCR written off to service farms | 29 |

- According to the reduced production cost, all general operating costs are charged directly to the operating cost of sales. In this case, a monthly accounting entry is generated:

| Operation | Debit | Credit |

| OCR written off as the cost of products, works, services | 90-2 “Cost of sales” | 26 |

Details

Basic properties of 20 accounts

— only the valuation is taken into account;

- considered active, not having a negative balance at the end of the reporting period, however, a positive balance is possible (this is an indicator of work in progress);

— provision is made for maintaining both synthetic accounting and analytical accounting (by types of products, estimates, divisions of the enterprise).

The actions taken to close the reporting month in accounting allow us to determine the net cost of goods taking into account all expenses. 20 the account may be completely closed or part of the expenses may be transferred to work in progress.

There are three ways to close an account

- straight,

- intermediate (indirect),

— direct marketing (sale) of manufactured products.

The direct method is used in enterprises if the real cost of the finished product is unknown. In this case, the company takes into account expenses at the planned cost; at the end of the reporting month, an adjustment is made to bring the price of manufactured products to the actual price. Using this method, it is impossible to account for manufactured goods at actual cost for the entire month.

Intermediate (indirect) - when used, the month is closed manually. In this case, additional account 40 “Product Output” is used (the discrepancy (deviation) of the planned cost from the actual one is taken into account. Actual - by debit, planned - by credit. At the end of the reporting period (final) The total amount of deviations is written off proportionally to accounts 43 ("Ready products") and 90.02 ("Cost of sales").

The simplest is direct sales (sales). It is suitable for service-providing businesses. In this case, there is no talk of trade, defective products and work in progress. In this case, finished products are not stored, but are immediately sold from production, and production costs are written off as cost of sales. You can use an accounting certificate in 1C.

It is necessary to create a balance sheet for account 20 in order to track the final balance at closing. Enter the “Accounting, Taxes, Reporting” menu, then the “Accounting” submenu, the next section “Transaction Log”, then the “Create” button. You need to enter the following entry into the operation: Dt90.02 “Cost of sales” Kt20 - enter the debit balance from the balance sheet.

Closing production accounts

Let's make a reservation right away that the balance for BSC 20, 23, 29 is unfinished and does not require mandatory write-off at the end of the reporting or financial periods.

How to determine? If the production cycle does not coincide with the reporting periods, then a debit balance is formed on the BSC - the cost of work in progress. And if the production process fits into a calendar month (year), then, according to the BSC, there should be no leftovers. Typical entries for writing off production costs:

| Operation | Debit | Credit |

| Production costs written off to cost of sales | 90-2 “Cost of sales” | 20 |

| 23 | ||

| 29 |

Note that companies whose activities are related to the provision of services can additionally establish in their accounting policies which accounts are closed at the close of the month. In other words, to secure that BSCs 20, 23, 29 will be closed monthly, without any work in progress balances.

Tips for Closing the month in Enterprise Accounting 2.0

CONDUCTING INVENTORY

To begin with, before closing the year or month, we need to make sure that everything in our accounting is correct, all transactions are reflected correctly, and we have not forgotten anything.

It would not be amiss at the end of the year, and sometimes even the month (depending on our accounting policies and the specifics of the organization’s activities), to carry out an inventory in order to know for sure what we will have in balance at the beginning of the new year.

Please note that the document inventory of goods in a warehouse carries out an inventory separately for each warehouse. And if our organization has several warehouses, then there should be several inventory documents, corresponding to the number of warehouses.

The accounting quantity column is filled in based on the balances according to accounting data, i.e. shows the amount that we have left after the transactions are reflected in the system documents. In the actual quantity column, we can indicate the quantity of each item that is physically available in warehouses.

Based on the inventory document, documents for the receipt of goods can be entered if the actual quantity of the item exceeds the accounting quantity. A posting document will be generated automatically based on the excess amount. Any surplus will be charged to other income.

Also, based on the inventory document, the document write-off of goods can be entered; the document will also be filled out automatically if the accounting quantity exceeds the actual one. All shortages will be attributed to 94 “shortages and losses of valuables.”

EXPRESS ANALYSIS

After we have counted all our property, we can move on to checking the accuracy of the accounting.

For these purposes, the 1C program offers us to use an express check of accounting (“Reports – Express check of accounting”).

Having opened our assistant, you need to select an organization, a period, which will be a calendar year. By clicking the check button, the program will begin checking accounting in 4 sections:

- Accounting Policies

- Cash transactions

- Sales book introduction

- Introduction of the purchase book

If errors are found in the accounting for any section, the program will display the number of errors opposite the section name. By expanding each section, you can see in detail at which point the error was made, in addition to this, you can expand the error message in even more detail, and the program itself will advise in which area to look for the error, possible solutions, and the program can also refer to a specific document, in which may have an error.

We move from error to error, we will correct all the inaccuracies in our accounting. Having received a report that no longer contains errors, you can move on to the next stage of checks.

ANALYSIS OF THE STATE OF ACCOUNTING

The next stage is Analysis of the state of accounting (“Reports – Analysis of the state of accounting”).

The report is intended for: analysis of the chart of accounts in terms of the composition of accounts (sub-accounts) and the structure of analytical accounting in order to identify possible errors in reporting;

- identifying technical accounting errors.

The main purpose of the report is to help identify errors that affect the formation of financial statements. Errors that are detected by the report require verification by the enterprise's accounting service. In some cases, the report provides a detailed description of the situation.

Before generating a report, you must select the organization for which the analysis will be performed.

Technological analysis of accounting includes 4 stages.

1. Analysis of the working chart of accounts

This section analyzes the status of the working chart of accounts. The program compares the working chart of accounts with the reference chart of accounts recommended by. If the required account is not found in the chart of accounts, the activity attribute of the account has been changed, warnings will be issued. The structure of analytical accounting on the accounts involved in the algorithms for compiling regulated reporting forms is also checked.

2. Analysis of accounts to be closed at the end of the reporting period.

The accounting results at the end of the reporting period are analyzed. If accounts to be closed at the end of the reporting period have balances, information about such accounts is provided.

3. Analysis of accounting results.

In the process of performing the analysis in this section, the following are identified:

- erroneous balances on accounting accounts (highlighted in red);

- errors in maintaining quantitative accounting (lack of balance in quantity or amount in the corresponding accounts);

- errors in the revaluation of foreign currency at the end of the reporting period (for the correct operation of this section, it is necessary to set the exchange rate at the end of the reporting period).

4. Analysis of accounting entries.

The data section displays “suspicious” transactions. The existing entries in the accounting register are checked against the database of invalid entries. If an invalid entry is detected, the program will display a line with an error, which will indicate which correspondence aroused suspicion and a brief comment on the characterization of the accounting transaction.

For convenience, in the top panel of the form there is a button “All transactions” , by clicking on which you can go to the journal of accounting transactions. Also, if there are errors in any section of the report, by double-clicking on the line with the error, you can call up the account card or transaction form with the erroneous posting.

You can print the report using standard means by selecting “Print” from the “File” menu.

After making sure that there are no errors in all sections of the report, you can proceed to closing the month. As we all already know, the “Month Closing” procedure is one of the most difficult and responsible in the work of every accountant.

And in order to make this operation easier for you, we will share our experience with you and give several recommendations for correcting possible errors.

CALCULATION OF TAXES (CONTRIBUTIONS) FROM PAYWARE

Carrying out this regulatory operation allows you to calculate insurance premiums from the payroll fund. If we go into this regulatory operation and check the checkbox, calculation adjustment, we will be able to see how much contributions were accrued for each employee of the organization.

But we should not forget to uncheck the calculation adjustment checkbox, because if we suddenly decide to re-calculate something in the salary, then when we re-post the document for calculating taxes from the payroll, the data will not be updated or changed. And as a result, in our accounting there will be a situation where the basis for calculating taxes will be one - the one that will be generated by the payroll document, and the amount of taxes will be calculated from another - the one that is fixed in the Tax Accrual document, and since there is an adjustment on it, the data in it is not updated.

CLOSING AN ACCOUNT 97 “Deferred expenses”

This regulatory operation writes off our deferred expenses to the expense accounts that we previously indicated in the “Deferred Expenses” directory. In general, this operation occurs automatically and does not require special control. But, if, when carrying out the operation of closing 20 accounts, an error is given that in routine operation No.. the division for writing off expenses is not indicated, then this means that we need to correct a small error in accounting. Namely, go to the document that reflected the accrual of expenses for future periods (For example, entering initial balances, Receipt of goods and services) and fill in the department details. This detail must be present in this document.

CALCULATION OF SHARE OF WRITTEN OFF INDIRECT COSTS

The need to perform this operation is due to the fact that in the activities of almost any organization there are certain standardized expenses. Or the organization applies UTII to certain types of activities. Performing this operation allows you to obtain the rate of write-off of transportation costs, since they are written off in proportion to the goods sold and the balance in the warehouse; calculate the rate of recognized advertising expenses, obtain the percentage of distribution of expenses under UTII (which in turn is calculated in relation to the revenue received from activities that fall under the payment of UTII and are not subject to a special taxation procedure). All these calculated indicators can be viewed after performing operations by selecting the “Show transactions” action.

CLOSING 20 ACCOUNTS

There are a lot of difficulties encountered when closing 20 accounts. Let's look at a few common mistakes: Let's start by closing the 26th account.

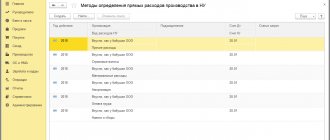

When closing the 26th account of an organization, it is necessary to determine first of all to which account it will be closed, there are not many options here, either it will be closed at 20 or at 90. If the organization has established that the 26th account will be closed at 20, then to carry out For this operation, it is necessary to establish methods for distributing “General production expenses”; this can be done in the accounting policy on the “Production” tab. By clicking on the button “Set methods for distributing general production and general business expenses”, we can go to the rules for describing their closure. In this register, it is necessary to reflect at least the following information: indicate the date, select the organization, indicate the cost account, and be sure to select the distribution base. The remaining fields can be left blank, and then the configured rules will apply to all departments and cost items. Particular attention should be paid to the choice of distribution base, since the correct closure of the account will depend on this. The following distribution bases are available for selection: revenue, output volume, planned production cost, wages, material costs, direct costs, individual cost items, or select the “not distributed” method to close the account manually.

We must not forget that if one or another base is selected, it must actually be present, for example, if the wage base is selected, this means that wages must be accrued to the 20th account, or for example, if the output volume base is selected, then it must be a document “Production report for the shift” in which at least some output volume will be indicated. Other distribution bases will work similarly. Thus, if suddenly, after closing the month, account 26 remains unclosed, you need to check whether there was the required distribution base for a given month.

If our organization uses the direct costing method, that is, account 26 should be closed at 90.8 “Management expenses”, then for the program to work correctly you should pay attention to the following points: It is necessary to check the appropriate box in the accounting policy on the “Production” tab, and It is also necessary to make sure that in the “Methods for the distribution of general production and general business expenses” there are no lines for account 26. Otherwise, a conflict in the order of closing an account will arise in the program, because Established methods for distributing expenses say that the account should be closed on the 20th, and the direct costing checkbox should be closed on 90.8. It is also necessary to check, when using the direct costing method, that in the accounting policy on the “Income Tax” tab, by clicking on the “Specify list of direct expenses” button, you need to make sure that account 26 is not in the list of direct expenses, since the inclusion of the account in this the list indicates that all expenses on it are direct, which is incorrect from the point of view of the direct costing method, since when using it it is considered that these expenses are considered indirect and are recognized as expenses of the current period for tax accounting purposes. profit.

To summarize, when using the direct costing method, it is only necessary to have this checkbox in the accounting policy, and the absence of account 26 in the methods for distributing overhead costs and the list of direct expenses of the organization. If these conditions are met, 26 the account will close at 90.8 without any problems.

Now let's look at what problems you might encounter when closing account 20.

If an organization is engaged in the provision of services, without producing products, then to close the 20th account it is necessary to clarify which account closure base is selected for the provision of services. This information can also be obtained from the accounting policy on the production tab.

Here you can choose from three options. To make a choice, you need to be guided by the following, you must first decide with the help of which document the sale of services will be carried out, namely, choose whether it will be the document “Sales of goods and . Depending on the choice made, we determine that if the document “Sales of goods and services” is used, then the method should be selected by Revenue, and if the document “Act on the provision of production services” is selected, then - By planned prices. If the revenue method is selected, and account 20 is not completely closed, then it makes sense to check the presence of revenue for all item groups, since there is a possibility that revenue was present, but, say, not for all groups, this can be checked using the “Subconto Analysis” report , with the choice as a subconto – Nomenclature groups.

In the report, you need to check whether for all item groups there is turnover on the 90th account, and whether there are costs on the 20th account that did not fall into any item group, and are now reflected in the report with empty analytics. If there are such lines in the report, then you need to go into the documents and enter this analytics.

If an organization is engaged in the production of products, then to close the 20th account it is necessary that for each product group the production of products is reflected, that is, the document “Production Report for the Shift” is entered. Since it is this document that will create the basis for closing the 20th account, subject to the conduct of production activities.

To summarize, if at the end of the month there are still 20 account closing operations that have not been completed, then you should carefully read the error messages, as they contain explanations about what actions could have resulted in errors, and tips for correcting them.

CLOSING 90'S ACCOUNTS

When closing the month, another problem that you may encounter is closing 90x accounts. Let's look at what difficulties may arise.

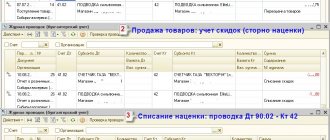

If suddenly the 90th account is not closed automatically, first of all it is worth checking whether there were any transactions entered manually. What makes manual operations difficult is that they may not contain the required analytics, and accordingly the program does not understand what needs to be done with the “stuck” amounts. This error can be corrected by generating a card for account 90, in which you can track the completion of all the required analytics; if the required analytics are not filled out, then the card in the “Analytics” column will have a “” sign, then you should enter this operation and simply deliver it .

Also, when using manual operations, you should carefully consider the formation of the posting itself, namely, if the posting is drawn up incorrectly, for example: Debit 90.01 was used, or vice versa Credit 90.02 was used, then the program will regard this correspondence as incorrect and, accordingly, the closure of 90 accounts will not occur.

Also, if after closing the month there are still amounts remaining on the 90th account, and all the analytics are indicated correctly, you need to check whether the regulatory operation to close the 90th accounts has not occurred due to doubling. This can be checked by opening the routine operations log. In it, you need to make sure that for the current month there is only one scheduled operation with the type “Closing 90, 91”. If there are more of them, then it is best to delete both transactions and close the month again. We should not forget that during the year the total 90 and 91 accounts are closed, and the amounts for sub-accounts remain at the end of the month, and will be closed at the end of the year when the operation is completed balance sheet reformation, and the financial result for the month is calculated using subaccount 9. So if after closing the month you have an amount left on account 90.01.1, this does not mean that account 90 was not closed, the correctness of the closure can be checked by generating a total turnover balance statement, as shown in the figure.

After successfully completing the month-end closing, you can always generate calculation certificates and once again check the correctness of the results obtained. And finally, once you are completely convinced of the resulting numbers, you can move on to the next stage of verification.

ANALYSIS OF THE STATE OF TAX ACCOUNTING

After successfully completing the “Month Closing”, you and I can see what is happening in our tax accounting. Enterprise Accounting Services 8, ed. 2.0 allow you to evaluate tax accounting data both for the general taxation system (income tax calculations) and for the simplified system.”

GENERAL TAX SYSTEM

Let's consider processing based on income tax data (“Reports – Analysis of the status of tax accounting for income tax”).

The report also selects the organization and period, and after that, you can click on each fragment to decipher the numbers in more detail.

The blocks illustrate the value of the organization's assets, liabilities, income and expenses according to:

- accounting (yellow background),

- tax accounting (blue background),

- accounting for permanent differences in the valuation of assets and liabilities (pink background),

- accounting for temporary differences in the valuation of assets and liabilities (green background).

A signal of an error is the recording of block indicators without observing the appropriate background (yellow, blue, pink, green). For example, in the “Indirect expenses” diagram in the “Indirect expenses not included in the reduction of profit” block, an entry on a brown background means that the indirect expenses accounts were closed incorrectly.

If for the indicators of one block the rule “ Value assessment according to accounting data = Value assessment according to tax accounting data + Permanent and temporary differences ” is not followed, then the block is surrounded by a red frame. This is a signal of accounting errors. It is recommended to consider the history of the formation of block indicators, find out the reason for non-compliance with the rule and eliminate it.

Each amount can be detailed down to the document in which it appeared.

SIMPLIFIED TAX SYSTEM

If our tax system is Simplified, then for ease of analysis there is a report “Analysis of the state of tax accounting under the simplified tax system”

The report is intended to analyze the structure of tax accounting income and expenses according to the simplified tax system

The report consists of a general scheme of the tax base and explanations of individual blocks of this scheme.

The transition between reports of different levels is carried out by clicking the Back button and the Tax base structure. Its work is carried out similarly to the analysis of income tax. All numbers can also be detailed into documents, which in turn can be opened and viewed

Well, now we have used the tools to check the accuracy of accounting for the entire year, analyzed all the balances and indicators, and made sure that everything was filled out correctly. If this was not the case, then we corrected all the errors, double-checked it again, and finally remained convinced that everything was correct and good. And now you can completely calmly start generating reports.

We once again wish you successful reporting preparation, and sincerely hope that our advice could help you and facilitate such a difficult process.

We close accounting account 90 “Sales”

At the end of the reporting month, the company is obliged to determine the financial result of its activities. This operation is a comparison of subaccounts. 90. That is, the accountant compares the indicators of subaccount 90-1 “Revenue” and the value of cost of sales, which is defined as the sum of subaccounts 90-2 “Cost”, 90-3 “VAT”, 90-4 “Excise taxes”, 90-5 “Trade and export duties."

If the company made a profit (revenue exceeded total costs), then the accountant generates the following entry:

Dt 90-9 Kt 99 - profit from sales is reflected.

If the company operates at a loss (revenue is lower than total costs), then the following entry is recorded:

Dt 99 Kt 90-9 - reflects the monthly loss for the company’s activities.

Consequently, subaccounts. 90 may have a balance at the end of the reporting month, but the total value of the synthetic BSC must be equal to zero.

Which accounts are closed at the close of the year? The following accounting entries are generated for this account at the end of the year:

| Operation | Debit | Credit |

| The “Revenue” sub-account was closed at the end of the year | 90-1 | 90-9 |

| The cost of production is included in the financial result | 90-9 | 90-2 |

| VAT is written off in favor of profits and losses | 90-9 | 90-3 |

| Excise taxes are included in the financial results of operations | 90-9 | 90-4 |

| Export trade duties written off at the end of the year | 90-9 | 90-5 |

General information

Let's define what belongs to work in progress:

- material assets that are in production, in addition, not yet participating in the production process, but accepted into it,

- manufactured products, but not shipped to a warehouse for storage.

To establish the amount of work in progress, initially at the end of the reporting month, all material assets are taken into account and then their value is determined.

Upon completion of the work, it is necessary to close the loan account. If a defect is detected during the production process, 20 the account is closed for the amount of defective products: Dt 28 “Defects in production” Kt20 “Main production”. The entries in the debit of account 20 take into account direct costs that are directly related to the manufacture of main products, activities performed and services provided. In addition, the costs of various related productions, losses incurred from low-quality products and other costs (25.26 accounts) for management and service work related to the main production.

Credit 20 of the account takes into account the return of semi-finished products and raw materials from production and the write-off of accumulated expenses for finished goods. According to PBU 10/99, production costs and

provision of products to the buyer is classified according to the following types:

— material costs (purchase of raw materials for use in the production process),

- salary,

— social plan accruals on wages,

— repair (depreciation) of fixed capital (equipment),

- other expenses.

Each enterprise establishes a more detailed list of costs independently.

We close account 91 “Other income and expenses”

The company must determine monthly financial results based on income and expenses from other activities. This financial result is determined as the difference between the subaccounts of the account. 91. That is, we compare 91-1 “Other income” with 91-2 “Other expenses”.

The results of activities are reflected in the following accounting entries:

| Operation | Debit | Credit |

| Profit at the end of the month from other types of company activities is reflected | 91-9 | 99 |

| Reflected loss from other activities | 99 | 91-9 |

At the end of the financial year, the accountant makes the following entries:

| Operation | Debit | Credit |

| Profit for the year from other types of company activities was written off | 91-1 | 91-9 |

| Reflected loss from other activities for the year | 91-9 | 91-2 |

In turn, count. 99 “Profit and Loss” remains unclosed. This BSCH closes on December 31st. The accountant generates the following entries:

- Dt 99 Kt 84—– reflects the net profit of the reporting year;

- Dt 84 Kt 99 - the company's uncovered loss is reflected.

How to close reporting periods in accounting and determine financial results during the year

It is clear that this is an unusual and difficult task for beginners, so we will briefly and in an accessible form describe this process.

To determine the financial result of an organization’s activities, it is necessary to close the reporting period. In accounting, a month is recognized as a reporting period (clause 48 of PBU 4/99).

All accounts related to the display of production costs, revenue (income), and the formation of financial results for compiling the balance sheet of a small enterprise can be conditionally divided into three groups:

1 . Accounts that, in accordance with Order of the Ministry of Finance of the Russian Federation dated October 31, 2000 N 94n “On approval of the Chart of Accounts for accounting financial and economic activities of organizations and instructions for its application,” do not have a balance at the end of the month - 25 “General operating expenses” 26 “ General running costs".

2. Accounts that, in most cases, have a balance of work in progress, but can be completely closed (20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”)

3. Accounts that generally do not have a balance at the end of the month, but have a balance for each subaccount - 90 “Sales”, 91 “Other income and expenses”.

to menu