In this article we will look at the reversal method. Corrections of errors in accounting. Let's figure out what a reversal is. Let's learn about the cancellation rules.

The need to adjust accounting data in transactions arises due to the inaccuracy of the initial entry or the need to make changes to the indicators. Deleting accounting entries when it is necessary to make changes to accounting is not performed. Corrections in accounting documents are made using the reversal method. The reversal operation is used to adjust transactions - correspondence or amounts.

Differences in the application of red and black reversal methods

Changes to accounting entries can be made with a plus or minus sign. The black reversal method is a plus operation. The red reversal provides for re-recording the erroneous posting with a minus sign while simultaneously indicating the correct data. Negative entries are made in red ink or in parentheses. When maintaining automated accounting, the entry is highlighted in red.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

| Conditions | Red reversal | Black reversal |

| Operation sign | Minus | Plus |

| Purpose | Changing totals with an adjusted entry | Deleting an invalid entry |

| Procedure | Drawing up a reversing entry for the exact amount of incorrect data (repetition with a minus sign) while simultaneously recording the correct entry | Drawing up additional return wiring with a plus sign |

Enterprises that use the red reversal method in everyday turnover, for example, when the planned cost deviates from the actual cost, must secure the right to carry out operations in their accounting policies.

Red reversal in accounting

A reversal transaction record is generated with a negative parameter value. For example, the wiring was initially made:

Debit 20 Main production Credit 10 Materials in the amount of 120,854.45 rubles. at the planned cost of inventories. To get the actual price of 115,145.17 rubles, you will need the red reversal method:

Dt 20 Kt 10 – 5,709.28 rub. REVERSE

This method is used in the following cases:

- when it is necessary to make corrections to current accounting;

- to write off already realized trade margins;

- if the company's estimated reserves are to be adjusted;

- it is necessary to bring the accounting price of uninvoiced supplies to the actual one.

Red reversal method. Example

Let’s assume that we have created a reserve for doubtful debts with the following accounting entry:

Debit 91.02 “Other expenses” Credit 63 “Provisions for doubtful debts” in the amount of 1200 thousand rubles.

At the end of the reporting period, part of the reserve was written off as follows:

Dt 63 Kt 62 95 thousand rubles, and part of it is built - Dt 91.02 Kt 63 - 15 thousand rubles.

Please note that all reversals in accounting must be accompanied by an “Accounting Certificate” document.

What is red reversal in accounting?

If we look at the legislative acts, we can see that the mechanism for adjustments in accounting is not strictly regulated, so accountants use both a reversal entry with a minus and a system of reverse entries. A red reversal in accounting implies the action of canceling a previous incorrect entry, because the amounts recorded in red are deducted from the total account turnover.

An entry with a minus is universal, since it allows you to correct synthetic data as soon as an error is detected, and does not distort the turnover of accounts for the period, since the incorrect amount is actually destroyed, both in debit and credit. For clarity, you can consider several options for adjusting amounts using specific examples:

| Account debit | Account credit | Sum | operations |

| 20 | 10 | 77 890-50 | Materials released into production (77,890-50 is indicated incorrectly, in fact the amount should be 7890-50) |

| 20 | 10 | -77 890-50 | REVERSE incorrect entry based on accounting certificate |

| 20 | 10 | 7890-50 | Correct accounting entry |

As a result, the turnover in accounts 20 “Main production” and 10 “Materials” will be only 7890-50 rubles, the turnover will not double. A reversal entry is just an opportunity to comply with all accounting rules by correcting incorrect entries immediately after an error is discovered.

Why is the posting with a minus called a red reversal?

The reversal entry is made with a minus sign; in addition, it is written on paper in red ink, and is highlighted in red in the automated accounting program. Therefore, the usual wiring is usually called “black”, and the reversal wiring with a minus is called “red”.

Why can't you do regular “black” wiring instead of “red”?

Sometimes, by mistake in accounting, instead of posting a reversal, the accountant makes a reverse entry. For example, you need to reverse an erroneous posting:

Debit 26 Credit 60 in the amount of 150,000 rubles. due to an error by the accounting service - in fact there should not be a write-off.

https://youtu.be/g4RTCzYUWJY

The specialist does not make the correction by writing:

Dt 26 Kt 60 – 150,000 REVERSE, and by recording Dt 60 Kt 26,150,000

The final account balances will be identical for both accounting entry options, but with reverse entries, the accountant artificially increases the turnover of debit and credit accounts, which distorts the data and requires additional analytics during analysis.

When is it necessary to do without STORNO?

Inaccuracies in accounting are possible both due to a technical error, a malfunction of the software product, and due to fatigue of the accounting specialist. Local errors, when only the date is distorted, are easier to correct than transit errors, which involve several registers at once.

Errors in numbers are the most common. To make adjustments, the accountant uses:

- proofreading method;

- red STORNO;

- additional entry.

Additional posting cannot be avoided if the amount is underestimated; for example, it was necessary to make an entry:

Debit 26 – Credit 70 for 120,850 rubles. - the director’s salary has been accrued, but only 120,050 rubles are listed in the accounting records, and after issuing the correct amount, 800 rubles are stuck, they will need to be additionally accrued in the same way in Dt 26 from Kta 70 by 800 rubles.

Reversal entries are used when the amount of the transaction is overstated, for example, instead of RUB 120,850. 120,855 rubles would have been charged. (5 rubles will “freeze” if you do not make an adjustment in red).

The red reversal rule is enshrined in PBU 22/2010 on the procedure for correcting errors in accounting. It was approved on April 19, 2010 and is applied from reporting for 2011.

You can use STORNO for the entire amount of the incorrect entry, adding an accounting entry with the correct amount, or only for the difference.

For example, the following entry was made in accounting:

Debit 62 – Credit 90 – sale of the machine for 925,125 rubles.

In fact, 920,125 rubles were received for the machine. By posting to Debit 51 and Credit 62, the amount of 5,000 rubles was stuck in the account for settlements with customers under this agreement.

Having raised the contract, the accountant was convinced that the sales amounted to 925,125 rubles. was carried out erroneously, the sales accounts should have had the amount of 920,125 rubles.

The following fixes are possible:

1 way

Dt 62 Kt 90 – 925 125 rub. REVERSE for the entire amount

Dt 62 Kt 90 920 125 rub. – posting to the correct sales value

Method 2

Dt 62 Kt 90 – 5,000 rub. REVERSE the difference

3 way

Dt 90 Kt 62 5,000 rub. – reverse posting for the difference.

Mathematically, all 3 options will be correct, but from an accounting point of view, only the first method of adjusting the overstated amount will be the most informative.

Source: https://spmag.ru/articles/krasnoe-storno-v-buhgalterskom-uchete

Eligibility of using the black reversal method

A number of accountants, instead of making adjustments by canceling entries while simultaneously recording the correct indicators, use reverse entries using the black reversal method. Recording a reverse entry that does not have a documentary justification is an incorrect accounting operation.

The fundamentals of accounting legislation do not contain the concept of “black reversal”. The concept of reversal in domestic accounting applies only to transactions with a minus sign. The method is typical for Western schools of accounting.

There is no specific prohibition in the legislation on the use of black reversals, with the exception of credit institutions in which solvency is based on reporting indicators. When using reverse entry in accounting, debit and credit turnover unreasonably increases, distorting accounting data. Additional turnover appears in the reporting. Black reversal is used to exclude transaction amounts.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

https://youtu.be/AiKoa6judf0

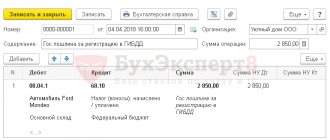

How to make a reversal in 1C 8.3 - the receipt was reflected incorrectly

Let's consider reversing a receipt document in 1C 8.3 Accounting if the accountant entered it incorrectly in the previous period.

On May 18, the accountant discovered that on March 27 he had mistakenly entered the incoming act dated April 7 into the program.

The document Adjustment of receipts will not help in this case. VAT is reflected correctly and there are no errors in the registered invoice. Corrections need to be made only for BU and NU. And also submit an updated income tax return for the first quarter.

Cancel a document manually: open the Manual Transactions and create Document Cancellation .

Fill out the document with reversal entries by selecting erroneously entered receipt Reversed document

Please note: the VAT register data submitted is also cancelled.

Next, register the receipt document on the required date.

To correctly reflect VAT, go to the invoice and delete the second, erroneously entered basis document.

The amount on the invoice will be reflected correctly, and the VAT deduction will not be duplicated.

To exclude such situations, Bukhekspert8 recommends closing the period from adjustments. Read more How to protect yourself from accidental adjustments during closed periods.

We have looked at how reversals are processed in 1C 8.3 Accounting.

For more information on how to make a reversal in 1C 8.3, see the video:

The need for reversal methods

When reversing, amounts are deducted from the debit and credit entries and changes are made to the registers and documentation. Red reversal is used in the following cases:

- The need to make adjustments to accounting due to a technical error or inattention of the accountant. The method is used for correct postings in cases of incorrect indication of the amount;

- Bringing the value expression of uninvoiced supplies to the actual value;

- Withdrawal of the amount of trade margin on goods sold or written off according to the act;

- The need to reduce valuation reserves;

- Adjustments for excess costs of actual costs over planned costs;

- Providing retrospective discounts based on the results of previous shipments of goods.

Reversal data affecting business accounting indicators must be communicated to partners in order to avoid discrepancies in indicators.

We study ways to correct errors in accounting and documents

There is a very good saying: “He who does nothing makes no mistakes.” And an accountant performs a very large amount of work and often makes decisions in non-standard situations. Therefore, there may be errors in accounting. There is no need to be afraid of them, but you need to be able to correct them correctly. How to correct accounting errors will depend on the situation. Let's study!

The main regulatory act that defines and classifies errors, and also regulates the rules for correcting errors in accounting ─ PBU 22/2010 “Correcting errors in accounting and reporting.”

articles:

1. What are accounting errors

2. Significant and immaterial accounting error

3. Correction of errors in accounting documents

4. Ways to correct errors in accounting

5. Drawing up additional postings

6. Reversal entries

7. How to correct errors 1C: Accounting

8. Rules for correcting errors in accounting

So, let's go in order.

What are accounting errors?

An error is considered to be the incorrect reflection of business transactions in accounting and/or reporting as a result (clause 3 of PBU 22/2010):

- Incorrect application of legislation. This often happens in cases where laws or regulations are adopted, but it is not clear how to work according to them. After clarifications appear, many accountants have to make changes to accounting and reporting.

- Incorrect application of accounting policies. In order to avoid such errors, the accounting policy must be drawn up very carefully and everything that is written in it should not have double interpretation.

- Inaccuracies in calculations.

- Incorrect classification or assessment of facts of economic activity. For example, an organization purchased expensive technical equipment. If you look at the cost, then the equipment can be classified as a fixed asset, and if you look at the service life, then it can be classified as materials. The formation of cost and profit in the future depends on how the asset is capitalized. Therefore, it is important to correctly classify any, especially non-standard, business transactions.

- Incorrect use of information that existed on the date of signing the reporting.

- Unfair actions of officials.

An example for the last two points. The materials were brought to the organization at the end of December. But the documents remained with the responsible executor; he did not bring them to the accounting department. If there are no documents, then the materials were accepted for safekeeping and put on balance sheet. After the holidays, they forgot about the documents; the income was not reflected in the annual reports.

Even before signing the reports, they remembered the materials, found the documents, but decided not to make changes to the accounting and reporting. In fact, it turns out the following: the organization had documents and information, but they were not reflected in the accounting records. As a result: the balance sheet asset is missing the amount in the “Inventories” line, and the liability is missing in the “Accounts Payable” line. At the same time, the balance is overestimated.

Errors are not considered those cases when business transactions were not reflected in accounting due to the fact that the organization did not have information about them at the time of signing the reports.

Significant and immaterial accounting error

An accounting error is considered significant if it affects the economic performance of the company. For example, misuse of prices in invoicing resulted in understated revenue.

The error amounted to 100,000 rubles. For a small company, this amount can be 30% of the “revenue” indicator, and for an organization with huge turnover ─ 0.1%.

Therefore, materiality is usually considered not in absolute, but in relative terms ─ shares or percentages.

Until 2010, the materiality of 5% was determined by Order of the Ministry of Finance of Russia dated July 22, 2003 No. 67n. This order was canceled in September 2010.

Since 2010, according to clause 3 of PBU 22/2010, the company must determine the significance of errors independently . The level of materiality may differ for different items. All this must be spelled out in the accounting policy.

Correcting errors in accounting documents

Source: https://azbuha.ru/buxgalterskij-uchet/sposoby-ispravleniya-oshibok-v-uchete/

Using the reversal method in payroll

Reversal of excessively accrued wages is carried out only in the cases specified in Art. 137 Labor Code of the Russian Federation. Withholding is possible if an accountant commits a counting error or recognizes for employees a failure to comply with labor standards established by a labor dispute commission or a judicial body. Overpayments resulting from incorrect information provided by the employee are withheld based on a court decision. Counting errors occur most often in accounting.

The definition of a counting error is not established by law. It is assumed that a counting error is understood as an inaccuracy due to inaccurate calculation, incorrect rounding of amounts, or the accountant performing erroneous arithmetic operations. In other cases, overpaid amounts are not withheld, but can be paid by the employee voluntarily. To withhold an overpayment in the event of a counting error, it is also necessary to have the consent of the employees. The employer must decide to withhold the excess accrued amount within a month.

An example of adjusting salary data when deducting by reversing

Employee K. was paid a salary of 22,700 rubles for October 2020. The amount of personal income tax withheld was 2,951 rubles, the amount of insurance premiums was 6,855 rubles. When accruing, the accountant made an arithmetic error in calculating the allowance. The correct amount of accrued wages was 22,300 rubles. The deduction was made in the statement for November.

| Operation | Wiring | Amount (in rubles) |

| Operations for October 2016 | ||

| Payroll | Dt 20 Kt 70 | 22 700 |

| Calculation of insurance premiums | Dt 20 Kt 69 | 6 855 |

| Personal income tax accrual | Dt 70 Kt 68 | 2 951 |

| Issuing the amount to the employee | Dt 70 Kt 51 | 19 749 |

| Operations for November 2016 | ||

| Reversal of accrued amount | Dt 20 Kt 70 | 22 700 |

| Reversal of contributions | Dt 20 Kt 69 | 6 855 |

| Reversal of personal income tax | Dt 70 Kt 68 | 2 951 |

| Reversal of the issued amount | Dt 70 Kt 51 | 19 749 |

| Payroll calculation | Dt 20 Kt 70 | 22 300 |

| Calculation of contributions | Dt 20 Kt 69 | 2 899 |

| Personal income tax accrual | Dt 70 Kt 68 | 6 735 |

| Issuing the amount to the employee | Dt 70 Kt 51 | 19 401 |

Corrections and reversals in 1C: Salaries and personnel management

Published 11/19/2019 10:55 Author: Administrator “He who does not make mistakes does nothing,” the famous Russian proverb tells us. But corrections can affect you not only due to inattention. Often, it is necessary to make adjustments to reflect such transactions as recall from vacation due to production needs, early return from a business trip, sick leave during vacation, etc. What is the difference between correction and reversal? Let's analyze these concepts using practical examples in 1C: Salaries and personnel management edition 3.

A correction is usually introduced when a specific parameter is changed, and does not require a complete cancellation of the document. For example, in the case of recalculation of vacation pay due to a decrease in the number of vacation days.

And reversal is the complete cancellation of a document, which is reflected by registering negative amounts in the current period. Most often, reversal is used to completely cancel a vacation, business trip, or even payroll for the month.

All corrections can be divided into two types: changes in personnel documents and payroll documents.

Suppose an accountant mistakenly entered the wrong department for an employee when hiring. Accordingly, the error needs to be corrected. This can be done in two ways: either by making changes to the original document and refilling the payroll if it has already been entered, or by entering the “Correction” document.

Errors in documents by which certain amounts were accrued or withheld to employees are corrected in settlement documents. For example, if an employee gets sick on a business trip, you can enter a correction document in which you indicate new conditions. Let's look at examples of each type of correction.

Correction of personnel documents

Let's assume that we made a mistake when hiring Pushkin's employee, indicating the wrong salary. Let’s enter the initial “Hiring” document by selecting the “Hirings, transfers, dismissals” item in the “Personnel” section. Pay attention to the amount indicated in the “PAYroll” column. We indicated it erroneously; in fact, the salary should be 80,000 rubles.

We will calculate payroll for the month by selecting the required employee through selection. An accrual document can be created in the “Salary” - “Salary and Contributions” section. For a more convenient calculation, we will assume that the month has been fully worked.

Now let’s correct the error by clicking on the “Correction” button in the footer of the “Hiring” document.

In the created document, enter a new salary, leave the appointment date the same, and leave the document date current. Please note that after a correction is made, an indication appears in the footer of the document that this document is not the original document.

When you subsequently calculate wages, the program will display a message about the need for recalculation.

Correction of payment documents

Let's look at correcting errors in settlement documents using the following example:

On September 2, Employee Ivanova was sent on a business trip for a period of 5 calendar days. Let us remind you that payment for days on a business trip is calculated based on the employee’s average earnings. Due to production needs, management decided to shorten Ivanova’s business trip to 3 days.

Let's reflect the conditions of the example in the program. To do this, go to the “Salary” section and select the “Business Trips” item. Let's create a new document into which we will enter the initial data. The header of the document indicates the seconded employee, the date and month of accrual. On the “Main” tab, the period of the trip and the payment option are indicated. The program fills in the amount of average earnings and total accrual automatically. You can view the detailed calculation by clicking on the button. We will process the document and make the payment by clicking on the appropriate button.

Now let’s make a correction document by clicking on the link in the footer of the “Correction” document, as shown in the figure.

In the created document, set the date for making changes and on the “Main” tab indicate the new end date of the business trip. The document performs recalculation, which is most conveniently checked on the “Accrued (details)” tab.

We will create a payslip. To do this, in the “Salary” section, select the “Salary reports” item and in the window that opens, go to the “Pay slip”.

In connection with the change, the business trip is reflected in two lines: the initial accrual and the corrected one.

Reversal

Let’s assume that the accounting department received documents for the business trip of employee Ivanova, which were reflected in the program in a timely manner. At the end of the month, after payroll was calculated, the employee contacted the accounting department with an explanation that she did not go on a business trip, and, accordingly, the salary calculation based on average earnings for the days of the business trip was done incorrectly, and the “Business trip” document must be cancelled.

Since the information became clear in the next billing period, the document cannot be deleted or canceled. It can only be reversed.

Reversal can be carried out in two ways: directly in the payment document by clicking on the “Reversal” button, or by creating a document “Reversal of accruals” in the “Salary” section. Let's consider the second option. In the created document, when you click on the button for selecting the document to be reversed, a list is displayed with all types of documents that can be reversed.

In our case, select “Business trip”, and in the window that opens with all the business trip documents, select the one that is subject to cancellation.

The program automatically calculates the amounts that should be canceled and displays them in red with a negative sign. If the reversal of a document should lead to the recalculation of wages, allowances or some other accruals, then you need to set the “Add wages if necessary” flag. In the example under consideration, we need to cancel accrual based on average earnings for the period of a failed business trip and make accrual based on salary for the same period, so we set the flag and check the accrual on the “Additional accruals and recalculations” tab.

We will process the document and generate a payslip. Pay attention to the formation period. If we generate a sheet for the period in which changes were made, the recalculation will not be reflected there, since reversal is precisely the cancellation of a document from a previous period in the current one.

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Our training courses and webinars

Reviews from our clients

Add a comment

Comments

0 Alina Kalendzhan 05/01/2020 04:00 I quote Alexander:

I quote Alina Kalendzhan: I quote Alexandra: Hello! How to do it correctly in the following case: the salary for March has been calculated and paid. On April 20, you receive sick leave from March 25 to April 8. Document Sick leave, tab Recalculation of the previous period - there with a minus amount of Payment at the hourly rate, Additional payment for night hours, RK and SN (for those shifts that fell from March 25 to March 31). In March, I introduced the Overtime Registration, including for this employee. If you are on sick leave, there are no overtime hours. But the ZUP in the Hospital does not remove the amount of Additional payment for overtime in the aggregated accounting of work time. Somewhere the program needs to indicate that in March, taking into account sick leave, there is no overtime? Tell. Thank you.

Good afternoon.

In this case, before entering the “Registration of Overtime” document, you would have to register the employee’s absence with the document “Absence (truancy, illness, no-show)”, and the overtime would be calculated correctly. Unfortunately, the processing registration document does not have a correction or reversal function. Therefore, the recalculation will have to be done in March. The fact is that before registering overtime and calculating salary, I did not know that the employee was on sick leave (geographically remote), the time sheet was sent as if he had been at work the whole month. The sick leave was sent only on April 20. To do the recalculation in March - is it as if it was known that there would be sick leave? enter absence? Then it turns out that I paid more for the salary for March at the beginning of April due to my stupidity (in the eyes of the director). We need some other way, to recount it in April. How to do something? Try in the “Settings” section, in the “Salary calculation” item, check the “Perform additional accrual and recalculation as a separate document” flag. In this case, the “Recalculations” item will appear in the “Salary” section. The program should see the difference in calculations for the employee. There you can click on the “Add up now” button and make corrections from March to April. Quote 0 Alexandra 04/29/2020 13:29 Quote Alina Kalendzhan:

I quote Alexander: Hello! How to do it correctly in the following case: the salary for March has been calculated and paid. On April 20, you receive sick leave from March 25 to April 8. Document Sick leave, tab Recalculation of the previous period - there with a minus amount of Payment at the hourly rate, Additional payment for night hours, RK and SN (for those shifts that fell from March 25 to March 31). In March, I introduced the Overtime Registration, including for this employee. If you are on sick leave, there are no overtime hours. But the ZUP in the Hospital does not remove the amount of Additional payment for overtime in the aggregated accounting of work time. Somewhere should the program indicate that in March, taking into account sick leave, there is no overtime? Tell. Thank you.

Good afternoon.

In this case, before entering the “Registration of Overtime” document, you would have to register the employee’s absence with the document “Absence (truancy, illness, no-show)”, and the overtime would be calculated correctly. Unfortunately, the processing registration document does not have a correction or reversal function. Therefore, the recalculation will have to be done in March. The fact is that before registering overtime and calculating salary, I did not know that the employee was on sick leave (geographically remote), the time sheet was sent as if he had been at work the whole month. The sick leave was sent only on April 20. To do the recalculation in March - is it as if it was known that there would be sick leave? enter absence? Then it turns out that I paid more for the salary for March at the beginning of April due to my stupidity (in the eyes of the director). We need some other way, to recount it in April. How to do something? Quote 0 Alina Kalendzhan 04/24/2020 20:59 I quote Alexander:

Hello! How to do it correctly in the following case: the salary for March has been calculated and paid. On April 20, you receive sick leave from March 25 to April 8. Document Sick leave, tab Recalculation of the previous period - there with a minus amount of Payment at the hourly rate, Additional payment for night hours, RK and SN (for those shifts that fell from March 25 to March 31). In March, I introduced the Overtime Registration, including for this employee. If you are on sick leave, there are no overtime hours. But the ZUP in the Hospital does not remove the amount of Additional payment for overtime in the aggregated accounting of work time. Somewhere should the program indicate that in March, taking into account sick leave, there is no overtime? Tell. Thank you.

Good afternoon.

In this case, before entering the “Registration of Overtime” document, you should have registered the employee’s absence with the document “Absence (truancy, illness, no-show)”, and the overtime would have been calculated correctly. Unfortunately, the processing registration document does not have a correction or reversal function. Therefore, the recalculation will have to be done in March. Quote 0 Alexandra 04/22/2020 17:28 Hello! How to do it correctly in the following case: the salary for March has been calculated and paid. On April 20, you receive sick leave from March 25 to April 8. Document Sick leave, tab Recalculation of the previous period - there with a minus amount of Payment at the hourly rate, Additional payment for night hours, RK and SN (for those shifts that fell from March 25 to March 31). In March, I introduced the Overtime Registration, including for this employee. If you are on sick leave, there are no overtime hours. But the ZUP in the Hospital does not remove the amount of Additional payment for overtime in the aggregated accounting of work time. Somewhere should the program indicate that in March, taking into account sick leave, there is no overtime? Tell. Thank you.

Quote

Update list of comments

JComments

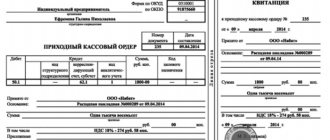

Document confirming the changes

The use of the red reversal method is confirmed by an accounting certificate . The document does not have a unified form and is drawn up in any form. An accounting certificate acts as a primary accounting document with the obligatory indication of details:

- Names of the enterprise, department;

- Dates of the certificate;

- Data of the responsible person;

- Information about the purpose of the operation;

- Incorrect and correct accounting indicators;

- Value expression and posting accounts;

- The reasons that caused the need for reversal;

- Signatures of the employee who carried out the posting.

The form of the accounting certificate is developed by the enterprise independently and approved in the annex to the accounting policy. Persons responsible for maintaining records are allowed to correct records.

Reversal rules

Proper reversal solves several problems at once. A correctly compiled report helps you quickly understand the trading operations carried out. It is also important to ensure the company's protection during tax audits. Let's look at the basic rules for making a reversal:

- If an incorrectly entered entry was identified in the current period before the delivery was made, then the corrections are indicated under the date of the day ending the quarter.

- The reversal can be made on the discovery date, but this is subject to certain conditions. In particular, this is relevant when identifying an error in the delivery period, which has already passed.

- Each of the adjusting entries must be confirmed by an accounting certificate. This document states the reason for making the corrections, as well as the amount of the new entry.

- All accounting entries must match the primary documentation. Entries are always supported by associated papers. If the information does not match, the company will have problems when passing tax audits.

Rules for reversing accounts

When making adjustments, a number of rules must be followed. To apply the red reversal method, it is necessary to determine the date of the adjustment. The order of the chronology of corrections is established in PBU 22/2010. The regulation defines the time frame for correcting errors. The adjustment is made in the current or previous accounting periods. Changes to records from the previous period depend on the fact of reporting. No changes are made to the registers after reporting is submitted.

| Period of inaccuracy | Carrying out adjustments |

| Current period error | Month the error was discovered |

| Error of the previous period discovered before reporting | December of the reporting year |

| Error of the previous period identified after reporting | Current period of operations |

In a similar manner, changes are made to accounting if it is necessary to adjust the facts of economic activity when removing the markup, bringing the planned indicators to the actual ones.

Example of using reversal

Let's assume that the organization received materials worth 100,000 rubles. When reflecting in the posting, the accountant automatically made a mistake by indicating 120,000 rubles instead of 100,000.

The first entry must be canceled without crossing out.

We see what it means to reverse by canceling the original posting.

Add the following entry.

We focus attention on changes by highlighting them in red.

Without a certificate explaining the reasons for the operations performed, the changes made will be illegitimate. Therefore, additional explanations are prepared:

“Name of organization (registration details of legal entity)

December 20, 2019

Accounting certificate No. 3On making changes to accounting

In December 2020, a technical error was made when preparing documents for the receipt of materials from contract No. 67 dated December 12, 2019. Instead of the required cost of 100 thousand rubles, 120 thousand rubles were indicated. The error was identified in December 2019. Corrections to the accounting accounts entered on December 20, 2019.

| Contents of operation | Accounting entries | ||

| actual | corrected | Right | |

| Receiving materials from the supplier | D-t 10 K-t 60 120 | D-t 10 K-t 60 120 | D-t 10 K-t 60 100 |

Chief accountant (signature) I.R. Anikeeva

Spanish accountant (signature) N.V. Martynov”

document can be found here:

As an example, we can cite various circumstances when adjustments to accounting transactions may be necessary:

- the employee will have to withhold vacation pay paid in advance if he quits before he has worked for the required period;

- During paid leave, the employee fell ill, as a result of which the rest will be extended, and the days when he was under treatment will be paid on the basis of the provided certificate of incapacity for work.

Reversal method. Correcting Accounting Errors: Examples of Using Reversals

One of the mistakes is when an incorrect entry may be made when reflecting accounts. Cashier M. of the enterprise gave employee S. an accountable amount of 5,200 rubles for business needs. At the time of the transaction, the cashier applied the amount to the payroll account. The error was discovered in the current period when summing up monthly results. In the accounting of an enterprise, the accountant makes entries:

- Adjustment of postings using the reversal method: Dt 70 Kt 50 in the amount of 5,200 rubles;

- The amount given to the employee is reflected: Dt 71 Kt 50 in the amount of 5,200 rubles.

Conclusion: the red reversal adjustment did not affect the results of the month. Another common mistake is recording the transaction amount in a larger amount.

Cashier N. carries out payroll calculations in the branch using a cashier authorized to issue amounts in the branch. The amount of the payroll for the payment of wages for March amounted to 87,250 rubles. Cashier N. indicated to the cash register and issued the amount of 97,250 rubles. The error was discovered when the settlement with employees was completed and the statement was submitted to the cashier. The following entries are made in the company's accounting:

- Reversing an incorrect transaction amount: Dt 70 Kt 50 in the amount of 97,250 rubles;

- Entering the correct entry: Dt 70 Kt 50 in the amount of 87,250 rubles.

Conclusion: the error, which arose due to the carelessness of the cashier and the distributor, was eliminated this month.

What is a reversal? Postings in accounting. Example of a red reversal

Reversal is a tool used in accounting to make corrections in documentation; it is relevant if there is an error in accounting.

What is a reversal?

It is prohibited to delete entries in accounting documents. You also cannot cross out incorrect information. Reversal is used to correct errors. This is wiring with a minus sign.

It allows you to correct incorrect data. As a result, two mutually exclusive entries appear in accounting, one of which has a minus. The wiring duplicates each other.

Let's look at the main features of reversal:

- the entry is made for the period in which the error was made;

- the main sign of a reversal is the presence of a minus;

- without such a record, the final reporting will be incorrect;

- The adjusting entry is made for the amount for which the difference was established.

IMPORTANT! Reversal rules are extremely important. If they are ignored, turnover is likely to be overestimated, which is unprofitable for the enterprise.

In what cases is reversal used?

Adjustment entries are relevant under the following circumstances:

- correction of mistakes;

- write-off of the realized trade margin;

- the planned cost of inventories is brought into line with the actual price. This is relevant for those cases when the actual price is less than the accounting price. A similar situation may arise when uninvoiced supplies are recorded;

- the need for correction to reduce the amount of valuation allowances.

Reversal is a common tool in accounting practice.

What is a “red storno”?

“Red reversal” is a correction method that is relevant when the amounts indicated in the accounting are overstated. Applicable in the following ways:

- if this is a paper journal for accounting, then the reversed entry can be circled with a red pen;

- If a transaction is entered into a computer database, it must be highlighted in red.

At the end of the reporting year, it is necessary to make a calculation in which the amount of the reversed entry is subtracted from the total amount. The correction method is determined by the enterprise itself. The choice of instrument is not specified by accounting rules.

IMPORTANT! It must be borne in mind that the balance will be similar when using any of the types of reversals. The turnover in the accounting account differs.

Example of a “red reversal”

The company has created a reserve for doubtful debts. This operation is reflected by the entry:

- DT 91.02 “Other expenses”;

- CT 63 “Provisions for doubtful debts.” The amount is 1,200 thousand rubles.

Part of the created reserve is written off. It looks like this:

- DT 63 CT 62. Amount 95,000 rubles;

- DT 91 (subaccount 02) CT 63. Amount 15,000 rubles.

ATTENTION! All adjusting entries must be supported by an accounting statement.

Additional recording correction method

Additional posting is relevant to increase the indicated amounts if they have been underestimated in accounting. The accountant needs to enter an entry with correspondence similar to the correspondence of the erroneous entry. The entry must not indicate the entire amount, but only the missing value.

Example

The cost of repair work in the report is indicated at 5,000, but in fact the amount is 6,000 rubles. The figure is underestimated by 1,000 rubles. Accounting corrections can be made as follows:

- DT 26 CT 60 “Settlements with suppliers.” The amount is 1000 rubles.

That is, the missing amount is recorded in the record.

Why are “black” and “red” wiring not mutually exclusive?

Each correction method differs in its functional purpose. Entering a reversal instead of a reverse entry is a mistake. Let's look at an example. The accountant makes entries that do not correspond to the actual transaction. It looks like this:

- DT 26 CT 60. Amount 150,000 rubles.

You need to correct the entry using the following wiring:

- DT 60 CT 26. Amount 150,000 rubles.

Entering the entry DT 26 CT 60 would be a mistake.

IMPORTANT! An accounting error will lead to an artificial increase in turnover in both debit and credit. All this distorts accounting data. When checking or analyzing, you will have to spend time on auxiliary analytics.

Reversal rules

Proper reversal solves several problems at once. A correctly compiled report helps you quickly understand the trading operations carried out. It is also important to ensure the company's protection during tax audits. Let's look at the basic rules for making a reversal:

- If an incorrectly entered entry was identified in the current period before the delivery was made, then the corrections are indicated under the date of the day ending the quarter.

- The reversal can be made on the discovery date, but this is subject to certain conditions. In particular, this is relevant when identifying an error in the delivery period, which has already passed.

- Each of the adjusting entries must be confirmed by an accounting certificate. This document states the reason for making the corrections, as well as the amount of the new entry.

- All accounting entries must match the primary documentation. Entries are always supported by associated papers. If the information does not match, the company will have problems when passing tax audits.

Making a reversal is a relatively simple procedure. However, in practice, this wiring raises many questions.

IMPORTANT! Clause 3, Article 10 of the Federal Law “On Accounting” establishes the need for protection against unauthorized amendments.

Execution of reversals must be justified. The accounting certificate for this entry must contain the signature of the accountant who made the reversal.

The posting date and the accounting statement date must match.

What should I do if an error is discovered after accounting approval?

If the error is found for the next accounting year, there is no need to make corrections to the old accounts. The reversal is entered in the new accounting.

For example, in February 2020, an error was made that was found only in 2020. Adjustments are made to the accounting records for 2020.

This rule is due to the fact that no changes are ever made to the reporting of previous years.

https://youtu.be/cn3rrmOt8GU

Errors from previous years are considered gains or losses. Expenses or income must be reflected in account 92 “Non-operating income (expenses)”. It is also necessary to reflect them in the line “Profit (loss) of previous years.”

So. Accounting documents require strict reporting. They should not contain arbitrary information. All errors found must be corrected immediately.

You can do this in two ways:

- reversal,

- making additional entries.

The first method will be relevant if the transaction amounts were inflated.

To make an adjustment, it is not enough to simply make an entry, which must be confirmed by an accounting certificate.

Source: https://assistentus.ru/buhuchet/storno/