Kontur.Accounting is a web service for small businesses!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

In accounting and tax accounting, income and expenses can be recognized in two ways.

The first one is the accrual method. It is associated with the period of actual conduct of a business transaction. The corresponding income or expense must be taken into account on the date of its occurrence according to documents or on the date of transfer of raw materials or provision of services, that is, at the moment when the income or expense was accrued.

The second option is the cash method. When using it, income or expenses should be recognized in the period when the payment occurred, that is, when money arrived or left the cash register or current account, or when the organization received or transferred other property.

In practice, most often companies keep records using the first method, following the instructions of accounting standards and the Tax Code. It is believed that the recognition of income and expenses upon shipment most accurately reflects the results of the business. However, sometimes businesses may, or are even required to, account for expenses upon payment.

The main advantage of the cash method is the reduction of cash gaps: the situation is eliminated when a company must pay tax, but the funds have not yet been received.

Who can keep tax records of income and expenses using the cash method?

Most often, payers of the simplified tax system switch to the cash method. Such companies have no choice: they cannot keep records of receipts and shipping costs. Some organizations on OSNO also have the right to recognize income and expenses upon payment when calculating income tax. The main condition is that the average revenue excluding VAT for the previous four quarters in each of them should not exceed one million rubles.

Who cannot use the cash method even if the revenue limit is observed (Article 273 of the Tax Code of the Russian Federation):

- banks;

- credit consumer cooperatives;

- microfinance organizations;

- companies that are controlling persons of the CFC;

- companies operating in the production of hydrocarbons in a new offshore field.

Another restriction for the listed organizations is the prohibition on concluding property trust management agreements, simple or investment partnership agreements.

https://youtu.be/P1A9u3BS-po

Differences between the cash method and the accrual method

The difference between the two methods is the period in which income and expenses are recorded.

Income is recognized:

– with the accrual method – in the reporting (tax) period in which they occurred, regardless of the actual receipt of funds and other property ( clause 1 of Article 271 of the Tax Code of the Russian Federation );

– with the cash method – on the date of receipt of funds to bank accounts and (or) to the cash desk, receipt of other property, repayment of debt to the taxpayer in another way ( clause 2 of Article 273 of the Tax Code of the Russian Federation ).

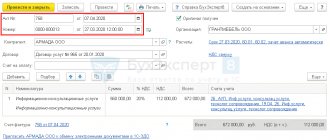

| Operations | Revenue recognition period | |

| With cash method | With the accrual method | |

| Goods were shipped in the third quarter. Payment received in Q4 | IV quarter | III quarter |

| The advance payment was received in the third quarter. Goods shipped in Q4 | III quarter | IV quarter |

Expenses are recognized:

– with the accrual method – in the reporting (tax) period to which they relate, regardless of the time of actual payment of funds and (or) other form of payment (clause 1 of Article 272 of the Tax Code of the Russian Federation );

– with the cash method – after actual payment ( clause 3 of Article 273 of the Tax Code of the Russian Federation ), taking into account some features.