Postings to account 91 - Other income and expenses

Accounting account 91 is used to display and analyze information about expenses incurred and income received from activities that are not core for the organization.

In the article we will look at typical entries for account 91, and also use examples to understand operations for recording income and expenses from non-core activities. Dt Kt Description Amount Document 76 91.01 The amount of income from the sale of materials is taken into account: RUB 12,450. Invoice 91.02 68 VAT VAT accrued on materials sold RUB 1,899. Invoice 91.02 10 Cost of materials written off as expenses RUB 7,140. Cost calculation 91.02 23 Selling expenses written off 4,120 rub. Payroll 51 76 Funds credited towards payment for materials sold RUB 12,450. Bank statement

Postings Dt 01 and Kt 01, 08 (nuances)

Dt 01 Kt 01 is a posting indicating the disposal (alienation) of fixed assets (hereinafter referred to as fixed assets) of the organization. Accounting and movement of own fixed assets are regulated by the norms of the Tax Code of the Russian Federation and PBU 6/01. However, in the process of accounting for them, accountants have a lot of questions. Some will be discussed in this article.

The cost of fixed assets is formed from the price of the property and additional costs associated with their acquisition. These may include costs for delivery, installation, information or intermediary services, as well as payment for state registration, exchange rate differences, and others. All expenses are collected in the debit of the 08th account.

Problem 2

Name of transactions Primary document Amount thousand rubles. Dr Kt 1. The initial cost of intangible assets is reflected. Intangible asset registration card-1 2. The amortization of intangible assets is reflected. Calculation 3. Income from the sale of intangible assets is accrued. Agreement 4. Money received from the sale of intangible assets. Bank statement 5. Profit received from the sale of intangible assets. Calculation.

Name of transactions Primary documents Amount thousand rubles. Dt Kt 1. materials from the warehouse were transferred to the construction of the capital construction facility Invoice 2. Wages were accrued for the execution of work on the construction of the capital construction facility Payroll 3. The facility was put into operation Act OS-1 4. VAT was accrued (18%) calculation 5. VAT was taken into account for purchased materials (18%) calculation 6. VAT transferred to tax authorities (45-18 = 27) Calculation, Payment order, Bank statement

What does wiring dt 01 kt 08 mean?

When deciding whether to account for property as part of fixed assets, in addition to the useful life criterion, the cost indicator should also be taken into account. Non-production objects and land plots whose accounting value exceeds 40,000 rubles must also be included in fixed assets.

According to the fixed assets account, the register of accounting for fixed assets at the place of their operation (location) and to financially responsible persons is the inventory list of fixed assets. Accounting is carried out by classification groups of fixed assets (buildings, structures, machines, etc.) indicating the place of their operation. At the beginning of the year, entries are made on the basis of inventory records and inventory cards, and later - on documents for receipt and disposal, for which separate columns are provided. The inventory list must contain accurate information characterizing each object: the inventory number of the object, its full name, the original cost, the number and date of the inventory card, information about the disposal (relocation) of the object, etc.

What do the postings for Dt 02 and Kt 02 reflect?

The value expression of fixed assets listed on the company’s balance sheet is recorded in account 01 “Fixed Assets”. To account for the amount of wear and tear (depreciation) incurred, refer to account 02 “Depreciation of fixed assets.”

Let's look at how postings according to Dt 02 Kt 02 . Kt 02 records the amount of accumulated wear and tear on fixed assets. The following correspondences with cost and sales expense accounts are possible:

- Dt 20 (23, 25, 26) Kt 02 – accrued depreciation as part of production costs;

- Dt 44 Kt 02 - the amount of depreciation is taken into account in selling expenses.

If depreciation is accrued on leased property (and the rental does not relate to the main activity of the company), the posting appears:

- Dt 91 Kt 02 - depreciation on leased fixed assets.

The organization may also cease further operational use of expensive assets. One of the main reasons for this is its sale.

Then, when writing off property according to Dt 02, the amount of accumulated depreciation on it is reflected. The following entry appears:

- Dt 02 Kt 01 – write-off of accumulated depreciation.

The same wiring is used in the following situations:

- disposal of fixed assets received free of charge;

- transfer of property in favor of third parties as a contribution to the management company;

- write-off of the OS if it is found missing or damaged.

For other nuances when selling an organization’s property, see the material “Calculation and procedure for paying VAT on the sale (realization) of fixed assets.”

Correct wiring dt 90 kt 86 01

In October, account 90 will look like this: In subaccount 90.9, the financial result at the end of the month is calculated, which is defined as the difference between the debit and credit of the account. The figure shows in red the balances at the end of the month for each subaccount.

Dt 08, Dt 10/ Kt 98-1 The amount of income accepted for accounting is written off as it is charged to expenses, or when calculating depreciation: Dt 98-1/ Kt 91-1 When subsidies, state aid or grants are received, the entry is reflected: Dt 86/ Kt 98-2 To reflect the shortfalls of previous years, their amount is shown in the entries: Dt 94 / Kt 98-3 The debt for shortfalls must be attributed to the direct culprit: Dt 73 / Kt 94 As the identified guilty employee pays off the resulting debt, in the accounting entries are made: Dt 50, Dt 70/ Kt 73 In case of deduction of the shortfall amounts from the employee’s earnings, or their receipt at the cash desk, entries are made to account for DBP as part of others: Dt 98-3/ Kt 91-1 Inventory of account 98 When taking inventory of DBP it is necessary to check how correctly their assessment was formed.

Interesting read: What category of citizens do Chernobyl victims belong to?

attachments_22-04-2012_18-04-31 / Spurs GOS / database 1 tasks

11.On account of the previously issued advance, the supplier supplied the company with raw materials in the amount of 120 thousand rubles, including VAT - 21.6 thousand rubles. The company's quality control service revealed that the quality of 30% of raw materials did not meet the level established in the contract, as a result of which the low-quality raw materials were returned to the supplier and a claim was made in the amount of 36 thousand rubles. VAT included.

What accounting entries were made in the buyer's company records for this delivery and the claim made?

Solution:

Dt 60 Kt 51 – 120000 advance issued

Dt 10 Kt 60 – 98 400 accepted for raw material accounting

Dt 19 Kt 60 – 21 600 VAT

Dt 76 Kt 10 – 36000 presented. Claim

Dt 51 Kt 76 – 36000 claim satisfied.

68 19 21 600. 19 68 – 5 500 (18% of 36 000)

12.

As a result of the audit of the cash register, a shortage of funds in the amount of 1,500 rubles was discovered. The commission found the financially responsible person – the cashier – guilty.

500 rubles were deposited into the cash register. The remaining amount is withheld from the cashier's salary.

Record shortages and compensation for damages in the accounting accounts.

Solution:

Dt 94 Kt 50 1500 shortage identified

Dt 73 Kt 94 1500 shortage attributed to the guilty party

Dt 50 Kt 73 500 entered into the cash register by the guilty person

Dt 70 Kt 73 1000 the shortage is written off as charge. Fee (withholding)

Dt 50 Kt 70 1000 reimbursement to the enterprise cash desk from salary

13.

The wage fund for September 2010 at SPK Kolos amounted to 705,890 rubles.

The payroll accountant calculated and paid wages to the following categories of workers: crop production workers - 247,800 rubles; livestock workers - 257,500 rubles; industrial production workers - 56,090 rubles; auxiliary production workers - 84,300 rubles; administrative and managerial personnel - 60,200 rubles. Compile accounting records indicating primary documents. Solution:

Dt 20/1 Kt 70 accrued wages for crop production, Dt 20/2 Kt 70 257500 accrued wages for livestock farming, Dt 20/3 Kt 70 56090 accrued wages for workers. Prom. Production, Dt 23 Kt 70 84300 accrued auxiliary wages. Production, Dt 26 Kt 70 60200 salary accrued for admin. The staff, Dt 70 Kt 50 705890, was given a salary. (payroll, payroll).

14.

Chief accountant Nikolaeva N.P. was sent on a business trip from Ufa to Moscow for a period of 5 days from December 20 to December 25, 2010 inclusive due to production needs. In the organization, in accordance with the collective agreement for 2010, a norm for spending funds on daily allowance was established in the amount of 700 rubles.

Advance amount – 15,000 rubles. Actual expenses at the end of the trip amounted to 13,400 rubles. The following documents were presented: round-trip train tickets - 7,400 rubles. (including VAT - 18%). Hotel bill – 2,500 rubles. (500 rub. x 5 days). Daily allowance – 3,500 rubles. (700 rub.x5), incl. within the standards - 500 (100x5).

Prepare accounting records. Solution:

Dt 71 Kt 50 15000 report issued, Dt 26 Kt 71 7400+2500+500=expenses written off. within the limits, Dt 91 Kt 71 3000 expenses above the norm are written off, Dt 50 Kt 71 1600 return to the cash desk

26.

The organization sells materials. Negotiated sale price RUB 8,850. (including VAT).

The cost of materials according to accounting data is 5,000 rubles.

Indicate the correspondence of accounts, primary documents used to document each transaction and accounting registers.

Solution:

Dt 62 Kt 91 – 8850 rub. Sales (waybill, invoice), Dt 91 Kt 68 – 1350 rub. VAT, Dt 91 Kt 10 – 5000 rub. The actual cost of materials has been written off.

27.

The organization purchased the raw materials necessary for the production of products. The cost of raw materials according to the supplier’s documents is 159 3000 rubles. (including VAT).

The cost of delivery of raw materials according to the documents of the transport organization is 14,750 rubles. (including VAT).

The raw materials have been entered into the warehouse.

The invoices of the supplier and the transport organization have been paid.

According to the accounting policy of the enterprise, the actual cost of materials is formed on account 10 “Materials”.

Indicate the correspondence of accounts, primary documents used to document each transaction and accounting registers.

Solution:

Dt 10 Kt 60 1350000, Dt 19 Kt 60 – 243000 oprich. Materials, VAT (invoice, invoice), Dt 60 Kt 51 – 1593000 – payment, Dt 10 Kt 76 – 12500 r, Dt 19 Kt 76 – 2250, Dt 76 Kt 51 – 14750 oprich. Materials, VAT (invoice, invoice). Actual cost=1350000+12500.

28.

JSC "Don" purchased a printer for a personal computer in January 2010 at a price of 14,160 rubles. (including VAT - 2,160 rubles) and a telephone at a price of 5,900 rubles. (including VAT - 900 rubles) and put into operation in the same month. The acquired low-value fixed assets were paid for in cash by the accountable person.

Reflect on the accounts transactions for accounting for the acquisition of low-value fixed assets, indicate primary documents.

Solution:

Dt 10 Kt 60 – 14160 a printer was purchased, Dt 19 Kt 60 – 2160 VAT, Dt 26 Kt 10 – 12000 the printer was transferred to general use. Expenses, Dt 10 Kt 60 – 5900 telephone purchased, Dt 19 Kt 60 – 900 VAT, Dt 26 Kt 10 – 500 rub. The telephone number has been transferred to the general office. Expenses, Dt 71 Kt 50 – 20060 rub. Issued under report for payment of MPB, Dt 60 Kt 71 – 20060 rub. The calculation was made by the accountable person, D68 K19 3060.

29.

At the end of the reporting year, the net profit of the LLC amounted to 100,000 rubles. By the decision of the general meeting of the founders of the LLC, a decision was made on the following procedure for the distribution of profits: 15% of net profit was directed to the formation of reserve capital, 10% - to increase the authorized capital, 65% - distributed among the founders and the remaining part of the net profit - to pay bonuses to LLC employees.

Indicate the correspondence of accounts, primary documents used to document each transaction and accounting registers. Solution:

D 84 K 99 – 100,000. Dt 84 Kt 82 – 15% - formed. RK, Dt 84 Kt 80 – 10% increased increase. UK, Dt 84 Kt 75 - 65% distributed among the founders, Dt 84 Kt 70 - 10% bonus accrued.

Account 01

Debit Credit Description Document 02 01 “Disposal of fixed assets” Write-off of the amount of accrued depreciation of the liquidated object Act OS-4 01 “Disposal of fixed assets” 01 Write-off of the initial cost of fixed assets Act OS-4 91.2 01 “Disposal of fixed assets” Expenses for writing off the residual value of the fixed assets Act OS- 4

If an organization identifies a shortage of OS, then a special commission is created based on this fact to conduct an investigation, identify the causes and identify the culprit. In the absence of the culprit, the amount of the shortage of fixed assets is written off in accounting using the following entries:

DEBIT 02 CREDIT 01

– the amount of accrued depreciation of a fixed asset item is written off;

DEBIT 91-2 CREDIT 01

– the residual value of the fixed asset item is written off.

The cost of materials remaining after the write-off of a fixed asset must be recorded by the accountant at the current market value as of the write-off date. The wiring will be like this:

DEBIT 10 CREDIT 91-1

– materials remaining after write-off of fixed assets and suitable for further use are capitalized.

To account for the disposal of fixed assets, the accountant can open a separate subaccount “Retirement of fixed assets” for account 01. Such a subaccount is primarily necessary for cases where the disposal of fixed assets takes a long time (for example, when dismantling complex equipment).

If this subaccount is used, then when writing off the balance sheet of a fixed asset object, the postings will be as follows:

DEBIT 01 subaccount “Disposal of fixed assets” CREDIT 01

– the initial cost of the fixed asset item is written off;

DEBIT 02 CREDIT 01 subaccount “Disposal of fixed assets”

– the amount of accrued depreciation is written off;

DEBIT 91-2 CREDIT 01 subaccount “Disposal of fixed assets”

– the residual value of the object is written off.

If an item of fixed assets is disposed of, the value of which was increased as a result of revaluation, then the amount of its revaluation, listed in account 83 “Additional capital”, the accountant must include in retained earnings:

DEBIT 83 CREDIT 84

– the amount of revaluation of the disposed fixed asset item is included in retained earnings.

Example

On December 24, 2011, the director of Aktiv CJSC decided to write off the Hewlett-Packard 340/S server due to obsolescence.

The initial cost of the server is 60,000 rubles. At the time of write-off, depreciation was accrued on the server in the amount of 40,000 rubles.

After the server was decommissioned, the following materials were capitalized:

· hard drive worth 1,500 rubles;

· RAM costs 2000 rubles.

The act of decommissioning the server looks like this:

Act on write-off of motor vehicles (form No. OS-4a)

A standard form is provided for the act of writing off motor vehicles. Its form was approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

The act is drawn up by a commission appointed by order of the head.

The act is drawn up in two copies. The first copy, together with a document confirming the deregistration of the car with the traffic police, is transferred to the accounting department. The second copy remains with the financially responsible employee. Based on this, he delivers spare parts and materials received during liquidation to the warehouse.

The act is signed by all members of the commission and the chief accountant. The head of the company must approve the act.

An example will show you how to fill out a vehicle write-off report.

Example

VAZ-2101 car (engine No. 678ДХ970665, chassis No. 797890, state license plate N789АХ, technical passport No. 456789, inventory number 278, serial number 90887).

The car's mileage since the start of operation is 420,000 km, and after the last major overhaul - 150,000 km.

The initial cost of the car is 30,000 rubles. At the time of write-off, depreciation was accrued on the car in the amount of 30,000 rubles.

For dismantling the car, the workers of the repair shop were charged 1000 rubles. As a result of dismantling, the battery and scrap metal were capitalized.

The car write-off act looks like this:

Certificate of acceptance and transfer of equipment for installation (form No. OS-15)

A report is drawn up if the equipment is transferred to a contractor for installation. A standard form is provided for the act. Its form was approved by Decree of the State Statistics Committee of Russia dated January 21, 2003 No. 7.

The act is drawn up in two copies:

· the first copy is transferred to the accounting department;

· the second copy – to the contractor.

The act is signed by the employee who handed over the equipment for installation, a representative of the contractor and the employee responsible for the safety of the equipment.

When transferring equipment for installation, the accountant must make the following entries:

Date added: 2015-10-06; | Copyright infringement

Recommended context: Related information: Search the site:

Nuances of wiring Dt 41 and Kt 41

- Dt 62.1 Kt 90.1 - revenue from sales of products - 413,000 rubles.

- Dt 90.3 Kt 68.2 - VAT payable to the treasury - 63,000 rubles.

- Dt 90.2 Kt 41 - write-off of the purchase price of goods sold - 280,000 rubles.

- Dt 51 Kt 62.1 - funds received as payment for goods - 413,000 rubles.

In addition to these, it is also possible to open other sub-accounts that reflect the specifics of the activity and differ from the generally accepted ones. For example, subaccount 41.5, where you can keep records of goods transferred for processing. They will need to be fixed in the accounting policies. It can be seen that the accounting records for Dt 41 and Kt 41 must be specified in the analytics.

Dt 68 Kt 19

It is usually recommended that the manager approve a list of accountable persons by order, indicating when and what amounts are given to them and when the accountable persons must account for this money. For example, a company gives the deputy chief accountant 1000 rubles monthly. for the purchase of stationery, and he must report for this amount no later than the 25th of each month. Naturally, such a rule can be established when expenses are more or less regular. In general, funds are issued to those who need it and for the period for which it is appropriate. There are no legal restrictions on how long and what amounts can be issued. However, the main criteria here should be common sense and production necessity. You can give an employee 50,000 rubles. to purchase computers, you can give the same amount to an employee if he goes on a business trip to the ends of the earth to inspect the purchased equipment, but if the company gives 50,000 rubles. for a period of six months to purchase stationery, which is abundant in all local stores, this is very strange. When checking, tax inspectors will most likely guess that the company simply lent this amount to the employee, and the company will be found guilty of underpaying personal income taxes.

Accountable persons are employees of the organization who received funds (advances) from the enterprise for business, administrative and other expenses. When an employee receives money to buy office supplies, or is instructed to pay another company for services in cash, or goes on a business trip, in all these cases he is an accountable person. Only employees of the organization can be accountable persons; an outsider cannot be accountable. In principle, this can be any employee of the company, but usually the circle of such persons is limited, because the company does not need to allocate funds to each employee. An employee does not have the right to transfer the money given to him to another person. If an employee is given money, it must be indicated to him for what needs it was issued and for how long. Within three days after this period, the accountable person must report for the expense and return the remaining funds. If such a period is not specified, then it is considered to be three days from the date of issue of money, and for posted workers - three days from the date of return from a business trip. If an employee went on a business trip abroad, then the reporting period is 10 days from the date of return from the business trip. There is a strict rule established by the “Procedure for conducting cash transactions in the Russian Federation” (approved by the Decision of the Board of Directors of the Central Bank of the Russian Federation dated September 22, 1993 No. 40): until the accountable person reports for previously issued funds, new advances cannot be issued to him.

Interesting to read: How long is an extract from the Unified State Register valid for registration?

31.05.2020What support measures will media and publishing houses receive?

The affected industries in the context of the spread of coronavirus infection are the media and publishing houses. Companies operating in these areas now have access to support measures for small and medium-sized businesses announced by the government due to the pandemic.

30.05.2020Bonus for a dismissed employee: how to take into account?

The bonus paid to a dismissed employee is taken into account as expenses when calculating the tax base for profits. But, only if the payment of this premium is provided for by local regulations.

29.05.20203 situations with personal income tax when testing for coronavirus

Testing for coronavirus has now become a very popular paid procedure. It is carried out by companies that are obliged to do this. Some companies test employees to ensure they have a safe working environment. Some compensate employees for the cost of tests they underwent on their own initiative. Well, in all these situations, the accountant has to resolve the issue of expenses and personal income tax. We'll help you figure it out.

29.05.2020Full list of OKVED affected industries as of May 26, 2020

Two new OKVEDs have been added to the list of those affected by the COVID-19 pandemic - media and publishing.

29.05.2020What has changed in accounting and tax legislation since June 1, 2020

June 2020 is not the richest month for changes in tax and accounting legislation. Just a few changes come into force on June 1, 2020.

29.05.2020Received “viral” subsidies! How to spend it?

The country's government continues to take measures to save businesses. One of these measures was the receipt of subsidies. Companies turn to the tax office for funds, the Federal Tax Service reports that entrepreneurs receive money. Some accounting specialists have a question: what to do after the funds have been received, how to properly account for them, and is it necessary to pay taxes on these amounts?

29.05.2020List of jobs for which postponing periodic medical examinations is prohibited

The Ministry of Health also did not waste time during the coronavirus epidemic. He issued an order according to which, from June 2, employers received the right to postpone mandatory periodic medical examinations of employees in connection with the declaration of a state of emergency or high alert. But not everyone. See the full list of such works.

29.05.2020How to fill out an application for a subsidy?

Small businesses most affected by the pandemic may receive a subsidy from the state. How to correctly fill out an application for a subsidy?

29.05.2020Will it become easier to fire workers during an epidemic?

The Ministry of Labor has prepared a draft resolution regulating the relationship between workers and employers during epidemics. It simplifies the procedure for dismissing employees, allows for the introduction of a simple shift work schedule and changes in an employee’s duties during an epidemic without the consent of the employee.

29.05.2020Vacation at your own expense: what do you need to know?

For family reasons and other valid reasons, an employee may be granted leave without pay. This is a vacation at your own expense. An employee cannot be forced to take such leave. However, during a crisis, companies go to great lengths to save money. Let us consider here the important nuances that an accountant needs to know.

29.05.2020Recommendations for children's holiday camps for the summer of 2020

Organizing children's holidays during a period of risk of an epidemic is not easy. Rospotrebnadzor prepared recommendations dated May 25, 2020 MR 3.1/2.4.0185-20.3.1, in which it spoke about the features of organizing children’s recreation and health improvement.

29.05.2020The law on how to “send” a landlord

When assessing the law, experts disagree. Some lawyers believe that the changes will balance the rights of participants in the turnover. Others warn that tenants will abuse their rights because the law has not been finalized. In addition, the lawyer compared the new norm with those already in force and debunked the idea that large businesses cannot get a “discount”.

28.05.2020How to round up insurance premiums correctly?

In order to correctly pay insurance premiums to the budget, they need to be calculated correctly. If the salary is calculated in rubles and kopecks, then contributions may also be in rubles and kopecks. And these pennies need to be rounded correctly. Let's figure out how.

28.05.2020What taxes will be written off for the second quarter of 2020? See the table!

SMEs operating in industries most affected by the coronavirus and socially oriented non-profits will not have to pay taxes, with the exception of VAT, and insurance premiums for the second quarter of 2020, with the exception of contributions for injuries. The State Duma adopted the law on amendments to the Tax Code in the third reading on May 22. We are waiting for the official publication of the law when it comes into force.

28.05.2020Preferential business loan 2.0

From the beginning of summer, the authorities will launch a new program of preferential business lending. The second version of the anti-crisis loan program provides for full repayment of the loan at the expense of the state. Let's talk about the new business lending program.

28.05.2020Ministry of Labor: non-working days of self-isolation do not need to be taken into account when calculating average earnings

The Russian Ministry of Labor recently clarified an important and currently pressing question for all accountants: how to take into account non-working days from March 30 to May 8 when determining average earnings. Let's take a closer look at letter dated May 18, 2020 No. 14-1/B-585.

28.05.2020How to obtain a license for agricultural wine producers

The activities of production, storage, supply and retail sale of wine products by agricultural producers are licensed activities. Obtaining such licenses is important for agricultural producers in the south of Russia and Crimea.

28.05.2020Let's open. We are opening! Are we opening?

Moscow was called ready for the first and even the second stage of lifting restrictions. And owners of beauty salons and restaurant workers in other regions launched flash mobs for the speedy opening of business.

27.05.2020A paper work book is a double burden for an accountant

It is impossible to keep work books in both electronic and paper form at the same time. But not everyone made the choice in favor of electronic ones. Someone still left a paper version. But due to this, the accountant has more work. For such “conservatives” they will still have to keep records in electronic form. Let's figure out why.

27.05.2020Remote business - satisfaction and efficiency

The massive transition to remote work has provoked a lot of research on both the comfort and satisfaction of the specialists themselves, and the reaction of employers who have already seen a change in the efficiency of employees.

We studied several surveys to understand how satisfied specialists and businessmen are with this format of work. 1 Next page >>

Postings Dt 01 and Kt 01, 08 (nuances)

The cost of fixed assets is formed from the price of the property and additional costs associated with their acquisition. These may include costs for delivery, installation, information or intermediary services, as well as payment for state registration, exchange rate differences, and others. All expenses are collected in the debit of the 08th account.

Dt 01 Kt 01 is a posting indicating the disposal (alienation) of fixed assets (hereinafter referred to as fixed assets) of the organization. Accounting and movement of own fixed assets are regulated by the norms of the Tax Code of the Russian Federation and PBU 6/01. However, in the process of accounting for them, accountants have a lot of questions. Some will be discussed in this article.

Accounting: 01 account

As stated above, OS is accepted at its original cost. In accounting, receipts are recognized when costs associated with the acquisition of property, installation, transportation, payment for the services of builders, adjusters, intermediaries, etc. have been incurred and documented.

In cases where an organization is engaged in the construction of buildings, complex technical objects and structures, an invoice is used when registering the receipt of fixed assets. 07 “Equipment for installation”. All expenses for installation and connection to communications are collected on the account, then debited from the account account. 07 at Dr. 08, and further from count. 08 in Dt ch.01.

Also read: How many times can you withdraw money from maternity capital per year?

D62 k90 what does wiring mean?

As is known, income is recognized as an increase in economic benefits as a result of the receipt of assets (cash, other property) and (or) repayment of liabilities, leading to an increase in the capital of the organization (clause 2 of PBU 9/99). The cost of goods transferred free of charge represents costs not associated with generating income (economic benefits are not derived) and is not taken into account as part of the seller’s expenses when calculating income tax (clause 16 of Article 270 of the Tax Code of the Russian Federation). It is known that the transfer of ownership of goods free of charge is recognized as a sale, which, in turn, is subject to VAT (clause 1 of Article 146 of the Tax Code of the Russian Federation). Thus, the seller has an obligation to pay VAT on the value of the property transferred free of charge.

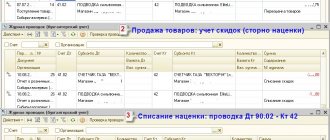

D 90-3 K 68 — 33,330 rub. - VAT has been charged. In this case, the discount is reflected upon the sale of that batch of goods, the purchase of which gave the buyer the right to receive it. In this case, no separate wiring for its reflection is required. Changing the price after concluding a contract is allowed in cases and under the conditions provided for in the purchase and sale agreement (Article 424

Typical causes of errors in income tax calculations

| # | Problem | Solution |

| 1 | Incorrectly closed cost accounts for BU or NU in the context of accounting types NU/PR/BP. Balances in cost registers get stuck. | Check SALT and cost statement. There should be no final residues. Correct errors if any. If necessary, re-calculate the cost (make sure that the calculation is carried out without errors). Then carry out the determination of fin. results and income tax calculations. |

| 2 | The turnover in the cost accounts does not correspond to the turnover in the cost register. | Somewhere in the documents the cost item is incorrectly indicated (the nature of the costs is not correct). |

| 3 | Failure to comply with the basic rule: «BU = NU + PR + VR« (so-called “boroto”) | Discrepancies can be found by requesting accounting accounts by registrars and, if necessary, account analytics. A report on analyzing the state of tax accounting can help with this, but it is not very convenient to use. |

| 4 | There are BP balances on accounts for which SHE and IT are not automatically generated. Example: Dt 91.02 VR Kt 14 There is no account 14 in tax accounting, so you have to replace account 14 with account 96. | For a list of accounts for which ONA and ONO are generated automatically, see the table of types of assets and liabilities. If it is necessary to reflect BP where SHE and ONO are not calculated automatically, it is necessary to perform the calculation manually and reflect it by posting to the account. 09 or 77 in correspondence with account 68.04.2 In practice, I recently had to manually reflect IT by asset type “Accounts payable”, because... the debt was reflected in the accounting system earlier than in the non-accounting account, which resulted in a temporary difference. |

| 5 | Income and expense accounts (20, 26, 44, 90, 91, 99) according to the type of accounting BP correspond with other types of accounting. As a result, no deferred tax is generated. Example: Dt 91.02.1 VR Kt 01.09 NU | It is necessary to either replace the BP with another type of accounting (if the BP was indicated incorrectly), or select a loan according to the type of BP accounting with an account for which SHE/IT is automatically calculated (see Appendix 1 below). I had to correct the wiring from the example to Dt 91.02 VR Kt 01.09 VR. |

| 6 | BP is written off to PR (directly or indirectly). | Most often it happens when an asset is written off for items that are not accepted for tax accounting. In this case, excessive accrual of PNA/PNO occurs. It is treated by writing off VR for VR, methodically this is more correct. Technically, it is solved by substituting the accepted cost item into the TC of the cost document and resetting the amount of the accounting unit to zero (if the accounting amount is non-zero) - this is how a posting is obtained according to the accounting type BP. |

| 7 | Assets containing temporary differences are credited and written off according to different analysts. As a result, postings may be generated at 77 instead of 09 and vice versa. | For example, a construction project entered using the “self-supporting” construction method, but left from the “contract” construction method (there was a “re-grading” according to subcontos, in the context of which ONA and ONO are formed). Analytics needs to be fixed. |

| 8 | Standardized cost items in tax accounting are closed incorrectly. | It is necessary to timely retransmit the document “Routine tax accounting operations (for income tax)” during the closing of the month. |

| 9 | The “Determination of Financial Results” document was re-posted in December when the “Year Closing” document was carried out. | Remove the “Year Closing” document from execution, then redo the financial determination. results and income tax calculations. Don't forget to close the year at the end of the calculation. |

| 10 | In the period there are manual entries for 09 and/or 77 accounts. | Such postings need to be found and either transferred to a future period, or the activity must be removed for the period of income tax calculations. If you leave them, the tax calculation will take into account their presence and make such entries so that the final balance corresponds to the calculated balance. If you manually adjust invoices 09 and 77, then either do not re-post the tax calculations after this, or cancel the activity/take the document forward! |

| 11 | Manual postings to accounts. 09 “Loss of the current period” | Manually adjusting account 09 for the loss of the current period is a very strange idea. Most likely, such wiring can (and even better) be removed. The rule “ ConOstDt 09_UbTekPer = ConOstDt_99.01_NU x 20% ” must always be observed! |

| 12 | There are postings in correspondence with account 84 | It is necessary to manually calculate and accrue conditional income/expenses. The calculation algorithm is the same as in stage 4 of income tax calculations (see above). In the resulting posting, instead of the 99th account, substitute 84. |

If you know other reasons for incorrect income tax calculations, write in the comments!

ANNEX 1:

Account 75 in accounting: entries for settlements with founders

Synthetic account 75 “Settlements with founders” reflects information on each type of settlements with founders. First-order subaccounts are opened for the account in the context of obligations: 75.01 “Calculations for contributions to the authorized capital” and 75.02 “Calculations for payment of income”. Analytical accounting for account 75 is carried out for each founder in the context of open sub-accounts:

Share transferred to the company Reflects the nominal value of the share transferred to the LLC or shares of the JSC Accounting certificate 75 68 Withheld personal income tax or income tax on the value of shares, shares, paid to participants Tax accounting register (tax card) or accounting certificate-calculation 75 50 (51) Paid (transferred) the cost of the share in the authorized capital to the participants Cash order, bank statement on the current account Transactions on the distribution of the transferred share between the remaining participants: 75 81 The share (shares) in the authorized capital of the transferred LLC (JSC) was distributed among the remaining participants Minutes of the decision of the general meeting of participants 80

Stage 2 – calculation of OTA for current loss. period (according to NU data, only if there is a loss)

We look at balances 99 by accounting type and balances 09 “LossTekPer” by accounting.

Loss of the current period 09 = AmountFinalBalanceDt_account99.01NU * ProfitTax Rate - AmountFinalBalanceDt_account09BU for the subaccount Loss of the CurrentPeriod

Postings are generated:

Dt 68.04.2 Kt 09 – if the amount is negative

Dt 09 Kt 68.04.2 – if the amount is positive

It is necessary for the organization to have income tax rates filled in (through the accounting policy); without them, the calculation does not work correctly.

Stage 3 – calculation of ONA and ONO for BP in the accounts of types of assets and liabilities

Please note: unlike PNA/PNO, ONA and ONO are formed at the moment the temporary difference ARISES in the accounts of assets and liabilities, and not at the moment it is recognized as income or expenses.

Thus, the emergence of VR in the evaluation of materials on the account. 10 will lead to the formation of IT, even if these materials were in the warehouse for the entire month and were not written off anywhere!

The procedure for calculating “as it should be” , according to the 1C comments in the standard UPP code:

- The balance of taxable and deductible differences by type of asset as a whole is determined.

- Based on the balance of the differences, the balance of deferred tax assets and liabilities is calculated, which should be reflected in accounts 09 and 77 at the end of the month.

- The amount of deferred tax assets and liabilities is determined, which is reflected in accounts 09 and 77 at the end of the month.

- Accounts 09 and 77 are adjusted to the amount of the differences between what is reflected on the account and what should be based on the calculation results.

The calculation procedure “as is” , directly from the standard SCP code:

- Balances and turnover are calculated by type of accounting BP for types of assets and liabilities. Accounting accounts related to predefined types of assets and liabilities are specified in the code (see table below for types of assets and liabilities).

- The result of the calculation in the form Beginning Balance / TurnoverDt / TurnoverKt / BalanceCon (for all tax accounts of this type of asset) is processed separately for each set of subconto values according to the following algorithm:

- If Beginning Balance > 0 :

| (BalanceEn – BalanceStart) > 0 : | AmountKt77 = TurnoverDt-TurnoverKt |

| (BalanceCon < 0) : | AmountDt09 = — BalanceEnd AmountDt77 = BalanceStart |

| Otherwise | AmountDt77 = - (TurnoverDt-TurnoverKt) |

- If Beginning Balance <= 0 :

| (BalanceEn – BalanceStart) < 0 : | SumDt09 = - BalanceEnd + BalanceStart; |

| (BalanceCon > 0) : | SumKt77 = BalanceCon; SumKt09 = — Beginning Balance; |

| Otherwise | SumKt09 = TurnoverDt-TurnoverKt. |

For fixed assets and intangible assets, depreciation accounts are included in the calculation, i.e. The calculation is based on the residual value.

Postings to accounts 09, 77 are generated in correspondence with account 68.04.2.

When recording, entries are “rolled up” by type of asset and liability in each account.

The transaction amount is multiplied by the income tax rate. Accounting balances on accounts 09, 77 are not taken into account.

Wiring dt 01 kt 08 during building reconstruction

This takes into account the mode (number of shifts) and negative operating conditions of the fixed asset, as well as the system (frequency) of repairs. This procedure follows from paragraph 20 of PBU 6/01. The acceptance committee must indicate in the report in form No. OS-3 that the reconstruction work did not lead to an increase in useful life. The results of the review of the remaining useful life in connection with the reconstruction of a fixed asset must be formalized by order of the manager. Situation: how to calculate depreciation in accounting after reconstruction of a fixed asset? The procedure for calculating depreciation after the reconstruction of a fixed asset is not defined by accounting legislation. Paragraph 60 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, provides only an example of calculating depreciation charges using the linear method.

After revaluation, depreciation is calculated based on replacement cost rather than original cost. Upon reaching wear and tear or in connection with the sale, the asset is subject to write-off. The disposal of fixed assets is formalized by act OS-4 (a, b), signed by the commission. If an organization carries out the reconstruction of fixed assets with the involvement of a contractor, then reflect his remuneration by posting: Debit 08 subaccount “Reconstruction expenses” Credit 60 – costs for the reconstruction of fixed assets carried out by contract are taken into account. Upon completion of the reconstruction, the costs recorded on account 08 can be included in the initial cost of the fixed asset or taken into account separately on account 01 (03).

We write off fixed assets

The production equipment in one of the company's workshops is no longer used for its intended purpose.

It will not be possible to sell the equipment because it is obsolete. It is not profitable to update it. There is only one way out - to write it off and send it for scrap, having previously removed some useful parts. Let’s figure out how such an operation can be reflected in accounting and reporting. 04/27/2012 Magazine “Accounting. Simple, clear, practical" Author: Ilya Makalkin

What to follow

1. Order of the Ministry of Finance of Russia dated December 24, 2010 No. 186n “On amendments to regulatory legal acts on accounting.”

2. PBU 6/01 “Accounting for fixed assets.”

3. Guidelines for accounting of fixed assets, approved. by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

4. Regulations on accounting and financial reporting in the Russian Federation, approved. by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n.

5. Instructions for the application of the Chart of Accounts for accounting of financial and economic activities of organizations, approved. by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n.

6. IAS 16 “Property, Plant and Equipment”.

Until 2011, almost no questions arose about how to write off fixed assets (FPE), the further use of which is impossible. All details of the operation were described in regulatory documents (old version of the order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n). However, financiers issued Order No. 186n 1, which completely abolished the existing write-off procedure. The officials offered nothing in return.

Let's find out how to act now, for which we will first have to return to the previous order.

What happened before

Rules. The procedure for writing off fixed assets was enshrined in clause 84 of Methodological Instructions 3. There it was strongly recommended to use the subaccount “Retirement of fixed assets” to account 01 “Fixed assets”. In addition, a detailed (separate) reflection of expenses and income from disposal was provided for in account 91 “Other income and expenses”:

- the residual value of the object was written off from the credit of the subaccount “Disposal of fixed assets” to account 01 to the debit of account 91;

- the cost of capitalized material assets received from dismantling the object at the price of possible use, or the amount of proceeds from their sale was taken into account on the credit of account 91;

- expenses for the disposal of fixed assets were recorded as a debit to account 91. They could be preliminarily collected on account 23 “Auxiliary production”.

Another important conclusion from paragraph 84 of the Methodological Instructions: the procedure for disposing of a fixed asset item was completed by posting Dt 91-2 Kt 01 subaccount “Disposal of fixed assets” . This means that the fixed asset had to “hang” in the balance sheet until all procedures for the actual liquidation of the object were completed, that is, until all sections of the act of form OS-4, OS-4a or OS-4b were completed. These procedures could last up to several months, and during this time the company had to pay property taxes.

IT'S EASY TO KNOW

From October 1, 2011, VAT claimed by contractors on the cost of work to liquidate fixed assets can be deducted. There is a direct indication of this in paragraph 6 of Art. 171 of the Tax Code of the Russian Federation (as amended by Federal Law dated July 19, 2011 No. 245-FZ).

EXAMPLE 1

The management of Fabrika LLC decided to stop using the old hydraulic press from January 20, 2010. They planned to install new equipment in its place. To liquidate the facility, a commission was formed, which, from January 20, 2010 (after the press was stopped), began identifying valuable spare parts and materials in the press equipment and assessing the upcoming costs of disassembling and removing the parts. That is, the OS-4 act for decommissioning the press began to be filled out on January 20.

The press was purchased before 2001, so VAT does not need to be restored. The initial cost, taking into account revaluations, is RUB 2,000,000. As of January 20, 2010, the amount of accrued depreciation, taking into account revaluations, amounted to RUB 1,600,000.

“Factory” entered into an agreement with JSC “Kuvalda”, which undertook to disassemble the press, leave the necessary parts to the owner, and transfer the remaining scrap metal to LLC “Samodelkin”.

The market value of the useful spare parts and materials left behind was 300,000 rubles. Spare parts were received at the Factory warehouse on April 15, 2010. An interim certificate of work completed in the amount of 60,000 rubles was signed with Kuvalda. plus VAT 10,800 rub.

After weighing the scrap, Samodelkin paid Factory 180,000 rubles. (sales of scrap are not subject to VAT). The scrap receipt invoice was signed on June 20, 2010.

The total cost of the “Sledgehammer” work is 200,000 rubles. plus VAT 36,000 rub. The parties signed the final act on the work performed by Sledgehammer on June 30, 2010.

To simplify the example, we will assume that “Factory” is a small business and does not apply PBU 18/02.

Fabrika LLC made the following postings:

January 20 (filling out the act in form OS-4 begins)

Dt 01 subaccount “Disposal of fixed assets” Kt 01 2,000,000 rub. – the initial cost of the press has been written off;

Dt 02 Kt 01 subaccount “Disposal of fixed assets” 1,600,000 rub. – accrued depreciation is written off;

April 15

Dt 10-5 Kt 91-1 300 000 rub. – spare parts are capitalized;

Dt 23 Kt 60 60 000 rub. – the works of “Sledgehammer” were accepted;

Dt 19 Kt 60 10,800 rub. – VAT on work is taken into account.

June 20

Dt 10-6 Kt 91-1 RUB 180,000 – scrap metal from dismantling the press is taken into account;

Dt 62 Kt 91-1 RUB 180,000 – revenue from the sale of scrap metal is reflected;

Dt 91-2 Kt 10-6 180,000 rub. – the cost of scrap metal is written off.

June 30 (closing the act according to OS-4 form)

Dt 23 Kt 60 140 000 rub. (200,000 – 60,000) – “Sledgehammer” works accepted;

Dt 19 Kt 60 25 200 rub. (36,000 – 10,800) – VAT on work is taken into account;

Dt 91-2 Kt 23,200,000 rub. – the expense for the work of “Sledgehammer” is reflected;

Dt 68 Kt 19 36 600 rub. – VAT is accepted for deduction;

Dt 91-2 Kt 01 subaccount “Disposal of fixed assets” 400,000 rub. – the residual value of the press is written off.

The balance sheet of “Factory” for the first quarter of 2010 reflects the residual value of fixed assets of 400,000 rubles. The income statement under the item “Other income” reflects the amount of 660,000 rubles. (300,000 + 180,000 + 180,000), and under the item “Other expenses” - 780,000 rubles. (180,000 + 200,000 + 400,000).

How is it now?

After the publication of Order No. 186n 1, clause 84 of Methodological Instructions 3 became invalid. In addition, from clause 79 of the Methodological Instructions and clause 54 of Regulation 4 , the requirement that material assets received during the dismantling of fixed assets should be recognized with the simultaneous reflection of other income disappeared.

But officials emphasized that account 10 must be debited “on the date of write-off of fixed assets” (clause 79 of the Methodological Instructions).

As a result, confusion arose about how to record the write-off of fixed assets in accounting.

The decision on the procedure for reflecting income and expenses can be found in international financial reporting standards, as provided for in paragraph 7 of PBU 1/2008 “Accounting Policies”. In IFRS reporting, the financial result from the write-off of fixed assets is reflected in the profit and loss statement on a consolidated basis (clause 71 of IAS 16). That is, the difference between the net proceeds from disposal, if any, and the book value of the item is determined. A positive difference is income, a negative difference is expense. There are similar rules in the draft new PBU for accounting of fixed assets.

Thus, since 2011, when writing off fixed assets:

- income and expenses associated with write-off are reflected in a consolidated amount;

- The subaccount “Retirement of fixed assets” to account 01 may not be used.

However, after all the changes in the Instructions for the Chart of Accounts 5, the following phrase was retained:

“At the end of the disposal procedure, the residual value of the object is written off from account 01 to account 91.”

Let’s add here a calculation stating that account 10 must be debited on the date of write-off of fixed assets (from Guidelines 3 and Regulation 4, as well as a conclusion about the collapsed reflection of income and expenses.

It turns out that the residual value of fixed assets can be written off from account 01 only after all operations to liquidate the object have been carried out.

Is it possible to write off before the end of liquidation?

In fact, the company has the opportunity to write off the operating system without waiting for the liquidation to be completed. Let us justify this conclusion.

The appearance of Order No. 186n 1 is another attempt to bring Russian accounting and IFRS closer together. However, due to the phrase in Instruction 5, the requirement of clause 29 of PBU 6/01 remains unfulfilled. It states that the value of an asset that is retired or is unable to generate future income is subject to a write-off in accounting. This requirement is borrowed from IFRS. In particular, paragraph 67 of IAS 16 states: when no future economic benefits are expected from the use or disposal of an item of property, plant and equipment, the carrying amount of the item is derecognised.

Thus, according to the rules of PBU 6/01 and IFRS, when an object subject to liquidation ceases to be used, it immediately ceases to be reflected in fixed assets. This asset is subject to recharacterization into another. For example, the article “Non-current assets in the process of disposal” can be used. And such an asset should be shown in the “Current assets” section of the balance sheet, unless the disposal lasts for a period of more than a year. Instruction 5 actually does not allow this rule to be fulfilled.

In short, the company has two options:

- violate clause 29 of PBU 6/01, but comply with the requirements of the Instructions for the Chart of Accounts (as a result, overpay property tax). In other words, write off the OS after completing all procedures;

- do not deviate from PBU 6/01, but violate the requirements of the Instructions (but then stop paying property tax). In other words, write off the OS as soon as it is no longer in use.

We write off the fixed assets upon completion of liquidation. With this option, if an object ceases to be used before the reporting date, and part of the liquidation operations occurs after the reporting date, the residual value of the object appears in the balance sheet as of the reporting date. That is, the balance sheet shows an item of fixed assets that no longer brings economic benefits. This misleads reporting users.

In addition, the company continues to pay property tax, although it has no longer accrued depreciation in accounting and tax accounting.

EXAMPLE 2

Let's assume that all transactions occurred in 2012. At the same time, “Factory” decided not to take risks with property taxes. The accountant decided to use account 23 “Auxiliary production” (as before) and account 98 “Deferred income”.

The “Factory” postings will be as follows:

January 20 (opening of the act according to OS-4 form)

Dt 01 subaccount “Disposal of fixed assets” Kt 01 2,000,000 rub. – the original cost is written off;

Dt 02 Kt 01 subaccount “Disposal of fixed assets” 1,600,000 rub. – depreciation written off;

April 15

Dt 10-5 Kt 98,300,000 rub. – spare parts are capitalized;

Dt 23 Kt 60 60 000 rub. – the works of “Sledgehammer” were accepted;

Dt 19 Kt 60 10,800 rub. – VAT included.

June 20

Dt 10-6 Kt 98,180,000 rub. – scrap metal from dismantling the press is taken into account;

Dt 62 Kt 91-1 RUB 180,000 – revenue from the sale of scrap metal is reflected;

Dt 91-2 Kt 10-6 180,000 rub. – the cost of scrap metal is written off.

June 30 (closing the act according to OS-4 form)

Dt 23 Kt 60 140 000 rub. (200,000 – 60,000) – “Sledgehammer” works accepted;

Dt 19 Kt 60 25 200 rub. (36,000 – 10,800) – VAT included;

Dt 98 Kt 23,200,000 rub. – the expense for the work of “Sledgehammer” is reflected;

Dt 68 Kt 19 36 600 rub. – VAT is accepted for deduction;

Dt 98 Kt 01 subaccount “Disposal of fixed assets” 280,000 rub. (300,000 + 180,000 – 200,000) – part of the residual value of the press is written off (closing account 98);

Dt 91-2 Kt 01 subaccount “Disposal of fixed assets” 120,000 rub. (400,000 – 280,000) – another part of the residual value is written off, the loss on disposal is determined.

The balance sheet for the first quarter of 2012 reflects the residual value of fixed assets of 400,000 rubles. The income statement under the item “Other expenses” reflects the amount of 300,000 rubles. (120,000 + 180,000).

We write off the object immediately. So, the company can write off the remaining fixed asset from account 01 immediately as soon as the object ceases to be used, without waiting for the completion of liquidation procedures.

PRACTICALLY USE

The decision to write off a fixed asset as soon as it ceases to be used in business activities, it is important to formalize this decision with an organizational and administrative document. For example, by order of management.

For example, an object ceases to be used before the reporting date, and part of the liquidation operations occurs after it. Then the balance sheet as of the reporting date will no longer contain the residual value of the object. This option is closer to the provisions of IAS 16, and the reporting will be more reliable. In addition, a company can save on property taxes by stopping paying it earlier. With this accounting option, the subaccount “Retirement of fixed assets” is not used.

EXAMPLE 3

Factory plans not to overpay the tax and write off the operating system immediately. The accountant decided to use account 97 “Deferred expenses” and account 98 “Deferred income”. Moreover, the company reflects income and expenses from the sale of scrap metal with a zero result in a scaled-down manner. “Factory” made the following postings:

January 20 (opening of the act according to OS-4 form)

Dt 02 Kt 01 1,600,000 rub. – depreciation of the object is written off;

Dt 97 Kt 01,400,000 rub. – the residual value is written off.

April 15

Dt 10-5 Kt 98,300,000 rub. – spare parts are capitalized;

Dt 97 Kt 60 60 000 rub. – the works of “Sledgehammer” were accepted;

Dt 19 Kt 60 10,800 rub. – VAT included.

June 20

Dt 10-6 Kt 98,180,000 rub. – scrap metal from dismantling the press is taken into account;

Dt 62 Kt 91-1 RUB 180,000 – revenue from the sale of scrap metal is reflected;

Dt 91-2 Kt 10-6 180,000 rub. – the cost of scrap metal is written off.

June 30 (closing the act according to OS-4 form)

Dt 97 Kt 60 140 000 rub. (200,000 – 60,000) – “Sledgehammer” works accepted;

Dt 19 Kt 60 25 200 rub. (36,000 – 10,800) – VAT included;

Dt 68 Kt 19 36 600 rub. – VAT is accepted for deduction;

Dt 98 Kt 97,480,000 rub. (300,000 + 180,000) – closing account 98 upon completion of the liquidation of the object;

Dt 91-2 Kt 97 120 000 rub. (400,000 + 60,000 + 140,000 – 480,000) – loss on disposal is determined.

The balance sheet for the first quarter of 2012 does not reflect the residual value of the press. Instead, in the group of articles “Inventories” of the section “Current assets” there is an article “Liquidation of property”, which reflects the amount of 400,000 rubles. from account 97. The income statement under the item “Other expenses” reflects the amount of 120,000 rubles.

Post: