March 04, 2020 5107

5

An additional fine and blocking of a current account are the possible consequences of late payment of a traffic police fine. Correctly filling out the payment form is a guarantee that the money will go as intended and the fine will be paid off successfully. Therefore, it is important to be careful when filling out a payment order and take into account all the nuances.

The article contains a sample and instructions for filling it out correctly to avoid risks.

- Traffic police fines for an organization - who pays?

- How can an organization pay a fine?

- Details for paying a traffic police fine - where to get it

- Correctly filling out a payment order for a traffic police fine

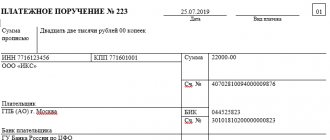

- Sample payment order

- How to control the repayment of a fine paid by bank transfer

- How to automate the generation of payment orders for fines

Responsibility for non-payment of insurance premiums

This rule is applied taking into account clause 19 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57. This clause states that failure to pay to the budget the amount of tax specified in the declaration does not fall under Art. 122 of the Tax Code of the Russian Federation. In this case, only penalties are collected from the taxpayer.

The Supreme Court of the Russian Federation ruled that fines for non-payment of contributions can only be made at the end of the year.

How will tax authorities calculate the amount of the fine for late payment of contributions? To calculate the fine, the unpaid amount of contributions is determined on the 30th day of the month following the reporting or billing period, and not on the 15th day, when the contributions should have been transferred. So, if on the 30th the contributions are paid in full, then for late payment the fine will be 1 thousand rubles. Such clarifications were given by the Federal Tax Service of the Russian Federation in letter dated November 9, 2017 No. GD-4-11/ [email protected]

At the same time, late payment of insurance premiums entails the risk of accrual of penalties (Article 75 of the Tax Code of the Russian Federation, Article 26.11 of Law No. 125-FZ).

https://youtu.be/ZS_IOToE_u8

Procedure for paying fines

The Federal Tax Service has the right to impose monetary sanctions on taxpayers for violations listed in the Tax Code of the Russian Federation. Such offenses include failure to meet reporting deadlines, failure to pay taxes on time, refusal to provide tax authorities with requested information, errors in registration procedures, etc. The amount of the fine is indicated in the decision or demand sent to the business entity.

Transfer of taxes, penalties and fines according to the decision of the Federal Tax Service is made in separate payments. It is unacceptable to combine these amounts in one order.

The law does not oblige companies to make all transfers on one day: the taxpayer has the right to split them into different dates. It is recommended to pay off the arrears first so that no penalties are charged on them. Next, the penalties themselves are transferred for the entire period of delay. The latter can be sent a fine, the main thing is to meet the deadlines specified in the demand.

Fill in field 107 in the payment order in 2020 to pay personal income tax

In field 107 of the payment order you must indicate the tax period for which the tax or contribution is paid. From the contents of field 107 it should be clear for what period the tax is paid. Also, a specific date can be indicated in field 107. Recently, the Federal Tax Service issued a letter dated July 12, 2016 No. ZN-4-1/12498, in which it stated that tax agents should fill out several payment slips to pay personal income tax. According to the new rules for filling out payment slips, should field 107 be indicated now? Is it possible to continue making one payment? Let's figure it out.

Common mistakes

Error No. 1: In the payment order, a zero value was entered in the “Code” field, when the debt on penalties was repaid by the enterprise independently, without waiting for a request from the Federal Tax Service. The next time the tax office received a notice of payment of a fine, the accountant automatically entered “0” in the “Code” column.

Comment: When a company receives a document requesting the Federal Tax Service to pay penalties or fines, a unique accrual identifier specified in the request is entered in the “Code” field of the payment. And only if it is not specified there, you can leave a zero value.

Error No. 2: Indication by the organization that received a request from the tax service to pay penalties, the code “ZD” in the “Base of payment” field.

Comment: When an official request from the Federal Tax Service has already been received, the payment is considered to have been made not on a voluntary basis, but at the insistence of the tax inspectorate, therefore the code “TP” must be indicated in the “Base of payment” field.

Error No. 3: Indication in the KBK payment order of the tax period in which the tax arrears arose and when penalties were accrued.

Comment: The BCC is indicated as current as of the date of actual repayment of the debt.

Introductory information

Field 107 must be filled in to indicate the frequency of payment of the tax payment or the specific date for payment of the tax payment, if such a date is established by the Tax Code of the Russian Federation (clause 8 of the Rules, approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n).

In field 107 the 10-digit tax period code is entered. The first two characters are the tax payment period. For example, for quarterly - CV, monthly - MS, annual - GD.

The fourth and fifth digits are the tax period number. For example, if the tax is paid for August, “08” is indicated.

The seventh to tenth signs indicate the year. Dots are always placed in the third and sixth characters. For example – KV.03.2016.

If the organization has a separate division

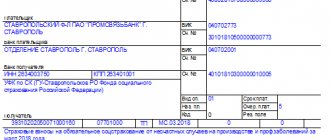

Then personal income tax on income paid to employees of a separate unit (SB) must be transferred to the location of this SB (Clause 7, Article 226 of the Tax Code of the Russian Federation). Accordingly, in the personal income tax payment you must correctly indicate the checkpoint of the separate division, OKTMO, as well as the details of the Federal Tax Service at the location of the OP.

You can find the payment details of the Federal Tax Service in ours.

Keep in mind that at the location of the OP, you must also list personal income tax calculated on income paid to individuals under civil contracts that separate divisions entered into with them on behalf of the parent organization (

What exactly should I indicate in field 107 now?

When paying personal income tax, tax legislation establishes several payment deadlines and for each of these deadlines there is a specific payment date (See “Personal income tax payment deadline”). Here are some examples.

Personal income tax from salary

Personal income tax on wages, bonuses and material benefits must be transferred to the budget no later than the day following the day of payment of income (paragraph 1, clause 6, article 226 of the Tax Code of the Russian Federation).

Example. The employer paid wages for July to employees on August 4, 2020. In this case, the date of receipt of income will be July 31, the date of tax withholding will be August 4. And the last date when personal income tax should be transferred to the budget is August 5, 2020. Does this mean that you need to put 08/05/2016 on your payment slip?

Or can you indicate “MS.07.2016” in field 107 of the payment order to make it clear that this is a tax for July?

Personal income tax on sick leave and vacation pay

Personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay must be transferred no later than the last day of the month in which the income was paid (paragraph 2, clause 6, article 226 of the Tax Code of the Russian Federation).

Example. The employee goes on vacation from August 25 to September 15, 2020. His vacation pay was paid on August 15. In this case, the date of receipt of income and the date of withholding personal income tax is August 15, and the last date when the tax must be transferred to the budget is August 31, 2020. Would it be correct to mark 08/31/2016 in field 107 of the personal income tax payment slip? Or should I indicate “MS.08.2016”?

The rules for filling out payment orders do not have a clear answer to these questions. Therefore, we will express our opinion on how to implement the new recommendations given in the letter of the Federal Tax Service dated July 12, 2016 No. ZN-4-1/12498.

Sample of filling out instructions for personal income tax penalties for employees of organizations

The employer can transfer penalties voluntarily, as well as the debt for this tax. But more often they are collected as arrears on demand.

Voluntary transfer of fines

It can be argued whether penalties paid voluntarily are arrears, or whether they become arrears only after the deadline for their payment, and until then they are current payments. It doesn't matter. You can put “ZD” or “TP” in the details of the payment basis. However, in our opinion, it is correct to pay penalties as a debt.

Filling out the basic details for payment of penalties by an organization

| Field no. | Props name | Contents of the props |

| 101 | Payer status | 02 |

| 18 | Type of operation | 01 |

| 21 | Sequence | 5 |

| 22 | Code | 0 |

| 104 | Budget Classification Code (BCC) | 18210102010012000110 |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service is located, where the report on this tax is submitted |

| 106 | Basis of payment | ZD (TP) |

| 107 | Taxable period | MS.01.2013 – MS.12.2013; MS.01.2014 – MS.12.2014 |

| 108 | Document Number | 0 |

| 109 | Document date | 0 |

| 110 | Payment type | 0 (from March 28, 2020, the value of attribute 110 is not indicated) |

Voluntary payment of penalties for personal income tax for employees of organizations sample of filling out a payment order 2014

Download in format or

Penalties at the request of the Federal Tax Service

We fill in the tax fields details differently. We take into account whether or not the UIN is in the document from the Federal Tax Service. Two photos with samples for different cases of payment of fines upon request.

Filling in details for paying penalties upon request

| Field no. | Props name | Contents of the props |

| 101 | Payer status | 02 |

| 18 | Type of operation | 01 |

| 21 | Sequence | 5 |

| 22 | Code | 0 or 20-digit UIN code |

| 104 | Budget Classification Code (BCC) | 18210102010012000110 |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service is located, where the 2-NDFL report is submitted |

| 106 | Basis of payment | TR |

| 107 | Taxable period | The deadline for payment of the penalty established in the request, in the format DD.MM.YYYY |

| 108 | Document Number | Requirement No. |

| 109 | Document date | Request date in corner stamp |

| 110 | Payment type | 0 (from March 28, 2020, the value of attribute 110 is not indicated) |

UIN is not included in the requirement

Penalties for personal income tax for employees of organizations upon request, sample payment slip 2014

Payment order in 2018-2019 - you will see a sample of this document in this article. What is its form, what are the rules for filling it out, have there been any changes recently? Let's look at how to fill out a payment order in 2018-2019.

Our opinion: rely on the month of income occurrence

We believe that there is no need to indicate a specific date in payment orders. After all, most likely, the main thing for tax inspectors is not to collect a lot of information about different dates, but to understand for what period the personal income tax was paid and compare it with the 6-personal income tax calculation. And if so, then accountants, in our opinion, need to rely specifically on the month in which the employees had taxable income.

To determine which month personal income tax applies to, refer to the date of recognition of income under Article 223 of the Tax Code of the Russian Federation. For example, for salaries, this is the last day of the month for which money is issued. For vacation and sick leave - the day of payment (Article 223 of the Tax Code of the Russian Federation). Let us explain with examples and samples of payment slips.

Wage

It follows from paragraph 2 of Article 223 of the Tax Code of the Russian Federation that wages become income on the last day of the month for which it is accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Therefore, enter in field 107 the number of the month for which the salary was accrued. Let's assume that an accountant prepares a personal income tax payment from wages for August. Then in field 107 he will indicate “MS.08.2016”. Even though the payment is drawn up in September. And this, in our opinion, will be correct.

Vacation pay

Vacation pay becomes income on the last day of the month in which they were paid (clause 6 of Article 223 of the Tax Code of the Russian Federation). For example, if you pay vacation pay to an employee in September, then in field 107 of the income tax payment slip, indicate “MS.09.2016”. Even if the vacation “shifts” to October.

Sick leave

Vacation pay becomes income on the last day of the month in which they are paid (clause 6 of Article 223 of the Tax Code of the Russian Federation). For example, if you pay vacation pay to an employee in October 2020, then in field 107 of the payment slip you need to fill in “MS.10.2016”. And thereby show that vacation pay was paid in the tenth month of 2020.

Material benefit

Sometimes employees receive income in the form of material benefits, for example, from a loan received. To transfer income tax from him in field 107 of the payment order, fill in the month on the last day of which the person gained material benefit. For example, if the material benefit from using the loan arose in November 2016, then fill out field 107 as follows:

Personal income tax payment details

Let's look at the main fields of a payment slip when paying taxes:

- Field 101 is intended for selecting the payer status. For example, if the payment is made by a tax agent, then code 02 is entered.

More information about what code should be indicated for payments in other cases is described in the article “Filling out field 101 in the payment order in 2020 - 2020.”

- In field 104 enter the BCC of a specific tax. At the same time, there are codes for penalties and fines. Tax codes are approved every year, so it is important to keep track of any possible changes.

The material “KBK in a payment order in 2020-2020” will explain what an incorrect indication of the KBK can lead to. And for the KBK values relevant for 2017-2018, see the article “Changes in the KBK for 2020 - 2020 - table with explanation”

- Field 105 - OKTMO. This is a code that determines the territorial affiliation (either of the payer or the object of taxation).

You will learn from this publication whether the error in this detail is significant.

- Field 106 - basis of payment. Here they most often indicate “TP” - current payment; “ZD” - payment of debt and “TR” - repayment at the request of the Federal Tax Service are also often used.

Other possible options for filling out this field are discussed in this publication.

- Field 107 is necessary to reflect the reporting or tax period for which tax is paid. For example, if payment is made for January 2020, “MS.01.2018” is indicated, if for 2020, “GD.00.2017” is indicated.

Other values that can be used to specify in this field can be found here.

- Field 108 is intended for payments made on the basis of any executive or administrative documents - the numbers of such documents are indicated here.

Please note cases when this field is entered with 0; details are here.

- In field 109 indicate the date of the document. For example, if payment of a tax, fine, or penalty is made at the request of the tax office, then the date of the request is indicated; If the tax amount is paid at the end of the tax period, then the date of submission of the declaration must be indicated.

The format for filling out this detail, as well as examples of possible values, are presented in this publication.

- Field 110 records the order to transfer funds, but due to the abolition of this detail in 2020, until recently it indicated 0 or a dash. This field should remain empty for now.

Find out more in the article “Filling out field 110 in a payment order in 2020.”

- Field 22 (UIN) is intended for the payment identification number for payment of penalties and arrears of fines. In other cases, it is set to 0.

Read more about this here.

- Field 24 is the purpose of the payment, which reflects what exactly the payment is for, for example, “Payment of VAT for the 4th quarter of 2017.”

Since 2020, insurance premiums that were previously calculated in accordance with the Law “On Insurance Contributions...” dated July 24, 2009 No. 212-FZ and paid to extra-budgetary funds are now subject to the rules of Chapter. 34 of the Tax Code of the Russian Federation and are paid to the budget. Accordingly, payment documents for them should be prepared in the same way as for tax payments.

There have been no changes to “unfortunate” contributions to the Social Insurance Fund since 2020, and they must still be paid to the Social Insurance Fund according to the same details and rules. For a sample of such a payment, see this article.

Entering details into the payment slip for budget payments is a very responsible undertaking, since mistakes made can lead to fines and penalties for taxes and contributions.

Our section “Details for paying taxes and contributions” will help you avoid problems in filling out payment slips.

Page content

For employees

TAX KBK

| Personal income tax on income the source of which is a tax agent (personal income tax for employees of individual entrepreneurs, LLCs and JSCs) | 182 1 0100 110 |

PENIES, INTEREST, FINALES KBC

| Penalties, interest, personal income tax fines on income the source of which is a tax agent (personal income tax for employees of individual entrepreneurs, LLCs and JSCs) | penalties | 182 1 0100 110 |

| interest | 182 1 0100 110 | |

| fines | 182 1 0100 110 |

For individual entrepreneurs

TAX KBK

| Personal income tax on income received by citizens registered as: individual entrepreneur; private lawyers; notaries; other persons engaged in private practice (personal income tax for individual entrepreneurs for themselves) | 182 1 0100 110 |

PENIES, INTEREST, FINALES KBC

| Penalties, interest, personal income tax fines on income received by citizens registered as: individual entrepreneur; private lawyers; notaries; other persons engaged in private practice (personal income tax for individual entrepreneurs for themselves) | penalties | 182 1 0100 110 |

| interest | 182 1 0100 110 | |

| fines | 182 1 0100 110 |

For individuals

TAX KBK

| Personal income tax on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation (personal income tax for individuals who must independently pay tax on their income) | 182 1 0100 110 |

PENIES, INTEREST, FINALES KBC

| Penalties, interest, personal income tax fines on income received by citizens in accordance with Article 228 of the Tax Code of the Russian Federation (personal income tax for individuals who must independently pay tax on their income) | penalties | 182 1 0100 110 |

| interest | 182 1 0100 110 | |

| fines | 182 1 0100 110 |

From dividends and working under a patent

TAX KBK

| Personal income tax on dividends, the recipient of the dividends is a tax agent | 182 1 0100 110 |

| Personal income tax on dividends, dividend recipient - individual | 182 1 0100 110 |

NAME TYPE OF PAYMENT KBK

| Personal income tax on income (in the form of fixed advance payments) received by non-residents working for citizens on the basis of a patent | tax | 182 1 0100 110 |

| penalties | 182 1 0100 110 | |

| interest | 182 1 0100 110 | |

| fines | 182 1 0100 110 |

In accordance with the Tax Code of the Russian Federation, the obligation to pay tax is fulfilled in the currency of the Russian Federation. The obligation to pay tax is not considered fulfilled if the taxpayer incorrectly indicates in the order to transfer tax the account number of the Federal Treasury for the relevant constituent entity of the Russian Federation and the name of the recipient's bank.

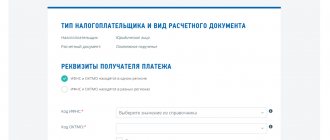

AttentionGoIn order to avoid errors when filling out the details of settlement documents, you can use the service “Address and payment details of your inspection”, with the help of which, by selecting the necessary details, you can generate a settlement document in electronic form

- Directories of codes of the All-Russian Classifier of Municipal Territories (OKTMO), published on the website of the Federal State Statistics Service.

- All-Russian Classifier of Units of Measurement (OKEI), posted on the website of the Federal Agency for Technical Regulation and Metrology

- The procedure for specifying a unique accrual identifier (UIN)

The information below depends on your region (77 Moscow city) Your region was detected automatically. You can always change it using the switch in the upper left corner of the page.

A complete list of codes can be found in Appendix 3 to Order No. 106n. Field 104 is for budget classification codes, field 105 is for OKATO code.

Field 106 is intended to indicate the basis for the payment; it consists of two capital letters (for example, “Voluntary repayment of debt for expired tax periods, provided that the tax authority has not made a demand for payment of tax (fee)” - ZD). In field 107 write the tax period code, 108 - document number.

As with any other document, a payment order for an individual entrepreneur can be drawn up with an error, but whether the funds will be credited in this case and whether liability will arise for the entrepreneur if the payment order was drawn up to pay mandatory fees and taxes depends on the size of the error. Modern means of data transmission simply will not miss an incorrect payment, and the operator himself will enter the necessary details when indicating the exact address of the recipient (for example, the tax office). If the error arose due to the fault of the bank, then even if there is a significant delay, the sender of the payment does not pay a penalty and is not responsible.

Number of impressions:5706

Return to list

Order of the Ministry of Finance of Russia No. 180n introduced additions to Appendix 1 to the Instructions on the procedure for applying the budget classification of the Russian Federation, namely to the List of codes for types of budget revenues. They are related to amendments to the current legislation of the Russian Federation.

Budget classification codes (BCC) for personal income tax are brought by the Ministry of Finance of Russia in accordance with the provisions of the articles of Chapter 23 of the Tax Code, depending on the category of payers and the types of income they receive.

For tax agents, the BCC has become unified, regardless of the type of income, tax rate and status of the income recipient.

1) 182 1 0100 110 – “Income tax for individuals on income the source of which is a tax agent, with the exception of income in respect of which the calculation and payment of tax are carried out in accordance with Articles 227, 2271 and 228 of the Tax Code of the Russian Federation”;

Note! In the 14th category of the KBK, the number 1 is indicated - when paying tax; 2 - when paying a penalty; 3 - upon payment of a fine.

If you pay the tax itself, you must indicate BCC 18210102010011000110.

If you pay penalties on this tax, indicate KBK 18210102010012000110.

If a fine is paid, then KBK 18210102010013000110 is indicated.

2) 182 1 0100 110 – “Income tax for individuals on income received from the activities of individuals registered as individual entrepreneurs, notaries engaged in private practice, lawyers who have established law offices and other persons engaged in private practice in accordance with Article 227 of the Tax Code of the Russian Federation";

Payment of the above tax is made to KBK 18210102020011000110.

Payment of penalties - KBK 18210102020012000110.

Payment of the fine for this tax - KBK 18210102020013000110.

3) 182 1 0100 110 “Income tax for individuals on income received by individuals in accordance with Article 228 of the Tax Code of the Russian Federation”;

When paying the tax itself, the payment slip indicates KBK 18210102030011000110.

How to fill out field 107 in ambiguous situations

Now let's look at several common situations for filling out field 107 when transferring personal income tax.

Situation 1. Salary and vacation pay at the same time

In August, the organization simultaneously issued salaries for July and vacation pay on the same day.

Solution. In relation to wages, the income date is the last day of the month for which it is accrued. For vacation pay, this is the day the money is issued. Therefore, you need to make two payments. In field 107 for salary tax, enter “MS.07.2016”, and in field 107 for vacation pay tax - “MS.08.2016”. This will make it clear which month you are transferring tax for. And this approach will meet the new recommendations of tax authorities.

Situation 2. Salary and sick leave at the same time

In September, the organization simultaneously issued salaries for August and vacation pay on the same day.

Solution. In relation to wages, the income date is the last day of the month for which it is accrued. For vacation pay, this is the day the money is paid. Therefore, you need to make two payments. In field 107 for salary tax, enter “MS.08.2016”, and in field 107 for vacation pay tax - “MS.09.2016”.

Situation 3. Vacation pay was issued in another month

The employee goes on vacation on September 1, and vacation pay was issued on August 29.

Solution. In relation to vacation pay, the date of income is the day the money is issued. It doesn’t matter what month the employee takes a vacation. Therefore, in field 107 of the payment slip for the transfer of personal income tax from vacation pay, indicate “MS.08.2016”. That is, show that you issued vacation pay in August 2020.

Situation 4. Salary and bonus at the same time

In August, the salary and bonus for July were issued simultaneously. Also see “How to reflect the payment of bonuses in the calculation of 6-NDFL”.

Solution. Salary becomes income on the last day of the month for which it is accrued. That is, in our case, on the last day of July. The bonus becomes income directly on the day of its payment. Therefore, the bonus is August's income. In such a situation, the tax agent needs to prepare two payments. For salary tax, in field 107, enter “MS.07.2016”, and for premium tax, “MS.08.2016”. There is no need to combine bonuses and salaries into one payment slip. Moreover, bonuses and salaries are also separated in the calculation of 6-NDFL (See “How to reflect the payment of bonuses in the calculation of 6-NDFL”)

Do the same when paying quarterly bonuses. Quarterly bonuses are also defined as earnings on the payment date. Accordingly, also make separate payments for them. Also see “Terms for payment of bonuses under the new wage law: what has changed.”

Situation 5: payments to contractors

The contractor was paid in September for services rendered in August.

Solution. The date of receipt of income under a civil contract is the day the money is issued. This day fell in September. Therefore, in the payment slip for personal income tax, in field 107, enter “MS.09.2016”.

Situation 6: daily allowance

In August, the employee received excess daily allowance related to his business trip. Personal income tax must be withheld from them. The advance report on the results of the business trip was approved in September 2020. The tax was withheld from the salary for September.

Solution. The date of receipt of income for excess daily allowance is the last day of the month in which the advance report for the business trip was approved (clause 6, clause 1, article 223 of the Tax Code of the Russian Federation). For wages, the date of income is the last day of the month for which the money was paid (clause 2 of Article 223 of the Tax Code of the Russian Federation). That is, in both cases it is the last day of the month. Therefore, in our opinion, it is possible to make one payment in field 107 o. After all, the tax authorities in their explanations did not say that the tax should be divided into different payments and with the same payment deadlines.

Samples of personal income tax payment slips for legal entities for employees

So, in order not to return to this issue again, we note that the status of the preparer of the payment document for the transfer of employee income tax by the organization in all samples of filling out payment slips will have the value “02” - tax agent. This applies to deductions from payments not only under employment contracts, but also under civil contracts.

Monthly tax transfers

Wages must be paid at least for each half of the month, but the tax withheld from employee income is calculated once per month on an accrual basis from the beginning of the year. It must be paid on the day the salary is paid in cash (receipt of money from the bank) or on the day the salary is transferred to the bank cards of employees. Not later, but not earlier!

Filling out the basic details of the payment form

| Field no. | Props name | Contents of the props |

| 101 | Payer status | 02 |

| 18 | Type of operation | 01 |

| 21 | Sequence | 5 |

| 22 | Code | 0 |

| 104 | 18210102010011000110 | |

| 105 | OKTMO | |

| 106 | Basis of payment | TP |

| 107 | Taxable period | MS.01.2014; MS.02.2014 – MS.12.2014 |

| 108 | Document Number | 0 |

| 109 | Document date | 0 |

| 110 | Payment type | 0 |

Sample payment order for personal income tax for employees of an organization

in Word or Excel format

Tax debt paid voluntarily

Cases when it is necessary to recalculate tax accruals and withholdings on employee income for previous months and even years are not that rare. If the organization’s accounting department itself discovered an error and recalculated the personal income tax, it is better to pay the arrears voluntarily. In the tax period indicator of the payment order, we indicate the month for which we make the additional payment.

Filling out basic details for debt transfer

| Field no. | Props name | Contents of the props |

| 101 | Payer status | 02 |

| 18 | Type of operation | 01 |

| 21 | Sequence | 5 |

| 22 | Code | 0 |

| 104 | Budget Classification Code (BCC) | 18210102010011000110 |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service is located, where the tax report is submitted |

| 106 | Basis of payment | ZD |

| 107 | Taxable period | |

| 108 | Document Number | 0 |

| 109 | Document date | 0 |

| 110 | Payment type | 0 (from March 28, 2020, the value of attribute 110 is not indicated) |

Voluntary payment of personal income tax debt for employees, sample of filling out payment forms for legal entities in 2014

Download in format or

Tax arrears for employees upon request

If you voluntarily did not manage to pay the debt, and the organization is required to pay the arrears, the information in the tax fields of the payment order changes. In addition, the requirement may or may not contain a UIN. We have provided you with both options for filling samples in the pictures in the photo after the table.

Filling out debt details at the request of the Federal Tax Service

| Field no. | Props name | Contents of the props |

| 101 | Payer status | 02 |

| 18 | Type of operation | 01 |

| 21 | Sequence | 5 |

| 22 | Code | 0 or 20-digit UIN code |

| 104 | Budget Classification Code (BCC) | 18210102010011000110 |

| 105 | OKTMO | OKTMO code of the municipality in which the Federal Tax Service is located, where 2-NDFL certificates are submitted |

| 106 | Basis of payment | TR |

| 107 | Taxable period | Payment deadline specified in the request, in the format DD.MM.YYYY |

| 108 | Document Number | Requirement No. |

| 109 | Document date | Date of the request itself |

| 110 | Payment type | 0 (from March 28, 2020, the value of attribute 110 is not indicated) |

UIN is not included in the requirements of the Federal Tax Service

Payment of personal income tax debt at the request of the Federal Tax Service, sample filling 2014 for organizations

Download in format or

Sample payment on demand with UIN

We replace the zero in field “22” with the UIN code taken from the tax authority’s requirement.

Sample of filling out a payment order for personal income tax debt for employees of organizations 2014 upon request indicating the UIN

Download in or

Professional accounting for organizations and individual entrepreneurs in Ivanovo

. We will relieve you of the problems and daily worries of maintaining all types of accounting and reporting. LLC NEW tel. 929-553

Questions and answers

- If the payment is filled out with an error, then what could happen?

Answer: This may result in your payment being classified as unknown and result in non-payment of tax. Be careful when creating a payment order.

- Which BCCs are used to pay personal income tax in 20019?

| Personal income tax | KBK |

| Personal income tax transfers from income paid by a tax agent to a taxpayer (excluding income in Articles 227, 227.1, 228 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| Transfers of personal income tax received by an individual - an individual entrepreneur, a notary or lawyer or a person engaged in other business activities (Article 227 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| Transfer of tax on personal income (Article 228 of the Tax Code of the Russian Federation) | 182 1 0100 110 |

| Transfer of tax on the income of foreign citizens carrying out activities in accordance with a patent (fixed advance payment Article 227.1 of the Tax Code of the Russian Federation) | 182 1 0100 110 |