Payment order for the transfer of VAT by the taxpayer - 2019

Before we talk about filling out the payment form, let us remind you of the deadlines for paying VAT.

In 2020, taxpayers pay the tax in 3 equal payments no later than the 25th day of each of the 3 months following the quarter for which the tax was assessed (clause 1 of Article 174 of the Tax Code of the Russian Federation). If the 25th is a weekend or holiday, the payment deadline is shifted to the first working day following it (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). By the way, you can pay the entire amount ahead of schedule (Clause 1, Article 45 of the Tax Code of the Russian Federation).

We will not consider all payment details. We will focus only on those that are directly related to VAT. So, in the payment order you need to indicate:

- Payer status (field 101). When paying tax by a taxpayer who is a legal entity, enter 01, and by a taxpayer who is an individual entrepreneur, enter 09.

- Your details and the recipient's. In this case, this is the Federal Tax Service, with which you are registered (clause 2 of Article 174 of the Tax Code of the Russian Federation).

- Type of operation (field 18). This is payment order code 01.

- Payment order (field 21). For self-pay taxes it is 5.

- Universal payment identifier (field 22). We set it to 0, because it is not set for current tax payments.

Read this article about filling out this field.

- Field 105 "OKTMO". We indicate your OKTMO.

- KBK. In 2020 it is as follows: 182 1 0300 110.

- Basis of payment. We set TP, i.e. payments for the current year.

- Taxable period. You must indicate the quarter for which VAT is paid. For example, for the tax for the 2nd quarter of 2020 we set: KV.02.2019.

- In field 108 “Document number” we put 0, and in field 109 “Document date” - the date of signing the declaration in which the tax was calculated.

- Field 110 is not filled in.

- The purpose of payment can include the standard phrase: “1/3 VAT, for the 2nd quarter of 2020 (due for payment on July 25, 2019).”

A completed sample VAT payment form can be downloaded from our website.

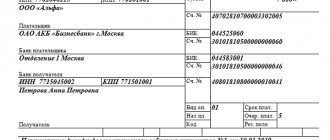

Sample of filling out the fields of a payment order in 2020

The form of the settlement document is presented in the form OKUD 0401060 (below is a typical file for downloading in Word format).

You can see the payment order (sample) with the code for each field below. For convenience, we have assigned each field a unique code (it is indicated in parentheses). You will find a transcript with an explanation of what to write when filling out a particular field in the table below.

INN and KBK details are the most important values in payments. If they are correct, then the payment will most likely go through. Period, payer status, priority - if there are errors in these fields (they didn’t make it in time), then payments almost always go through anyway, but it’s better not to take risks. There are no fines for filling out payment slips incorrectly (it’s your money), but the payment may not go through, in which case you will have to look for it, return it, and possibly pay penalties.

The account (number) of payment orders (above) can be anything and they can be made with the same numbers. But it's better to take turns.

VAT in payment orders is always indicated in the purpose of payment. If it does not exist or cannot exist, it is attributed “Without VAT”.

The order of payment in all examples is fifth, except for wages - there it is third.

Individuals and individual entrepreneurs put “0” in the “Checkpoint” field.

https://www.youtube.com/watch?v=https:accounts.google.comServiceLogin

TIN, KPP and OKTMO should not start from scratch.

In the Code field (aka UIN), starting from 2020, all tax payments are set to 0 (this is the answer to where to get the UIN). A UIN is indicated if the payer’s TIN is not indicated on the payment slips or if payments are transferred at the request of officials. They don’t put anything in the non-tax department.

On the payment order at the bottom in the top line there must be the signature of the manager (IP) or the person acting by proxy. Also, if an organization or individual entrepreneur uses a seal, then it should also be there.

In field 109 (date, below the “reserve field”, on the right) enter the date of the declaration on which the tax is paid. But under the simplified tax system and all funds (PFR, FSS, MHIF) they set 0.

In the detail (field) “110” of the order for the transfer of funds until 2020, the indicator of the type of payment was indicated (“PE” - payment of penalties; “PC” - payment of interest). Now there is nothing indicated there.

From October 1, 2020, instead of “OPERU-1” you need to indicate “Operations Department of the Bank of Russia” in the Recipient’s Bank field for state duties, customs and some other payments.

In the payment order field “Type of op.” (type of operation) is always set to 01.

Fig. Sample of filling out a tax payment order.

Payment order for VAT penalties - 2020

If you have calculated and paid the penalties yourself, in the payment order for penalties for VAT 2020, unlike the tax payment, you need to indicate:

- BCC for VAT penalties 182 1 03 010 0001 2100 110.

- The basis of payment is TP, that is, payments of the current year. ZD, that is, voluntary repayment of debt in the absence of a requirement from the tax authority, is not shown as a basis for payment when paying a fine. The basis for the payment of the tax is indicated in case of voluntary repayment of debts on taxes and fees (clause 7 of Appendix 2 to the order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n).

- And of course, in the purpose of payment it is necessary to explain that this is a penalty.

If payment is made on the basis of a request, then indicate:

- UIP in field 22. We take it from the requirement, and if it is not assigned, set it to 0.

- The basis for payment is TR, i.e. repayment of debt at the request of the Federal Tax Service.

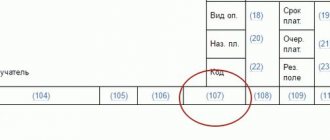

- In field 107 - the payment deadline set in the request in the format DD.MM.YYYY (for example, 05/16/2019).

- In field 108 - the requirement number without the No. sign.

- In field 109 - the date of the request.

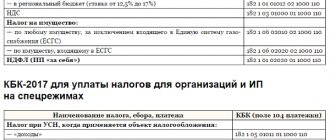

KBK VAT for legal entities and individual entrepreneurs in 2020

VAT codes for legal entities and individual entrepreneurs are divided into three types depending on the operation:

- when selling goods, services, works on the territory of the Russian Federation;

- when importing products from states that are members of the EAEU;

- when importing products from other states not members of the EAEU.

BCC for payment of penalties and fines correspond to the above types of transactions. In this case, penalties are paid for each day of delay, and fines are paid once if the tax is not transferred on time. For current VAT payment codes for Russian enterprises and individual entrepreneurs in 2020, see the table.

KBK for VAT 2020

| Type of operation | Tax code |

| Sales of goods, services, works in Russia | 182 1 0300 110 |

| Import of products from countries included in the EAEU | 182 1 0400 110 |

| Import of products from other countries not members of the EAEU | 153 1 0400 110 |

Please note that in the codes for penalties and tax fines, only the 14th and 15th characters are changed: “21” for penalties, “30” for fines. All other values are the same as in KBK for the main payment.

KBK VAT penalties 2020

| Type of operation | Tax code |

| Sales of goods, services, works in Russia | 182 1 0300 110 |

| Import of products from countries included in the EAEU | 182 1 0400 110 |

| Import of products from other countries not members of the EAEU | 153 1 0400 110 |

KBK VAT fines 2020

| Type of operation | Tax code |

| Sales of goods, services, works in Russia | 182 1 0300 110 |

| Import of products from countries included in the EAEU | 182 1 0400 110 |

| Import of products from other countries not members of the EAEU | 153 1 0400 110 |

If VAT is transferred for a third party

The procedure for filling out a payment order in case of payment for another person is described in the information of the Federal Tax Service of Russia “On tax payments transferred by another person.” When paying VAT for another person in the field:

- 101 “Payer status” indicates the status of the person for whom the tax is transferred.

- 60 “TIN of the payer”, 102 “KPP of the payer” indicates the TIN and KPP of the payer for whom the tax is transferred.

The payer's details indicate the details of the person who fills out the payment order for the transfer of tax to the budget.

The recipient's details indicate the details of the tax authority - the recipient of the VAT.

Fields 22, 104–109 are filled in with data provided by the person whose tax obligation is being fulfilled.

In the “Purpose of payment” field, you need to indicate your INN, KPP, then through the “//” sign the name of the organization for which you are transferring the tax, and through the “//” sign the purpose of payment.

A payment order to pay tax for a third party is available on our website.

If the tax is transferred by a defaulter

As is known, persons who are not VAT payers, for example, “simplified people”, in the case of issuing an invoice with the tax allocated in it, are obliged to pay it to the budget (clause 5 of Article 173 of the Tax Code of the Russian Federation). When making a payment, these persons may be asked what payer status to indicate in field 101.

There is no special code specifically for this situation in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, which determines the procedure for filling out this detail. In this regard, we believe that it is possible to set status 01, corresponding to the category “taxpayer-legal entity” or status 09 if VAT is paid by an individual entrepreneur. The remaining details must also be filled out according to the rules established for VAT taxpayers.

Results

The given samples of filling out a payment order for VAT in 2019 and its details discussed in the article will allow you to accurately fulfill the obligation to pay tax to the budget.

Sample payment order for VAT in 2020

As a general rule, taxpayers and VAT tax agents pay tax for the past quarter in equal installments no later than the 25th day of each of the 3 months of the next quarter (clause 1 of Article 174 of the Tax Code of the Russian Federation). In our consultation, we will provide a sample payment order for VAT in 2018-2019.

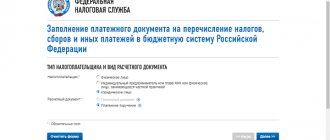

For tax to be considered paid

Tax legislation provides for errors in a payment order for the payment of taxes, incl. VAT are critical. This means that the transferred VAT on payments with such errors will not be considered paid, and the obligation of the taxpayer or agent to pay the tax will remain unfulfilled.

Such errors include incorrect indication:

- Federal Treasury account numbers;

- name of the recipient's bank.

The specified details can be clarified at your tax office, or you can contact the “Address and payment details of your inspection” service on the Federal Tax Service website nalog.ru or use the Directory on our website.

Other details are no less important

To avoid having to clarify the payment due to incorrect indication of other details, you need to pay attention to the correct completion of individual fields of the VAT payment form. The Rules, approved, will help with this. By Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, Regulations, approved. Bank of Russia 06/19/2012 No. 383-P.

Here are the payment details to be filled in when paying VAT:

| Field | What is indicated | How to fill |

| 101 | Payer status | 01 (if the taxpayer is an organization); 09 (if the taxpayer is an individual entrepreneur); 02 (for tax agent) |

| 104 | KBK | 18210301000011000110 (tax, except for imports from the EAEU); 18210301000012100110 (penalties); 18210301000013000110 (fine) |

| 105 | OKTMO | OKTMO at the location of the organization (place of residence of the individual entrepreneur) |

| 106 | Basis of payment | TP – payments of the current year; ZD – voluntary repayment of debt for expired tax periods in the absence of a requirement for payment; TR – repayment of debt at the request of the tax authority; etc. |

| 107 | Tax period indicator | КВ.XX.YYYY, where XX is the quarter number (for example, for the 1st quarter, code 01), YYYY is the year for which payment is made (for example, 2018) |

| 108 | Number of the payment basis document | When paying current payments on the basis of a tax return or when voluntarily repaying debt in the absence of a requirement from the Federal Tax Service (payment basis “TP” or “ZD”), indicate 0 |

| 109 | Date of payment basis document | date of signing of the declaration, if the basis of payment is “TP”; 0, if the basis of payment is “ZD” or if it is impossible to indicate a specific value (for example, the payment is made before filing the declaration); date of request, if the basis of payment is “TR”; etc. |

| 24 | Purpose of payment | For example, “Value added tax on goods (work, services) sold on the territory of the Russian Federation (3rd payment for the 1st quarter of 2018)” |

Important details in payments

Please fill out payment orders for tax transfers in accordance with Bank of Russia Regulation No. 383-P dated June 19, 2012 and Appendices No. 1 and 2 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013.

Please note that some errors in the VAT payment order are fatal. This means that the transferred VAT on payments with such errors will not be considered paid, and the obligation of the taxpayer or agent to pay the tax will remain unfulfilled.

Such shortcomings include errors:

- in the Federal Treasury account number;

- in the name of the recipient's bank.

It also makes sense to pay attention to other details of the payment order so that the VAT payment transferred in 2020 is considered credited to the treasury.

Below is a table that explains the individual VAT payment details.

| Field | Content | Filling |

| 101 | Payer status | 01 (if the taxpayer is an organization); |

09 (if the taxpayer is an individual entrepreneur);

02 (for tax agent)

18210301000013000110 (fine).

ZD – voluntary repayment of debt for expired tax periods in the absence of a requirement for payment;

TR – repayment of debt at the request of the tax authority;

and etc.

VAT payment in 2018-2019: sample

We will provide a sample payment order for VAT in 2018-2019 for an organization that is a VAT taxpayer registered with the Federal Tax Service No. 36 of Moscow at its location. As an example, a payment order for payment of VAT in 2020 is given, because the procedure for filling out payment slips in 2020 and 2020 has not changed.

In this article we will talk about how to fill out a payment order to pay VAT when importing from the EAEU countries. The article discusses the key points of preparing a payment order:

We will also make payments together and check mutual settlements with the budget.

If penalties are due

All of the above-mentioned features of payments for penalties now also apply to the payment of penalties for insurance premiums (except for contributions for injuries), which have become payments to the tax office since 2020.

Learn about the procedure for processing payment orders for insurance premiums from this material.

However, these changes did not affect accident insurance contributions, and penalties for them, as well as these contributions themselves, are still paid to social insurance. When paying both contributions and penalties on them to the Social Insurance Fund, fields 106 “Basis of payment”, 107 “Tax period”, 108 “Document number” and 109 “Date of document” are entered as 0 (paragraphs

Procedure for paying VAT

Payment of VAT to the budget when importing from the EAEU countries is carried out no later than the 20th day of the month following the month (clause 19 of the Protocol on the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods..., Appendix No. 18 to the Agreement on EAEU dated May 29, 2014 (hereinafter referred to as the EAEU Protocol)):

- registration of imported goods;

- payment period stipulated by the leasing agreement.

Payment is made to the Federal Tax Service:

- by the buyer, at the place of registration of the organization or individual entrepreneur (clause 13 of the EAEU Protocol, clause 4 of Article 72 of the Treaty on the EAEU dated April 24, 2014).

The completed payment order for VAT payment looks like this.

Let's take a closer look at the procedure for its formation and payment of VAT to the budget in the program.

Payment order for VAT payment

General details

A payment order for the payment of VAT to the budget when importing from the EAEU countries is generated using the Payment order in the Bank and cash desk section - Bank - Payment orders.

In this case, it is necessary to correctly indicate the type of transaction Tax payment , then the document form takes the form for payment of payments to the budget system of the Russian Federation.

You can also quickly generate a payment order using the Tax Payment Assistant :

- through the section Main – Tasks – List of tasks;

- through the section Bank and cash desk - Payment orders using the Pay button - Accrued taxes and contributions.

Please pay attention to filling out the fields:

- Tax - VAT on goods imported into the territory of the Russian Federation , is selected from the Taxes and Contributions directory .

VAT on goods imported into the territory of the Russian Federation is predetermined in the Taxes and Contributions . Parameters are set for it

- corresponding KBK code;

- text template inserted into the Payment purpose ;

- tax account.

- Type of liability – Tax . The choice of the type of obligation affects the BCC, which will be indicated in the payment order;

- The order of payment is 5 Other payments (including taxes and contributions) , filled in automatically, as for all tax payments to the budget paid on time (clause 2 of Article 855 of the Civil Code of the Russian Federation).

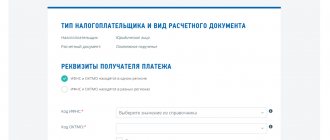

Recipient details – Federal Tax Service

Since the recipient of the VAT is the tax office with which the taxpayer is registered, it is its details that must be reflected in the Payment order .

- The recipient - the Federal Tax Service, to which the tax is paid, is selected from the Counterparties directory.

- Recipient's account – bank details of the tax authority specified in the Recipient .

- Recipient's details - TIN , KPP and Recipient's name , these are the data that are used to print the payment order. If necessary, the recipient's details can be edited in the form that opens via the link.

Structure of the KBK code

KBK is a numeric code, one of the payment order details for encrypting budget payments, in particular for VAT. Codes change frequently; if you specify the wrong BCC, the operation will not be performed correctly. To ensure that the payment does not end up among the unknown, use the current BCC for VAT in 2020, which are listed below.

Kontur.Accounting is a web service for small businesses!

If an organization indicates an incorrect code for a tax, penalty or fine, the payment will be frozen and you will need to clarify the details. To do this, you need to send an application to the tax service to clarify the payment. Previously, the Ministry of Finance reported that an incorrectly specified BCC is not considered a critical error.

The order of payments is determined in accordance with Article 855 of the Civil Code of the Russian Federation. When transferring payments to suppliers, the priority is “5”. The same order applies to simple payments to the budget, for example, during scheduled tax transfers. If payment of a tax, fine or penalty is made at the request of a regulatory authority, priority is given to “3”

Payment of VAT to the budget

After paying VAT to the budget, based on the bank statement, you need to create a document Write-off from current account transaction type Tax payment . A document can be created based on a Payment Order using the link Enter document debited from current account . PDF

The basic data will be transferred from the Payment order .

Or it can be downloaded from the Client-Bank program or directly from the bank if the 1C: DirectBank service .

It is necessary to pay attention to filling out the fields in the document:

- from – date of tax payment, according to the bank statement;

- In. Number and In. Date – number and date of the payment order;

- Tax - VAT on goods imported into the territory of the Russian Federation , is selected from the Taxes and Contributions directory and affects the automatic completion of the Account account ;

- Type of liability - Tax ;

- Reflection in accounting :

- Debit account - 68.42 “VAT on import of goods from the Customs Union”;

- Counterparties - the supplier from the EAEU from whom the goods were purchased;

- Contracts are the basis for settlements with a supplier from the EAEU, selected from the Contracts directory Type of contract With a supplier .

- Invoices received - Statement of importation of goods to which payment of tax applies. Selected from the list of Applications for the import of goods from the Customs Union .

Postings according to the document

The document generates the posting:

- Dt 68.42 Kt 51 – payment of VAT to the budget.