What the Ministry of Finance of the Russian Federation says about VAT deduction on a cash receipt

Hidden text

- the goods were purchased at retail (even if the VAT amount is highlighted as a separate line in the cash receipt);

- the company wishes to include VAT as an expense when calculating income tax.

A common situation was considered. An employee is given money on account for the purchase of office supplies, for example. There is no invoice. The employee draws up an advance report and attaches a cash receipt with the VAT amount highlighted on a separate line. The company is wondering whether the accountant has the right to deduct VAT. If this is not possible, then can VAT be included as an expense when calculating the taxable base for income tax?

Please note that from July 1, 2020, all sellers of goods and services switched to online cash registers, which means that absolutely all cash register receipts will include information about VAT and the tax rate - this is the requirement of the law “On the use of cash registers”. technology in the Russian Federation."

The Ministry of Finance of the Russian Federation emphasizes that, according to the instructions of paragraph 1 of Art. 172 of the Tax Code of the Russian Federation, VAT can be deducted on the basis of the following documents:

- Invoice issued by the seller.

- Documents proving payment of VAT withheld by tax agents.

- Documents that prove the fact of payment of VAT when importing goods into the territory of the Russian Federation.

- Any other documents in cases where a deduction can be made for VAT paid by the organization as part of entertainment or travel expenses, as well as directly to the budget.

Based on the instructions of paragraph 1 of Article 172 of the Tax Code of the Russian Federation, the financial department concluded that VAT deduction is impossible when purchasing goods at retail. Even the fact that VAT is listed as a separate line on the cash receipt does not allow taxpayers to make a deduction. The Ministry of Finance of the Russian Federation does not allow the accounting of VAT as part of income tax expenses - clause 2 of Art. 170 of the Tax Code of the Russian Federation does not provide for the possibility of including the amount of tax in the cost of goods. But according to paragraph 1 of Art. 170 of the Tax Code of the Russian Federation, in other cases, amounts of value added tax presented at the time of purchase of goods cannot be taken into account as part of income tax costs

.

General rules for applying deductions

The procedure for applying deductions for value added tax is regulated by paragraph 1 of Article 172 of the Tax Code of the Russian Federation. In general, this right arises when several conditions are simultaneously met.

Use in taxable transactions

To take advantage of the deduction, a company must use the property, work or services it acquired in an activity subject to value added tax. This conclusion can be drawn, for example, from a letter from the Russian Ministry of Finance dated June 1, 2010. No. 03-07-11/230.

If, when calculating income tax, expenses are taken into account according to standards, then the amount of the deduction must correspond to such standards. That is, for expenses that are recognized evenly over a certain period (without any norms), the deduction can be declared in full (letter of the Ministry of Finance of Russia dated October 5, 2011 No. 03-07-11/261).

Acceptance for registration

The right to deduction arises only after the acceptance of fixed assets, goods, works or services for accounting (Clause 1 of Article 172 of the Tax Code of the Russian Federation). Financiers also agree with this. This conclusion follows from letters dated October 28, 2011. No. 03-07-11/290, dated March 4, 2011 No. 03-07-14/09. In this case, the relevant documents must be drawn up in accordance with the accounting rules. The arbitrators explain that for the application of the deduction, the fact of capitalization itself is important, and not the account in which goods, work, services or fixed assets will be recorded (resolutions of the Federal Antimonopoly Service of the North-Western District dated January 27, 2012 No. A56-10457/2011, FAS Moscow District dated July 8 2011 No. KA-A41/6099-11).

Availability of invoice

VAT is deductible on the basis of an invoice (clause 1 of Article 172 of the Tax Code of the Russian Federation). It must be filled out in accordance with the requirements of Article 169 of the Tax Code of the Russian Federation and the Decree of the Government of the Russian Federation dated December 26, 2011. No. 1137 (hereinafter referred to as Resolution No. 1137).

Financial department specialists have repeatedly emphasized that the invoice is the main document according to which the buyer has the right to deduct tax.

VAT deduction on a cash receipt - the opinion of the courts

The courts turned out to be not as categorical on the issue of deducting VAT on a cash receipt as the Ministry of Finance of the Russian Federation. For example, the Presidium of the Supreme Arbitration Court indicated that when selling goods at retail for cash, the requirements for issuing invoices are recognized as fulfilled when the seller issues the buyer a cash receipt (or other document of the proper form) (clause 7 of Art. 168 of the Tax Code of the Russian Federation). Accordingly, the buyer has the right to deduct VAT if payment for goods was made taking into account value added tax. See Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 13, 2008 No. 17718/07, Resolution of the Federal Antimonopoly Service of the Moscow District dated August 20, 2007 No. KA-A40/7956-07.

How to account for VAT in advance reports

Expenditure of accountable funds is, as a rule, cash payments. In this connection, difficulties arise in the administration of VAT. Article 172 of the Tax Code of the Russian Federation determines that the basis for deducting value added tax is an invoice (IF).

Meanwhile, this document is issued in settlements with legal entities, most often for non-cash payments. In the case of spending accountable funds, the norm is cases when goods (works) are carried out as an individual, without issuing an invoice. This happens when making payments to retail companies and small firms.

Documents required for VAT deduction

If the specified document is issued, then it is not difficult to take into account the amount of tax. These amounts are posted as input VAT with subsequent deduction.

There are two ways to reflect VAT in the advance report in accounting and tax accounting.

1. The method of reflecting VAT according to the approved advance report involves the following entries:

| Debit 20, 26, 44, 91 | Credit 71 | Amount according to the approved advance report |

| Debit19 | Credit 71 | VAT on expenses |

| Debit68 | Credit19 | VAT is accepted for deduction |

2. Method of reflection according to payment documents:

| Debit 20, 26, 44, 91 | Credit 60 | Amount of expenses according to payment documents |

| Debit 19 | Credit 60 | VAT amount in payment documents |

| Debit 60 | Credit 71 | Advance report approved |

| Debit 68 | Credit 19 | VAT is accepted for deduction |

If there is no SF, then the payer still has the opportunity to write off VAT. This is associated with possible claims from tax authorities, but the prospects for using this right are favorable.

When is VAT allowed to be deducted?

In the event that an LLC or individual entrepreneur who owns a store pays VAT, the purchase amount will include the amount of value added tax.

If the following conditions are met, input VAT is allowed to be deducted: (click to expand)

- the company has documents indicating the existence of the right to deduct VAT;

- the purchased goods were capitalized on the company’s balance sheet;

- goods were purchased for the purpose of carrying out production activities, resale or any other operations that are subject to value added tax.

As for the first point about the availability of documents proving the right to a tax deduction, this condition previously caused disputes with the Federal Tax Service. The Tax Service believes that the right to deduction is confirmed by only one document - the invoice issued by the seller. See Letter of the Ministry of Science of the Russian Federation dated May 13, 2004 No. 03-1-08/1191/ [email protected] The Ministry of Finance agreed with the decision of the Federal Tax Service, as evidenced by:

- Letter of the Ministry of Finance of the Russian Federation dated August 25, 2017 No. 03-07-14/54643;

- Letter of the Ministry of Finance of the Russian Federation dated January 12, 2020 No. 03-07-09/634;

- Letter of the Ministry of Finance of the Russian Federation dated June 2, 2020 No. 03-07-14/45605.

Important!

At the time of purchasing goods in a store, an invoice issued by the seller is not required. Typically, sellers issue only a sales receipt and a cash receipt.

As stated in the text of paragraph 7 of Art. 168 of the Tax Code of the Russian Federation, in the case of selling goods for cash, the requirements for issuing invoices and drawing up settlement documents are considered fully met if the buyer received a cash receipt or other document of the established form from the seller (for example, a strict reporting form). Accordingly, current tax legislation allows taxpayers to deduct VAT if:

- the product was purchased at a retail outlet;

- the seller did not issue an invoice;

- In the cash register and sales receipt, the VAT amount is highlighted as a separate line.

When an invoice is not used

However, in some cases, an invoice is not recognized as a basis for a deduction.

Import of goods into the territory of the Russian Federation

One of such cases is the importation of goods into the territory of the Russian Federation (clause 1 of Article 172 of the Tax Code of the Russian Federation). The general rule here is as follows: the customs declaration and payment documents confirming the actual payment of value added tax are registered in the purchase book (clause 17 of section II of Appendix No. 4 to Resolution No. 1137).

Capital contribution

When receiving property or intangible assets as a contribution to the authorized capital, the VAT on which was restored by the transferring party, documents that document the transfer of assets are required for deduction. They must indicate the restored tax amounts (clause 14 of section II of Appendix No. 4 to Resolution No. 1137).

Ticket deductions

The company can deduct tax on expenses for travel to and from the place of business travel, including the use of bedding on trains, as well as for rental housing (clause 1 of Article 172 of the Tax Code of the Russian Federation).

You can take advantage of this right by registering strict reporting forms (SRF) or copies thereof in the purchase book with the VAT amount highlighted in a separate line (clause 18 of section II of Appendix No. 4 to Resolution No. 1137). For example, when purchasing air tickets (letter from the Ministry of Finance of Russia dated September 21, 2012 No. 03-07-11/393).

The route/receipt of an electronic ticket is also considered a document of strict accountability (clause 2 of the order of the Ministry of Transport of Russia dated November 18, 2006 No. 134). Financiers are of the same opinion (letter dated January 10, 2013 No. 03-07-11/01).

Let us recall that the possibility of using strict reporting forms for travel documents is confirmed by paragraph 2 of the Regulations... approved by resolution of the Government of the Russian Federation dated May 6, 2008. No. 359 (hereinafter referred to as the Regulations).

Officials agree with this (letter of the Ministry of Finance of Russia dated December 3, 2013 No. 03-07-11/52565), but pay attention: only the amount of tax that is highlighted as a separate line in the strict reporting form is accepted for deduction. For example, this applies to BSO issued by hotels (letter of the Ministry of Finance of Russia dated November 21, 2012 No. 03-07-11/502).

If the company itself allocates the tax, then paragraph 6 of Article 168 of the Tax Code of the Russian Federation can serve as a justification for this. In accordance with it, when selling goods, works, services to an individual, that is, in this case to a posted worker, the tax is not allocated in the documents. However, such a position will have to be defended in court. If the enterprise is not ready for this, then it is better to include the entire cost of travel as part of other expenses associated with production and sales.

Requirements for BSO

It is important that the strict reporting form meets certain requirements (letter No. 03-07-11/502). Thus, it must be produced by printing or generated using automated systems (clause 4 of the Regulations). If the ticket does not indicate, for example, the cost of services, then the company will not be able to confirm the right to deduction (letter of the Ministry of Finance of Russia dated September 26, 2012 No. 03-07-11/398).

Note that if the strict reporting form is drawn up in a foreign language, the deduction is also legal. True, for this you need to translate information related to the deduction into Russian. There is no need to translate any other information. These are the explanations of officials regarding, for example, air tickets (letter from the Ministry of Finance of Russia dated October 1, 2013 No. 03-07-15/40623).

Suburban train ticket

A supporting document confirming travel expenses can also be a ticket for a commuter train, for example, an Aeroexpress. In this case, the control coupon of an electronic travel ticket (extract from the automated control system for passenger transportation on railway transport) is a document of strict accountability (clause 2 of the order of the Ministry of Transport of Russia dated August 21, 2012 No. 322).

Therefore, if the required details are available, the company has the right to register an Aeroexpress ticket in the purchase book, deducting the tax allocated in it.

VAT deduction on a cash receipt - conclusions

When an item is purchased at a retail store for cash, taxpayers are entitled to a VAT deduction based on the sales receipt, even if there is no invoice. The main thing is that the VAT amount is highlighted as a separate line in the goods and the cash receipt.

If a conflict arises with the tax service, you can refer to arbitration practice. The judges are of the opinion that it is impossible to refuse a VAT deduction only because of the absence of an invoice if there is a cash receipt or other document of the established form.

To avoid problems with the Federal Tax Service, whose inspectors refuse to deduct VAT in the absence of an invoice at the time of the on-site inspection, it is better to carry out the purchase and sale operation in special contract departments of retail stores

– specialists will issue an invoice, cash receipt order or invoice to the buyer who paid in cash. When the VAT amount is highlighted as a separate line in the listed documents, VAT can be deducted.

VAT deduction without invoice

There are no plans to cancel invoices, including for advances paid (letters dated October 17, 2013 No. 03-07-14/43330, dated October 9, 2013 No. 03-07-14/42124). At the same time, it is permissible to enter additional information into the invoice (letters dated April 3, 2012 No. 03-07-09/31, dated February 9, 2012 No. 03-07-15/17).

In addition, the invoice can be issued electronically. And the buyer has the right to deduct tax on the basis of such a document (letter of the Federal Tax Service of Russia dated February 6, 2014 No. GD-4-3 / [email protected] ).

Common mistakes

Error:

The taxpayer accepted VAT as a deduction after purchasing goods for cash in a retail store. In the cash receipt, VAT was not highlighted as a separate line.

A comment:

If the seller did not issue an invoice when purchasing goods at retail, VAT can be deducted on the basis of a sales or cash receipt, but the VAT amount must be highlighted on a separate line.

Error:

The purchased goods were not recorded on the company's balance sheet. The taxpayer accepted VAT for deduction on the basis of a cash receipt with the amount of value added tax highlighted as a separate line.

A comment:

In order to have grounds for deducting VAT, it is necessary to capitalize the purchased goods on the balance sheet of the enterprise, retain documents confirming the right to deduct, resell the goods or use them in the course of production activities or in carrying out other transactions subject to VAT.

Is it necessary to highlight VAT in advance reports?

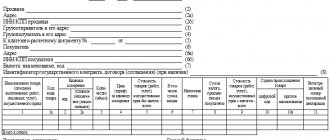

Let us remind you that information about the spent accountable amounts must be prepared in the form of an advance report on a unified form approved by the State Statistics Committee (AO-1). But the enterprise has the right to independently develop a report form containing the required details.

Important!

The advance report form, which is developed independently, must be approved by a local regulatory act (order).

There are no clear instructions for filling out the advance report form. Our experts recommend following general office rules when entering data. In addition, the form itself suggests that the allocated VAT must be indicated in the report.

Both on the front and back sides of the form there are columns for accounting entries indicating the correspondence of accounts. Obviously, the tax amount must be allocated for posting to account 19.

Answers to common questions about VAT deduction on a cash receipt

Question #1:

Can you be sure that the tax office, during an on-site audit, will not refuse to deduct VAT due to the lack of an invoice?

Answer:

The Federal Tax Service is of the opinion that VAT deductions can only be made if there is an invoice. Therefore, if the taxpayer only has a cash receipt in which VAT is highlighted as a separate line, claims from the tax inspectorate cannot be avoided, despite the fact that the opinion of the arbitration judges does not agree with the position of the Federal Tax Service. The only way to avoid claims is to complete the purchase of goods in a special contract department of the store, where sellers issue an invoice, delivery note and cash settlement for buyers who paid in cash.

Question #2:

There is a cash receipt for the purchase of goods in a retail store. Is it possible to deduct VAT without an invoice if the goods were not purchased for the purpose of using them in the business of the company?

Answer:

It is allowed to deduct VAT on the purchase of goods that were purchased for the purpose of resale or use in the economic activities of the enterprise. If the goods were purchased for other purposes, VAT cannot be deducted in any case.