Every year, thousands of Russian taxpayers fill out and submit VAT returns. Unfortunately, this procedure does not always occur without any incidents. Sometimes the sender makes certain mistakes that tax authorities require to be corrected.

Fortunately, in response to an incorrectly completed document, tax authorities send special VAT return error codes. In this article we will look at each of them in detail. We will also tell you what to do if one of the error codes 4 20.21 occurs.

Mandatory invoice details

Mandatory invoice details are determined by several paragraphs of Art. 169 Tax Code of the Russian Federation:

- item 5 - for registration of sales;

- clause 5.1 - for received advances;

- clause 5.2 - to make adjustments to sales data related to changes in volume or price and entailing a change in the total cost of sales and, accordingly, the amount of accrued VAT;

- clause 6 - for document signatures.

What has changed in invoices recently?

From 2020, they reflect the new VAT rate of 20%. This important change did not directly affect the form of the document, since the rate is not included in the form, but is added to the document when it is filled out. The form itself was adjusted in 2017, and this happened twice.

Read more about the changes here.

So, in paragraphs. 5, 5.1, 5.2 art. 169 of the Tax Code of the Russian Federation, Law dated April 3, 2017 No. 56-FZ, introduced additional subparagraphs, according to which another additional detail was introduced into invoices: “Identifier of the state contract, agreement (agreement) (if any).” This detail has become mandatory since 07/01/2017 and must be filled in if a sales invoice, advance or adjustment is issued under a government contract. The detail “Identifier of the state contract, agreement (agreement) (if any)” was introduced into the invoice form by Decree of the Government of the Russian Federation dated May 25, 2017 No. 625.

Since July 2020, the required invoice details include the code of the type of goods when exported to member countries of the EAEU (subparagraph “b”, paragraph 2 of the law of May 30, 2016 No. 150-FZ, subparagraph 15, paragraph 5 of Art. 169 of the Tax Code of the Russian Federation). However, until October 1, 2017, the invoice form did not contain such mandatory details and sellers when exporting to EAEU member countries had to indicate information about the code of the type of goods in additional lines and columns (letter of the Ministry of Finance of Russia dated November 14, 2016 No. 03-07-09 /66475). By Decree of the Government of the Russian Federation dated August 19, 2017 No. 981, the invoice form was supplemented with this detail. Based on the indicated articles of the Tax Code of the Russian Federation, two forms of invoices have been developed in Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137:

- The main one (Appendix 1), which is used when processing shipments, receiving advances and correcting technical errors in these documents.

- Adjustment (Appendix 2), which is issued when the volume or sales price changes. It contains additional lines to reflect differences arising in the cost of the goods and the amount of tax related to it.

ConsultantPlus experts have prepared step-by-step instructions, explaining the procedure for filling out an invoice line by line. If you don't have access to the system yet, get a trial demo access for free.

Now the invoice form, incl. corrective, is valid in this edition (from 10/01/2017). You can download the forms from our website.

See also article.

https://youtu.be/5dM3u0N7WmU

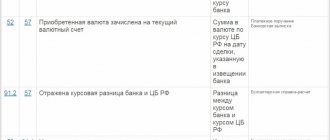

How to indicate the number from the customs declaration?

And one more change has been made to the invoice form, but it is no longer caused by amendments to the Tax Code of the Russian Federation. As a result of this change, column 11 will generally differ slightly from what the Tax Code requires.

After all, in paragraphs. 14 clause 5 art. 169 of the Tax Code of the Russian Federation states that the customs declaration number is indicated in the invoice. And column 11 will now be called “Registration number of the customs declaration.”