How to switch from USN 6 to USN 15 – Business Guide

A fairly common occurrence in the everyday life of entrepreneurs is the high rate of development or decline in business potential and, as a consequence, the transition of payers to another system or type of taxation. This direction did not bypass the “simplification”. So how to switch from 15 simplified tax system to 6 simplified tax system and vice versa ? This will be discussed in more detail in this article.

We also recommend reading: How to pay transport tax through State Services? Replacement of passport at 45 years of age. Who is entitled to tax benefits?

What is the difference?

Despite the fact that 15 simplified taxation systems and 6 simplified taxation systems belong to the same taxation system, the above tax objects have significant differences, for example:

- With a simplified tax system of 6%, an entrepreneur who has subordinate employees has the right to reduce the tax on the amount of contributions paid for employees, in turn, with a simplified tax system of 15%, a businessman has the right to reduce the tax base at the expense of existing expenses. Thus, all documented expenses are taken into account when determining the total tax amount.

- At 6 USN, the entrepreneur is not burdened with the obligation to pay the minimum tax, while at 15 USN there is a minimum tax limit, however, this regime provides the opportunity to carry forward losses.

- When using the tax object “income”, an entrepreneur with an unprofitable business only needs to submit a zero return, however, he will not be able to transfer these losses to next year’s expenses. A businessman using “income minus expenses” has the right to stipulate the transfer of expenses, but at the same time he is also obliged to pay tax, regardless of the profitability of the enterprise.

How to switch to the simplified tax system from 6 to 15?

So how can you switch from 6 to 15 under the simplified tax system ? The procedure for changing a tax object under the simplified taxation system can be carried out no more than once a year. For this purpose, the taxpayer must submit a notification in form No. 26.2-6 to the territorial office of the tax service.

This document is relevant both for replacing the object “ income ” with “ income minus expenses ” , and in the reverse order for switching to another type of simplified tax system.

The specified notification is submitted to the tax office located at the place of registration of the enterprise or registration of the individual entrepreneur.

The deadline for submitting a notification is December thirty-first of the year preceding the year in which it is planned to change the type of simplified taxation system. The agreed deadline requires mandatory fulfillment, since if it is missed next time, the opportunity to change the object of the simplified tax system will be provided to the interested person only next year.

When switching from the simplified tax system 6 to the simplified tax system 15 , it should be taken into account that if the deadline for submitting the relevant documentation falls on a weekend or holiday, then the specified period is extended until the next business day. However, it is not advisable to delay submitting documents; it is best to resolve this issue in advance, without waiting for the holidays.

The best way to submit the mentioned document to the tax office is a personal visit to the specified body by the taxpayer . To do this, first of all, the entrepreneur needs to draw up two samples of the relevant notification.

The first sample will be given to an authorized tax officer for reporting, the second, in turn, must be marked with a receipt of the document, which will serve as confirmation of the will of the taxpayer to change the “simplified” type, and will also give the latter the right to work under the new regime from next year .

Also, the notification can be delivered to the Federal Tax Service by mail . This option is not the most reliable, since taking into account the specifics of the work of post offices of the Russian Federation, this letter may simply be lost.

In addition, you can send a notification electronically using the Internet resource of the Federal Tax Service . To do this, the taxpayer must register on the official website of the tax service, then fill out the appropriate application and submit it remotely online.

At the same time, it should be understood that regardless of the chosen method of transferring the agreed documentation, tax authority officials do not issue any response documents allowing the use of the new rate under the simplified tax system.

This is precisely the main nuance of the notification procedure: the entrepreneur simply informs the Federal Tax Service authorities about his decision to change the object under the current tax regime, after which he begins to maintain his tax records according to the new procedure.

How to switch from USN 15 to USN 6?

The transition from a simplified tax system of 15 percent to a simplified tax system of 6 percent may be advisable only if part of the expenses of the total revenue is sixty percent or more.

The “income minus expenses” option does not have any restrictive rules. Thus, any enterprise or organization that meets the requirements of the simplified tax system as a whole can carry out the specified operation.

However, in this situation, taxpayers should carefully select suppliers, since deduction of costs from the tax base may only be possible if accompanied by supporting documentation.

Otherwise, the procedure for switching from simplified tax system 15 to simplified tax system 6 is no different from that previously given. As in the previous case, the entrepreneur is required to submit a notification in form No. 26.2-6, which must be sent to the competent authorities before December thirty-first of the current year.

Source:

Changing the simplified tax system 15 to 6

Step 2. Send a notification to the Federal Tax Service. Depending on your desire and convenience, you can:

- fill out the notification at home and submit it to the fiscal service in person. In this case, it is advisable to make 2 copies of the document: one for the Federal Tax Service specialists, the second for you with a note from the office about acceptance;

- send the document in paper form by mail. To do this, you will need to go to the nearest post office, where you can send a notification letter. Upon receipt of the document, the Federal Tax Service employee will sign for receipt, and you will be sent a “stub” with the date the document was accepted;

- use the electronic resource of the Federal Tax Service and send a notification via the Internet. To do this, you need to first register on the Federal Tax Service website.

The procedure for switching from the simplified tax system 6% to the simplified tax system 15%

Important

Add to favoritesSend by email The transition from simplified tax system 6% to simplified tax system 15% can be carried out subject to a number of conditions.

Let's look at them in this article, determine the procedure and documentary support for changing the object of taxation.

What is the simplified tax system Conditions for applying the simplified tax system How to switch to the simplified tax system The procedure for switching from the simplified tax system 6% to the simplified tax system 15% Results What is the simplified tax system The simplified tax system is a tax regime, which stands for “simplified taxation system.”

It implies a special procedure for paying taxes and simplified reporting. Many enterprises and individual entrepreneurs prefer to use this particular system, because...

it is one of the most economical in terms of paying taxes and is easy to account for, according to accountants who prepare reports and are responsible for reflecting all business transactions in accounting.

That is, simplification is a tax payment system that has more advantages than disadvantages.

How to switch from the standard 15% to the 6% standard and vice versa from 6% to 15%

If we are talking about an individual entrepreneur who pays contributions “for himself,” then in this case the amount of contributions can be taken into account in full. You cannot take expenses into account when calculating tax. Regardless of the amount of expenses incurred by you in the course of conducting business, you do not have the right to take into account the amount of such expenses when calculating the tax base.

How to switch from simplified tax system 15% to simplified tax system 6% and vice versa from 6% to 15%

The right to reduce the tax base due to expenses.

All expenses reflected in the Accounting Book and supported by documents are taken into account by the “USN agent” when calculating the tax (reduces the taxable base). Closed list of expenses taken into account. When calculating the tax, the “USN officer” has the right to take into account only those expenses that are specified in the Tax Code. If the costs of the “simplified tax” are not included in the closed list of tax codes, then the tax base cannot be reduced by their amount.

Source: https://business-gid.ru/zakon/kak-perejti-s-usn-6-na-usn-15.html

Some nuances of the transition

Finally, let's look at a few nuances so that you don't have any questions about switching to a new system. We will analyze very real situations and questions that aspiring entrepreneurs have.

- On December 10, 2020, individual entrepreneur Vasko Nikolay contacts the territorial office and submits an application to switch to a new taxation system. The application was delivered to the Federal Tax Service in person, one copy was given to the employee, the second was left with Vasko. Will the individual entrepreneur receive a notification about the successful transition to the new system? No, according to the law, the Federal Tax Service does not have to notify entrepreneurs or LLCs that changes are occurring. If the document is registered and taken into account, it will automatically switch to the new system from January 1, 2020.

- switched to a 15% income minus expenses system from January 1, 2018. At the same time, in December she purchased a batch of clothes worth 20 thousand rubles for the purpose of their subsequent sale. Can this money be converted into expenses? Since the purchase was made at a rate of 6%, it was not reflected in expenses. Since the sale was carried out in February 2020, that is, after applying the rate of income minus expenses of 15%, they can be included in expenses (with an amount of exactly 20 thousand rubles). The tax office will accept this option as correct, on the basis that the clothes were sold already in the new period.

As you can see, there is nothing particularly difficult about the transition. It is enough to simply draw up a corresponding application and send it to the tax office.

Attention:

The date of submission of the application is not important, the main thing is to submit it before the end of the year. The deadline for the official transition to the new system is January 1 next year.

Before moving on, compare the modes and decide whether such an action makes sense. As a rule, this is advisable if your expenses are quite high, but keep in mind that the tax authorities will not count the purchase of an air conditioner for the office or a 500-liter aquarium as expenses.

The procedure for switching from simplified tax system 15% to 6% and back

To switch from the simplified tax system of 15% to 6%, a certain number of formalities are required when preparing the relevant documentation. Below we will look at the detailed instructions. Also in this material you will find a link to a notification form that will need to be sent to your tax office.

Return

What is the simplified tax system?

The simplified taxation regime stands for “Simplified Taxation System”. It is based on a simpler form of reporting and a different procedure for making tax contributions. Many forms of legal entities use this tax accounting system as a basis, since it has a number of advantages.

Let us describe the advantages of this system:

- according to paragraph 14 of Article 346 of the Tax Code of the Russian Federation, in this system it is possible to choose the tax object “income taxes” (6%) or “income taxes minus expenses” (15%);

- the most economical tax accounting system;

- according to accountants, it allows for the simplest form of reporting;

- absence of other tax levies (property, VAT, etc.), but there are exceptions;

- Possibility of submitting declaration reports once per calendar year.

Note! Better than 6% or 15%, each legal entity must make its own choice. But if your expenditure is 55% and above, then it is better to work in the simplified taxation system of 15%.

Pay attention to Article 346 (clause 16) of the Tax Code - detailed information about which items can be written off as expenses when operating your legal entity.

Also keep in mind that it is prohibited to use two taxation objects at the same time on the simplified tax system: 6% and 15%.

Return

Conditions for applying the simplified tax system

In order for tax payers to find and apply this tax system, they must comply with the following basic conditions for its application:

- The number of employees in his company should not exceed 100 people;

- The revenue of this legal entity should not exceed 150 million rubles;

- The residual value of its fixed assets should not exceed 150 million rubles.

- A legal entity must not have branches and have shares in the authorized capital of other companies exceeding 25%;

- His type of activity should not be included in the list of those prohibited for the simplified tax system in accordance with Article 346 (clause 12) of the Tax Code.

Note! To increase VAT - https://fincan.ru/articles/57_povyshenije-nds-s-1-janvarya-2019-goda/.

Return

How to switch from simplified tax system 15% to 6%?

The taxpayer has the right to change the tax object at the beginning of the new calendar year, but an application for its change must be submitted before December 31 of the current year preceding the new calendar year.

To change the tax payment collection regime using the simplified system, the taxpayer must follow the following step-by-step instructions:

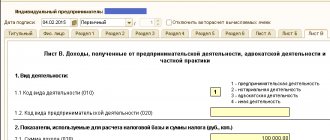

1) Fill out the form:

Pay attention to the designation in the column “Selected as an object of taxation”:

- 1 is a transition from 15% to 6% (on taxes only on income);

- 2 is the reverse transition from 6% to 15% (tax income minus expenses).

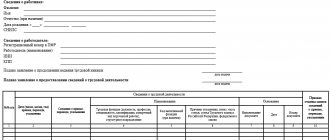

Sample form for transition from simplified tax system 15% to 6% (download in “.xls” format – obrazec-zapolnenia-blanka-perehoda-s-usn-15-na-6.xls – 11/02/2012 No. ММВ-7-3 /829) :

If, for example, your legal entity has the form of an LLC, then filling out this form will look like this (if you indicate the number 2, then do not forget to attach a document or a copy of it confirming the authority of the representative of your organization):

2) Submit to the Federal Tax Service

This completed notification form must be sent to your Federal Tax Service to which you are assigned. It is worth noting that the object of taxation can be changed at least every new year.

At the same time, the Federal Tax Service does not issue a document confirming the change of your tax object.

Therefore, if you fill out everything correctly the first time and manage to submit it before December 31, then from the 1st day of the new calendar year you can apply a new tax object (that is, work instead of the 15% regime in the 6% regime or vice versa).

When changing the tax object from “income” (6%) to “income - expenses”, it will be more advantageous to transfer payment for all work or services to a new calendar year (in which the change of object will occur), as well as the commissioning of fixed assets purchased under end of current of the year. This must be done in order to take them into account in the expenditure side when calculating the simplified tax system of 15%.

When changing the tax object from “income - expenses” (15%) to “income” (6%), the opposite is true, since in this case it is better, if possible, to pay for all the work or services that need to be taken into account in the expenditure side when calculating the tax, as well as pay for and put into operation fixed assets currently. year.

in “.xls” format – obrazec-zapolnenia-blanka-perehoda-s-usn-15-na-6.xls.

Source: https://fincan.ru/articles/69_kak-perejti-s-usn-15-na-6-i-naoborot/

Who will be denied a special regime?

The legislation does not allow everyone to benefit from simplified taxation. They do not have the right to switch to the simplified tax system (clause 3 of article 346.12 of the Tax Code of the Russian Federation):

insurers, banks, lawyers or notaries, private employment agencies;

gambling organizers;

investment and non-state pension funds;

persons who have switched to paying the Unified Agricultural Tax;

those who extract and sell minerals;

participants in production sharing agreements;

government and budgetary institutions.

Companies with branches also cannot use the simplified tax system. All others have the right to switch to the simplified tax system.

About separate divisions and branches

A ban on the use of the simplified tax system has been introduced in relation to companies with registered branches. But not every division is recognized as a branch. The concept of a separate division implies the creation of a stationary workplace (one or more) for a period of more than a month outside the location of the head office to represent and protect the interests of the legal entity. Unlike a branch (acting on the basis of an approved regulation), a subdivision is not endowed with the rights and functions of the parent organization (Article 55 of the Civil Code of the Russian Federation). In addition, in the state register of legal entities, a branch is indicated precisely as a branch.

This is important to know: Zero balance for an LLC on the simplified tax system: sample

For an entrepreneur: how to switch from 15 simplified tax system to 6 simplified tax system?

A fairly common occurrence in the everyday life of entrepreneurs is the high rate of development or decline in business potential and, as a consequence, the transition of payers to another system or type of taxation. This direction did not bypass the “simplification”. So how to switch from 15 simplified tax system to 6 simplified tax system and vice versa ? This will be discussed in more detail in this article.

We also recommend reading: How to pay transport tax through State Services? Replacement of passport at 45 years of age. Who is entitled to tax benefits?

Voluntary refusal

The tax inspectorate at the location of the organization must be notified of the voluntary refusal of the unified agricultural tax (clause 6 of article 346.3 of the Tax Code of the Russian Federation). This must be done no later than January 15 of the year from which the organization will apply a different taxation system. The recommended form of notification of refusal to apply the special regime was approved by Order of the Federal Tax Service of Russia dated January 28, 2013 No. ММВ-7-3/41.

When transitioning from the Unified Agricultural Tax to a general tax system or a simplified tax system, the organization must form a tax base for the transition period.

Transition from simplified tax system 6% to simplified tax system 15%

Good day! Today I will continue the topic of simplified taxation and tell you how you can switch from a 6% simplified tax system to a 15% simplified tax system.

The fact is that just the other day I myself went through this procedure at my tax office, although I switched from the simplified tax system of 15% to the simplified tax system of 6%, because they thought that this taxation would be more profitable for my organization.

I’ll probably start from the very beginning, I had to visit the tax office to close the UTII tax on which I had a store. For the store, it was decided to purchase a patent for my business, since the amount of taxes on the PSN turned out to be simply ridiculous - 30,000 rubles. per year, on the UTII tax for the organization, the tax amounted to 63,000 rubles. per month. The difference is simply gigantic, 20 times.

In order to close the UTII for the LLC, I submitted an application for UTII3 and asked the tax inspector how the organization could switch from the simplified tax system of 15% to the simplified tax system of 6%

. It turned out that there is a special notification that must be submitted to the tax office before the end of the year, since the transition can only be made from the beginning of the calendar year.

After explanations, the tax inspector gave me a notice in form No. 26.2-6 and said that it needed to be filled out and submitted to the Federal Tax Service.

The notification was on paper... ATTENTION from 2010! Arriving at the office, I decided not to fill it out manually from the tax office website and what was my surprise when I saw that the downloaded notification was from 2012.

I filled out a new notification and submitted it to the tax office, and when handing it in, I asked the tax inspector why they still have old-style notifications, which angered him a little and he simply said that they issue the notifications that they have and they accept them as new and old forms, this is where I became indignant.

What is the point of making different notifications of the same form, which are practically no different and, in addition, the tax office accepts both new and old forms?

My newer notification about the transition from the simplified tax system of 15% to the simplified tax system of 6% was accepted without any problems.

And they said that I would receive a notification that the simplified tax system had changed from 15% to 6% in a month.

Sometimes I myself don’t understand our tax office, sometimes they dig in to the last tick, or sometimes they don’t even pay attention to the fact that they themselves have outdated forms.

This is my story with the change of the tax regime from the simplified tax system Income minus Expenses to the simplified tax system Income.

This is, so to speak, a preface to the article itself, I hope I didn’t bore you too much, now let’s move directly to how to change the simplified tax system 6% to simplified tax system 15%.

How to switch from simplified tax system 6% to simplified tax system 15%

At the beginning, I’ll immediately point out that switching from simplified tax system 6% to simplified tax system 15% is the same as switching from simplified tax system 15% to simplified tax system 6%, here of course I mean that the same notification No. 26.2-6 is used

And let me remind you that the simplified tax system 6% is the simplified tax system for Income, and the simplified tax system 15% is the simplified tax system for income minus expenses.

Notification of transition from simplified tax system 6% to simplified tax system 15%

Especially for you, I am posting the latest version of the notification from 2012 on my Yandex Disk: download notification No. 26.2-6

This notification must be filled out, the procedure is simple, if you have a problem with this, I will post my completed notification below.

How to fill out notice No. 26.2-6

We look below the completed and accepted tax notice about the transition from the simplified tax system 15% to the simplified tax system 6%:

After filling out the notification, it must be printed in 2 copies. We put a stamp if there is one and our own painting. The tax inspector will take one of them, and on the second he will make a note that you handed it over and return it to you (this will confirm that you handed it over to the tax office).

When submitting notice No. 26.2-6 to the tax office, you do not need to notarize it yourself; just take your passport with you.

How to submit notice No. 26.2-6 by proxy

If a stranger submits a notification about a change in the simplified taxation system, he can do this only by proxy. In this case, notification No. 26.2-6 itself must be notarized and there must be a notarized power of attorney for the person who will submit this notification.

How to send notification No. 26.2-6 by letter

You can also send a notification about a change in the simplified tax system modes by a valuable letter with a list of attachments in the letter. When sending notification No. 26.2-6 by letter, it must also be notarized.

As I said above, you will receive a document from the tax office stating that you changed the simplified tax system from one to another in a month. And also, the fact that you can change one mode to another only from the new calendar year, there is no other way.

Currently, many entrepreneurs use this Internet accounting to switch to the simplified tax system, calculate taxes, contributions and submit reports online, try it for free. The service helped me save on accountant services and saved me from going to the tax office.

The procedure for state registration of an individual entrepreneur or LLC has now become even simpler. If you have not yet registered your business, prepare documents for registration completely free of charge without leaving your home through the online service I have tested: Registration of an individual entrepreneur or LLC for free in 15 minutes. All documents comply with the current legislation of the Russian Federation.

That's probably all! If you have any questions, write in the comments to the article or in my group on the VKontakte social network.

Good luck in business! Bye!

Source: https://biz911.net/nalogooblazhenie/nalogooblozhenie-usn/perekhod-s-naloga-usn-6-na-usn-15/

Rubric “Question and answer”

Question No. 1. 12/14/17 Individual Entrepreneur Murashkin submitted documents to the Federal Tax Service on the transition to the simplified tax system of 15%. Murashkin delivered the notification personally; Murashkin kept one copy of the document as confirmation of the application. From what moment is Murashkin considered a tax payer at rate 15? Does Murashkin need to receive additional notification from the Federal Tax Service?

The law does not oblige the Federal Tax Service to additionally inform payers about the transition from the simplified tax system of 6% to 15%. Based on the notification that Murashkin submitted on 12/14/17, he is considered a tax payer at a rate of 15% from 01/01/18.

Question No. 2. Zeus LLC, which previously used the simplified tax system of 6%, changed the regime to the simplified tax system of 15% from 01/01/18. In November 2020, Zeus purchased a batch of stationery for resale (cost 12,303 rubles). Stationery products were sold on 02/12/18 (sales price 18,401 rubles). How can Zeus take into account income and expenses from the sale of stationery?

The sale price (18,401 rubles) should be reflected in the income of the 1st quarter. 2020. Despite the fact that stationery was purchased during the period of application of the simplified tax system of 6%, their cost can be taken into account in expenses (RUB 12,303). Reason – stationery products were sold during the period of application of the simplified tax system of 15%.

The procedure for switching from the simplified tax system 6% to the simplified tax system 15% - all about taxes

05.10.2018

The transition from simplified tax system 6% to simplified tax system 15% can be carried out subject to a number of conditions. We will consider them in this article, we will give the opportunity to notify about the transition from one object of taxation of the simplified tax system to another, and we will also show a sample of filling.

What is the simplified tax system

Conditions for applying the simplified tax system

How to switch to simplified tax system

The procedure for switching from the simplified tax system 6% to the simplified tax system 15%

Results

What is the simplified tax system

STS is a tax regime that stands for “simplified taxation system.” It implies a special procedure for paying taxes and simplified reporting.

Many enterprises and individual entrepreneurs prefer to use this particular system, because... it is one of the most economical in terms of paying taxes and is easy to account for, according to accountants who prepare reports and are responsible for reflecting all business transactions in accounting.

That is, simplification is a tax payment system that has more advantages than disadvantages.

Its advantages are:

- the ability to choose one of the existing objects - “income” (basic tax rate - 6%) and “income minus expenses” (basic rate 15%) (Article 346.14 of the Tax Code of the Russian Federation);

- exemption (with some exceptions) from other types of payments to the budget (VAT, profit, property, personal income tax on business activities);

- simplified reporting;

- submitting the declaration once a year.

It is impossible to unequivocally answer the question which of the objects of taxation under the simplified tax system is more profitable. Organizations and individual entrepreneurs must decide for themselves what to use, depending on the type of their activity and the income they receive.

However, if the amount of expenses is 60% or more, there are grounds to use a taxable object at a rate of 15%. What expenses can be taken into account in the costs of an enterprise are reflected in Art. 346.16 Tax Code of the Russian Federation.

We draw your attention to the fact that it is unacceptable to use both simplified taxation system objects together.

How to switch to simplified tax system

The payer can switch to simplified payment in 2 ways:

- By submitting a notice of transfer to the Federal Tax Service together with the documents submitted upon registration within 30 days from the date of state registration (clause 2 of Article 346.13 of the Tax Code of the Russian Federation).

- By changing one system for calculating and paying taxes to another, you can switch to the simplified tax system starting next year by notifying the Federal Tax Service no later than December 31.

You can read about how to change the simplified tax system to another tax payment regime in the section “Transition from the simplified tax system to another regime.”

You will learn what will happen if you start applying the simplified tax system without submitting a notification from the material “Do not delay the transition to a simplified tax system.”

To find out whether you need to receive confirmation of the transition to the simplified tax system, read the article “Certificate of a simplified taxation system (STS).”

The tax period for the simplified tax system is a year during which it is not possible to change the system and object of taxation.

To switch from a simplified tax system of 6% to a simplified tax system of 15%, you must submit to the Federal Tax Service a notification of your desire to change the tax object before December 31. However, it will change only from next year. The document is drawn up by the taxpayer in accordance with Form 26.2-6 (preferably in 2 copies) and sent to the Federal Tax Service by mail or submitted in person.

View sample notification

“Notification of a change in the object of taxation.”

Source:

Features and procedure for transition from simplified tax system 6% to simplified tax system 15%

Legal entities and individual entrepreneurs using the simplified tax system and paying tax on income have the right to switch to the tax scheme “income minus expenses 15%”. In the article we will tell you about the transition from simplified tax system 6 to simplified tax system 15%, and we will answer what documents the simplified tax system officer needs to change the tax regime.

General information about the tax regime of the simplified tax system

Business entities using the simplified tax system under the “6% income” scheme are required to pay a tax amount of 6% of the income received, excluding reflected expenses.

This tax regime is beneficial to entrepreneurs and organizations that have a consistently low income, but do not incur regular expenses.

In addition, the legislation imposes minimum requirements for “USN” employees who pay tax at a rate of 6% regarding accounting and reporting.

If a “simplified person” receives a high income, but at the same time his activities involve regular expenses, then it is advisable for such a business entity to use the simplified tax system according to the “income minus expenses 15%” scheme. This tax regime allows the “USN agent” to reduce the tax base at the expense of incurred expenses.

Usn at a rate of 6% and 15%: pros and cons

When choosing a tax regime, take into account the specifics of your company’s activities, the level of income and expenses, and their regularity. Below we provide a comparative description of the regimes within the framework of the simplified tax system. If you are a simplified tax payer, then regardless of the chosen scheme (6% or 15%), you can take advantage of the following main advantages of the simplified regime:

Source: https://nalogmak.ru/zadolzhennost/poryadok-perehoda-s-usn-6-na-usn-15-vse-o-nalogah.html

Typical errors in calculations

Let's consider three main mistakes made by organizations and individual entrepreneurs when switching to a non-USN 15%.

Mistake #1. Transition to the simplified tax system of 15% during the reporting year.

Individual Entrepreneur Kukushkin is a payer of the simplified tax system of 6%. In June 2020, due to a change in the specifics of his activities and a significant increase in the level of expenses, Kukushkin submitted an application to change the regime - from the simplified tax system of 6% to 15%. From 07/01/17 Kukushkin calculates the tax at a rate of 15%, taking into account expenses incurred.

Kukushkin has the right to change the regime only from the beginning of next year (not earlier than 01/01/18). This rule applies to all taxpayers, regardless of the reasons for the regime change. Based on the notification submitted in June, Kukushkin becomes a tax payer at a rate of 15% from 01/01/18.

Mistake #2. Transfer of organizations - parties to the property trust management agreement.

Kursiv LLC is a party to the property trust management agreement. In December 2020, due to a decrease in expenses, Kursiv submitted a notice of change of regime to the simplified tax system of 6%. “Kursiv” does not have the right to change the regime to the simplified tax system of 6%, since the company is participating in a management agreement. This limitation is provided for in Art. 346.14 Tax Code. “Kursiv” can apply the simplified tax system only at a rate of 15%.

Mistake #3. Change of tax regime after reorganization.

In March 2020, Factor LLC (payer of the simplified tax system 6%) was reorganized into Vector LLC. Upon the fact of the reorganization, “Vector” filed a notice of change of regime to the simplified tax system of 15%. From 2nd quarter 2020 “Vector” pays advance tax at a rate of 16%.

For reorganized companies, the general rule for switching to the simplified tax system is 15%: organizations can change the regime only from the beginning of the year. The notification submitted by Vector in March 2020 is the basis for the application of the simplified tax system of 15% from 01/01/18.

The procedure for switching from the simplified tax system 6% to the simplified tax system 15% – State Collection Info

Most beginning entrepreneurs operate on a simplified taxation system, which allows them to save on taxes and simplify reporting as much as possible.

Moreover, almost all of them operate at a tax rate of 6% on income. But in some cases it may be more profitable to operate on an income minus expenses system.

In this article we will look at what is better than USN 6 or 15, and we will also tell you how to switch from one system to another.

Introduction

When registering, individual entrepreneurs usually choose the “6% income” scheme, committing to pay six percent tax on the income received. This is quite profitable and easy to calculate, so most individual entrepreneurs stay on it.

This tax is used by small entrepreneurs and firms that have low turnover and practically no expenses for organizing their business. But they always have the right to switch to another taxation system, for example, to “income minus expenses 15%”.

The transition is advisable when the company’s profitability is high, but at the same time it spends large sums on maintaining business activities. In general, this is beneficial if you engage outsourcers, rent capacity, etc.

All this can be recorded as expenses to reduce your tax bill.

USN - a convenient tax for small entrepreneurs

Advantages of the systems

To choose the right taxation system, you need to clearly understand the specifics of the company’s work, know general indicators and be able to calculate what will be more profitable for your company.

Before we talk about the transition from the simplified tax system 6 to the simplified tax system 15, let's compare how beneficial one and the other system is.

First, let’s look at what advantages a tax collector who works using these systems receives:

- Maximum simplification of tax payment and reporting. Unlike the classical system, individual entrepreneurs do not need to submit tax returns every month and report for each action. The simplifier submits a declaration once a year, and in case of overpayment/underpayment of tax, he pays the difference. The only documents he needs are the Book of Income and Expenses, which is filled out in accordance with established standards.

- Ability to work at variable rates. The fact is that regional authorities can change rates, reducing them in order to reduce the burden on entrepreneurs. This is done to stimulate payers in various areas of economic activity and production. For example, in some regions there is a tax rate of 2% on income, but according to the system, income minus expenses pays not 15, but only 5 percent. If an individual entrepreneur belongs to preferential categories, then a zero rate may apply to him (for example, a disabled person or a veteran).

- Individual entrepreneurs using the simplified tax system do not pay a large number of taxes. For example, he does not need to pay property tax, profit tax, or value added tax. Of course, this is beneficial for small companies, since they will not receive claims and will not be fined for violations by tax authorities.

As you can see, these taxes have something in common. Now let's look at the difference between them. Let's make a table to make it clearer and clearer.

| For a simplified tax rate of 6% | For a simplified tax rate of 15% | ||

| Advantages | Flaws | Advantages | Flaws |

| The individual entrepreneur receives the right to issue a tax deduction. | Expenses are not included in the tax calculation, that is, even if your expenses are more than your income, you will still have to pay. | The individual entrepreneur has the opportunity to reduce the rate by subtracting from it the expenditure portion reflected in the Accounting Book. | Not all expenses are recognized by the tax authorities as expenses. Their list is spelled out in the Tax Code, everything else is cut off. |

| There is no minimum payment amount. If there is no profit at the end of the year, then you do not need to pay - just submit a zero declaration. | Carrying forward losses is prohibited. If you worked at a loss for the past year or several years, then the losses cannot be transferred to expenses. | An individual entrepreneur has the right to transfer losses to expenses, thereby reducing the tax rate for the next year for the previous year. | Mandatory payment of taxes. You will have to pay taxes in any case, even if you have no profit or are unprofitable: you will be taxed at a rate of 1% of the income received. |

STS 6% is quite profitable if you have low expenses

As you can see, it is impossible to say unequivocally what is more profitable, since everything depends on the profile of the company, the profit received, the level of expenses, the region of work, etc. In addition, according to the Tax Code, some nuances of work apply to simplified taxation system officers.

For example, a simplified tax system at a rate of 6% can reduce its taxes due to the fact that it employs employees and pays appropriate contributions for them. That is, the contributions are summed up, 50% is taken from them and the resulting amount is deducted from the total tax amount.

If the entrepreneur pays himself, then the entire amount can be deducted. Further, the simplified tax system of 6% does not have to pay taxes if he has not received any income at all or has incurred losses.

The same nuances are present in the simplified tax system of 15%, so study the issue well before choosing one or another system, read the tax code or consult with a lawyer.

How the transition is made

So, you have decided to move from one system to another.

Practice shows that such a solution is advisable when expenses in the course of business activities grow higher than 50% of the income.

This happens often, especially during a crisis or due to sanctions, because the purchasing power of the population is constantly falling. Let's look at how to switch from USN 6 to USN 15 and where to go for this.

Let's look at the whole procedure step by step:

- You need to complete an application in Form 26.2–6. You can get the form from the tax office, download it and print it, or simply send it using the Federal Tax Service website in your personal account. The option of sending by registered mail or delivery through an intermediary is allowed if he has the appropriate power of attorney.

- The notification must be completed according to the attached instructions. If you fill it out manually, use a black pen, write in capital letters and make it as clear as possible. Errors or blots are unacceptable on the form; if they are made, they simply will not accept it from you. When submitting in paper form, two copies are made. They will take one from the tax office, ask them to leave the second one with you, making a corresponding note in the office. When transmitting electronically, second copies are not needed.

After this, your application is reviewed and a decision is made on transfer, and you are notified by letter that the procedure was successful. Usually, if you have no debts and there are no errors in the application, then no problems with the transfer arise.

The simplified tax system of 15% allows you to reduce taxes below 6 percent

To submit an application online, you need to register on the Federal Tax Service website, log into your personal account and send the appropriate notification through it. It should be remembered when transferring to a new regime.

Doing this in the middle or beginning of the year is pointless, since the transfer is carried out only from the new reporting period, that is, from the new year. You must submit your application before December 31st in order to be transferred from the new year, but since 31 are non-working days, the deadlines are usually postponed to the 9th.

We recommend submitting applications in early to mid-December, as there will be huge queues in the last days.

Mistakes Entrepreneurs Make

Let's look at the main mistakes when changing the tax system. Russian individual entrepreneurs quite often make the following inaccuracies:

- The change takes place in the middle of the year. A simple example: PE Ivanchuk understands that his expenses amounted to more than 50% of his income. He writes an application to the tax office and submits it on a general basis on May 20, 2018. He believes that since the application has been submitted, it has been transferred to another system, and recalculates the amount of taxes from June 2020. In fact, the transition will only occur on January 1, 2020, since it is possible only once in the reporting period. It doesn’t matter for what reasons Ivanchuk decided to change the system and from which one he is transferring to - accounting under the new one begins only on January 1. He will have to return the unpaid taxes, otherwise sanctions may be applied by the tax service.

- The transition is carried out not by the individual entrepreneur, but by the organization in which the agreement on the right of trust management is valid. Let us remind you that, according to Article 346 of the Tax Code, such enterprises do not have the right to transfer to the simplified tax system of 6%, since they operate on the basis of a management agreement. Accordingly, a transition to reduce taxation from a rate of 6% to a rate of 15% minus expenses is impossible for such a company.

- The transfer to the new regime is carried out immediately after the reorganization of the company. For example, in May 2020, Kizil LLC, which operated at a rate of 6%, filed an application for reorganization. The reorganization was successfully carried out, as a result of which Armavir LLC was formed, which began to work on a system of income minus expenses of 15%. Since July (the beginning of the third quarter), Armavir LLC has been paying taxes at the estimated rate of income minus expenses, which is a violation. The fact is that reorganized companies can switch to a different taxation regime within the framework of the simplified tax system only from the new year. Although the application submitted by Armavir was taken into account, it will work from January 1, 2020 . Therefore, the company will have to pay off the debt that has arisen, and also explain to employees that a mistake was made. Delaying payment will lead to the imposition of sanctions and extraordinary inspections, so we do not recommend delaying until the last minute.

Source: https://pravospb812.ru/dokumenty/poryadok-perehoda-s-usn-6-na-usn-15.html

What changes are planned

The latest news says that all individual entrepreneurs who are representatives of small businesses will face some changes. Some adjustments to the tax legislation have already been adopted, while others are just being prepared or are at the approval stage. Below are the main areas of the simplified tax system that will change.

Limits for transition

The conditions for the transition to the simplified tax system imply limits on the number of employees and on annual total income:

- The number of people working in the organization is no more than one hundred people on staff.

But starting from 2020, the transition criteria will be slightly changed. Thus, the Ministry of Finance proposed the introduction of the so-called second level of limits, for which increased rates will apply. That is, if an entrepreneur goes beyond the lower limits, he will pay a higher percentage to the Federal Tax Service.

The following limits apply for the second level:

- In terms of income: more than 150 million per year, but not more than 200 million.

- By number of employees: from one hundred to one hundred thirty.

If the indicators of an individual entrepreneur exceed the specified maximum limit values, then he loses his right to pay taxes under the simplified tax regulating system, switching to the main one.

Rates current for 2020

Rates for small businesses that do not exceed the limits will remain at the same levels in 2020:

- For the “Revenue” system, the figure is equal to 6 percent. But this parameter, established by federal legislation, is the maximum permissible: regional authorities can lower it to a minimum of 1%.

- When applying the “Income and Expenses” system for individual entrepreneurs, a rate of up to 15% will apply. But again, regional authorities are allowed to lower this figure to a minimum of five percent.

This is important to know: Closing an individual entrepreneur on the simplified tax system without employees in 2020

If an enterprise exceeds the limits of the lower first level, then it must move to the second (up to 130 employees and up to 200 million in income), at which increased interest will apply:

- When using the “Revenue” system, provided that the staff number is up to 130 employees and the profit amount is up to 200 million, an equal 8% rate will apply.

- If the “Income and Expenses” system is used, then if the lower limits are exceeded to 130 people in terms of the number of employees and up to 200 million in terms of profit, the rate increases to 20%.

For your information! The transition to new interest rates of taxation when the lower limits of the first limit level are exceeded will occur already in the current tax period, that is, in the quarter in which the indicators for employees and profits went beyond fixed limits.

New rules of the simplified tax system online

At the legislative level, it is planned to introduce a new regime for all individual entrepreneurs using online cash register systems, that is, online cash registers. Such organizations will be able to start using the simplified tax system online from July 1, 2020.

With the help of remotely operating cash register equipment (CCT), individual entrepreneurs will enter all income indicators and regularly transmit them online to the Federal Tax Service. The Federal Tax Service will automatically calculate tax amounts based on the data received.

The new STS-online mode will simplify calculations as much as possible and eliminate the need for paper reporting. That is, entrepreneurs using this program do not have to submit any documents to the Federal Tax Service (at the moment, declarations are accepted until April 30 for the previous year).

Helpful information! An entrepreneur will have to submit an application to switch to the simplified tax system online at the territorial tax authority. But the request form has not yet been prepared.

Cancellation of declarations

As already noted, an innovation is planned that involves the complete abolition of tax returns annually submitted by businessmen to the tax service. But only individual entrepreneurs who use remote cash register services (online cash register services), work according to the “Revenue” system and have chosen the online simplified tax system mode discussed above will be able to refuse them completely.

For your information! There will also be no need to keep books of income and expenses.

New contributions

In 2020, individual entrepreneurs should prepare for an increase in mandatory contributions. The following fixed amounts are established:

- The pension contribution will be 32 thousand and 448 rubles.

- Contributions for health insurance will be equal to a constant amount of 8 thousand 426 rubles.

Payment of the fixed contributions discussed above is carried out where the individual entrepreneur was registered. And the tax authority is indicated as the recipient.

Important! Exact amounts have not been finalized and may change. They can be found out in 2020 at the Federal Tax Service.

New accounting of fixed assets

Real estate expenses from 2020 will be taken into account much faster and easier. Thus, previously it was necessary to register ownership of a real estate property related to fixed assets. And only then was it transferred to the expense category.

Now an individual entrepreneur can write off fixed assets as expenses after payment for such objects and their commissioning. And even if the legislation requires mandatory registration of ownership rights, there is no longer a need to wait for it to be written off, which is much more convenient and profitable for businessmen.

Important information! If a single tax is paid by an organization according to a simplified scheme from the difference between income received and expenses taken into account, then income can simply be reduced by the value of intangible assets and basic finance received.

VAT upon transition to Unified Agricultural Tax

Entities that have chosen the Unified Agricultural Tax as the current regime are not recognized as VAT payers. At the same time, when issuing documents to counterparties with the amount of tax allocated in them, it will be necessary to transfer it later to the budget, without using the received VAT deductions. Amounts of input tax payers of the unified agricultural tax can be classified as expenses when determining the VAT tax base.

If the entity, before the transition to paying agricultural tax, accepted VAT on acquired property, including fixed assets, for deduction, there is no need to restore these amounts. Such an obligation arises only for persons who have transferred from the general regime to the simplified tax system or UTII.

Who can become a payer of the Unified Agricultural Tax

As I already said, both a legal entity and an individual entrepreneur can switch to the Unified Agricultural Tax. But for this you need to meet certain criteria. Which one exactly?

Only an agricultural producer can be a taxpayer under this special regime. Who is it?

According to the Tax Code of the Russian Federation, the following are recognized as agricultural producers:

- legal entities and individual entrepreneurs engaged in the production of agricultural products, their processing (this means both primary and subsequent (that is, industrial) processing) and the sale of these products. It is important here that income from this activity is equal to at least 70% of the taxpayer’s total income.

- agricultural consumer cooperatives (gardening, market gardening, livestock farming, as well as those processing agricultural products, selling them or working in the field of agricultural supply). At the same time, the criterion for the share of income of 70% also remains here!

- fisheries, fishery organizations and individual entrepreneurs, if: the average number of employees for the tax period is no more than 300 people;

- if the share of “core” income (sales of catch and market products) is at least the same 70% of total income;

- if they are engaged in fishing on vessels that are owned by them or used under a charter agreement.

What is considered agricultural products? This concept includes:

- crop products (not only agriculture, but also forestry);

- livestock products (including growing / growing fish and other biological water resources);

- catch of aquatic biological resources, fish and other products from them.

Summarize. To apply the Unified Agricultural Tax, you must meet the following criteria:

- Engage in production/processing/sale of agricultural products.

- The share of income from this activity must be equal to at least 70% of all income.

- For fisheries, there are additional restrictions in the form of the number of employees (up to 300 people) and the availability of their own and rented vessels.

Unified agricultural tax does not have the right to apply:

- Those who produce excisable goods;

- Those who work in the gambling business;

- State and budgetary institutions.