This can also lead to an error in accounting, a shortage or surplus and, as a consequence, additional tax charges, which will subsequently have to be defended in court;

- There are situations when your buyer is a state employee, and he has the right to spend money only on the product for which he was financed and, as a result, he insists on a certain name of the product;

- if you are engaged in production, you account for raw materials and components by their names and codes, which are indicated in your technical documentation, and they do not coincide with the names indicated by your supplier; and etc.

It is possible to assign your own name to goods and materials. There is no direct permission to assign received goods and materials a different name than that indicated in the supplier’s shipping documents and to reflect it in the primary documents in regulations.

Download a sample act of renaming a product

Employees may need a certificate about renaming an organization when applying for pensions, loans, etc.

On our website you can download a certificate of renaming an organization, a sample of which was developed by qualified lawyers. Secretary Ryzhova L.V. within no later than one working day from the date of publication of this order, bring this order to the attention of the persons specified in paragraphs.

In accordance with paragraph 8 of Article 9 of Law No. 996, liability for untimely preparation of primary documents and registers - confirmation of nomenclature, price, quantity of goods for a separate delivery; — confirmation of the total amount of payment for the delivery of goods Forms: Certificate of Product Conformity. Annex 1.

to the Instructions on the procedure. What documents are needed to sell peat from the Republic of Belarus and the Russian Federation. Samples of citizens' statements. Samples of court documents on the discovery of non-conformity in the quality and completeness of products. (goods) requirements of the standard or other documents Where can I find the delivery certificate for the goods.

What claims can tax authorities make?

Ensure the production of new Company letterheads, seals and stamps in the manner prescribed by the Instructions for Office Work (version No. 2), approved by Order No. 23-I dated 02.02.2010, by September 30, 2012.

When receiving goods, the accountant and storekeeper must draw up a name transfer act and endorse it from the employees who are members of the commission.

Or the situation is simpler, but also unpleasant: there is an error/typo in the product name in the supplier’s documents, and for some reason it is impossible to correct the documents.

The accountant is faced with questions: is it possible to reflect this product in your accounting under a different name? What does this mean for the company and its customers: will the tax inspector, when checking, consider that these are different goods? There is an opinion that “with the name we bought it with, we sell it with exactly the same name.”

Our service allows you to save a specialist from routine work: detailed proofreading after edits, correcting missing links, searching for errors and contradictions, filling out details. The built-in designer allows you to easily create and generate a sample certificate for renaming an organization.

Also, when creating an agreement, you automatically (instantly!) generate a package of related documents (applications, acts, schedules).

Employment contract, Additional agreement, Financial liability, Collective financial liability, Personnel transfer, Indexation, T-53 for ZUP 3 external (7 printed forms).

How bad is this? We receive it like a park bench, we serve it as Inspiration. Imagine that you are buying rubber blanks, and at the end - seals and stamps. We receive it as a park bench, serve it as Inspiration, etc.

How bad is this? If it’s just trade, then you’ll explain to the tax authorities that it’s the same thing))) The name cannot be changed, it’s something else, which means you’re modifying the product, and this is production.

The accountant needs to ensure that the initial receipt for the receipt of goods is linked to the act of renaming. To do this, it is fashionable to supplement the receipt order or act with a column with the details of the invoice and the act of renaming. Or make notes manually.

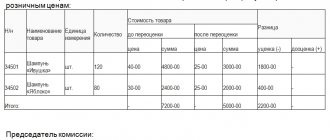

The chief accountant must draw up and approve by order of the manager the internal nomenclature of materials and goods, as well as a correspondence table with the names that. For more details on how to rename a product, see sample acts below.

For example: you are engaged in the export of goods and when exporting the goods you need to indicate in the customs declaration and transportation documents what is given in the Commodity Nomenclature. A huge nomenclature list will only make it difficult to control the accounting of inventory items. Order on approval of the nomenclature of cases sample (2016).

As for the order approving the nomenclature of cases as an independent normative act, it is more often an order of the head) of the internal document “Table of correspondence of product names.” Tests for an accountant.

All business transactions must be documented with primary documents. The requirements for the “primary” are given in paragraph 2 of Article 9 of the above-mentioned Law of November 21, 1996 No. 129-FZ. They say nothing about how the name of the product is correctly documented.

Next, let us turn to the papers that directly regulate the accounting of inventories in general and goods in particular.

Having analyzed all the regulatory documents on accounting that are necessary and sufficient to apply when accounting for goods, it is now possible to draw conclusions and answer the questions posed at the beginning of the study.

The accounting policy must state that for rational accounting of goods and materials, the company maintains it according to internal nomenclature. The order also needs to approve the procedure for renaming goods and materials, the form of the act and the composition of the commission.

The supplier, at its own expense, "___"________ 2013 eliminated the specified deficiency.

The need to account for goods and materials received under a name other than that indicated in the supplier's invoice occurs constantly for some companies, while for others it arises only from time to time.

Let’s figure out when such a renaming may be necessary and how to do it, so that later you don’t have to prove to the tax authorities that the printer supplied to you, for example, and the printing device accepted for accounting are one and the same.

Practical encyclopedia of an accountant All changes for 2020 have already been made to the berator by experts. In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents.

Why can you assign your own name to inventory items?

You may need to account for purchased inventory items under a name other than that indicated in your shipping documents by your supplier, in particular if:

Source: https://teatr-nuradilova.ru/korporativnoe-pravo/2587-akt-o-pereimenovanii-tovara-obrazec-skachat.html

Renaming an organization

Organize notification of all employees of the Company with the order by posting it on the Company’s information portal. 4. To the head of the IT department, V.M. Vasilkov: 4.1. Organize the introduction of changes in connection with the renaming of the Company into the Company's information systems by September 30, 2012. 4.2. Organize a change in the Company's Internet domain name to vgk.ru by September 30, 2012.

5. To the head of the material support department, O.I. Minkov: 5.1. Ensure the production of a new sign for the Company and its proper installation by September 30, 2012. 5.2. Carry out the necessary measures to re-register documents for the Company’s vehicles in the registration authorities of the State Traffic Safety Inspectorate by September 30, 2012.

6. Secretary Ryzhova L.V. within no later than one working day from the date of publication of this order, bring this order to the attention of the persons specified in paragraphs.

Certificate of renaming of goods sample

A copy of the Certificate of state registration of changes made to the constituent documents dated September 20, 2012.

for UAH 4517294437221 for 1 liter. in 1 copy. 2. A copy of the registered charter of VGK LLC (version No. 2) on 34 pages. in 1 copy. General Director Makov I.N.

Makov Order on renaming the organization Limited Liability Company "VGK" On renaming the Limited Liability Company "VEK" 1. Use the new name of the Company - Limited Liability Company "VGK" - in all documentation, information systems, as well as on the Internet on the website Society since September 20, 2012

2. To the head of the office N.K. Nosova: 2.1. Organize notification of counterparties under concluded agreements on the renaming of the Company in the form given in Appendix 1 to the order by September 30, 2012.

2.2.

Let's consider the requirements of each of the existing technical regulation systems regarding the possibility of using certificates of conformity with outdated information about the manufacturer.

To date, the issues of reissuing certificates, as well as the corresponding procedures, are not stipulated in any way in the legislation of the Customs Union. Let's analyze this problem using available documents related to the field of certification of goods according to the standards of the Customs Union.

There are also no clear instructions regarding the obligation to replace a product certificate when data about the manufacturer changes.

Documents regulating the requirements for re-issuance of declarations of product conformity:

- Regulations on the registration of a declaration of conformity of products with the requirements of technical regulations of the Customs Union (clauses 8, 11), adopted by decision of the Board of the Eurasian Economic Commission No. 76 of April 9, 2013.

- The procedure for accepting a declaration of conformity and its registration (clause 17), adopted by Decree of the Government of the Russian Federation No. 766 of July 7, 1999.

- the name of the product manufacturer or its applicant.

- The name is included in the content (clauses 1, 4, article 52 of the Civil Code of the Russian Federation):

- The name is not included in the standard charter if the enterprise (institution) chooses it as its constituent act (clauses

2, 3 of Article 52 of the Civil Code of the Russian Federation). It should be noted that currently no standard charter has been approved.

For what reasons is it possible to change the company name? They can be divided into two groups: The procedure we are analyzing has the following algorithm:

- company name, address, OGRN, INN;

- date and place of issue of the internal act;

- details of the name of the document “ORDER” and its number;

- the position of the signatory, his signature and its transcript.

We take into account purchased goods and materials under a different name

Different companies can sell the same product under different names.

For example, suiting fabric, woolen fabric, combed fabric - all this is the same fabric.

Elena Krasivtseva, chief accountant,

Samara The need to record purchased inventory items under a name other than that indicated by your supplier in its shipping documents may arise in you, in particular, if: In addition, accounting for inventory items must ensure control over their safety and use of items.

3, sub. “c” clause 6 of the Guidelines. A bloated nomenclature list, on the contrary, makes such control difficult. Tax officials are unlikely to begin “excavations” in your accounting, finding out how the goods and materials you renamed were called before.

Find out what: Order on declaration of gratitude sample - Advice from lawyers

They will simply refuse to deduct or refund VAT and charge additional income tax. These fears, as practice shows, are not in vain.

If the documents do not clearly show that you registered, sold or wrote off for production exactly what you bought, the tax authorities may impose additional charges: And exporters, due to a discrepancy in the names of the goods purchased and then exported abroad, may have difficulty confirming the zero VAT rates.

STEP 1. Secure by order of the director that for the purpose of proper accounting and control over the use of inventory items, your organization keeps records of them under the names specified in the internal nomenclature. STEP 2. Draw up and approve by order of the director:

- internal nomenclature of goods and materials;

- a table of correspondence of each name given there to all those names that your suppliers use for this position, as well as, separately, to those names that buyers require to be indicated in documents.

Thus, you will confirm the registration of purchased goods and materials under a different name, clause 1 of Art. 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”; P.

After all, you don't actually do anything with the product.

- Whiskers, paws, tail - these are my documents!, No. 22

- We are collecting a dossier on the counterparty, No. 18

- Is it possible to “sign” the initial document only by fax?, No. 18

- Lawyer master class: service agreement, No. 17

- Accounting reading of the supply agreement, No. 10

- Master class: checking the premises rental agreement, No. 7

- Exchange of experience: document flow on customer-supplied materials in construction, No. 5

- Who, other than the director, can sign the act of provision of services, No. 4

- Primary: how to save and... throw away, No. 2

- 2013

Order on approval of the list of cases

This can also lead to an error in accounting, a shortage or surplus and, as a consequence, additional tax charges, which will subsequently have to be defended in court;

- There are situations when your buyer is a state employee, and he has the right to spend money only on the product for which he was financed and, as a result, he insists on a certain name of the product;

- if you are engaged in production, you account for raw materials and components by their names and codes, which are indicated in your technical documentation, and they do not coincide with the names indicated by your supplier; and etc.

It is possible to assign your own name to goods and materials. There is no direct permission to assign received goods and materials a different name than that indicated in the supplier’s shipping documents and to reflect it in the primary documents in regulations.

The mechanism for maintaining the nomenclature of affairs at the enterprise should be approved by a separate order of the manager. Through it, it is legally established:

- the actual nomenclature of the company’s files (list of categories of documents used in the enterprise);

- responsibilities of specific employees for maintaining the approved list of cases.

The procedure for approving the nomenclature of cases in private companies is not regulated by the legislation of the Russian Federation. Another thing is budgetary organizations.

Secure by order of the director that for the purpose of proper accounting and control over the use of inventory items, your organization keeps records of them under the names specified in the internal nomenclature. STEP 2. Draw up and approve by order of the director:

internal nomenclature of goods and materials; a table of correspondence of each name given there to all those names that your suppliers use for this item, as well as - separately - those names that buyers require to indicate in documents. STEP 3.

When accepting goods, compare the name indicated in the supplier’s documents with the name from the internal nomenclature and, in accordance with the latter, register the inventory items. Many accounting and warehouse programs make it easy to automate this process. STEP 4.

Find out what: Payment guarantee letter - sample

Unified form TORG-1 - Certificate of acceptance of goods

Organizations received the right to independently develop certain forms of primary documents and approve them in their accounting policies. Forms from albums of unified forms are no longer mandatory for use in accounting. Own documents must have the required details, which are specified in Art.

9 of the current Law No. 402-FZ, for example:

- title of the document and its date;

- Name of the organization;

- nomenclature of goods, works and services (fact of a business transaction) and their measurement;

- Full name, position and signatures of the persons responsible for the transaction.

Order on renaming positions

If it is necessary to change the position title of an existing employee, then resort to drawing up an order to rename positions.

https://www.youtube.com/watch?v=qmEasXjiiR4

The document is convenient to use, but a number of nuances should be taken into account.

Changing the name of the position in which the employee is located, in accordance with Art.

57 of the Labor Code of the Russian Federation is considered an essential condition for changing the employment contract. Therefore, in order for the order to have legal force, it is necessary to prepare for its approval and signing. FOR EXAMPLE. Simply, “accountant” can be replaced by “materials accountant” or “deputy chief engineer” can be replaced by “senior engineer”, if this replacement cannot be avoided.

It is especially important to draw up such a paper if there are any harmful factors during the performance of duties. FOR YOUR INFORMATION! If an employee has signed a notice or agreement, the chances of winning his case are slim to none.

The dismissal of such an employee in the absence of vacant positions with the same name will be carried out officially and legally, in accordance with clause 7 of Art. 77 Labor Code of the Russian Federation. Attention! Renaming a position will not be considered a transfer.

Sale of goods under names other than receipt documents

nomenclature.

How bad is this? We receive the goods as a park bench, we serve them as Inspiration Hmm.

Imagine that you buy rubber blanks, and the output is seals and stamps. How legal is this? We receive the goods as a park bench, serve them as Inspiration, etc.

across the entire range. How bad is this? If it’s just trade, then you’ll explain to the tax authorities that it’s the same thing))) The name cannot be changed, it’s a different product, which means you’re modifying the product, and this is production. You must have a quality certificate for the product.

Naturally, this is actually production. They stuck their label on the product and changed the name. Completed, so to speak.

If there is some kind of certificate required (“which I personally doubt”), then the certificate issued by the supplier of these shops will do just fine. There is a list of goods subject to mandatory certification; if it is not the right product, rename it. Corrections: 1; the last one was at 02/14/2013, 17:18.

Source: https://fileddl.info/pereimenovanii-tovara-obrazets/

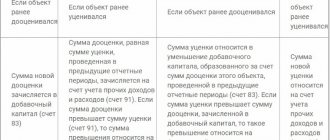

Unified form No. MX-15 - form and sample

The MX-15 is usually issued as a 3-page primary warehouse document.

It records a decrease in the price of inventory items (inventory items), which occurred for various reasons. Read more about this form and how to fill it out in our article. The result of the markdown of inventory items, made due to their obsolescence, decreased demand, when a deterioration in quality characteristics is detected, and for other reasons, is displayed in the MX-15 form. But most often, the second copy of the MX-15 is simply given to the financially responsible person at the warehouse where discounted goods are stored.

The markdown of goods is carried out by a commission, whose members are warned of liability for providing false information.

All commission members must sign Form MX-15 upon completion of the markdown. So, the act form consists of 3 pages.

Accounting for purchased inventory items under a name different from their name from the supplier

.

It often happens that the same goods, materials, and raw materials received from different suppliers have different names. For example, the same product may be: self-tapping screw, self-tapping screw, article 5025, Regulatory documents, which state the permission or prohibition to assign the name accepted in the organization to incoming goods and materials and reflect it in the primary documents accompanying the product/raw materials/materials from acceptance to sale or use not in production. In order to avoid claims from the tax authorities, it must clearly follow from the documents that it is the product/material/raw material that was registered that was sold or written off for production.

We recommend reading: What to do if your neighbors below are flooded

So what should you do to protect yourself?

Suppliers' documents contain different names of the same product: how to reflect it in accounting?

What is the problem: how to capitalize a similar product, the name of which differs from different suppliers.

There is a solution: to provide in the accounting policy the ability to create groups of homogeneous materials and assign your own item names.

Situation

In the supplier's receipt documents, the product is called “Teenage Backpack”. In the analytical accounting, the purchasing company lists a product with similar characteristics, but in the card this product has the name “Knapsack”.

Question:

What should a company do? Open a new item number in the item directory and a new material inventory card? Or can the products be combined under one number into one name?

Situation analysis and conclusions

There is a certain product in the item directory created by the enterprise, but in the supplier's receipt documents it is called differently. And it happens that different suppliers have their own names for the same product. Such situations are not uncommon.

What to do? Should we separate the “new product” into a separate nomenclature? But this leads to the fact that the reference book of items increases, making it difficult to find a product.

Unfortunately, this issue is not often covered in explanations, so enterprises are forced to make decisions on their own. But nevertheless, certain conclusions can be drawn from various sources.

Let's start with the main regulatory act on accounting - Law of July 16, 1999 No. 996-XIV. According to Part 2 of Art. 9 of this Law, one of the mandatory details of primary documents is the content, volume and unit of measurement of a business operation.

For goods this will be their name, quantity and their unit of measurement. That is, when selling a product, the supplier must clearly indicate its name.

It turns out that the buyer cannot change anything in his accounting, because he has the primary document?

Let's see what other regulatory documents tell us about this.

The main document regulating the accounting of inventories at an enterprise is P(S)BU 9 “Inventories”. In particular, clause 7 of the standard stipulates that the unit of accounting for inventories is their name or homogeneous group (type)

. That is, P(S)BU allows you to choose what is more convenient for accounting.

There are also Methodological Recommendations approved by Order of the Ministry of Finance dated January 10, 2007 No. 2. And there in paragraph 1.4 it is said that in order to organize inventory accounting, an administrative document approved by the owner of the enterprise determines:

- document flow rules and technology for processing accounting information, the procedure for controlling the movement of inventories and the responsibility of officials;

- the procedure for analytical accounting of reserves;

- unit of physical measurement of inventory for each accounting unit.

That is, the procedure for forming a material accounting unit must be prescribed in the administrative document. For example, in an order on accounting policies.

It is in the accounting policy that the enterprise records all the inherent features of accounting for business operations, for which there may be several options for reflection.

There is also one old letter from the USSR Ministry of Finance dated April 30, 1974 No. 103, from which it follows that nomenclatures of materials are created by name or by a homogeneous interchangeable group

. In paragraph 7 of section.

In the first appendix to this letter, the Ministry of Finance indicated that in order to improve accounting, it is advisable to determine the appropriate number of accounting groups of materials, while avoiding their excessive consolidation.

However, in some cases, consolidation of item numbers may be allowed by combining several sizes, grades, and types of homogeneous materials into one item number. That is, for the correct and rational organization of material accounting, it is necessary to use nomenclatures that are developed for a group of materials.

So, based on the analysis of regulations and letters, we realized that it is possible to assign a proper name to inventory items.

We offer a solution

How can I assign my own name to the purchased material? We recommend the following algorithm of actions:

1.

Fix the procedure for forming an inventory accounting unit in the accounting policy (see

sample 1

).

2.

Develop a table as an appendix to the accounting policy order in which enterprise employees will be able to reflect and combine into groups goods received from suppliers with different names.

Name such a document, for example, “Name Correspondence Table” (see sample 2

):

3.

Make changes to the Table as necessary.

This document, approved by the head of the enterprise, will be the basis for assigning proper names to goods (materials) purchased from the supplier. For example, in the situation under consideration, the following information will be entered into the Table (see sample 3

).

Sample 1

2.3.

The unit of inventory accounting is their name or group of similar inventories. Groups are created in the event of the acquisition of inventory items similar in their characteristics with different names.

In order to streamline the reflection of purchased goods and materials in accordance with the reference book of items and combine such materials into groups, record information on the assignment of proper names in the Item Conformity Table in the approved form (Appendix 3).

Sample 2

APPROVED: Director of Kvitka LLC _________________________

M.P.

Name correspondence table

Sample 3

The question may arise:

How to fill out documents in case of returning goods?

In such a situation, you will have to indicate in the documents the name that was originally indicated on the supplier’s delivery note and invoice. If you use an accounting program, then you can add a note to the product card with the name of the product according to the supplier’s primary documents. Or use the completed Correspondence Table.

If necessary, the purchasing enterprise can capitalize inventory items under a name other than that indicated in the supplier’s documents, based on its unified reference book of items.

To do this, we recommend that you draw up, for example, a Name Correspondence Table (as an appendix to the order on accounting policies). The table will allow us to draw a conclusion about the identity of the names of inventory items.

Then the fiscal authorities will have no complaints.

Source: https://uteka.ua/publication/commerce-12-dokumentooborot-2-v-dokumentax-postavshhikov-raznye-nazvaniya-odnogo-tovara-kak-otrazit-v-uchete

Equipment replacement act

Equipment of significant value includes equipment whose cost exceeds 40 thousand rubles. If the breakdown occurred specifically with equipment from the “especially valuable” category, then in order to replace it you need not only to draw up a report, but also to issue a return of the goods to the seller (if the warranty period has not yet expired). You will also need to compile, (valuable property belongs to this accounting line) and do.

The acceptance of new equipment that has come to replace the old one must also be formalized with a transfer and acceptance certificate and a new one must be assigned to it.

Strict adherence to this procedure will allow you to avoid possible claims from regulatory structures and counterparties - equipment suppliers.

If you are entrusted with the function of drawing up an equipment replacement act, and you do not have a very good idea of how exactly to do this, we will give you some useful recommendations.

Changing the name of a product when selling how to legalize it

However, this was soon abandoned, among other reasons, due to customer dissatisfaction.

They were not happy with the situation when, under an agreement concluded for the supply of ten woolen hats, during shipment we gave them documents for seven knitted hats and three colored earflaps, despite the fact that these were absolutely identical hats from the same manufacturer, they simply came from different suppliers "

Elena Krasivtseva, chief accountant, Samara The need to record purchased inventory items under a name other than that indicated in your shipping documents by your supplier may arise, in particular, if:

- you purchase the same property from several suppliers, each of which names this product in its own way and all in different ways. If goods arrive from each batch under the name specified by the supplier, you will have to take into account the same thing under a dozen different names.

The Tax Code of the Russian Federation recognizes as expenses justified and documented expenses incurred (incurred) by the taxpayer. Justified expenses mean economically justified expenses, the assessment of which is expressed in monetary form.

Documented expenses mean expenses confirmed (in particular) by documents drawn up in accordance with the legislation of the Russian Federation. In addition to documentary evidence and economic justification of costs, paragraph 4 of clause 1 of Art.

252 of the Tax Code of the Russian Federation establishes a rule: any expenses are recognized as expenses, provided that they are incurred to carry out activities aimed at generating income.

We take into account purchased goods and materials under a different name

There is no need to despair! As a rule, such claims from the tax authorities can be eliminated at the stage of consideration of the tax audit materials by filing an objection to the on-site tax audit report or filing an appeal against the decision to prosecute for a tax offense to a higher tax authority. If the issue cannot be resolved at the pre-trial settlement stage, then it is worth going to court. To avoid a controversial situation with the tax authorities, it is necessary to rename the goods and materials so that you can clearly identify that you purchased from the supplier exactly those goods and materials that are indicated both in his documents and in yours. In your actions, you need to build on how often you need to change the name of incoming valuables, i.e. on an ongoing basis or is this just a one-time need.

Act on changing the name of the product

An order to rename a company - a sample can be downloaded in our article - is issued when a decision is made about the need to change the name of the organization. Read on to learn about some of the nuances of this process and the procedure for issuing a renaming order.

Sample order for renaming.doc

There are several reasons why you can change the name of an existing LLC.

Thus, the name of an LLC can be changed either voluntarily or forcibly, and the basis for changing the name in the charter and, accordingly, the register of legal entities will not be an order, but a decision of the participants or the competent authority.

The role of the order is to bring all the documentation of the company into conformity with the changed charter: rename the company in the accounting documents, change the seal and stamps, and the letterhead.

The basic requirements for the name of the organization are specified in Art.

1473 of the Civil Code of the Russian Federation and are disclosed in our article “How to choose the right LLC name when opening?”

Changing the name of an organization consists of the following steps:

All partners of the legal entity are notified of the procedure performed.

If the name has changed due to the reorganization of the company, then all documentation will need to not only be brought into compliance, but updated. Accounting and registration of documents occurs anew, from the first number.

https://www.youtube.com/watch?v=zpL8fhYpc2Q

Since the new name has not yet come into use by the organization before the order to rename the LLC is issued, the order is issued on the old form.

The order to rename the LLC contains:

Thus, the issuance of an order to rename the LLC allows us to begin work on bringing the company’s documentation into compliance with the new charter.

Renaming a product

Thus, from the literal interpretation of these norms it follows that it is necessary to accept the purchased goods for accounting in accordance with the names indicated by the supplier (seller) in the primary documents.

However, regulatory acts in the field of accounting do not contain a direct prohibition on renaming goods or assigning a unified name to homogeneous goods.

These documents refer only to accounting units and units of measurement of inventory items (TMV), namely:

Also, tax legislation does not contain the rule that the name received from the supplier (seller) must coincide with the name of the goods received by the organization.

Accordingly, the organization has the right to rename goods received from the supplier (seller) and intended for resale.

For example, according to the supplier’s documents, an organization purchases “Cow’s Milk” and later sells it as “Milk”.

In this case, the connection between the goods purchased and sold under a different name must be confirmed. To do this you need:

There is no need to register the renaming of a product for sale under a different name as a refurbishment or modification, if in fact no additional work was carried out.

The answer to this question and additional information can be found in the Service at the following link:

This answer is prepared based on the information contained in the question.

If the question referred to a different situation, it is necessary to specify it, outlining it in as much detail as possible.

In this case, the answer can be obtained with a greater degree of accuracy.

All operations of the organization’s economic activities must be documented (confirmed) by primary accounting documents, including the movement (receipt, movement, consumption) of goods intended for resale (Part 1 of Article 9.

How to officially rename a product?

The issue of the name of the product during purchase and sale is rather not a legal problem but an accounting (reporting) problem.

After purchase, you are actually the owner of the product and have the right to do with it as you please, including renaming it (legal aspect).

Reporting point: how are you going to prove that the product you purchased and sold under a different name is the same?

From a legal point of view, renaming is formalized as follows:

1.

The goods are recorded under the name under which they came from the supplier.

2. An order is issued from the owner to rename (separately for each batch of goods): “I order to rename...”

3.

A renaming act is drawn up: goods under the old name = goods under the new name. Each unit of goods is separately, with a separate serial number assigned.

4.

Source: https://dolgoletie126.ru/akt-ob-izmenenii-naimenovanija-tovara-15848/

Accounting for purchased inventory items under a name different from their name from the supplier

In order to avoid claims from the tax authorities, it must clearly follow from the documents that it is the product/material/raw material that was registered that was sold or written off for production.

So what should you do to protect yourself?

After these activities, in accordance with the inventory, the goods and materials are registered according to the name of the internal nomenclature in accordance with the correspondence table.

How to correctly draw up an order to rename an employee’s position

Among the benefits mentioned in the Labor Code, one of the most common is early retirement.

An employee of the human resources department of the mainline railway is preparing to hire a catenary electrician. What regulatory documents need to be looked at in order not to violate the rights of an employee by making an erroneous entry in his work book? In the last document we find:

"Contact line electrician employed on mainline railways"

.

Risks of renaming received goods

Next, this internal nomenclature should be drawn up and approved by order. In addition, it is imperative to draw up a table of correspondence between the names of goods used by suppliers (names specified in documents from suppliers) and the names of the internal nomenclature.

Separately, for cases when buyers ask to indicate certain names of certain goods in documents, make a table of correspondence between the names of the internal nomenclature and the names of buyers.

for free

December 07, 2019

The Ministry of Finance of Russia has prepared guidelines for the application of the transitional provisions of the GHS “Fixed Assets” in relation to issues of reflection in accounting on the corresponding balance sheet accounts of real estate assets.

This article discusses the issue of bringing to administrative liability for filing knowingly unreliable budget reports.

Business activity in all segments of SMEs - micro, small and medium-sized businesses - is growing, the RSBI Support Index showed for the third quarter of 2020.

23 percent of surveyed businessmen reported an increase in revenue; 35 percent expect sales growth in the fourth quarter.

Russian President Vladimir Putin signed laws changing the procedure for calculating and paying VAT from 2020 and 2020.

The procedure for registering the disposal of fixed assets in a company

The most common situations of disposal of fixed assets from production activity are associated with one of the following circumstances:

- the company decided to sell the OS;

- The enterprise's fixed assets are recognized as subject to write-off.

Each of the above circumstances requires specific documentation.

If a company sells its OS, then, as in the case of a purchase, it is necessary to draw up an acceptance certificate for the OS (clause 81 of guidelines No. 91n). It is drawn up according to the rules and forms described above in relation to the situation with the receipt of OS by the company. That is, if a company sells an asset that is not a building, then the act can be drawn up in the OS-1 form. If the building is being sold, then the most suitable template for the act is OS-1a. And in the case when a company simultaneously sells a group of homogeneous fixed assets, the disposal should be formalized by act OS-1b.

NOTE! The above acts should be drawn up not only in a situation where the OS is directly sold, but also when an object is transferred by a company to the authorized capital of another organization, as well as when transferred free of charge to a third party.

Such documents must be completed in any case, regardless of who the buyer is (an individual or a company). This was indicated by the Department of Tax Administration of the Russian Federation for Moscow in a letter dated May 17, 2004 No. 26-12/33266.

The second possible option is that the company’s OS is outdated, has completely served the allotted time period, or has broken down as a result of the influence of some external factors, while restoring or repairing such an OS is not economically feasible for the company. Such an OS should be decommissioned.

But for this, paragraph 77 of methodological instructions No. 91n requires the creation of a special commission of production experts who will decide whether such an OS should be written off or not.

If such a commission decides not to restore an asset, but to write it off completely, then after receiving a written decision of the commission, the company will have to document the fact of disposal of the asset with a special act. Its form, as well as according to the previously described documents, can be developed by the company independently or selected from standardized ones. In the latter case, these will be the following forms:

- OS-4 - if the company writes off one asset that is not a motor vehicle (for motor transport, form OS-4a should be used);

- OS-4b - when not one fixed asset is written off, but a group of similar ones.

After the act of disposal of the fixed assets is drawn up, the accounting specialist puts a mark on the inventory card of the object that the fixed assets have been disposed of.

For information about what entries are made when disposing of fixed assets and how to calculate the retirement ratio, read the article . ”

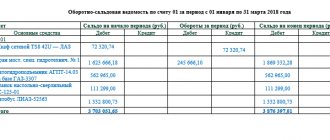

Transition to the application of the standard for fixed assets

The concepts of fixed assets defined by the GHS “Fixed Assets” and Instruction No. 157n differ.

Let's compare them. Fixed assets accounted for in the corresponding analytical accounts of account 0 101 00 000 are in accordance with the GHS “Fixed assets in accordance with Instruction No. 157n Material assets, regardless of their cost, with a useful life of more than 12 months, intended for repeated or permanent use by the entity accounting on the right of operational management (the right of ownership and (or) use of property arising under a lease agreement (property lease) or an agreement for free use) in order to perform state (municipal) powers (functions), carry out activities to perform work, provide

Calculation of depreciation using the reducing balance method

After amendments are made to PBU 6/01, any organization can calculate depreciation on fixed assets using the reducing balance method. To do this, she needs to determine the value of the acceleration coefficient (not higher than 3) and consolidate it in the accounting policy.

It should be remembered that the method of calculating depreciation is applied to a group of homogeneous fixed assets. And it should be applied throughout the entire useful life of these objects. Consequently, for those fixed assets for which before January 1, 2006 the organization calculated depreciation in a different way, nothing can be changed.

Using the reducing balance method using an acceleration factor, you can calculate depreciation only for those fixed assets that were acquired after this date. Provided that appropriate changes are made to the accounting policies for 2006.

Example. The management of Coliseum LLC decided to calculate depreciation on office equipment using the reducing balance method.

The acceleration factor used when calculating depreciation is set to 3.

The organization purchased a computer worth 30,000 rubles. (excluding VAT). The useful life for accounting purposes is 5 years. The annual depreciation rate was 20% (1: 5 years x 100%).

In the first year, the organization must write off 18,000 rubles. (RUB 30,000 x 20% x 3); monthly it will include 1,500 rubles in depreciation charges. (RUB 18,000: 12 months);

- in the second year - 7200 rubles. ((30,000 rub. - 18,000 rub.) x 20% x 3), monthly - 600 rub.;

- in the third year - 2880 rubles. ((30,000 rub. - 18,000 rub. - 7,200 rub.) x 20% x 3), monthly - 240 rub.;

- in the fourth year - 1152 rubles. ((4800 rub. - 2880 rub.) x 20% x 3), monthly - 96 rub.;

- in the fifth year - 461 rubles. ((1920 rubles - 1152 rubles) x 20% x 3), monthly - 38.42 rubles.

The balance of under-depreciated cost in the amount of RUB 307. should be additionally written off in the last month of the fifth year.

Order on approval of the list of cases

PBU 1/2008 “Accounting policy of the organization”, approved. By Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n. Obviously, accounting for the same thing under different names cannot be called rational (due to an unjustified increase in item items, the need to track the write-off of inventory items exactly under the name under which they are registered, etc.).

In addition, accounting for inventory items must ensure control over their safety and use. 3, sub. “c” clause 6 of the Guidelines. A bloated nomenclature list, on the contrary, makes such control difficult.

As you can see, if you begin to assign names to the purchased goods and materials based on your needs, this will not contradict the principles of accounting. The main thing is that these names correspond to reality and allow you to correctly identify goods and materials (obviously, you cannot call a table a chair). Guidelines for accounting of MPZp.

- VAT, removing the deduction of input tax on purchased goods and materials due to the fact that you did not take them into account.

Then I write in TORG-12 the name they require, and in parentheses I indicate the one under which the product is registered with us, for example, “Semi-linen canvas (Tarpaulin).” Often this compromise suits the buyer.”

- your buyer insists on a certain name, but it does not match the one indicated in the shipping documents by your supplier.

Methodical instructions); — control over the safety of inventories in places of their storage (operation) and at all stages of their movement (clauses

Having considered the issue, we came to the following conclusion: In the absence of documentary confirmation from the registration authority about the introduction of appropriate changes to the Unified State Register of Legal Entities, the accounting department has no reason to indicate a new name in the primary documents (invoices).

We see no reason to adjust the executed primary documents and invoices issued (accepted) by the organization before receiving confirmation from the registration authority that the corresponding changes have been made to the Unified State Register of Legal Entities.

We recommend that you familiarize yourself with the following materials: - Resolution of the Arbitration Court of the Volga District of November 26, 2014 No. F06-17753/13 in case No. A06-2423/2014; - Resolution of the Volga District Arbitration Court dated October 15, 2014.

N F06-15848/13 in case N A65-27018/2013.

Expert of the Legal Consulting Service GARANT Reviewer of the Legal Consulting Service GARANT The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

Grounds for making changes to the work book

According to the Instructions for filling out work books, approved by Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69, the work book of each employee must contain the full name of the organization and an abbreviated version (if available). In this case, you cannot enter only an abbreviated name without indicating the full name.

This means that after the company where the employee works has changed its name, this must be reflected in the work book.

Find out more about the procedure for filling out work books here.

The basis for making changes to the work book will be the internal administrative document on the change of name. This could be an order, resolution, decision of a meeting of founders, etc.

Only after the publication of this document can new entries be made in the work book.