Why do debt collectors call?

In accordance with Russian legislation, collection organizations are legal entities whose activities are aimed at returning the debtor’s overdue financial obligations to a bank or microfinance organization.

At the same time, collectors have the right to carry out their activities on the basis of an agency agreement (representing the interests of the bank before the debtor) or an assignment agreement (assignment of rights to claim debt). An important point: if collectors contact you, you must carefully review the credit (loan) agreement. The agreement may contain a clause according to which the bank (MFI) does not have the right to resell the existing debt to third parties. Consequently, collection organizations cannot work on the return of existing debt. Thus, the collectors are employees of the relevant agencies. In theory, collectors are a link between the debtor and the bank, and their activity mainly consists of pre-trial decisions on the return of funds using legal methods. In practice, in addition to these legal methods of returning overdue debts, collection agencies also use methods of psychological pressure and intimidation of persons with overdue and outstanding financial obligations.

Federal Law No. 230 outlined the following ways and methods of interaction between collection organizations and the debtor:

- calls;

- personal meetings;

- telephone and telegraph messages;

- postal items.

Collectors are calling about a debt.

If the debtor has an overdue outstanding debt, calls from collection organizations cannot be avoided. However, you shouldn't be afraid of them. This is a completely “ordinary” procedure for interacting with collectors. The “scenario” of calls is usually like this: An employee of a collection agency calls you. According to the law, he must introduce himself: give his last name, first name and patronymic. He must also indicate the name of the organization whose interests he represents. Next, the debtor must be informed of the amount of the existing debt. In particular, the collector can offer options for resolving the debt dispute that has arisen. The conversation with bona fide collection organizations occurs in a similar way. Unfortunately, telephone conversations do not always take place in a constructive manner and not in a raised voice. Let's look at examples of other, “non-ideal” telephone calls between debt collectors and debtors.

- employees of collection organizations call from “hidden” numbers. According to current legislation, it is prohibited to hide information and the telephone number from which collection agencies contact the debtor through calls and SMS messages. The very fact of using “hidden” numbers speaks not only of a violation of the law by collectors, but also of dishonesty of activity.

- collectors call without introducing themselves or indicating the organization they represent. If the caller refuses to provide such information, you can safely end the telephone conversation. You are not obligated to provide any information to a person whose identity and occupation is unknown.

- During the conversation, employees of the collection organization ask you to clarify your data (for example, date of birth, address of registration and actual residence, etc.). The debtor is not obliged to provide the collector with information (they already have it) that is the subject of your personal data.

- For failure to pay an existing debt, collectors threaten physical harm and damage to property. These actions are illegal and are punishable by criminal liability against unscrupulous employees of collection organizations.

- the conversation moves from a constructive direction into threats and psychological pressure by misleading the debtor about the nature of the debt and possible consequences: threat of seizure of accounts and cards, description of property, deduction of funds from wages, departure of “reaction teams”, intimidation with criminal liability.

Here is a far from exhaustive list of “rosy prospects” for non-repayment of existing debt. Remember, all actions to collect funds are applied to the debtor by court decision and only by the relevant authorities. The “peak” influence of collectors on persons with overdue debts is the right to sue to resolve the existing dispute.

Get a free consultation

Collectors call about someone else's loan.

Often employees of collection organizations contact relatives, friends, neighbors, and employers of the debtor. However, there are often cases when debt collectors call about other people's loans. At the same time, it is not necessary to be a guarantor or co-borrower.

Let's describe the main reasons why debt collectors call on someone else's loan:

- The loan was taken by your relative or people from your immediate circle. Your number has been indicated as a contact number.

- A recently purchased SIM card is receiving calls from debt collectors. Often, unscrupulous debtors change mobile phone numbers, and their old ones, after some time, go on sale again. New SIM card owners also “inherit” calls from collectors demanding repayment of a debt that you didn’t even know about.

- The person who assumed financial obligations mistakenly or intentionally incorrectly indicated his telephone number or contact person.

- There may have been fraudulent activity against you. Unfortunately, nowadays it is not a problem to get other people’s personal data. Fraudsters have learned how to apply for microloans via the Internet, having in hand the passport details of any person. In this case, protect yourself - check your credit history.

They call about someone else's debt: how is this possible?

Bank employees will not let the debtor forget about the loan. After the first delay in payments, the bank will contact the defaulter and demand to repay the debt. The longer the delay, the higher the likelihood of facing lawsuits and demands from collection companies.

If the debt really exists, collectors have the right to call the debtor, seek personal meetings, and use other methods of influence.

A call from collectors may be completely unexpected if you have repaid the loan a long time ago, or have never contacted a bank or microfinance organization at all.

Why debt collectors may call about someone else's debt

- An error was made when concluding an agreement between the bank and the collection company

- for example, incorrect information about the borrower was indicated or the full name of a namesake was used if a long-repaid loan was not written off in the database; - You had to act as a guarantor or co-borrower on the loan

- in this case, the rule of joint liability applies, so the actions of the collectors will be legal; - The borrower indicated you as a contact person in the loan application

- in this case, you will not be responsible for other people’s debts, but the error must be immediately reported by a representative of the collection company or credit institution; - You are a relative of the defaulter

- although the practice of contacting the debtor’s relatives and friends is still common, this is a gross violation of the law; - You are the heir of the defaulter and took over the property after his death

- in this case, demands for repayment of someone else's debt are legal, but there are a number of ways to avoid payments.

The list does not include openly illegal actions that fall under the Criminal Code of the Russian Federation. This could be a scam when loans and credits are issued using your passport data. Illegal debt collectors can use information from databases leaked by bank employees.

Such facts may be considered extortion and a violation of the law on personal data. To protect against criminal acts, you must contact the Ministry of Internal Affairs, demand the initiation of a criminal case and search for the perpetrators.

Collectors call relatives and friends.

In accordance with Art. 5 Federal Law No. 230, collection organizations can interact with relatives, family members and other third parties only if the following conditions are met:

- there is the debtor’s consent to interact with third parties;

- third parties do not express their consent to such interaction.

Remember the main thing: other people's financial obligations are not the basis for constant calls from collection agency employees. And even more so, someone else’s debt is not your debt burden, no matter how much you are assured of the opposite. The only exceptions are guarantors and co-borrowers of the debtor. You have the right to refuse such telephone conversations. If refusing to communicate with debt collectors does not stop the “telephone terror,” then file a complaint with the competent authorities.

Get a free consultation

How often can debt collectors call?

To protect debtors from illegal attacks on their rights and freedoms, the legislator introduced the following restrictions:

- Collectors do not have the right to contact the debtor at night.

- The permitted time period for direct interaction between collectors and debtors is:

— from 8 to 22 hours on weekdays;

— from 9 to 20 hours on weekends and non-working holidays.

- Furthermore, in accordance with Art. 7 Federal Law No. 230, the following quantitative restrictions were introduced:

— personal meetings with the debtor can be made no more than once a week;— they can call no more than once a day, 2 times a week and 8 times a month.

The legislation also specifies categories of citizens with whom collectors cannot contact through calls and messages. These include:

- citizens declared bankrupt;

- persons recognized as incompetent or partially capable;

- persons undergoing treatment in inpatient facilities;

- disabled people of group I;

- minors (except for emancipated ones).

Collectors can call and write to the debtor within 4 months from the moment the loan is overdue, after which the debtor has the right to refuse to communicate with collection agency employees.

If the number of such calls, messages and meetings between collectors and the debtor exceeds, the latter have the right to report a violation of the law to the Federal Bailiff Service. It is the bailiffs who have the right to control and punish collection organizations for their unlawful actions. Otherwise, a fine may be imposed on unscrupulous collectors. And in case of more serious excesses there is criminal liability.

How to talk to debt collectors?

Collection agency employees can be very persistent: this is their job, and they receive bonuses for each debt collected. Refusing to engage in conversation with them or dropping the call will not lead to a positive result. It is better to answer the call and communicate with them in a friendly tone.

What do you need to know from debt collectors?

- The reason for the call, how you feel about the debt.

- Information about the collector: company name, full name of the employee, address, contact phone number.

- If the agency has erroneous information, find out which bank the debt was transferred from, the name of the debtor, the amount of the debt and other data.

Federal Law No. 230-FZ of July 3, 2016 “On the Protection of Rights...” specifies that collectors can make calls subject to the following rules:

- frequency – no more than 1 time a day, 2 times a week, no more than 8 times a month;

- It is prohibited to call during the following time periods: from 22 o'clock to 8 am - on weekdays, from 20 o'clock to 9 am - on weekends and holidays;

- It is prohibited to call from hidden numbers or refuse to provide the contact number of the caller;

- During the telephone conversation, the collector must give his information and clarify which creditor he is calling from.

Even if the call is erroneous, the collector will not be able to remove your data from the general database only with an oral statement; you must have documents confirming your words. We recommend that you clarify all issues with the creditor bank or collectors, since until the number is removed from the database, it will be displayed on the software and calls will be received.

Link to document: Federal Law No. 230-FZ of July 3, 2016 “On the protection of the rights and legitimate interests of individuals when carrying out activities to repay overdue debts...”

How to communicate with collectors?

When calling collectors, the following rules must be observed:

- It is your right to communicate or not to communicate with employees of collection organizations. The debtor will not be held liable. Neither administrative, nor civil, nor criminal. However, the fact of refusing to communicate with bank representatives or collection agency employees can also have negative consequences.

- In the case of a judicial resolution of the issue of repayment of overdue debt, this may serve as a reason that the debtor did not follow the path of pre-trial settlement of the dispute and, accordingly, did not try to find compromises for repayment of the debt.

- Make sure that the caller is indeed an employee of a collection agency. If the collector has not introduced himself or indicated the name of the organization he represents (although, by law, he is required to do so), ask him to do so. You can check the legality of the activities of the named collection organization through the state register of collection agencies on the website of the Federal Bailiff Service.

- If you do communicate with debt collectors, then remain calm. Don't show emotion. Listen to the caller without interrupting. Behave confidently during the conversation and do not make excuses. Do not be disrespectful, rude or insulting. You are also responsible for any unlawful acts.

- Be sure to make audio recordings of conversations. They can serve as confirmation of the fact that collectors have committed illegal actions, including during legal proceedings.

How to negotiate with debt collectors?

Before drawing up written complaints and visiting various authorities in search of justice, it is worth trying to resolve the problem through negotiations with the caller. The probability of success of such an enterprise is extremely low, but, nevertheless, it exists.

During a telephone conversation with a debt collector, it is worth noting that the conversation is recorded on a voice recorder, which allows it to be used as evidence in court proceedings (if the case comes to it). The collector should be informed that you do not have any contacts with the debtor, and you do not have the opportunity to convey to him information that a representative of the debt collection service is looking for him.

Help with calls from collectors.

If the debtor has become a victim of unlawful actions on the part of collection organizations, you need to contact the following bodies and organizations:

- Bank. A written application to the head office of the bank where the loan was issued, with an application to withdraw your consent to the processing and transfer of personal data to third parties. You can also report unlawful actions of debt collectors to the bank. Often the bank administration does not want problems and goes to meet the debtor, eliminating violations that have arisen with employees of collection organizations.

- Federal Bailiff Service. For any actions that seem illegal to you, you can contact the Federal Bailiff Service. They not only deal with enforcement proceedings based on a court decision, but also accept citizens’ appeals regarding illegal actions of collection agencies.

- Police. The police are contacted if threats of murder, bodily harm, property damage, or threats against relatives have been used against the debtor.

- Prosecutor's office. Considers any violations of current legislation.

- Rospotrebnadzor. Receives and considers consumer protection complaints.

- Roskomnadzor. If legal quantity requirements are violated, call times.

If debt collectors call you, remember a few simple rules.

- Telephone calls, personal meetings, and mail messages are actions of debt collectors permitted by law.

- Collectors cannot call at night. The permitted time period for communication between employees of collection agencies and debtors: from 8 to 22 o'clock on weekdays, from 9 to 20 o'clock on weekends and non-working holidays.

- Number of allowed calls: no more than 1 time per day, 2 times per week and 8 times per month.

- Calling collectors must introduce themselves, name the organization they represent, as well as information about the debt (amount, terms, etc.).

- Threatening physical harm, damaging property, or misleading the debtor about the nature of the debt and the onset of adverse consequences (an inventory of property, seizure of accounts and cards, withholding part of wages, etc.) is not allowed. For such actions, collection organizations are punished, including criminal liability.

- Calls to relatives, family members, and employers are possible only with the consent of the debtor and the absence of disagreement of third parties.

- The debtor must contact the bank that issued the credit (loan), the police, the Federal Bailiff Service, the prosecutor's office, Rospotrebnadzor, and Roskomnadzor regarding unlawful and illegal actions of collection organizations to return an overdue debt.

- Try to conduct the conversation calmly, do not stoop to insults.

Communication with debt collectors is always unpleasant for a debtor, but there is no need to be afraid or nervous, because the law protects you from dishonest actions.

However, if you are unable to repay the debt, it is better to turn to professionals who will help you get out of this situation with minimal losses. Contact our lawyers for free legal advice

Get a free consultation

Reasons for calling about other people's loans

Surely everyone is familiar with the procedure for applying for a loan at a bank. When drawing up an application, an employee of a bank or microcredit organization indicates not only the borrower’s passport information, but also a contact phone number. In addition to everything, many institutions require additional telephone numbers. These could be relatives or friends. Why does the bank need this?

The bank lends money to the client and, if necessary, it must know how to find the client. If the borrower’s main phone number is unavailable, then employees of the credit institution must make calls using the information left, including to the borrower’s place of work. The main goal of such calls is to return the debtor to the payment schedule and avoid delays in the future.

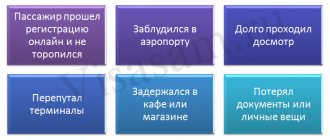

There are a number of reasons for telephone anxiety. These include:

- The number was indicated when signing the contract - your number was indicated as the contact number of a friend or relative, in case the substitute cannot be contacted.

- An employee of the institution made a mistake - it also happens that an employee of a credit institution made a mistake when concluding an agreement.

- The client deliberately left an unfamiliar phone number. Large financial institutions try to make calls and ask whether the caller really knows the borrower. However, most, for example, microcredit organizations do not adhere to this rule.

- When making dubious purchases, for example, when purchasing a phone second-hand, or buying a SIM card without registering with the buyer, etc. — It may well be that the former owner of a telephone purchased, for example, became a debtor during the transfer. This was the reason for the calls from the bank. Buying a new SIM card can help resolve this problem.