Debt disputes are one of the most common and at the same time the most complex. They can have dozens of aspects and nuances that in one way or another influence their consideration and outcome. In the most difficult cases, disputes over debts can go to court, which may well force collection.

In most disputes that end unfavorably for the borrower, a decision is made to seize the property. And the first thing to be seized, as a rule, is the car. But it’s no secret that a car is a very important property, and imposing restrictions on it can create a lot of problems. In this article we will tell you what to do if the bailiffs seized the car.

How does an arrest proceed?

A car is seized through the court if its owner has significant debts that he cannot or does not want to pay. As a rule, arrest serves to impose certain restrictions on the use of a vehicle, as well as to prohibit its sale, donation and other transactions related to the change of ownership.

- The step-by-step donation procedure is as follows:

- The creditor goes to court with a claim to forcibly collect funds from the debtor;

- The creditor wins the case and receives a writ of execution;

- The writ of execution is transferred to the Federal Bailiff Service;

- A bailiff is appointed - a executor who opens enforcement proceedings;

- The bailiff evaluates the car and issues an encumbrance on it;

- When issuing a corresponding resolution, the bailiff organizes debts, in which the car is sold, and the money is sent to pay off the debts.

Info

As you can see, the procedure is very complicated and at the same time very lengthy. So the debtor will have enough time to prepare to return his vehicle. However, you should not try to sell it or give it away - all such transactions carried out over the last three years will be cancelled.

Reasons for car seizure and consequences

Arrest, as an administrative penalty, can be applied to the car and other property of the offender.

Arrest means either one of the following legal restrictions or a combination of them:

- inability to dispose of the car as your property (prohibition on sale, exchange, gift, etc.);

- limiting vehicle use;

- car confiscation.

Exactly what sanctions were applied in a particular case becomes clear from the accompanying documents. The resolution must indicate the type of punishment, its scope and limitation period. Each case is individual, and the type of arrest depends on many factors.

Another penalty involving a car is the inability to register it. A ban on registration differs from an arrest in that the vehicle does not directly participate in it. So, if an offender hides his car in the hope of avoiding punishment, data about the car and the ban imposed on it is transferred to the traffic police.

Thus, even without knowing where the car is currently located, the bailiff can apply a ban on registration actions. And if the debtor decides to sell the car, at the time it is re-registered to the new owner, the truth will emerge, and the arrest will be carried out in any case.

Before you find out how to remove a car from judicial seizure, you need to find out why this action was carried out in the first place. To do this, you need to contact the bailiff service. The reasons for the arrest are also indicated in the resolution on the commencement of enforcement proceedings, a copy of which is received by the car owner.

We recommend

“Untimely registration of a car: crime and punishment” Read more

In most cases, the answer to the question of whether it is possible to remove the arrest from a car is positive. Sometimes the problem is resolved quite quickly, and sometimes it may require filing a claim in court. Unfortunately, it will not be possible to solve the problem “on the spot”. Get ready to spend time and nerves.

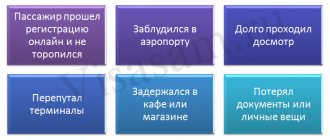

The most common reasons for car seizure:

- Significant debt on a car loan. The bank's notices and requests were not answered, so the creditor was forced to go to court. Thus, the car is seized by court decision.

- The owner of the car is a persistent non-payer of alimony. If this fact is proven in court, the car is seized until alimony debts are repaid.

- The car is part of the joint property. In case of divorce, it is also subject to division, so it may be arrested.

- Incorrect execution of documents when importing a vehicle into the territory of the Russian Federation. If the documents are drawn up incorrectly or not drawn up at all, the car will be seized.

- The car was pawned and sold under a fraudulent scheme using false documents.

Often, bailiffs seize a car without having the right to do so. There are a number of reasons why arrest cannot be imposed:

- The car belongs to a citizen with disabilities.

- The debtor is not the legal owner of the vehicle (ownership rights are held by a close relative - father, spouse, child).

- The citizen carries out labor activities on this vehicle, and the arrest will deprive him of his earnings.

When a car cannot be impounded

There is a certain list of restrictions that do not allow the bailiff to arrest the car. This list includes the following reasons:

- A car is the only source of income for a citizen; he uses it for work;

- The car is not registered in the name of the citizen whose property is seized, but in the name of his relative, employer, etc.;

- The car belongs to a disabled person and is equipped with special devices that allow him to move.

Attention

If the car falls under one of these categories, but was still arrested, then it can be easily returned by filing a claim with the senior bailiff at the FSSP. It will need to include information on the basis for the seizure of the car, as well as the reason why it cannot be seized.

How to find out about the seizure of a car by bailiffs?

Bailiffs do not have the right to seize a car without any reason. A court decision is required, according to which the owner of the property is recognized as a debtor. And only after it comes into force can the procedure be carried out. The bailiffs will issue a decision to initiate enforcement proceedings. A copy of it will be sent by registered mail to the debtor.

Among the reasons for the seizure of a car by bailiffs, the most common are:

- unpaid bank loans and credits;

- overdue unpaid administrative fines;

- debts to pay utility bills;

- monetary obligations for assigned alimony;

- violation of the rules for importing vehicles. In this case, the customs authorities make a decision on seizure.

How to return a car

The owner can return the car in several ways. There are three of them in total, and each of them will take place completely differently.

The first , and at the same time the easiest way to remove the seizure from a car is to pay off debts. As soon as the debt is repaid, enforcement proceedings by the bailiffs will be terminated, which automatically leads to the removal of all encumbrances, including the seizure of the car. You just need to return the money correctly, keeping all checks, papers and submitting them to the FSSP. But you need to hurry - you need to deposit the money 10 days in advance, otherwise the car will go to auction.

The second way is to challenge the court's decision. The debtor who loses the case will have exactly 10 days to file an appeal. If he manages to challenge the decision to forcibly collect the debt, then a writ of execution will not be issued and, as a result, there will be no grounds for arresting the car.

The third way to return the car is to suspend enforcement proceedings. To do this, you need to contact the senior bailiff or the court with a complaint that certain violations were committed during the enforcement proceedings. You will not get rid of the debt, and the seizure will not be completely removed from the car, but you will have a lot of time to prepare for the cancellation of the seizure.

The fourth way is to provide proof that the car cannot be taken away. Just show the bailiff that he cannot pick up the car due to the restrictions on arrest described above. In case of refusal, you have the right to suspend the proceedings and file a claim by contacting the FSSP.

The fifth way is to ask someone to buy your car. This method will allow you to get the vehicle back only if the amount owed is much greater than the value of the vehicle. Otherwise, it will be easier for you to pay off your debts. If your car is dear to you, then you can ask someone to buy your car at auction at your own expense, and then after a certain period buy it back. This way you will return the car, although not for free.

The sixth way is to wait until the debts are settled and, if no one bought the car, ask for it back. If your car was not purchased, and the creditor does not need it, then by law the owner has the opportunity to file an appeal to the bailiff and ask for the return of your car. But this can only be done if the car has not been sold in 2 weeks.

How to withdraw if your car is seized

- Method 1

This path involves full repayment of the debt.After the car is seized, the owner can pay the debt within the next ten days. If the debt is not repaid within the specified period, the car is sent for sale to the Russian Federal Property Fund. For the sale, open auctions are held with the participation of those interested who submit their applications in a timely manner. The money raised for the car at auction is used to pay off debts. How to remove the seizure from the car imposed by the bailiffs in this case? Find money and pay off the debt before the car goes under the hammer.

- Method 2

Going to court. To do this, you should file a claim in the name of the judge who made the decision recognizing the owner of the car as a debtor.The statement of claim sets out the requirement to lift the seizure or restriction of the right to use the car, as well as the reason for satisfying the claim.

We recommend

“Caring for a black car: rules that must not be broken” Read more

In case of a positive court decision, it is better for the car owner to carry a supporting document with him. Data transfer between services is not always carried out in a timely manner, so there is a high probability of misunderstandings. The traffic police inspector who stopped the car may see outdated information about the seized vehicle in the database, then he will need to provide proof of the arrest being lifted. - Method 3

Pick up the car if it was not purchased at open auction. There are situations when the car did not interest the auction participants, and the lender needs money, not the car.This gives you the opportunity to submit an application to the bailiff service for the return of the vehicle. If the request is not satisfied, you can send a complaint to the senior bailiff.

According to current legislation, a vehicle that has not been sold two months after its revaluation can be transferred to the claimant. If the lender refuses to accept the car, the property may be returned to the owner. If the debtor does not have any other property that can be sold or income that covers the debt, the writ of execution is returned to the claimant.

Can debt collectors make arrests?

Citizens often ask the question, “Can collectors seize a car and sell it?” The answer to this question is quite strictly defined by law - no, under no circumstances can collectors seize property, much less sell it on their own . So if a debt collector threatens to arrest you, then this is just a threat, and an unlawful one.

The only way a collector can seize a car is to go to court and win the case. So if the debt belongs to a collection agency, then in this way, on its initiative, the car can be encumbered and sold. In this case, it will be possible to return the car after arrest in accordance with the general procedure.

Can a car be taken away for loan debts?

If we are talking about a car that serves as collateral for a loan, then the only way to keep the vehicle is to negotiate with the bank and pay off the debt. Ideally, a restructuring should be carried out, making the payment schedule more convenient. You can also delay the withdrawal by repaying the debt at least in small parts, that is, constantly depositing a certain amount into the credit account. But sooner or later the bank will get tired of this and will still go to court.

We suggest you read: How long can a court consider a criminal case?

If the car is not pledged, then the best option to avoid problems is to negotiate with the bailiff. A citizen can also initially try to peacefully resolve the issue with the bank so that it does not go to court. But a lawsuit in this case is not a fatal situation; it does not mean that you will lose your car.

Ideal solutions to the situation:

- If you are officially employed, the bailiff will issue a ruling to withhold 50% of your income. As a result, you will gradually repay the debt, and the bailiff will no longer take any measures. If necessary, the debtor has the right to go to court to reduce the amount of withholding.

- If you do not work officially, agree with the bailiff to partially repay the debt yourself. Draw up an agreement according to which you will deposit, for example, 5,000 rubles monthly into the account. The movement of funds and the gradual repayment of debt will protect you from other actions of the bailiff, including seizure of property.

And remember that the concept of proportionality of debt applies in this matter. For example, if you owe 200,000 rubles, the bailiff will not take away your car worth 500,000 rubles. The exception is pawned cars.

If you commit violations in the payment algorithm, the bank has every right to apply penalties and organize the process of collecting credit debt. And collection may involve the seizure of borrowers’ property (read more about collection of credit debt).

Can a car belonging to a citizen be taken away for credit debts? Let's look at this issue in more detail.

If the car is pledged

In this case, the answer is obvious - the bank has every right to take your car. But creditors are in no hurry to take away the collateral; first, they will try to return the debtor to the payment schedule.

This can happen on your own, and if actions are unsuccessful, the creditor attracts collectors, now they will be in contact with the debtor and these contacts are not entirely friendly.

In fact, from the moment of delay to the actual seizure of the car left as collateral, it may take 6-12 months. If the bank cannot influence the debtor in any way, then it goes to court to obtain permission to seize the property and sell it at auction.

This can also be done forcibly; as they say, resistance is useless.

After seizure, the car goes to auction, where it is sold below the average market value. The proceeds from the sale are used to pay off the loan debt, which by that time had accumulated penalties and fines for overdue loans.

It is possible that not all proceeds from the sale will be used to pay off the debt. If the borrower has previously paid off the loan, then part of the debt has already been paid, so funds may remain (the car was sold at a price that is higher than the loan debt).

In this case, the bank returns the difference to the borrower.

If the car is not pledged under a loan agreement, then things are completely different. The bank cannot lay claim to the debtor’s car, no matter how large the debt is.

The bank cannot, but the bailiff has every right to seize the vehicle and seize it from a citizen who does not want to pay his debts.

But this is very far away, so let’s look at what will precede the seizure of an unsecured car, how they can seize a car for debt on a loan.

The bank will operate according to the standard scheme. First, he will start calling the debtor, trying to come to an agreement, and if unsuccessful, he will transfer the debt to collectors for collection.

Collectors very often scare debtors by saying that they will come and take away the property if the debt is not repaid by a certain date. But these are only deterrent measures; in fact, collectors know very well that only bailiffs can take away the property of debtors after the relevant court decision has been made.

If collectors threaten to take away your vehicle, apartment or other property, remember - these are empty threats. No one will come to you and take anything away.

If the collectors are unable to influence the debtor, then the bank has no choice - it files a lawsuit to get its money back through the courts. The seizure of the vehicle will also not appear here, because there is no encumbrance imposed on it.

This is an obvious plus for borrowers.

There is a period specified by law to appeal the decision, and if no complaints are received, then the court decision enters into legal force. The case is transferred to the bailiff service for collection. And it is the bailiffs who have the right to seize the debtor’s property, including their car for debts.

First, a portion of the debtor's wages will be levied. The bailiff, through the tax service, finds out where the debtor works and sends a writ of execution to the place of work, according to which a withholding of up to 50% is imposed on the debtor's wages. If such a debt collection measure is completed, then you don’t have to worry about your car, the debt will be gradually repaid.

The bailiff can also seize the debtor's bank accounts. If funds are found on them, then all the money goes to the bank. With further receipts of funds to these accounts, they are also subject to withdrawal.

If the debtor does not work and does not have bank accounts, then the bailiff has no choice - he turns his attention to the debtor’s property in order to seize it. But here, too, it should be understood that in order to repossess a car, there must be a credit debt of appropriate size. No one will take your car for a small debt.

Even at the initial stage of collection, you may find that your car is subject to a registration ban. This is done just in case, so that the debtor will not be able to sell the car until he pays off the loan. In the future, the bailiff may seize this vehicle.

The bailiff applies to the court to obtain permission to seize the debtor's car in order to pay off the debt to the bank. After receiving permission, the bailiff begins searching for the car: at the place of residence, registration, work of the debtor. In order to find seized vehicles, joint raids by bailiffs and traffic police officers are often carried out.

What needs to be done to avoid getting into such a situation?

- Check the car for encumbrances: arrest, ban on registration, presence in the pledge database of the Federal Notary Chamber.

- Check the documents carefully - for a new car, the PTS must be original (not a duplicate) and issued within a year from the date of release of the car. If the car has a duplicate title, then ask for a copy of the original. Some owners do it to prove that there are no encumbrances on the car. It may well be that the original PTS is in the bank, and the car is pledged. In this case, the seller’s actions may be regarded as fraud and you will end up with a lot of problems in the form of a seized car and loss of money.

- Ask the seller for a passport and check his first and last name with the entry in the PTS. If the seller claims that he is selling this car at the request of third parties, then ask him for a notarized power of attorney. If there is no power of attorney, then ask the representative to arrange a meeting with the owner at the conclusion of the transaction. It is necessary for the owner of the car to personally sign the purchase and sale agreement in your presence. If the seller refuses these requests, we recommend that you refrain from purchasing.

- Check the current and previous owners of the car from the title on the FSSP website for large debts.

- You can check the car to see if it is pledged by a notary. In this case, what did you have proof that you took all measures to inspect the car before purchasing. Even if something doesn't go according to plan, you will have proof that you are a bona fide purchaser.

- In the purchase and sale agreement it is worth indicating the real value of the car, that is, the amount that you give to the person.

You may think that the advice given by our experts is unreasonably redundant. In the end, many of us successfully purchase a car on the secondary market without any problems. We would have agreed with you if Ivan had not turned to us for help about including Fedor in the register of creditors.