The procedure for foreclosure of property that is under collateral occurs only in court, unless other options were provided for in the agreement. The algorithm and instructions that are aimed at collecting collateral property are prescribed in article number 349 of the Code of the Russian Federation.

In this material we will talk in detail about in which cases collection can only be carried out with the participation of a court, and in which situations this issue can be resolved by agreement between the parties to the agreement. We will also learn a simplified version of the claim and other important nuances.

How is property that is under collateral recovered by court order?

Cases when a citizen must apply to a judicial institution

Article number 349, part 3 of the Code of the Russian Federation describes in detail cases when the issue of collection must necessarily be resolved with the participation of the defense authorities. So, it is necessary to solve the problem with the help of the court in the following situations:

- When the collateral is the only real estate that belongs to a person as a property.

- When the pledged item is a movable or immovable thing that has great historical, artistic or other cultural significance for the population.

- When the person who pledged the item was found to be missing in action.

- When the property is under several collaterals at once. In addition, such pledges have different procedures for claiming and different ways of selling the pledged items.

- When the pledged item serves as a subject to secure various obligations of several holders of this pledge. The exception here is cases when the terms of the agreement regulate the pre-trial procedure for collecting collateral.

- Other situations provided for by legislative acts.

Agreements that specify the procedure for pre-trial recovery of property in the situations listed above are considered invalid.

Situations in which the mortgagee is obliged to apply to a judicial authority

Part 3 art. 349 of the Code describes situations in which the issue of collection cannot be resolved without legal proceedings.

Resolution of the issue of recovery through the court will be mandatory in the following cases:

- collateral is the only immovable premises that belongs to a person by right of ownership;

- a pledged item is a movable or immovable thing that has enormous historical, artistic or other cultural significance for society;

- the pledgor's missing person status was established;

- property is the subject of several pledges at once, and each of them has different collection procedures and different methods of selling pledged items;

- the pledged item is the subject of ensuring the fulfillment of various obligations of several pledgees, except in cases where the terms of the agreement between all co-pledgeholders and the pledgor regulate the extrajudicial procedure for foreclosure on the pledged property;

- in other situations specified by law.

Agreements that provide for extrajudicial recovery under the above circumstances are considered void.

Algorithm for collecting collateral without the participation of a judicial institution

Article number 349 of the Civil Code of the Russian Federation specifies situations when it is possible to recover collateral property without the participation of a judicial institution:

- All parties to the process have the right to include in the contract a clause on pre-trial recovery of property. It turns out that two agreements will immediately arise here: a collateral contract and a resolution of the dispute without recourse to the defense authorities.

- If the agreement is concluded separately, it must necessarily correspond to the pledge agreement.

- This type of agreement can be concluded at any time. It can be executed both after the conclusion of the collateral contract and before this conclusion. This is permissible within the framework of the law.

- It is also allowed to conclude an agreement without specifying a specific collateral. This is called a future lien agreement.

- The following information must be specified in the collateral contract: options for selling the property, as well as its initial cost. You can specify a method for determining the price if the cost is initially unknown.

- If the contract specifies several ways to sell the pledged property, then the holder of the pledge has the right to choose one of them. But if the right to choose is not specified in the contract.

- If the claim of collateral is carried out without the participation of a judicial institution with a notary inscription, then the governing documents here will be: legislative acts on notaries; Federal Law “On Enforcement Proceedings”.

- The following requirements must be taken into account: the debtor does not fulfill or fulfills the pledge obligation, but without following the rules; a pledge agreement, which contains a condition on the right to sell property without the participation of a judicial institution, is certified by a notary.

- In a situation where the demand occurs in a pre-trial manner, the person conducting the seizure on the basis of established rules is obliged to inform the pledgor, the pledge holders and the debtor himself about this procedure about the initiation of the process.

How to foreclose on mortgaged property without court participation

It should be noted that there is no description in the Civil Code of the process during which a specific mortgaged property title is recovered. However, the following facts are noted and described in the table below.

Table 1. Under what circumstances does extrajudicial foreclosure of property under collateral become possible?

| Subject to agreement | In the absence of legislative obstacles |

| The first and fundamentally important point from a legal point of view is that such a solution becomes possible only if both parties have previously entered into an agreement of the appropriate content, that is, they have actually expressed consent to carry out extrajudicial collection. | The second mandatory condition under which collection can be carried out without the participation of a court is that there are no circumstances that could serve as a reason to transfer the proceedings to the court (we listed these grounds in the previous section). |

What rules govern tax collection proceedings carried out without the participation of a court?

Next, we will consider the rules that govern the procedure for collecting collateral property carried out in a non-judicial manner. All the rules listed below are determined by the Civil Code of the Russian Federation.

1. The parties participating in the procedure have the opportunity to initially indicate the condition that the seizure of the collateral will be carried out without the participation of the court, directly in the contract drawn up initially. With the help of such an instruction, this document will be connected with a separately concluded agreement on refusal to go to court if a situation arises in which the property will have to be confiscated.

2. A separate agreement to resolve the issue may also be drawn up, however, it must be prepared in the same form in which the agreement on the pledge of property was prepared.

3. The conclusion of the agreement in question can be carried out absolutely at any time. In other words, you can arrange it:

- before the collateral agreement;

- after the collateral agreement.

4. As for the rules for drawing up this agreement, it is important to understand that it is possible to draw up an agreement to resolve the issue without the participation of the court, including without specifying a specific item that will pass into the possession of the mortgagee in the event of the occurrence of expected circumstances.

5. This agreement will also need to indicate the following points:

- methods by which the received property will be sold in the future;

- the value of the pledged item at which it was initially assessed, or the method for determining it.

6. Provided that, according to the concluded agreement, not one method of selling property, but several, will be used, the mortgagee has the right to choose a specific one independently, provided that the agreement does not indicate that another person should determine this nuance.

Article 349 Procedure for foreclosure on pledged property

7. In the event that foreclosure on any property takes place in an extrajudicial manner using a notary’s writ of execution, the required procedure will be regulated in accordance with the following legislative acts:

- according to the Federal Law “On Enforcement Proceedings”;

- regulations in the field of notaries in our country.

In this case, the following settings must be executed:

- the person who is the mortgagor does not fulfill the obligations assigned to him by the contract, or performs it improperly;

- the agreement under which the property was pledged, which includes an agreement to receive the property subject to pledge, without the participation of the court, is notarized.

8. Provided that the recovery of the property will be carried out without the participation of the court, the person entitled to carry out this procedure is obliged to send advance notice of the initiation of the process to the following persons:

- pledgor;

- debtor;

- mortgagee.

Additional rules governing the conduct of the procedure in a manner that does not involve going to court establish requirements for indicating the following nuances in the agreement:

- the name of the immovable property object, the pledge of which took place under the agreement on obtaining a mortgage;

- the primary price of the mortgaged real estate at which it was sold, as well as the methods by which it was determined;

- the amount of money that must be paid to the holder of the mortgage in accordance with the concluded agreement on obtaining a mortgage;

- methods for the sale of property objects included in the category of real estate, or the conditions for the acquisition of this name by the pledge holder;

- an indication of the so-called encumbrances that exist and are known to all parties to the process on a specific immovable object.

The main nuances of claiming collateral property without the participation of a court

The Federal Law, namely Article No. 55 of the Russian Federation “On Mortgage (Pledge of Real Estate),” stipulates special conditions under which it is possible to sell pledged items and things without contacting the authorities for the protection of rights and interests.

Such an article indicates the essential terms of the agreement between all participants in the process in the pre-trial procedure for resolving a dispute:

- Indicate the name of the subject of real estate collateral for mortgage lending.

- The original cost of a property or the method for determining its final price.

- The amount of money that must be transferred to the mortgagee under a mortgage agreement.

- The method of sale of real estate or the conditions for its purchase by the mortgagee.

- Possible encumbrances on this property. In addition, other persons have rights to this property.

Foreclosure of pledged property under a loan agreement

Many residents of our country have encountered such a problem as issuing a credit loan with the condition of mortgaging property. Most often in this case a deposit is made:

- cars;

- apartments;

- other real estate.

The bank has the right to carry out the procedure in question in the event that the borrower, or the person who vouched for him when borrowing money, avoids repaying the monthly payments assigned to him. At the same time, even if the amount of overdue is insignificant, to initiate production it is enough to simply not deposit funds only 3 times in a year.

Immovable objects such as a car, apartment, cottage, etc. can act as collateral.

The bank has the right, if there are legal grounds, to take the following two paths:

- settle the matter through an out-of-court settlement;

- file a formal foreclosure with the court on the mortgaged property.

In order to settle the matter peacefully, without bringing the process to the court, this possibility must first be stated in the loan agreement concluded between the parties. We assure you that the bank does not want to go to court any less than yours, and therefore will be happy to sort it out within the framework of peaceful negotiations.

Please note that the law has established a limitation that must be taken into account when drawing up such contracts.

Thus, it is illegal to state in them that the parties will resolve the issue amicably if the borrower pledges a home that:

- is the only one for him;

- belongs to a person according to property rights.

In such a situation, the issue can only be resolved through the court, which will help choose a solution that is adequate to the situation, taking into account the interests of each party.

If you pledge the only property of the family, the law prohibits deciding on its collection without the participation of the court

Out-of-court settlement procedure

Let's look at what steps a creditor must take in order to foreclose on property without going to court.

- First of all, the debtor is sent a notice containing a requirement to repay the amount accumulated behind him, indicating:

- the amount of the amount;

- the time frame within which payment must take place.

- If there is no reaction from the debtor, then the creditor sends him a letter stating that the procedure for foreclosure on the property previously pledged by him as a guarantee of debt repayment has begun.

- At the third stage, the debtor transfers to the bank the object that was previously pledged by him. A corresponding act is drawn up.

- The fourth step of peaceful settlement implies that the bank will send the borrower another notice, which will indicate:

- the place where the auction will be held for the purpose of selling the property;

- the time at which the auction will begin.

Please note: when the auction is held and creditors receive some funds for the sale of the property, payments will be made from them:

- for a debt left by the debtor;

- as a reward to the person who organized these auctions.

After the sale of the property, some of the funds will go to the creditor, the auction organizer, and the rest will be returned to the former owner

If, after all, there are still any funds left from the proceeds, then this balance will be returned to the person who accumulated the debt.

Provided that for some reason the auction did not take place, the credit institution has the right to purchase this property within the next 10 days from the expected date of sale, and count the purchase amount as repayment of claims to cover the debt.

When the bank refuses such an option as purchasing a mortgaged property, then a re-tender can be held within a month. If even in this case the plan does not take place, then the creditor will be given another 30 days to purchase material goods, the cost of which can officially be reduced by 25% of the original amount.

If this opportunity is not taken advantage of this time, the bank will be forced to terminate the pledge.

Judicial procedure for foreclosure

If a decision is made to go to court to repay the debt by obtaining the property pledged by the debtor, the creditor’s steps will be as follows.

- First of all, the debtor is sent a claim in which they are informed that if the demands for repayment of the debt are ignored, the case will be taken to court.

- In a situation where the debtor has ignored your demands, you file a claim with the court, which, during the proceedings, will certainly make a decision regarding the foreclosure of the pledged property.

The court will act as a reliable intermediary in the matter of foreclosure of pledged property

The procedure for foreclosure on mortgaged property

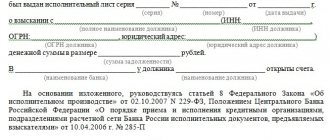

So, here you are holding a court decision in your hands, giving you the right to carry out your plans. Now you have to send all the necessary papers to the FSSP specialists.

The designated officials are required to carry out the procedure for repossessing a previously mortgaged property from its current owner, or obtain other documentation necessary to carry out foreclosure.

Selling property at public auction

The material goods received by the bailiffs are subject to sale at auction. As in the situation with a peaceful settlement of the issue, the monetary value received after the implementation will be divided between:

- credit institution covering the debt;

- auction organizers receiving payment for services;

- by the debtor, provided that by the time of distribution between the above-mentioned persons, some portion of the proceeds will remain.

If, after selling the property, the debt is still not repaid, you will have to again turn to the debtor to find items for bargaining

Please note: if the property is sold, but the funds received after the sale are not enough to pay the first two items, then the balance of the debt will similarly be obtained from other material goods belonging to the debtor.

If the auction in this case is declared invalid, the lender, as in the situation described above, is given 10 days to redeem the mortgaged property. If this is refused, a second auction will be held. If they are also recognized as unsuccessful, the credit institution will again be able to buy the object, receiving a “discount” of 25% of the original amount.

If in this situation the bank decides to refuse, then the collateral will terminate.

As you can see, the procedure for foreclosure on mortgaged property and its consequences will be similar:

- as in the case when preference is given to an out-of-court resolution of the issue;

- and in a situation where a decision has been made on proceedings involving the court.

The only difference will be who will finally demand the transfer of material wealth:

- in case of a peaceful resolution of the issue, the bank will be responsible for the implementation of this aspect;

- in a situation involving the court, this authority will be transferred to the bailiff.

The final demand for the transfer of material wealth will be either the bank or the bailiff

Repayment of collateral obligations to the creditor ahead of schedule

Article number 351, paragraph 1 of the Civil Code of the Russian Federation spells out cases when the creditor has the authority to demand the closure of obligations ahead of schedule. Situations here may be as follows:

- The object or thing was transferred to the pledgor, but ceased to be the object of pledge on terms that do not comply with the terms of the pledge agreement.

- The property was liquidated or lost for reasons that did not depend on the actions of the creditor, since it was outside his area of responsibility.

- Other options that are specified in the contract or legislation of the Russian Federation.

Expert opinion

Yurchenko Ekaterina Vasilievna

Deputy Chairman of the Committee for Debt Dispute Resolution and Crisis Management

Article number 351, paragraph 2 of the Civil Code of the Russian Federation spells out cases when the creditor-mortgagee has the authority to demand from the debtor the early fulfillment of his obligations, as well as to reclaim his property. This is permitted if the requirement for early fulfillment of obligations is not fulfilled.

Such cases include:

- When the pledgor violated the requirements that were provided for the further pledge contract.

- When the mortgagor did not fulfill specific obligations that were provided for by specific regulations of article number 343, paragraph 1, subparagraph 1 and subparagraph three of paragraph number 1 of the Civil Code of the Russian Federation.

- When the pledgor fails to comply with the conditions that are aimed at regulating the seizure of the property pledged. And also, if the rules that are created to regulate such collateral property that is in temporary use are not followed.

- Other cases provided for by the legislation of the Russian Federation.

How can a mortgagee ensure his interests when selling the pledged property?

To sell the pledged property, you have the right to make the necessary transactions and demand that the pledgor transfer the property to you (Clause 4 of Article 350.1 of the Civil Code of the Russian Federation).

If the pledgor transferred the pledged movable thing for the possession or use of a third party, you can also reclaim the thing from this person (Clause 4 of Article 350.1 of the Civil Code of the Russian Federation).

If they refuse to transfer the collateral to you, you can turn to a notary for help (clause 4 of Article 350.1 of the Civil Code of the Russian Federation). Based on his writ of execution, the bailiff will be able to seize and transfer to you the pledged movable property or take the necessary actions in relation to real estate (Part 1.1 of Article 78 of the Law on Enforcement Proceedings). In addition, you can request that the bailiff sell the collateral (Part 1.2 of Article 78 of the Law on Enforcement Proceedings).

This is important to know: Application for a court order to collect debt for housing and communal services: sample

We recommend:

Didn't find the answer to your question?

Find out how to solve

How is collateral valued? Main stages

If the property is pledged to a banking institution, its value will be assessed according to the following scheme:

- The market (reasonable) value of the property will be indicated, which is relevant in the process of drawing up the collateral agreement.

- The collateral value of the object is calculated. The legislation of the Russian Federation does not provide for a specific algorithm for this type of calculation. As a rule, specialists rely on the internal documentation of their institution. It is extremely important to provide up-to-date information about possible risks. And also prepare an accurate calculation of possible financial expenses that will be associated with the future sale of the collateral.

- Calculation of the initial cost of the object for future auctions. The original sale price is indicated here. According to general rules, this cost is calculated using the indexation of the collateral price multiplied by the inflation percentage.

The process of claiming collateral without the participation of a judicial institution. Procedure instructions

Let's look at the steps of the process that you can put into practice:

- The debtor is first notified that he has debt obligations. This can be done both in writing and orally. Do not forget to indicate the name of the collateral, the option for its sale and the period for fulfilling the obligations.

- The debtor is sent a written message about the initiation of the foreclosure process.

- The debtor must transfer the pledged item to the pledgee on the basis of a transfer deed.

- The pledgee notifies the debtor of the time and place of the auction for the sale of the pledged property. Here the lender must be responsible for the sale.

- After the auction is closed (sale of the collateral), a certain part of the funds is transferred to the pledgee (repayment of the debt), the other part is paid to the person who organized the auction. All remaining funds (if any remain) are given to the debtor.

- If the auction was declared invalid, then the pledgee has the authority to keep the object with an offset to its value (within ten days after the auction did not take place).

- If the pledge holder does not want to redeem the pledged item, then the second auction can be held only after a month.

- If the second auction also does not take place due to various reasons, then the pledgee has the right to redeem the pledged item within thirty days. In this case, the property value will be 25 percent lower than at the very first auction.

- If the mortgagee refuses to redeem the property a second time, the mortgage obligations are terminated.

All other sale options are specified in article number 350, paragraph 1 of the Civil Code of the Russian Federation.

Sample process initiation message

Extrajudicial procedure for foreclosure on mortgaged property: algorithm

The sequence of actions can be described in 9 steps:

- The pledgor-debtor is reminded (in any way: in writing, orally) that he has outstanding obligations (indicate the subject of the pledge, its value, method of sale, deadline for fulfilling the obligation).

- The pledgor-debtor is sent a written notice of the commencement of the procedure for transferring collection to the pledged asset.

- The pledgor-debtor must transfer the pledged item to the pledgee under the transfer and acceptance certificate.

- The pledgee informs the debtor about the place and time of the auction for the sale of the pledged property (the creditor is responsible for the sale).

- When the auction is recognized as having taken place, the debt is paid to the pledge holder from the proceeds, and the organizer of the auction is remunerated. Cash balances (if any) are returned to the debtor.

- If the auction does not take place, the mortgagee may retain the property with the purchase price set off (within 10 days after the failed auction).

- If the mortgagee refuses to repurchase, the second auction is held a month later.

- If the second auction does not take place, the pledgee has the right to purchase the pledged item within a month. Then the property value will be 25% less than it was at the first auction.

- The mortgagee's secondary refusal to purchase the property terminates the mortgage. Other implementation nuances are established by Art. 350.1 Civil Code of the Russian Federation.

Sample notification of the beginning of the procedure

Sample transfer and acceptance certificate

Simplified claim scheme for pledged items and things

Article number 12 of the Federal Law “On Pawnshops” specifies a simplified recovery scheme for pledged items and things.

Expert opinion

Yurchenko Ekaterina Vasilievna

Deputy Chairman of the Committee for Debt Dispute Resolution and Crisis Management

If the borrower does not fulfill the obligations specified in the agreement within thirty days (grace period), then such an item takes on the status of unclaimed. The grace period begins to be calculated when the day of refund arrives.

The pawnshop has the authority to reclaim unclaimed items.

This is indicated in article number 12 of part 2.

Collection is carried out by virtue of a notarial execution inscription. But it is important to note that the agreement can specify conditions on the possibility of collection without such an inscription.

The legislation of the Russian Federation provides for the authority of the borrower to close the debt to the pawnshop at any time before the sale of the property. This is followed immediately by the termination of the process of claiming collateral and items.

Problems arising when foreclosure on mortgaged property

When carrying out the procedure we are interested in, various difficulties may arise, which in some cases must be prevented in advance.

Table 2. Difficulties in foreclosure

| Emerging complexity | Description of the problem |

| Using different indicators when assessing the value of property | Before the mortgaged property is sold, it is appraised. Unfortunately, in this case, a difficulty may arise such as the use of different indicators to determine it by different specialists, since there is no single method for calculating this amount. |

| Reimbursement of bidding costs | The cost of the work of the person responsible for organizing and conducting auctions is 3% of the proceeds from the sale of property. It turns out that if there was barely enough money to cover the debt, then the bank will have to pay for the work of the designated person from its own pocket. |

| Cancellation of the sale of property and subsequent imposition of fines and other sanctions on the debtor | If the person who owes the bank money has valid reasons for not paying the debt, the bank may delay the repossession of the pledged property for a year. However, the citizen’s debt will continue to grow during this year, and will also be subject to:

|

| Failed auction due to late notification | We have already mentioned above that when making a decision to put foreclosed property up for auction, it is necessary to notify its former owner about this. If you fail to send the notification within 10 days, the auction is considered invalid. |

Try to avoid taking out secured loans